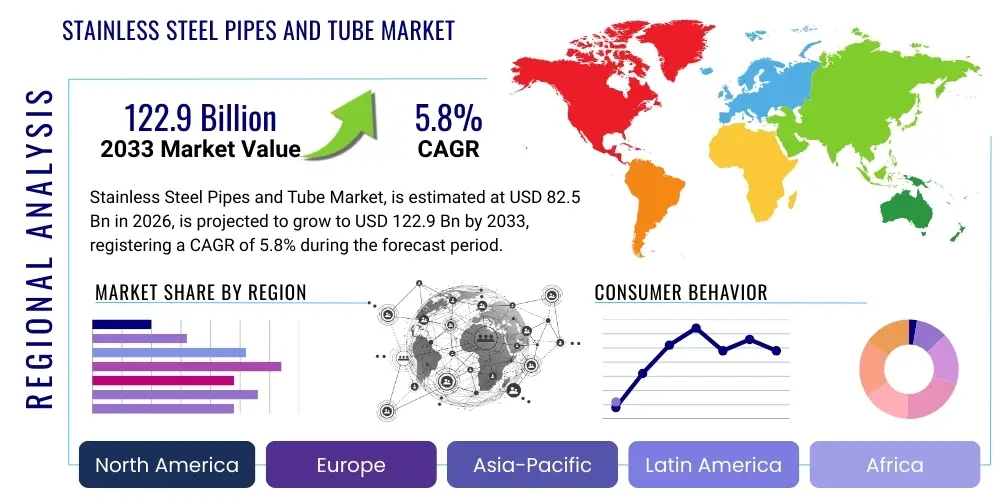

Stainless Steel Pipes and Tube Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434924 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Stainless Steel Pipes and Tube Market Size

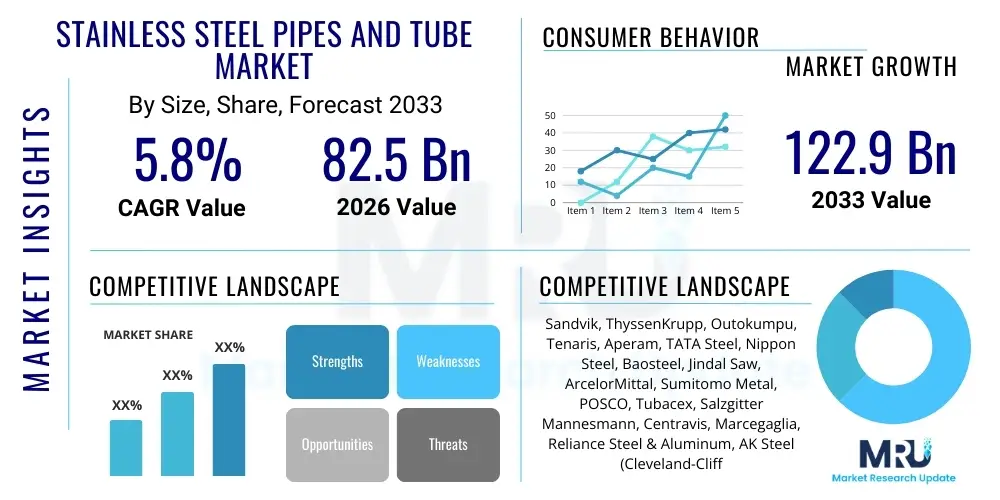

The Stainless Steel Pipes and Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 82.5 Billion in 2026 and is projected to reach USD 122.9 Billion by the end of the forecast period in 2033.

Stainless Steel Pipes and Tube Market introduction

The Stainless Steel Pipes and Tube Market encompasses the production, distribution, and consumption of various grades of stainless steel used for fluid and gas conveyance, structural applications, and heat transfer. Stainless steel, defined by its minimum chromium content of 10.5%, offers superior corrosion resistance, high tensile strength, and excellent heat resistance compared to standard carbon steel, making it indispensable across critical industrial sectors. These products are broadly classified into seamless pipes (preferred for high-pressure, high-temperature applications due to their uniformity) and welded pipes (more cost-effective and suitable for lower-pressure uses), catering to diverse mechanical, physical, and chemical demands. The market dynamics are intricately linked to global infrastructure spending, industrial automation, and the stringent regulatory environment governing material safety and longevity in key sectors like oil and gas, petrochemicals, pharmaceuticals, and nuclear power generation. Significant investment in large-scale infrastructure projects, particularly in developing economies, coupled with the mandatory replacement of aging carbon steel infrastructure with durable stainless steel solutions, acts as a pivotal growth engine. The continuous evolution of stainless steel metallurgy, including the development of advanced duplex and super-duplex grades, further enhances the applicability of these products in extremely corrosive and demanding environments, reinforcing their premium position in the global materials landscape.

Major applications for stainless steel piping include transporting corrosive chemicals in the chemical processing industry (CPI), conveying potable water and wastewater, handling high-purity media in the pharmaceutical and food and beverage sectors, and structural use in architecture and construction where aesthetic appeal and durability are paramount. The inherent benefits of using stainless steel, such as its hygienic properties, ease of sterilization, and long lifecycle, drastically reduce maintenance costs and operational downtime compared to alternative materials. Furthermore, the sustainability aspect, derived from stainless steel's 100% recyclability without degradation, aligns well with global environmental, social, and governance (ESG) mandates, providing a competitive advantage. Key driving factors include the rapid expansion of the energy sector, specifically liquefied natural gas (LNG) infrastructure and renewable energy projects requiring specialized piping, coupled with robust growth in automotive manufacturing demanding lightweight, corrosion-resistant exhaust systems and structural components. The technological advancements focused on improving welding techniques and reducing manufacturing costs for seamless products are also contributing significantly to market accessibility and penetration across new application areas. The market remains sensitive to fluctuations in raw material prices, particularly nickel and chromium, which directly influence production costs and end-product pricing strategies globally.

Stainless Steel Pipes and Tube Market Executive Summary

The Stainless Steel Pipes and Tube Market is witnessing robust growth propelled by accelerated industrialization in the Asia Pacific region, significant capital expenditure in energy infrastructure, and increasingly stringent material specifications mandated by health and environmental regulations across North America and Europe. Business trends indicate a strong shift towards higher-performance alloys, particularly duplex and super-duplex stainless steel, driven by complex offshore oil and gas exploration and chemical processing environments that demand superior resistance to stress corrosion cracking and pitting. Furthermore, manufacturers are increasingly adopting advanced production techniques, such as laser welding and additive manufacturing for specialized fittings, to enhance product quality, reduce lead times, and optimize material usage. Strategic mergers, acquisitions, and joint ventures among key players are common business strategies aimed at achieving vertical integration, securing stable raw material supply chains, and expanding geographic reach, especially into emerging markets characterized by rapid urbanization and infrastructure build-out. The prevailing trend focuses on sustainable manufacturing practices, with many producers investing in energy-efficient mills and optimizing scrap utilization to minimize their carbon footprint, addressing growing stakeholder demand for environmentally responsible sourcing.

Regionally, Asia Pacific maintains its dominance in both production and consumption, primarily fueled by massive infrastructure projects in China, India, and Southeast Asian nations, coupled with the relentless expansion of their chemical and automotive industries. North America and Europe, while mature markets, exhibit strong demand driven by replacement cycles for existing infrastructure, strict regulatory requirements (like those in the pharmaceutical and nuclear sectors), and high-value applications requiring specialized, custom-fabricated stainless steel solutions. Latin America and the Middle East & Africa (MEA) are emerging as critical growth hubs, powered by large-scale oil and gas investments (especially in Saudi Arabia and the UAE) and significant urbanization initiatives requiring reliable water and sanitation systems. Segment trends highlight that the Welded segment continues to hold a larger market share due to its cost-effectiveness and broad utility in standard industrial applications, although the Seamless segment is expected to register a higher CAGR due to its essential role in high-pressure steam lines, heat exchangers, and sensitive process piping in the energy and aerospace sectors. The Austenitic grade remains the most widely used due to its versatility and high resistance to corrosion, but the Duplex grades are gaining significant traction due to their optimal blend of strength and ductility, positioning them as the material of choice for demanding corrosive environments.

AI Impact Analysis on Stainless Steel Pipes and Tube Market

User queries regarding AI's influence in the Stainless Steel Pipes and Tube market primarily revolve around operational efficiency, quality control, predictive maintenance, and supply chain optimization. Key themes indicate that users are seeking definitive information on how machine learning algorithms can enhance the precision of steel production, specifically in areas like metallurgy control during melting and casting to achieve desired chemical compositions and mechanical properties with minimal variability. Concerns are often raised regarding the initial capital investment required for implementing sophisticated AI-driven inspection systems and the need for a skilled workforce capable of managing and interpreting complex data models. Expectations are centered on AI's potential to dramatically reduce defects in welding processes, predict equipment failure in rolling mills and pipe drawing facilities before critical breakdown occurs, thereby minimizing expensive downtime, and optimizing inventory levels across global distribution networks to respond dynamically to fluctuating end-user demand. The consensus suggests that while AI adoption is nascent, its strategic integration into the manufacturing lifecycle promises significant improvements in yield rates, material traceability, and overall operational sustainability, driving competitive advantage for early adopters.

- AI-powered predictive maintenance optimizes uptime of mill machinery, reducing unexpected failures in welding and annealing processes.

- Machine learning algorithms enhance quality control by analyzing real-time sensor data during production, immediately identifying subtle defects in pipe wall thickness or surface finish.

- AI integration optimizes supply chain logistics by forecasting demand, managing raw material procurement (nickel, chromium), and routing distribution networks efficiently.

- Advanced image recognition using AI improves automated non-destructive testing (NDT), such as ultrasonic and eddy current inspections, increasing detection accuracy beyond human capability.

- AI modeling assists metallurgists in rapid alloy development and optimization, streamlining the creation of specialized stainless steel grades (e.g., super-duplex) tailored for extreme applications.

DRO & Impact Forces Of Stainless Steel Pipes and Tube Market

The market is significantly driven by robust global infrastructure spending and the crucial demand for corrosion-resistant materials in the rapidly expanding chemical, petrochemical, and oil & gas sectors, particularly in severe environments where material failure is costly and hazardous. Key restraints include the inherent volatility of raw material prices, primarily nickel and chromium, which directly impacts manufacturing costs and profit margins, coupled with the high capital investment required for setting up specialized stainless steel production facilities meeting strict quality standards. Opportunities are abundant in the burgeoning renewable energy sector, especially solar and geothermal power generation requiring high-temperature resistant stainless steel tubing, and the widespread adoption of specialized duplex and super-duplex grades in challenging applications, offering superior performance compared to traditional alloys. These forces interact to create a complex market landscape where technological advancements in production efficiency and alloy formulation are critical differentiators, influencing market share and determining the overall economic viability of stainless steel production relative to cheaper substitutes. The combined effect of infrastructure development and strict environmental regulations requiring non-corrosive, long-lasting materials provides a powerful, enduring momentum for market expansion despite persistent raw material price volatility.

Segmentation Analysis

The segmentation of the Stainless Steel Pipes and Tube Market is crucial for understanding specific growth dynamics across product forms, material grades, and industrial applications. This analysis reveals the distinct preferences of various end-use sectors, helping manufacturers tailor production capacities and strategic investments. The market is primarily segmented based on the method of manufacturing (seamless vs. welded), which dictates application suitability (high-pressure vs. general conveyance), the specific metallurgical composition (austenitic, ferritic, etc.) which determines physical properties like corrosion resistance and strength, and the ultimate end-use industry, which drives volume and specification requirements. The predominance of the Welded segment is largely due to its cost advantage and use in construction and general industrial water transportation, while the high-performance demands from the Oil & Gas and Power Generation industries solidify the importance of the Seamless segment and advanced Duplex grades, showcasing a highly stratified market structure driven by performance and regulatory compliance.

- By Product Type:

- Seamless Pipes and Tubes

- Welded Pipes and Tubes

- By Material Grade:

- Austenitic Stainless Steel (304, 316, etc.)

- Ferritic Stainless Steel

- Martensitic Stainless Steel

- Duplex Stainless Steel

- Super Duplex Stainless Steel

- By End-Use Industry:

- Oil and Gas

- Chemical and Petrochemical

- Food and Beverage

- Automotive and Transportation

- Construction and Architecture

- Power Generation (Nuclear, Thermal, Renewables)

- Water Treatment and Desalination

- Pharmaceuticals and Healthcare

Value Chain Analysis For Stainless Steel Pipes and Tube Market

The value chain for the Stainless Steel Pipes and Tube Market begins with the highly concentrated upstream segment focused on raw material procurement, chiefly nickel, chromium, iron ore, and molybdenum, along with extensive scrap metal processing essential for sustainable stainless steel production. This phase is characterized by significant price volatility and reliance on global mining output and geopolitical stability, directly impacting the cost structure of finished products. The subsequent manufacturing phase involves complex processes such as melting, casting, hot rolling, cold drawing, and specialized welding or extrusion for forming pipes and tubes. This midstream phase requires substantial capital investment in high-precision machinery, sophisticated quality control systems, and energy-intensive operations. Direct distribution channels, often utilized for large, bespoke projects in the Oil & Gas sector, involve direct relationships between the producer and the engineering, procurement, and construction (EPC) contractors, ensuring strict specification adherence and streamlined delivery logistics. Conversely, indirect distribution, relying on global distributors, stockists, and regional agents, caters more effectively to fragmented industrial maintenance, repair, and operations (MRO) demand and smaller construction projects, providing essential inventory management and logistical support closer to the end-users.

The downstream analysis focuses on the transformation and installation of the pipes and tubes within complex industrial systems. This includes highly specialized fabrication services like bending, cutting, and surface finishing, often performed by regional service centers or dedicated fabricators who add significant value by customizing the standard product to precise project requirements, especially for applications like heat exchangers and industrial boilers. The end-use sectors, particularly the energy and chemical industries, dictate the technical specifications and certifications required, influencing the choice of material grade (e.g., Duplex for offshore) and product form (seamless for high-pressure lines). Effective management of the distribution channel is paramount; large manufacturers often employ a dual strategy, utilizing their own sales force for high-volume, predictable sales and leveraging third-party distribution networks to access a broader base of small-to-medium enterprises and maintain local inventory accessibility. The success across the value chain is increasingly dependent on maintaining rigorous quality standards and achieving certifications (e.g., ASME, ASTM, PED), which are non-negotiable entry barriers, ensuring material integrity throughout its lifecycle and protecting critical downstream assets from failure.

Stainless Steel Pipes and Tube Market Potential Customers

The primary consumers, or potential customers, of stainless steel pipes and tubes are large-scale industrial operators and EPC contractors across energy, processing, and infrastructure sectors. In the energy domain, this includes national oil companies, major international oil companies, independent exploration and production firms, and power generation utilities (thermal, nuclear, and renewable), which require vast quantities of high-specification seamless pipe for pipelines, heat exchangers, and boiler components designed to withstand extreme temperatures and pressures. Within the chemical and petrochemical sectors, customers include global manufacturers of basic chemicals, specialty chemicals, and fertilizer producers, who are consistent buyers of austenitic and duplex grades for transporting highly corrosive media. Furthermore, the burgeoning water and wastewater treatment industry, particularly municipal water authorities and private desalination plant operators, represents a significant and rapidly growing customer segment, seeking corrosion-proof and hygienic piping solutions for large conveyance networks.

Beyond the heavy industrial sectors, the food and beverage industry constitutes a vital segment, encompassing breweries, dairies, and pharmaceutical manufacturers who demand ultra-high purity, smooth-surface pipes (often electropolished stainless steel 316L) to meet stringent sanitary standards, prevent contamination, and facilitate effective clean-in-place (CIP) operations. Automotive original equipment manufacturers (OEMs) are consistent consumers, utilizing smaller diameter tubing for exhaust systems, fuel lines, and structural components where weight reduction and corrosion resistance are key performance requirements. Lastly, the construction and architecture sector, including developers of high-end commercial properties and public infrastructure projects, utilizes stainless steel for aesthetic structural elements, railing systems, and durable building services piping. These diverse customer bases require varied services, ranging from massive bulk orders of standard materials to small batches of highly customized, certified alloys, necessitating flexible production and distribution models from market suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 82.5 Billion |

| Market Forecast in 2033 | USD 122.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik, ThyssenKrupp, Outokumpu, Tenaris, Aperam, TATA Steel, Nippon Steel, Baosteel, Jindal Saw, ArcelorMittal, Sumitomo Metal, POSCO, Tubacex, Salzgitter Mannesmann, Centravis, Marcegaglia, Reliance Steel & Aluminum, AK Steel (Cleveland-Cliffs), Bristol Metals, Zhejiang Huadi Steel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Pipes and Tube Market Key Technology Landscape

The manufacturing landscape for stainless steel pipes and tubes is continuously being redefined by advancements in forming, welding, and inspection technologies, aiming for superior strength, improved corrosion resistance, and greater cost efficiency. Key technological innovations center around precision cold drawing techniques for seamless tubes, which ensure tighter tolerances and smoother inner surfaces critical for high-purity applications, and advanced orbital welding technologies used in the production of welded pipes, which yield uniform, high-integrity welds minimizing potential failure points in critical infrastructure. Furthermore, the adoption of computer numerical control (CNC) machining and automated robotic handling systems is standardizing production processes, increasing throughput, and significantly reducing manual errors. The push for digitalization includes the integration of advanced sensor technology within rolling mills to monitor temperature, pressure, and dimensions in real time, feeding data back into control loops for immediate process adjustment, thus maximizing material yield and quality consistency across large production batches. This technological progression is vital for meeting the ever-increasing demand for specialized alloys and customized pipe geometries required by demanding sectors like aerospace and nuclear power, which often require specific, often unique, metallurgical properties and dimensional accuracy.

A significant technological focus is placed on the enhancement of non-destructive testing (NDT) methodologies, which are crucial for assuring product integrity and compliance with international standards such as ASTM and ISO. Technologies like Phased Array Ultrasonic Testing (PAUT) and Electromagnetic Acoustic Transducers (EMAT) are replacing older methods, offering faster, more comprehensive internal defect detection, including subtle cracks, laminations, and porosity that could compromise structural performance under pressure or thermal cycling. Moreover, the development and industrial scaling of Duplex and Super Duplex stainless steels (e.g., UNS S32750, UNS S32205) represent a metallurgical triumph, balancing high mechanical strength with excellent resistance to pitting and chloride stress corrosion cracking. This necessitates specialized hot working and heat treatment protocols to achieve the desired ferrite-austenite balance, requiring precise control enabled by sophisticated furnace technology and process automation. The ongoing research into additive manufacturing (3D printing) of specialized stainless steel components, while still niche, promises future disruption for complex fittings and low-volume, high-value components, potentially shortening lead times and reducing material waste in complex geometric fabrication, thereby reshaping the traditional supply chain model for specialized stainless steel products globally.

Regional Highlights

- Asia Pacific (APAC): This region dominates the global market, driven by rapid industrialization, massive urban development, and substantial government spending on public infrastructure, including high-speed rail, smart cities, and power generation capacity expansion, particularly in China and India. The APAC market is characterized by high volume consumption, robust domestic production capabilities, and intense competition, with a growing focus on meeting environmental standards which necessitates the replacement of older carbon steel infrastructure with more durable, stainless steel systems in chemical and water treatment facilities.

- North America: The market here is mature and characterized by high demand for premium, highly certified products, primarily driven by the refurbishment and expansion of the oil and gas midstream infrastructure (pipelines), strict sanitary requirements in the pharmaceutical and food processing sectors, and ongoing investments in aerospace and defense applications. Regulatory mandates, such as those governing pipeline safety and environmental protection, enforce the use of high-quality seamless and specialized alloy grades, sustaining high average selling prices in this region.

- Europe: Europe is a technologically advanced market focusing heavily on sustainability and innovation. Demand is spurred by the modernization of aging industrial plants, the shift towards hydrogen and other green energy infrastructure (requiring specialized piping), and the strong presence of the automotive sector demanding advanced stainless steel for lighter vehicle components. Strict European Union (EU) directives regarding material traceability and environmental compliance drive innovation in production techniques and promote high-grade material usage across chemical and nuclear industries.

- Middle East and Africa (MEA): This region exhibits fast growth primarily fueled by massive, ongoing investments in the upstream and downstream oil and gas sector (e.g., LNG terminals, refineries), coupled with significant water infrastructure development, especially large-scale desalination projects in Gulf Cooperation Council (GCC) countries. The highly corrosive marine and high-salinity environments necessitate the widespread adoption of high-performance duplex and super-duplex stainless steel grades, positioning MEA as a critical growth engine for specialized alloy manufacturers.

- Latin America: The market growth is linked to fluctuating economic conditions but shows underlying strength driven by infrastructure revitalization, particularly in Brazil and Mexico, and sustained investments in the region’s vast oil and gas reserves. The expansion of mining operations also contributes significantly, requiring corrosion-resistant piping for processing plants, creating steady demand for standard and intermediate stainless steel grades tailored to withstand challenging operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Pipes and Tube Market.- Sandvik

- ThyssenKrupp

- Outokumpu

- Tenaris

- Aperam

- TATA Steel

- Nippon Steel

- Baosteel

- Jindal Saw

- ArcelorMittal

- Sumitomo Metal

- POSCO

- Tubacex

- Salzgitter Mannesmann

- Centravis

- Marcegaglia

- Reliance Steel & Aluminum

- AK Steel (Cleveland-Cliffs)

- Bristol Metals

- Zhejiang Huadi Steel

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Pipes and Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Duplex stainless steel grades?

The primary factor driving the demand for Duplex and Super Duplex stainless steel grades is their superior combination of high mechanical strength and exceptional corrosion resistance, particularly against chloride stress corrosion cracking and pitting, making them ideal for aggressive environments found in offshore oil and gas, chemical processing, and desalination plants where material failure is critically expensive and dangerous.

How does the volatility of raw material prices affect market profitability?

The volatility of key raw materials like nickel and chromium significantly impacts market profitability by directly influencing the cost of production. Manufacturers often employ hedging strategies and implement price escalation clauses in long-term contracts to mitigate this risk, but sustained price spikes can narrow margins, especially for producers of standard austenitic grades.

Which end-use industry contributes most significantly to the market revenue?

The Oil and Gas industry, encompassing upstream, midstream, and downstream operations, along with the Chemical and Petrochemical sector, collectively contribute the most significant share to the market revenue. These industries require vast volumes of high-specification, certified seamless stainless steel pipes for high-pressure, corrosive fluid transport and processing equipment, driving premium segment growth.

What is the difference between Seamless and Welded stainless steel pipes and their typical applications?

Seamless pipes are produced without any welded seams, offering superior wall uniformity and integrity, making them mandatory for high-pressure, high-temperature critical applications like boiler tubes and high-pressure oil pipelines. Welded pipes are manufactured from stainless steel sheets and are more cost-effective, typically used for lower-pressure applications, general conveyance, construction, and ornamental purposes.

How is technological innovation impacting the competitive landscape of the market?

Technological innovation is impacting the competitive landscape by enabling higher production efficiency through automation, enhancing product quality via advanced NDT methods (like PAUT), and allowing for the development of new, high-performance alloys. Companies investing heavily in precise manufacturing and digitalization gain a significant advantage in securing specialized, high-margin contracts globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager