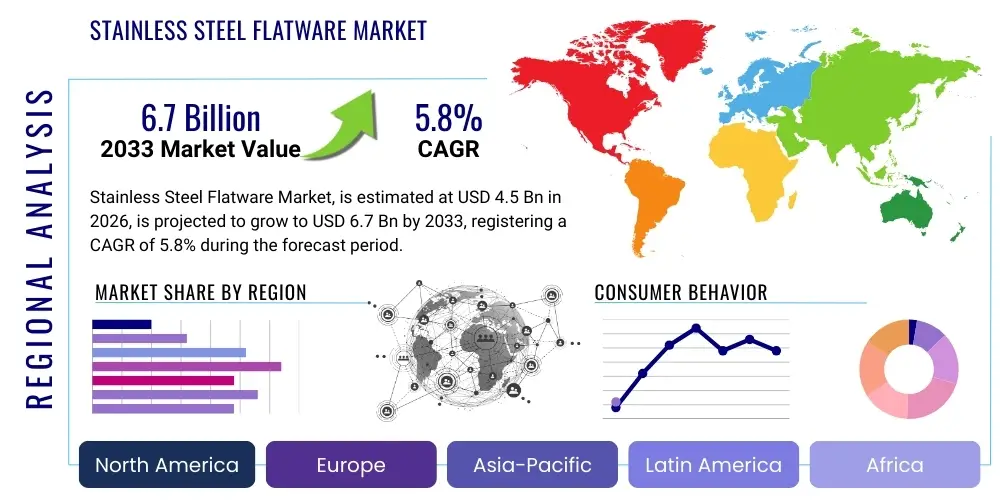

Stainless Steel Flatware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435870 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Stainless Steel Flatware Market Size

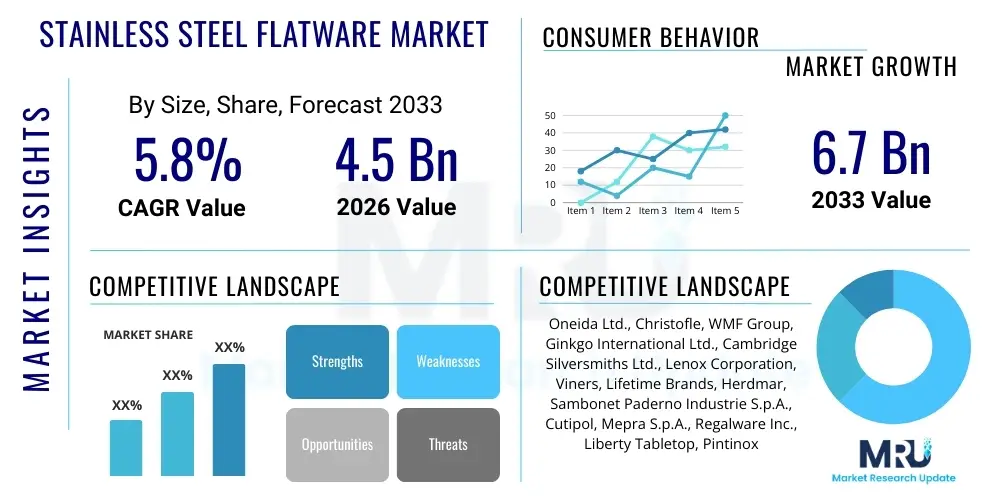

The Stainless Steel Flatware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Stainless Steel Flatware Market introduction

The Stainless Steel Flatware Market encompasses the production, distribution, and sale of essential dining instruments such as forks, spoons, and knives, primarily manufactured from various grades of stainless steel alloy. This market is fundamentally driven by the inherent durability, corrosion resistance, aesthetic versatility, and cost-effectiveness that stainless steel offers compared to alternatives like silver, gold, or plastics. Stainless steel flatware, typically composed of alloys such as 18/10, 18/8, or 18/0 (referring to chromium and nickel content), dominates both household and commercial settings due to its long lifespan and easy maintenance. The robust material properties ensure suitability for intensive use in the hospitality sector, contributing significantly to its sustained market demand across developed and emerging economies.

Major applications of stainless steel flatware span residential kitchens, commercial establishments, including restaurants, hotels, cafes (HoReCa sector), and institutional settings such as hospitals, educational facilities, and corporate cafeterias. The flatware serves a critical functional purpose in modern dining, and its design has increasingly become a component of interior decor and luxury branding, particularly in high-end hospitality venues. Market growth is closely linked to global urbanization, rising disposable incomes in APAC and Latin America, and the consistent renovation and expansion cycles within the global food service industry. Furthermore, the push towards sustainability and away from single-use plastics strengthens the demand for durable, reusable stainless steel options.

The primary benefits driving the sustained adoption of stainless steel flatware include hygiene, which is paramount in food handling; longevity, minimizing replacement costs; and aesthetic adaptability, allowing manufacturers to produce a wide range of styles, finishes (e.g., polished, satin, brushed, black PVD coating), and ergonomic designs. Key driving factors include the revival of the global travel and tourism industry post-pandemic, the continuous growth of the e-commerce channel facilitating direct-to-consumer sales, and technological advancements in manufacturing processes such as forging and electroplating, which enhance product quality and design complexity. These factors collectively establish stainless steel flatware as a staple investment in both consumer goods and commercial operational expenditure.

Stainless Steel Flatware Market Executive Summary

The Stainless Steel Flatware Market exhibits robust growth propelled by significant structural shifts in consumer lifestyle and global hospitality infrastructure investment. Business trends highlight a strong focus on premiumization, where consumers seek higher gauge, heavier-weight, and designer flatware sets, favoring 18/10 stainless steel for its superior resistance to corrosion and lasting luster. The shift towards sustainable and ethical sourcing is also a key business imperative, with companies investing in transparent supply chains and efficient, low-waste manufacturing techniques. Furthermore, the expansion of online retail channels, offering greater product variety and price comparison capabilities, fundamentally shapes the competitive landscape, encouraging traditional manufacturers to pivot toward direct-to-consumer models and personalized product offerings to maintain market share and improve margin capture.

Regional trends indicate that Asia Pacific (APAC) remains the fastest-growing market, primarily fueled by rapid urbanization, increased household formation, and the booming HoReCa sector in countries like China and India, where dining culture is rapidly evolving. North America and Europe, while mature, demonstrate stable demand characterized by replacement cycles, consumer interest in specialized serving utensils, and a strong preference for branded luxury collections. The Middle East and Africa (MEA) region is emerging as a significant market, driven by substantial infrastructure development related to luxury tourism and large-scale residential projects, which necessitates large volume procurement of high-quality, durable flatware for new hotels and hospitality venues, often favoring gold or copper-toned PVD finishes for aesthetic appeal.

Segment trends underscore the dominance of the commercial segment, particularly institutional sales, although the residential segment is experiencing accelerated growth driven by aesthetic trends, such as the popularity of minimalist design and matte finishes, encouraging consumers to frequently update their dining sets. By product type, spoons and forks collectively account for the largest volume share, reflecting their necessity in nearly all dining applications, while specialized flatware sets (e.g., steak knives, dessert forks) offer higher revenue potential through premium pricing. The segmentation by material grade shows a clear movement towards higher-quality nickel-containing alloys (18/10) in developed markets, emphasizing the consumer prioritization of quality and longevity over minimal cost savings, reflecting an overall trend toward durable, investment-grade household items.

AI Impact Analysis on Stainless Steel Flatware Market

Users frequently inquire about how Artificial Intelligence (AI) and associated digital technologies will affect the traditionally low-tech manufacturing process of flatware, focusing on efficiency, cost reduction, and customization. Common questions revolve around the feasibility of AI-driven quality control systems replacing manual inspection, the role of generative design AI in creating novel ergonomic flatware shapes, and the integration of predictive analytics for inventory management and supply chain optimization in response to volatile raw material costs. The consensus expectation is that AI will not fundamentally alter the product itself, but rather revolutionize the back-end operations, enhancing manufacturing precision, automating complex finishing steps, and allowing for unprecedented levels of mass customization tailored to specific consumer demographics or HoReCa needs, ultimately leading to higher margins and faster product cycles.

The immediate impact of AI is most observable in two areas: advanced manufacturing orchestration and demand forecasting. In manufacturing, AI algorithms optimize stamping, polishing, and grinding parameters, minimizing material waste and energy consumption while ensuring consistent surface quality, which is critical for preventing corrosion points. Generative design tools are also being explored by premium brands to prototype and test thousands of design iterations rapidly, optimizing handle balance, weight distribution, and functional aesthetics before committing to expensive tooling. This digital iteration capability drastically reduces time-to-market for new collections. Furthermore, integrating machine vision with AI allows manufacturers to achieve near-perfect quality control by identifying microscopic flaws or deviations in polishing that human inspectors might miss, thereby reducing defect rates and improving brand reputation for quality.

In the commercial sphere, AI applications are crucial for managing complex global supply chains that characterize the flatware industry, which relies heavily on international stainless steel sourcing and overseas production facilities. Predictive maintenance powered by AI monitors equipment health in factories, preventing costly downtime associated with forging presses and polishing machines. Additionally, sophisticated predictive analytics utilize historical sales data, seasonal trends, and macro-economic indicators (such as housing starts and hospitality investment forecasts) to accurately predict demand spikes and troughs. This allows manufacturers to optimize raw material procurement and inventory levels, mitigating risks associated with stainless steel price volatility and ensuring inventory freshness, especially for fast-moving customized or seasonal flatware lines.

- AI-driven optimization of stamping and polishing parameters for reduced material waste and enhanced consistency.

- Predictive maintenance schedules for minimizing equipment downtime in high-volume manufacturing facilities.

- Generative design tools facilitating rapid prototyping of ergonomic and aesthetic flatware designs.

- Integration of AI-powered machine vision for automated, high-precision quality control (QC) inspection, reducing defect rates.

- Advanced demand forecasting using machine learning to optimize inventory levels and procurement of stainless steel alloys.

- Personalized marketing and product bundling recommendations for e-commerce platforms based on consumer purchase history.

- Supply chain risk management utilizing AI to track and predict delays or pricing volatility for key raw materials (nickel, chromium).

- Automation of complex logistical operations, including warehousing and fulfillment, particularly for global distribution networks.

DRO & Impact Forces Of Stainless Steel Flatware Market

The Stainless Steel Flatware Market is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively dictate market trajectory and competitive intensity. The primary Drivers revolve around the inherent characteristics of stainless steel—its unparalleled durability, resistance to rust and staining, and comparatively low long-term ownership cost relative to silver. Global demographic trends, specifically increasing urbanization and the burgeoning middle class in developing regions, consistently fuel demand for essential household goods like flatware. Furthermore, the robust expansion of the global hospitality and tourism sector necessitates continuous investment in high-quality, high-volume dining accessories, ensuring a stable commercial market base, especially for 18/10 grade flatware which withstands repeated industrial washing cycles.

However, the market faces significant Restraints, primarily stemming from the volatility in raw material prices, particularly nickel and chromium, which are essential components of high-grade stainless steel. These price fluctuations directly impact manufacturing costs and profitability, necessitating complex hedging strategies and influencing final consumer pricing. Another restraint is the market saturation in highly developed economies of North America and Western Europe, where demand is primarily driven by replacement cycles rather than new household formation. Moreover, the increasing regulatory scrutiny concerning environmental impact and energy consumption during the smelting and manufacturing processes poses compliance and cost challenges for manufacturers, potentially slowing the adoption of certain high-nickel alloys if sustainable alternatives are not prioritized.

Opportunities for growth are abundant, focusing largely on innovation in design, material finishing, and market penetration into untapped or rapidly expanding segments. The growing consumer interest in specialized flatware—such as dedicated sets for ethnic cuisines, children's flatware, or specific cocktail utensils—presents lucrative niche markets. Technological advancements in Physical Vapor Deposition (PVD) coating allow for the creation of unique, durable colors and finishes (e.g., matte black, rose gold, iridescent), revitalizing aesthetic appeal and allowing premium pricing. Furthermore, the strong global movement toward banning single-use plastic cutlery offers an immense opportunity for stainless steel manufacturers to capture the disposable cutlery market by providing sustainable, aesthetically superior, and reusable alternatives for catering, quick-service restaurants, and takeaway operations, dramatically broadening the potential application base for the product. The focus on sustainability also drives opportunities in manufacturing efficiency and closed-loop recycling programs for end-of-life flatware.

Segmentation Analysis

The Stainless Steel Flatware Market is comprehensively segmented based on product type, material grade, application (end-user), distribution channel, and aesthetic finish, providing a detailed view of market dynamics and consumer preferences across various price points and functional requirements. Understanding these segments is crucial for manufacturers to tailor their production, pricing, and marketing strategies effectively. For instance, the distinction between 18/10 and 18/0 material grades often separates the premium HoReCa segment from the budget residential market, reflecting varying priorities regarding corrosion resistance and cost. The application segmentation delineates the distinct volume and quality needs of the commercial sector (restaurants, institutions) versus the residential sector (household use), which typically prioritizes design aesthetics and smaller set configurations. Distribution channels, particularly the shift toward e-commerce and specialized retail, are reshaping how consumers purchase flatware, influencing logistics and promotional spending strategies.

- By Product Type:

- Spoons (Dinner Spoons, Teaspoons, Soup Spoons)

- Forks (Dinner Forks, Salad Forks, Dessert Forks)

- Knives (Dinner Knives, Steak Knives, Butter Knives)

- Sets and Assortments

- Specialized Utensils (Serving Spoons, Ladles, Tongs)

- By Material Grade:

- 18/10 Stainless Steel (18% Chromium, 10% Nickel)

- 18/8 Stainless Steel (18% Chromium, 8% Nickel)

- 18/0 Stainless Steel (18% Chromium, 0% Nickel)

- By Application (End-User):

- Residential Use (Household)

- Commercial Use (HoReCa, Catering)

- Institutional Use (Hospitals, Schools, Government)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Offline Retail (Department Stores, Specialty Stores, Supermarkets, Hypermarkets)

- Direct Sales/B2B Procurement

- By Finish/Design:

- Polished/Mirror Finish

- Satin/Brushed Finish

- Matte Finish

- PVD Coated (Black, Gold, Copper Tones)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Stainless Steel Flatware Market

The value chain of the Stainless Steel Flatware Market begins with the highly capital-intensive upstream segment involving the sourcing and processing of raw materials, primarily high-grade iron ore, chromium, and nickel, which are alloyed to produce stainless steel coil or sheet metal. Upstream analysis focuses heavily on global metal commodity markets and the capabilities of major stainless steel mills. Since the quality of the final flatware product—specifically its resistance to corrosion and staining—is directly dependent on the precise alloy composition, securing stable, high-quality material supply is critical. Manufacturers often enter long-term contracts with steel suppliers to mitigate price volatility, as these raw material costs represent a substantial portion of the total manufacturing expenditure. Efficiency at this stage dictates the fundamental cost structure of the end product.

The midstream segment involves the core manufacturing processes: stamping, forging, grinding, heat treating, and advanced finishing techniques. Stamping is cost-effective for high-volume, standard flatware (often 18/0), while forging is reserved for premium, heavy-gauge 18/10 pieces that demand superior balance and aesthetic detail. Technological innovation, such as automated polishing robotics and sophisticated PVD coating machinery, adds significant value at this stage by improving surface quality, durability, and aesthetic variance. Successful midstream operations require significant investment in specialized tooling and highly controlled environments to achieve the mirror or satin finishes expected by consumers, transforming the raw stainless steel into marketable, functional pieces of art.

The downstream distribution channels are categorized into direct and indirect routes. Direct distribution (B2B) involves large volume sales to commercial clients (HoReCa, institutions) through specialized procurement agencies or manufacturer sales teams, often involving customized engraving or specifications. Indirect distribution serves the residential market through both traditional brick-and-mortar retail (department stores, hypermarkets) and the rapidly expanding e-commerce sector. E-commerce platforms provide manufacturers with direct access to consumers, enabling personalized marketing and faster feedback loops, optimizing inventory management based on real-time sales data. Effective inventory management and robust logistics are paramount in the downstream segment, especially given the varying size and weight of flatware sets that require careful packaging to prevent damage during transit to maintain the pristine aesthetic finish.

Stainless Steel Flatware Market Potential Customers

Potential customers for stainless steel flatware are broadly segmented into residential consumers (B2C) and large-scale commercial/institutional buyers (B2B), each possessing distinct purchasing behaviors, volume requirements, and quality expectations. Residential consumers constitute the B2C segment, driven by factors such as home renovation cycles, gifting occasions (weddings, housewarmings), and general aesthetic upgrades. These buyers are highly influenced by branding, design trends (e.g., minimalist styles, colored finishes), and ergonomic comfort, often prioritizing 18/10 or 18/8 grade flatware for long-term household use. The purchasing decision for this segment is often emotionally driven and linked to perceived lifestyle quality, leading to demand for complementary serving pieces and specialized accessories, reflecting a focus on complete dining experiences rather than purely functional utility.

The B2B segment, primarily comprising the HoReCa industry (Hotels, Restaurants, Cafes, and Catering) and Institutional sectors, represents the highest volume opportunity. HoReCa buyers prioritize extreme durability, cost-effectiveness over the product lifecycle, and standardization for ease of replacement and inventory control. Their selection criteria heavily favor 18/10 grade for its ability to withstand frequent, high-heat industrial washing without pitting or staining. Institutional buyers, such as hospitals, schools, and government facilities, prioritize highly robust, sometimes tamper-proof, 18/0 flatware sets where pure function, hygiene, and low replacement cost are critical factors. For both B2B segments, procurement is centralized, driven by detailed specification lists, bulk pricing negotiation, and contractual agreements guaranteeing minimum order quantities and sustained supply, making them reliable, high-volume end-users of durable stainless steel products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oneida Ltd., Christofle, WMF Group, Ginkgo International Ltd., Cambridge Silversmiths Ltd., Lenox Corporation, Viners, Lifetime Brands, Herdmar, Sambonet Paderno Industrie S.p.A., Cutipol, Mepra S.p.A., Regalware Inc., Liberty Tabletop, Pintinox S.p.A., Amefa B.V., BergHOFF Worldwide, IKEA Systems B.V., Zwilling J.A. Henckels, Target Brands Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Flatware Market Key Technology Landscape

The technological landscape of the Stainless Steel Flatware Market is continually evolving, moving beyond simple stamping and manual polishing to incorporate advanced automation and surface treatment techniques that improve product quality, manufacturing efficiency, and aesthetic diversity. A crucial technological advancement is the deployment of Computer Numerical Control (CNC) machining and robotic automation in the grinding and polishing stages. Traditional polishing is labor-intensive and prone to inconsistencies; automated polishing systems utilize precise pressure and movement control to ensure a uniform mirror or satin finish across large production batches, significantly reducing human error and boosting throughput. Furthermore, modern forging presses integrate sophisticated sensor technology to monitor and control temperature and pressure during the shaping of high-end flatware, ensuring optimal metal structure and minimizing internal stress, which contributes directly to the final piece's longevity and structural integrity.

Another significant technological driver is the maturation of advanced surface treatment processes, most notably Physical Vapor Deposition (PVD) coating. PVD technology involves bombarding the stainless steel substrate with ions in a vacuum chamber, depositing thin, highly durable ceramic or metallic layers. This process allows manufacturers to create unique, highly coveted finishes, such as matte black, copper, or iridescent rainbow tones, that are far more scratch and corrosion-resistant than traditional electroplating or chemical coloring methods. PVD coatings not only enhance the aesthetic appeal, driving demand for premium, designer flatware, but also improve the functional properties, ensuring the colored finishes withstand the harsh detergents and high temperatures common in commercial dishwashing environments, thereby making high-fashion flatware practical for the HoReCa sector.

Sustainability and resource efficiency are also major technological focus areas. Manufacturers are increasingly adopting induction heating and laser cutting technologies, which are more energy-efficient than traditional methods and allow for greater precision and less material wastage during the initial shaping phase. Furthermore, the development of specialized, low-carbon stainless steel alloys, sometimes substituting part of the nickel content with manganese or nitrogen while maintaining corrosion resistance, represents a materials technology trend driven by environmental and cost considerations. These innovations ensure that the manufacturing process adheres to stricter global environmental regulations while providing a cost-effective alternative for certain market segments, solidifying the market's long-term sustainability and appealing to environmentally conscious consumers and procurement officers.

Regional Highlights

- North America Market Dynamics: North America, encompassing the United States and Canada, represents a mature but highly valuable market characterized by high consumer purchasing power and a strong preference for high-quality, branded flatware, typically focusing on 18/10 stainless steel grade. Demand is primarily driven by replacement cycles, demographic shifts (such as increasing household formation rates), and the consistently robust HoReCa sector which constantly updates its table settings to align with contemporary dining aesthetics and rigorous hygiene standards. The U.S. market, in particular, exhibits strong consumer interest in specialized flatware, including specific sets for grilling and entertaining, driving growth in niche, higher-margin product categories. E-commerce penetration is extremely high, allowing direct-to-consumer brands to challenge established legacy players through innovative marketing and optimized supply chains.

- European Market Dynamics: Europe is a highly sophisticated and diverse market, historically dominated by established manufacturers in Germany, Italy, and Portugal, known for their focus on quality craftsmanship and design excellence. The market here is segmented between premium brands (emphasizing artisanal quality and PVD finishes) and mass-market producers. Sustainability regulations and consumer awareness regarding ethical sourcing are exceptionally high in Western European countries, compelling manufacturers to invest in environmentally friendly production processes and transparent supply chains. The HoReCa segment remains a cornerstone of demand, especially in major tourist destinations, requiring standardized, heavy-gauge flatware that meets strict European Union safety and quality standards. The replacement cycle for durable goods is longer in this region, necessitating differentiation through design and brand heritage to secure consumer loyalty and higher average selling prices.

- Asia Pacific (APAC) Market Dynamics: APAC is the fastest-growing region globally, fueled by rapid economic development, escalating urbanization, and the expansion of the middle-class demographic across China, India, and Southeast Asia. This region is characterized by immense variability in consumer purchasing power and preferences, leading to strong demand across all segments, from budget 18/0 flatware to luxury 18/10 designer sets. The construction boom in the commercial sector, particularly the rapid growth of international hotel chains and fine dining establishments, ensures high volume commercial sales. India and China are not only massive consumers but also major global production hubs, benefiting from lower labor costs and large-scale manufacturing capacity, which allows them to serve both domestic and export markets, although quality control standards are becoming increasingly stringent in line with global expectations.

- Latin America (LATAM) Market Dynamics: The LATAM market, while facing economic volatility in some areas, presents substantial long-term growth potential due to improving living standards and increasing foreign investment in tourism infrastructure (especially in Mexico, Brazil, and the Caribbean). Demand is highly price-sensitive, with consumers often prioritizing affordability, leading to strong sales of 18/0 and standard 18/8 grades. However, there is a growing, affluent consumer base in major urban centers increasingly seeking international design trends and premium branded flatware. The challenge in LATAM often lies in navigating complex import tariffs and establishing efficient distribution networks across varied geographical terrains.

- Middle East and Africa (MEA) Market Dynamics: The MEA region is demonstrating strong demand, particularly driven by colossal investment in luxury tourism, high-end residential projects, and national diversification strategies (e.g., Saudi Arabia's Vision 2030 and UAE's focus on hospitality). The Middle Eastern segment is characterized by a strong aesthetic preference for opulent finishes, such as highly polished gold or copper-toned PVD flatware, often procured in large quantities for new palace hotels and upscale restaurants. Africa’s growth is concentrated around urban centers and is primarily driven by affordability and functional utility, though South Africa maintains a developed market segment focused on branded, imported goods. Political stability and oil revenue fluctuations remain key variables influencing market demand and purchasing power in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Flatware Market.- Oneida Ltd.

- WMF Group

- Christofle

- Ginkgo International Ltd.

- Cambridge Silversmiths Ltd.

- Lenox Corporation

- Viners

- Lifetime Brands

- Herdmar

- Sambonet Paderno Industrie S.p.A.

- Cutipol

- Mepra S.p.A.

- Regalware Inc.

- Liberty Tabletop

- Pintinox S.p.A.

- Amefa B.V.

- BergHOFF Worldwide

- IKEA Systems B.V.

- Zwilling J.A. Henckels

- Target Brands Inc.

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Flatware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between 18/10, 18/8, and 18/0 stainless steel grades for flatware?

The numbers refer to the percentage of chromium and nickel content, respectively. 18/10 (18% Chromium, 10% Nickel) is considered the premium standard, offering maximum rust resistance, a superior luster, and higher strength, making it ideal for both luxury residential use and industrial HoReCa applications. 18/8 provides good corrosion resistance but slightly less shine. 18/0 (Nickel-Free) is the most budget-friendly option, offering basic durability but is more susceptible to staining and corrosion over long-term or industrial washing, often preferred where magnetic properties (for commercial dish sorting) or specific metal allergies are concerns.

How is the rising popularity of colored flatware impacting the market and product longevity?

The demand for colored flatware (such as matte black, gold, or copper) is significantly driving the residential segment, allowing consumers to align cutlery with home aesthetics. This color is achieved primarily through Physical Vapor Deposition (PVD) coating, a highly durable technological process that applies a thin, hard ceramic film. Unlike traditional electroplating, PVD coatings offer superior scratch and corrosion resistance, ensuring that the aesthetic finish withstands daily use and industrial dishwashing, thereby minimizing concerns about diminished product longevity, provided the underlying stainless steel is of good quality (e.g., 18/10).

Which geographical region is expected to demonstrate the highest growth rate for stainless steel flatware and why?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly expanding middle-class populations, significant increases in disposable income, and massive ongoing infrastructure investment, particularly in the HoReCa (Hotel, Restaurant, Cafe) sector across key economies like China, India, and Southeast Asia. The combination of high domestic consumption, increasing adoption of Western dining styles, and the region's role as a major global manufacturing hub fuels this superior market expansion compared to mature Western markets.

What is the primary influence of e-commerce on the competitive landscape of flatware sales?

E-commerce has profoundly democratized the market by reducing reliance on traditional retail channels, enabling smaller, specialized, and design-focused brands (often selling PVD-coated or artisan-style flatware) to compete directly with established global manufacturers. Online platforms offer unparalleled transparency regarding pricing, detailed product specifications (including steel grade and weight), and customer reviews. This shift forces incumbent companies to optimize their digital presence, focus on unique direct-to-consumer experiences, and improve supply chain agility to manage last-mile delivery expectations for heavy, multi-piece flatware sets efficiently.

How are environmental sustainability mandates affecting stainless steel flatware manufacturing?

Environmental mandates are driving manufacturers to adopt cleaner, more energy-efficient production methods, such as utilizing induction heating and optimizing forging processes to reduce carbon emissions associated with steel production. Furthermore, the global push to eliminate single-use plastic cutlery has created a significant opportunity for reusable stainless steel alternatives in catering and quick-service settings. Companies are also focusing on designing products with high recycled content and establishing robust end-of-life flatware recycling programs, catering to both regulatory compliance and increasing consumer demand for ethically manufactured, long-lasting goods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager