Stainless Steel Jewelry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434168 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Stainless Steel Jewelry Market Size

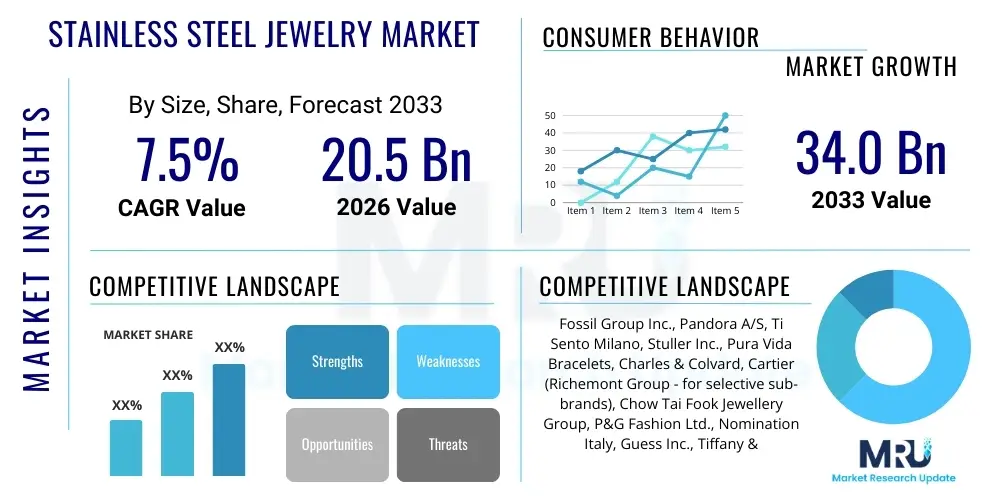

The Stainless Steel Jewelry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 34.0 Billion by the end of the forecast period in 2033.

Stainless Steel Jewelry Market introduction

The Stainless Steel Jewelry Market is characterized by robust expansion driven primarily by shifting consumer preferences towards durable, hypoallergenic, and affordable luxury alternatives. Stainless steel jewelry, often utilizing high-grade alloys such as 316L (known colloquially as surgical steel), has cemented its position in the fashion accessories sector due to its inherent material strengths. This material offers exceptional resistance to common degradation factors, including corrosion, oxidation, and general tarnish, alongside high resistance to scratching and deformation, making it an extraordinarily practical choice for jewelry intended for high-frequency, everyday wear. The market encompasses a comprehensive portfolio of products, ranging from essential staple items such as classic rings, sophisticated necklaces, sturdy bracelets, and detailed earrings, through to specialized items like medical identification bracelets and robust watch cases. This broad product scope allows the material to successfully appeal to diverse demographic segments globally, spanning from young consumers driven by fast fashion cycles to discerning, conscious buyers who prioritize longevity, environmental sustainability, and functional durability in their purchasing decisions. The global momentum of this material reflects a fundamental democratization of design and style, making fashion accessibility a core market mandate.

Major applications of stainless steel have extended significantly beyond traditional fashion accessories in recent years. For instance, the material is increasingly favored in specialized segments such as high-end custom jewelry, industrial-style pieces, and for creating 'permanent jewelry' installations, capitalizing on the alloy's inert properties, high tensile strength, and minimal maintenance needs. The accelerating pace of global digitalization, marked by the rapid expansion of e-commerce platforms, dedicated social media storefronts, and highly effective digital marketing strategies, serves as a crucial infrastructural driver accelerating market penetration. These digital channels empower smaller, innovative, and niche brands specializing in stainless steel to establish a significant global footprint and compete effectively on design and value proposition against long-established fine jewelry houses whose materials command a substantially higher price point. This competitive dynamic is especially pronounced in urban centers where fashion trends disseminate quickly. Manufacturers are also increasingly focused on improving the finish and weight of stainless steel items to mimic the tactile feel of fine jewelry, further blurring the lines between fashion and luxury segments.

Key benefits crucially underpinning widespread market adoption include the material's virtually non-existent maintenance requirements; its thoroughly proven hypoallergenic nature—an essential consideration for the large segment of consumers with sensitivity to nickel found in lower-grade alloys—and the significant environmental advantage derived from its high rate of recyclability compared to many other metals used in the fashion sector. Driving factors further contributing to market momentum encompass the steady rise in disposable incomes across key emerging economies, particularly in the APAC region, the widespread cultural acceptance of personalized and custom jewelry pieces enabled by advanced laser technology, and continuous technological refinements in advanced plating and surface finishing techniques. These advancements, which notably include enhancements to Physical Vapor Deposition (PVD) processes, elevate the visual aesthetic appeal and perceived quality of stainless steel pieces, collectively ensuring sustained market momentum and robust global growth throughout the projected forecast period of 2026–2033. The material’s ability to withstand harsh environmental conditions, such as high humidity and constant exposure to water, also makes it highly popular in coastal and subtropical markets, distinguishing it from traditional costume jewelry materials.

Stainless Steel Jewelry Market Executive Summary

The global Stainless Steel Jewelry Market is experiencing significant dynamic shifts, primarily fueled by prevailing business trends focusing heavily on lean manufacturing principles, rapid supply chain integration, and scalable direct-to-consumer (D2C) operating models. The contemporary market landscape is defined by the acceleration of mass customization and personalization services, facilitated by the widespread availability of advanced manufacturing tools such as precision laser engraving and sophisticated 3D printing technologies. These technological deployments permit brands to swiftly respond to volatile, fast-changing global fashion cycles, critically optimizing inventory levels, minimizing obsolescence risk, and sharply reducing production lead times. A key business catalyst is the strategic formation of collaborations between established jewelry manufacturers and highly influential digital fashion personalities or social media influencers, which effectively generates immediate market traction and defines consumer expectations regarding emerging style trends across various geographical segments. The optimization of logistics, often utilizing sophisticated predictive analytics, ensures that rapid fashion cycles are supported by reliable and agile distribution networks.

From a regional perspective, the Asia Pacific (APAC) region continues to distinguish itself as the primary engine for future market growth, holding the highest potential CAGR projection throughout the forecast period. This anticipated expansion is intricately linked to fundamental socio-economic drivers, including the proliferation of expanding middle-class populations in densely populated nations like the People's Republic of China, the Republic of India, and various Southeast Asian states, coupled with the increasing cultural assimilation of global fashion standards and Western aesthetic influences. Conversely, established markets in North America and Europe retain substantial market control, supported by extraordinarily high consumer discretionary spending capacities and the entrenched presence of major, influential global fashion retailers and established luxury brands that have strategically begun to integrate high-quality stainless steel lines into their core offerings. Crucially, these mature Western markets increasingly place significant emphasis on supply chain transparency, ethical sourcing, and demonstrable sustainability credentials, which in turn compels manufacturers worldwide to adhere to higher standards of responsible production and operational ethics, thereby influencing global market benchmarks.

Analysis of specific segment trends consistently indicates strong revenue generation and growth stability within the bracelet and necklace categories, particularly those pieces that incorporate advanced, durable finishing processes such as Physical Vapor Deposition (PVD) gold plating to achieve a high-end, premium aesthetic. Furthermore, the specialized men’s jewelry segment is exhibiting disproportionately high Compound Annual Growth Rates (CAGR), as stainless steel naturally lends itself to the creation of masculine, substantial, and robust designs that are available at highly competitive and accessible price points, meeting the increasing demand for male self-expression through accessories. Examination of the distribution channel dynamics reveals a sustained and significant surge in online sales channels, effectively capitalizing on consumer demands for ultimate convenience, broad product selection, and competitive pricing transparency. Despite this digital dominance, highly specialized, dedicated retail stores continue to play an indispensable role in the distribution matrix, particularly for premium designer stainless steel offerings that rely on providing a personalized, high-touch, and tactile in-store consumer experience to validate the perceived quality of the product.

AI Impact Analysis on Stainless Steel Jewelry Market

User inquiries consistently related to the intersection of Artificial Intelligence (AI) and the Stainless Steel Jewelry Market primarily focus on assessing potential transformation across three crucial operational pillars: accelerating design innovation, dramatically improving supply chain and manufacturing efficiency, and revolutionizing personalized customer interaction. Consumers and industry stakeholders are intensely interested in understanding precisely how sophisticated AI algorithms, often utilizing deep learning and neural networks, can be effectively deployed to accurately forecast complex seasonal trends, potentially automating or at least significantly semi-automating the initial design conceptualization and creation processes. This focus aims to drastically compress the standard time-to-market for new collections, a vital metric in the fast-paced fashion accessory industry. While expectations for efficiency gains are high, parallel concerns frequently arise regarding the potential for large-scale job displacement affecting traditional artisans, jewelry designers, and manual labor roles within specialized manufacturing facilities. High expectations are specifically channeled toward AI’s capacity to optimize intricate global logistics, perform precise, real-time inventory management, and fundamentally enhance the pre- and post-purchase customer service experience through the deployment of highly advanced, context-aware chatbots and generating hyper-personalized product recommendations derived from exhaustive analysis of individual purchasing histories, demographic data, and observed browsing patterns, ultimately leading to minimized material waste and maximized market profitability across the entire complex value chain.

The practical application of AI is already beginning to redefine operational methodologies within the stainless steel sector. AI-driven systems are being developed and implemented to analyze enormous datasets, including macro-economic indicators, localized search engine queries, social media sentiment surrounding specific materials and styles, and historical sales performance across various geographic regions. This analytical capability translates into highly accurate predictive models, guiding decisions related to material procurement volumes, optimal manufacturing capacity utilization, and targeted marketing spend allocation. By integrating AI into the early stages of product lifecycle management, companies can ensure that resource investments are strategically focused only on designs with the highest predicted sell-through rates, significantly mitigating financial exposure associated with speculative or poorly received collections. Furthermore, the development of sophisticated vision systems powered by machine learning allows for unprecedented precision in quality assurance, automatically inspecting polished and plated surfaces for micro-imperfections invisible to the human eye, thereby guaranteeing a consistently high-quality final product reaching the consumer.

Looking forward, the deployment of generative AI tools promises to democratize jewelry design itself. These tools enable non-expert users, or small internal design teams, to rapidly iterate and visualize thousands of potential product variations based on simple textual prompts or defined geometric constraints pertinent to stainless steel’s specific tensile strength and malleability. This capability supports the burgeoning customization market, allowing brands to offer ‘design your own’ services where AI assists in creating unique, production-ready files instantly. From a commerce perspective, AI is critical for optimizing dynamic pricing strategies in response to competitor actions and real-time inventory levels. For example, personalized discounts and bundled offers, determined by AI analysis of customer lifetime value (CLV), ensure maximum profitability per transaction. This strategic adoption of AI infrastructure is transforming stainless steel jewelry manufacturing from a craft-based industry to a technology-driven, data-optimized operational system, providing a sustainable competitive advantage to early adopters in this highly fragmented global market.

- AI-Powered Trend Forecasting: Utilizing sophisticated machine learning algorithms (e.g., recurrent neural networks) to analyze unstructured data from global social media trends, localized search engine data, and detailed analysis of high-fashion runway shows to predict high-demand consumer tastes for specific styles, structural forms, color palettes, and surface textures, crucially minimizing the logistical risk associated with overstocking potentially unpopular designs.

- Optimized Inventory and Supply Chain Management: Implementing AI systems and predictive analytics to dynamically manage the procurement of necessary raw materials, optimize intricate, multi-stage production schedules, and strategically allocate warehousing space, consequently ensuring genuine just-in-time (JIT) manufacturing protocols and substantially lowering aggregated operational holding and transit costs across the entire supply chain.

- Generative Design and Rapid Prototyping: Employing advanced generative adversarial network (GAN) AI tools to instantaneously explore and render a vast spectrum of aesthetic design variations within strict material constraints (e.g., maximum metal thickness, specific weight limits, optimal structural integrity), thereby dramatically speeding up the initial design conceptualization and final approval phase for complex geometric stainless steel components.

- Hyper-Personalized Marketing and Sales Funnels: Utilizing comprehensive customer data analytics combined with AI segmentation models to deliver highly targeted advertisements, personalized website user experiences, and customized product recommendations, resulting in a demonstrable and significant boost in critical e-commerce conversion rates and optimizing digital marketing ROI.

- Enhanced Quality Control (QC) and Defect Detection: Integrating high-resolution computer vision systems coupled with deep learning AI analysis directly into high-speed manufacturing lines to meticulously detect minuscule material flaws, surface scratches, or defects in the precise finishing and critical plating process of stainless steel items, thereby ensuring consistently uniform product quality before packaging and final shipment.

- Customer Service Automation and Support: Strategic deployment of sophisticated natural language processing (NLP) bots, often integrated with complex knowledge bases, to efficiently handle high volumes of routine customer inquiries, manage complex returns logistics, provide precise sizing guides, and offer instantaneous, reliable 24/7 support across multiple international time zones.

DRO & Impact Forces Of Stainless Steel Jewelry Market

The expansion trajectory of the Stainless Steel Jewelry Market is fundamentally determined by an intricate interplay of powerful drivers, structural restraints, and strategic opportunities, all subject to intense pressure from core impact forces that shape its long-term viability and competitive structure. Key drivers underpinning consumer preference and market growth include the material’s intrinsic and widely recognized advantages: superior durability, complete resistance to common corrosion agents, highly reliable hypoallergenic properties, and substantially lower cost compared to high-purity precious metals such as 14k gold or sterling silver. These characteristics collectively appeal directly to a global consumer base that is increasingly budget-conscious, environmentally aware, and practical in their demand for daily-wear accessories. Furthermore, the exponential proliferation of highly accessible global e-commerce channels and sophisticated social media marketing infrastructures provides an unprecedented market reach, allowing smaller, highly specialized stainless steel brands to bypass entrenched traditional retail barriers and achieve exponential, scalable growth, particularly among the younger, technologically sophisticated, digitally-native demographic cohorts.

Despite the strong demand drivers, the market navigates several notable structural restraints. The most significant challenge remains the persistent negative perception among certain established consumer demographics and within traditional high-end gifting cultures that stainless steel inherently lacks the perceived prestige, intrinsic investment value, and symbolic emotional weight traditionally associated with fine jewelry crafted from gold or platinum. This perception often limits its overall penetration into the high-value luxury and ceremonial gifting market segments. Operational restraints include intense market saturation, particularly from large-scale Asian manufacturers, leading to aggressive pricing wars that compress profit margins. Furthermore, maintaining flawless consistency and high-fidelity quality control in advanced plating processes, especially concerning high-demand colored pieces (e.g., rose gold PVD), presents technical challenges related to material adhesion and fade resistance over extended periods, which, if not managed, can undermine consumer trust in product quality.

Strategic opportunities for significant expansion are abundant and primarily concentrate on continuous product innovation and aggressive diversification. This includes developing next-generation high-tech surface finishes, such as complex ceramic coatings and multi-layer PVD applications, specifically designed to closely mimic the premium aesthetics and tactile feel of fine jewelry, thus enhancing the perceived market value. Targeting the exceptionally rapid growth in the dedicated men's jewelry segment, which seeks robust and masculine designs, and strategically capitalizing on the accelerating global demand for clearly verifiable sustainable and ethically produced fashion accessories provide critical, high-potential avenues for substantial market penetration and brand differentiation. The major impact forces acting upon the market are dual-natured: persistent technological innovation in advanced manufacturing, which constantly lowers production costs and improves quality; and the strong, demonstrable consumer preference shifts toward sustainability and verifiable supply chain ethics. Additionally, the highly competitive, volume-driven pricing strategies perpetually employed by major Asian manufacturing hubs exert a sustained competitive pressure wave across the global supply chain, which ultimately results in benefits for end-consumers through lower average prices and a vastly expanded product variety.

Segmentation Analysis

The Stainless Steel Jewelry Market undergoes comprehensive segmentation analysis based on three foundational criteria: product form type, the demographic identity of the end-user, and the method of distribution utilized, providing essential, granular visibility into specific consumer purchasing behaviors and overall market vitality. The segmentation by product type is critical as it delineates precisely which specific jewelry articles—such as intricate rings, statement necklaces, or functional watches—are generating the highest revenue streams and exhibiting the fastest growth rates. This detail informs production volume allocation and design investment priorities. Simultaneously, the end-user analysis provides vital differentiation between the purchasing motivations and preferred aesthetics of men, women, and the increasingly prominent unisex category, the latter gaining significant cultural traction due to the blurring and softening of traditional gender lines within contemporary global fashion trends. Understanding these demographic preferences is key to targeted product development.

The segmentation based on distribution channel is equally crucial, highlighting the fundamental and transformative role that high-volume online platforms and advanced digital sales ecosystems play in comparison to the sustained relevance of traditional brick-and-mortar retail establishments. This segmentation reflects stainless steel’s highly versatile market appeal, which successfully traverses various retail settings, from accessible mass-market hypermarkets to high-end, dedicated specialty boutiques. The ongoing competitive dynamic between pure-play e-commerce sellers, who prioritize pricing and convenience, and physical retailers, who focus on tactile interaction and immediate gratification, defines the current state of consumer access. Furthermore, the inclusion of segmentation by material grade, notably distinguishing the industrial-grade 304 from the specialized, medical-grade 316L (surgical stainless steel), offers critical insight into the quality spectrum demanded by different customer applications, particularly for items designed for sensitive skin or high-stress environments.

By analyzing these segments in conjunction, stakeholders can identify highly specific market niches, such as the growth rate of unisex necklaces sold through direct-to-consumer online channels, or the demand stability for 316L rings sold via specialty stores in major metropolitan areas. This multi-faceted segmentation structure is essential for accurate forecasting, strategic product portfolio management, and optimizing regional marketing efforts to effectively capture the diverse and widespread consumer interest in durable, affordable, and fashionable stainless steel jewelry across the global landscape, ensuring that product supply accurately meets localized demand patterns and quality expectations.

- Product Type:

- Rings (Wedding bands, Fashion rings, Signet rings)

- Necklaces and Pendants (Chain necklaces, Statement pendants, Layering pieces)

- Bracelets and Bangles (Cuffs, Charm bracelets, Chain link styles, Identification bracelets)

- Earrings (Studs, Hoops, Dangles, Climbers, Threaders)

- Watches and Watch Components (Watch cases, Bands, Bezels)

- Others (Body jewelry, Pins, Cufflinks, Tie clips)

- End-User:

- Men (Focus on robust, masculine, and minimalist designs)

- Women (Emphasis on intricate, plated, and fashion-forward aesthetics)

- Unisex (Gender-neutral and versatile styles)

- Distribution Channel:

- Online Retail (Dedicated brand websites, Third-party marketplaces like Amazon, Social Commerce platforms)

- Offline Retail (Specialty Stores, Department Stores, Supermarkets/Hypermarkets, Independent Jewelers)

- Grade Type:

- 304 Stainless Steel (Standard Fashion Grade)

- 316L Stainless Steel (Surgical Grade, High-end fashion, medical applications)

- Others (Specialized alloys or proprietary blends)

Value Chain Analysis For Stainless Steel Jewelry Market

The intricate value chain of the stainless steel jewelry market begins critically with the upstream analysis, which encompasses the sourcing and processing of core raw materials, predominantly high-purity iron ore, chromium, and nickel—elements essential for forging the robust stainless steel alloys, with a specific focus on the highly demanded 316L surgical steel. Key stakeholders in this foundational phase include major global mining corporations and specialized metallurgical processing facilities responsible for creating steel billets and wire forms that meet the stringent material specifications required for jewelry production (e.g., low-level magnetic properties and high corrosion resistance). Effective supply chain management at this stage hinges on securing consistent material quality, negotiating favorable procurement costs, and increasingly, demonstrating commitment to sustainable and ethically compliant sourcing practices, which are becoming non-negotiable prerequisites for brands targeting environmentally conscious Western markets.

The midstream segment is dedicated to high-precision manufacturing, a phase defined by advanced technological integration. This involves sophisticated processes such as computer numerical control (CNC) machining, specialized laser cutting and welding for seamless construction, high-pressure casting, meticulous surface polishing, and, most importantly, the application of cutting-edge finishing techniques. Physical Vapor Deposition (PVD) represents the gold standard for applying durable coatings, offering superior longevity for plated pieces compared to traditional methods. Downstream activities commence once the finished product is ready, focusing on comprehensive logistics, strategic marketing, sales execution, and customer fulfillment. Products transition from centralized manufacturing facilities to a dual system of sales channels: direct and indirect. Direct distribution (D2C) utilizes company-owned e-commerce platforms and flagship retail locations, ensuring maximum brand control and capturing essential customer data for future personalization strategies.

Indirect channels involve leveraging the established scale and geographic reach of third-party partners, including large national wholesalers, major department store chains, high-traffic online marketplaces (e.g., Etsy, eBay), and specialized fashion distributors. While indirect distribution provides extensive market penetration quickly, it often results in lower profit margins per unit due to retailer markups. The critical success factor across the entire chain lies in maintaining rapid turnaround times from design concept to consumer availability, especially crucial for remaining relevant within the accelerated trend cycle of fashion accessories. Continuous optimization across the value chain, from material science innovation at the upstream level to efficient last-mile delivery in the downstream phase, is essential for maintaining competitive pricing and high customer satisfaction in the globally competitive stainless steel jewelry segment.

Stainless Steel Jewelry Market Potential Customers

The diverse clientele for stainless steel jewelry encompasses a wide spectrum of consumer groups, meticulously delineated by varying levels of purchasing power, specific lifestyle demands, and dominant fashion orientations, establishing the market’s reputation for profound accessibility and universal appeal. The bedrock of the current consumer base primarily consists of the Millennial (Gen Y) and Gen Z populations who overwhelmingly favor accessories that strike a perfect balance between being intensely trendy, exceptionally durable, and highly budget-friendly, placing functionality and aesthetic value above the traditional focus on intrinsic investment value. These digitally native consumers maintain high levels of engagement across social media platforms, respond strongly to authentic D2C branding narratives, and place a premium on transparency regarding sustainability and ethical material sourcing, which stainless steel, often being highly recyclable, generally supports effectively.

A second, critically important segment includes individuals who suffer from common dermatological reactions or metal sensitivities, particularly to nickel, making them acutely dependent on hypoallergenic materials. The inert nature of high-quality 316L surgical stainless steel renders it the preferred material for continuous, long-duration wear, particularly essential for body piercing jewelry, medical alert tags, and general everyday pieces where sustained skin contact is inevitable. Furthermore, the massive cohort of budget-conscious purchasers who actively seek the premium visual and textural appearance of fine metals, notably the sophisticated luster of 18k gold or the subdued elegance of silver, without having to commit to the associated, prohibitive luxury price points, constitutes a primary and consistently growing demand pool for meticulously crafted, high-durability PVD-coated stainless steel items.

Beyond these foundational segments, the rapidly expanding professional workforce globally represents a significant potential market for discreet, sophisticated, and durable stainless steel watches and accessories perfectly suited for conservative corporate and business-casual environments. Moreover, the niche but aggressively accelerating men's accessory market forms a substantial revenue stream, with male consumers increasingly embracing jewelry items such as heavy-gauge chains, robust signet rings, and durable bracelets. Stainless steel resonates profoundly with this segment due to its inherent strength, capacity for masculine, industrial aesthetics, and exceptional resistance to the wear and tear associated with active lifestyles. Ultimately, the market strategically caters to any consumer group—ranging from students to high-level executives—seeking a perfect synthesis of contemporary style, proven physical durability, and economic accessibility, firmly cementing stainless steel jewelry as an indispensable, mainstream fashion staple globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 34.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fossil Group Inc., Pandora A/S, Ti Sento Milano, Stuller Inc., Pura Vida Bracelets, Charles & Colvard, Cartier (Richemont Group - for selective sub-brands), Chow Tai Fook Jewellery Group, P&G Fashion Ltd., Nomination Italy, Guess Inc., Tiffany & Co. (LVMH - for accessible lines), Daniel Wellington AB, Luca + Danni, Alex and Ani, Ana Luisa, Astrid & Miyu, MVMT, King Baby Studio, Zales, Michael Kors Holdings, Ted Baker PLC, Diesel S.p.A., H. Stern. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Jewelry Market Key Technology Landscape

The core technology landscape driving innovation and efficiency within the Stainless Steel Jewelry Market is rapidly migrating away from labor-intensive, imprecise traditional casting methodologies toward sophisticated, digitized manufacturing systems that prioritize extreme precision and material optimization. A paramount technological evolution involves the pervasive, integrated adoption of high-fidelity Computer-Aided Design (CAD) and advanced Computer-Aided Manufacturing (CAM) platforms. These systems empower designers to conceive and realize extraordinarily intricate, complex geometric patterns—including lattice structures and micro-engravings—that were previously either technically infeasible or economically prohibitive using purely manual or analog techniques. The holistic deployment of CAD/CAM systems is vital for guaranteeing absolute product uniformity across mass production runs, aggressively minimizing raw material waste through optimization algorithms, and critically enabling rapid prototyping capabilities, which are indispensable for maintaining competitiveness within the volatile, accelerated trend cycles characteristic of the fashion accessory sector.

Furthermore, the specialized field of surface treatment technology remains the critical differentiator between commodity stainless steel pieces and premium market offerings. Physical Vapor Vapor Deposition (PVD) coating has emphatically solidified its position as the industry benchmark for applying highly durable, chemically stable, and non-toxic metallic finishes, particularly replicating the rich, sought-after hues of 18k gold and refined rose gold. PVD provides substantially superior bonding strength, exceptional scratch resistance, and dramatically extended longevity compared to outdated, less environmentally friendly traditional electroplating methods. This technical superiority significantly extends the product’s aesthetic lifespan and elevates its perceived market value, strategically enabling stainless steel products to successfully challenge the market dominance previously held by conventional gold vermeil and sterling silver pieces, especially in the high-quality fashion jewelry category. Manufacturers continue to heavily invest in refining PVD parameters, experimenting with advanced interlayer technologies and novel alloy compositions to achieve deeper, more consistent colors and unsurpassed wear resistance.

Beyond surface finishing, the overarching goal of manufacturing efficiency is actively propelled by the precise application of advanced laser technology for tasks demanding extreme accuracy, including micro-cutting, high-resolution engraving of personalized messages, and structural welding that ensures clean, invisible joints with maximum strength. In parallel, advanced 3D printing technology, particularly methods like Selective Laser Melting (SLM) for direct metal printing, although still considered premium for high-volume mass production, is rapidly gaining ground. It is extensively utilized for creating complex, specialized molds and highly detailed wax patterns with unprecedented speed and dimensional accuracy, thereby facilitating high levels of customization and enabling swift, cost-effective limited-edition product runs. The synergistic convergence of these digital design tools and physical fabrication technologies is fundamentally transforming the quality benchmarks, drastically reducing overall production costs, and dramatically broadening the entire design scope achievable within the resilient stainless steel jewelry sector, confirming its status as a technologically forward industry.

Regional Highlights

A rigorous geographical analysis of the Stainless Steel Jewelry Market confirms that expansion dynamics and consumer preferences diverge significantly across major global regions, influenced markedly by varying levels of economic maturity, the strength of local fashion cultures, established material biases, and the effectiveness of retail infrastructure. This regional differentiation mandates tailored market entry strategies and product offerings for manufacturers targeting specific consumer populations.

- Asia Pacific (APAC): APAC is emphatically forecasted to be the leading region in terms of market growth, exhibiting the highest Compound Annual Growth Rate (CAGR) throughout the 2026–2033 period. This robust growth is intrinsically linked to macro-economic drivers, including swift urbanization rates, the persistent expansion of the consumption-driven middle-class segments across pivotal economies such as China, India, Indonesia, and Vietnam, and a strong, localized cultural adoption of Westernized fashion aesthetics and accessories. Crucially, the region hosts extensive, globally competitive stainless steel manufacturing and processing hubs, which contribute to high-volume production, aggressive pricing strategies, and rapid innovation in advanced material finishes. The extremely high penetration rate of mobile commerce and digital platforms significantly facilitates swift, direct market access, further amplifying sales velocity in this high-growth area.

- North America: North America maintains a substantial and strategically dominant market share, characterized by the highest per capita consumer spending on discretionary fashion accessories and a deeply established, sophisticated retail and brand marketing infrastructure. Regional demand is intensely responsive to social media trends, powerful celebrity and influencer endorsements, and the perceived ethical sourcing status of products. The market overwhelmingly favors durable, minimalist, and functionally designed stainless steel pieces. A major regional catalyst is the heightened consumer awareness regarding skin sensitivities, making the hypoallergenic properties of 316L stainless steel a critical purchase determinant across the United States and Canada. Furthermore, the region is highly accepting of premium-priced stainless steel watches and high-fashion collaborations.

- Europe: Europe is recognized as a mature yet highly discerning market where the tangible quality, proven longevity, and detailed craftsmanship of accessories are paramount consumer values. Major fashion-setting economies, including Italy, France, and Germany, are progressively and strategically integrating high-quality, aesthetically refined stainless steel into their traditional luxury and contemporary bridge-jewelry collections. Sustainability, verifiable ethical production practices, and transparent supply chain reporting are considered essential purchasing criteria by the modern European consumer, thereby imposing stringent operational standards on all manufacturers serving this market. The demand here tends toward classical designs with modern PVD finishes, often sourced from high-reputation national brands.

- Latin America (LATAM): The LATAM market continues to expand at a healthy, consistent rate, substantially supported by stabilizing economic conditions, particularly in high-volume markets like Brazil, Mexico, and Chile, and the accelerating assimilation of global fashion and lifestyle trends among younger, urban populations. Price elasticity is a key consideration in LATAM; thus, the inherent affordability of stainless steel provides a crucial competitive edge against more costly precious metal alternatives. The region exhibits robust, culturally informed demand for colorful, expressive, and substantial statement pieces, requiring reliable and fade-resistant PVD coating technologies to withstand local climatic conditions.

- Middle East and Africa (MEA): While the MEA region has historically been profoundly dominated by the cultural significance and investment value associated with traditional high-carat gold jewelry, the market is currently witnessing a notable, gradual acceptance of stainless steel. This shift is primarily driven by the influence of large expatriate populations, the increasing purchasing power and modern aesthetic preferences of younger local generations, who seek sophisticated, contemporary items suitable for daily, professional wear. Specifically, the Gulf Cooperation Council (GCC) nations show rising interest in luxury-look stainless steel wristwatches, tailored men's accessories, and professional jewelry that provides a high-end appearance without the constant security concerns associated with high-value gold, signaling a measured, yet definite, transformation in consumer material acceptance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Jewelry Market.- Fossil Group Inc.

- Pandora A/S

- Ti Sento Milano

- Stuller Inc.

- Pura Vida Bracelets

- Charles & Colvard

- Cartier (Richemont Group - operating selective fashion lines)

- Chow Tai Fook Jewellery Group

- P&G Fashion Ltd.

- Nomination Italy

- Guess Inc.

- Tiffany & Co. (LVMH - through certain diffusion brands)

- Daniel Wellington AB

- Luca + Danni

- Alex and Ani

- Ana Luisa

- Astrid & Miyu

- MVMT

- King Baby Studio

- Zales

- Tribe Amrapali

- APM Monaco

- David Yurman

- Kendra Scott

- Mejuri

- Blue Nile

- James Avery Artisan Jewelry

- John Hardy

- Thomas Sabo

- Stainless Steel Creations

- Weide Watch Co.

- Titan Company Limited

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Jewelry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of choosing stainless steel over traditional jewelry materials like silver or brass?

Stainless steel, particularly the corrosion-resistant 316L grade, is highly valued for its exceptional durability, complete resistance to tarnish, and certified hypoallergenic properties. Unlike sterling silver, stainless steel does not oxidize or require frequent polishing, offering a low-maintenance, robust, and cost-effective alternative for everyday wear accessories.

Is 316L stainless steel truly hypoallergenic and safe for consumers with sensitive skin?

Yes, 316L surgical stainless steel is generally considered the safest metal for sensitive skin. Although it contains trace amounts of nickel, the metal is tightly bound within the robust alloy structure, preventing its leaching onto the skin, which drastically minimizes the risk of allergic contact dermatitis or irritation, making it ideal for continuous contact items like earrings and body jewelry.

How does Physical Vapor Deposition (PVD) significantly affect the longevity and quality of gold-plated stainless steel?

PVD is a technologically advanced vacuum-based coating process that deposits a thin, dense, and highly adhesive layer of metal (like gold) onto stainless steel. This method provides vastly superior resistance to abrasion, scratching, and fading compared to standard, less durable electroplating, thereby substantially extending the jewelry's aesthetic lifespan and maintaining its premium appearance over time.

Which geographical region is expected to lead the future growth in the stainless steel jewelry market?

The Asia Pacific (APAC) region is strongly projected to register the fastest growth rate (highest CAGR) through 2033. This acceleration is driven by major factors including rapid economic expansion, increasing discretionary consumer spending, and the intense demand for affordable, fashionable, and durable accessories among the region's vast, growing middle-class and young, urban populations.

What major technological advancement is currently driving innovation in stainless steel jewelry design and manufacturing efficiency?

The strategic integration of Computer-Aided Design (CAD) software with advanced manufacturing processes, including precision laser cutting and 3D printing, is the key technological driver. This synergy enables manufacturers to swiftly prototype, iterate, and mass-produce highly complex, intricate geometric designs with optimal material utilization and exceptional consistency, significantly improving time-to-market for new collections.

What is the primary constraint limiting the market penetration of stainless steel jewelry in the luxury segment?

The primary constraint is the entrenched cultural and historical perception that stainless steel lacks the intrinsic financial and symbolic investment value associated with traditional fine metals (gold and platinum). This often restricts its acceptance in high-end gifting, ceremonial events, and segments focused purely on inherited material wealth, despite advancements in aesthetic quality.

How do sustainability trends influence consumer demand for stainless steel jewelry?

Sustainability significantly boosts demand for stainless steel because the material is highly recyclable, durable, and minimizes the need for frequent replacement, aligning with eco-conscious consumer values. Brands demonstrating transparent, ethical sourcing and energy-efficient manufacturing processes gain a competitive edge in environmentally sensitive markets like Europe and North America.

What role does e-commerce play in shaping the stainless steel jewelry market distribution landscape?

E-commerce is the dominant distribution channel, facilitating the D2C model which offers brands higher margins and direct consumer data access. Online platforms allow for vast product catalogs, transparent pricing, and efficient scaling, making them essential for reaching the global, digitally-engaged customer base characteristic of this market.

Why is the men's jewelry segment showing particularly strong growth potential in this market?

The men's jewelry segment is experiencing robust growth because stainless steel is ideally suited for masculine designs, offering strength, durability, and a robust aesthetic at an accessible price point. This allows male consumers to experiment with accessories like chains, rings, and bracelets without a significant financial commitment, driving higher frequency of purchase.

Are there different grades of stainless steel used, and how do they differ?

Yes, the two most common grades are 304 and 316L. Grade 304 is the general standard used in fashion jewelry, offering good resistance. Grade 316L, or surgical steel, is superior, featuring enhanced corrosion resistance and nickel binding, making it the preferred, safer choice for high-quality, long-wear, and sensitive skin applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager