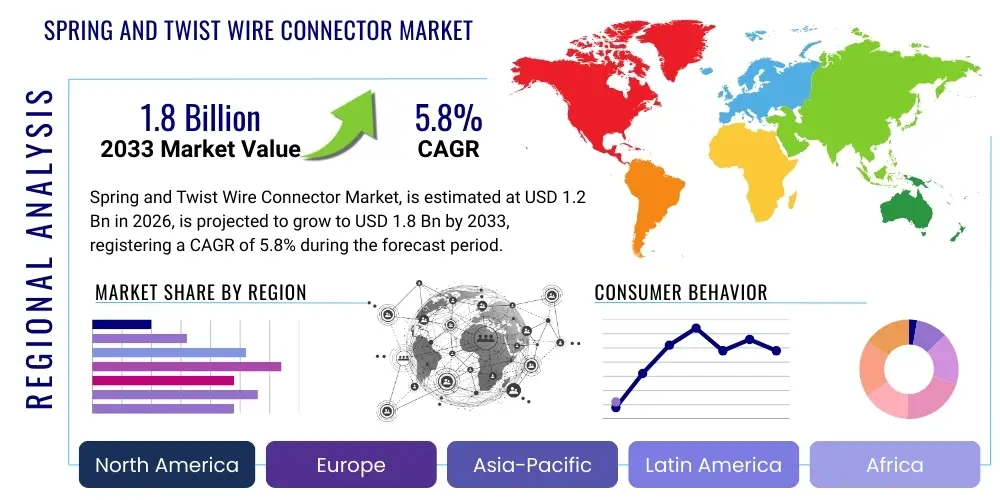

Spring and Twist Wire Connector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437041 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Spring and Twist Wire Connector Market Size

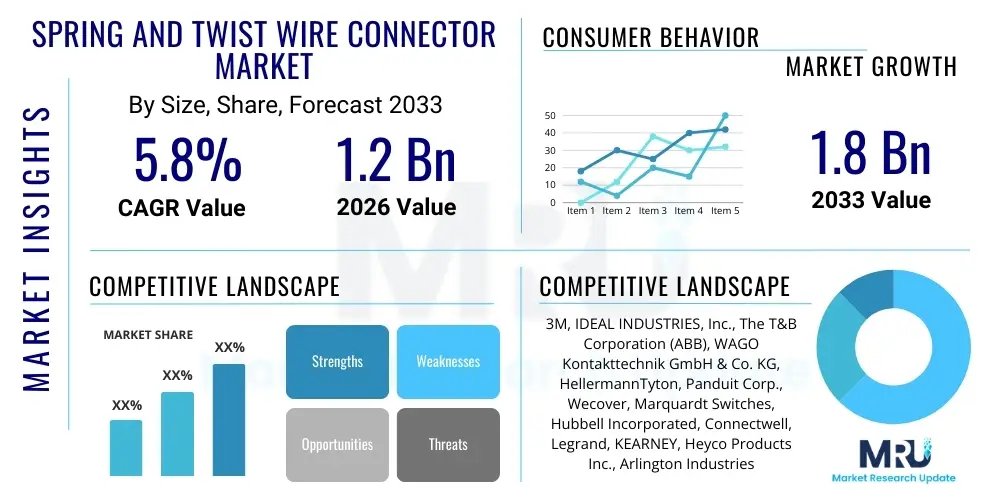

The Spring and Twist Wire Connector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by accelerated global construction activities, particularly in residential and commercial infrastructure, alongside stringent electrical safety regulations mandating the use of approved, high-efficiency connecting solutions.

The valuation reflects robust demand stemming from two major sectors: professional electrical contracting, which prioritizes performance and compliance, and the DIY/home improvement segment, which values ease of installation and safety. Geographical market expansion, particularly across emerging economies in Asia Pacific and Latin America, where electrification rates are rapidly increasing, further supports this substantial growth projection. The shift from traditional splicing methods to certified mechanical connectors is a key underlying factor driving volume growth.

Spring and Twist Wire Connector Market introduction

The Spring and Twist Wire Connector Market comprises devices specifically designed to securely and efficiently join two or more low-voltage electrical conductors. These connectors, commonly known as wire nuts or twist-on connectors, utilize an internal coiled metal spring housed within a flame-retardant plastic or nylon shell. When twisted onto stripped wires, the internal spring mechanism provides a strong mechanical and electrical connection, ensuring conductivity and preventing accidental disconnections or short circuits. They are indispensable components in modern electrical wiring installations, balancing safety requirements with installation speed.

The primary applications of these connectors span residential, commercial, and industrial electrical systems, including lighting circuits, power outlets, appliance wiring, and general circuit maintenance. Their widespread adoption is attributed to significant benefits such as enhanced safety through insulation, reduced installation time compared to soldering or taping, and reliable performance over long operational periods. Furthermore, regulatory bodies across North America and Europe mandate the use of compliant connectors, providing a stable foundation for sustained market demand and discouraging the use of uncertified splicing methods.

Major driving factors include the global surge in smart building infrastructure development, necessitating complex and reliable wiring systems, coupled with ongoing renovation and retrofitting activities in older buildings. The continuous innovation in materials science, leading to connectors capable of handling higher temperatures and different wire gauges (including solid and stranded conductors), further bolsters market adoption. Efficiency gains for electrical contractors due to the rapid installation process also significantly contribute to the market's positive trajectory.

Spring and Twist Wire Connector Market Executive Summary

The Spring and Twist Wire Connector Market is characterized by stable growth driven by global infrastructural development and rigorous electrical safety standards. Business trends highlight a strong emphasis on product differentiation through enhanced flame resistance (FR), specialized high-temperature applications, and the introduction of winged designs for improved ergonomic grip during installation. Consolidation among small manufacturers and strategic acquisitions by major industry players are common business strategies aimed at expanding geographical footprints and broadening product portfolios to cater to diverse regulatory environments across different regions.

Regionally, North America maintains market dominance due to deeply established safety codes (such as NEC standards) and high per-capita spending on electrical maintenance and new construction. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), propelled by massive urbanization, large-scale public infrastructure projects, and increasing consumer awareness regarding electrical compliance. Europe maintains a mature, steady growth trajectory, focusing heavily on eco-friendly materials and compliance with RoHS directives.

Segment trends reveal that the Flame Retardant (FR) type segment holds the largest market share due to universal safety mandates in residential and commercial sectors. Application-wise, the Residential Wiring segment remains the cornerstone of demand, though the Industrial Machinery segment is expanding rapidly, demanding specialized, vibration-resistant connectors. Material innovation is focused on improving the durability of the thermoplastic shells and the conductive efficiency of the internal steel springs, driving a premiumization trend in the high-performance sub-segment.

AI Impact Analysis on Spring and Twist Wire Connector Market

Common user inquiries regarding AI’s impact on the Spring and Twist Wire Connector Market revolve around automation in manufacturing, predictive failure analysis in installation, and optimization of supply chain logistics. Users are keen to understand how AI-driven quality control systems can improve connector reliability and reduce defect rates during high-volume production. Furthermore, there is significant interest in utilizing machine learning algorithms to optimize inventory management, ensuring that contractors and distributors have the right sizes and types of connectors available, thereby minimizing project delays. The prevailing concerns center on the initial capital investment required for AI implementation in traditional manufacturing facilities and the necessity for specialized training for existing workforces to manage these advanced systems.

AI is beginning to influence the manufacturing efficiency of wire connectors through the integration of sophisticated robotics and computer vision systems. These systems provide real-time quality assurance checks far exceeding human capabilities, identifying microscopic flaws in spring tension, shell molding, or internal threading. This automation ensures stringent compliance with safety standards and significantly reduces manufacturing variability, addressing a core concern of end-users regarding product consistency. Furthermore, AI contributes to smart warehousing and demand forecasting, streamlining the distribution channel which is crucial for a high-volume, low-cost component like the wire connector.

- Enhanced quality control through AI-driven computer vision systems reducing manufacturing defects.

- Predictive maintenance in manufacturing lines, minimizing downtime and optimizing machinery lifespan.

- Optimization of complex supply chain routes and inventory management using machine learning algorithms.

- Improved demand forecasting accuracy, aligning production cycles with seasonal construction activity peaks.

- Potential for automated connector installation (robotics) in large-scale prefabrication wiring projects.

- AI-enabled material stress testing and modeling for developing next-generation, high-performance connectors.

DRO & Impact Forces Of Spring and Twist Wire Connector Market

The dynamics of the Spring and Twist Wire Connector Market are shaped by powerful Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces influencing future growth trajectories. The primary driving force is the global adherence to strict electrical safety and building codes, particularly in developed economies, which mandates certified connection solutions. This regulatory framework ensures consistent baseline demand, complemented by significant opportunity arising from infrastructural investment and urbanization trends in emerging markets. However, the market faces significant restraint from the fluctuating costs of raw materials, particularly plastics and steel used for the casing and spring mechanism, which puts constant pressure on manufacturers' profit margins and pricing strategies.

Key drivers include the pervasive growth of the global construction industry, encompassing both new residential builds and massive commercial infrastructure projects (e.g., data centers, hospitals, and office complexes). Furthermore, the global emphasis on energy efficiency and the subsequent retrofitting of older electrical systems necessitate reliable, modern connectors. These factors ensure a continuous, high-volume requirement for standardized electrical components. The rise of smart home technology also contributes to this demand, as interconnected devices require complex, yet reliably managed, wiring systems within confined spaces.

Conversely, the primary restraints include intense price competition due to the high degree of product commoditization, making brand differentiation challenging and often leading to margin erosion. Another significant constraint is the proliferation of low-quality, non-certified imitation products, particularly in unregulated markets, which pose safety risks and undermine certified brands. Opportunities lie in developing specialized connectors (e.g., moisture-resistant, extreme temperature) for niche applications like renewable energy installations (solar and wind farms) and electric vehicle charging infrastructure. Additionally, market expansion through innovative packaging and retail strategies targeting the lucrative DIY market presents a sustainable long-term growth avenue.

- Drivers:

- Stringent global electrical safety regulations and building codes (e.g., UL, CE compliance).

- Rapid expansion of the residential and commercial construction sectors globally.

- Increased demand for reliable, high-speed installation solutions by electrical contractors.

- Growing trend of modernization and retrofitting of aging electrical infrastructure.

- Restraints:

- Volatile pricing and supply chain instability of key raw materials (thermoplastics and steel).

- Intense price-based competition and market commoditization leading to margin pressure.

- Risk posed by non-certified, low-cost imitation products compromising safety standards.

- Opportunities:

- Untapped potential in high-growth infrastructure sectors like renewable energy and EV charging stations.

- Development of specialized connectors for harsh environment applications (waterproof, UV resistant).

- Geographical expansion into rapidly urbanizing economies in the Asia Pacific and Africa.

- Impact Forces:

- Demand for highly standardized products enforces compliance adherence across the value chain.

- Economic fluctuations directly impact construction spending, affecting connector volume demand.

- Technological advancements in insulating materials and spring alloys influence product longevity and performance metrics.

Segmentation Analysis

The Spring and Twist Wire Connector Market is systematically segmented based on Type, Material, Application, and End-Use, providing a comprehensive framework for understanding market dynamics and targeted strategies. Analyzing these segments helps manufacturers tailor product specifications to specific regulatory requirements and consumer needs, such as developing high-temperature connectors for industrial ovens or flame-retardant connectors for standard residential wiring. The diversity in applications—from simple home lighting systems to complex industrial control panels—necessitates a highly nuanced approach to product offering, driving continuous minor innovations within each segment.

The segmentation by Type is critical, differentiating standard components from specialized offerings like high-temperature rated or winged ergonomic designs. High-Temperature connectors, while representing a smaller volume, often command a premium due to their specialized material composition (e.g., ceramic or specialized polymers) necessary to withstand continuous elevated heat, crucial in industrial settings. Conversely, the segmentation by Application clearly delineates volume leaders, with Residential Wiring typically accounting for the largest share due to the sheer volume of housing starts and refurbishment projects globally. Understanding these proportions is vital for capacity planning and resource allocation.

Furthermore, the End-Use segmentation—differentiating between professional Electrical Contractors, OEMs, and the DIY consumer—dictates marketing and distribution strategies. Contractors prioritize bulk purchasing, certification, and ease of use under professional pressure, while DIY customers prioritize clear instructions, retail availability, and user-friendliness (often favoring winged or ergonomic designs). Manufacturers must maintain distinct product lines and pricing tiers to effectively serve these diverse customer groups and maximize market penetration across all key verticals.

- By Type:

- Standard Twist Connectors

- Winged Twist Connectors

- High Temperature Connectors

- Flame Retardant (FR) Connectors

- By Material:

- Thermoplastic Shell (Polypropylene, Polycarbonate)

- Nylon Shell

- Stainless Steel Spring

- By Wire Gauge Supported:

- Small Gauge (22-14 AWG)

- Medium Gauge (12-10 AWG)

- Large Gauge (8 AWG and larger)

- By Application:

- Residential Wiring and Lighting

- Commercial Building Construction

- Industrial Machinery and Control Panels

- Automotive and Transport (Niche)

- By End-Use:

- Electrical Contractors and Professionals

- Original Equipment Manufacturers (OEMs)

- DIY and Home Improvement Users

- Distributors and Wholesalers

Value Chain Analysis For Spring and Twist Wire Connector Market

The Value Chain for the Spring and Twist Wire Connector Market is relatively straightforward but highly optimized for efficiency and cost reduction, essential characteristics for a high-volume commodity product. The chain begins with the upstream sourcing of raw materials, primarily specialized thermoplastics (Polypropylene or Nylon) for the insulating shell and high-tensile steel wire for the internal spring mechanism. Efficiency at this stage is crucial, as raw material cost volatility directly impacts the final product price and manufacturer profitability. Strong relationships with reliable plastic resin and steel wire suppliers are paramount to maintaining production continuity and achieving economies of scale in procurement.

Midstream activities involve sophisticated manufacturing processes, including high-speed injection molding for the plastic shells and precision coiling and hardening for the internal springs, followed by automated assembly and strict quality control checks (e.g., torque testing and dielectric strength testing). Given the global nature of construction, certification and compliance testing (UL, CE, CSA) are integral to the manufacturing step, adding complexity but guaranteeing market access. Manufacturers continuously invest in automation to reduce labor costs and maintain the high throughput required to serve the expansive global electrical market.

Downstream distribution relies on both direct and indirect channels. Indirect channels dominate, utilizing a tiered structure comprising national and regional wholesale electrical distributors who maintain vast inventories and supply smaller local contractors and retail chains. Direct sales, though less common, are typically used for large-volume OEM agreements (Original Equipment Manufacturers, like appliance or lighting fixture producers) where specialized or customized connectors are required. Retail channels, including large home improvement centers (e.g., Home Depot, Lowe's), are critical for reaching the DIY and small-scale contractor segments, demanding attractive packaging and clear consumer-facing branding.

Spring and Twist Wire Connector Market Potential Customers

Potential customers for Spring and Twist Wire Connectors are highly diversified, extending across professional trades, large-scale industrial operations, and consumer households. The primary and highest-volume segment consists of professional electrical contractors and installation firms. These buyers are primarily driven by product reliability, compliance with national electrical codes, bulk pricing, and availability through wholesale distribution channels. Their consistent demand is intrinsically linked to the macroeconomic performance of the construction and renovation sectors globally. They require connectors that offer consistent performance under various installation conditions and strict safety certifications.

The second major category involves Original Equipment Manufacturers (OEMs), who integrate these connectors directly into their products, such as lighting fixtures, HVAC systems, industrial control boxes, and machinery. OEMs demand extremely consistent dimensions, high compliance, and often require just-in-time delivery models. Their purchasing decisions are usually finalized through long-term contracts and hinge on rigorous quality audits and specification adherence. This segment offers steady, large-volume business and requires minimal packaging.

The final significant segment is the retail consumer, encompassing DIY enthusiasts and homeowners undertaking small-scale repairs or renovations. These customers purchase smaller quantities primarily through large retail home improvement stores or e-commerce platforms. Their buying decisions are influenced by ease of use (e.g., winged design), clear branding, positive peer reviews, and accessible packaging. Manufacturers often employ tailored retail packaging and marketing specific to this segment, emphasizing safety and simplicity of installation over highly technical specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, IDEAL INDUSTRIES, Inc., The T&B Corporation (ABB), WAGO Kontakttechnik GmbH & Co. KG, HellermannTyton, Panduit Corp., Wecover, Marquardt Switches, Hubbell Incorporated, Connectwell, Legrand, KEARNEY, Heyco Products Inc., Arlington Industries, Gardner Bender. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spring and Twist Wire Connector Market Key Technology Landscape

The technology landscape for the Spring and Twist Wire Connector Market, while seemingly straightforward, is characterized by incremental but vital innovations focused on enhancing safety, material efficiency, and ease of installation. A primary technological focus involves advanced polymer chemistry to develop high-performance thermoplastic shells. This includes utilizing specialized polycarbonates or flame-retardant nylon variants that offer superior dielectric strength, higher temperature resistance (e.g., 105°C and above), and robust UV stabilization for external or exposed installations. These material advancements are crucial for meeting increasingly strict fire safety standards globally, ensuring the connector maintains integrity under fault conditions.

Another area of significant technological development is the design and metallurgy of the internal spring. Manufacturers utilize precision-engineered square-wire or proprietary-shaped springs made of high-carbon or stainless steel alloys. The key innovation here is optimizing the coiling geometry and tempering process to ensure consistent, high-pressure gripping force across the specified range of wire gauges (solid and stranded), thereby minimizing resistance and heat generation at the splice point. Advanced torque-testing equipment and computer modeling are used in R&D to simulate long-term operational stresses and validate the mechanical reliability of the spring mechanism.

Furthermore, technology is applied heavily in the manufacturing process itself, leveraging high-precision injection molding machines with tight tolerance controls to ensure dimensional consistency. Automation technology, including robotic assembly and integrated vision systems, ensures that the spring is perfectly positioned and crimped within the shell, minimizing manufacturing defects. Recent trends also include the introduction of Push-In Technology (a related segment, but often competing with twist-ons) which streamlines installation further, although twist-on connectors remain dominant in North American residential applications due to established regulatory acceptance and cost effectiveness. Innovation in packaging, such as color-coding based on wire gauge combinations, also constitutes a significant technological advantage for improving contractor efficiency.

Regional Highlights

- North America: Market Leader Driven by Compliance

North America, particularly the United States and Canada, holds the largest market share for Spring and Twist Wire Connectors, largely due to deeply embedded regulatory structures like the National Electrical Code (NEC) and the strong presence of bodies such as Underwriters Laboratories (UL) and Canadian Standards Association (CSA). These regulations effectively mandate the use of certified connectors, creating consistent, high-volume demand. The robust housing market, coupled with significant commercial investment (data centers, large office renovations), sustains continuous market growth. Manufacturers in this region focus intensely on UL listing and ergonomic designs (winged connectors) favored by local professional electricians. The market is mature but highly responsive to safety innovations.

- Europe: Focus on Environmental Compliance and Efficiency

The European market exhibits steady growth, driven by renovation activities and the high standards set by IEC and CE marking requirements. A distinct feature of the European landscape is the emphasis on environmental sustainability, driving manufacturers to utilize RoHS-compliant materials and explore halogen-free polymers. While traditional twist connectors are widely used, Europe also shows a higher penetration rate of terminal block and cage clamp (push-in) connectors, particularly in industrial and modern commercial installations, creating intense competition within the splicing market. Countries like Germany and the UK are key contributors to the demand for high-specification, reliable connectors.

- Asia Pacific (APAC): Fastest Growing Region

The APAC region, encompassing China, India, and Southeast Asia, is projected to be the fastest-growing market globally. This exponential growth is underpinned by rapid urbanization, massive infrastructural investments (rail, power grids, commercial complexes), and increasing electrification rates in rural areas. While price sensitivity remains a factor, the gradual adoption of standardized international safety codes (moving away from purely local, sometimes lax, standards) is accelerating the demand for certified, quality twist connectors. China dominates manufacturing capacity, but India and Indonesia represent enormous consumer markets driving future demand volume.

- Latin America (LATAM): Modernization and Import Dependence

The LATAM market is characterized by varying levels of regulatory enforcement but steady growth tied to housing and commercial development in major economies like Brazil and Mexico. The market often relies on imports, particularly from North American and Chinese manufacturers. Opportunities exist through standardization initiatives and local manufacturing partnerships. Demand is primarily cost-sensitive, but growing awareness of long-term electrical safety benefits is slowly driving adoption of premium, certified products, challenging the dominance of basic, uncertified splicing methods.

- Middle East and Africa (MEA): Infrastructure Mega-Projects

Growth in the MEA region is strongly tied to large-scale government-backed infrastructure and construction mega-projects (e.g., NEOM in Saudi Arabia, rapid development in the UAE). These projects often adhere to high international standards (US or European), generating high demand for premium, certified connectors, particularly those with superior heat resistance required for high-ambient temperature environments. Africa presents a long-term potential market, with increasing foreign investment pushing electrification and standardized building practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spring and Twist Wire Connector Market.- 3M

- IDEAL INDUSTRIES, Inc.

- The T&B Corporation (ABB)

- WAGO Kontakttechnik GmbH & Co. KG

- HellermannTyton

- Panduit Corp.

- Wecover

- Marquardt Switches

- Hubbell Incorporated

- Connectwell

- Legrand

- KEARNEY

- Heyco Products Inc.

- Arlington Industries

- Gardner Bender

- NSI Industries

- Penn Union Corp.

- Ilsco Corporation

- Burndy LLC (Hubbell)

- Reliance Electric

Frequently Asked Questions

Analyze common user questions about the Spring and Twist Wire Connector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Spring and Twist Wire Connector Market?

The market is primarily driven by stringent global electrical safety regulations, continuous expansion of residential and commercial construction worldwide, and the need for high-efficiency, reliable solutions that speed up the installation process for professional contractors.

How does the segmentation by material influence connector performance?

Material segmentation dictates critical performance metrics; thermoplastic shells (Polypropylene/Nylon) offer insulation and flame retardancy, while the specialized high-tensile steel spring ensures the mechanical and electrical integrity of the connection, directly influencing temperature rating and vibration resistance.

Which geographical region holds the largest market share for these connectors?

North America currently holds the largest market share, predominantly fueled by mandatory adherence to established electrical codes (NEC, UL standards) and a mature, large-scale professional electrical contracting industry.

What is the main challenge facing manufacturers in this highly competitive market?

The primary challenge is intense price-based competition due to product commoditization, coupled with volatile raw material costs (plastics and steel), which continuously exert downward pressure on profit margins across the industry.

Are twist-on connectors being replaced by newer splicing technologies?

While competing technologies like push-in connectors (WAGO type) are gaining traction, especially in Europe, twist-on connectors maintain strong market dominance in North American residential and commercial wiring due to their proven reliability, regulatory approval, and significant cost advantages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager