Stamping and Welding Torque Converter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432493 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Stamping and Welding Torque Converter Market Size

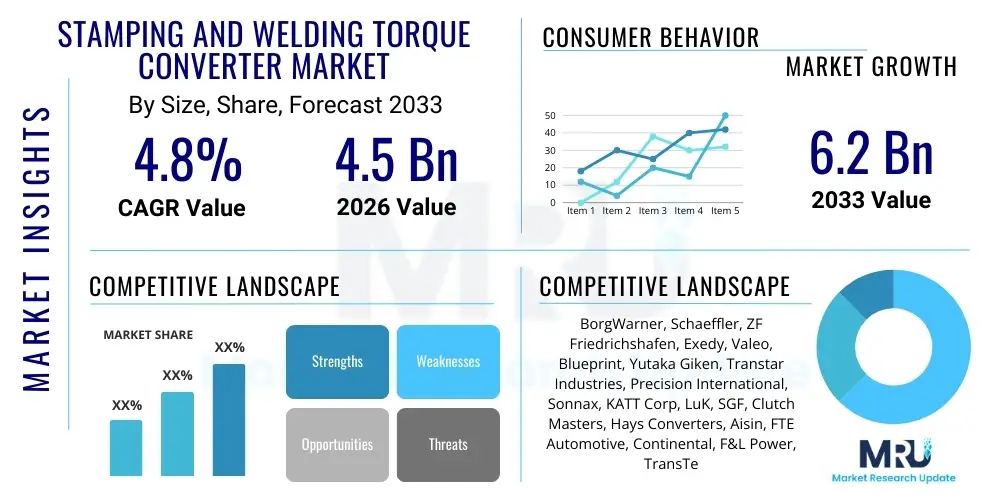

The Stamping and Welding Torque Converter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Stamping and Welding Torque Converter Market introduction

The Stamping and Welding Torque Converter Market encompasses the manufacturing and supply chain of critical components utilized primarily in automatic transmission systems (ATs) within the automotive industry. Torque converters, essential hydrostatic devices, facilitate smooth power transfer from the engine to the transmission by modulating fluid coupling, thereby enabling the vehicle to idle without stalling and providing necessary torque multiplication during acceleration. These converters are predominantly manufactured using stamping and welding processes—stamping for creating precise housing components, impellers, and turbines, and specialized welding techniques (such as laser or electron beam welding) for assembling these parts into a robust, high-integrity unit capable of withstanding extreme rotational stress and thermal loads.

Major applications for these sophisticated devices span across passenger vehicles, commercial trucks, and off-highway machinery, where reliable and efficient power transfer is paramount. The primary benefit of employing stamping and welding techniques lies in achieving high volume production scalability, precision dimensioning, and cost efficiency compared to alternative casting methods, while ensuring structural rigidity necessary for high-performance applications. This manufacturing approach allows for intricate internal designs crucial for enhancing fuel efficiency and improving shift quality in modern automatic transmissions, including those used in hybrid electric vehicles (HEVs) and stepped-gear ATs.

Key driving factors supporting the market growth include the persistent global demand for automatic transmission vehicles, especially in rapidly industrializing regions like Asia Pacific, where driver convenience is increasingly prioritized. Furthermore, continuous advancements in AT technology, such as the adoption of 8-speed and 10-speed transmissions, necessitate lighter, more efficient, and structurally optimized torque converters. Regulatory pressures aimed at reducing vehicular emissions also push manufacturers toward developing converters with reduced hydrodynamic losses and enhanced lock-up clutch mechanisms, ensuring the stamping and welding sector remains vital for optimizing powertrain efficiency.

Stamping and Welding Torque Converter Market Executive Summary

The Stamping and Welding Torque Converter Market is experiencing dynamic shifts driven by the transition toward higher gear ratio automatic transmissions and increasing penetration of hybrid vehicle powertrains, which rely heavily on specialized torque converter designs. Current business trends indicate a strong focus on lightweighting materials, such as high-strength steel alloys, and the integration of advanced laser welding processes to achieve superior structural integrity while minimizing mass. Consolidation among major tier-one suppliers continues, focusing on vertical integration to control component quality and supply chain resilience. Innovation is concentrated on optimizing the lock-up clutch mechanisms and integrating torsional vibration dampers (TVDs) directly into the converter assembly to manage engine harmonics, thereby enhancing overall vehicle refinement and fuel economy performance metrics.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, exhibits the highest growth trajectory due to burgeoning passenger vehicle production and a swift shift away from manual transmission dominance. North America and Europe, while mature, remain crucial hubs for high-performance and specialty vehicle applications, driving demand for advanced, electronically controlled torque converters compliant with stringent Euro 6 and CAFE standards. The transition to electric vehicles (EVs) presents a long-term restraint, but in the medium term (2026-2033), the entrenched infrastructure and consumer preference for internal combustion engine (ICE) and hybrid vehicles ensures sustained demand, particularly in the heavy-duty and light commercial vehicle segments.

Segment trends reveal that the Passenger Vehicle application segment dominates the market volume, though the Commercial Vehicle segment provides significant revenue stability due to the robust nature and higher unit price of heavy-duty converters. From a manufacturing perspective, specialized laser welding technology is gaining prominence over traditional welding methods due to its ability to handle complex geometries and deliver superior joint quality necessary for high-speed rotational components. Furthermore, the push for miniaturization and integration in hybrid powertrains is stimulating the development of new stamping dies capable of producing ultra-precise components for multi-plate lock-up systems, differentiating suppliers based on their tooling and manufacturing precision capabilities.

AI Impact Analysis on Stamping and Welding Torque Converter Market

User inquiries regarding AI's influence in the Stamping and Welding Torque Converter market frequently revolve around quality control enhancement, predictive maintenance in manufacturing, and optimizing the design process itself. Key themes consistently appearing include questions on whether AI can entirely replace human inspection of welding seams, how machine learning algorithms can minimize material waste during the stamping process, and the potential for generative design to create novel, more efficient converter geometries. Users are highly concerned with maintaining the zero-defect standard required for high-speed rotational parts and seek validation that AI integration will lead to measurable improvements in component fatigue life and dimensional accuracy. The overall expectation is that AI will revolutionize the shop floor by increasing throughput and reducing operational expenditure associated with material rejection and unscheduled equipment downtime.

The integration of Artificial Intelligence, specifically machine vision and machine learning (ML), is fundamentally transforming manufacturing operations within the torque converter sector. AI-powered vision systems are deployed to conduct real-time, high-speed inspection of stamped parts for micro-cracks and dimensional variances far exceeding human capability, ensuring adherence to tight tolerances crucial for balance and vibration management. Furthermore, ML algorithms are being used to analyze vast datasets collected from stamping presses and welding robots, enabling predictive maintenance schedules that anticipate component failure, thus minimizing expensive production stoppages and optimizing asset utilization. This proactive approach significantly enhances overall equipment effectiveness (OEE).

Beyond the manufacturing floor, AI assists in the design and engineering phase. Generative design tools, guided by performance parameters such as required torque multiplication, heat dissipation capacity, and weight constraints, are exploring component geometries previously unattainable or unimagined by traditional CAD methods. This allows manufacturers to iterate rapidly on designs that maximize fluid efficiency and structural rigidity. The adoption of AI also extends into supply chain logistics, where forecasting demand for specific converter types (e.g., those for 10-speed transmissions versus older 6-speed models) is optimized, leading to reduced inventory costs and faster response times to original equipment manufacturer (OEM) demands. The primary impact is higher quality, lower operational cost, and accelerated product development cycles.

- AI-driven machine vision systems ensure real-time, non-destructive inspection of complex weld seams and stamped component integrity.

- Machine learning optimizes stamping parameters (pressure, temperature, speed) to minimize material spring-back and waste generation.

- Predictive maintenance algorithms analyze sensor data from manufacturing equipment, reducing unplanned downtime and improving OEE.

- Generative design tools accelerate the creation of novel, lightweight, and hydrodynamically optimized torque converter internal structures.

- AI enhances supply chain forecasting precision for raw materials (steel, aluminum) and finished component demand management.

DRO & Impact Forces Of Stamping and Welding Torque Converter Market

The market dynamics are governed by a complex interplay of automotive industry trends, technological mandates, and regulatory shifts, creating a distinct set of Drivers, Restraints, and Opportunities (DRO). The prevailing impact forces stem from the dual pressure of achieving greater fuel efficiency in traditional powertrains and navigating the accelerating global shift toward vehicle electrification. Success in this market hinges upon manufacturers' ability to integrate high-precision manufacturing techniques with material science innovation, particularly concerning high-strength, low-weight alloys and specialized friction materials for enhanced lock-up clutches. These factors collectively determine the investment cycles and innovation trajectories for key market participants.

Key drivers include the global expansion of Automatic Transmission (AT) installation rates, especially in emerging markets, driven by consumer preference for ease of driving in congested urban environments. Furthermore, the persistent need for efficiency improvements in ICE and Hybrid Electric Vehicles (HEVs) mandates continuous optimization of torque converter performance, including faster lock-up activation and reduced parasitic losses. Restraints primarily center on the long-term threat posed by Battery Electric Vehicles (BEVs), which largely bypass the need for traditional torque converters, and the intense capital investment required for establishing and maintaining high-precision stamping and welding facilities. Additionally, fluctuations in raw material costs, particularly specialized steel grades, introduce significant volatility into manufacturing economics.

Opportunities are robust in the integration of specialized torque converters for hybrid architectures and dual-clutch transmission (DCT) applications, which often utilize specific converter designs for launch control and system dampening. The emerging trend of high-performance transmission fluid development also presents opportunities for manufacturers to design converters optimized for new thermal and viscosity profiles, further improving efficiency. Impact forces include significant regulatory pressure demanding lower CO2 emissions, pushing converters to operate more frequently in lock-up mode, necessitating stronger welding and superior stamping quality for components like the flex plate and turbine assembly. Competition is high, compelling companies to differentiate through proprietary welding methods and superior quality assurance systems to meet zero-defect standards required by demanding OEM assembly lines.

Segmentation Analysis

The Stamping and Welding Torque Converter Market is segmented primarily on the basis of manufacturing process type, the type of vehicle application, and the configuration of the lock-up mechanism. Analyzing these segmentations is critical for understanding market revenue distribution and identifying niche areas of accelerated growth. The segmentation by manufacturing process allows stakeholders to assess the relative dominance and technological maturity of stamping-centric versus casting-centric component fabrication within the industry, although stamping and welding methods are generally favored for mass-produced, performance-optimized units due to cost and precision advantages.

Application-based segmentation (Passenger Vehicles, Commercial Vehicles, Off-Highway) highlights differing requirements; passenger vehicles drive volume and demand for lightweighting and noise reduction, whereas commercial vehicles prioritize robust durability and high torque capacity, often necessitating heavier gauge stamped components and specialized, reinforced welding techniques. Geographically, segmentation reveals distinct market maturity and growth rates, with Asia Pacific driving volume growth while North America and Europe lead innovation in high-efficiency hybrid-specific converter designs. Understanding these overlaps provides a granular view of where investment in manufacturing technology and regional supply chain optimization is most advantageous.

- By Manufacturing Process Type:

- Stamping Converters

- Welding Converters (focusing on the assembly process efficiency)

- By Application:

- Passenger Vehicles (Sedans, SUVs, Light Trucks)

- Commercial Vehicles (Medium and Heavy-Duty Trucks)

- Off-Highway Vehicles (Construction, Agricultural, Mining Equipment)

- By Transmission Type Compatibility:

- Traditional Automatic Transmissions (AT)

- Continuously Variable Transmissions (CVT)

- Dual-Clutch Transmissions (DCT) with wet or dry clutches

- By Component Type:

- Housing and Covers (Stamped Steel)

- Internal Components (Impeller, Turbine, Stator)

- Lock-up Clutch Assemblies

- By Regional Analysis:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Stamping and Welding Torque Converter Market

The value chain for the Stamping and Welding Torque Converter Market begins upstream with raw material suppliers, predominantly specialized steel manufacturers providing high-strength, deep-drawing steel sheets optimized for the stamping process. These material providers must meet stringent quality and consistency standards to prevent cracking or structural failure during both the complex forming operation and subsequent high-stress vehicle operation. Following material procurement, tier-two suppliers often handle highly specialized processes such as precision deep drawing, machining, and heat treatment of individual components (impeller blades, turbine shells, and stator hubs) before delivery to the primary torque converter manufacturers.

The core of the value chain lies in the manufacturing and assembly phase performed by major Tier-one suppliers, which involves high-precision, multi-stage stamping of the housing and internal parts, followed by rigorous assembly and automated welding. Techniques such as electron beam or laser welding are critical here, ensuring hermetic sealing and rotational balance, which directly affects the final product quality and durability. Distribution channels primarily operate directly, involving long-term strategic contracts between Tier-one suppliers and Original Equipment Manufacturers (OEMs) like Ford, General Motors, Toyota, and Volkswagen, facilitating just-in-time (JIT) delivery of assembled units directly to the vehicle assembly lines across various regional manufacturing hubs.

Downstream analysis focuses on two primary sales channels: the OEM market (the largest consumer) and the Aftermarket. The Aftermarket, encompassing repair, maintenance, and performance modification shops, utilizes both direct distribution from the manufacturers' aftermarket divisions and indirect distribution through authorized dealers and independent parts distributors. Because torque converters are durable goods requiring high expertise for replacement, the indirect channel often involves specialized transmission parts wholesalers. The value chain is characterized by high capital intensity, proprietary technology in both stamping dies and welding equipment, and intense vertical integration to control quality and intellectual property associated with hydrodynamic design.

Stamping and Welding Torque Converter Market Potential Customers

The primary customer base for the Stamping and Welding Torque Converter Market consists overwhelmingly of Original Equipment Manufacturers (OEMs) within the global automotive and heavy equipment sectors. These customers require high volumes of precisely manufactured torque converters tailored to specific powertrain applications, including advanced specifications for modern high-efficiency 8-speed and 10-speed automatic transmissions. Key purchasing decisions are driven by component performance (efficiency, noise, vibration, and harshness (NVH) characteristics), long-term reliability metrics, scalability of production, and alignment with mandated regulatory compliance, such as fuel economy standards.

Beyond the major automotive groups, significant customer segments include manufacturers of heavy-duty vehicles such as commercial trucks (Class 6-8) and specialized machinery used in construction, agriculture, and mining operations. These industrial end-users demand converters designed for extreme stress, often involving specialized materials and robust welding to withstand continuous high-torque cycles and harsh operating environments. Furthermore, a smaller yet critical segment involves specialized performance transmission builders and the automotive aftermarket, which seeks replacement parts and upgraded torque converters for performance tuning and high-output applications. These customers often focus on customized specifications, including higher stall speeds and enhanced lock-up holding capacity.

The relationship between the supplier and the OEM is deeply collaborative, involving early integration into the vehicle development process, sometimes years before production. This ensures that the torque converter design is optimally matched to the engine and transmission specifications, making the supplier a technology partner rather than merely a parts provider. The increasing complexity of hybrid powertrains further intensifies this relationship, as hybrid-specific converters often integrate intricate mechanisms for seamless transition between electric motor and ICE power, requiring advanced engineering support and highly refined stamping and welding precision from the supplying partner.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BorgWarner, Schaeffler, ZF Friedrichshafen, Exedy, Valeo, Blueprint, Yutaka Giken, Transtar Industries, Precision International, Sonnax, KATT Corp, LuK, SGF, Clutch Masters, Hays Converters, Aisin, FTE Automotive, Continental, F&L Power, TransTec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stamping and Welding Torque Converter Market Key Technology Landscape

The manufacturing process for stamping and welding torque converters is highly dependent on sophisticated metal forming and joining technologies designed to meet exceptionally high standards for dimensional precision and structural integrity. Key technological advancements center around high-speed, multi-stage progressive stamping presses capable of handling high-strength steel alloys necessary for lightweighting the converter housing while maintaining burst strength under extreme rotational speeds. Specialized tooling and advanced die design, often utilizing computer-aided engineering (CAE) simulations, are critical to managing material flow, minimizing scrap, and ensuring the complex contours of the turbine and impeller blades are formed accurately to maximize hydrodynamic efficiency. The precision achieved during stamping directly impacts the subsequent balance and vibrational characteristics of the final assembled unit.

The welding phase represents the most critical technological bottleneck and opportunity for differentiation. Modern torque converter assembly utilizes high-energy beam welding techniques, primarily laser welding (fiber or CO2 lasers) and, less frequently, electron beam welding. Laser welding is favored for its high speed, low heat input, and ability to create narrow, deep, high-integrity welds between dissimilar metals or thick-walled components, essential for joining the converter housing and internal components without inducing significant thermal distortion that would compromise rotational balance. Automation and robotics are integrated extensively to ensure repeatable, high-quality welding paths and to handle the large volumes required by global automotive production lines.

Further technological integration involves advanced metrology and quality assurance systems, often incorporating non-contact measuring equipment, such as 3D scanners and ultrasonic testing, to verify weld penetration and dimensional accuracy post-assembly. Moreover, the integration of specialized friction materials, typically carbon or aramid-based, into the stamped lock-up clutch assemblies is paramount for improving torque capacity and durability in high-performance applications. The continuous evolution of these materials requires corresponding advancements in stamping and bonding processes to ensure seamless and reliable operation throughout the vehicle's lifecycle, marking the technology landscape as one defined by precision, high-throughput automation, and materials science innovation.

Regional Highlights

Regional dynamics play a significant role in shaping the demand and supply structure of the Stamping and Welding Torque Converter Market, reflecting varying levels of automotive production, consumer preferences for automatic transmissions, and the pace of regulatory adoption of electrification. Asia Pacific (APAC) currently dominates in terms of volume growth, fueled primarily by robust automotive manufacturing bases in China, India, and Southeast Asia. The region is rapidly increasing its penetration rate of automatic transmissions in entry-level and mid-range passenger vehicles, driving high demand for cost-effective, mass-produced stamped and welded converter units. China, specifically, leads the global adoption curve for newer AT technologies, influencing regional manufacturing investments.

North America and Europe represent mature markets characterized by stringent quality standards and a high preference for advanced, multi-speed ATs and HEVs. These regions drive demand for premium, highly efficient torque converters featuring advanced lock-up systems and integration with complex hybrid powertrains. While overall volume growth is moderate compared to APAC, the average selling price (ASP) of converters in these regions is higher due to the complexity and advanced materials required to meet fuel efficiency regulations (e.g., CAFE standards in the US and WLTP in Europe). This focuses regional suppliers on advanced research and development in stamping precision and specialized joining techniques necessary for these sophisticated designs.

Latin America and the Middle East & Africa (MEA) constitute smaller but growing markets. Latin America, centered mainly around Brazil and Mexico, exhibits increasing demand driven by rising urbanization and consumer wealth, gradually shifting preferences toward automatic vehicles, mirroring earlier trends observed in APAC. The MEA region is characterized by high demand for robust commercial vehicle converters and continued dependence on imported automotive components, making localized manufacturing a potential future investment area, particularly in established manufacturing zones like Turkey and South Africa, focusing on stamped and welded converter units for durability in challenging road conditions.

- Asia Pacific (APAC): Dominates volume and growth, driven by mass production in China and India and increasing AT adoption rates in emerging economies.

- North America: Focuses on high-performance converters for heavy-duty trucks and high-efficiency units for the vast SUV and pickup truck market, adhering to strict CAFE standards.

- Europe: Leads innovation in hybridization and highly specialized, compact converters designed for integration with mild-hybrid and plug-in hybrid electric vehicle (PHEV) systems, emphasizing lightweighting and reduced losses.

- Latin America: Growing demand stimulated by increased passenger vehicle sales and urbanization in Brazil and Mexico, shifting toward higher penetration of entry-level automatic transmissions.

- Middle East & Africa (MEA): Stable market for replacement and new installations, characterized by demand for durable components in commercial transport and reliance on imports from European and Asian manufacturing bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stamping and Welding Torque Converter Market.- BorgWarner

- Schaeffler

- ZF Friedrichshafen

- Exedy

- Valeo

- Blueprint

- Yutaka Giken

- Transtar Industries

- Precision International

- Sonnax

- KATT Corp

- LuK (part of Schaeffler Group)

- SGF

- Clutch Masters

- Hays Converters

- Aisin

- FTE Automotive

- Continental

- F&L Power

- TransTec

Frequently Asked Questions

Analyze common user questions about the Stamping and Welding Torque Converter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary manufacturing method used for modern torque converters?

Modern torque converters are predominantly manufactured using high-precision stamping techniques for forming the steel housing and internal components (impeller, turbine) combined with automated, high-energy welding (laser or electron beam) for assembly to ensure rotational balance and structural integrity.

How does the shift to electric vehicles (EVs) impact the demand for stamping and welding torque converters?

The transition to battery electric vehicles (BEVs) generally reduces the long-term demand for traditional torque converters, as BEVs typically use fixed-ratio transmissions. However, hybrid electric vehicles (HEVs) and high-performance transmissions still require advanced, stamped, and welded converters, sustaining the market in the medium term (up to 2033).

Which geographical region exhibits the fastest growth in the torque converter market?

The Asia Pacific (APAC) region, driven primarily by increasing passenger vehicle production and the rapid consumer shift towards automatic transmission vehicles in major markets like China and India, exhibits the highest growth rate for stamping and welding torque converters.

What technological advancement is crucial for improving torque converter efficiency and fuel economy?

The most crucial advancement is the optimization of the lock-up clutch mechanism and associated stamped components. This involves using advanced friction materials and precise stamping/welding to ensure fast, reliable engagement, minimizing slip and allowing the converter to operate in direct drive more frequently, thus enhancing fuel efficiency.

What is the role of AI in the manufacturing of stamped and welded torque converters?

AI is primarily used for quality assurance via high-speed machine vision systems inspecting critical weld seams and stamped component dimensions, and for implementing predictive maintenance on stamping presses and welding robotics to minimize operational downtime and maintain zero-defect standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager