Square Tables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431945 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Square Tables Market Size

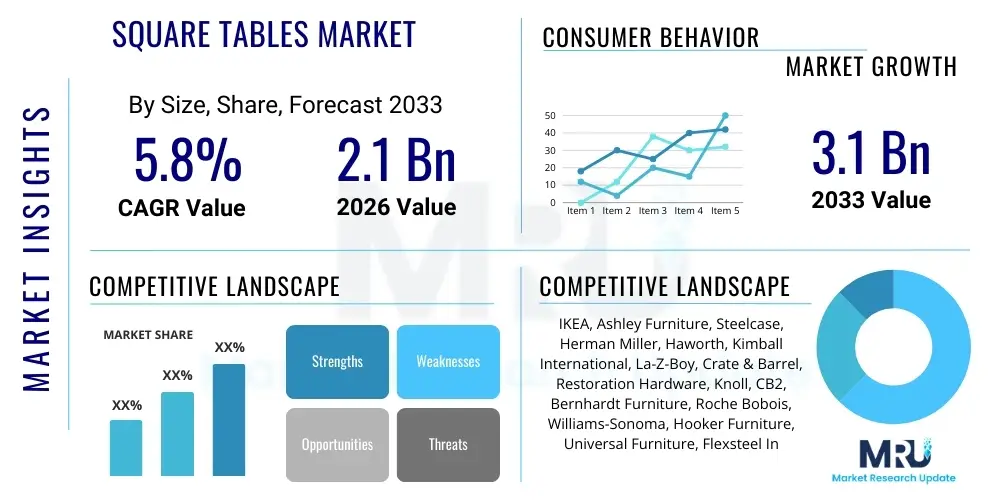

The Square Tables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.1 Billion by the end of the forecast period in 2033.

Square Tables Market introduction

The Square Tables Market encompasses the global production, distribution, and sale of dining tables, coffee tables, end tables, and modular workspace surfaces characterized by a square or near-square geometry. These items are integral components of both residential and commercial furnishings, valued for their symmetrical aesthetic, space efficiency, and adaptability, particularly in smaller living spaces or optimized office layouts. The utility of square tables spans dining, collaboration, display, and storage, making them perpetually relevant across diverse end-user sectors. Key product features often revolve around material choice (wood, metal, glass, composites), functionality (foldable, expandable, height-adjustable), and design philosophy (modern, traditional, minimalist).

Major applications for square tables are predominantly segmented across the residential, commercial, and institutional sectors. In the residential segment, square dining tables are popular for their ability to promote close conversation and fit efficiently into compact dining areas, while square coffee tables and side tables serve essential aesthetic and practical roles in living rooms. Commercially, they are crucial in the hospitality sector, including restaurants and cafes, where square formations allow for flexible seating arrangements and efficient space utilization. Furthermore, within modern office environments, square tables are frequently utilized as collaborative workstations or meeting points, supporting agile work structures and maximizing visual symmetry within open-plan settings.

The market is primarily driven by sustained urbanization, leading to an increased demand for functional, space-saving furniture solutions that square tables inherently offer. Rapid expansion in the global hospitality and foodservice industries necessitates continuous investment in durable and aesthetically pleasing dining solutions, favoring the robust and easily standardized square format. Additionally, technological advancements in material science and manufacturing processes enable the creation of highly durable, lightweight, and customizable square tables, incorporating features like integrated charging ports or modular extensions, further enhancing their market attractiveness and providing crucial differentiation among manufacturers.

Square Tables Market Executive Summary

The Square Tables Market is characterized by robust growth underpinned by strong business trends focusing on sustainability and modular design, particularly catering to evolving residential demographics and rapid expansion in the commercial sector. A significant business trend involves the shift towards eco-friendly materials, with consumers increasingly favoring reclaimed wood, bamboo, and recycled metals, prompting manufacturers to revamp supply chains and acquire sustainability certifications. Furthermore, the adoption of customization and direct-to-consumer (D2C) models, facilitated by augmented reality tools for visualization, is allowing brands to capture higher margins and better address specific consumer preferences related to size, finish, and functionality, enhancing competitive dynamics across established furniture brands and emerging digital retailers.

Regionally, the market exhibits divergent growth patterns. The Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate, fueled by massive infrastructure development, rising disposable incomes in economies such as China and India, and a burgeoning middle class demanding modern, quality residential furnishings. North America and Europe maintain substantial market share, driven by strong replacement cycles in the mature residential sector and significant investments in commercial renovation projects, including corporate offices, boutique hotels, and fast-casual dining establishments. Regulatory frameworks focusing on fire safety and material standards, particularly in the European Union, influence product development, emphasizing adherence to high quality and safety specifications.

Segment trends reveal a growing preference for composite and engineered wood materials due to their cost-effectiveness, durability, and versatility in imitating high-end natural finishes, positioning them favorably against traditional solid wood offerings. Within the application segment, the Commercial category, specifically hospitality (restaurants and cafes), remains highly lucrative, demanding bulk orders of durable, easy-to-clean square tables capable of withstanding heavy traffic. The distribution channel is experiencing a profound migration towards online retail, which provides consumers with broader choices, comparative pricing models, and logistical convenience, although traditional furniture stores still dominate the high-end and bespoke segments where physical examination of craftsmanship is paramount.

AI Impact Analysis on Square Tables Market

Common user inquiries concerning the impact of Artificial Intelligence on the Square Tables Market frequently revolve around how manufacturing efficiency can be boosted, how design processes might be automated, and the role of AI in optimizing supply chain logistics and personalized consumer experience. Users are particularly interested in whether AI can facilitate mass customization, allowing for individual design specifications to be seamlessly integrated into large-scale production runs without incurring excessive costs or delays. Key concerns also include the potential displacement of human designers by generative design algorithms and the ethical implications of using predictive AI for consumer trend forecasting, influencing inventory decisions and market strategy.

The analysis indicates that AI’s primary influence is currently realized in streamlining operational efficiency rather than revolutionary product design. AI-powered predictive maintenance models are optimizing factory floor uptime by anticipating equipment failures in CNC routers and finishing lines, directly reducing manufacturing waste and lowering operational costs for producers of high-volume metal and composite tables. Furthermore, AI algorithms are becoming indispensable in sophisticated inventory management systems, analyzing real-time sales data, seasonal fluctuations, and external economic indicators to forecast demand accurately, thereby minimizing overstocking or understocking of popular square table variants, especially those with diverse material and color options.

Looking forward, Generative AI holds significant potential in furniture design. Algorithms can swiftly create thousands of feasible square table designs optimized for specific parameters, such as material stress tolerance, aesthetic alignment with prevailing trends, or footprint constraints, dramatically accelerating the prototyping phase. Additionally, AI-driven chatbots and recommendation engines are enhancing the online shopping experience by offering personalized table suggestions based on uploaded room photos or expressed preferences, improving conversion rates and customer satisfaction within the increasingly important e-commerce distribution channel for square tables.

- AI optimizes material usage and reduces waste through predictive cutting algorithms in manufacturing.

- Generative design tools accelerate the creation of novel, structurally sound square table models.

- Predictive analytics enhance supply chain efficiency and inventory management, reducing storage costs.

- AI-driven e-commerce personalization improves product discovery and sales conversion rates.

- Automated quality control systems use machine vision to detect surface flaws and structural defects rapidly.

DRO & Impact Forces Of Square Tables Market

The market trajectory for Square Tables is dictated by a critical balance of stimulating Drivers, restrictive Restraints, emerging Opportunities, and interconnected Impact Forces. Key drivers include accelerating rates of global urbanization and the corresponding necessity for space-efficient furniture solutions suited to smaller apartment footprints, alongside robust expansion within the global hospitality sector which requires standardized, durable commercial dining and meeting tables. Restraints primarily encompass the volatility and unpredictability of global raw material costs, particularly timber and steel, which impact manufacturing margins, coupled with environmental compliance pressures requiring costly supply chain adjustments. Opportunities center around leveraging e-commerce penetration, developing smart furniture integrations, and expanding into fast-growing emerging markets, providing avenues for competitive differentiation and market share gain.

Analyzing the specific drivers, the increasing popularity of remote work models significantly boosts demand for dedicated, aesthetically pleasing home office furniture, often including smaller, square-format desks or collaboration tables that fit seamlessly into residential environments. Furthermore, architectural trends favoring open-plan offices and collaborative workspaces necessitate modular and easily reconfigurable furniture, where square tables excel in facilitating impromptu meetings and team interactions, driving corporate procurement cycles. The aesthetic appeal of square symmetry, which offers a sense of stability and formal balance, also acts as a subtle but persistent driver across interior design preferences in both residential and high-end commercial settings, ensuring consistent market penetration.

However, the market faces significant headwinds from intense competition, particularly from unorganized local manufacturers in APAC and Latin America who can offer highly competitive pricing due to lower overheads and less stringent regulatory compliance regarding material sourcing. This competitive pressure forces established global brands to focus heavily on brand value, quality assurance, and design innovation to justify premium pricing. Additionally, increasing scrutiny on carbon footprints associated with material transportation and processing necessitates significant investment in localizing production or adopting circular economy principles, posing a cost restraint that smaller players often struggle to absorb, contributing to a polarized market structure.

Segmentation Analysis

The Square Tables Market segmentation provides a crucial framework for understanding consumer behavior and market dynamics, primarily categorizing the market based on material composition, end-use application, and distribution channel. Material composition dictates durability, price point, and aesthetic value, ranging from cost-effective plastic laminates to premium solid woods like oak and teak. The application segment reveals demand concentration, differentiating between the high-volume replacement needs of the residential sector versus the large-scale procurement and stringent durability requirements of the commercial and institutional sectors. Analyzing these segments helps manufacturers tailor product lines, optimize pricing strategies, and target promotional campaigns effectively across distinct market demographics.

- By Material: Solid Wood, Engineered Wood/Laminate, Metal, Glass, Plastic/Fiberglass, Composite Materials

- By Application: Residential (Dining, Coffee, End Tables), Commercial (Hospitality, Office, Retail), Institutional (Educational, Healthcare)

- By Distribution Channel: Offline (Furniture Stores, Specialty Stores, Departmental Stores), Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Square Tables Market

The value chain for the Square Tables Market begins with upstream activities involving the sourcing and processing of core raw materials such as timber, steel, aluminum, glass, and composite polymers. Upstream analysis focuses on managing raw material supply risks, ensuring sustainable sourcing certifications (especially for wood products like FSC), and optimizing primary manufacturing processes like cutting, forming, and finishing. Key challenges in this stage involve price volatility, geopolitical instability affecting timber imports, and the necessity of investing in high-precision machinery to ensure dimensional accuracy, critical for modular and collapsible square table designs. Relationships with primary material suppliers dictate overall production cost and lead times, making strategic supplier partnerships essential for maintaining competitive pricing and consistent quality.

Midstream activities involve the core manufacturing, assembly, finishing, and quality control processes. Manufacturers convert processed raw materials into finished square table components, applying specialized finishes, fittings, and hardware. The efficiency of the assembly process, often involving automated or semi-automated lines, directly influences output capacity and unit cost. Quality control is paramount, checking for structural integrity, surface blemishes, and adherence to specified dimensions and safety standards. Innovation at this stage often relates to adopting advanced joining techniques, incorporating integrated functionalities (e.g., cable management), and implementing flexible manufacturing systems capable of handling customized small batches efficiently.

The downstream segment centers on distribution, sales, and post-sale services. Distribution channels are bifurcated into direct sales (manufacturer to large commercial client or D2C via brand websites) and indirect sales (retailers, wholesalers, and e-commerce platforms). The rise of e-commerce has necessitated significant investment in logistics, warehousing, and last-mile delivery capabilities to handle bulky furniture. Direct channels offer greater control over branding and customer data, while indirect channels provide wider market reach. Effective after-sales support, including warranty provisions and modular replacement part availability, is crucial for building brand loyalty and managing customer expectations, particularly in the high-end residential and demanding commercial sectors.

Square Tables Market Potential Customers

Potential customers for the Square Tables Market are highly diversified, encompassing residential consumers, various commercial entities, and governmental or educational institutions, each with unique procurement criteria and volume requirements. Residential end-users represent a large volume segment driven by lifestyle changes, home renovations, and new home construction. These buyers prioritize aesthetic design, material durability compatible with family use, and features optimizing space, such as extendable or nesting square tables. Purchases are often characterized by emotional factors, brand perception, and budget constraints, typically channeled through retail stores and online platforms, demanding sophisticated marketing and visualization tools.

The commercial sector stands as the most lucrative segment in terms of bulk purchasing and high-specification demand. This includes the rapidly expanding Hospitality Industry—specifically restaurants, cafes, hotels, and event venues—where square tables are preferred for their versatility in seating configuration and robustness against daily wear and tear. Corporate offices and co-working spaces represent another major customer base, prioritizing ergonomic design, data accessibility integration, and modularity to facilitate dynamic team collaboration. Commercial customers base purchasing decisions on total cost of ownership, long-term durability, fire safety compliance, and the ability to fulfill large, standardized orders within tight deadlines.

Institutional buyers, comprising educational facilities (schools, universities) and healthcare centers, constitute a stable, albeit requirement-specific, customer segment. Educational institutions require extremely durable, easy-to-clean, and often stackable square tables suitable for classrooms and cafeterias, with cost-effectiveness and safety standards being paramount. Healthcare facilities demand non-porous, infection-control-compliant materials and specialized finishes for patient rooms and dining areas. Procurement in the institutional segment is typically managed through formalized tenders and government contracts, prioritizing certifications, proven track records, and adherence to public sector budgetary guidelines over pure aesthetic luxury.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA, Ashley Furniture, Steelcase, Herman Miller, Haworth, Kimball International, La-Z-Boy, Crate & Barrel, Restoration Hardware, Knoll, CB2, Bernhardt Furniture, Roche Bobois, Williams-Sonoma, Hooker Furniture, Universal Furniture, Flexsteel Industries, Bassett Furniture, Vitra, Poltrona Frau |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Square Tables Market Key Technology Landscape

The technology landscape governing the Square Tables Market is rapidly evolving, moving beyond traditional carpentry towards advanced manufacturing and smart integration. Key technologies currently employed center on computer-aided design (CAD) and computer numerical control (CNC) machining, which ensure high precision and consistency in mass production, particularly crucial for composite and engineered wood products. Advanced material technologies, such as scratch-resistant laminates, specialized powder coatings for metal bases, and lightweight, high-strength composites (e.g., carbon fiber infused resins), are significantly improving product longevity and aesthetic appeal while maintaining functional square geometries. These manufacturing methods enable manufacturers to quickly scale production and respond to demand for varied sizes and finishes.

A significant trend involves the incorporation of smart furniture technology, transforming static tables into interactive workstations. This includes the integration of wireless charging pads seamlessly embedded into the tabletop surface, concealed power outlets, and sophisticated cable management systems designed to maintain a clean aesthetic in both office and residential settings. Height-adjustable square tables, utilizing smooth electronic linear actuators and programmable memory settings, are becoming standard in ergonomic office environments, reflecting a growing technological focus on user wellness and adaptability. These technological enhancements are aimed at improving utility and justifying higher price points in premium segments.

Furthermore, digital technologies are redefining the consumer experience. The adoption of Augmented Reality (AR) tools allows customers to visualize different square table models within their actual space before purchase, significantly reducing return rates and increasing purchasing confidence, particularly in the online retail segment. Manufacturing processes are increasingly leveraging robotics for repetitive assembly tasks and automated sanding and finishing, improving labor efficiency and consistency in surface treatment. The convergence of IoT sensors for environmental monitoring (e.g., temperature/humidity) and structural integrity checks is a nascent but important technological frontier for high-value commercial tables.

Regional Highlights

- North America (U.S., Canada, Mexico)

North America holds a substantial share of the global Square Tables Market, characterized by high consumer spending power, mature residential renovation cycles, and robust corporate investment in modern office redesigns. The market is driven by high demand for quality, aesthetically pleasing designs from major design hubs and a strong emphasis on ergonomic and sustainable sourcing practices. The U.S. remains the largest market, witnessing significant growth in the residential segment due to sustained suburban housing development and the permanent adoption of hybrid work models, requiring functional home office furnishings. Canada also demonstrates consistent growth, often mirroring U.S. trends but with a slightly higher emphasis on locally sourced timber products. Competition is fierce, dominated by large international retailers and high-end specialty manufacturers focusing on differentiated design and technological features.

Europe represents a crucial market, distinguished by its stringent regulatory standards for furniture quality, fire safety (e.g., EU standards), and environmental sustainability (e.g., EUTR for wood traceability). Western European countries, including Germany, the UK, France, and Italy, are key consumers and innovation centers, emphasizing minimalist, modular, and multifunctional square table designs catering to compact urban living and sophisticated commercial hospitality venues. Demand is largely stable, driven by replacement purchases and design-conscious consumers willing to invest in premium, long-lasting furniture. The region is seeing increased penetration of space-saving and convertible square tables designed for smaller apartments prevalent across major European metropolitan areas.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by unprecedented economic development, rapid urbanization, and massive infrastructure projects across its developing economies. China and India are the primary growth engines, driven by a burgeoning middle class demanding contemporary, value-for-money furniture. The market is fragmented, comprising both large global manufacturers and a vast number of regional, unorganized players. Demand in APAC is characterized by a strong preference for durable, simple designs suitable for high-density living, although there is also a rapidly growing segment for luxury imported furniture catering to the ultra-high-net-worth segment. Investment in local manufacturing capabilities is increasing, often leveraging high-volume production techniques to meet domestic and regional demand efficiently.

- Highlight key countries or regions and their market relevance

- North America: Driven by ergonomic office furniture and high residential replacement rates.

- Europe: Characterized by stringent quality regulations and a strong preference for minimalist, sustainable design.

- Asia Pacific (APAC): Fastest-growing region due to urbanization, commercial infrastructure investment, and rising disposable incomes.

- Latin America (LATAM): Emerging market focused on cost-effective and locally sourced timber products.

- Middle East & Africa (MEA): Growth driven by luxury residential projects and high-end hospitality development in key Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Square Tables Market.- IKEA

- Ashley Furniture

- Steelcase

- Herman Miller

- Haworth

- Kimball International

- La-Z-Boy

- Crate & Barrel

- Restoration Hardware

- Knoll

- CB2

- Bernhardt Furniture

- Roche Bobois

- Williams-Sonoma

- Hooker Furniture

- Universal Furniture

- Flexsteel Industries

- Bassett Furniture

- Vitra

- Poltrona Frau

Frequently Asked Questions

Analyze common user questions about the Square Tables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials offer the best durability for commercial square tables?

For high-traffic commercial environments, materials such as high-pressure laminate (HPL) tops over engineered wood cores, stainless steel bases, and powder-coated aluminum frames offer superior durability, resistance to moisture, and ease of cleaning compared to natural solid woods.

How does the shift to remote work affect demand for residential square tables?

The increasing prevalence of remote and hybrid work models has significantly boosted the demand for smaller, multifunctional square tables that can serve dual purposes—as temporary workstations and compact dining surfaces—optimizing space efficiency in smaller urban apartments and home offices.

Which geographical region exhibits the highest growth potential for square tables?

The Asia Pacific (APAC) region is projected to demonstrate the highest growth potential, driven by rapid urbanization, significant commercial construction, rising middle-class disposable income, and increasing adoption of modern furniture designs across countries like China, India, and Southeast Asia.

What is the current technological focus in square table manufacturing?

The key technological focus includes precision manufacturing using CNC machinery for high dimensional accuracy, the integration of smart features like wireless charging and automated height adjustment mechanisms, and the deployment of AR tools for enhanced online consumer visualization prior to purchase.

Are square tables generally preferred over round tables in the hospitality sector?

Yes, square tables are often preferred in the hospitality sector, particularly in cafes and restaurants, because they can be easily pushed together or separated, allowing operators maximum flexibility to adjust seating arrangements efficiently to accommodate varying party sizes and maximize dining area utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager