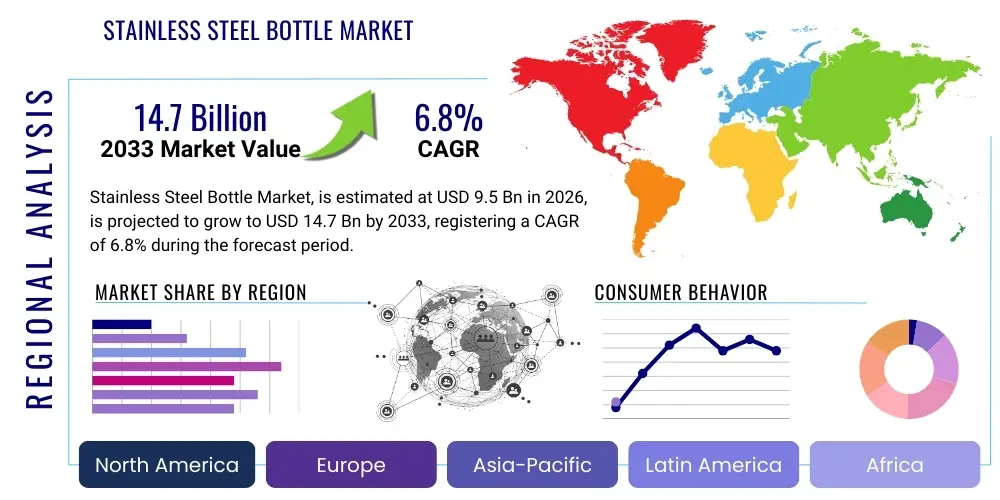

Stainless Steel Bottle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437978 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Stainless Steel Bottle Market Size

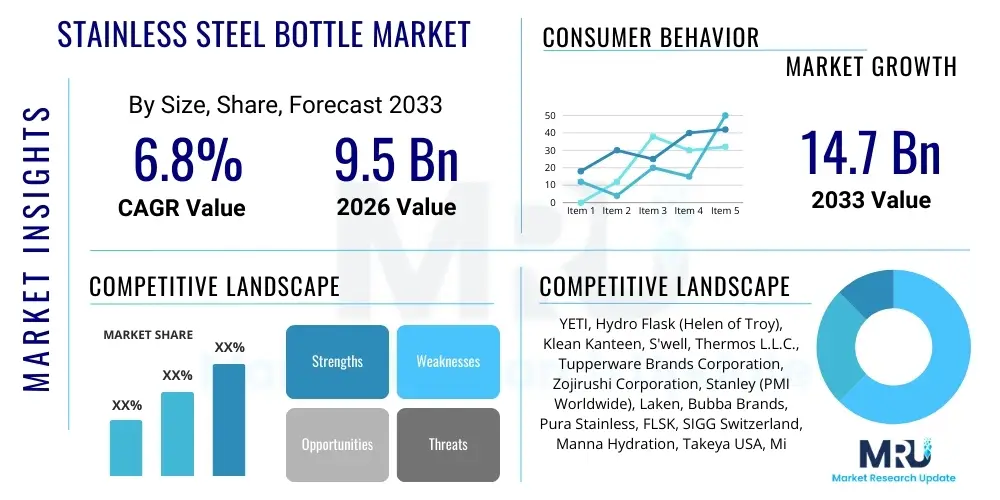

The Stainless Steel Bottle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 14.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally driven by escalating consumer awareness regarding the detrimental effects of single-use plastics, coupled with a surging global emphasis on sustainable living and hydration convenience. The robust mechanical properties and inherent safety features of stainless steel, particularly grades 304 and 316, position these bottles as the preferred, long-term alternative across residential, commercial, and outdoor segments.

Stainless Steel Bottle Market introduction

The Stainless Steel Bottle Market encompasses the production, distribution, and sale of reusable drinking containers primarily manufactured from food-grade stainless steel alloys. These products serve as durable, environmentally friendly alternatives to conventional plastic and glass bottles, offering superior thermal retention capabilities, resistance to corrosion, and longevity. The core product attributes include vacuum insulation technology, various closure mechanisms (screw caps, straw lids, flip tops), and aesthetic customization options, catering to a diverse consumer base ranging from fitness enthusiasts to corporate entities seeking sustainable branding solutions. The market is characterized by intense competition focused on design innovation, material certification, and price efficiency to capture the growing demand for portable hydration.

Major applications of stainless steel bottles span personal hydration, beverage insulation (hot and cold), and corporate merchandising. Key benefits include the elimination of Bisphenol A (BPA) exposure associated with plastics, enhanced thermal performance (keeping liquids hot for 12 hours or cold for 24 hours), reduced ecological footprint through reusability, and hygienic properties that prevent bacterial accumulation and odor retention. These functional advantages reinforce their positioning as a premium item within the broader consumer goods sector, increasingly replacing disposable containers in daily life, schools, offices, and travel scenarios. The perceived value addition often justifies the higher initial cost compared to disposable alternatives.

Driving factors fueling this market expansion include stringent government regulations targeting single-use plastics across various jurisdictions, massive shifts in consumer lifestyle towards health consciousness and fitness, and the proliferation of aesthetically pleasing, design-focused products that appeal to fashion trends. Furthermore, infrastructural development supporting public hydration stations and refill points, especially in developed economies, enhances the practicality and usability of reusable bottles. The strong influence of digital marketing and sustainability campaigns, particularly targeting younger demographics, significantly accelerates the adoption rate, making the stainless steel bottle a cultural symbol of environmental responsibility and modern convenience.

Stainless Steel Bottle Market Executive Summary

The Stainless Steel Bottle Market is currently experiencing transformative business trends characterized by aggressive product diversification, strategic mergers and acquisitions among key market players, and a heightened focus on direct-to-consumer (D2C) and e-commerce distribution models. Companies are prioritizing technological advancements, such as lighter weight designs through advanced forging techniques and integration of smart features like temperature sensors and tracking capabilities, to maintain competitive differentiation. Supply chain resilience, particularly the sourcing of high-grade, certified stainless steel (e.g., 18/8 grade), is a critical success factor, alongside optimizing production processes to reduce manufacturing waste and achieve carbon neutrality targets, thereby aligning corporate strategy with global sustainability mandates.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, increasing disposable incomes in countries like China and India, and governmental policies promoting environmental protection. North America and Europe, however, maintain the largest market share in terms of value, primarily due to high consumer spending power, established retail infrastructure, and mature consumer awareness concerning environmental issues. Regional trends also show a disparity in product preference: North American consumers favor large-capacity, high-performance insulated bottles for outdoor activities, while European and APAC consumers often prefer sleek, smaller-capacity bottles suitable for urban commutes and office environments. Regulatory variances concerning material safety and recycling infrastructure also shape regional market evolution.

Segmentation trends indicate that the vacuum-insulated segment continues to dominate the market due to its superior performance characteristics, particularly in regions with extreme climate variations. Distribution channel analysis reveals a strong pivot towards online retail, driven by logistical efficiencies and broader product visibility, though specialized sporting goods stores and supermarkets remain vital for immediate purchase and brand experience. In terms of end-use, the commercial and institutional segment (including schools, hospitals, and corporate offices purchasing branded bottles) is exhibiting significant growth, reflecting organizational commitments to reduce plastic waste and promote employee wellness. Customization and personalization capabilities across all segments are becoming non-negotiable requirements for market penetration.

AI Impact Analysis on Stainless Steel Bottle Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Stainless Steel Bottle Market predominantly revolve around three critical areas: optimizing the supply chain and manufacturing efficiency, enhancing personalized consumer experiences through predictive analytics, and developing 'smart' bottle functionalities. Consumers and B2B buyers frequently ask how AI can reduce the environmental footprint associated with manufacturing, specifically through waste reduction in steel fabrication and optimizing transportation logistics. There is also significant curiosity about AI’s role in forecasting rapidly shifting consumer preferences for specific colors, designs, and capacities, ensuring that manufacturers can implement just-in-time production, thereby minimizing inventory risks and meeting fluctuating demands with greater precision. The overarching theme is the application of AI to drive both sustainability and operational cost efficiency in a highly competitive, design-driven consumer goods sector.

The implementation of AI and Machine Learning (ML) algorithms is set to revolutionize the supply chain management of stainless steel bottle production. Predictive maintenance, facilitated by AI, ensures optimal performance of specialized machinery used for deep drawing, welding, and vacuum sealing, minimizing downtime and guaranteeing consistent product quality, which is crucial for maintaining thermal integrity. Furthermore, AI-driven demand forecasting leverages historical sales data, social media trends, and macroeconomic indicators to generate highly accurate predictions, allowing companies to manage raw material inventory (stainless steel coils, powder coatings, silicone seals) more effectively, preventing shortages or costly overstocking, particularly in the face of volatile global commodity prices.

At the consumer interaction level, AI significantly enhances marketing effectiveness and product design cycles. Generative AI tools are being utilized to rapidly prototype new aesthetic designs and ergonomic features based on collected user feedback and biometric data, accelerating the time-to-market for innovative products. For e-commerce platforms, AI-powered recommendation engines suggest personalized bottle choices based on usage context (gym, travel, office) and previous purchases, drastically improving conversion rates. Moreover, in future product iterations, AI could manage integration with personal health apps, monitoring hydration goals and advising users, transforming the bottle from a simple vessel into an active health accessory, thereby commanding a higher market price and establishing brand loyalty.

- AI-driven optimization of manufacturing processes to reduce stainless steel waste and energy consumption.

- Predictive maintenance for specialized vacuum insulation and molding equipment, enhancing operational efficiency.

- Advanced demand forecasting using ML to align production schedules with volatile consumer trends (color, capacity).

- Personalized marketing and product recommendation systems boosting e-commerce conversion rates.

- Integration of smart features (hydration tracking, temperature control) managed by embedded AI algorithms.

- Enhanced quality control through computer vision systems detecting microscopic defects in steel surfaces and coatings.

- Optimization of complex global logistics networks to reduce shipping costs and associated carbon emissions.

DRO & Impact Forces Of Stainless Steel Bottle Market

The Stainless Steel Bottle Market is primarily driven by the global imperative for sustainability, spurred by regulations banning single-use plastics and high consumer awareness regarding environmental responsibility. These drivers are complemented by the growing trend of health and wellness, which necessitates convenient, safe, and portable hydration solutions. However, the market faces significant restraints, chiefly the relatively high initial cost of insulated stainless steel bottles compared to ubiquitous plastic alternatives, creating a barrier to entry for low-income segments. Furthermore, intense market competition and the ease with which new entrants can copy designs lead to rapid price erosion and margin pressure. Despite these restraints, substantial opportunities exist in developing specialized, high-performance materials (lighter, stronger steel alloys), expanding into untapped rural and emerging markets, and capitalizing on corporate branding opportunities through high-volume personalized orders. These opportunities, when strategically addressed, can significantly mitigate the existing restraints and leverage the core drivers.

The key impact forces shaping this market dynamic include the accelerating speed of material innovation and design evolution, driven by consumer demand for superior aesthetics and functionality. Social impact forces, particularly influencer marketing campaigns promoting sustainable lifestyle choices on platforms like Instagram and TikTok, exert immense pressure on consumers to adopt reusable products. Economically, fluctuations in global stainless steel and nickel prices directly impact manufacturing costs, requiring companies to implement sophisticated hedging strategies. Environmentally, the push for circular economy models mandates that manufacturers consider end-of-life recycling for their products, necessitating design changes to simplify material separation and reprocessing, thereby impacting production complexity and cost structure.

Successfully navigating these market forces requires a strategic balance between maintaining high product quality (durability and insulation performance) and achieving cost efficiency to remain competitive against cheaper substitutes. The rapid acceptance of reusable culture represents a potent driving force, compelling businesses and institutions to invest in stainless steel solutions. Opportunities exist in expanding product lines beyond traditional water bottles to include insulated food containers and specialized mugs, capturing a broader share of the portable consumption market. Restraints such as supply chain disruptions (like those experienced during global crises) can be mitigated by diversifying sourcing channels and implementing robust inventory management systems, ensuring consistent availability of finished products to meet surging consumer demand across all major geographies.

Segmentation Analysis

The Stainless Steel Bottle Market is meticulously segmented based on product type, capacity, distribution channel, and end-use application, allowing for precise targeting and strategic market penetration. Product segmentation distinguishes between non-insulated single-wall bottles and high-performance vacuum-insulated double-wall bottles, with the latter commanding a premium price due to superior thermal retention. Capacity segmentation caters to specific user needs, ranging from small (under 500 ml) for children and commuting to large (over 1000 ml) favored by athletes and outdoor enthusiasts. Analyzing these segments helps companies tailor their marketing messages and distribution strategies, ensuring optimal alignment between product features and consumer demand across various demographics and geographical regions.

The segmentation by distribution channel is crucial, highlighting the shift from traditional brick-and-mortar stores (supermarkets, hypermarkets, specialized sporting goods outlets) towards online platforms. E-commerce platforms offer global reach and the capability for extensive customization, whereas physical retail provides immediate availability and the consumer’s ability to assess product ergonomics and material feel. End-use segmentation divides the market into residential (personal use), commercial (offices, gyms, cafes), and industrial/institutional (schools, hospitals, manufacturing facilities), each with distinct purchasing criteria related to volume, customization needs, and durability standards. Understanding the unique demands of each segment is vital for designing appropriate packaging, pricing models, and after-sales support services.

Detailed segmentation analysis allows market players to identify niche opportunities, such as lightweight titanium-steel hybrid bottles for high-end mountaineering or ruggedized, specialized bottles designed for construction sites. Furthermore, demographic segmentation (age, income, lifestyle) aids in predicting future consumption patterns; for instance, younger, affluent consumers often prioritize branded, aesthetically appealing designs, while budget-conscious buyers focus primarily on durability and basic thermal functionality. The constant interplay between innovation in insulation technology and evolving design trends means that manufacturers must continuously monitor segmentation shifts to maintain their competitive edge in this rapidly maturing consumer category.

- By Product Type:

- Insulated (Vacuum-Sealed Double Wall)

- Non-Insulated (Single Wall)

- By Capacity:

- Less than 500 ml

- 500 ml to 1000 ml

- More than 1000 ml

- By End-Use Application:

- Residential/Personal Use

- Commercial (Offices, Gyms, Cafes, Travel)

- Institutional (Schools, Hospitals)

- By Distribution Channel:

- Online Retail (E-commerce platforms, Company Websites)

- Offline Retail (Supermarkets, Hypermarkets, Specialty Stores)

Value Chain Analysis For Stainless Steel Bottle Market

The value chain for the Stainless Steel Bottle Market begins with upstream activities centered on the procurement and processing of raw materials. The primary raw material is high-quality, food-grade stainless steel, typically 304 (18/8) or 316, sourced globally from major steel producers. Upstream analysis also includes the acquisition of specialized components such as plastics for lids (PP, Tritan), silicone for seals, and advanced coating materials. Maintaining stringent quality control at this stage is paramount, as the integrity of the steel directly impacts the bottle’s safety, corrosion resistance, and longevity. Manufacturers often engage in long-term contracts with certified material suppliers to ensure consistent quality and manage price volatility associated with global commodity markets, particularly nickel and chrome.

Midstream activities encompass the core manufacturing processes: stamping, deep drawing, hydroforming, welding, surface finishing, and crucially, vacuum sealing for insulated products. Efficiency in vacuum sealing is a major competitive differentiator, as it determines the thermal performance of the final product. Direct distribution involves sales through proprietary e-commerce channels and flagship retail stores, providing higher margin control and direct customer interaction. Indirect distribution relies heavily on partnerships with large e-tailers (Amazon, Alibaba), mass merchandisers, and global sporting goods retailers, which offer vast market reach but necessitate robust logistical management and often involve lower profit margins due to retailer markups. The effective management of both channels is essential for maximizing market penetration and brand visibility across diverse consumer touchpoints.

Downstream analysis focuses on logistics, marketing, branding, and end-user engagement. Effective logistics management is required to handle the volume and fragility of finished products, ensuring safe transit to distribution centers and retail shelves. Marketing efforts focus heavily on AEO-optimized digital content emphasizing sustainability, health benefits, and design aesthetics. Post-sale activities, including warranty services and facilitating product recycling, are increasingly integrated into the value chain as sustainability commitments become central to brand identity. Potential customers are heavily influenced by branding that aligns with environmental and active lifestyle values, making robust marketing and ethical supply chain transparency critical elements that add significant value to the final product perceived by the consumer.

Stainless Steel Bottle Market Potential Customers

The primary segment of potential customers for the Stainless Steel Bottle Market comprises environmentally conscious millennials and Gen Z consumers who prioritize sustainable choices and are willing to pay a premium for reusable goods. These consumers are typically urban dwellers, digitally savvy, and active users of social media, deriving utility not only from the bottle’s function but also from its status as a reflection of their ethical values and lifestyle. They are highly responsive to aesthetic design, customization options, and endorsements from influencers or sustainable certification bodies, making targeted digital marketing and strong brand narratives crucial for capture. This segment drives the demand for high-performance, aesthetically pleasing, and technologically integrated products.

A second major segment includes B2B buyers from corporate, institutional, and organizational sectors. Corporate clients frequently purchase large volumes of customized, branded stainless steel bottles for employee gifts, promotional giveaways, and internal sustainability initiatives. Educational institutions, including universities and schools, are transitioning to reusable bottles as part of campus-wide plastic reduction policies. These institutional buyers prioritize durability, large volume procurement discounts, and compliance with health and safety standards. Their purchasing decisions are driven by long-term cost-effectiveness, organizational commitment to sustainability reporting, and the ability to source consistently high-quality, certified products that enhance the organization's public image.

The third critical customer group encompasses health, fitness, and outdoor enthusiasts. This group demands bottles with highly specific functional requirements, such as extended thermal retention for extreme climates, ruggedized construction for demanding environments, and ergonomic designs suitable for activity-specific holders (e.g., bicycle cages, backpack pockets). Athletes and hikers often seek specialized features like built-in filters, high-flow spouts, and lightweight materials. Manufacturers target this demographic through partnerships with sporting events, endorsements from athletic figures, and distribution through specialized outdoor and fitness retail chains, focusing the marketing narrative on unparalleled performance, durability, and maintaining optimal hydration during prolonged physical exertion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 14.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | YETI, Hydro Flask (Helen of Troy), Klean Kanteen, S'well, Thermos L.L.C., Tupperware Brands Corporation, Zojirushi Corporation, Stanley (PMI Worldwide), Laken, Bubba Brands, Pura Stainless, FLSK, SIGG Switzerland, Manna Hydration, Takeya USA, Mizu, Corkcicle, Iron Flask, Contigo, One Green Bottle |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Bottle Market Key Technology Landscape

The technological landscape of the Stainless Steel Bottle Market is dominated by advanced metal forming and high-efficiency thermal insulation techniques. The core technology involves deep drawing and hydroforming processes, which transform stainless steel sheets into seamless, structurally sound cylindrical shapes, minimizing potential weak points. Precision laser welding is then utilized to join the inner and outer walls of vacuum-insulated bottles, creating a double-walled structure. The most critical technological component is the high-vacuum pumping system used to extract air between the two walls, resulting in a near-perfect vacuum which dramatically minimizes heat transfer via convection and conduction. The longevity of the thermal performance is entirely dependent on maintaining this vacuum seal integrity, leading to continuous research into proprietary sealing mechanisms and getter materials that absorb residual gases over the product's lifespan.

Material science innovation plays a significant role, focusing on developing lighter, yet durable, stainless steel alloys that reduce overall product weight without sacrificing strength or thermal performance. The adoption of advanced powder coating techniques, such as electrostatic powder application, ensures a highly durable, chip-resistant, and aesthetically appealing finish that adheres to stringent food safety standards (FDA approval). Furthermore, recent technological shifts include the integration of antimicrobial coatings and easy-to-clean electro-polished interior surfaces, enhancing the hygienic properties of the bottles and addressing consumer concerns regarding mold and bacteria buildup, further solidifying the product's premium market position compared to inferior materials.

Emerging technologies focus on 'smart' functionality and enhanced user interface. This includes integrating IoT sensors that monitor water temperature, track daily hydration intake, and communicate data wirelessly to smartphone applications. Inductive charging capabilities for smart components, coupled with LED displays that provide real-time thermal readings, are moving from niche features to expected functionalities in high-end models. Furthermore, automation technologies, including robotic assembly and AI-driven quality inspection (detecting vacuum leaks or surface imperfections), are being deployed across major manufacturing facilities to ensure scalability, reduce labor costs, and maintain zero-defect standards for highly technical products like vacuum-insulated stainless steel bottles.

Regional Highlights

- North America: Market Dominance and High Consumer Spending

- Europe: Focus on Sustainability and Design Aesthetics

- Asia Pacific (APAC): Fastest Growth Trajectory and Manufacturing Hub

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Markets

North America, particularly the United States, commands the largest revenue share in the global stainless steel bottle market. This dominance is driven by a strong, established culture of health, fitness, and outdoor activities, which necessitates durable, large-capacity hydration solutions. Key market players, including YETI and Hydro Flask, originated and heavily market in this region, setting high standards for thermal performance and brand-driven consumer loyalty. Furthermore, the region benefits from widespread availability of high-quality retail channels, aggressive anti-plastic campaigns at the municipal level, and affluent consumer demographics willing to invest in premium, high-cost insulated products.

Consumer behavior in North America is highly influenced by active lifestyle trends and corporate branding. The demand for 24- to 40-ounce capacity bottles is particularly strong, reflecting their use in gyms, hiking trails, and long commutes. Regulatory trends, such as city-level bans on plastic water bottles and corporate sustainability mandates, continue to push institutional buyers toward stainless steel alternatives. Manufacturers focus heavily on robust marketing campaigns emphasizing rugged durability and the lifetime warranty offered by many premium brands, positioning the purchase as a long-term investment in sustainability and health, thereby sustaining the region's strong growth trajectory.

The European market is characterized by exceptionally high environmental consciousness and stringent regulations pertaining to plastic waste, particularly the EU Single-Use Plastics Directive. This legislative push is a primary driver for rapid adoption across the continent. European consumers often prioritize sleek design, portability, and minimalist aesthetics suitable for urban commuting and office use, leading to higher demand for smaller to medium capacity (500 ml to 750 ml) bottles. Countries like Germany, the UK, and France are mature markets where reusable culture is deeply ingrained.

Competition in Europe focuses heavily on ethical sourcing and certified supply chains. Brands successful here often highlight their carbon neutrality claims and utilize eco-friendly packaging materials. The market also exhibits a strong preference for high-quality, non-toxic coatings and specialized ergonomic features suitable for active travel. Retail distribution is diversified, with high street retailers, department stores, and specialized outdoor equipment stores playing a major role alongside rapidly growing e-commerce platforms, providing manufacturers multiple avenues for reaching sustainability-focused consumers across Western and Northern Europe.

APAC is projected to be the fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and a burgeoning middle class in countries like China, India, and Southeast Asia. While APAC is a major manufacturing hub for stainless steel bottles, it is also becoming a massive consumer market. Growing public awareness campaigns addressing pollution, particularly in metropolitan areas, are accelerating the shift from cheap disposable options to reusable bottles. The market is highly price-sensitive, balancing the need for quality insulation with cost competitiveness.

Demand in APAC is segmented by usage, with significant growth observed in the institutional sector (schools and universities) and the personal health segment, driven by traditional tea and hot beverage consumption patterns in many Asian cultures, making thermal performance a crucial requirement. Local and regional players leverage their proximity to the supply chain to offer competitive pricing, often posing a challenge to global brands. Strategic investment in localized distribution networks, particularly targeting developing urban centers, is essential for capturing the vast potential consumer base across this diverse regional landscape.

The LATAM and MEA regions represent emerging markets characterized by strong growth potential, primarily driven by increasing tourism, rising health consciousness, and developing retail infrastructure. In LATAM, economic stability and growing awareness of environmental degradation are slowly fostering the adoption of stainless steel bottles, particularly in Brazil and Mexico. The demand is currently concentrated in urban centers and high-end retail channels, with pricing remaining a significant barrier for mass adoption. Local companies are starting to emerge, focusing on regional cultural preferences and competitive pricing strategies.

In the MEA region, the market is driven by extreme climatic conditions, which necessitate high-performance insulated bottles for maintaining cold temperatures, coupled with high per capita spending power in the Gulf Cooperation Council (GCC) countries. Government initiatives promoting sustainable development and large-scale sporting events also stimulate demand for premium, customized products. The institutional segment, particularly hospitals and large corporations, is a significant consumer base in the GCC. Logistical challenges and dependence on imports characterize the supply chain in both LATAM and MEA, requiring robust international distribution partnerships for market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Bottle Market.- YETI

- Hydro Flask (Helen of Troy)

- Klean Kanteen

- S'well

- Thermos L.L.C.

- Zojirushi Corporation

- Stanley (PMI Worldwide)

- Laken

- Bubba Brands

- Pura Stainless

- FLSK

- SIGG Switzerland

- Manna Hydration

- Takeya USA

- Mizu

- Corkcicle

- Iron Flask

- Contigo

- One Green Bottle

- Newell Brands (Contigo)

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Bottle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the current growth of the Stainless Steel Bottle Market?

The primary drivers are global regulatory crackdowns on single-use plastics, rising consumer environmental consciousness, and the increasing consumer preference for durable, non-toxic, and high-performance hydration solutions, especially vacuum-insulated bottles offering superior thermal retention.

How does the segmentation by insulation type affect market value and consumer choice?

The insulated (vacuum-sealed double wall) segment dominates market value due to its superior technology and thermal capabilities, commanding a higher price. Consumers choose insulated options based on the need for extended temperature retention, while non-insulated options are preferred for lightweight, general hydration at a lower cost.

Which geographical region holds the highest market share and why is it dominant?

North America holds the largest revenue share, driven by high consumer purchasing power, a deeply embedded active and outdoor lifestyle culture, strong brand loyalty to premium labels (like YETI and Hydro Flask), and widespread municipal policies aggressively reducing plastic waste.

What role does technology play in the competitiveness of the stainless steel bottle industry?

Technology is crucial for competitive differentiation, particularly through advanced manufacturing techniques (deep drawing, precision vacuum sealing) that enhance durability and thermal efficiency, and emerging integration of smart features (IoT, temperature tracking) to create premium, value-added products.

What are the main supply chain challenges facing manufacturers in this market?

Key challenges include managing the high volatility and pricing of raw materials (stainless steel, nickel), ensuring consistent quality control for vacuum sealing integrity, and navigating complex global logistics to maintain efficient distribution across rapidly expanding international markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager