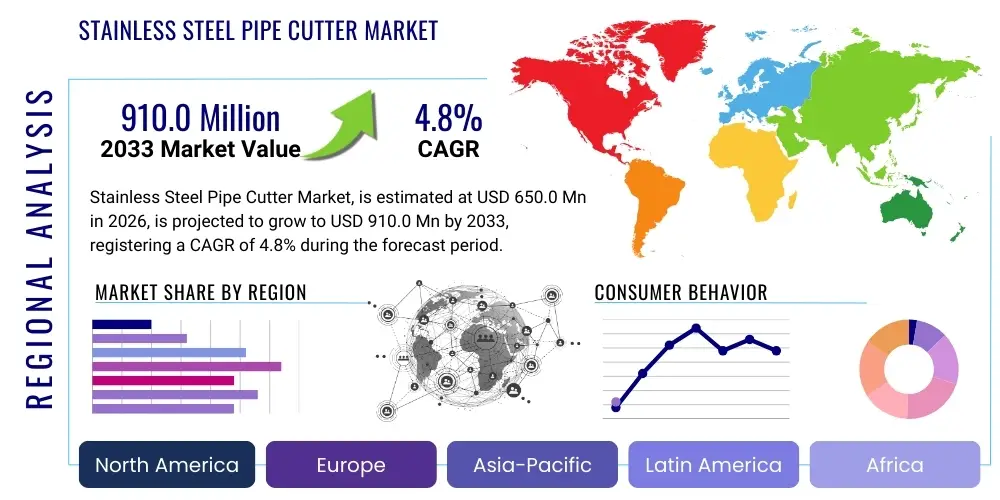

Stainless Steel Pipe Cutter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438720 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Stainless Steel Pipe Cutter Market Size

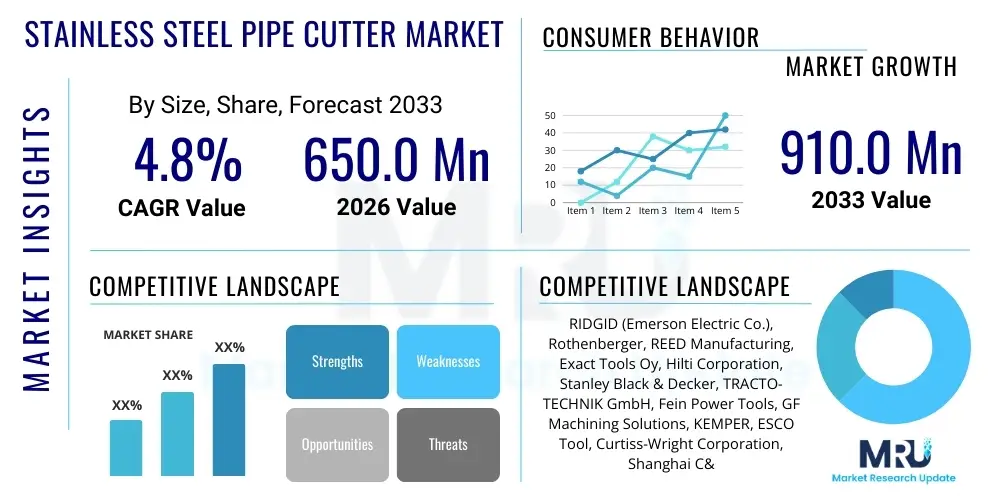

The Stainless Steel Pipe Cutter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 650.0 Million in 2026 and is projected to reach USD 910.0 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating expansion of infrastructure development globally, particularly in developing economies, which necessitates high-precision tools for plumbing, oil and gas, and general construction applications.

The inherent strength and corrosion resistance of stainless steel make it the material of choice for critical piping systems across industries, driving sustained demand for specialized cutting equipment. The shift toward automated and hydraulic pipe cutters, offering enhanced efficiency and reduced labor time compared to traditional manual tools, further contributes significantly to market valuation growth. Furthermore, the stringent safety and quality standards imposed on industrial piping, especially in petrochemical and marine applications, mandate the use of cutters that provide clean, burr-free edges, solidifying the market's upward trend.

Stainless Steel Pipe Cutter Market introduction

The Stainless Steel Pipe Cutter Market encompasses the global manufacturing, distribution, and utilization of specialized tools designed for efficiently and accurately severing stainless steel piping. These tools range from basic manual ratchet cutters and wheel cutters to highly sophisticated electric, hydraulic, and orbital cutting systems. Stainless steel pipe cutters are engineered with specific blade materials, typically hardened steel or titanium nitrite coated, to handle the high tensile strength and anti-corrosive properties of stainless steel grades such as 304 and 316, ensuring a clean, perpendicular cut without deformation or sparking.

Major applications for stainless steel pipe cutters span critical infrastructure sectors. The oil and gas industry utilizes these tools extensively for pipelines and process piping where material integrity is paramount. Similarly, the automotive, marine, aerospace, and semiconductor industries rely on these cutters for precise fabrication and installation of specialized fluid delivery systems. The key benefits driving the adoption of these specialized tools include increased cutting speed, improved safety through reduced manual effort and minimized risk of sparks (especially with cold cutting methods), and most importantly, the ability to produce high-quality, square cuts necessary for optimal welding and joining processes, which is crucial for preventing leaks and maintaining system longevity.

The market is actively driven by escalating global investments in municipal water treatment facilities, chemical processing plants, and energy infrastructure modernization. The need for precise, repeatable cuts is amplified by the widespread adoption of high-purity piping systems in industries like pharmaceuticals and food and beverage, demanding cutting technology that minimizes contamination and surface damage. Advancements in portable battery-powered cutters that combine precision with mobility are further enhancing operational efficiency on demanding job sites, acting as a pivotal driver for the overall market expansion.

Stainless Steel Pipe Cutter Market Executive Summary

The Stainless Steel Pipe Cutter Market is characterized by robust growth, propelled by sustained global infrastructure spending and a pervasive trend toward industrial automation. Key business trends include the consolidation of specialized tooling providers and an intensified focus on developing portable, ergonomic, and battery-powered hydraulic cutters that cater to field service and maintenance operations. The market is witnessing a shift where end-users prioritize total cost of ownership (TCO) over initial tool cost, favoring high-durability, long-lasting blades and robust cutter bodies capable of handling high-volume repetitive work in demanding environments like shipyards and large construction sites.

Regional trends highlight the Asia Pacific (APAC) region as the dominant growth engine, driven by massive urbanization, large-scale public infrastructure projects in China and India, and the rapid expansion of manufacturing capabilities across Southeast Asia. North America and Europe maintain high market maturity, focusing on replacement cycles, integrating smart tools for data logging, and adopting orbital cutting technology for aerospace and pharmaceutical-grade piping, reflecting a demand for extremely tight tolerance and quality assurance. This geographical segmentation underscores the varied levels of technological adoption, with emerging markets still leaning heavily on high-quality manual and electric cutters, while mature markets gravitate toward advanced, digitally integrated cold cutting systems.

Segment trends reveal that the Hydraulic/Electric cutter segment is poised for the fastest expansion, driven by its suitability for large diameter pipes and high-volume applications, offering significant labor savings. Conversely, the manual cutter segment, while experiencing slower growth, maintains a foundational presence due to its portability, low maintenance, and necessity for small-scale repair and confined space applications. Furthermore, the segmentation by end-user shows that the Oil and Gas sector, alongside the Commercial and Residential Construction sector, remain the primary revenue generators, consistently requiring reliable, corrosion-resistant stainless steel piping and the specialized tools to install and maintain them effectively.

AI Impact Analysis on Stainless Steel Pipe Cutter Market

Users frequently inquire about how artificial intelligence (AI) and machine learning (ML) can improve the precision, efficiency, and longevity of stainless steel cutting operations. Key themes revolve around predictive maintenance for cutter wheel degradation, optimizing cutting parameters (speed, feed rate, torque) based on material hardness variations, and the integration of automated robotic systems for large-scale fabrication. Users are concerned about the complexity and cost associated with implementing AI-driven quality control, particularly for smaller fabrication shops, yet they express high expectations for AI to minimize material wastage and improve worker safety by automating repetitive and hazardous cutting tasks.

The primary influence of AI in this domain is channeled through the optimization of cutting processes and the maintenance of tooling assets. AI algorithms analyze real-time sensor data—such as vibration, motor load, and cutting time—to predict when a cutter wheel or blade is reaching the end of its optimal performance life. This transition from reactive maintenance to proactive, predictive scheduling minimizes downtime, ensures consistent cut quality, and significantly reduces operational costs associated with unexpected tool failure. Furthermore, ML models are being developed to recommend the ideal cutting speed and pressure based on the specific grade and diameter of the stainless steel being processed, drastically improving cut finish and reducing burr formation, a critical factor for subsequent welding stages.

Beyond the tool itself, AI contributes to broader operational efficiency in the fabrication and construction sectors. AI-powered vision systems are employed for automated quality inspection of cut ends, quickly identifying deviations from tolerance, eccentricity, or surface defects that could compromise weld integrity. In advanced orbital cutting applications, AI assists in path planning and collision avoidance for multi-axis robotic arms, leading to unprecedented levels of precision and throughput in high-volume manufacturing environments. This integration ensures that the final installed piping system meets the highly stringent specifications required by nuclear, semiconductor, and pharmaceutical industries.

- AI-Driven Predictive Maintenance: Forecasting cutter wheel wear and scheduling proactive replacement, maximizing tool lifespan and operational uptime.

- Optimized Cutting Parameters: Machine learning models calculate optimal speed and feed rates based on material density and cutter type, ensuring superior cut quality.

- Automated Quality Control (AQC): Vision systems utilizing AI rapidly inspect cut faces for perpendicularity, ovality, and surface finish, guaranteeing compliance with engineering tolerances.

- Robotic Integration: AI enables sophisticated path planning for automated orbital and stationary pipe cutting systems, improving safety and repeatability in high-volume production.

- Supply Chain and Inventory Management: ML algorithms optimize the stocking levels for consumable blades and wheels based on projected project timelines and material throughput.

DRO & Impact Forces Of Stainless Steel Pipe Cutter Market

The Stainless Steel Pipe Cutter Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), forming the core Impact Forces shaping its trajectory. Key drivers include aggressive global expenditure on new energy infrastructure, such as LNG terminals and nuclear power plants, which heavily rely on stainless steel piping for high-temperature and high-pressure applications. Simultaneously, the persistent trend toward compact, high-efficiency plumbing and HVAC systems in commercial buildings necessitates precise, deformation-free cutting tools. However, restraints such as the high initial investment cost for advanced hydraulic or orbital cutting systems, coupled with the specialized training required for their operation and maintenance, can limit adoption in smaller enterprises and emerging markets. Opportunities arise primarily from the development of lighter, more powerful battery technologies for portable cutters and the increasing demand for cold cutting techniques that eliminate fire hazards on site, appealing directly to the safety mandates of the oil and gas sector. These forces collectively dictate the innovation speed, pricing strategies, and regional focus of major market participants.

The primary impact forces driving growth stem from regulatory pressures and material science evolution. Stricter environmental and safety regulations globally, particularly in developed regions like the EU and North America, mandate the use of stainless steel over less durable materials for crucial transport systems, inherently boosting demand for specialized tools. The continuous development of new, high-tensile stainless steel alloys necessitates corresponding innovations in cutter wheel composition and geometry, pushing manufacturers to invest heavily in R&D to maintain market relevance. Furthermore, the skilled labor shortage in many construction and fabrication markets accelerates the demand for automated, easy-to-use pipe cutters that reduce reliance on highly experienced technicians, thereby increasing efficiency and mitigating workforce challenges.

Conversely, significant restraining forces include economic volatility and the cyclical nature of the construction and oil and gas industries, which directly influence capital expenditure on tooling. Price sensitivity in large developing economies often favors lower-cost, manual alternatives, potentially slowing the adoption rate of advanced, high-precision equipment. Furthermore, the proliferation of counterfeit or substandard cutting tools, particularly in APAC, poses a challenge to established, high-quality manufacturers, impacting their market share and potentially compromising safety and cut integrity for end-users. Mitigating these restraints requires focused market education and demonstration of the long-term cost benefits associated with professional-grade, specialized stainless steel cutters.

Segmentation Analysis

The Stainless Steel Pipe Cutter Market is extensively segmented based on the mechanism of operation (Type), the size of the pipe being cut (Diameter), and the industrial application (End-User). This multi-dimensional segmentation is crucial for understanding specific product demand patterns and regional market maturity. The segmentation by Type—Manual, Electric, and Hydraulic/Pneumatic—reveals the trade-off between portability and power, with manual cutters dominating small-scale repairs and installations, while powered options are essential for large-diameter, high-volume industrial projects. Diameter-based segmentation helps manufacturers target tooling design for specific market niches, ranging from small-bore tubing used in instrumentation to large-bore piping required in municipal infrastructure and industrial cooling systems. Understanding these segments is key for strategic market entry and product line development, ensuring offerings are optimized for performance, cost-efficiency, and job-site suitability across the diverse needs of the global piping industry.

- By Type:

- Manual Pipe Cutters (Ratchet, Wheel, Hinged)

- Electric Pipe Cutters (Orbital, Rotary)

- Hydraulic/Pneumatic Pipe Cutters

- By Diameter Size:

- Up to 2 Inches

- 2 to 6 Inches

- Above 6 Inches

- By End-User:

- Oil & Gas

- Construction (Commercial & Residential)

- Chemical & Petrochemical

- Water & Wastewater Treatment

- Marine & Shipbuilding

- Automotive & Aerospace

- Pharmaceutical & Food Processing

Value Chain Analysis For Stainless Steel Pipe Cutter Market

The value chain for the Stainless Steel Pipe Cutter Market begins with the upstream procurement of specialized raw materials, primarily high-grade tool steel (such as HSS or alloy steel), precision bearings, and materials required for specific coatings (e.g., Titanium Nitride or Carbide inserts) necessary for the cutter wheels and blades. Key activities at this stage include rigorous quality control over material composition to ensure the longevity and precision of the cutting edge, which is critical when processing tough materials like stainless steel. The manufacturing phase involves precision machining, heat treatment, assembly, and testing. Manufacturers focus heavily on optimizing ergonomics, integrating durability features, and maintaining tight dimensional tolerances to ensure the cutters deliver consistent, clean, and burr-free cuts under challenging industrial conditions. Innovation in this stage is driven by automation and advanced robotics to maintain production consistency and cost efficiency.

The downstream segment of the value chain is focused on distribution and sales, which is typically bifurcated into direct and indirect channels. Direct channels involve large industrial manufacturers or specialized equipment rental companies purchasing high-volume, advanced hydraulic or orbital cutters directly from the OEM, often involving long-term service contracts and customized training programs. Indirect channels, which dominate the distribution of manual and smaller electric cutters, rely heavily on a network of industrial distributors, specialized plumbing supply houses, and large e-commerce platforms. These distributors provide essential services such as localized inventory, technical support, and immediate availability of consumable components like replacement cutter wheels and blades, catering to the immediate needs of contractors and maintenance technicians.

The efficiency of the distribution channel is a major determinant of market success. Given the global nature of construction and energy projects, seamless logistics and effective inventory management are vital to ensure that specialized cutters and their corresponding consumables are available globally. E-commerce platforms are increasingly important for connecting manufacturers directly with smaller contractors, offering transparent pricing and detailed product specifications. Furthermore, after-sales service, including warranty support and the availability of genuine spare parts, forms a critical concluding link in the value chain, heavily influencing customer loyalty and repeat purchasing decisions, especially for high-value hydraulic and orbital cutting systems used in mission-critical applications.

Stainless Steel Pipe Cutter Market Potential Customers

The primary end-users and potential customers of stainless steel pipe cutters span a wide spectrum of industrial and commercial activities where the integrity of fluid transport systems is critical. The largest customer base resides within the construction industry, specifically general contractors and specialized mechanical, electrical, and plumbing (MEP) firms responsible for installing high-end HVAC systems, sanitary piping, and fire suppression lines in commercial, institutional, and high-rise residential buildings. These customers seek tools that offer maximum portability combined with the capability to perform precise, perpendicular cuts required for leak-proof connections in confined spaces.

Another significant customer segment is the heavy industry sector, particularly the Oil and Gas, Chemical, and Power Generation industries. These entities, including pipeline operators, refineries, and petrochemical processors, require heavy-duty, often hydraulically powered or automated orbital cutters capable of handling large-diameter, thick-walled stainless steel pipes (such as API 5L grades and specialized duplex stainless steel). Their purchasing criteria prioritize durability, safety features (e.g., cold cutting to prevent sparks), and the ability to maintain extremely tight tolerances to meet regulatory standards and minimize downtime in critical operational environments.

Furthermore, niche but high-value customer groups include specialized fabricators serving the semiconductor, pharmaceutical, and food & beverage industries. These sectors demand ultra-high-purity (UHP) piping systems, meaning their cutting tools must offer exceptional precision, minimize internal contamination, and produce minimal surface roughness (Ra values). For these applications, orbital cutting machines dominate the market, as they offer the highest degree of repeatability and contamination control, making specialized UHP system installers a rapidly growing and highly profitable segment of the potential customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Million |

| Market Forecast in 2033 | USD 910.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RIDGID (Emerson Electric Co.), Rothenberger, REED Manufacturing, Exact Tools Oy, Hilti Corporation, Stanley Black & Decker, TRACTO-TECHNIK GmbH, Fein Power Tools, GF Machining Solutions, KEMPER, ESCO Tool, Curtiss-Wright Corporation, Shanghai C&G Engineering, TT Technologies, Milwaukee Tool (Techtronic Industries Co. Ltd.), Sumner Manufacturing, Foster Tools, Klauke GmbH, Rems GmbH & Co KG, Geberit AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Pipe Cutter Market Key Technology Landscape

The technology landscape of the Stainless Steel Pipe Cutter Market is defined by continuous innovation aimed at enhancing precision, speed, and safety, specifically addressing the unique challenges posed by cutting high-tensile stainless steel. A primary technological focus is on orbital cutting systems, particularly prevalent in applications requiring high purity and perfect perpendicularity, such as in the semiconductor or aerospace industries. Orbital cutters utilize a rotating cutting head that moves around the stationary pipe, offering exceptional repeatability and minimizing burr formation. Recent technological advancements include integrating brushless motor technology into electric and battery-powered cutters, significantly improving power-to-weight ratio, extending battery life, and reducing maintenance requirements compared to older brushed designs, thereby making high-performance cutting systems increasingly portable and site-friendly.

Another crucial technological development involves cold cutting techniques, which are rapidly gaining traction, especially in hazardous environments like petrochemical plants and refineries. Technologies such as abrasive cutting wheels using specialized composite materials and advanced milling or beveling heads prevent the generation of sparks, minimizing explosion and fire risks. Furthermore, manufacturers are investing heavily in developing advanced cutter wheel materials, utilizing specialized carbide inserts, ceramic coatings, and proprietary heat treatments to dramatically increase the longevity and sharpness of the cutting edge. This technological arms race focuses on improving the ability of the blade to slice through challenging grades of stainless steel, such as Duplex and Super Duplex alloys, without premature dulling or tool chatter.

The integration of smart technology (IoT) into hydraulic and electric cutters represents a significant shift in the technological landscape. Modern professional-grade cutters are now equipped with sensors that monitor key performance metrics like torque, cutting pressure, and operational cycles. This data can be transmitted wirelessly to a management system, enabling real-time diagnostics, performance tracking, and the implementation of AI-driven predictive maintenance schedules. This connectivity not only ensures optimal tool performance but also provides valuable operational data for quality assurance and compliance reporting, particularly important for large construction management firms seeking to standardize tool usage and minimize human error across multiple project sites globally.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market segment, primarily fueled by unprecedented investment in urban and national infrastructure, including extensive pipeline networks, mass transit systems, and massive industrial park development across China, India, and Southeast Asia. The region’s booming manufacturing sector, particularly in automotive and electronics fabrication, necessitates high volumes of stainless steel tubing, driving consistent demand for both manual, cost-effective cutters and high-throughput automated cutting solutions. While price sensitivity remains a factor, the increasing adoption of stringent quality standards in critical infrastructure projects is accelerating the demand for precision electric and hydraulic cutters, pushing the region towards higher-value product segments.

- North America: North America is characterized by high market maturity, focusing on replacement cycles, adherence to rigorous safety standards, and technological integration. The primary demand drivers here include modernization of aging infrastructure (water/wastewater treatment and gas distribution), strict environmental regulations favoring corrosion-resistant stainless steel, and substantial growth in high-purity sectors like pharmaceuticals and biotechnology. The market exhibits a strong preference for battery-powered, ergonomic tools that prioritize worker safety and operational efficiency. The integration of IoT capabilities for asset tracking and maintenance scheduling is more prevalent in the US and Canada than in other regions, reflecting a technologically advanced end-user base willing to pay a premium for smart tooling solutions.

- Europe: The European market is highly regulated and emphasizes sustainability, precision engineering, and worker health and safety. Demand is consistently driven by the rigorous standards imposed on HVAC, industrial fluid control systems, and complex fabrication work in Germany, France, and the UK. There is a strong uptake of specialized orbital cutting equipment, particularly in industrial automation and cleanroom applications. Furthermore, the region is a key hub for developing and adopting innovative cold cutting technologies to comply with strict workplace safety directives, ensuring that high-quality, high-precision tools, often supplied by regional specialized manufacturers, dominate the market landscape.

- Latin America (LATAM): The LATAM market, while exhibiting volatility, presents significant growth opportunities tied directly to large-scale commodity projects, including mining expansion and ongoing oil and gas exploration in countries like Brazil and Mexico. The demand for stainless steel pipe cutters here is cyclical, heavily influenced by foreign investment in infrastructure development. Manual and basic electric cutters remain highly popular due to cost constraints, but there is a growing, localized need for heavy-duty hydraulic cutters to service large-diameter pipelines associated with energy and resource extraction. Improving economic stability and increasing investment in domestic processing capabilities will be crucial for sustained growth in the advanced cutter segment.

- Middle East and Africa (MEA): The MEA region is fundamentally driven by massive ongoing and planned capital projects in the energy sector, including new refinery construction, petrochemical complexes, and extensive water desalination plants, all of which rely heavily on stainless steel piping to handle aggressive chemicals and corrosive water. The demand profile is skewed towards large-diameter, high-performance hydraulic and mechanized cutting systems capable of handling rigorous operational demands and extreme site conditions. Safety and reliability are paramount, leading to a strong preference for global premium brands that offer robust technical support and certified training programs for operating these high-value specialized tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Pipe Cutter Market.- RIDGID (Emerson Electric Co.)

- Rothenberger

- REED Manufacturing

- Exact Tools Oy

- Hilti Corporation

- Stanley Black & Decker

- TRACTO-TECHNIK GmbH

- Fein Power Tools

- GF Machining Solutions

- KEMPER

- ESCO Tool

- Curtiss-Wright Corporation

- Shanghai C&G Engineering

- TT Technologies

- Milwaukee Tool (Techtronic Industries Co. Ltd.)

- Sumner Manufacturing

- Foster Tools

- Klauke GmbH

- Rems GmbH & Co KG

- Geberit AG

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Pipe Cutter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Stainless Steel Pipe Cutter Market between 2026 and 2033?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2026 to 2033, driven primarily by global infrastructure development and industrial modernization efforts.

Which type of stainless steel pipe cutter is expected to see the fastest growth?

The Hydraulic/Electric Pipe Cutter segment, including advanced orbital cutting systems, is expected to experience the fastest growth due to increasing industrial automation, demand for high-precision cuts in large-diameter piping, and a focus on reducing manual labor and improving job-site efficiency.

How does AI impact the stainless steel pipe cutting industry?

AI primarily impacts the industry through predictive maintenance algorithms that monitor cutter wear to prevent unexpected failures, automated quality control (AQC) using vision systems for cut integrity, and optimization of cutting parameters (speed/torque) for superior finish and reduced material wastage.

Which region currently dominates the Stainless Steel Pipe Cutter Market?

The Asia Pacific (APAC) region currently dominates the market in terms of volume and growth rate, attributed to significant public and private investments in infrastructure, manufacturing expansion, and urbanization across major economies like China and India.

What are the main drivers accelerating the adoption of specialized cutters for stainless steel?

Key drivers include stringent industry regulations requiring high-integrity, corrosion-resistant stainless steel piping; aggressive global investment in energy and water infrastructure; and the demand for cold cutting technologies to enhance safety in hazardous environments like petrochemical processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager