Spring Brake Chamber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432153 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Spring Brake Chamber Market Size

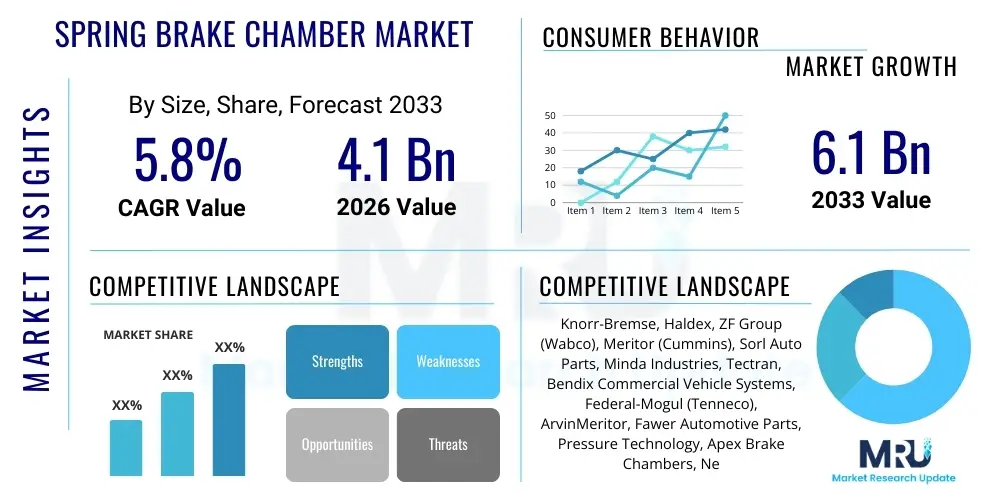

The Spring Brake Chamber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by stringent global safety regulations mandating sophisticated braking systems in commercial vehicles, alongside the sustained expansion of logistics and freight transportation industries across emerging economies. The increasing average age of commercial vehicle fleets globally necessitates robust aftermarket demand for replacement components, further bolstering the market's valuation and volume over the subsequent years.

Spring Brake Chamber Market introduction

The Spring Brake Chamber Market encompasses the design, manufacturing, and distribution of critical safety components primarily used in air brake systems of heavy and medium commercial vehicles (HCVs and MCVs), trailers, and buses. These chambers serve a dual function: providing routine service braking using compressed air, and acting as an emergency and parking brake via a powerful integrated spring mechanism. This spring mechanism is crucial for safety, automatically engaging the brakes if air pressure is lost, ensuring the vehicle remains stationary or decelerates safely during failure conditions, thus mitigating catastrophic accidents on highways and urban roads. The core product, the spring brake chamber, is indispensable for meeting global vehicle safety standards.

Major applications for these sophisticated devices are concentrated within the commercial automotive sector, driven by the indispensable need for reliable deceleration and parking capabilities in large vehicles carrying substantial loads. Benefits derived from modern spring brake chambers include enhanced durability, reduced maintenance downtime due to superior sealing technology, and improved responsiveness, directly translating to superior operational safety and lower total cost of ownership (TCO) for fleet operators. Manufacturers are continuously innovating, focusing on lightweight materials and advanced diaphragm or piston designs to improve efficiency and longevity under harsh operating conditions, addressing issues such as corrosion resistance and heat dissipation effectively.

The primary driving factors propelling market expansion are the robust recovery and growth in the global freight and logistics sector, particularly in Asia Pacific, coupled with increasingly severe mandates regarding vehicle safety and performance standards enacted by regulatory bodies in North America and Europe. Furthermore, technological advancements leading to the development of electronic braking systems (EBS) and integration with complex telematics require compatible, high-performance brake chambers. The continuous modernization of aging vehicle fleets in mature markets and rapid industrialization in developing regions ensure a steady, high-volume demand for both Original Equipment Manufacturers (OEMs) and the specialized aftermarket segment.

Spring Brake Chamber Market Executive Summary

The global Spring Brake Chamber Market is experiencing steady growth, largely propelled by favorable business trends centered on infrastructure development and the globalization of supply chains, necessitating higher volumes of commercial vehicles. Key business trends include the consolidation of major component suppliers, leading to economies of scale and accelerated technological integration, particularly in high-pressure sealing and corrosion-resistant materials. Furthermore, the shift towards predictive maintenance strategies enabled by sensor integration into braking systems is opening new service opportunities within the aftermarket segment. Manufacturers are heavily investing in localized production facilities in high-growth regions like Southeast Asia and India to reduce logistical costs and cater directly to regional regulatory requirements, strengthening the global supply footprint.

Regional trends indicate that Asia Pacific (APAC) is the dominant and fastest-growing region, driven by massive domestic freight movement, urbanization, and laxer vehicle retirement policies compared to Western nations, stimulating sustained demand for both new installations and replacement parts. North America and Europe, while mature, remain critical markets characterized by stringent regulatory oversight (e.g., FMVSS 121 standards in the US) and a strong preference for high-quality, high-reliability products, favoring premium suppliers offering advanced features like reduced weight and extended service life. Regulatory harmonisation across trading blocs, such as the UN ECE regulations, is influencing product specifications globally, necessitating multi-regional compliant product portfolios from international suppliers.

Segmentation trends highlight the Diaphragm Type segment maintaining market dominance due to its cost-effectiveness and relatively simple design, although the Piston Type segment is gaining traction, particularly in severe-duty applications requiring superior resistance to contamination and higher force output. The OEM segment currently holds the larger market share, intrinsically linked to new vehicle production cycles, but the aftermarket segment is forecast to witness a higher CAGR due to the large existing installed base and the critical nature of brake chamber replacement for safety compliance. Applications in Heavy Commercial Vehicles (HCVs) represent the largest revenue contributor, reflecting the high number of axles and the operational intensity associated with long-haul trucking and heavy construction equipment.

AI Impact Analysis on Spring Brake Chamber Market

User inquiries regarding the influence of Artificial Intelligence on the Spring Brake Chamber Market predominantly focus on how AI-driven predictive maintenance, vehicle health monitoring, and advanced driver-assistance systems (ADAS) will interact with mechanical braking components. Key themes include the potential for AI to drastically extend the operational life of brake chambers by optimizing usage patterns and alerting operators to microscopic wear long before failure occurs, leading to reduced catastrophic failures but potentially decreasing overall aftermarket replacement frequency. Concerns also revolve around the complexity of integrating traditional pneumatic components with sophisticated AI hardware, requiring enhanced sensor packages and standardized communication protocols. Users expect AI to primarily impact the monitoring and maintenance phases, rather than the core mechanical design of the chamber itself, though manufacturing processes might become more automated and precise through machine learning applications.

- AI-driven Predictive Maintenance: Utilizing sensor data (pressure, temperature, stroke length) integrated into chambers to forecast component failure, maximizing uptime and reducing unexpected roadside incidents.

- Optimized Manufacturing Processes: Implementing machine learning algorithms in production lines for fault detection, material inspection, and quality control, ensuring higher precision and reduced defect rates in spring coils and diaphragms.

- Integration with ADAS and Autonomous Systems: Ensuring robust, rapid communication between AI-controlled vehicle dynamics systems and the mechanical actuation of the brake chamber for instantaneous emergency stops and optimized service braking.

- Supply Chain Efficiency: Applying AI for demand forecasting in the aftermarket, optimizing inventory management of various chamber types, and streamlining logistics for global distribution.

- Design Optimization: Using generative AI tools to rapidly iterate on chamber housing geometry and material composition to reduce weight while maintaining structural integrity and high force output capacity.

DRO & Impact Forces Of Spring Brake Chamber Market

The market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively dictate the impact forces exerted on market growth and strategic direction. The primary driving force is the global adherence to stringent commercial vehicle safety regulations (e.g., UN ECE R13), making the installation of robust spring brake chambers mandatory for new vehicle registrations and roadworthiness checks. This regulatory environment is reinforced by the underlying economic driver of expanding global trade, requiring larger and more efficient commercial vehicle fleets worldwide, creating continuous demand for both OEM fitting and aftermarket service parts. Furthermore, technological innovation focused on improving product durability, reducing weight through aluminum housing, and increasing pressure tolerances supports premiumization and market value growth.

However, the market faces significant restraints, including the high volatility of raw material prices, particularly steel and aluminum, which directly impacts manufacturing costs and profit margins across the supply chain. Another major restraint is the extended lifecycle and high durability of current generation brake chambers; while beneficial for end-users, this inherently lengthens the replacement cycle, constraining the annual volume growth of the aftermarket. Additionally, the prevalence of counterfeit or low-quality brake chambers, particularly in unorganized markets, poses a severe safety risk and puts downward pressure on the pricing structure of certified, reliable products, forcing manufacturers to heavily invest in brand protection and certification programs.

Significant opportunities exist, particularly in the rapid development of electric and hydrogen fuel cell commercial vehicles, which, while changing propulsion systems, still rely heavily on pneumatic spring brake chambers for parking and emergency functions, creating a new OEM replacement cycle. The integration of IoT and sensor technology into brake chambers for real-time monitoring and predictive maintenance presents a premium opportunity, allowing manufacturers to move up the value chain by offering sophisticated, data-driven service packages. The expansion into untapped and underserved rural commercial vehicle markets in Africa and Latin America, where fleet modernization is accelerating, represents substantial potential for market penetration and establishing long-term regional dominance for proactive suppliers.

Segmentation Analysis

The Spring Brake Chamber Market is meticulously segmented based on product type, operational mechanism, application in different vehicle classes, and the sales channel utilized, providing a granular view of market dynamics and targeted strategic investment areas. Product segmentation, categorized primarily into Diaphragm Type and Piston Type, reflects differences in manufacturing complexity, cost, and suitability for varying load and environmental conditions. The Piston Type, often preferred for heavy-duty, extreme-environment applications due to its rugged construction and resistance to internal contamination, typically commands a higher price point, whereas the Diaphragm Type dominates the volume market due to its lower cost and established reliability in standard commercial vehicle operations.

Application segmentation reveals the market's dependence on the commercial vehicle industry, with Heavy Commercial Vehicles (HCVs) being the predominant revenue generator, encompassing long-haul tractors, dump trucks, and specialized heavy machinery requiring maximum stopping power. Medium Commercial Vehicles (MCVs) and Buses represent substantial, stable segments driven by urban logistics and public transportation investments, respectively, often requiring specialized chambers that prioritize noise reduction and compact packaging. The Sales Channel split between OEM (Original Equipment Manufacturer) and Aftermarket highlights the cyclical nature of demand: OEM tracks new vehicle production, while the Aftermarket provides continuous, non-cyclical revenue driven by fleet age, operational intensity, and mandatory replacement schedules, often offering higher margin opportunities.

Geographic segmentation is crucial, demonstrating the varied regulatory environments and fleet characteristics globally. Asia Pacific leads due to sheer volume and rapid fleet expansion, but North America and Europe lead in terms of technological adoption and demand for premium, complex chambers featuring advanced coatings and lightweight materials. Understanding these segments allows manufacturers to tailor product specifications—such as metric versus imperial fittings, specific corrosion protection required for coastal environments, or compatibility with regional regulatory safety requirements—optimizing production and inventory management for greater market responsiveness and maximized profitability across diverse operational landscapes.

- By Type:

- Diaphragm Type

- Piston Type

- By Application:

- Heavy Commercial Vehicles (HCVs)

- Medium Commercial Vehicles (MCVs)

- Buses and Coaches

- Trailers and Semi-Trailers

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Spring Brake Chamber Market

The value chain for the Spring Brake Chamber Market begins with upstream activities, which include the procurement and processing of fundamental raw materials such as high-grade steel for spring coils and housing components, specialized rubber compounds for diaphragms and seals, and often aluminum alloys for lightweight casings. Suppliers of these primary materials, especially those providing certified, high-tensile spring steel, exert considerable influence over manufacturing costs and quality control, necessitating strong, long-term supplier relationships to mitigate supply chain risk and price volatility. Manufacturing involves highly specialized assembly processes, precision casting, and rigorous testing, often requiring high capital investment in automated machinery to achieve the demanding tolerances and safety specifications required for pneumatic braking components.

Downstream analysis focuses on the distribution channels, which are bifurcated into the direct OEM channel and the complex aftermarket structure. The OEM channel involves direct supply contracts with major commercial vehicle manufacturers (e.g., Volvo, Daimler, PACCAR), characterized by high volume, low margin, and highly demanding quality and scheduling requirements tied to vehicle production cycles. The indirect aftermarket channel, which is crucial for stability and margin generation, utilizes a network of authorized distributors, independent workshops, and fleet maintenance operations. This channel requires extensive geographical coverage, inventory depth, and specialized training for technicians to ensure correct installation and compliance with safety standards, differentiating reliable suppliers from generic parts providers.

The structure of the distribution channel is increasingly favoring direct-to-fleet sales models for major component suppliers, especially in regions with concentrated logistics operations, allowing for greater control over pricing and service delivery. However, the reliance on regional parts wholesalers and retailers remains high, especially in fragmented markets, creating complexity in managing brand presence and ensuring authenticity, a key challenge given the criticality of the safety component. Effective management of this multi-tiered distribution system, supported by digital inventory tracking and robust anti-counterfeiting measures, is essential for maximizing market reach and maintaining the integrity of the safety-critical product category.

Spring Brake Chamber Market Potential Customers

The primary customer base for the Spring Brake Chamber Market is overwhelmingly concentrated in the commercial vehicle sector, encompassing a diverse array of organizations that rely on heavy-duty and medium-duty vehicles for their core operations. The largest and most influential customer group comprises global Original Equipment Manufacturers (OEMs) of commercial trucks and buses, such as Daimler Truck, Volvo Group, PACCAR, and Tata Motors, who integrate these chambers directly into their assembly lines. These OEMs prioritize long-term contracts, advanced technological partnership, and strict adherence to specific national and international regulatory standards, making supplier selection a rigorous process based on established track record and mass production capability.

The second major group includes large-scale private and public fleet operators, encompassing logistics companies (e.g., FedEx, DHL), regional trucking firms, public transportation authorities, and major construction and mining companies. These end-users are driven primarily by operational efficiency, minimizing vehicle downtime, and maximizing safety compliance. For this customer segment, purchasing decisions are influenced by product longevity, ease of maintenance, and availability of quality replacement parts through established aftermarket channels. They often engage in direct purchasing agreements with distributors or major suppliers to ensure consistency across their extensive fleets.

Finally, the extensive network of independent repair workshops, authorized service centers, and spare parts retailers constitute a third critical customer segment, functioning as the primary purchasers within the aftermarket distribution chain. These buyers stock various sizes and types of spring brake chambers to service a diverse range of older and newer vehicles. Their buying criteria revolve around competitive pricing, reliable product warranty, rapid availability, and compatibility with numerous vehicle models. Catering effectively to this fragmented but highly necessary segment requires efficient logistics and strong local distribution partnerships, ensuring market penetration beyond the OEM warranty period.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Knorr-Bremse, Haldex, ZF Group (Wabco), Meritor (Cummins), Sorl Auto Parts, Minda Industries, Tectran, Bendix Commercial Vehicle Systems, Federal-Mogul (Tenneco), ArvinMeritor, Fawer Automotive Parts, Pressure Technology, Apex Brake Chambers, Newman Tools, China North Industries Group (NORINCO), Bosch, Continental. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spring Brake Chamber Market Key Technology Landscape

The technological landscape of the Spring Brake Chamber Market is continuously evolving, driven primarily by the need for enhanced safety, reduced weight, and improved durability, especially as commercial vehicles are expected to operate under increasingly demanding conditions. A key technological trend is the proliferation of lightweight materials, moving away from traditional heavy steel casings towards high-strength aluminum alloys and specialized composites. This material shift directly contributes to overall vehicle weight reduction, improving fuel efficiency and increasing payload capacity, which is a major focus area for fleet operators facing tightening emissions regulations. Furthermore, manufacturers are employing advanced surface treatments and corrosion-resistant coatings, particularly essential for components exposed to road salt and harsh weather, significantly extending the service life of the chamber components, especially the critical spring mechanism.

Another significant area of technological advancement involves the integration of smart components and sensor technologies. Modern spring brake chambers are increasingly being equipped with integrated position sensors (stroke sensors) that provide real-time feedback on brake adjustment and wear levels to the vehicle’s Electronic Braking System (EBS) or telematics unit. This integration enables sophisticated predictive maintenance strategies, allowing fleet managers to preemptively schedule brake servicing, reducing the risk of unexpected failures and optimizing resource allocation. The development of high-pressure sealing technology is also critical, utilizing advanced elastomeric materials that maintain integrity under extreme temperature variations and high pneumatic pressures, enhancing overall reliability and preventing the loss of critical air pressure.

The transition toward electronic air processing and control units in commercial vehicles mandates higher precision and compatibility in the pneumatic actuation mechanism. This is leading to optimized internal designs, focusing on faster response times and lower hysteresis in the actuation cycle, crucial for effective synchronization with ADAS and future autonomous driving systems. While the fundamental principle of the spring brake chamber remains pneumatic, its interface and functional requirements are becoming increasingly electronic, demanding specialized manufacturing processes and stringent quality control protocols to ensure seamless operation between mechanical components and complex digital control systems installed on modern trucks and trailers across all major markets.

Regional Highlights

- Asia Pacific (APAC): APAC represents the epicenter of market growth, characterized by the largest volume demand driven by rapid industrialization, massive infrastructure projects, and unparalleled growth in intra-regional trade and logistics, especially in China and India. The region benefits from a high rate of new commercial vehicle production and a substantial aftermarket need due to extended operational lifecycles of vehicles.

- North America: North America is a high-value market defined by strict Federal Motor Vehicle Safety Standards (FMVSS 121), compelling the use of high-performance, robust spring brake chambers. Demand is stable, driven by the replacement cycle of large, aging truck fleets and a strong focus on advanced, premium products that offer superior durability and are compatible with advanced telematics systems.

- Europe: Europe is characterized by stringent emission norms and a push towards electrification, demanding lightweight and highly efficient components. The market relies heavily on technological sophistication, with a strong preference for integrated safety features and compliance with complex UNECE regulations. The OEM segment is robust, reflecting high new vehicle registration rates driven by fleet modernization mandates.

- Latin America (LATAM): LATAM is an emerging market with significant growth potential, fueled by commodity exports and infrastructure development. The region often presents challenges related to varying road conditions, leading to higher wear rates and consistent aftermarket demand. Economic stability is a key determinant of new vehicle sales and associated OEM component procurement.

- Middle East and Africa (MEA): This region offers niche opportunities, primarily driven by massive energy sector projects, mining, and long-haul transportation across challenging desert environments. Demand is localized but growing, requiring specialized chambers that are highly resistant to heat, dust, and sand contamination, favoring robust, low-maintenance designs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spring Brake Chamber Market.- Knorr-Bremse

- Haldex

- ZF Group (Wabco)

- Meritor (A business unit of Cummins)

- Sorl Auto Parts

- Minda Industries

- Tectran

- Bendix Commercial Vehicle Systems

- Federal-Mogul (Tenneco)

- ArvinMeritor

- Fawer Automotive Parts

- Pressure Technology Co., Ltd.

- Apex Brake Chambers

- Newman Tools Inc.

- China North Industries Group Corporation (NORINCO)

- Bosch (Automotive Division)

- Continental AG

- Canton Parts

- Vigilant Vehicle Components

- Raufoss Technology AS

Frequently Asked Questions

Analyze common user questions about the Spring Brake Chamber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a spring brake chamber in a commercial vehicle?

The spring brake chamber performs two critical functions: standard service braking using compressed air, and providing automatic emergency and parking brake application through a powerful internal spring mechanism if air pressure drops below a safe threshold, ensuring regulatory compliance and vehicle immobilization.

How does the Diaphragm Type chamber differ from the Piston Type chamber?

The Diaphragm Type is typically more cost-effective and used in standard applications, relying on a flexible rubber membrane. The Piston Type is generally more robust, offering superior sealing and contamination resistance, making it preferred for high-force, severe-duty environments and specialized commercial vehicles.

Which factors are driving the greatest growth in the Spring Brake Chamber aftermarket?

The aftermarket growth is primarily driven by the increasing average age of commercial vehicle fleets globally, coupled with stringent safety inspections and mandatory replacement schedules for safety-critical components, ensuring continuous demand for reliable replacement chambers.

How do new safety regulations impact the design and technology of brake chambers?

New regulations mandate higher performance standards, pushing manufacturers toward lighter materials, enhanced corrosion resistance, and the integration of smart sensors (stroke indicators) necessary for compatibility with modern Electronic Braking Systems (EBS) and ADAS features.

Is the electrification of commercial vehicles expected to eliminate the need for spring brake chambers?

No, while electric commercial vehicles use regenerative braking, they still require mechanical pneumatic systems, including spring brake chambers, for parking and fail-safe emergency stopping functions as mandated by current global safety standards, maintaining core component demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager