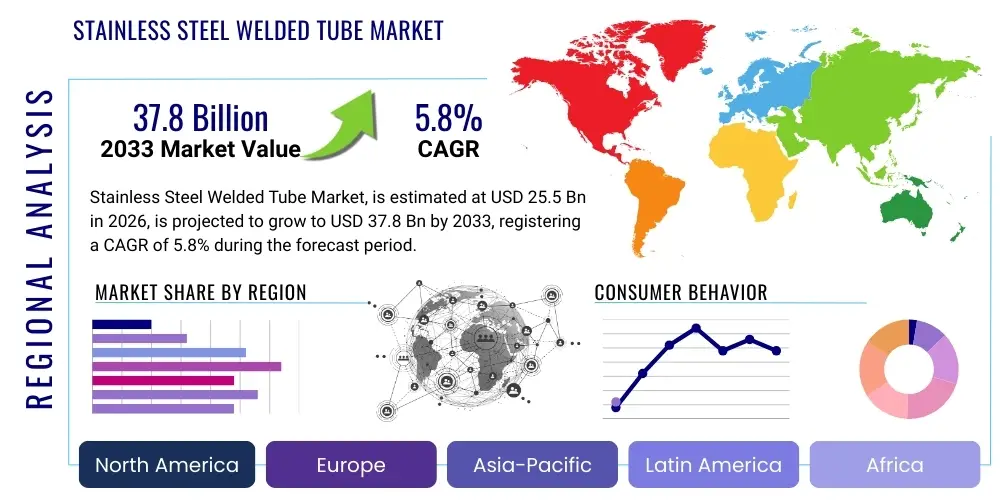

Stainless Steel Welded Tube Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436533 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Stainless Steel Welded Tube Market Size

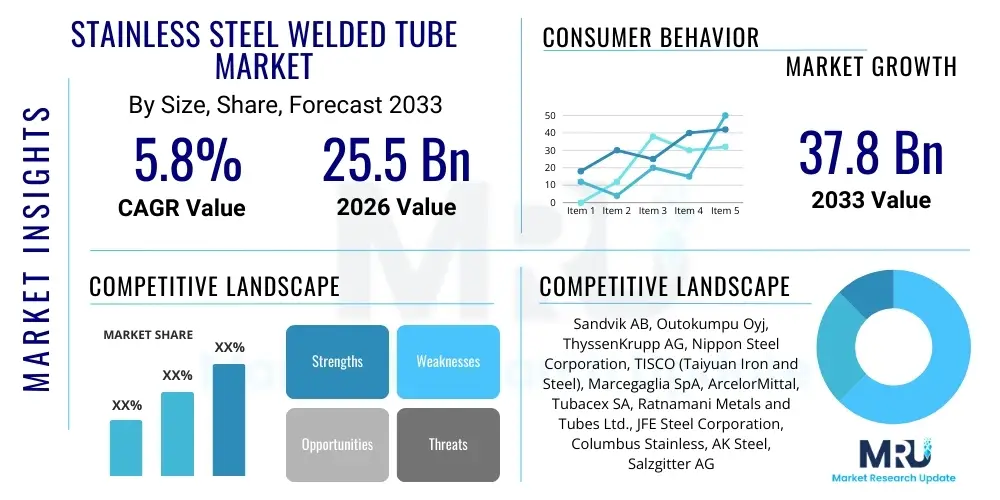

The Stainless Steel Welded Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2033.

Stainless Steel Welded Tube Market introduction

The Stainless Steel Welded Tube Market encompasses the production, distribution, and consumption of tubes manufactured by forming stainless steel strip into a cylindrical shape and welding the seam longitudinally. These tubes offer superior corrosion resistance, high strength-to-weight ratio, and excellent hygienic properties, making them indispensable components across highly demanding industries. Unlike seamless tubes, welded tubes are cost-effective to produce in large volumes and can achieve tighter dimensional tolerances, particularly for large diameters. This method of production is highly scalable and supports the increasing global demand for resilient piping and structural materials, especially in sectors prioritizing longevity and low maintenance costs.

The primary product portfolio includes austenitic, ferritic, and duplex stainless steel grades, catering to specific application requirements such as high temperature, high pressure, or highly corrosive environments. Major applications span critical infrastructure, including heat exchangers in power generation, fluid conveyance systems in oil and gas, structural components in architecture, and ultra-clean piping in the pharmaceutical and food and beverage industries. The versatility of stainless steel, coupled with advancements in welding technology such as laser and plasma welding, continues to enhance the reliability and performance characteristics of welded tubes, thus broadening their addressable market.

The market is predominantly driven by accelerated infrastructure development worldwide, particularly in emerging economies, and the stringent regulatory environment in developed regions necessitating non-corrosive and durable materials for sanitary and industrial processes. Key benefits, such as recyclability, minimal environmental impact, and superior aesthetic appeal, further solidify the position of stainless steel welded tubes as a preferred material choice over conventional alternatives like carbon steel or certain plastics. Continuous innovation in metallurgy and manufacturing processes is focused on developing thinner-walled tubes with enhanced structural integrity, optimizing material usage, and reducing overall production expenditure.

Stainless Steel Welded Tube Market Executive Summary

The Stainless Steel Welded Tube Market is experiencing robust expansion, primarily fueled by massive industrialization and urbanization across the Asia Pacific region, particularly China and India, which are undertaking significant investments in chemical processing, power generation, and transportation networks. Global business trends indicate a critical shift towards sustainability and high-performance materials; this is driving the adoption of stainless steel tubes due to their extended lifespan and complete recyclability. Furthermore, the oil and gas sector's rebound and increased exploration activities, especially in offshore and unconventional reserves, necessitate high-grade, corrosion-resistant tubing, boosting demand for duplex and super-duplex welded varieties. Technological integration, focusing on advanced non-destructive testing (NDT) techniques and automated welding systems, is improving product quality and reducing manufacturing lead times, making welded tubes increasingly competitive against seamless counterparts.

Regionally, Asia Pacific holds the largest market share owing to its dominance in manufacturing and continuous large-scale infrastructure projects. North America and Europe demonstrate mature markets, characterized by high demand for specialized, high-specification tubes for medical, aerospace, and nuclear applications, often driven by strict regulatory standards and emphasis on material traceability. Segment-wise, the market sees dominant growth in the Austenitic Stainless Steel segment due to its widespread applicability and relatively lower cost, while the application segment is led by the Chemical and Petrochemical industry, where extreme temperature and corrosive media handling are mandatory. The increasing focus on sanitary applications is simultaneously propelling the growth of precision-welded tubes in the food and beverage and pharmaceutical sectors, requiring mirror finishes and zero contamination risk, thereby ensuring specialized segment growth remains strong throughout the forecast period.

AI Impact Analysis on Stainless Steel Welded Tube Market

Analysis of common user questions regarding AI's impact reveals key areas of interest focusing on predictive maintenance, supply chain optimization, and enhanced quality control during manufacturing. Users frequently inquire about how AI-driven machine vision systems can detect microscopic weld defects in real-time and how predictive algorithms can forecast material requirements or equipment failure rates in mills. The overriding expectation is that AI will significantly reduce operational costs, minimize material waste, and elevate the standard of quality beyond human inspection capabilities. Users are concerned about the implementation costs and the required upskilling of the existing workforce to manage AI-integrated production lines, anticipating a transition towards fully autonomous welding and inspection processes to meet increasingly stringent industry specifications for critical applications.

- AI-powered machine vision systems enable non-destructive, real-time detection of minute weld imperfections and dimensional inconsistencies.

- Predictive maintenance analytics, driven by machine learning, optimize mill uptime by forecasting failure of welding equipment, rollers, or forming tools.

- AI integration into ERP systems facilitates dynamic supply chain management, optimizing raw material (stainless steel coil) inventory levels and reducing procurement costs.

- Generative design algorithms assist in optimizing tube design specifications, particularly for custom heat exchanger or boiler tubes, enhancing thermal efficiency.

- Automated process control utilizing AI fine-tunes welding parameters (speed, current, gas mixture) dynamically to ensure consistent weld quality across high-volume production runs, boosting AEO.

DRO & Impact Forces Of Stainless Steel Welded Tube Market

The Stainless Steel Welded Tube Market dynamics are shaped by a complex interplay of growth stimulants, market inhibitors, and emerging avenues for expansion, collectively creating significant impact forces. Key drivers include accelerating industrialization and infrastructure investment globally, the inherent corrosion resistance and longevity of stainless steel, and increasingly stringent quality mandates in critical end-use sectors like nuclear power and pharmaceuticals. Conversely, high volatility in stainless steel raw material prices, primarily nickel and chromium, poses a significant restraint, challenging manufacturers' profit margins and leading to unpredictable product pricing. The availability of substitute materials, such as certain alloys or plastics for specific non-critical applications, also acts as a constraint, albeit minor in high-pressure environments. Opportunities are largely concentrated in the expansion of niche markets requiring high-precision tubes, such as hydrogen transportation infrastructure and photovoltaic power systems, and leveraging advanced manufacturing techniques like additive manufacturing for specialized fittings.

Impact forces are strongly tied to global economic cycles and regulatory shifts. The global push for cleaner energy sources, including nuclear power and specialized chemical processing for hydrogen production, creates a high-impact force driving demand for specialized welded grades (e.g., Duplex). Trade tariffs and geopolitical instability can significantly disrupt the supply chain of both raw materials and finished products, leading to market fragmentation and regional price disparities. Furthermore, continuous innovation in welding techniques, such as the application of high-frequency induction welding (HFIW) and laser welding for thinner gauges, enhances production efficiency and quality standards, exerting a positive, transformative impact on the competitiveness of welded products versus seamless alternatives.

Segmentation Analysis

The Stainless Steel Welded Tube market is comprehensively segmented based on material type, product type, manufacturing technology, and end-use application, providing a granular view of market dynamics and specialized demand areas. The material segmentation reveals a reliance on common austenitic grades (304, 316) for general industrial applications, while the growing need for superior strength and corrosion resistance in highly aggressive environments is driving the adoption of Duplex and Super-Duplex steels. Product differentiation is primarily based on wall thickness and diameter, catering to heat exchange systems (thin wall) and structural/process piping (thick wall). Understanding these segments is crucial for manufacturers to tailor their production capabilities and marketing strategies to capture high-value niche opportunities, particularly those arising from regulated sectors like healthcare and aerospace.

Manufacturing technology segmentation, which includes traditional TIG/MIG welding alongside advanced laser and plasma welding, dictates the precision, finish, and cost structure of the final product, influencing competitive advantage. The application segment remains the primary determinant of market size, with substantial consumption emanating from the energy (oil, gas, power), chemical processing, and construction sectors. The high growth rates observed in the food and beverage and pharmaceutical segments reflect the increasing global standards for hygiene and non-contamination, emphasizing the market's trajectory towards higher-specification, premium products. This segmentation structure enables accurate forecasting of regional demands based on prevalent industrial activities and regulatory frameworks.

- By Material Type:

- Austenitic Stainless Steel (304/304L, 316/316L, 321, 310S)

- Ferritic Stainless Steel (409, 439, 441)

- Duplex and Super-Duplex Stainless Steel (2205, 2507)

- Martensitic Stainless Steel

- By Manufacturing Technology:

- Tungsten Inert Gas (TIG) Welding

- High-Frequency Induction Welding (HFIW)

- Laser Beam Welding

- Plasma Arc Welding (PAW)

- By Product Type:

- Standard Wall Thickness Tubes

- Thin Wall Tubes (Precision Tubes)

- Heavy Wall Tubes

- By Application/End-Use Industry:

- Oil and Gas

- Chemical and Petrochemical

- Food and Beverage

- Pharmaceutical and Biotechnology

- Power Generation (Boilers, Heat Exchangers)

- Automotive and Transportation

- Construction and Architecture

- Pulp and Paper

Value Chain Analysis For Stainless Steel Welded Tube Market

The value chain for the Stainless Steel Welded Tube Market begins with the highly capital-intensive upstream segment involving the mining of raw materials, such as iron ore, chromium, and nickel, followed by the smelting and alloying processes to produce stainless steel coil (strip). Volatility in raw material pricing at this stage significantly impacts the subsequent cost structure for tube manufacturers. Key suppliers in the upstream segment are large integrated steel producers that manage complex procurement and metallurgical processes, demanding high purity and specific alloy compositions to ensure the final tube product meets international standards for quality and performance. Efficiency in the upstream segment, particularly concerning energy consumption and yield optimization, is critical for competitive pricing downstream.

The midstream segment involves tube manufacturing, where stainless steel coil is slit, roll-formed into a tube shape, and welded using various technologies (TIG, HFIW, Laser). This stage requires specialized machinery, high-precision tooling, and rigorous quality control, including eddy current testing and hydrostatic testing. Manufacturers often invest heavily in automation and digital monitoring systems to maintain consistent weld quality and dimensional accuracy, which is essential for end-use in critical applications. The downstream segment encompasses distribution and end-use application. Distribution channels involve large stocking distributors, specialized pipe suppliers, and direct sales to major OEMs or engineering, procurement, and construction (EPC) firms. Direct sales are common for high-volume, custom orders, while distributors serve smaller projects and maintenance, repair, and overhaul (MRO) requirements.

Direct channels offer better control over pricing and customer relationships, particularly for specialized, high-grade tubes used in critical sectors like aerospace and nuclear power. Indirect channels, through specialized distributors, provide market penetration and logistical support, especially in geographically dispersed markets. The final stage involves integration into end-user infrastructure—such as installing heat exchanger bundles, process piping in refineries, or structural components in buildings. The end-users' specifications drive material selection and quality requirements back up the chain, highlighting the critical role of material certification and traceability throughout the entire process.

Stainless Steel Welded Tube Market Potential Customers

Potential customers for Stainless Steel Welded Tubes span a wide spectrum of industrial and infrastructural sectors, primarily defined by the requirement for materials that can withstand corrosive, high-temperature, or high-pressure environments, or those demanding superior hygiene. The largest consuming sectors include the Oil and Gas industry, which utilizes welded tubes extensively for process pipelines, heat exchanger units in refineries, and subsea hydraulic lines, prioritizing durability and resistance to sour service conditions. Chemical and Petrochemical plants are major buyers, relying on austenitic and duplex grades for transporting aggressive chemicals and managing extreme temperature gradients in reactors and distillation columns, where material integrity is paramount for safety and efficiency.

Furthermore, the Power Generation sector, particularly conventional thermal power plants and emerging nuclear facilities, represents a core customer base, requiring specialized stainless tubes for boiler tubes, condensers, and superheaters due to their excellent performance under high thermal stress and corrosive water environments. The Food and Beverage and Pharmaceutical industries constitute high-growth segments, demanding sanitary-grade, precision-welded tubes with ultra-smooth internal surfaces to prevent microbial growth and ensure product purity, making them critical buyers of polished stainless steel tubing. Finally, infrastructure projects, including structural support in architecture, municipal water treatment facilities, and automotive exhaust systems, represent persistent, high-volume buyers seeking cost-effective and long-lasting solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 37.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Outokumpu Oyj, ThyssenKrupp AG, Nippon Steel Corporation, TISCO (Taiyuan Iron and Steel), Marcegaglia SpA, ArcelorMittal, Tubacex SA, Ratnamani Metals and Tubes Ltd., JFE Steel Corporation, Columbus Stainless, AK Steel, Salzgitter AG, Zekelman Industries, Bristol Metals, Mueller Industries, Felker Brothers, Valmont Industries, Sosta, Penn Stainless Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Welded Tube Market Key Technology Landscape

The manufacturing process for stainless steel welded tubes is increasingly characterized by the adoption of advanced welding techniques and automation to ensure superior quality, especially concerning weld integrity and surface finish. Traditional Tungsten Inert Gas (TIG) welding remains widely used, particularly for high-precision, small-diameter tubes, offering excellent bead control and minimal material contamination necessary for sanitary applications. However, modern manufacturing places significant emphasis on High-Frequency Induction Welding (HFIW), which provides very high production speeds and is cost-effective for medium to large diameter industrial and structural tubing, allowing for rapid throughput and consistent quality suitable for high-volume automotive and construction applications.

The growing demand for high-specification products has accelerated the integration of Laser Beam Welding (LBW) and Plasma Arc Welding (PAW). LBW offers extremely narrow, deep penetration welds with minimal heat-affected zone (HAZ), crucial for maintaining the mechanical properties of advanced alloys like Duplex stainless steel, which are sensitive to thermal cycles. PAW, meanwhile, offers faster welding speeds and better control over the weld pool compared to traditional TIG, making it suitable for thicker-walled pipes requiring deeper penetration and structural robustness. These advanced technologies minimize residual stress and distortion, leading to tubes with enhanced reliability and longer service life, particularly critical for high-pressure applications in oil & gas exploration and power generation systems.

Beyond the welding process itself, non-destructive testing (NDT) technologies are foundational to the modern landscape, ensuring compliance with stringent safety standards. Automated ultrasonic testing (AUT) and eddy current testing (ECT) are now standard practice, offering real-time detection of weld defects, porosity, and longitudinal flaws during the production line. Furthermore, specialized surface finishing technologies, such as bright annealing and electropolishing, are critical for tubes destined for the food, pharmaceutical, and semiconductor industries, ensuring the requisite surface smoothness (Ra value) for hygienic fluid transport. The synergy between high-precision welding, automated quality assurance, and specialized finishing defines the technological competitiveness in the current market.

Regional Highlights

The global Stainless Steel Welded Tube Market demonstrates distinct characteristics across major geographical regions, influenced heavily by regional industrialization levels, regulatory environments, and expenditure on infrastructure. Asia Pacific (APAC) stands out as the dominant and fastest-growing region, driven by massive governmental investments in urbanization, rapid expansion of chemical processing facilities in China and India, and surging demand from the burgeoning automotive and power generation sectors. The lower manufacturing costs in countries like China and South Korea, coupled with significant local raw material production capabilities, further solidify APAC’s market leadership, serving both domestic and export demands. The sheer scale of infrastructure build-out across Southeast Asian nations ensures sustained high-volume demand throughout the forecast period.

North America and Europe represent mature markets characterized by high demand for specialized, high-specification products. In North America, growth is concentrated in the energy sector, particularly pipelines and liquefied natural gas (LNG) infrastructure, requiring robust, certified tubes, alongside strong demand from the aerospace and medical device sectors. European markets, governed by strict environmental and safety regulations (e.g., PED compliance), prioritize high-grade, traceable stainless steel tubes for chemical, pharmaceutical, and nuclear applications. While volume growth is slower than in APAC, the average selling price and profitability per unit are significantly higher in these regions due to the stringent quality requirements and demand for duplex and super-duplex alloys.

The Middle East and Africa (MEA) and Latin America are emerging markets exhibiting strong growth potential, largely tied to fluctuating commodity prices and infrastructure projects. MEA is heavily reliant on oil and gas exploration, refinery upgrades, and desalination plant construction, fueling demand for corrosion-resistant tubes in aggressive environments. Latin America’s demand is primarily driven by mining, petrochemical projects in Brazil and Mexico, and agricultural infrastructure. These regions often rely on imports from established manufacturers in Asia and Europe, focusing on cost-effectiveness and adherence to international quality benchmarks for large-scale projects, thereby creating substantial export opportunities for global manufacturers.

- Asia Pacific (APAC): Dominant market share due to rapid industrial growth, infrastructure projects in China and India, and high volume consumption by general manufacturing and power generation sectors.

- North America: High demand for specialized precision tubes in critical sectors like oil & gas transmission, aerospace, and medical devices, focusing on high-grade, certified materials.

- Europe: Characterized by strict regulatory environments driving adoption in nuclear, chemical, and pharmaceutical industries; strong emphasis on environmental compliance and material traceability.

- Middle East & Africa (MEA): Growth tied to significant investment in oil and gas infrastructure, refinery expansion projects, and increasing water desalination capacity requiring highly corrosion-resistant alloys.

- Latin America: Emerging market driven by mining activities, petrochemical investments, and regional infrastructural development, primarily focusing on cost-efficient general industrial grades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Welded Tube Market.- Sandvik AB

- Outokumpu Oyj

- ThyssenKrupp AG

- Nippon Steel Corporation

- TISCO (Taiyuan Iron and Steel)

- Marcegaglia SpA

- ArcelorMittal

- Tubacex SA

- Ratnamani Metals and Tubes Ltd.

- JFE Steel Corporation

- Columbus Stainless

- AK Steel

- Salzgitter AG

- Zekelman Industries

- Bristol Metals

- Mueller Industries

- Felker Brothers

- Valmont Industries

- Sosta

- Penn Stainless Products

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Welded Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between seamless and welded stainless steel tubes in terms of application?

Seamless tubes, produced without a weld joint, are typically preferred for extremely high-pressure, high-temperature, and critical applications, such as specialized downhole tools in oil and gas, where absolute structural uniformity is mandatory. Welded tubes, formed from strip and welded, are cost-effective, offer better surface finish, and are standard for heat exchangers, structural components, and process piping in chemical and sanitary industries where pressure ratings are lower or moderate.

Which stainless steel grade is most commonly used in the food and beverage industry and why?

Austenitic grade 316L is the most commonly used stainless steel grade in the food and beverage industry. The 'L' denotes low carbon content, minimizing sensitization during welding, while the added molybdenum provides superior resistance to pitting corrosion from chlorides often present in cleaning solutions, ensuring maximum hygiene and product purity for AEO queries.

How does the volatility of nickel prices affect the production cost of stainless steel welded tubes?

Nickel is a critical alloying element in austenitic stainless steels (like 304 and 316), which dominate the welded tube market. Volatility in global nickel prices directly translates to higher and unpredictable raw material costs for manufacturers, necessitating the use of complex surcharge mechanisms and hedging strategies to stabilize final product pricing and protect profit margins.

What are the key drivers for the adoption of Duplex stainless steel welded tubes?

The key drivers for Duplex tube adoption are their superior strength-to-weight ratio and enhanced resistance to stress corrosion cracking (SCC) compared to standard austenitic grades. These properties make Duplex tubes ideal for highly demanding applications in offshore oil and gas, desalination plants, and chemical transportation where corrosive environments and high mechanical loads are present, maximizing material performance.

What role does High-Frequency Induction Welding (HFIW) play in the Stainless Steel Welded Tube market?

HFIW is a crucial manufacturing technology enabling high-speed, cost-effective production of medium to large diameter industrial and structural tubing. It provides a highly efficient method for achieving consistent, quality welds at high throughput rates, making it particularly valuable for high-volume applications in automotive, construction, and general industrial sectors, significantly reducing production lead times.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager