Stainless Steel Coil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431943 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Stainless Steel Coil Market Size

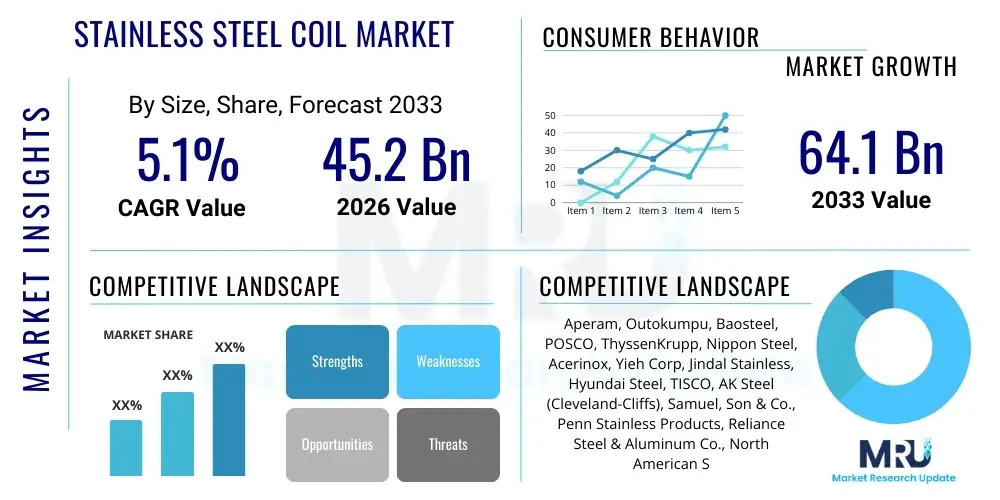

The Stainless Steel Coil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 64.1 Billion by the end of the forecast period in 2033.

Stainless Steel Coil Market introduction

The Stainless Steel Coil Market encompasses the production, distribution, and consumption of various grades of stainless steel in coiled form, which serves as a fundamental input material across numerous heavy and light industries globally. Stainless steel, an iron alloy containing a minimum of 10.5% chromium, is prized for its exceptional corrosion resistance, high tensile strength, and appealing aesthetic qualities, making coils a versatile product used extensively in fabrication processes. The inherent properties of stainless steel, such as its hygienic nature and recyclability, further solidify its indispensable role in modern industrial applications, driving sustained demand globally.

Major applications for stainless steel coils span critical sectors including automotive manufacturing, where coils are essential for exhaust systems and structural components due to their heat and corrosion resistance; construction, utilized in architectural cladding, roofing, and structural support; and consumer goods, particularly in durable domestic appliances like refrigerators and washing machines. Additionally, the increasing focus on advanced infrastructure projects, coupled with strict regulatory standards concerning material longevity and hygiene in the food and beverage and pharmaceutical sectors, continues to bolster the uptake of specific high-grade stainless steel coils. The production process involves hot rolling, followed by cold rolling or annealing to achieve desired thickness and surface finish, ensuring the material meets the stringent quality requirements of end-users.

Driving factors in this market are primarily linked to rapid urbanization and industrialization in emerging economies, necessitating robust infrastructure and residential development. Furthermore, the global transition towards sustainable energy solutions, particularly the construction of solar panels and wind turbine components requiring high durability and corrosion resistance, presents a significant demand opportunity. The inherent benefits, including low maintenance costs and extended operational lifespan compared to conventional steel, reinforce stainless steel coils as the preferred material choice for capital-intensive and long-term projects worldwide, thereby sustaining market momentum through the forecast period.

Stainless Steel Coil Market Executive Summary

The Stainless Steel Coil Market demonstrates resilient growth driven by expanding industrial capacity, particularly in the Asia-Pacific region, which remains the dominant consumer and producer due to massive infrastructure investments and robust manufacturing output. Business trends indicate a continuous shift towards premium and specialized stainless steel grades, such as duplex and super-austenitic variants, necessitated by stricter performance requirements in chemical processing and marine environments. Companies are focusing intensely on optimizing production efficiency, leveraging digital technologies to manage energy costs and raw material volatility, primarily concerning nickel and chromium, which remain significant determinants of profitability and price stability in the global supply chain.

Regional trends highlight a disparity in growth trajectories, with North America and Europe prioritizing lightweighting applications in automotive sectors and sustainability initiatives, driving demand for advanced cold-rolled coils with superior surface finishes. Conversely, the APAC market, led by China and India, is characterized by high volume demand for hot-rolled coils used in large-scale construction and heavy machinery. Segments trends show that the Austenitic segment (300 series) maintains its dominance due to versatility and widespread use in appliances and architecture, although the Ferritic segment (400 series) is gaining traction, particularly in automotive non-structural parts, offering a more stable pricing alternative due to lower or zero nickel content. The major growth application remains general construction and durable goods, with emerging demand concentrated in high-performance piping and medical equipment fabrication.

AI Impact Analysis on Stainless Steel Coil Market

Common user questions regarding AI's impact on the Stainless Steel Coil Market frequently revolve around optimizing complex manufacturing processes, enhancing material quality consistency, and mitigating risks associated with volatile raw material procurement and pricing. Users are keen to understand how AI-driven predictive maintenance can reduce costly unplanned downtimes in hot and cold rolling mills, which operate under extreme conditions. Furthermore, there is significant interest in utilizing AI for advanced demand forecasting across highly fragmented end-user sectors and improving supply chain resilience through real-time logistical optimization. The overarching theme is the pursuit of higher operational efficiency and better material utilization, crucial for maintaining competitiveness in a capital-intensive industry facing global price pressure.

AI technologies, including machine learning and deep learning algorithms, are fundamentally reshaping the operational blueprint of stainless steel manufacturing. These technologies are being deployed extensively in metallurgical processes to monitor and control parameters such as temperature, pressure, and chemical composition during melting and casting, ensuring superior material properties and reducing batch variations. This precision allows producers to meet increasingly tight tolerance specifications required by advanced manufacturing clients, especially in aerospace and medical device production. The implementation of AI-powered systems for flaw detection using high-resolution vision systems during the rolling phase drastically improves quality control, minimizing scrap rates and enhancing overall yield efficiency, thereby offering a competitive edge.

Beyond the factory floor, AI provides critical support for strategic decision-making. Predictive analytics models analyze global commodity markets, geopolitical stability, and energy price fluctuations to optimize raw material hedging strategies, specifically for nickel, molybdenum, and chromium. On the commercial side, AI algorithms process vast amounts of external market data—including infrastructure spending projections and consumer sentiment—to generate highly accurate demand forecasts, allowing coil producers to optimize inventory levels and production schedules. This strategic capability ensures better alignment between supply and dynamic market needs, reducing storage costs and maximizing market responsiveness.

- AI-driven optimization of rolling mill parameters to enhance dimensional accuracy and surface finish.

- Predictive maintenance deployment in critical machinery (e.g., annealing furnaces, pickling lines) to minimize operational downtime.

- Enhanced quality control and automated defect detection using machine vision and deep learning in production lines.

- Advanced market forecasting and raw material price hedging through machine learning algorithms.

- Optimization of complex supply chain logistics, including inventory management and transport route planning.

- Simulation and modeling of new alloy compositions to accelerate material research and development (R&D).

DRO & Impact Forces Of Stainless Steel Coil Market

The Stainless Steel Coil Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and profitability, which are amplified by significant impact forces. Key drivers include the surge in global infrastructure spending, particularly on transportation networks, renewable energy installations, and urban housing, all requiring durable, corrosion-resistant materials. This underlying structural demand provides strong market stability. However, the market is restrained primarily by the extreme volatility and reliance on key input raw materials, notably nickel, the price fluctuations of which directly influence production costs and final product pricing, making long-term strategic planning challenging for manufacturers and procurement difficult for end-users. Opportunities arise from technological advancements leading to the development of new, high-performance stainless steel grades (e.g., lean duplex, high-nitrogen austenitic), offering superior strength-to-weight ratios and niche applications in demanding environments.

Impact forces in the market are primarily centered around macro-environmental factors and industry-specific regulations. Global trade tariffs and protectionist policies significantly impact cross-border supply chains and pricing dynamics, creating localized price disparities and influencing capacity utilization decisions. Furthermore, stringent environmental regulations regarding carbon emissions and industrial waste management, especially in Europe and North America, impose higher operational costs on producers but simultaneously create opportunities for companies specializing in sustainable, low-carbon steel production techniques. The balance between meeting high-volume construction demand and catering to specialized, high-margin industrial applications determines market segmentation attractiveness and long-term investment priorities.

A crucial restraint is the availability and cost of reliable energy sources, as stainless steel production is highly energy-intensive, making profitability vulnerable to geopolitical instability and fluctuating fossil fuel prices. To counteract this, manufacturers are increasingly exploring technological opportunities, such as process digitalization (Industry 4.0), which improves energy efficiency and reduces waste. The market dynamic is further impacted by the substitution threat posed by alternative materials, such as specialized aluminum alloys or composite materials, especially in lightweighting applications, although stainless steel’s superior durability and weldability often provide a defensive barrier in critical applications.

Segmentation Analysis

The Stainless Steel Coil Market is extensively segmented based on product type, grade, finish type, application, and geography, reflecting the highly diverse end-user requirements across industries. Segmentation by product type primarily distinguishes between Hot Rolled (HR) and Cold Rolled (CR) coils, where HR coils are generally thicker and used in structural components, while CR coils possess superior surface finishes, dimensional accuracy, and are utilized in applications demanding aesthetic appeal and precise specifications, such as consumer appliances and architectural elements. The interplay between these physical properties and specific application needs dictates pricing and volume trends within the market, with CR coils often commanding a premium due to the intensive processing required.

Segmentation by grade is crucial as it determines the coil’s mechanical and chemical performance. Austenitic stainless steels (300 series, particularly 304 and 316) dominate the market due to their excellent formability and corrosion resistance, making them the standard for general industrial and consumer use. However, the Ferritic (400 series) and Duplex grades are gaining significant traction. Ferritic grades offer a lower-cost, nickel-free alternative, appealing to appliance and automotive manufacturers focused on cost optimization, while Duplex grades (combining austenitic and ferritic structures) are highly valued in harsh environments like oil and gas processing and desalination plants due to their exceptional strength and resistance to stress corrosion cracking, justifying their higher cost structure.

Application-based segmentation highlights construction and infrastructure as the largest consumer sector globally, followed closely by general manufacturing and consumer goods. The continuous need for resilient building materials and the replacement cycles of durable goods ensure sustained market demand. Furthermore, specialized industries such as chemical and petrochemical, relying on grade 316 and higher alloys for extreme chemical inertness, represent high-value, albeit smaller, market niches. Understanding these segmented demands allows manufacturers to align their production capabilities and inventory management strategies with the specific technical requirements and economic cycles of their target end-user industries.

- Product Type:

- Hot Rolled (HR) Coils

- Cold Rolled (CR) Coils

- Grade:

- Austenitic (e.g., 304, 316)

- Ferritic (e.g., 430)

- Martensitic (e.g., 410)

- Duplex (e.g., 2205, 2507)

- Finish Type:

- 2B

- BA (Bright Annealed)

- No. 1

- No. 4

- Mirror Finish (No. 8)

- Application:

- Construction and Infrastructure

- Automotive and Transportation

- Consumer Goods and Appliances

- Industrial Machinery

- Chemical and Petrochemical

- Medical and Healthcare

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Stainless Steel Coil Market

The value chain for the Stainless Steel Coil Market is linear and highly integrated, beginning with the upstream sourcing of crucial raw materials, primarily nickel, chromium, iron ore, and scrap steel. Upstream analysis focuses on the mining, processing, and commodity trading of these metals, which critically determines the input cost structure for steel producers. Volatility in commodity prices necessitates robust risk management and long-term supply contracts within the primary production stage. Major integrated steel manufacturers often engage in recycling, utilizing high-quality scrap stainless steel, which mitigates reliance on virgin ore and aligns with global sustainability mandates, adding complexity and strategic importance to scrap processing within the upstream segment.

The midstream stage involves the highly capital-intensive processes of melting, casting, hot rolling, pickling, cold rolling, and finishing coils. Efficiency and technological superiority in this stage are paramount for cost leadership and quality consistency. Production processes vary significantly based on the desired product (HR vs. CR) and required grade. Distribution channels subsequently move the finished coils from the mills to end-users. Direct distribution often involves large volume contracts between major mills and Original Equipment Manufacturers (OEMs) in sectors like automotive or large infrastructure projects. This approach ensures technical support and streamlined supply chains but requires significant logistical capabilities from the producer.

Indirect distribution, conversely, relies on a network of service centers, distributors, and traders. These intermediaries play a vital role in cutting, slitting, and processing large coils into smaller, customized sheets and strips, offering just-in-time delivery and localized inventory management to thousands of smaller fabricators and end-users. Downstream analysis focuses on these fabrication processes, where coils are transformed into final products such as chemical tanks, architectural facades, or domestic appliances. The performance of this downstream segment is directly tied to global economic health, industrial capacity utilization rates, and consumer spending patterns, completing the integrated feedback loop of the stainless steel coil value chain.

Stainless Steel Coil Market Potential Customers

The potential customer base for the Stainless Steel Coil Market is highly diversified, spanning multiple industrial sectors where corrosion resistance, durability, and aesthetics are non-negotiable material requirements. Primary buyers include large-scale construction companies and civil engineering firms requiring high volumes of austenitic and duplex coils for architectural elements, cladding, piping systems, and supportive structures in corrosive or high-stress environments. These customers often procure coils through competitive bidding processes, emphasizing quality certifications and consistent supply delivery schedules for long-term projects. The shift towards green building standards globally is increasingly positioning stainless steel as a preferred material for sustainable construction, broadening the customer base in this sector.

Another major segment comprises manufacturers in the automotive and transportation industry, which use coils extensively for lightweight structural components, exhaust systems, and trim. As electric vehicle (EV) production ramps up, the demand for specialized, non-magnetic, and high-strength stainless steels for battery enclosures and thermal management systems represents an emerging and critical customer niche. Furthermore, manufacturers of heavy industrial machinery, food processing equipment, and chemical storage vessels are high-value customers, requiring specialized grades like 316L and higher alloys to ensure compliance with strict hygiene standards and chemical resistance necessary for prolonged operational integrity and safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 64.1 Billion |

| Growth Rate | CAGR 5.1% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aperam, Outokumpu, Baosteel, POSCO, ThyssenKrupp, Nippon Steel, Acerinox, Yieh Corp, Jindal Stainless, Hyundai Steel, TISCO, AK Steel (Cleveland-Cliffs), Samuel, Son & Co., Penn Stainless Products, Reliance Steel & Aluminum Co., North American Stainless, Viraj Profiles Ltd., Shagang Group, Tata Steel, Guangxi LiuZhou Iron and Steel Group Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Coil Market Key Technology Landscape

The technology landscape for the Stainless Steel Coil Market is characterized by continuous process innovation aimed at improving yield, reducing energy consumption, and enhancing the metallurgical properties of the final product. A significant area of focus is on advanced rolling technologies, including multi-stand tandem mills and continuous annealing and pickling (CAP) lines. These advancements ensure higher productivity rates and superior dimensional accuracy in cold-rolled coils, crucial for meeting the stringent specifications demanded by high-precision sectors like electronics and automotive stamping. Furthermore, modern steel mills increasingly utilize Level 2 and Level 3 automation systems, integrating sophisticated process control software to maintain consistent temperature profiles and rolling speeds, which are vital for controlling the microstructure and mechanical performance of various stainless steel grades.

In metallurgy, key technological advancements center on developing novel and specialized alloys. This includes the proliferation of lean duplex stainless steels, which offer comparable performance to traditional high-nickel alloys but at a reduced cost and with greater price stability due to lower nickel reliance. Researchers are also exploring techniques like vacuum oxygen decarburization (VOD) and argon oxygen decarburization (AOD) processes to refine molten steel composition, allowing for the precise removal of impurities and adjustment of carbon content. This refinement capability is essential for producing ultra-low carbon grades (L grades), which exhibit superior resistance to sensitization and intergranular corrosion, essential in demanding chemical processing environments.

Digital transformation, aligned with Industry 4.0 principles, represents a paradigm shift in steel manufacturing operations. The integration of the Internet of Things (IoT) sensors throughout the production facility enables real-time data collection on equipment health, material flow, and process variables. This data feeds into AI and machine learning systems for advanced analytics, optimizing complex parameters like energy usage and optimizing the scheduling of maintenance activities. Furthermore, digital twins of the production line are used to simulate potential operational changes and test new material compositions before physical implementation, significantly reducing R&D cycle times and operational risks, thereby cementing the role of data-driven decision-making in modern stainless steel coil production.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for stainless steel coil production and consumption, driven overwhelmingly by China, India, and South Korea. China, being the world's largest steel producer, dictates global supply dynamics, fueled by massive government investment in infrastructure, including railways, bridges, and renewable energy farms. India's accelerating urbanization and the growth of its domestic manufacturing base, particularly in automotive and construction, ensure a high CAGR for the region. The sustained demand from regional processing industries coupled with lower operational costs relative to Western markets reinforces APAC's dominance. The region focuses heavily on volume production of both standard and high-grade coils to feed its expansive manufacturing ecosystem.

- Europe: The European market is characterized by high-value, specialized demand and stringent regulatory compliance, particularly regarding material traceability and environmental performance. Western European countries emphasize the use of high-quality coils in sophisticated engineering applications, high-end architecture, and the automotive sector, prioritizing lightweighting and advanced safety features. European producers are leaders in developing sustainable steel production techniques (e.g., using hydrogen and CCUS), positioning the region as a hub for innovation in environmentally responsible steel manufacturing. Regulatory drivers, such as the European Green Deal, are shaping market demand towards certified low-carbon stainless steel coils.

- North America: North America presents a mature market characterized by robust demand from the oil and gas sector (for Duplex grades), construction, and a powerful domestic appliance industry. The market is supported by significant governmental infrastructure spending (e.g., in the US, through infrastructure bills) and a strong focus on domestic sourcing and supply chain security. While consumption volumes are lower than in APAC, the market commands premium prices for specialized, high-performance alloys. Manufacturers are heavily invested in digitalization and automation to optimize high labor costs and meet increasingly strict quality and dimensional standards for advanced manufacturing clients.

- Latin America: The market in Latin America, while smaller, shows steady growth, particularly in Brazil and Mexico. Demand is tied to regional economic stability, mining operations, and burgeoning infrastructure projects. Mexico benefits significantly from its proximity to the US automotive supply chain, driving demand for specific grades of stainless steel coils used in vehicle components. Market growth often relies on imports, making it susceptible to global pricing volatility and trade policies affecting primary production regions.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, propelled by massive investments in diversification projects, including tourism, construction (e.g., mega-cities), and downstream oil and gas processing facilities. These environments, often hot and highly corrosive, necessitate the use of high-performance duplex and super-austenitic coils for structural integrity and longevity. South Africa remains the key industrial base within the African segment, focusing on manufacturing and mining-related infrastructure, sustaining localized demand for common coil grades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Coil Market.- Aperam

- Outokumpu

- Baosteel

- POSCO

- ThyssenKrupp

- Nippon Steel

- Acerinox

- Yieh Corp

- Jindal Stainless

- Hyundai Steel

- TISCO (Taiyuan Iron and Steel Co.)

- AK Steel (Cleveland-Cliffs)

- Samuel, Son & Co.

- Penn Stainless Products

- Reliance Steel & Aluminum Co.

- North American Stainless

- Viraj Profiles Ltd.

- Shagang Group

- Tata Steel

- Guangxi LiuZhou Iron and Steel Group Co.

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Coil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the global demand for stainless steel coils?

Global demand is primarily driven by expansion in the construction and infrastructure sectors, especially in Asia Pacific, coupled with the increasing adoption of stainless steel in automotive lightweighting and renewable energy systems due to its durability and corrosion resistance.

How does raw material price volatility affect the stainless steel coil market?

Volatility in prices of key alloying elements, particularly nickel and chromium, directly impacts the production cost of austenitic grades. Manufacturers mitigate this through hedging strategies and by promoting lower-cost alternatives like ferritic and lean duplex stainless steels.

Which stainless steel grade segment holds the largest market share?

The Austenitic grade segment (300 series, e.g., 304 and 316) holds the largest market share due to its superior formability, excellent corrosion resistance, and widespread application across construction, consumer goods, and industrial processing industries.

What is the significance of the Cold Rolled (CR) coil segment?

The CR coil segment is critical for high-precision applications requiring specific dimensional tolerances, superior flatness, and high-quality surface finishes (such as 2B or BA). It serves premium segments like automotive exteriors, domestic appliances, and medical equipment manufacturing.

How is sustainability impacting stainless steel coil production technology?

Sustainability drives innovation in production technologies, focusing on increasing the use of recycled scrap, improving energy efficiency through digitalization (Industry 4.0), and exploring low-carbon production methods, such as utilizing hydrogen or carbon capture technologies, to meet global emissions standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager