Sprayer Tyres Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435714 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sprayer Tyres Market Size

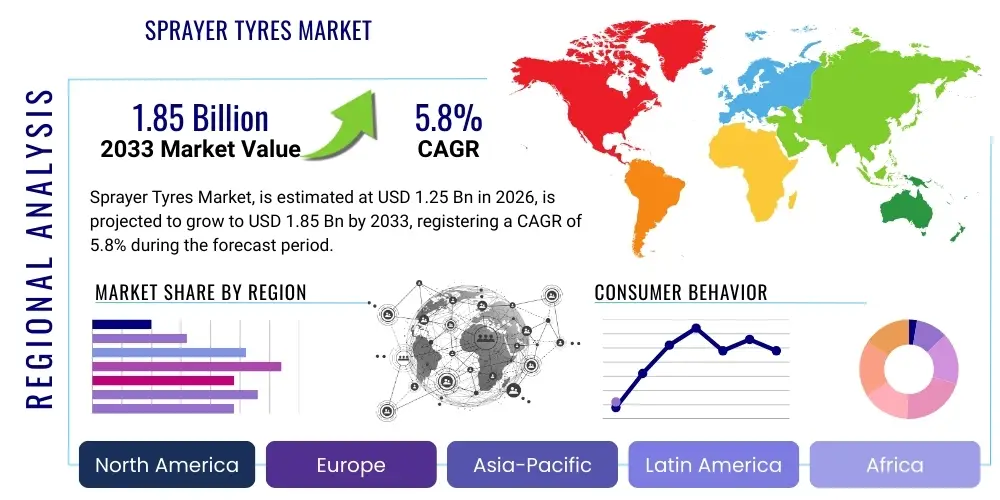

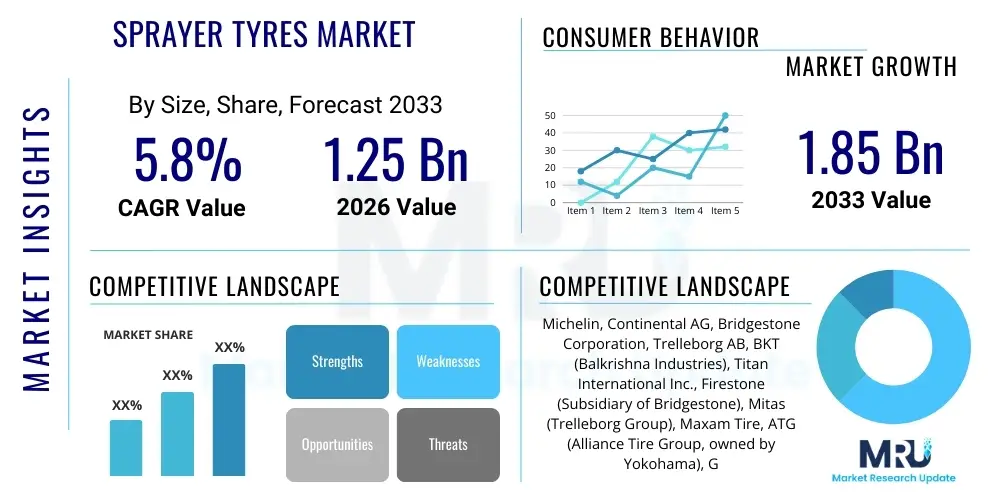

The Sprayer Tyres Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033.

Sprayer Tyres Market introduction

The Sprayer Tyres Market encompasses the global production, distribution, and sale of specialized pneumatic tyres designed for agricultural spraying equipment, including self-propelled, trailed, and mounted sprayers. These tyres are engineered to handle heavy loads, operate at varying speeds, and, crucially, minimize soil compaction—a critical factor in modern precision agriculture. They feature unique tread patterns and robust construction, often utilizing Very High Flexion (VF) or Increased Flexion (IF) technology, which allows them to carry the same load at lower inflation pressures compared to standard agricultural tyres, thereby preserving soil health and enhancing crop yield potential.

The core product description centers on high-performance rubber compounds and reinforced sidewalls, built to withstand abrasive field conditions and chemical exposure prevalent during spraying operations. Major applications lie primarily within large-scale commercial farming operations globally, specifically for the timely and efficient application of fertilizers, herbicides, and pesticides. The inherent benefits include improved machine stability, reduced fuel consumption due to enhanced traction, and the critical advantage of minimizing rutting and soil disturbance, which directly impacts long-term farm productivity and sustainability metrics.

Driving factors propelling market growth include the global shift towards precision agriculture practices, necessitating high-efficiency equipment capable of precise field maneuvering without damaging crops or soil structure. Furthermore, the increasing mechanization of agriculture in developing economies and the replacement cycle of existing specialized sprayer fleets in mature markets contribute significantly to demand. Strict environmental regulations regarding soil health and sustainable farming also compel farmers to adopt advanced tyre technologies like VF and IF tyres, further stimulating innovation and market expansion.

Sprayer Tyres Market Executive Summary

The Sprayer Tyres Market is characterized by robust growth, driven primarily by technological advancements in tyre design focusing on reducing soil compaction and improving operational efficiency. Key business trends include aggressive investment in Very High Flexion (VF) and Increased Flexion (IF) tyre technologies by major manufacturers, aiming to capture the high-performance segment. The aftermarket segment currently holds a significant share, yet the Original Equipment Manufacturer (OEM) segment is expanding rapidly due to the rising sales of new, high-specification sprayers globally. Consolidation among major agricultural machinery manufacturers influences OEM sourcing strategies, emphasizing long-term supplier partnerships focused on innovation and sustainability credentials.

Regionally, North America and Europe dominate the market, attributed to high adoption rates of advanced farming techniques and stringent regulations regarding sustainable farming practices. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fuelled by increasing government support for agricultural modernization in countries like India and China, alongside the rise of large-scale commercial farming enterprises. Latin America, particularly Brazil and Argentina, represents substantial demand due to vast arable land and heavy reliance on sophisticated self-propelled spraying equipment, driving specialized tyre needs.

Segment trends highlight the dominance of Radial Tyres due to their superior performance characteristics, though VF technology is rapidly gaining traction within the radial segment, becoming a standard feature for new high-capacity sprayers. The self-propelled sprayer application segment remains the largest consumer, reflecting the high capital investment in large, powerful machinery requiring specialized, durable tyres. Overall, the market trajectory is highly sensitive to crop prices, agricultural machinery sales cycles, and global regulatory pushes toward eco-friendly farming methods.

AI Impact Analysis on Sprayer Tyres Market

User inquiries regarding AI's influence on the Sprayer Tyres Market primarily revolve around how autonomous spraying vehicles will alter tyre specifications, the integration of smart sensors into tyre systems for real-time monitoring, and the use of AI in predicting tyre wear and optimizing maintenance schedules. Users are keen to understand if AI-driven routing and field mapping will necessitate softer, more specialized tyre compounds or if the trend toward standardization will continue. The key themes summarized from user concerns focus on autonomous operation requirements (zero downtime, optimized load balance), predictive maintenance capabilities, and the potential for AI algorithms to dictate the optimal tyre pressure based on instantaneous soil conditions, terrain topography, and sprayer payload, ultimately extending tyre life and maximizing spraying efficiency.

- AI-Powered Telemetry Integration: Real-time monitoring of tyre pressure, temperature, and wear patterns using integrated sensors feeding data to AI platforms for predictive failure analysis, minimizing unplanned downtime during critical spraying windows.

- Optimized Field Navigation: AI-driven route optimization and guidance systems reduce unnecessary travel and sharp turns, directly decreasing tire scrub and stress, thus extending the lifespan of high-value VF tyres.

- Autonomous Sprayer Requirements: The rise of fully autonomous sprayers necessitates tyres designed for consistent, low-pressure operation under varying loads, managed entirely by AI systems without human intervention, emphasizing durability and stability.

- Material Science Acceleration: AI and Machine Learning (ML) are increasingly used in R&D to simulate and test new rubber compounds and tread designs, accelerating the development of highly durable, chemical-resistant, and low-compaction sprayer tyres.

- Predictive Maintenance Models: AI algorithms analyze historical usage data (soil type, speed, load) to precisely forecast the optimal time for tyre replacement or maintenance, moving away from scheduled checks to condition-based servicing.

DRO & Impact Forces Of Sprayer Tyres Market

The market dynamics are fundamentally shaped by the necessity of maximizing agricultural output while minimizing environmental impact. Key drivers include the widespread adoption of precision farming techniques, which mandate equipment capable of high-speed operation combined with minimal soil disturbance, directly boosting demand for VF and IF technologies. Furthermore, increasing global population necessitates enhanced food production efficiency, driving investment in sophisticated spraying machinery requiring premium tyre solutions. These driving forces are strongly correlated with advancements in agricultural machinery design and the continuous global emphasis on sustainability.

Restraints primarily involve the high initial cost associated with specialized sprayer tyres, particularly those incorporating advanced flexible sidewall technologies (VF/IF), which can be prohibitive for small and medium-sized farm operations, especially in developing regions. Market growth is also subject to the cyclical nature of the agricultural economy, influenced by volatile crop prices, weather patterns, and government subsidy schemes for farm equipment. Trade barriers and fluctuations in raw material prices (synthetic and natural rubber, carbon black) pose additional constraints on manufacturing profitability and final product pricing, impacting market access.

Opportunities are abundant in the integration of smart tyre technology, enabling real-time data collection on soil compaction and operational parameters, enhancing decision-making for farmers. The emerging market potential in Eastern Europe and Asia Pacific, characterized by vast tracts of under-mechanized agricultural land, offers significant avenues for expansion. Moreover, manufacturers focusing on sustainable production processes, utilizing recycled materials, and offering comprehensive tire-as-a-service models, are positioned to capitalize on future regulatory trends and farmer preferences. The combined impact forces result from the tension between the technological demand for high efficiency and the economic constraints imposed by high capital expenditure and raw material volatility.

Segmentation Analysis

The Sprayer Tyres Market is segmented based on critical factors including tyre type, application (the specific type of sprayer), end-use channel, and load capacity. This comprehensive segmentation allows market participants to tailor their product offerings and marketing strategies to specific needs within the highly diversified agricultural sector. The segmentation by tyre type, particularly the differentiation between traditional Bias, conventional Radial, and advanced Very High Flexion (VF) technologies, highlights the ongoing technological evolution driving premium segment growth. Analyzing these segments provides deep insights into purchasing behaviors across various farming scales and geographical regions, optimizing inventory and production forecasting.

- By Type:

- Bias Tyres

- Radial Tyres

- Very High Flexion (VF) Tyres

- Increased Flexion (IF) Tyres

- By Application:

- Self-Propelled Sprayers

- Trailed Sprayers

- Mounted Sprayers

- By End-Use:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Load Capacity:

- High Capacity (Above 6,000 kg per axle)

- Medium Capacity (3,000 kg to 6,000 kg per axle)

- Low Capacity (Below 3,000 kg per axle)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Sprayer Tyres Market

The value chain for the Sprayer Tyres Market begins with the upstream segment, encompassing the sourcing and processing of raw materials. This includes natural rubber latex harvesting, synthetic rubber production (derived from petrochemicals), and the supply of reinforcing materials like steel cord and fabric textiles, along with specialized chemicals such as carbon black and accelerators. High raw material volatility necessitates robust supply chain management and hedging strategies for manufacturers. The competitive advantage in the upstream segment often lies in secure long-term contracts and diversified sourcing to mitigate geopolitical and commodity price risks inherent in rubber and oil markets.

The core manufacturing stage involves sophisticated processes including compounding, extrusion, calendering, and curing, requiring significant capital investment in highly specialized machinery and quality control systems to produce precision agricultural tyres that meet stringent load and speed ratings. Direct distribution channels involve sales straight from the manufacturer to large Original Equipment Manufacturers (OEMs) of agricultural sprayers (e.g., John Deere, AGCO, CNH Industrial). These relationships are governed by rigorous specifications and just-in-time delivery requirements. Indirect distribution, crucial for the highly fragmented aftermarket, utilizes networks of authorized distributors, independent agricultural equipment dealers, and specialized tyre retailers, ensuring widespread availability and localized service support to end-users.

The downstream analysis focuses on the end-user—the large commercial farms, contract spraying services, and smaller individual farmers—who drive demand based on machinery replacement cycles and technological upgrades. The aftermarket plays a critical role, as sprayer tyres are replacement parts with defined lifespans. Effective after-sales support, maintenance advisory services, and recycling/retreading programs form vital components of the downstream value proposition. Optimized logistics and warehousing, particularly in agricultural centers, are essential for timely delivery, minimizing farmer waiting periods during peak operational seasons, which is a major factor differentiating successful market participants.

Sprayer Tyres Market Potential Customers

The primary end-users and buyers of sprayer tyres are characterized by diverse operational scales but share a common need for specialized, reliable, and durable components that enhance operational productivity and minimize soil impact. Large-scale commercial farms, particularly those specializing in row crops such as corn, soy, and wheat, represent the largest customer segment. These operations utilize high-capacity, self-propelled sprayers frequently and demand advanced Very High Flexion (VF) tyres to maximize field coverage rates while adhering strictly to conservation tillage practices. Their purchasing decisions are highly informed by total cost of ownership (TCO) and the tyre's impact on fuel efficiency and long-term soil health.

Another crucial customer segment consists of professional custom applicators or contract spraying service providers. These businesses own extensive fleets of specialized equipment and operate across multiple farms, subjecting their tyres to extreme wear and diverse field conditions. They require tyres that offer maximum durability, chemical resistance, and versatility, prioritizing long service life and minimal downtime. For contract sprayers, immediate availability of replacement tyres (aftermarket support) is paramount, making reliable distribution networks a key factor in supplier selection.

Original Equipment Manufacturers (OEMs) form the third critical customer group, purchasing tyres in bulk for factory fitting onto new sprayers. OEMs demand highly consistent quality, competitive pricing, and collaborative partnerships for joint R&D on integrated systems, especially as sprayers become more autonomous and high-tech. Furthermore, small to medium-sized farms utilizing mounted or trailed sprayers constitute a significant portion of the aftermarket, typically favoring durable radial tyres that balance performance requirements with manageable upfront costs. These customers often rely on localized dealer recommendations for replacement purchases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Continental AG, Bridgestone Corporation, Trelleborg AB, BKT (Balkrishna Industries), Titan International Inc., Firestone (Subsidiary of Bridgestone), Mitas (Trelleborg Group), Maxam Tire, ATG (Alliance Tire Group, owned by Yokohama), GoodYear, Belshina, CEAT Specialty Tyres, Apollo Tyres, Sumitomo Rubber Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sprayer Tyres Market Key Technology Landscape

The technological landscape of the Sprayer Tyres Market is rapidly evolving, driven primarily by the critical need to reduce soil compaction, which is estimated to cause substantial yield losses globally. The most significant technological leap is the widespread adoption of Very High Flexion (VF) and Increased Flexion (IF) technology. VF tyres are engineered with highly resilient sidewall materials and advanced carcass structures, allowing them to carry up to 40% more load than conventional radial tyres at the same inflation pressure, or carry the same load at 40% less pressure. This low-pressure operation dramatically increases the tyre footprint, significantly reducing ground pressure and, consequently, minimizing soil compaction and rutting, leading to superior crop protection and operational efficiency.

Beyond flexibility, materials science plays a crucial role. Manufacturers are utilizing specialized rubber compounds formulated for enhanced chemical resistance against fertilizers and crop protection agents, alongside improved UV stability. These compounds also focus on reducing rolling resistance to improve fuel efficiency during long operational hours. Advanced tread designs, featuring self-cleaning patterns and deep lugs, are engineered to provide maximum traction on diverse soil types while maintaining minimal damage to cover crops or emerging plants, directly supporting the high-speed requirements of modern self-propelled sprayers.

Furthermore, the integration of smart tyre technology, often referred to as Tyre Pressure Monitoring Systems (TPMS) or more complex sensor networks, is becoming standard. These systems provide real-time data on tyre pressure and temperature, allowing both the operator and integrated vehicle systems (including AI management platforms) to dynamically adjust pressure settings based on speed, load, and field conditions. This level of precision maximizes both tyre life and spraying performance, representing the shift towards connected farm equipment and enhancing the overall value proposition of premium sprayer tyres in the ecosystem of digital agriculture.

Regional Highlights

- North America: Dominates the market share due to large farm sizes, high levels of agricultural mechanization, and early adoption of precision agriculture techniques. The region exhibits high demand for high-capacity, self-propelled sprayers and, consequently, premium VF and IF tyres. Strict regulations regarding soil conservation and high operational costs necessitate the use of advanced, fuel-efficient tyre technologies.

- Europe: A mature and highly regulated market driven by the European Union's focus on sustainable agriculture (e.g., Green Deal). Demand is consistently strong for VF tyres to comply with environmental mandates aimed at reducing soil compaction. Germany, France, and the UK are key markets, characterized by rapid replacement cycles and a preference for tyres offering excellent on-road handling and stability alongside high field performance.

- Asia Pacific (APAC): Recognized as the fastest-growing region, fueled by agricultural modernization initiatives, increasing farm consolidation, and growing mechanization, particularly in China, India, and Australia. While the market historically favored lower-cost bias tyres, the demand for radial and IF/VF technologies is accelerating rapidly due to government subsidies and the entry of large corporate farming entities seeking Western-standard efficiency.

- Latin America: A significant consumer of specialized sprayer tyres, primarily driven by the massive soybean, corn, and sugarcane industries in Brazil and Argentina. This region demands robust, durable tyres capable of handling extreme heat and large, powerful machinery (often equipped with large booms). The market is highly price-sensitive but increasingly values performance characteristics that ensure long operational lifecycles under challenging conditions.

- Middle East & Africa (MEA): Represents a niche but expanding market, focused on specific crop production zones like South Africa and parts of the Middle East relying on intensive irrigation. Growth is linked to investments in agricultural infrastructure and the adoption of modern, trailed sprayer systems. Demand here is often centered on durable tyres that can withstand abrasive, rocky, and sandy soil conditions prevalent in arid environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sprayer Tyres Market.- Michelin

- Continental AG

- Bridgestone Corporation

- Trelleborg AB

- BKT (Balkrishna Industries)

- Titan International Inc.

- Firestone (Subsidiary of Bridgestone)

- Mitas (Trelleborg Group)

- Maxam Tire

- ATG (Alliance Tire Group, owned by Yokohama)

- GoodYear

- Belshina

- CEAT Specialty Tyres

- Apollo Tyres

- Sumitomo Rubber Industries

- Zhongce Rubber Group Co. Ltd.

- Pirelli S.p.A.

- Shandong Linglong Tyre Co., Ltd.

- Sichuan Tyre & Rubber Group Co., Ltd.

- Jiangsu General Science Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sprayer Tyres market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Very High Flexion (VF) sprayer tyres?

The primary driver is the critical need to reduce soil compaction in modern farming. VF tyres allow sprayers to carry heavy loads at significantly lower inflation pressures, increasing the tyre footprint and distributing the machine's weight over a larger area, thereby preserving soil health and maximizing crop yield potential.

How does the aftermarket segment compare to the OEM segment in the Sprayer Tyres Market?

The aftermarket segment historically holds a larger volume share as sprayer tyres are replacement parts with defined operational lifecycles. However, the OEM segment is expanding rapidly in value due to increased sales of new, technologically advanced self-propelled sprayers, which come factory-fitted with high-value IF and VF technologies.

Which regional market is exhibiting the fastest growth rate for specialized agricultural sprayer tyres?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This accelerated expansion is attributed to widespread agricultural modernization, increasing farm mechanization subsidies from governments, and the transition towards large-scale commercial farming operations demanding high-performance equipment and corresponding specialized tyres.

What role does smart technology play in the future of sprayer tyre manufacturing?

Smart technology, including integrated sensors (TPMS), enables real-time monitoring of tyre parameters like pressure and temperature. This data is utilized for dynamic pressure adjustment, optimization of operational efficiency, and implementing predictive maintenance schedules, significantly extending tyre life and ensuring optimal field performance.

What are the key differences between Bias and Radial tyres for sprayer applications?

Radial tyres offer superior traction, better fuel economy, and a larger, more even footprint resulting in less soil compaction compared to Bias tyres. While Bias tyres are cheaper initially, Radial (and advanced VF/IF) tyres are preferred for high-speed, heavy-duty spraying applications due to their overall performance and reduced impact on long-term soil productivity.

How do volatile raw material prices affect the Sprayer Tyres Market?

Raw material volatility, particularly in the pricing of natural rubber, synthetic rubber (petrochemical derivatives), and steel cord, significantly impacts manufacturing costs and profit margins. This volatility often leads to increased end-product prices, which can occasionally restrain market growth, particularly in price-sensitive developing markets.

What is the standard lifespan of a high-performance radial sprayer tyre?

The lifespan of a high-performance radial sprayer tyre varies widely based on usage, load, speed, and maintenance practices. Generally, these specialized tyres are designed for several seasons, often lasting between 3,000 to 5,000 operational hours under ideal conditions, with meticulous pressure management being the key factor in maximizing longevity.

Do sprayer tyres need specific chemical resistance features?

Yes, sprayer tyres are frequently exposed to concentrated agricultural chemicals, including herbicides, pesticides, and liquid fertilizers. Manufacturers incorporate specialized rubber compounds that exhibit high resistance to these substances to prevent degradation, cracking, and premature failure, ensuring safety and durability.

What is the influence of autonomous vehicles on sprayer tyre design requirements?

Autonomous sprayers require extremely consistent, reliable tyre performance without human intervention. This drives demand for integrated sensor technology, ultra-stable sidewalls, and designs optimized for continuous, repetitive, low-impact operation dictated by AI pathfinding algorithms, prioritizing durability and integrated data capabilities.

In the value chain, where is the highest profit margin typically realized in this market?

The highest profit margins are generally realized by manufacturers operating in the specialized production of advanced technologies, specifically Very High Flexion (VF) and Increased Flexion (IF) tyres, due to the proprietary nature of the technology, the high barrier to entry, and the premium pricing commanded by superior performance characteristics essential for precision agriculture.

How are government regulations affecting the adoption of sprayer tyre technology?

Government regulations, particularly in North America and Europe, increasingly favor sustainable farming practices. Mandates and subsidies encouraging soil conservation and reduced environmental impact are accelerating the transition away from traditional high-pressure tyres towards low-compaction technologies like VF, driving market growth in the premium segment.

Which segment of sprayer application holds the largest market share?

The Self-Propelled Sprayers application segment holds the largest market share in terms of value. These high-power machines require larger, more complex, and thus more expensive specialized tyres, reflecting the high capital investment associated with large-scale, high-efficiency commercial farming operations globally.

What is the role of tire pressure monitoring systems (TPMS) in maximizing tyre performance?

TPMS is crucial as it allows operators to dynamically manage inflation pressure based on field conditions and load, which is essential for VF/IF technology. Maintaining optimal low pressure maximizes the footprint, drastically reduces soil compaction, improves traction, minimizes fuel consumption, and prevents premature wear.

Are retreaded tyres commonly used in the sprayer segment?

While retreading is utilized for some heavy agricultural machinery tyres, it is less common for high-performance sprayer tyres (VF/IF) due to the highly specialized sidewall construction and the critical performance requirements related to stability and low soil impact. Farmers typically prioritize new, guaranteed performance for their sprayer fleets.

How does the trend toward larger boom widths influence sprayer tyre design?

Larger boom widths increase the weight and complexity of self-propelled sprayers, demanding tyres with significantly higher load-carrying capacities, superior stability, and enhanced resistance to lateral forces, all while maintaining minimal ground pressure to protect crops and soil health during wide passes.

What are the primary challenges facing sprayer tyre manufacturers in the European market?

Key challenges in the European market include navigating stringent environmental regulations (requiring costly R&D into sustainable materials and low-impact designs) and managing fierce competition in a mature market where performance requirements and pricing pressures are exceptionally high.

What makes the agricultural tyre replacement cycle different from passenger vehicle tyre replacement?

Agricultural tyre replacement cycles are based on operational hours and seasons rather than mileage. The environment is harsher, requiring specialized diagnostics for wear due to soil abrasion, chemical exposure, and complex load fluctuations, often necessitating specific, scheduled replacement based on agronomic needs rather than just visible wear.

Which material property is prioritized in the development of new sprayer tyre compounds?

Chemical resistance and heat dissipation are highly prioritized. Given the exposure to aggressive chemicals and the high-speed operation required by large sprayers, compounds must maintain structural integrity, flexibility, and minimize heat buildup to prevent sudden failures during critical, time-sensitive applications.

How do fluctuating crop prices impact the Sprayer Tyres Market?

Volatile crop prices directly influence farmer profitability and, consequently, capital expenditure on agricultural machinery and premium replacement parts. High crop prices typically boost farmer income, leading to increased investment in new sprayers and advanced VF tyres, stimulating market growth.

Is there a noticeable shift from Bias to Radial tyres in emerging markets like India and China?

Yes, a significant, rapid shift is occurring in emerging markets. As farm consolidation increases and agricultural practices modernize, the demand for efficiency and soil health preservation drives large commercial operators to adopt durable, fuel-efficient radial and IF/VF technologies, moving away from cheaper, less efficient bias options.

What competitive advantage do manufacturers gain by integrating smart sensors into sprayer tyres?

Manufacturers gain a significant competitive advantage by offering data-driven performance and longevity. Smart sensor integration allows for performance guarantees, enhanced customer service through predictive maintenance, and the ability to charge a premium for superior, optimized operational efficiency and reduced risk of downtime.

What are the technological challenges associated with designing VF sprayer tyres?

Designing VF tyres involves overcoming engineering challenges related to maintaining stability under high deflection and low pressure. Manufacturers must ensure the sidewall structure can handle significant flexing without overheating or permanent damage, requiring sophisticated carcass construction and highly resilient rubber compounds that balance flexibility and durability.

How does the demand for organic farming affect the Sprayer Tyres Market?

While organic farming reduces the use of chemical inputs, it often relies heavily on precise, timely mechanical operations, including the use of sprayers for specific organic solutions. The emphasis on soil structure is even greater in organic systems, meaning the demand for minimal soil compaction (VF technology) remains strong, or even increases, to avoid disturbing fragile organic soil biology.

What is the market outlook for mounted sprayer tyres?

The market outlook for mounted sprayer tyres, typically used by smaller to medium-sized farms, is stable. While self-propelled units dominate the value segment, mounted sprayers remain a necessary, cost-effective solution. Demand for these tyres is primarily driven by the aftermarket and is less focused on ultra-premium VF technology compared to the large self-propelled segment.

Which segment, by Load Capacity, is experiencing the highest growth?

The High Capacity segment (Above 6,000 kg per axle) is experiencing the highest growth in terms of value and technological advancement. This growth is directly linked to the global trend of manufacturing increasingly large, powerful, and heavier self-propelled sprayers designed for efficiency in vast commercial farming environments.

How critical is distribution channel efficiency for the Sprayer Tyres Aftermarket?

Distribution channel efficiency is extremely critical for the aftermarket. Spraying operations are highly seasonal and time-sensitive; unplanned tyre failures require immediate replacement. Manufacturers must maintain robust, localized inventories through dealer networks to ensure rapid delivery, preventing costly downtime for farmers.

What impact does the increasing weight of modern farm machinery have on the market?

The increasing weight of modern farm machinery is a primary catalyst for innovation. It necessitates the continuous development of tyres (like VF/IF) specifically engineered to manage these high loads without exceeding critical ground pressure thresholds, driving substantial R&D expenditure and market shift toward premium, highly specialized products.

Are there any sustainability initiatives influencing sprayer tyre production?

Yes, sustainability is a key focus. Initiatives include the development of durable, retreadable compounds, the increased use of sustainable and recycled raw materials (like bio-based oils and recycled carbon black), and manufacturing processes aimed at reducing energy consumption and waste, aligning with global environmental governance.

What is the typical difference in cost between a standard radial sprayer tyre and a VF sprayer tyre?

A Very High Flexion (VF) sprayer tyre typically commands a premium of 25% to 40% or more compared to a standard radial tyre of the same size. This higher cost reflects the advanced material science, complex engineering, and the substantial long-term benefits derived from reduced soil compaction and enhanced operational efficiency.

How does the Latin American market structure differ from North America in terms of end-use?

While both markets utilize large self-propelled sprayers, the Latin American market, particularly Brazil and Argentina, relies heavily on large contract service providers and often focuses more intensely on robust durability and long life under extreme operational stress, whereas North America places a higher premium on integrated technology and precision farming features.

What drives the competitive environment among the top sprayer tyre manufacturers?

Competition is driven by three main factors: technological superiority (especially in VF/IF patents), deep integration with major OEM manufacturers, and the strength and geographic reach of the aftermarket service and distribution networks, which ensure proximity and reliability to end-users globally.

How is digitalization impacting the farmer’s purchasing decision for sprayer tyres?

Digitalization allows farmers to analyze the performance and total cost of ownership (TCO) of different tyre brands using integrated farm management software. This shifts purchasing decisions from being solely based on upfront price to being based on quantified performance metrics like fuel efficiency, minimized soil damage, and enhanced longevity.

What is the primary technical requirement for tyres used on trailed sprayers?

The primary technical requirement for trailed sprayer tyres is exceptional load stability and high flotation capability. These units often carry immense liquid weight, demanding tyres that manage vertical loads effectively and maintain low ground pressure to follow the tractor efficiently without creating deep ruts.

How are mergers and acquisitions affecting the competitive landscape?

M&A activities, such as the acquisition of Mitas by Trelleborg or Alliance Tire Group by Yokohama, are consolidating the market, leading to fewer but larger global players. This consolidation facilitates greater investment in R&D for advanced technologies and strengthens global distribution reach, particularly benefiting the premium segment.

What is the forecast for demand fluctuation in the next five years?

Demand is forecasted to remain stable with moderate growth, primarily shielded by the essential nature of food production. While minor fluctuations tied to global crop commodity prices and interest rates affecting machinery purchasing may occur, the underlying shift towards efficiency and soil health guarantees sustained demand for advanced VF/IF tyre solutions.

Why are specialized tread patterns important for sprayer tyres?

Specialized tread patterns are crucial for maximizing two conflicting requirements: minimizing surface damage (especially to emerging crops) and providing excellent traction and self-cleaning capabilities in wet or muddy field conditions, ensuring the sprayer can operate effectively and timely across various terrains.

Which type of sprayer tyre is most resistant to stubble damage?

Modern radial tyres designed with specialized stubble-resistant compounds and reinforced bead and shoulder areas are the most resistant. Manufacturers use proprietary rubber formulas and thicker sidewalls to protect against cuts and punctures caused by tough crop residues like corn stubble.

What proportion of the market is currently covered by VF/IF technology?

While specific percentages vary, VF/IF technology currently represents a smaller volume share of the overall market compared to traditional radial tyres but accounts for a disproportionately large share of the market value, driven by high adoption rates in new self-propelled sprayer OEM fitments in developed economies.

How do manufacturers ensure quality and consistency in mass production of specialized sprayer tyres?

Quality and consistency are ensured through stringent manufacturing protocols, advanced curing processes (often utilizing thermal mapping), automated inspection systems (X-ray and ultrasonic testing), and adherence to strict international standards (like ETRTO and TRA) for load indexing and speed rating specifically tailored for agricultural applications.

What factors influence the average selling price (ASP) of sprayer tyres globally?

The ASP is influenced by tyre technology (VF/IF being the highest), raw material commodity prices, the size and load rating of the tyre, brand reputation, distribution channel costs (OEM vs. aftermarket), and regional competitive dynamics and currency exchange rates.

How significant is the impact of reduced fuel consumption on farmer purchasing decisions?

Reduced fuel consumption is highly significant, contributing directly to a lower total cost of ownership. Advanced radial and VF tyres, through their superior traction and reduced rolling resistance compared to bias tyres, offer measurable fuel savings, making them an attractive long-term investment for efficiency-conscious farmers.

What is the expected life cycle for a sprayer tyre in the challenging climate of the Middle East?

In the challenging, arid climate of the Middle East, tyres face high heat stress and potential abrasion from sandy/rocky soils. Lifecycles may be shorter than in temperate zones, emphasizing the need for tyres with exceptional heat resistance, UV protection, and robust tread depth to handle abrasive wear efficiently.

Are there specific safety standards governing sprayer tyre manufacturing?

Yes, sprayer tyres must comply with general agricultural tyre safety standards regarding load index, speed symbols, burst pressure resistance, and dimensional uniformity. Specific attention is paid to on-road stability standards for high-speed self-propelled sprayers that frequently travel between fields.

How is the concept of 'Tyre as a Service' (TaaS) being adopted in the sprayer market?

TaaS adoption is nascent but growing, particularly among large corporate farms and contract applicators. This model involves manufacturers providing tyres, monitoring, and maintenance for a fixed fee, guaranteeing uptime and performance, leveraging sensor technology and AI to manage the fleet efficiently.

What is the typical lead time for specialized VF sprayer tyre orders?

Lead times for specialized VF sprayer tyres can range significantly. While common sizes might be readily available from distributors (2-4 weeks), highly specialized or custom sizes can require 8 to 16 weeks or more, depending on manufacturer backlog and current global supply chain stability.

Do economic fluctuations affect the OEM or Aftermarket segment more significantly?

Economic downturns typically affect the OEM segment more significantly, as farmers postpone large capital expenditures on new sprayers. The aftermarket, while also affected, remains relatively resilient as farmers prioritize maintenance and replacement of worn components to keep existing machinery operational.

What is the influence of regenerative agriculture on sprayer tyre design?

Regenerative agriculture principles heavily emphasize minimizing soil disturbance. This trend further intensifies the demand for ultra-low-pressure tyres (VF/IF) and specialized tread designs that cause minimal disruption to soil structure and delicate cover crops, driving specialized product development.

Which technology is currently considered the most disruptive in the sprayer tyre market?

The integration of advanced IoT sensors and AI-driven pressure management systems is considered the most disruptive. This technology moves tyres from being passive components to active, data-generating assets, fundamentally changing how efficiency, maintenance, and soil interaction are managed.

What key strategic focus areas are manufacturers prioritizing for the forecast period?

Manufacturers are prioritizing investment in VF/IF production capacity expansion, deepening strategic R&D partnerships with major OEMs, strengthening digital integration capabilities (smart tyre tech), and aggressively expanding aftermarket distribution networks in high-growth regions like APAC and Eastern Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager