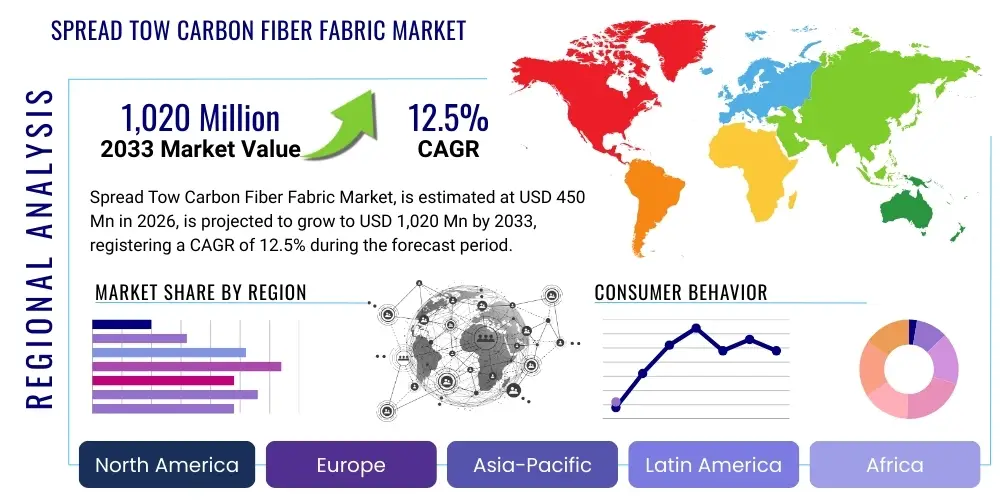

Spread Tow Carbon Fiber Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437142 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Spread Tow Carbon Fiber Fabric Market Size

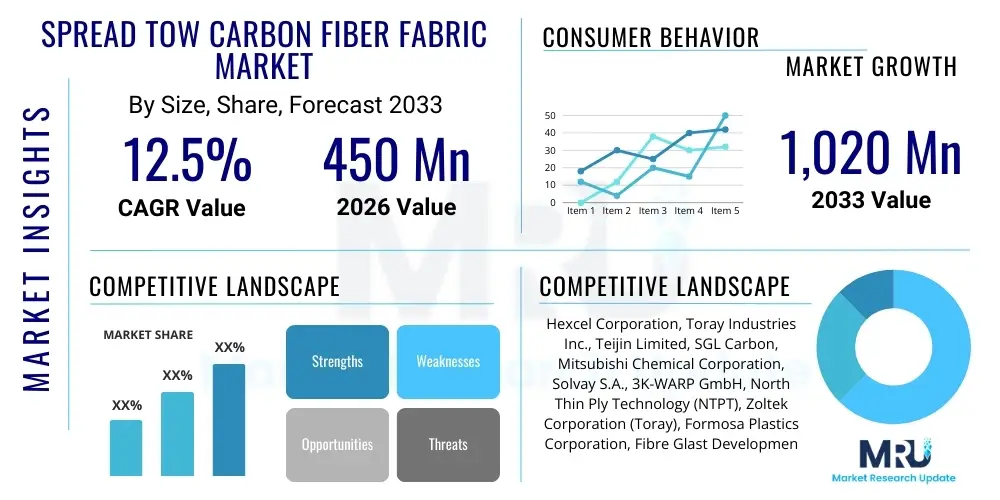

The Spread Tow Carbon Fiber Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

Spread Tow Carbon Fiber Fabric Market introduction

Spread Tow Carbon Fiber Fabric represents a highly specialized segment within the advanced composites industry, characterized by ultra-thin, highly aligned fiber bundles (tows) that are spread flat before weaving or stitching. This process significantly reduces crimp, improves fiber utilization, and allows for the creation of fabrics with very low aerial weight (FAW) while maintaining superior mechanical properties. These materials are critical for applications demanding high stiffness, minimal weight, and exceptional strength-to-weight ratios, making them indispensable in performance-driven sectors such as aerospace, high-end automotive manufacturing, and elite sports equipment production. The market’s growth is fundamentally driven by the escalating demand for fuel efficiency and enhanced performance across mobility sectors, which increasingly rely on lightweighting solutions.

The core product advantage of spread tow fabrics lies in their ability to enable thinner laminates with reduced matrix content and superior surface finish compared to traditional woven carbon fibers. This technical superiority translates directly into lower part weight and improved aerodynamic efficiency, particularly crucial for structural components in commercial aircraft and Formula 1 cars. The technology facilitates the use of standard carbon fiber tows (e.g., 12k or 24k) but spreads them out to create a uniformly thin, broad tape, which is then woven into fabrics weighing as little as 30 gsm. Major applications include primary and secondary structures in aircraft, body panels and chassis components in hypercars, wind turbine blades, and high-performance bicycles and sporting goods.

Driving factors for this market include rapid advancements in automated composite manufacturing techniques, growing military and defense procurement focused on stealth and lightweighting, and favorable regulatory environments promoting carbon emissions reduction in transportation. However, the market faces challenges related to the high initial investment required for specialized spreading and weaving equipment and the need for precision handling to maintain the integrity of the delicate spread tows. Nevertheless, the compelling benefits—such as increased fatigue resistance and reduced porosity in final components—ensure that the Spread Tow Carbon Fiber Fabric Market will continue its robust expansion, cementing its status as a key enabler of next-generation composite structures globally.

Spread Tow Carbon Fiber Fabric Market Executive Summary

The Spread Tow Carbon Fiber Fabric market is poised for robust expansion, fueled primarily by the aerospace and defense sectors, which prioritize materials offering significant weight reduction without compromising structural integrity. Current business trends indicate a strong focus on automation in preforming and layup processes, allowing manufacturers to handle these delicate materials more efficiently and reduce overall production costs. Furthermore, there is a distinct shift towards developing textile architectures that are compatible with faster curing resin systems, enabling quicker turnaround times in high-volume production environments, particularly within the luxury automotive segment where carbon fiber aesthetics and performance are paramount. Strategic partnerships between fiber producers, spread tow specialists, and Tier 1 composite parts manufacturers are defining the competitive landscape, aiming to establish vertically integrated supply chains capable of delivering tailored material specifications rapidly.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by expanding domestic aerospace programs, massive investments in renewable energy infrastructure (specifically larger wind turbine blades utilizing spread tow technology), and increasing adoption of advanced composites in consumer electronics and high-performance industrial machinery. North America and Europe, while mature markets, continue to dominate in terms of high-value applications, sustained by established aerospace giants and leading automotive original equipment manufacturers (OEMs). The tightening of environmental regulations in these Western economies further accelerates the switch from heavier traditional materials to lightweight carbon fiber solutions, thereby increasing the market penetration of spread tow variants due to their superior performance characteristics.

Segment trends reveal that the Spread Tow Carbon Fiber Fabric Market for 12k and 24k tow sizes maintains the largest share, balancing cost-effectiveness with mechanical performance, while the specialized 3k and 6k segments cater to niche, ultra-high-performance applications requiring exquisite surface finish and minimal material thickness. By Application, the Aerospace segment remains the dominant consumer due to stringent regulatory requirements and the premium placed on weight savings, though the Wind Energy segment is projected to exhibit the highest growth rate as blade lengths and material demands continue to increase globally. This structural superiority of spread tow materials ensures sustained growth across all segments seeking advanced composite solutions.

AI Impact Analysis on Spread Tow Carbon Fiber Fabric Market

User queries regarding AI in the Spread Tow Carbon Fiber Fabric market frequently revolve around quality control, optimization of the spreading process, and predictive maintenance for complex weaving machinery. Users are keen to understand how machine learning models can detect minute defects in the delicate spread tow before impregnation, which is crucial for preventing costly material failures in the final composite structure. Key themes emerging from user analysis include the expectation that AI can dramatically improve material utilization by optimizing cutting and nesting patterns (reducing expensive scrap) and potentially predicting the mechanical properties of a fabric based on variations in the spreading tension and weaving parameters in real time. There is also significant interest in using AI for simulating and validating complex lay-up sequences, especially for highly contoured components used in aerospace, ensuring maximum performance repeatability and adherence to strict certification standards.

- AI-driven real-time quality control enhances defect detection during the spreading and weaving processes, minimizing material waste.

- Machine learning algorithms optimize the tension and speed parameters of spreading equipment, improving the uniformity of fiber alignment.

- Predictive maintenance models for advanced weaving looms reduce unexpected downtime and enhance operational efficiency.

- AI optimizes composite material nesting and cutting patterns (ply cutting), leading to significant reduction in high-cost carbon fiber scrap.

- Generative design and simulation tools, powered by AI, enable faster design iterations for complex spread tow composite structures.

- Computer vision systems are deployed for automated inspection of prepreg surface quality and fiber orientation prior to curing.

DRO & Impact Forces Of Spread Tow Carbon Fiber Fabric Market

The Spread Tow Carbon Fiber Fabric market is strongly influenced by its unique dynamics, where drivers such as the relentless pursuit of lightweighting in aviation and high-performance mobility significantly accelerate adoption. Restraints primarily involve the high cost associated with the specialized production equipment and the proprietary nature of spreading technologies, which limits entry for new players and maintains high material pricing. Opportunities are abundant, especially in emerging fields like Urban Air Mobility (UAM), high-speed rail, and advanced pressure vessel manufacturing, which require the specific attributes of ultra-thin, high-stiffness laminates. The impact forces are severe, driven by competitive pressure from alternative advanced materials (such as basalt or specialized aramid fibers) and the cyclical investment patterns in the aerospace industry, requiring manufacturers to maintain operational flexibility and continuous innovation to secure long-term contracts.

Segmentation Analysis

The Spread Tow Carbon Fiber Fabric Market is comprehensively segmented based on various technical and application parameters, providing a detailed view of consumption patterns and future growth trajectories. Key segmentations include the type of tow size used (3K, 6K, 12K, 24K, and others), the fabric type (Unidirectional, Woven, Non-Crimp Fabric (NCF)), and the primary end-use application (Aerospace & Defense, Automotive, Wind Energy, Sports & Leisure, and Marine). This granular segmentation helps stakeholders understand where specialized demand for ultra-lightweight, high-performance fabrics is most concentrated, allowing for targeted product development and marketing strategies. The complexity of spread tow fabric production means that each segment requires tailored material specifications, influencing production methods and cost structures across the value chain. For instance, the aerospace segment demands extremely tight tolerance controls and extensive certification, distinguishing it from the high-volume, cost-sensitive demands of the automotive sector.

- By Tow Size: 3K, 6K, 12K, 24K, Others (e.g., 50K)

- By Fabric Type: Unidirectional (UD), Woven (Plain, Twill, Satin), Non-Crimp Fabric (NCF), Hybrid Spreads

- By Application: Aerospace & Defense, Automotive (Racing/Luxury), Wind Energy (Rotor Blades), Sports & Leisure (Bicycles, Rackets), Marine, Industrial

- By Geography: North America, Europe, Asia Pacific (APAC), Latin America, Middle East & Africa (MEA)

Value Chain Analysis For Spread Tow Carbon Fiber Fabric Market

The value chain for Spread Tow Carbon Fiber Fabric is highly sophisticated and vertically integrated, starting with the upstream production of standard carbon fiber precursor (typically polyacrylonitrile or pitch-based fiber). Midstream activities involve the specialized and technically challenging process of fiber spreading, where the original carbon fiber tow is carefully widened and thinned using proprietary mechanical or pneumatic techniques, followed by precision weaving or stitching to form the final fabric. This stage is crucial as it dictates the fabric’s areal weight and mechanical performance. Downstream, the fabrics are often impregnated by prepreggers who apply specialized thermoset or thermoplastic resins, preparing the material for end-use composite manufacturers who fabricate the final parts. The direct distribution channel involves large prepreggers or Tier 1 suppliers purchasing directly from the spread tow specialists, while indirect channels utilize distributors for smaller volume or specialized material requests, particularly prevalent in the burgeoning sports and leisure segment.

A major focus within the value chain is ensuring material traceability and quality control from the initial fiber batch through to the finished composite component, especially for critical aerospace applications. Upstream carbon fiber suppliers (like Toray, Hexcel, and Solvay) play a foundational role, but the competitive edge lies with the companies mastering the spreading process, as this technology is often patented and requires significant capital investment. Downstream processing by prepreggers is becoming increasingly critical, requiring close collaboration with end-users to optimize resin chemistry and lay-up characteristics specific to the unique low-crimp nature of spread tow fabrics. Efficiency gains in this chain are driven by reducing lead times and integrating material characterization data into digital manufacturing processes.

The distribution network relies heavily on technical sales support, given the complexity and application-specific nature of spread tow products. Direct distribution ensures tight control over material handling and logistics, vital for maintaining the integrity of low-FAW fabrics. Indirect channels serve markets where customization is high but volume is lower, providing flexibility and geographical reach. Successful companies in this market segment often maintain strong partnerships throughout the chain, moving beyond mere transactional relationships to collaborative development aimed at optimizing material properties for specific high-stress applications, thereby reinforcing brand loyalty and securing long-term contracts for sophisticated composite projects.

Spread Tow Carbon Fiber Fabric Market Potential Customers

Potential customers for Spread Tow Carbon Fiber Fabric are concentrated in industries where structural efficiency and weight reduction offer critical competitive or operational advantages. The primary end-users include major aerospace OEMs (e.g., Boeing, Airbus, Lockheed Martin) and their Tier 1 suppliers, who require these materials for high-stress components such as wings, fuselages, and tails in both commercial and military aircraft. In the automotive sector, customers are primarily high-end sports car manufacturers and Formula 1 teams that utilize these lightweight fabrics for monocoque chassis, body panels, and structural elements to enhance speed and fuel efficiency. The specific characteristics of spread tow—its minimal crimp and superior packing density—make it ideal for prepreg systems used in highly optimized structural components.

Beyond mobility, the wind energy sector represents a rapidly expanding customer base, particularly manufacturers of large-scale offshore wind turbine blades. The increasing length of these blades necessitates materials that offer stiffness without adding prohibitive weight, making spread tow fabrics crucial for achieving optimal aerodynamic performance and structural lifespan. Additionally, manufacturers of premium sports equipment (cycling, golf, skiing, marine racing) are consistent buyers, leveraging the material’s high stiffness-to-weight ratio to create elite-performance products. Other niche but growing customer segments include producers of advanced pressure vessels (Type IV hydrogen tanks), specialized medical equipment (imaging tables), and high-reliability industrial automation components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon SE, Toray Industries Inc., Hexcel Corporation, Solvay S.A., Teijin Limited, Chomarat Group, SAERTEX GmbH & Co. KG, Gurit Holding AG, ZOLTEK Corporation (Toray Group), Mitsubishi Chemical Corporation, Cytec Solvay Group, FiberCote Industries, Inc., Albany International Corp., Vartega Inc., Rockwood Composites Ltd., Euro-Composites S.A., TCR Composites Inc., Barrday Inc., North Thin Ply Technology (NPT), C. Cramer Weberei GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spread Tow Carbon Fiber Fabric Market Key Technology Landscape

The technological landscape of the Spread Tow Carbon Fiber Fabric market is defined by innovation focused on achieving superior fiber spreading uniformity, minimizing damage to the filaments, and increasing production speed while maintaining low areal weight. The primary technology involves specialized machinery that mechanically or pneumatically separates and aligns individual filaments within a carbon fiber tow (ranging from 3K to 50K) to create a tape-like structure with minimal twist or crimp. Key advancements are centered on optimizing the spreading process itself, moving toward highly automated, non-contact spreading techniques that preserve the tensile strength of the fibers. Furthermore, the development of specialized weaving and stitching machines capable of handling these extremely delicate, thin tapes without causing bunching or displacement is crucial, often utilizing bespoke tension control systems and wide, flat grippers.

Another significant technological driver is the convergence of spread tow fabrics with Non-Crimp Fabric (NCF) technology, allowing for precise, multi-axial reinforcement structures that maximize structural performance efficiency. NCFs utilizing spread tow materials offer tailored stiffness and strength in specific directions, crucial for optimizing complex parts like aircraft spars or wind turbine blade roots. Material compatibility is also vital; technology development is heavily invested in creating optimal resin systems (prepregs) that flow effectively through the tightly packed, thin spread tow layers, ensuring void-free components and maximizing the fiber volume fraction. Innovations in thermoplastic prepregs using spread tow are particularly notable, driven by demand for increased impact resistance and recyclability in high-volume applications.

Furthermore, digital manufacturing technologies, including advanced simulation and data analytics, are becoming integral to the spread tow landscape. Finite Element Analysis (FEA) software is increasingly used to model the anisotropic behavior of these unique materials accurately, while automated ply layup systems (ATL/AFP) are being adapted with specialized heads to handle the wider, thinner spread tow tapes efficiently. The ongoing evolution focuses on integrating quality assurance through in-line monitoring systems—often incorporating AI and machine vision—to ensure that every meter of fabric meets the stringent requirements demanded by aerospace and high-performance automotive clients, solidifying the market's reliance on cutting-edge engineering and processing methods.

Regional Highlights

- North America (USA and Canada): North America is a mature, high-value market dominated by the stringent demands of the aerospace and defense sectors, which are the primary consumers of spread tow fabrics for commercial aircraft programs (Boeing) and advanced military platforms. The region benefits from substantial governmental R&D funding into advanced materials and maintains a leading position in manufacturing complex prepreg systems utilizing spread tow technology. The US remains at the forefront of innovation in automated fiber placement (AFP) suitable for these specialized materials.

- Europe (Germany, UK, France): Europe holds a significant market share, driven by a strong presence in the automotive (high-performance vehicles like Formula 1 and luxury marques) and wind energy sectors. Germany, in particular, is a hub for high-end composite manufacturing and research. The focus here is on achieving high-volume production efficiency and integrating these materials into large-scale renewable energy projects, particularly long offshore wind blades, alongside robust military and commercial aviation activities (Airbus).

- Asia Pacific (China, Japan, South Korea, India): APAC is projected to be the fastest-growing region due to rapid industrialization, increasing investment in domestic aerospace manufacturing capabilities (especially in China and India), and the massive expansion of the wind energy market. Japan and South Korea, home to major carbon fiber producers (Toray, Teijin), are key technological innovators, focusing on mass-production techniques and lowering the material cost barrier for mid-tier applications.

- Latin America: The market in Latin America is currently nascent but growing, primarily driven by investments in regional infrastructure, aerospace maintenance, repair, and overhaul (MRO), and increasing adoption in high-performance marine applications and niche industrial sectors. Brazil leads the region due to its established aerospace industry and growing manufacturing base.

- Middle East & Africa (MEA): Growth in MEA is largely dependent on large-scale infrastructure projects, investments in diversified defense capabilities, and the burgeoning regional luxury automotive market. Adoption is accelerating as regional governments invest heavily in establishing domestic manufacturing capabilities and reducing reliance on imported composite structures for critical national projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spread Tow Carbon Fiber Fabric Market.- SGL Carbon SE

- Toray Industries Inc.

- Hexcel Corporation

- Solvay S.A.

- Teijin Limited

- Chomarat Group

- SAERTEX GmbH & Co. KG

- Gurit Holding AG

- ZOLTEK Corporation (Toray Group)

- Mitsubishi Chemical Corporation

- Cytec Solvay Group

- FiberCote Industries, Inc.

- Albany International Corp.

- Vartega Inc.

- Rockwood Composites Ltd.

- Euro-Composites S.A.

- TCR Composites Inc.

- Barrday Inc.

- North Thin Ply Technology (NPT)

- C. Cramer Weberei GmbH

Frequently Asked Questions

Analyze common user questions about the Spread Tow Carbon Fiber Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Spread Tow Carbon Fiber Fabric over standard woven carbon fiber?

The primary advantage is the significantly reduced crimp, achieved by spreading the fiber tow flat before weaving. This reduction in crimp maximizes fiber straightness and alignment, resulting in higher mechanical properties (stiffness and strength) and allowing for the creation of ultra-thin, low aerial weight (FAW) laminates with better surface finish and lower resin content.

Which end-use application segment currently dominates the Spread Tow Carbon Fiber Fabric market share?

The Aerospace and Defense segment dominates the market share due to its stringent requirements for extreme lightweighting, high stiffness, and reliability in critical structural components, where the premium cost of spread tow materials is justified by superior performance and fuel efficiency gains.

How does Spread Tow technology contribute to sustainability in the composite industry?

Spread Tow technology contributes to sustainability by enabling thinner, stronger composite parts, which reduces overall material consumption. More importantly, it facilitates significant weight reduction in transportation, directly lowering fuel consumption and carbon emissions in the aerospace and automotive sectors, supporting global environmental mandates.

What are the key challenges hindering the widespread adoption of Spread Tow Carbon Fiber Fabric?

The key challenges include the high capital investment required for specialized spreading and weaving equipment, resulting in higher material costs compared to traditional fabrics. Additionally, the delicate nature of ultra-thin spread tows necessitates precise handling and specialized expertise in downstream prepreg and layup processes.

How is the growth of the wind energy sector impacting the demand for Spread Tow fabrics?

The wind energy sector, particularly for offshore turbines, is rapidly increasing demand. As rotor blades become longer (exceeding 100 meters), spread tow fabrics are essential to maintain required stiffness while minimizing weight in the blade structure, optimizing aerodynamic performance and reducing structural loads on the turbine tower and foundation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager