SSL Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434196 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

SSL Devices Market Size

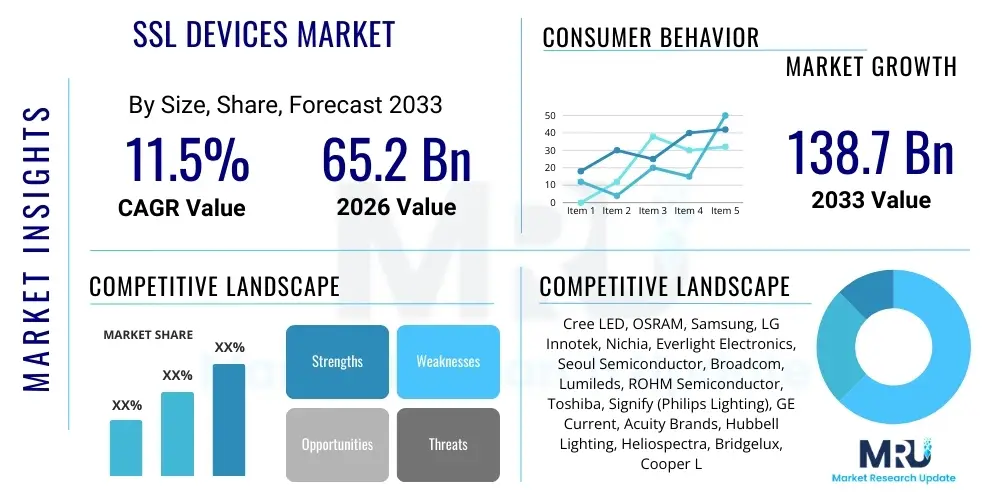

The SSL Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. This substantial expansion is fundamentally driven by global mandates toward energy conservation and the widespread adoption of smart infrastructure initiatives. The market scope encompasses a variety of semiconductor-based lighting products, including advanced LED fixtures, organic light-emitting diodes (OLEDs), and associated control electronics, which are displacing traditional incandescent and fluorescent technologies due to superior energy performance and extended lifespan. The transition in large-scale commercial and municipal projects, coupled with decreasing manufacturing costs, continues to stabilize the market trajectory.

The market is estimated at USD 65.2 Billion in 2026 and is projected to reach USD 138.7 Billion by the end of the forecast period in 2033. This remarkable growth valuation reflects the rapid integration of SSL devices into the Internet of Things (IoT) ecosystem, particularly in smart cities and connected homes. Furthermore, emerging applications in specialized fields, such as horticultural lighting (grow lights) and automotive lighting, are contributing significantly to revenue streams. Investment in R&D focusing on color rendering index (CRI) improvement and miniaturization of lighting components will be critical to maintaining this forecasted growth rate.

SSL Devices Market introduction

The SSL Devices Market, primarily centered around Light Emitting Diode (LED) and Organic Light Emitting Diode (OLED) technologies, represents the paradigm shift in the global illumination sector from conventional heat-based lighting to highly efficient semiconductor-based solutions. These devices are characterized by their extended operational life, exceptional energy efficiency, lower heat dissipation, and superior control capabilities, making them foundational components of modern sustainable infrastructure. Product descriptions within this market span across integrated LED lamps, modular fixtures, drivers, and sophisticated sensor-integrated smart lighting systems. The underlying technology relies on electroluminescence to produce light, offering significant environmental and operational advantages over legacy systems.

Major applications of SSL devices are highly diverse, ranging from general illumination in residential and commercial buildings to highly technical uses in industrial environments, medical facilities, automotive systems, and outdoor public spaces like streetlights and architectural lighting. The inherent flexibility and low maintenance requirements of SSL devices make them ideal for large-scale municipal deployment, forming the backbone of smart city initiatives focused on optimizing energy expenditure and enhancing public safety through adaptive lighting. Benefits include substantial reductions in electricity consumption (up to 80% compared to incandescent bulbs), minimized maintenance costs due to longer device life, improved light quality, and the ability to interface seamlessly with digital control networks for dynamic lighting management.

Driving factors for the market include stringent regulatory standards imposed by governments worldwide promoting energy-efficient lighting, such as the phasing out of inefficient bulbs. Economic incentives, rebates, and subsidies provided to businesses and consumers for adopting LED technology further accelerate penetration. Moreover, the increasing demand for advanced features like tunable white light, human-centric lighting (HCL), and seamless integration with IoT platforms for remote monitoring and predictive failure analysis are fueling innovation and market expansion. The continuous decrease in the price per lumen output, achieved through manufacturing scale and technological refinement, makes SSL devices an increasingly attractive investment for both new construction and retrofitting projects globally.

SSL Devices Market Executive Summary

The SSL Devices Market demonstrates robust growth trajectory, propelled by critical business trends focusing on sustainability and digitalization. Key strategic shifts include the move from simple product sales to offering Lighting-as-a-Service (LaaS) models, enabling enterprises to manage lighting infrastructure without large upfront capital expenditure, thereby broadening market access. Furthermore, market consolidation is observed, with major players aggressively acquiring specialized component manufacturers and software companies to enhance their smart lighting portfolio and vertical integration capabilities. Business trends highlight increasing collaboration between semiconductor manufacturers and AI analytics firms to develop self-optimizing lighting systems capable of dynamic environmental response and predictive maintenance, ensuring high operational uptime and maximized energy savings for large installations.

Regionally, the Asia Pacific (APAC) continues to dominate the market in terms of production and consumption, driven by rapid urbanization, significant infrastructure development, and supportive government policies promoting LED adoption in countries like China and India. North America and Europe, however, lead in the adoption of high-value, smart, networked lighting solutions, driven by sophisticated smart home penetration rates and high energy costs encouraging rapid retrofitting in commercial sectors. These mature markets prioritize interoperability standards and cybersecurity within connected lighting environments. The Middle East and Africa (MEA) and Latin America are emerging as high-growth regions, driven by large-scale commercial real estate developments and significant investments in smart city foundational projects.

Segment trends underscore the burgeoning demand for networked and connected lighting systems, particularly within the commercial and industrial segments where Return on Investment (ROI) from energy savings is rapid and substantial. The shift from basic LED bulbs (low-end segment) towards integrated smart fixtures (high-end segment) featuring embedded sensors (occupancy, daylight harvesting, temperature) and communication modules (Bluetooth Mesh, Zigbee, Wi-Fi) is highly evident. Component-wise, the market is seeing innovation in high-efficiency LED drivers and advanced thermal management solutions (heat sinks), which are critical for ensuring device longevity and performance, thus driving down the total cost of ownership (TCO) for end-users and solidifying segment growth across various application sectors.

AI Impact Analysis on SSL Devices Market

Common user inquiries regarding the impact of Artificial Intelligence on the SSL Devices Market frequently revolve around optimizing energy use, enhancing user experience through personalized illumination, and automating maintenance processes. Users are specifically concerned with how AI algorithms can interpret sensor data (occupancy, natural light levels, movement patterns) in real-time to adjust light output dynamically, thereby maximizing efficiency beyond simple daylight harvesting. They also question the capability of AI to manage vast, complex networks of thousands of connected fixtures in large commercial buildings or city-wide street lighting grids, ensuring seamless integration, cybersecurity, and predictive failure analysis without human intervention.

The integration of AI fundamentally transforms SSL systems from mere energy-saving lights into intelligent data-generating platforms. By employing machine learning models, these systems can analyze historical usage data and immediate environmental conditions to predict optimal lighting scenarios, leading to significant energy reductions often exceeding passive control systems. Furthermore, AI enables human-centric lighting (HCL) by subtly adjusting color temperature and intensity based on circadian rhythms, improving productivity and well-being in office and educational settings. The core thematic concern summarized from user interest is the shift from manual or rule-based lighting control to fully autonomous, self-learning, and self-diagnosing illumination networks, promising unprecedented levels of efficiency and personalization.

- AI optimizes energy consumption by predicting occupancy patterns and natural light availability, dynamically reducing light output in real-time without compromising visibility or comfort.

- Predictive maintenance schedules are generated by AI analyzing component performance data (e.g., driver current, temperature spikes), significantly reducing unexpected failures and maintenance costs.

- AI facilitates advanced human-centric lighting (HCL) systems by analyzing time of day and user activity to automatically adjust color temperature (tunable white) and intensity, supporting natural circadian rhythms.

- Machine learning algorithms enhance cybersecurity by detecting unusual usage patterns or unauthorized access attempts within connected lighting networks (IoLT - Internet of Lighting Things).

- AI simplifies commissioning and setup processes in large installations by auto-discovering fixtures and self-calibrating light levels, minimizing technician effort and installation time.

- Advanced image processing capabilities enable SSL devices to contribute to smart city management through integrated traffic flow monitoring, anomaly detection, and public safety applications.

DRO & Impact Forces Of SSL Devices Market

The dynamics of the SSL Devices Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively representing the impact forces shaping its evolution. The primary drivers are rooted in global sustainability goals and the inherent superior performance of SSL technology. Government regulations, such as mandatory efficiency standards and global initiatives to ban inefficient lighting sources, compel rapid adoption across industrial and commercial sectors. Simultaneously, the accelerating integration of IoT technology is creating high demand for connected lighting devices, which serve not only as illuminators but also as data hubs, leveraging existing infrastructure for broader smart building applications. These forces ensure continuous market momentum and technological advancement.

Restraints, however, pose challenges, particularly the high initial capital expenditure (CAPEX) required for large-scale retrofitting projects compared to cheaper, traditional alternatives, although this cost disparity is rapidly narrowing. Issues related to standardization and interoperability also constrain growth; the diversity of communication protocols (Zigbee, DALI, Bluetooth Mesh) and proprietary ecosystems makes integration complex for end-users seeking universal smart solutions. Furthermore, the perceived technical complexity of advanced networked lighting systems, requiring specialized installation and maintenance expertise, sometimes acts as a barrier to widespread deployment in smaller enterprises or less technologically mature regions, necessitating simplified user interfaces and robust plug-and-play solutions.

Opportunities for market expansion are significant, particularly through the development of specialized applications. The emergence of Li-Fi (Light Fidelity) technology, which uses visible light communication for wireless data transmission via SSL fixtures, presents a revolutionary avenue for secure, high-speed indoor networking, especially in RF-sensitive environments. Furthermore, rapid growth in the horticultural sector utilizing customized spectrum LED grow lights promises high-margin revenue streams. Impact forces, therefore, lean heavily towards accelerating technological maturity and regulatory pressure, positioning the SSL market as one of high innovation where successful navigation of standardization challenges will unlock exponential growth, particularly within the interconnected environment of future smart cities and industrial automation.

Segmentation Analysis

The SSL Devices Market is extensively segmented based on product type, component, application, and end-use, allowing for detailed analysis of market dynamics and targeted strategic investment. Product segmentation identifies whether the device is a replacement lamp (retrofit market) or an integrated fixture (new construction/major renovation), with the latter segment showing higher value growth due to embedded smart technologies. Component segmentation provides insight into the supply chain, focusing on critical elements like LED chips (wafers, dies), drivers (power electronics), optics, and thermal solutions. This detailed segmentation is vital for manufacturers optimizing their supply chains and competitive positioning across the value spectrum, from raw material sourcing to final product assembly and distribution.

Application and end-use segmentation are crucial for understanding demand patterns. Key applications include general lighting (the largest volume segment), automotive lighting, specialty lighting (medical, explosion-proof), and backlighting for displays. End-use categories—such as residential, commercial (office, retail), industrial (factories, warehouses), and outdoor/municipal—reveal specific requirements regarding lumen output, ingress protection (IP ratings), and control system complexity. The commercial and industrial sectors consistently drive the highest value growth due to large installation sizes and stringent requirements for energy efficiency compliance and integration with Building Management Systems (BMS), driving demand for sophisticated, networked SSL devices.

- By Product Type:

- Replacement Lamps (Bulbs)

- Integrated Fixtures (Luminaires)

- Light Engines and Modules

- By Component:

- LED Chips/Packages

- LED Drivers and Control Gear

- Heat Sinks and Thermal Management Solutions

- Optics (Lenses and Reflectors)

- By Application:

- General Illumination (Residential, Commercial, Industrial)

- Automotive Lighting (Headlights, Interior)

- Specialty Lighting (Horticulture, Medical, Entertainment)

- Display Backlighting

- By Installation Type:

- New Installation

- Retrofit/Replacement

- By Connectivity:

- Non-Connected

- Connected (Smart Lighting)

Value Chain Analysis For SSL Devices Market

The value chain of the SSL Devices Market is complex and highly specialized, beginning with upstream analysis focused on raw materials and fundamental component manufacturing. This stage involves the production of sapphire and silicon carbide substrates, semiconductor chips (epitaxial growth, wafer fabrication), and packaging materials. Key activities at this initial stage include R&D for improving luminous efficacy and reducing manufacturing defect rates. A small number of highly specialized companies, primarily concentrated in Asia, dominate the high-precision LED chip manufacturing segment, dictating the cost structure for subsequent downstream processes. Maintaining technological leadership in chip efficiency is paramount at this upstream stage to capture maximum value.

Midstream activities involve the assembly and integration of components: packaging the LED chips into modules, manufacturing the specialized LED drivers (which handle power conversion and control), and fabricating the thermal management systems (heat sinks). The value then progresses to the downstream segment, which focuses on the design and assembly of final lighting fixtures, optical design, and integrating communication technologies for smart functionality. This stage is characterized by intense competition among fixture manufacturers who differentiate themselves through design aesthetics, durability (IP ratings), and system integration capabilities (BMS compatibility).

Distribution channels for SSL devices are multifaceted, encompassing both direct and indirect routes. Large commercial and municipal projects often rely on direct distribution through manufacturers' sales teams or specialized electrical distributors/contractors who provide installation and maintenance services (indirect channel). The retail and residential markets are predominantly served through large big-box retailers, e-commerce platforms, and wholesale electrical suppliers (indirect channels). Direct channels are critical for capturing large governmental tenders and complex industrial orders where bespoke engineering solutions are required, ensuring quality control and specific project requirements are met, while indirect channels maximize market reach and volume sales, particularly for standardized products like retrofit bulbs. The efficiency of this distribution network is crucial for controlling inventory and reaching diverse end-users quickly.

SSL Devices Market Potential Customers

Potential customers for the SSL Devices Market span a wide array of sectors, reflecting the ubiquitous nature of illumination needs coupled with a global mandate for energy efficiency. The largest and most influential buyer segment includes commercial real estate owners and facility managers who seek high-performance, low-maintenance lighting solutions for office buildings, shopping centers, and hospitality venues. These customers prioritize Total Cost of Ownership (TCO) reduction, rapid ROI from energy savings, and integration capabilities with sophisticated Building Management Systems (BMS) for centralized control and optimization. The purchasing decision here is heavily influenced by quality certifications, warranty duration, and vendor reputation for large-scale system deployments.

Another major segment constitutes municipal and governmental bodies, particularly those involved in smart city planning and public infrastructure management. These entities are the primary buyers of robust, weather-resistant outdoor SSL fixtures (streetlights, tunnel lights) often equipped with advanced sensors for adaptive lighting, traffic monitoring, and public safety applications. Their purchasing criteria often include adherence to specific public sector procurement guidelines, longevity guarantees, and the capability of the systems to integrate into city-wide, wireless control networks. Residential consumers represent the volume market for retrofit lamps, driven primarily by price point, immediate energy savings, and ease of installation, increasingly favoring smart home compatibility features like voice control and smartphone application management for convenience and personalized lighting scenes.

Furthermore, specialized industrial sectors represent high-value potential customers. These include the automotive industry (for high-performance exterior and interior LED modules), the healthcare sector (requiring specific, often sterile, and highly controlled lighting for operating rooms and patient care), and the rapidly expanding agriculture/horticulture sector (utilizing spectral-specific LED grow lights to maximize crop yield and quality in controlled environment agriculture, or CEA). Each of these specialized end-users demands products tailored to unique operational and biological requirements, often requiring customized spectral outputs, extreme durability, or specialized optical designs, making them highly profitable niches within the broader SSL market ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.2 Billion |

| Market Forecast in 2033 | USD 138.7 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cree LED, OSRAM, Samsung, LG Innotek, Nichia, Everlight Electronics, Seoul Semiconductor, Broadcom, Lumileds, ROHM Semiconductor, Toshiba, Signify (Philips Lighting), GE Current, Acuity Brands, Hubbell Lighting, Heliospectra, Bridgelux, Cooper Lighting Solutions, Dialight, LITE-ON Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SSL Devices Market Key Technology Landscape

The technological landscape of the SSL Devices Market is characterized by continuous innovation in material science, semiconductor design, and digital connectivity protocols. At the core is the LED chip technology, which is rapidly moving towards achieving higher efficacy—lumens per watt—through advancements in epitaxial growth techniques, substrate materials (moving beyond sapphire to silicon carbide or gallium nitride on silicon, GaN-on-Si), and quantum dot technology for enhanced color rendering and spectral tuning. Miniaturization, specifically through Chip Scale Packages (CSP) and Micro-LEDs, is another significant trend, allowing for higher power density and integration into smaller form factors, crucial for applications like display backlighting and automotive headlamps. These material and structural improvements are fundamental to extending product lifespan and increasing overall energy savings.

Beyond the light source itself, the power electronics and control systems define the modern SSL device landscape. The development of highly efficient, smaller, and programmable LED drivers is critical. These drivers incorporate advanced features such as dimming control (e.g., Pulse Width Modulation or Constant Current Reduction), thermal protection, and power factor correction to maximize system reliability and efficiency. Furthermore, the integration of sensors—including ambient light sensors, passive infrared (PIR) sensors for occupancy detection, and acoustic sensors—directly into the fixture facilitates intelligent, localized control. This sensor integration transforms the SSL device into a multifunctional node capable of gathering environmental data, a key requirement for IoT and smart city deployment architectures.

Connectivity standards are arguably the most dynamic technological segment. While traditional wired protocols like DALI (Digital Addressable Lighting Interface) remain essential for large commercial and industrial installations, wireless protocols are rapidly gaining dominance. Bluetooth Mesh is emerging as a powerful, scalable technology for establishing large-scale, self-healing networks within buildings, enabling device-to-device communication without requiring complex centralized hubs. Other key technologies include Zigbee, Z-Wave, and dedicated Wi-Fi standards optimized for low-power consumption. The adoption of open API platforms and robust data encryption standards is crucial, ensuring seamless interoperability across different vendor ecosystems and addressing heightened concerns regarding data security in connected lighting infrastructure.

Regional Highlights

The Asia Pacific (APAC) region stands as the dominant force in the SSL Devices Market, leading both in manufacturing volume and market consumption. Countries such as China, South Korea, and Taiwan are global hubs for LED chip production and packaging, benefiting from significant government subsidies, mature supply chains, and large-scale manufacturing capacity which drives down unit costs worldwide. Market growth within APAC is intensely driven by rapid urbanization, massive infrastructural investments (e.g., smart city developments in China and India), and aggressive regulatory transitions away from conventional lighting, creating a vast retrofit and new installation demand. APAC is also seeing the fastest uptake of basic and mid-range SSL products, although high-end smart lighting adoption is also accelerating in mature economies like Japan and Australia.

North America and Europe represent the mature, high-value segments of the market, characterized by early adoption of sophisticated smart lighting and networked systems. In these regions, the emphasis is heavily placed on energy management legislation, high energy costs justifying higher initial investment in premium SSL solutions, and advanced building standards (e.g., LEED certification). North America, driven by residential smart home penetration and large commercial office retrofits, focuses on integration with existing IT infrastructure and sophisticated control interfaces. European markets, particularly Germany and the UK, prioritize environmental performance, standardization (e.g., EU Ecodesign regulation), and human-centric lighting solutions tailored for enhanced workplace productivity and well-being.

Emerging regions, including Latin America (LATAM) and the Middle East and Africa (MEA), are experiencing accelerated market expansion. MEA growth is primarily fueled by extensive construction projects, large-scale luxury real estate development, and ambitious national visions for sustainable urban development, such as those in the UAE and Saudi Arabia, which necessitate the deployment of cutting-edge, energy-efficient lighting systems for monumental projects. LATAM markets are driven by infrastructural modernization and energy policy shifts, often bypassing older conventional technologies and moving directly to LED solutions in a process known as "leapfrogging," particularly in public lighting and new residential construction sectors. While smaller in scale, these regions present significant long-term opportunities for premium and connected SSL providers.

- Asia Pacific (APAC): Dominates manufacturing and volume consumption; driven by urbanization, smart city initiatives, and high production efficiency in China, South Korea, and Taiwan.

- North America (NA): Leads in high-value smart lighting adoption; strong demand from commercial retrofits, high residential smart home penetration, and focus on BMS integration.

- Europe: High regulatory environment promoting efficiency (Ecodesign); strong emphasis on Human-Centric Lighting (HCL) and standardized protocols like DALI; major markets include Germany, UK, and France.

- Middle East and Africa (MEA): High growth potential driven by mega-projects, luxury construction, and foundational smart city investments, particularly in the Gulf Cooperation Council (GCC) countries.

- Latin America (LATAM): Emerging market characterized by rapid modernization of public infrastructure and residential sectors, often adopting SSL directly over traditional technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SSL Devices Market.- Signify (Philips Lighting)

- Cree LED

- OSRAM (AMS OSRAM)

- Nichia Corporation

- Samsung Electronics Co., Ltd.

- LG Innotek

- Seoul Semiconductor Co., Ltd.

- Lumileds Holding B.V.

- Everlight Electronics Co., Ltd.

- Bridgelux, Inc.

- Acuity Brands, Inc.

- Hubbell Lighting, Inc.

- GE Current, a Daintree Company

- ROHM Semiconductor

- Toshiba Corporation

- Broadcom Inc.

- Dialight plc

- LITE-ON Technology Corporation

- Zumtobel Group AG

- Fagerhult AB

Frequently Asked Questions

Analyze common user questions about the SSL Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption rate of SSL devices globally?

The primary driver is global energy efficiency mandates and the substantial reduction in operational costs achievable through SSL technology. SSL devices, particularly LEDs, consume up to 80% less energy than conventional lighting, offering rapid Return on Investment (ROI) for commercial and municipal entities.

How is IoT integration impacting the future of the SSL Devices Market?

IoT integration transforms SSL devices into connected, data-gathering nodes, enabling sophisticated smart lighting systems. This integration supports advanced features like predictive maintenance, real-time remote control, location-based services, and seamless interface with Building Management Systems (BMS), driving the high-value segment.

What are the main constraints hindering the exponential growth of connected SSL systems?

The main constraints include high initial capital expenditure (CAPEX) for sophisticated networked installations and challenges related to standardization and interoperability, as a multitude of competing wireless protocols (Bluetooth Mesh, Zigbee, DALI) complicates seamless system integration across different vendor products.

Which regional market holds the leading position in terms of SSL device manufacturing and consumption?

The Asia Pacific (APAC) region leads both global manufacturing volume and consumption due to concentrated supply chains, mature production facilities (especially in China and South Korea), rapid urbanization, and extensive government support for energy-efficient infrastructure deployment.

What role does Artificial Intelligence (AI) play in enhancing SSL device performance?

AI enhances SSL performance by employing machine learning algorithms to optimize energy consumption based on predicted occupancy and daylight levels. AI also facilitates human-centric lighting (HCL) adjustments and enables predictive fault detection within complex networked lighting ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager