SSL Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432116 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

SSL Certification Market Size

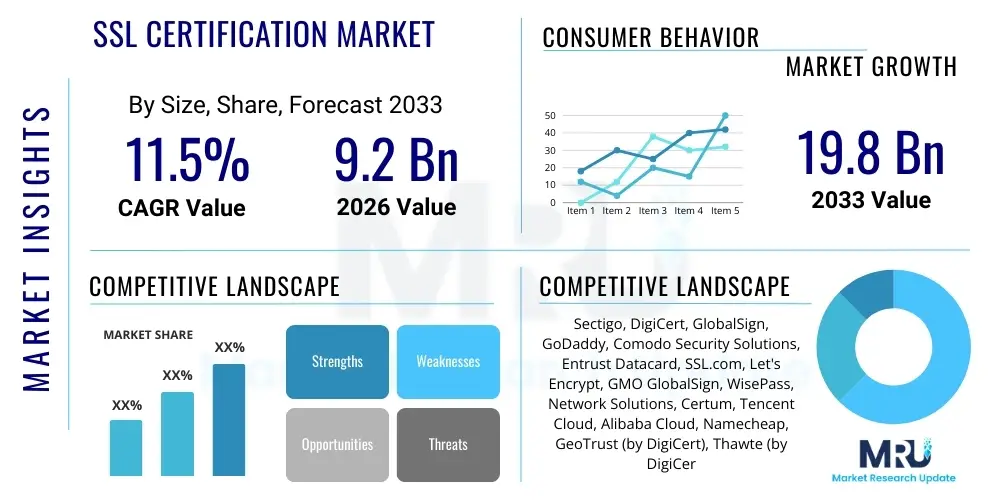

The SSL Certification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 9.2 Billion in 2026 and is projected to reach USD 19.8 Billion by the end of the forecast period in 2033.

SSL Certification Market introduction

The Secure Sockets Layer (SSL) Certification Market revolves around providing digital certificates essential for establishing encrypted connections (HTTPS) between a web server and a client browser. This foundational technology ensures data integrity, confidentiality, and authentication, critically underpinning the security framework of the internet economy. SSL certificates, now largely governed by the successor technology Transport Layer Security (TLS), are pivotal for e-commerce transactions, secure login portals, and regulatory compliance across virtually all sectors handling sensitive user data. The market is defined by the issuance, renewal, and management of these certificates, which vary in complexity and validation levels, primarily Domain Validated (DV), Organization Validated (OV), and Extended Validation (EV).

Major applications of SSL/TLS certificates span web security, email encryption, Virtual Private Network (VPN) communication, and code signing. They are indispensable for maintaining consumer trust and adhering to stringent global data protection regulations, such as the GDPR and CCPA, which mandate secure data transmission. Key benefits derived from adopting robust SSL certification include enhanced search engine rankings (as search engines prioritize HTTPS), mitigation of man-in-the-middle attacks, and compliance with industry standards like PCI DSS (Payment Card Industry Data Security Standard). The constant evolution of cyber threats, coupled with the exponential rise in online connectivity and cloud adoption, consistently drives market demand for more robust and efficiently managed certificate solutions.

Driving factors for sustained market growth include mandatory browser requirements (modern browsers flag non-HTTPS sites as "Not Secure"), the shift towards remote work accelerating the need for secure network access, and the transition of enterprise applications to multi-cloud environments. Furthermore, the proliferation of IoT devices requiring secure communication endpoints and the growing complexity of certificate management in large organizations, often leading to costly certificate expiration outages, fuel the demand for automated and sophisticated certificate lifecycle management (CLM) solutions. This persistent need for pervasive encryption across the digital ecosystem cements the SSL Certification Market as a critical component of global cybersecurity infrastructure.

SSL Certification Market Executive Summary

The SSL Certification Market is experiencing significant momentum driven by escalating regulatory pressures requiring ubiquitous encryption and the ongoing digital transformation across all industries. Business trends indicate a marked shift towards higher assurance certificates, specifically Organization Validated (OV) and Extended Validation (EV), particularly within financial services and highly regulated sectors where consumer trust is paramount. Simultaneously, the Domain Validated (DV) segment continues to dominate based on volume due to the massive uptake of free and automated certificate issuance services, notably through initiatives focused on internet-wide encryption. The market is consolidating around major Certificate Authorities (CAs) that are heavily investing in automation tools, API integration, and integrated Certificate Lifecycle Management (CLM) platforms to handle the complexity introduced by hybrid and multi-cloud environments. This focus on automation addresses critical enterprise concerns related to certificate expiry mismanagement and operational overhead.

Regional trends highlight North America and Europe as mature markets characterized by high security maturity, strong regulatory enforcement (e.g., GDPR), and a significant presence of large enterprises necessitating complex, enterprise-grade CLM solutions. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapid digitalization, the explosive growth of e-commerce markets, and increasing government initiatives promoting secure digital infrastructure. Emerging economies in Latin America and MEA are also showing accelerated adoption, although their market primarily relies on basic DV certificates initially, transitioning gradually towards OV as their digital economies mature and regulatory requirements tighten. The regional disparity often reflects differing levels of internet penetration, cyber maturity, and local data protection laws.

Segment trends underscore the increasing importance of multi-domain and wildcard certificates, which simplify management for organizations overseeing numerous subdomains or complex server infrastructures. While traditional certificates remain foundational, the future growth is increasingly tied to managed Public Key Infrastructure (PKI) services and CLM software that integrates seamlessly with DevOps pipelines and cloud service providers. Furthermore, the market is preparing for the post-quantum cryptography transition. Segments focusing on advanced algorithm implementation and agile crypto-migration strategies are expected to witness significant investment, positioning the market not just as a provider of current security solutions but also as a forward-looking entity preparing the digital landscape for future computational threats.

AI Impact Analysis on SSL Certification Market

User queries regarding the impact of Artificial Intelligence (AI) on the SSL Certification Market frequently center on three main themes: the use of AI in detecting fraudulent certificate applications, the potential for AI-driven threats (such as advanced phishing or deepfake authentication bypasses), and the role of AI in automating the highly complex process of Certificate Lifecycle Management (CLM). Users are keenly interested in how AI can enhance the vetting process used by Certificate Authorities (CAs) to prevent the issuance of certificates to malicious entities, thereby improving overall internet trust. Conversely, there is significant concern about AI being leveraged by attackers to optimize cryptographic attacks, potentially weakening the fundamental trust model built around SSL/TLS.

The integration of AI and Machine Learning (ML) is fundamentally changing how SSL certificates are issued and managed. CAs are beginning to employ ML algorithms to analyze massive datasets related to domain registration patterns, organizational data, and request behavior to detect anomalies indicative of potential fraud or malicious intent during the validation process for OV and EV certificates. This augmentation enhances the human review process, making the issuance system more resilient against sophisticated social engineering or fraudulent documentation attempts. Furthermore, AI tools are proving invaluable in proactively monitoring the global certificate landscape to identify misconfigurations or unauthorized issuance, contributing to a more robust global PKI ecosystem.

The most substantial impact of AI, however, lies in Certificate Lifecycle Management (CLM). Large organizations often manage thousands of certificates across diverse infrastructures, making manual tracking error-prone and resource-intensive, often resulting in severe, business-crippling outages when certificates expire unexpectedly. AI/ML-powered CLM solutions automate inventory discovery, predictive expiry alerting, renewal initiation, and even deployment across cloud environments and containerized applications. This automation reduces human error, ensures continuity, and allows security teams to focus on strategic threat mitigation rather than operational overhead. AI is transforming certificate management from a reactive, manual task into a proactive, optimized security function.

- AI-driven fraud detection enhances Certificate Authority vetting processes.

- Machine Learning optimizes domain registration analysis to identify phishing attempts prior to issuance.

- AI integration into CLM platforms automates certificate inventory, discovery, and renewal workflows.

- Predictive analytics minimizes certificate expiry outages for large enterprises.

- AI assists in threat intelligence gathering related to certificate abuse and revocation needs.

- Potential risk includes AI-optimized brute-force or side-channel attacks on cryptographic implementations.

- AI enables faster assessment of organizational compliance with evolving security policies during renewal.

DRO & Impact Forces Of SSL Certification Market

The SSL Certification Market is shaped by a powerful interplay of technological mandates and regulatory imperatives. Key drivers include the universal push towards HTTPS driven by browser vendors (such as Google and Mozilla) that actively penalize unsecured sites, coupled with the global expansion of e-commerce requiring mandatory encryption for financial transactions (PCI DSS compliance). Restraints primarily involve the operational complexity associated with managing large volumes of certificates in hybrid IT environments, the skills gap in internal security teams regarding advanced PKI management, and the pricing pressure exerted by free certificate providers like Let's Encrypt, which limits revenue growth in the fundamental DV segment. Opportunities abound in the burgeoning fields of IoT security, the necessity for multi-factor authentication (MFA) requiring robust PKI backbones, and the development of specialized, highly secure certificates for post-quantum computing environments.

The impact forces influencing the market are significant. Technological advances require continuous evolution, notably the transition from SHA-1 to SHA-2, the mandatory shortening of certificate lifetimes (currently around 398 days), and the ongoing requirement to support stronger key exchange mechanisms. Regulatory compliance is perhaps the strongest external force, as data protection laws worldwide make encryption a legal necessity rather than just a best practice. Economic forces, such as the overall investment in digital infrastructure and cloud adoption rates, directly correlate with the demand for certificates. Competitive forces remain high, driven by the juxtaposition of globally recognized, high-assurance CAs and the highly efficient, automated free certificate providers, forcing commercial CAs to innovate through value-added services like enhanced warranties, professional support, and advanced CLM tools.

Furthermore, the threat landscape acts as a perpetual driver. Increased sophistication of cyber-attacks, including those targeting certificate transparency logs or relying on compromised certificates, necessitates quicker certificate issuance and revocation processes. The impending shift towards quantum-resistant cryptography (QRC) represents a major, long-term impact force; organizations must begin planning for crypto-agility to seamlessly transition to new standards when classical cryptography becomes vulnerable. This monumental task provides significant opportunity for vendors offering CLM solutions capable of managing a mixed environment of classical and post-quantum certificates, ensuring the market remains dynamic and focused on cryptographic innovation rather than merely maintenance.

Segmentation Analysis

The SSL Certification Market is comprehensively segmented based on validation type, key size, end-user industry, and deployment model, reflecting the diverse needs of the global digital infrastructure. Segmentation by validation type—Domain Validated (DV), Organization Validated (OV), and Extended Validation (EV)—remains the most fundamental differentiator, distinguishing between basic domain ownership verification and rigorous enterprise vetting. The market dynamics show a high volume penetration by DV certificates, driven by ubiquity and cost, while revenue generation leans heavily towards the high-assurance OV and EV segments, favored by banking, government, and healthcare institutions where proof of organizational identity is critical for establishing high levels of user trust. The deployment model segmentation, covering cloud and on-premise solutions, is rapidly shifting towards cloud-based and managed PKI services due to the scalability and reduced operational burden offered by cloud environments.

- By Validation Type:

- Domain Validated (DV)

- Organization Validated (OV)

- Extended Validation (EV)

- By Certificate Type:

- Single Domain Certificates

- Wildcard Certificates

- Multi-Domain (SAN) Certificates

- By Key Size:

- 2048-bit

- 4096-bit and Higher

- By End-User:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- IT and Telecom

- Retail and E-commerce

- Healthcare and Life Sciences

- Others (Education, Media)

- By Deployment Model:

- On-Premise

- Cloud-Based/Managed Services

Value Chain Analysis For SSL Certification Market

The value chain of the SSL Certification Market begins with the upstream activities centered on cryptographic research and development, including algorithm specification (like ECC vs. RSA) and the maintenance of secure root certificate infrastructure, primarily managed by globally trusted root Certificate Authorities (CAs). These CAs perform the essential function of key generation, certificate signing, and maintaining the Certificate Revocation Lists (CRLs) and Certificate Transparency logs, ensuring the foundational trust in the digital identity ecosystem. Upstream also involves hardware and software security providers (HSMs, security modules) that ensure the physical and digital protection of the highly sensitive root keys, adhering to stringent standards like WebTrust and ETSI.

The core of the value chain is the issuance and distribution process. Direct distribution involves the CAs selling certificates directly to end-user organizations, often catering to large enterprises that require specialized services, direct support, and sophisticated CLM tools integrated via proprietary APIs. Indirect distribution channels, however, form a dominant part of the market, relying heavily on hosting providers, domain registrars, managed security service providers (MSSPs), and authorized resellers. These intermediaries bundle SSL certificates with domain registrations and hosting packages, serving the vast Small and Medium-sized Enterprise (SME) market and individual developers, often leveraging automated systems for volume distribution of DV certificates.

Downstream analysis focuses on deployment, management, and end-user consumption. Deployment involves integrating the issued certificate into server environments, cloud load balancers, and application delivery controllers—a process increasingly automated through API integration with CLM solutions. Post-issuance activities, such as monitoring certificate status, handling renewals, and performing mandatory revocation if a key is compromised, are critical downstream services. The trend towards managed PKI and CLM services signifies a vertical integration strategy, where major players move downstream to offer continuous management services, creating higher recurring revenue streams and addressing the complexity challenges faced by their clients in maintaining a robust security posture across distributed environments.

SSL Certification Market Potential Customers

Potential customers for SSL/TLS certificates encompass virtually every entity and organization that maintains an online presence or handles electronic data transmission, reflecting the certificates’ role as the fundamental trust mechanism of the internet. The primary buyers include large enterprises, particularly those in highly regulated sectors like Banking, Financial Services, and Insurance (BFSI) and Healthcare, which require high-assurance EV certificates to comply with privacy laws (e.g., HIPAA, GDPR) and maintain high customer confidence during sensitive transactions. These organizations are also the main consumers of sophisticated Certificate Lifecycle Management (CLM) software and managed PKI services due to the scale and complexity of their infrastructure.

Another major segment of potential customers comprises Small and Medium-sized Enterprises (SMEs) and e-commerce retailers. While SMEs often opt for cost-effective DV or OV certificates, their rapid digital migration and growing necessity to accept secure online payments (PCI compliance) drive substantial volume demand, often sourced indirectly through hosting providers and registrars. Furthermore, government and public sector bodies are significant consumers, requiring robust encryption for citizen services and defense applications, frequently relying on high-security, custom-PKI solutions tailored to national security standards. The ongoing proliferation of Internet of Things (IoT) devices also establishes these manufacturers as emerging critical customers, needing billions of certificates for device authentication and secure communication endpoints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.2 Billion |

| Market Forecast in 2033 | USD 19.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sectigo, DigiCert, GlobalSign, GoDaddy, Comodo Security Solutions, Entrust Datacard, SSL.com, Let's Encrypt, GMO GlobalSign, WisePass, Network Solutions, Certum, Tencent Cloud, Alibaba Cloud, Namecheap, GeoTrust (by DigiCert), Thawte (by DigiCert), AWS Certificate Manager. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SSL Certification Market Key Technology Landscape

The SSL Certification market is undergoing continuous technological refinement driven by the need for stronger security, faster performance, and seamless automation. The foundational technologies are the cryptographic standards themselves, including the evolution from RSA to Elliptic Curve Cryptography (ECC), which offers comparable security strength with smaller key sizes, leading to faster TLS handshakes and reduced latency, critical for mobile and high-traffic web applications. Certificate Transparency (CT) logs represent a critical technological advancement, acting as publicly auditable records of all issued certificates, enhancing accountability among Certificate Authorities (CAs) and providing organizations with the means to detect maliciously or mistakenly issued certificates targeting their domains. This transparency strengthens the overall trust model and requires significant infrastructural investment by CAs to maintain compliance.

A major technological focus is the development and adoption of automated certificate issuance and management protocols. The Automated Certificate Management Environment (ACME) protocol, popularized by providers like Let's Encrypt, has revolutionized the market by enabling instantaneous, fully automated issuance and renewal of DV certificates, integrating directly with web servers and application environments. Commercial vendors are adopting similar API-driven architectures to facilitate automated CLM for OV and EV certificates, offering integration points for DevOps tooling, container orchestration platforms (like Kubernetes), and multi-cloud environments (AWS, Azure, Google Cloud). This shift towards infrastructure-as-code principles requires CLM solutions to be highly agile and cloud-native.

Looking ahead, the most transformative technological shift is the migration toward Post-Quantum Cryptography (PQC). As quantum computing advances threaten to render current public key cryptography (RSA and ECC) obsolete, the industry is investing heavily in researching, standardizing (e.g., NIST competition), and implementing quantum-resistant algorithms, such as lattice-based cryptography. This necessitates the development of hybrid certificates that support both current classical and new quantum-resistant algorithms simultaneously, ensuring a smooth, crypto-agile transition. Furthermore, technologies like Delegated Credentialing and support for DNS-based Authentication of Named Entities (DANE) are emerging to further decentralize and secure the authentication process, adding layers of trust beyond the traditional CA model.

Regional Highlights

Regional dynamics significantly influence the SSL Certification Market, largely dictated by local security maturity, regulatory rigor, and digital adoption rates. North America holds the largest market share, characterized by its mature digital infrastructure, stringent corporate governance, and the presence of numerous global technology giants and financial institutions that demand high volumes of EV and managed PKI services. The region’s advanced security landscape and early adoption of cloud-native architectures drive demand for highly integrated Certificate Lifecycle Management (CLM) solutions to mitigate operational risk. Furthermore, the proactive nature of US-based security regulations and industry standards ensures continuous investment in cryptographic best practices and robust certificate management.

Europe represents the second-largest market, strongly propelled by the enforcement of the General Data Protection Regulation (GDPR) and the EU’s Network and Information Systems (NIS) Directive. These regulations mandate high levels of data security and encryption, universally driving demand for certified SSL/TLS protection, particularly within the government and public services sectors. The market here is highly fragmented, featuring numerous regional Certificate Authorities (CAs) alongside global leaders. The emphasis in Europe is often placed on robust data localization and adherence to specific regional trust services standards (e.g., eIDAS), influencing purchasing decisions towards CAs demonstrating clear compliance with EU jurisdiction requirements. Automation and central management are key growth areas as enterprises manage compliance across diverse member states.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is attributed to the massive scale of e-commerce expansion in countries like China and India, rapid growth in internet penetration, and increasing governmental focus on establishing secure national digital infrastructures. While the market initially relied heavily on basic DV certificates, the rise of sophisticated financial technology (FinTech) and the increasing number of data breaches are pushing major organizations in Japan, South Korea, and Australia toward adopting OV and EV certificates. Regulatory efforts, such as China’s Cybersecurity Law and other regional data sovereignty mandates, further cement the necessity for high-assurance, localized SSL/TLS solutions.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets exhibiting robust adoption driven by infrastructure development and mobile technology proliferation. In LATAM, growing concerns over cybercrime and the expansion of digital banking services necessitate stronger encryption, although budget constraints sometimes favor free or lower-cost certificate options. In the MEA region, particularly in the UAE and Saudi Arabia, large governmental digital transformation projects and investments in smart city initiatives are creating substantial demand for robust PKI infrastructure and associated high-assurance certificates, driven by state-level mandates for secure digital identity and communication.

- North America: Market leader; driven by advanced CLM solutions, high EV adoption, and strong regulatory compliance requirements (e.g., HIPAA).

- Europe: High growth fueled by GDPR compliance, mandatory encryption, and focus on regional trust standards (e.g., eIDAS).

- Asia Pacific (APAC): Fastest growing region; driven by e-commerce boom, mobile internet expansion, and increased local data security regulations.

- Latin America (LATAM): Emerging market; growth tied to digital banking adoption and increasing awareness of cyber threats.

- Middle East and Africa (MEA): Growth driven by government-led digital transformation projects and smart city initiatives requiring robust PKI.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SSL Certification Market.- Sectigo

- DigiCert

- GlobalSign

- GoDaddy

- Comodo Security Solutions

- Entrust Datacard

- SSL.com

- Let's Encrypt

- GMO GlobalSign

- WisePass

- Network Solutions

- Certum

- Tencent Cloud

- Alibaba Cloud

- Namecheap

- GeoTrust (by DigiCert)

- Thawte (by DigiCert)

- AWS Certificate Manager

Frequently Asked Questions

Analyze common user questions about the SSL Certification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between DV, OV, and EV certificates?

The difference lies in the level of validation. Domain Validated (DV) only verifies domain control. Organization Validated (OV) verifies the domain and the organization's existence and identity. Extended Validation (EV) requires the most rigorous, standardized identity verification, displaying the organization's name prominently in the browser interface (where supported), offering the highest assurance of trust.

How is Certificate Lifecycle Management (CLM) impacting enterprise security?

CLM is critical for preventing costly certificate expiration outages by automating the discovery, monitoring, renewal, and deployment of certificates across complex IT infrastructures. CLM solutions minimize human error, ensure continuous security, and maintain compliance across cloud and on-premise environments.

What is the role of Certificate Transparency (CT) in the market?

CT requires Certificate Authorities (CAs) to log all newly issued certificates into public, auditable logs. This increases accountability, allows domain owners to monitor for misissued or unauthorized certificates, and generally strengthens the trustworthiness and reliability of the global Public Key Infrastructure (PKI) ecosystem.

Are free SSL certificate providers a threat to commercial CAs?

Free providers, predominantly Let's Encrypt, dominate the high-volume Domain Validated (DV) segment, posing a competitive challenge in this basic segment. However, commercial CAs maintain dominance in the high-assurance (OV and EV) and enterprise managed PKI segments by offering warranties, technical support, and comprehensive CLM tools that free providers typically do not offer.

How will quantum computing affect current SSL/TLS security?

Quantum computers pose a significant long-term threat by potentially breaking current asymmetric cryptography algorithms (RSA and ECC). The industry is proactively transitioning towards Post-Quantum Cryptography (PQC) standards, requiring organizations to adopt crypto-agile certificates capable of supporting new, quantum-resistant algorithms to secure future digital communications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager