Stationary Neutron Generators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435401 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Stationary Neutron Generators Market Size

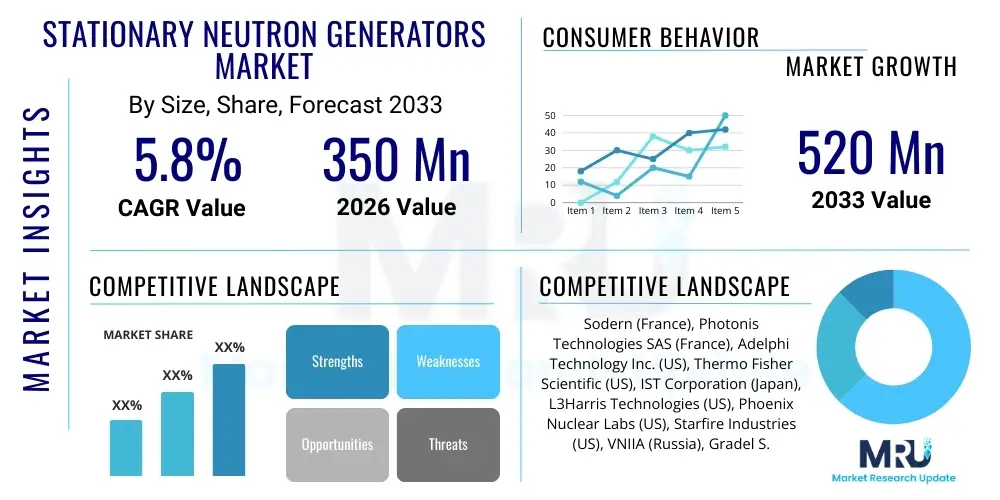

The Stationary Neutron Generators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 520 Million by the end of the forecast period in 2033.

Stationary Neutron Generators Market introduction

The Stationary Neutron Generators Market encompasses devices designed to produce controlled, high-flux beams of neutrons for various industrial, medical, and defense applications. Unlike nuclear reactors or large accelerators, these generators use compact particle accelerators to fuse deuterium and tritium (D-T) or deuterium and deuterium (D-D) isotopes, releasing monoenergetic neutrons. Stationary systems are characterized by their fixed installation, robust power requirements, and ability to generate consistent neutron output suitable for complex, long-duration analytical tasks. Key market drivers include the increasing global emphasis on non-destructive testing, advanced materials analysis, and the expanding need for isotopic tracers in therapeutic medicine.

Neutron generators serve as indispensable tools in sectors requiring deep material penetration and precise elemental identification. In the oil and gas industry, they are critical for well logging and subsurface analysis, providing detailed data on reservoir porosity and composition. For homeland security and defense, stationary generators are deployed in large cargo scanning systems for the detection of explosives, contraband, and nuclear materials, offering a superior alternative to X-ray technology due to the unique interaction of neutrons with light elements. Furthermore, the burgeoning demand for medical radioisotopes, particularly those requiring neutron activation for production, solidifies the generator's position as a crucial component in the nuclear medicine supply chain.

The core benefit of stationary neutron generators lies in their safety and operational flexibility compared to traditional isotopic sources, which decline over time and require complex handling and disposal procedures. Generators can be instantly turned off, eliminating residual radiation hazards and significantly reducing regulatory burdens. This "on-demand" neutron production capability drives adoption across high-security environments and research facilities where beam stability and control are paramount. Technological advancements focusing on miniaturization, increased neutron yield, and improved target lifetime are consistently bolstering market attractiveness, positioning stationary neutron generators as essential infrastructure in modern scientific and industrial processes.

Stationary Neutron Generators Market Executive Summary

The Stationary Neutron Generators Market is experiencing robust expansion, driven primarily by escalating demand in energy exploration, stringent homeland security regulations necessitating advanced threat detection systems, and technological leaps in medical isotope production methods. Business trends indicate a strong move toward developing sealed-tube generators offering enhanced longevity and portability (even for traditionally stationary systems), appealing to sectors like oilfield services seeking durable, low-maintenance equipment. Strategic partnerships between generator manufacturers and major defense contractors or medical technology firms are shaping the competitive landscape, focusing on integrating neutron generator technology into complex, multi-modal inspection platforms. Furthermore, sustainability requirements are pushing R&D towards D-D generators, which avoid the handling of radioactive tritium, increasing their appeal in environmentally sensitive research and educational settings.

Regionally, North America maintains market dominance, attributed to significant investments in defense research, extensive oil and gas exploration activities, and the presence of leading technological innovators. However, the Asia Pacific region is emerging as the fastest-growing market, fueled by rapid industrialization, increasing energy security concerns, and government initiatives promoting nuclear technology and advanced non-destructive testing (NDT) capabilities in countries like China and India. European adoption remains steady, particularly in advanced scientific research (e.g., fusion studies and materials science) and stringent border control applications. Segment trends highlight the dominance of D-T generators due to their high neutron yield, though D-D generators are gaining traction in academic and environmental monitoring applications. The oil and gas sector remains the primary end-user, but the medical segment, spurred by the need for alternative isotope production methods independent of aging research reactors, is poised for significant growth.

In terms of segment performance, the technology component segment, encompassing high-voltage power supplies, ion sources, and target assemblies, accounts for a substantial revenue share, reflecting the high technological intensity required for generator fabrication. The service segment, including maintenance, calibration, and refurbishment of sealed-tube units, is also showing accelerated growth, particularly as installed units mature and require specialized support. Overall, market stakeholders are strategically investing in optimizing reliability and neutron yield per watt consumed, crucial factors for large-scale industrial deployment. The synthesis of artificial intelligence (AI) with data analysis derived from neutron interrogation techniques is further enhancing the value proposition, allowing for faster and more accurate threat assessment and material analysis, thus underpinning sustained market growth through the forecast period.

AI Impact Analysis on Stationary Neutron Generators Market

Common user inquiries regarding AI's impact on stationary neutron generators primarily center on how machine learning algorithms can enhance the efficiency of neutron analysis (neutron activation analysis, pulsed fast neutron analysis) and improve system diagnostics. Users frequently question AI's role in noise reduction, rapid material identification in complex matrices (e.g., cargo scanning), and predictive maintenance for minimizing generator downtime and extending target life. Concerns often revolve around the reliability of AI interpretation in high-stakes security scenarios and the need for standardized data protocols to train accurate models. The overarching expectation is that AI will transform raw neutron count data into actionable intelligence, reducing the reliance on highly specialized human operators and accelerating decision-making processes across all application verticals, from well logging to explosives detection.

- AI enhances data processing speed, allowing for real-time interpretation of complex neutron signatures in cargo and baggage scanning.

- Machine learning models optimize neutron pulse sequencing and beam control, improving operational efficiency and reducing energy consumption.

- Predictive maintenance algorithms analyze system parameters (e.g., vacuum levels, power supply stability) to forecast component failure and maximize generator uptime.

- AI facilitates complex spectral analysis in oil and gas logging, accurately differentiating between oil, gas, and water based on elemental ratios derived from neutron interactions.

- Automated anomaly detection using neural networks improves security screening accuracy, minimizing false alarms in detecting hidden materials or nuclear threats.

DRO & Impact Forces Of Stationary Neutron Generators Market

The Stationary Neutron Generators Market is propelled by increasing global security mandates requiring advanced non-intrusive inspection tools, particularly at critical infrastructure and maritime ports. The expansion of shale gas and unconventional oil exploration demands high-precision well logging capabilities, which neutron generators uniquely provide for subterranean analysis. Opportunities lie in the emerging market for neutron beam imaging in industrial quality control and the growing transition within nuclear medicine towards accelerator-based isotope production, offering independence from geopolitical sensitivities associated with reactor-sourced isotopes. However, restraints include the high initial capital investment and the complexity of maintenance for high-vacuum, high-voltage systems, alongside regulatory hurdles concerning the use of tritium (in D-T generators) and public apprehension regarding radiation technology. These forces collectively dictate the adoption curve and market investment strategies over the forecast period.

Drivers for market growth are strongly linked to the superior analytical capabilities offered by neutrons compared to photons (X-rays). Neutrons are highly effective at interacting with light elements like hydrogen, nitrogen, and carbon, making them invaluable for detecting explosives, narcotics, and moisture content in materials where X-rays fail. The technological driver is the continuous improvement in sealed-tube technology, resulting in smaller, more rugged, and higher-flux generators suitable for deployment in harsh environments, such as deep boreholes or mobile defense units. Furthermore, government funding in fusion energy research indirectly benefits the generator market, as advancements in plasma physics and neutron source development often cross over into commercial generator technology, improving performance and reducing manufacturing costs.

Restraints fundamentally impact market accessibility, particularly for smaller organizations. The long lead times associated with procuring and installing stationary systems, coupled with the necessity for highly trained personnel to operate and maintain the equipment, restrict broader deployment. Although D-T generators offer the highest yield, the management, storage, and disposal protocols for tritium pose regulatory challenges and public perception issues. Opportunities are emerging through global initiatives focused on modernizing national security infrastructure, creating large procurement contracts for advanced inspection systems. Moreover, the niche but growing application of neutron radiography and computed tomography for advanced materials testing provides a high-value vertical where stationary generators are indispensable.

Segmentation Analysis

The Stationary Neutron Generators Market is segmented based on the reaction type employed, which defines the neutron energy and yield; the application area, which dictates the necessary operational characteristics and size constraints; and the end-user industry, reflecting diverse functional requirements. Understanding these segments is crucial as market dynamics differ significantly between high-flux generators used in large-scale industrial logging and lower-yield systems deployed in academic research. Key differentiators include whether the generator uses tritium (D-T) for maximum output or relies solely on deuterium (D-D) for enhanced safety, and whether the primary application involves pulsed neutron analysis for elemental composition or simply neutron irradiation for activation purposes. This granular segmentation allows manufacturers to tailor solutions precisely to customer needs, optimizing performance characteristics such as pulse width, repetition rate, and overall system longevity.

- By Reaction Type:

- Deuterium-Tritium (D-T) Generators

- Deuterium-Deuterium (D-D) Generators

- By Application:

- Neutron Activation Analysis (NAA)

- Prompt Gamma Neutron Activation Analysis (PGNAA)

- Pulsed Fast Neutron Analysis (PFNA)

- Neutron Radiography and Tomography

- Boron Neutron Capture Therapy (BNCT) (Emerging)

- By End-User:

- Oil and Gas Exploration and Production (E&P)

- Homeland Security and Defense (Cargo and Material Scanning)

- Research and Academia (Fusion and Materials Science)

- Medical and Healthcare (Radioisotope Production)

- Mining and Minerals

- By Output Type:

- Continuous Output Generators

- Pulsed Output Generators

Value Chain Analysis For Stationary Neutron Generators Market

The value chain for stationary neutron generators is characterized by high upfront R&D investment and highly specialized manufacturing processes. Upstream activities involve the sourcing of exotic materials crucial for high-vacuum components, specialized ion sources, and high-purity deuterium and tritium targets. Key suppliers in the upstream segment focus on manufacturing high-voltage power supplies, specialized vacuum components, and robust sealed tubes designed to withstand extreme operational conditions. This segment is highly concentrated, relying on a few specialized suppliers globally, underscoring the importance of vertical integration or secure long-term contracts to ensure material quality and supply stability for generator manufacturers.

The core manufacturing stage involves complex integration and testing, requiring specialized cleanroom facilities and expert engineering teams. Generator manufacturers design and assemble the accelerator tube, high-voltage systems, and neutron shielding. Downstream activities are dominated by system integration, where the neutron generator is incorporated into larger inspection platforms (e.g., logging tools, large port scanners) or research facilities. Distribution channels are predominantly direct, especially for large, custom-engineered stationary systems, involving close collaboration between the manufacturer and the end-user throughout the design, installation, and commissioning phases. Indirect channels, involving specialized engineering service firms or local integrators, are occasionally used for servicing smaller, regional academic customers or maintenance contracts.

The final stage involves extensive post-sale support, including calibration, regular maintenance, and the eventual refurbishment or disposal of the sealed tube unit. Given the longevity and high cost of these systems, the service and maintenance aspect represents a significant revenue stream. Direct sales ensure technical fidelity and provide critical feedback loops for R&D, which is vital in this technically demanding market. The tight coupling between R&D, manufacturing, and application development distinguishes this value chain from typical industrial equipment markets, emphasizing expertise in nuclear physics, high-voltage engineering, and vacuum technology as key value contributors.

Stationary Neutron Generators Market Potential Customers

Potential customers for stationary neutron generators span high-value, critical infrastructure sectors requiring non-destructive, elemental analysis or robust neutron fluxes for specialized industrial processes. The largest end-user group comprises major international and national Oil and Gas Exploration and Production (E&P) companies that utilize these generators for advanced subsurface well logging, ensuring reservoir characterization and maximizing yield recovery. Government defense agencies, port authorities, and customs organizations form another substantial customer base, investing heavily in stationary inspection portals for container and vehicle scanning to enhance border security and counter nuclear proliferation and smuggling activities.

Beyond security and energy, the nuclear medicine and pharmaceutical sectors represent a high-growth customer segment. Hospitals, cyclotron facilities, and radiopharmaceutical manufacturers are increasingly seeking stationary neutron generators to produce novel medical radioisotopes (such as Molybdenum-99 or Actinium-225) on-site or regionally, mitigating the supply risks associated with distant research reactors. Furthermore, academic institutions, national laboratories, and large industrial research centers constitute the core customer base for lower-flux generators used in materials science research, neutron physics experiments, and calibration of radiation detectors. These customers prioritize system stability, beam quality, and flexibility in pulse control for their diverse experimental requirements.

A specialized, albeit smaller, customer group includes mining and minerals companies employing PGNAA techniques using stationary generators for real-time analysis of ore composition on conveyor belts or in bulk samples. This allows for immediate process optimization and reduces the need for slow, traditional chemical assays. The decision-making process for these customers is driven by operational cost savings, regulatory compliance (especially in security), and the attainment of analytical capabilities unmatched by alternative technologies, cementing the generator's role as a critical piece of specialized capital equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 520 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sodern (France), Photonis Technologies SAS (France), Adelphi Technology Inc. (US), Thermo Fisher Scientific (US), IST Corporation (Japan), L3Harris Technologies (US), Phoenix Nuclear Labs (US), Starfire Industries (US), VNIIA (Russia), Gradel S.a r.l. (Luxembourg), AMETEK Inc. (US), QSA Global Inc. (US), NUKEM Technologies Engineering Services GmbH (Germany), Procon SA (Switzerland), General Dynamics (US), Baker Hughes (US), Schlumberger (US), Antech (UK), ANP (US), Xi'an Fanyi Technology (China) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stationary Neutron Generators Market Key Technology Landscape

The technological landscape of the stationary neutron generator market is dominated by the sealed-tube architecture, which is critical for providing a safe, reliable, and maintenance-free operational environment. These tubes utilize the D-T or D-D fusion reaction confined within a high-vacuum chamber, driven by sophisticated high-voltage power supplies (typically 80 kV to 120 kV). Key technological innovations center on maximizing the lifespan of the target material, typically titanium or scandium hydride loaded with deuterium or tritium, as target depletion limits the operational life of the unit. Advanced target cooling systems and proprietary ion source designs, such as Penning ion sources or radio-frequency (RF) driven ion sources, are focal points of R&D aimed at increasing neutron output (flux) stability and extending service intervals to meet demanding industrial timelines.

A significant technological divergence exists between Continuous Output Generators, preferred for certain types of activation analysis, and Pulsed Output Generators, essential for techniques like PFNA and pulsed neutron logging. Pulsed systems require high-precision timing electronics capable of generating extremely narrow pulses (nanosecond range) at high repetition rates, allowing for time-of-flight measurements crucial for elemental depth profiling. Furthermore, advancements in miniaturization are making traditionally stationary systems more transportable and easier to integrate into existing industrial workflows, such as mounting them onto mobile platforms or integrating them into confined spaces in manufacturing facilities. The integration of advanced shielding materials that minimize unwanted radiation exposure while maximizing neutron yield efficiency is also a key area of ongoing development.

The future technology landscape is heavily influenced by the adoption of sophisticated diagnostics and control systems. Digital control interfaces allow for precise tuning of beam current and energy, crucial for optimization across different applications. Moreover, ongoing fusion research is contributing foundational knowledge regarding plasma containment and high-power handling, which trickles down into commercial generator design, promising next-generation systems with significantly higher neutron output (greater than 10^11 n/s) and dramatically improved sealed-tube longevity. The market is increasingly focused on developing highly sensitive, integrated neutron detector packages that work seamlessly with the generator, optimizing the entire detection system rather than just the source itself.

Regional Highlights

- North America: This region is the largest market due to substantial defense budgets dedicated to threat detection and non-proliferation efforts, coupled with extensive use of neutron logging in the mature US and Canadian oil and gas sectors. The presence of major generator manufacturers and robust R&D spending in national laboratories solidify its leadership.

- Europe: Europe is a key hub for fundamental research in fusion energy (e.g., ITER related technologies) and materials science, driving demand for high-performance stationary generators. Strict regulations on cargo screening and the growing adoption of accelerator-based medical isotope production provide stable growth vectors.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by rapid infrastructure development, increased energy demand requiring sophisticated oil and gas surveying, and significant government investment in internal security infrastructure (China, India). Local manufacturing capabilities are also emerging, challenging the dominance of Western suppliers.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven almost entirely by the massive investment in large-scale oil and gas exploration and production projects, which rely heavily on advanced neutron well logging tools for reservoir management.

- Latin America: This region presents moderate growth, largely linked to resource extraction activities (mining and oil) in countries such as Brazil and Mexico. Market penetration is hampered by economic volatility and reliance on imported high-tech equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stationary Neutron Generators Market.- Sodern (A subsidiary of ArianeGroup)

- Photonis Technologies SAS

- Adelphi Technology Inc.

- Thermo Fisher Scientific

- IST Corporation

- L3Harris Technologies

- Phoenix Nuclear Labs

- Starfire Industries

- VNIIA (V.N. Khariton All-Russian Research Institute of Experimental Physics)

- Gradel S.a r.l.

- AMETEK Inc.

- QSA Global Inc.

- NUKEM Technologies Engineering Services GmbH

- Procon SA

- General Dynamics

- Baker Hughes

- Schlumberger

- Antech (A QinetiQ Company)

- ANP (Applied Neutron Physics)

- Xi'an Fanyi Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Stationary Neutron Generators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between stationary neutron generators and isotopic neutron sources?

Stationary neutron generators are accelerator-based devices that produce neutrons only when switched on, offering control, safety, and stable neutron flux without the half-life decay issues. Isotopic sources (e.g., Californium-252) continuously emit neutrons and decline over time, requiring complex regulation and disposal procedures.

In which industry does the Stationary Neutron Generators Market see the highest demand?

The Oil and Gas Exploration and Production (E&P) industry currently generates the highest demand. Stationary generators are integral to advanced pulsed neutron logging tools used deep underground to analyze rock formation porosity, saturation, and elemental composition in real time.

What are the key technological advancements driving generator market growth?

Key drivers include the development of highly stable and long-life sealed-tube technology, improved high-voltage power supplies for enhanced neutron yield, and the integration of advanced diagnostics and AI for optimizing performance and predictive maintenance.

How is the Stationary Neutron Generator technology utilized in homeland security?

Homeland security applications primarily involve Pulsed Fast Neutron Analysis (PFNA) and Prompt Gamma Neutron Activation Analysis (PGNAA) systems used in large, stationary cargo and vehicle portals to non-destructively detect concealed explosives, narcotics, and highly enriched nuclear materials.

Why are Deuterium-Deuterium (D-D) generators gaining traction despite lower neutron yield?

D-D generators eliminate the need for handling the radioactive isotope tritium, significantly reducing operational complexity, licensing requirements, and safety concerns, making them preferred in academic, environmental monitoring, and certain industrial research settings.

What role does the medical sector play in the future growth of stationary neutron generators?

The medical sector is crucial, particularly for transitioning radioisotope production (such as Mo-99/Tc-99m) away from aging research reactors toward accelerator-based neutron activation. This ensures a stable, independent, and secure supply chain for essential diagnostic and therapeutic isotopes.

What is the primary barrier to entry for new competitors in this market?

The primary barrier is the exceptionally high R&D cost, the need for deep specialization in high-voltage physics and vacuum technology, and the stringent regulatory approval process required for systems involving nuclear materials (even sealed-tube tritium).

How do stationary systems contribute to non-destructive testing (NDT)?

Stationary systems enable NDT through neutron radiography and tomography, providing unique insights into the internal structure of dense or complex objects (like turbine blades or specialized aerospace components) that conventional X-rays cannot penetrate or analyze effectively.

Is the cost of maintenance high for stationary neutron generators?

Yes, maintenance is specialized and can be costly, largely revolving around the need for tube refurbishment or replacement when the internal target is depleted. This necessitates specialized technicians and often involves complex shipping and handling procedures for spent units.

Which region shows the highest projected CAGR, and why?

The Asia Pacific region exhibits the highest projected CAGR, driven by massive government infrastructure projects in China and India, increased spending on energy security, and rapid adoption of advanced non-destructive analytical techniques across industrial sectors.

What is Prompt Gamma Neutron Activation Analysis (PGNAA) and its significance?

PGNAA is an analytical technique utilizing neutrons from stationary generators to interrogate materials. When neutrons are captured, characteristic gamma rays are emitted instantly, allowing for rapid, high-precision, non-destructive elemental analysis, vital in mining and security screening.

How does the longevity of the neutron generator sealed tube affect purchasing decisions?

Tube longevity is a critical factor, especially for industrial users (like oil and gas), as a longer life translates directly to reduced operational downtime, lower maintenance costs, and a better overall return on the substantial initial capital investment.

What is the impact of Artificial Intelligence on the data analysis from neutron generators?

AI streamlines data analysis by providing sophisticated algorithms for background noise reduction, spectral deconvolution, and rapid automated material classification, significantly increasing the accuracy and speed of interpretation in real-time applications such as cargo scanning.

Are stationary neutron generators used in academic research and materials science?

Yes, they are fundamental tools in academia for simulating fusion environments, calibrating high-energy detectors, performing activation analysis of novel materials, and studying neutron-induced radiation effects on electronic components.

What specific components define the upstream segment of the value chain?

The upstream segment involves suppliers of specialized components, including high-purity metal targets (titanium hydride), advanced ion sources, high-voltage pulse modulators, ultra-high vacuum components, and robust shielding materials necessary for system integrity.

How do regulatory requirements influence market dynamics?

Regulatory requirements, especially those governed by nuclear safety bodies, impact market dynamics by dictating licensing procedures, tritium handling protocols (for D-T systems), safety feature mandates, and disposal guidelines, often favoring the safer D-D technology in certain non-defense sectors.

What are the main advantages of pulsed output generators over continuous output generators?

Pulsed generators allow for time-of-flight measurements, enabling precise determination of the depth and location of elements within a scanned object, which is essential for advanced subsurface logging and detailed security inspection techniques like PFNA.

How is the market addressing the environmental concerns related to tritium?

The market addresses tritium concerns by investing heavily in R&D for high-yield Deuterium-Deuterium (D-D) generators, which eliminates tritium usage. Manufacturers are also improving sealed-tube technology to minimize tritium leakage risk during operation and disposal.

What are the emerging applications of stationary neutron generators in advanced manufacturing?

Emerging applications include neutron beam imaging and computerized tomography (CT) for quality assurance in additive manufacturing (3D printing) of complex internal geometries and non-destructive analysis of composites and specialized ceramics in aerospace manufacturing.

Which type of neutron generator (D-T or D-D) is currently dominant by revenue, and why?

Deuterium-Tritium (D-T) generators are currently dominant by revenue because they offer significantly higher neutron yield, making them essential for high-throughput, industrial applications like oil and gas well logging and large-scale cargo scanning.

What is the role of key defense contractors in this market?

Defense contractors often act as system integrators, incorporating neutron generator components from specialized manufacturers into large, complex, stationary inspection systems and radiation detection networks required by government and military end-users.

How does the Stationary Neutron Generator market relate to fusion energy research?

The technology developed for commercial stationary generators, particularly in high-power ion sources and target technologies, directly benefits from foundational research in magnetic and inertial confinement fusion, creating a beneficial technological feedback loop.

What factors influence the purchasing decision for a generator in the mining industry?

In the mining industry, purchasing decisions are influenced by the generator's ability to provide real-time, accurate elemental analysis (PGNAA) of bulk ores on conveyor belts, leading to improved efficiency, waste reduction, and instantaneous process control.

How do the regional market shares correlate with global oil and gas activities?

There is a strong positive correlation; regions with intense oil and gas exploration (North America, MEA) show high market shares for stationary generators, reflecting the deep reliance of modern reservoir management on neutron-based logging tools.

What strategic moves are generator manufacturers taking to sustain growth?

Manufacturers are focusing on strategic partnerships with large service providers (like Schlumberger and Baker Hughes), continuous optimization of sealed-tube lifespan, and developing generators optimized for emerging high-value applications like medical isotope production.

What is the typical lifespan of a neutron generator sealed tube in industrial use?

The typical operational lifespan varies significantly depending on the flux and application, but modern industrial sealed tubes are engineered to deliver 1,000 to 5,000 hours of high-output operation before requiring replacement or refurbishment.

How are stationary generators utilized in Boron Neutron Capture Therapy (BNCT)?

In BNCT, stationary generators are being developed as compact, hospital-based neutron sources to deliver a therapeutic neutron beam directly to a patient whose tumor has been selectively loaded with a Boron-10 compound, offering a precise radiation therapy alternative.

What is the significance of the high-voltage power supply in generator operation?

The high-voltage power supply is crucial as it accelerates the deuterium ions to sufficient kinetic energy (typically 80-120 keV) required to overcome the Coulomb barrier and induce the fusion reaction upon impact with the target material, generating the neutron flux.

How does neutron radiography compare to conventional X-ray radiography?

Neutron radiography provides superior contrast and penetration for hydrogenous, light materials (plastics, water, explosives) contained within dense metals, a capability that is often lacking in conventional X-ray systems, which are better suited for detecting differences in density.

What are the major challenges related to the disposal of spent generator tubes?

Disposal challenges arise primarily from the residual radioactivity, particularly in D-T tubes which may contain trace amounts of tritium and activated target material, requiring specific classification and secure handling procedures governed by nuclear waste regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager