Stable Isotope Analyzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437429 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Stable Isotope Analyzer Market Size

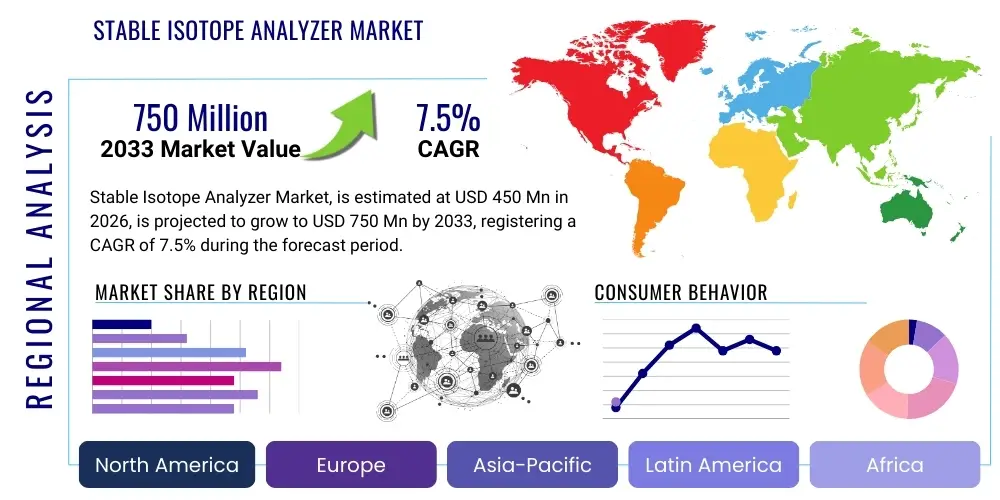

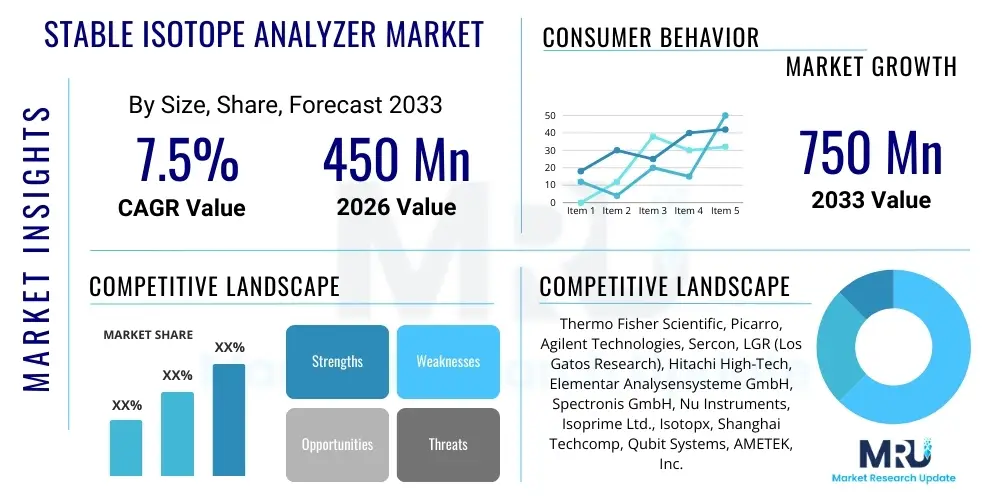

The Stable Isotope Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Stable Isotope Analyzer Market introduction

The Stable Isotope Analyzer Market encompasses advanced analytical instrumentation utilized for measuring the relative abundance of stable isotopes of elements such as carbon, hydrogen, oxygen, nitrogen, and sulfur within various matrices. These high-precision instruments, primarily based on Isotope Ratio Mass Spectrometry (IRMS) or increasingly on laser absorption spectroscopy (LASS), provide crucial insights into chemical, physical, and biological processes by analyzing subtle variations in isotopic composition. The primary product portfolio includes continuous flow IRMS systems, gas source IRMS, and laser-based cavity ring-down spectroscopy (CRDS) analyzers, each tailored for specific sample types and required sensitivities.

Major applications of stable isotope analyzers span diverse fields, including environmental monitoring (e.g., climate change studies, water resource management), food authenticity and provenance testing (e.g., verifying the origin of agricultural products), medical diagnostics (e.g., metabolic rate studies, breath tests), and forensic science (e.g., tracing illicit substances). The increasing global focus on environmental forensics, coupled with stringent regulatory requirements concerning food safety and traceability, has significantly amplified the demand for these sophisticated analytical tools. Their capability to deliver non-destructive and highly accurate measurements across a broad range of sample materials, from gases and liquids to solids, underpins their critical role in modern research and industrial quality control.

Driving factors for market expansion include substantial investments in climate research and geological studies globally, the escalating need for rapid and high-throughput isotopic analysis in industrial settings, and continuous technological advancements resulting in smaller, more portable, and easier-to-use instruments. Furthermore, the rising awareness regarding stable isotopes' utility in understanding biogeochemical cycles and developing novel therapeutic approaches in the pharmaceutical sector further catalyzes market growth. The inherent benefits of stable isotope analysis, such as high sensitivity, accuracy, and the provision of unique, unalterable chemical fingerprints, ensure sustained adoption across academic, governmental, and commercial laboratories.

Stable Isotope Analyzer Market Executive Summary

The Stable Isotope Analyzer Market is poised for robust expansion driven by converging trends in environmental preservation, food chain integrity, and advanced scientific research. Business trends indicate a shift towards highly integrated, automated systems capable of continuous, real-time analysis, particularly leveraging laser-based technologies which offer superior portability and reduced operational complexity compared to traditional Mass Spectrometry (MS) approaches. Manufacturers are strategically focusing on developing hybrid instruments that combine isotopic analysis with other spectrometric techniques to offer multi-functional platforms, enhancing versatility and reducing capital expenditure for end-users. Consolidation and strategic partnerships among technology providers and specialized application developers are also accelerating market penetration in emerging economies.

Regional trends highlight North America and Europe as dominant markets, primarily due to established research infrastructures, significant governmental funding for environmental and climate research, and the presence of leading key market players. However, the Asia Pacific region, particularly countries like China and India, is projected to register the fastest growth rate. This rapid growth is fueled by increasing investments in food testing laboratories, expanding industrial application of isotopic tracing in chemical manufacturing, and burgeoning academic research activities focused on water resources and agricultural optimization. Latin America and MEA are seeing gradual adoption, particularly in geological exploration and forensic applications.

Segment trends reveal that the Technology segment is witnessing a rapid adoption of Laser-Based Analyzers, driven by their lower maintenance requirements and suitability for field deployment, although Isotope Ratio Mass Spectrometry (IRMS) maintains dominance in applications requiring ultra-high precision (e.g., geochronology). Within the Application segment, Environmental and Climate Research remains the largest consumer, while Food and Beverage Testing is emerging as the fastest-growing application due to stringent global food fraud detection initiatives. End-user segmentation shows that Academic and Research Institutions are core purchasers, but commercial entities, including pharmaceutical and contract testing organizations, are rapidly increasing their share due to the commercialization of isotope-based analytical services.

AI Impact Analysis on Stable Isotope Analyzer Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the efficiency and interpretation of complex stable isotope data. Common concerns revolve around automating spectral processing, ensuring data quality control, and accelerating the correlation of isotopic signatures with real-world phenomena (e.g., linking water isotope ratios to regional climate models or food isotope profiles to geographical origin). The key expectation is that AI will move stable isotope analysis from a highly specialized, manual interpretation process to a scalable, automated system capable of handling large, multi-dimensional datasets generated by modern high-throughput analyzers, thereby democratizing the technology and improving the speed of discovery in climate science, forensics, and food authenticity verification.

- AI algorithms facilitate automated peak identification and spectral deconvolution in complex samples, significantly reducing manual data processing time.

- Machine learning models are employed for advanced predictive modeling, correlating stable isotope ratios with environmental, geographical, or metabolic markers with higher accuracy than traditional statistical methods.

- AI enhances system calibration and maintenance through predictive failure analysis, ensuring optimal performance and minimal downtime for sophisticated IRMS instruments.

- Integration of ML into quality assurance processes allows for real-time monitoring of measurement stability and automated flagging of anomalous data points, improving data reliability.

- Deep learning aids in the development of extensive global isotopic databases (isoscapes), enabling faster and more accurate geographical provenance determination for food and forensic samples.

DRO & Impact Forces Of Stable Isotope Analyzer Market

The stable isotope analyzer market dynamics are shaped by powerful drivers such as escalating global concerns regarding environmental pollution and climate change, which necessitate high-resolution monitoring tools. Significant governmental and institutional funding directed towards Earth system science and ecological research acts as a major catalyst. Furthermore, the increasing incidences of food fraud and the resulting regulatory push for detailed supply chain traceability across developed and developing nations bolster the adoption of isotopic fingerprinting technologies. These drivers collectively create a sustained demand base across academic, governmental, and commercial sectors, particularly favoring non-destructive, high-precision analytical methods.

Restraints, however, temper this growth trajectory. The initial capital investment required for high-end instruments, especially Isotope Ratio Mass Spectrometers (IRMS), is substantial, presenting a significant barrier to entry for smaller laboratories and research institutions in resource-constrained regions. Furthermore, the operation and maintenance of these complex analytical systems require highly skilled technical personnel, a specialized workforce that is often scarce, contributing to higher operational expenditures. Though laser-based analyzers offer a lower cost of ownership, overcoming the perception that only IRMS provides definitive precision remains a challenge in certain niche applications.

Opportunities for market expansion are abundant, particularly through technological innovation and application diversification. The development of miniaturized, portable, and field-deployable analyzers (especially those utilizing laser technologies) opens new avenues in remote environmental monitoring and on-site industrial quality control. Expanding the application scope into clinical diagnostics, leveraging stable isotope breath tests for rapid disease detection, represents a high-growth potential area. The increasing global regulatory emphasis on carbon accounting and greenhouse gas flux measurement also creates significant untapped potential for advanced stable isotope monitoring systems. These external forces exert a strong, positive impact on market evolution, pushing manufacturers towards greater automation and accessibility.

Segmentation Analysis

The Stable Isotope Analyzer Market is systematically segmented based on technology employed, the specific application domain, and the ultimate end-user utilizing the analytical output. This granular segmentation aids in understanding specific market needs and technological preferences across different sectors. The technology classification distinguishes between high-precision, established methods (IRMS) and newer, high-throughput, and portable methods (Laser-Based Analyzers). The application segment highlights the diverse utility of these tools, ranging from pure research to regulatory compliance. Analyzing these segments helps stakeholders tailor product development and marketing strategies to address specialized requirements for sensitivity, throughput, and operational ease.

- By Technology

- Isotope Ratio Mass Spectrometry (IRMS)

- Laser-Based Analyzers (CRDS, OA-ICOS, etc.)

- Others (e.g., specialized Atomic Absorption Spectroscopy)

- By Application

- Environmental & Climate Research (Hydrology, Paleoclimatology, Greenhouse Gas Monitoring)

- Geosciences & Geochronology (Petroleum Exploration, Mineral Tracing)

- Food & Beverage Testing (Authenticity, Provenance, Adulteration Detection)

- Medical & Pharmaceutical (Metabolic Studies, Clinical Diagnostics)

- Forensics & Doping Control

- Agriculture & Ecology

- By End-User

- Academic and Research Institutions

- Government Agencies & Environmental Regulatory Bodies

- Contract Testing Laboratories (CTLs)

- Oil and Gas Companies

- Pharmaceutical and Biotechnology Companies

Value Chain Analysis For Stable Isotope Analyzer Market

The value chain of the Stable Isotope Analyzer Market begins with complex upstream activities involving the sourcing and processing of ultra-high purity components, including specialized vacuum systems, ion sources, mass separation magnets, and sophisticated laser components (in the case of laser-based analyzers). Critical suppliers are those providing high-precision electronics, detection systems, and proprietary software crucial for data acquisition and interpretation. The high technological barriers to entry mean that raw material and component suppliers must adhere to extremely tight tolerances and quality standards, making this upstream segment capital and knowledge-intensive.

Midstream activities primarily involve manufacturing, assembly, and rigorous testing of the analyzer systems. Leading players integrate these complex components, develop proprietary software platforms, and calibrate the instruments for optimal isotopic precision. Research and Development (R&D) plays a dominant role here, focusing on improving instrument resolution, miniaturization, and automation capabilities. The specialized nature of the instrumentation dictates that manufacturing often involves cleanroom conditions and highly controlled assembly processes to maintain the vacuum integrity and optical alignment essential for accurate isotope analysis.

Downstream activities include distribution, sales, installation, training, and extensive post-sale technical support and maintenance. Distribution channels are typically a mix of direct sales forces for major academic and government contracts, and specialized regional distributors capable of providing localized technical support. Due to the complexity and high cost, installation often requires specialized manufacturer engineers. Direct channels are preferred for highly customized or high-value IRMS systems, ensuring close client relationships and tailored service agreements. Indirect channels through regional partners are more common for standardized, laser-based systems targeting broader industrial or educational markets. Ongoing service contracts, including calibration and software updates, form a crucial component of recurring revenue in the downstream segment.

Stable Isotope Analyzer Market Potential Customers

The primary consumers of stable isotope analyzers are institutions and organizations requiring definitive elemental tracing and authentication capabilities across various scientific and regulatory domains. Academic research institutions, including university geology, chemistry, and environmental science departments, constitute a cornerstone of the market, purchasing instruments for fundamental research and thesis work. Government agencies, particularly those focused on environmental protection (EPA, equivalent bodies), water resource management, and national security (forensics, customs), represent high-value customers due to mandated monitoring programs.

The rapidly growing segment of potential customers includes commercial contract testing laboratories (CTLs) specializing in food and beverage authenticity verification. As global trade increases and food fraud risks rise, companies require robust isotopic fingerprinting to assure consumer safety and regulatory compliance. Furthermore, the oil and gas sector utilizes these instruments extensively for subsurface exploration, tracing the origin and maturity of hydrocarbons, making geological survey organizations and major energy companies significant buyers. Finally, the niche but expanding medical sector uses analyzers for advanced metabolic research and non-invasive diagnostic breath tests, positioning specialized clinical laboratories and pharmaceutical R&D centers as emerging potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Picarro, Agilent Technologies, Sercon, LGR (Los Gatos Research), Hitachi High-Tech, Elementar Analysensysteme GmbH, Spectronis GmbH, Nu Instruments, Isoprime Ltd., Isotopx, Shanghai Techcomp, Qubit Systems, AMETEK, Inc., Teledyne Leeman Labs, Extrel CMS, Bruker Corporation, Shimadzu Corporation, PerkinElmer, LECO Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stable Isotope Analyzer Market Key Technology Landscape

The technological landscape of the Stable Isotope Analyzer Market is dominated by two primary methodologies: Isotope Ratio Mass Spectrometry (IRMS) and Laser-Based Isotope Analyzers. IRMS remains the gold standard, offering unparalleled precision (often below 0.1 permil) necessary for high-stakes applications like paleoclimatology, geochronology, and medical tracing where minute isotopic shifts are critical. Modern IRMS systems focus on continuous-flow capabilities, integrating peripherals like elemental analyzers, gas chromatographs, and water preparation systems to automate sample introduction and increase throughput. Advancements in detector technology and vacuum systems are continuously pushing the boundaries of detection limits and stability.

In contrast, Laser-Based Analyzers, primarily utilizing Cavity Ring-Down Spectroscopy (CRDS) and Off-Axis Integrated Cavity Output Spectroscopy (OA-ICOS), represent the disruptive technology segment. These systems are characterized by their smaller footprint, lower power consumption, superior portability, and ability to provide real-time, in-situ measurements, particularly for atmospheric gases and water isotopes. While they typically offer slightly lower precision than benchtop IRMS systems, their speed, ruggedness, and reduced cost of ownership make them ideal for field environmental monitoring, process control in industrial settings, and widespread deployment in large-scale sensor networks. The intense R&D focus in this area aims to close the precision gap with IRMS while expanding the range of detectable elements.

The evolving technology environment also includes enhanced data processing capabilities and software integration. Manufacturers are increasingly incorporating user-friendly interfaces, automated calibration routines, and robust data management systems compatible with cloud storage and advanced statistical packages. Furthermore, hybrid systems, which combine the pre-concentration capabilities required for IRMS analysis with the rapid measurement capabilities of laser technologies, are beginning to emerge, offering a blend of precision and throughput. This technological dichotomy ensures that the market caters effectively to both high-precision laboratory needs and distributed, rapid-analysis field requirements.

Regional Highlights

Market consumption and growth patterns for stable isotope analyzers exhibit significant regional variation, heavily influenced by local research funding, regulatory environments, and industrial activity. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to massive investments by governmental bodies (such as NASA, NOAA, DOE) in climate change research, extensive geological surveying related to oil and gas exploration, and a highly mature academic research ecosystem focused on environmental and biological sciences. The early adoption of cutting-edge IRMS and the rapid integration of new laser-based technologies solidify this region's leading position.

Europe represents the second-largest market, characterized by stringent European Union regulations governing food safety, traceability (e.g., wine and olive oil provenance), and environmental monitoring (e.g., carbon emissions). Strong government backing for pan-European climate initiatives and a high density of leading analytical instrument manufacturers drive consistent demand across countries like Germany, the UK, and France. The region is particularly advanced in applying isotopic techniques for forensic science and specialized clinical breath testing applications, pushing technological boundaries in low-concentration analysis.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market throughout the projection period. This rapid acceleration is primarily driven by massive infrastructure development, increasing urbanization leading to complex water resource management challenges, and substantial governmental investments in agricultural optimization and food security, particularly in China, India, and Japan. The escalating awareness and action against food fraud, coupled with the establishment of new academic and commercial testing laboratories, creates a burgeoning demand for both high-precision IRMS and portable laser systems in this region.

Latin America (LATAM) and the Middle East & Africa (MEA) constitute smaller but important markets. In LATAM, demand is often tied to large-scale geological exploration for minerals and energy resources, alongside crucial studies on Amazonian ecosystems and climate modeling. MEA growth is concentrated in the Gulf Cooperation Council (GCC) states, where investments in oil and gas exploration (requiring detailed source rock analysis) and water resource management (desalination monitoring and aquifer tracing) necessitate advanced isotopic analysis tools. However, economic volatility and limited research infrastructure pose ongoing challenges to widespread adoption in these regions.

- North America: Market leader, driven by extensive government funding for climate, environmental, and energy research, supported by robust infrastructure and key manufacturer presence.

- Europe: High adoption due to stringent food safety regulations, extensive environmental monitoring programs, and strong academic research collaboration, particularly in forensic science.

- Asia Pacific (APAC): Fastest-growing market, fueled by increasing investments in food traceability, agricultural research, water resource management, and rapidly expanding R&D infrastructure in China and India.

- Latin America (LATAM): Demand concentrated in geological surveying, mining operations, and regional ecosystem studies, with growth dependent on economic stability.

- Middle East & Africa (MEA): Growth driven primarily by oil and gas exploration, hydrocarbon analysis, and critical water management projects, especially in the GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stable Isotope Analyzer Market.- Thermo Fisher Scientific

- Picarro

- Agilent Technologies

- Sercon

- LGR (Los Gatos Research)

- Hitachi High-Tech

- Elementar Analysensysteme GmbH

- Spectronis GmbH

- Nu Instruments

- Isoprime Ltd.

- Isotopx

- Shanghai Techcomp

- Qubit Systems

- AMETEK, Inc.

- Teledyne Leeman Labs

- Extrel CMS

- Bruker Corporation

- Shimadzu Corporation

- PerkinElmer

- LECO Corporation

Frequently Asked Questions

Analyze common user questions about the Stable Isotope Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between IRMS and Laser-Based Stable Isotope Analyzers?

IRMS (Isotope Ratio Mass Spectrometry) is the established method offering the highest precision and accuracy (essential for geochronology and fine resolution studies) but typically requires complex vacuum systems and large capital investment. Laser-Based Analyzers (like CRDS) offer superior speed, portability, lower maintenance, and real-time analysis, making them ideal for field deployment and high-throughput gas monitoring, though often at a slight compromise in ultimate precision.

How are stable isotope analyzers used in ensuring food authenticity and safety?

Analyzers measure the characteristic isotopic ratios of elements (C, H, O, N) in food products, creating an isotopic fingerprint. This fingerprint is correlated with known 'isoscapes' or geographical origin databases. Deviations from expected ratios can conclusively prove adulteration, mixing, or mislabeling of geographical origin, ensuring supply chain integrity and consumer trust.

Which geographical region exhibits the highest growth potential for stable isotope analyzer adoption?

The Asia Pacific (APAC) region is projected to register the fastest compound annual growth rate (CAGR). This acceleration is driven by rapid expansion in food quality testing, increased governmental investment in environmental monitoring infrastructure, and burgeoning academic research activities across major economies like China and India.

What are the primary factors restraining the market growth for stable isotope analyzers?

The key restraining factors include the extremely high initial capital cost associated with purchasing high-resolution instruments (especially IRMS systems) and the ongoing challenge of securing and retaining highly specialized technical personnel required for the complex operation, calibration, and maintenance of these analytical platforms.

What recent technological advances are enhancing the utility of stable isotope analysis?

Key technological advances include the miniaturization and ruggedization of laser-based systems for field use, the integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated data processing and predictive modeling, and the development of continuous-flow interfaces that enable high-throughput analysis of complex liquid and solid matrices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stable Isotope Analyzer Market Statistics 2025 Analysis By Application (Environmental Sciences, Food Analysis, Medical, Industrial), By Type (Stable Isotope Ratio Mass Spectrometer, Laser-based Stable Isotope Analysis), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Stable Isotope Analyzer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stable Isotope Ratio Mass Spectrometer, Laser-based Stable Isotope Analysis), By Application (Environmental Sciences, Food Analysis, Medical, Industrial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager