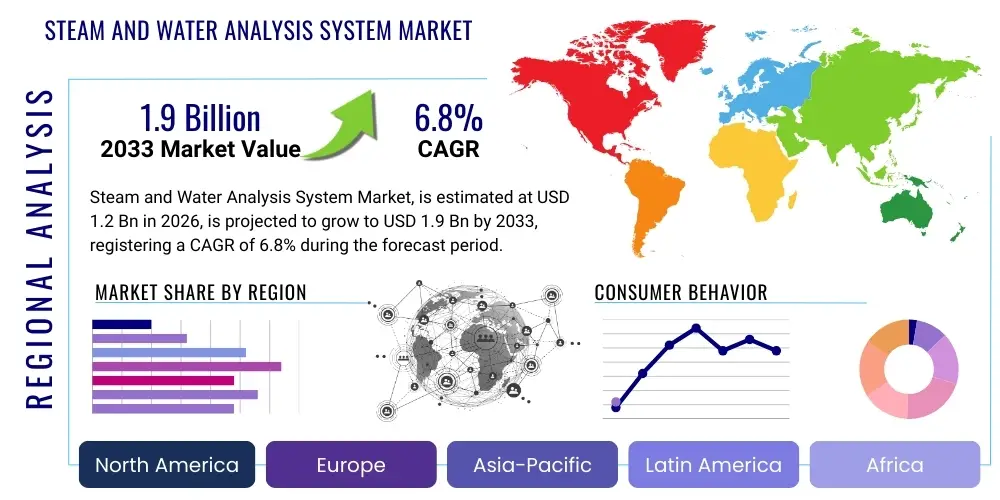

Steam and Water Analysis System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438778 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Steam and Water Analysis System Market Size

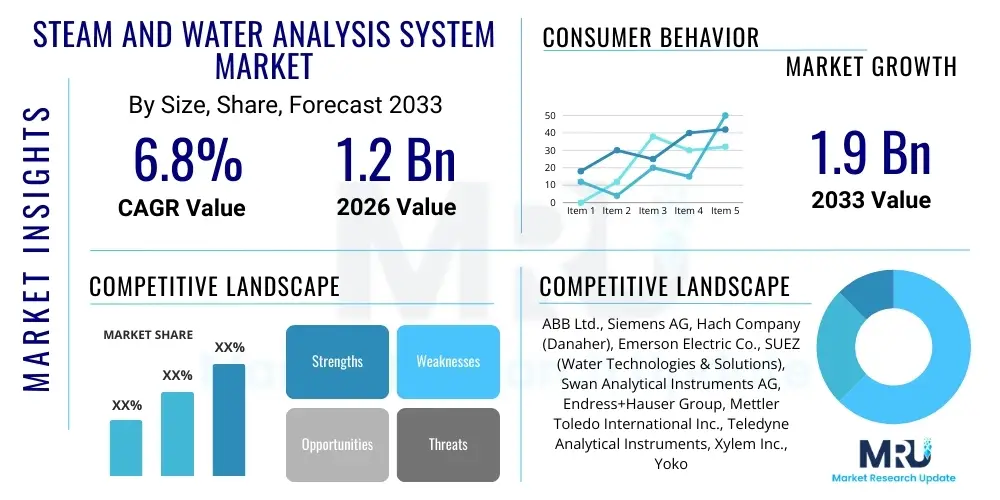

The Steam and Water Analysis System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Steam and Water Analysis System Market introduction

The Steam and Water Analysis System (SWAS) Market encompasses sophisticated integrated analytical solutions designed to continuously monitor the chemical purity of water and steam throughout critical industrial processes, most notably in thermal and nuclear power generation facilities. These systems are essential for maintaining the operational integrity of high-pressure boilers, turbines, and heat exchangers, where even trace levels of corrosive contaminants like dissolved oxygen, sodium, chlorides, or silica can lead to scaling, corrosion, and catastrophic equipment failure. A typical SWAS setup includes sample conditioning components that cool and depressurize the sample stream, followed by a suite of online analyzers—such as conductivity meters, pH probes, and dissolved oxygen sensors—to provide real-time data on water chemistry parameters. The necessity for these systems is driven fundamentally by stringent operational safety standards and the economic imperative to maximize asset life and minimize unscheduled downtime.

Major applications of SWAS extend beyond power generation into industries requiring high-purity water management, including petrochemical, refining, chemical processing, and microelectronics manufacturing. In the power sector, SWAS guarantees adherence to boiler water chemistry guidelines (often set by organizations like EPRI or IAPWS), which is directly correlated with plant efficiency and longevity. The benefits realized from deploying advanced SWAS units are substantial, primarily centering on the proactive mitigation of corrosion-induced damages, optimization of chemical treatment dosing, and sustained energy efficiency by preventing fouling of heat transfer surfaces. Furthermore, modern SWAS units are increasingly integrated with plant Distributed Control Systems (DCS), allowing for automated response actions based on real-time water quality deviations.

Driving factors propelling this market include the global expansion of thermal power infrastructure, particularly in Asia Pacific, the mandatory regulatory compliance environment governing environmental discharges and operational safety, and the necessity to upgrade aging analytical infrastructure in mature markets like North America and Europe. As power plants push for higher operational temperatures and pressures to achieve greater efficiency, the sensitivity required from analytical systems increases, driving demand for more precise and reliable sensor technology. Additionally, the shift towards modular, skid-mounted SWAS solutions simplifies installation and maintenance, further contributing to market acceleration.

Steam and Water Analysis System Market Executive Summary

The global Steam and Water Analysis System (SWAS) market is experiencing robust growth fueled by irreversible business trends emphasizing industrial digitalization, predictive maintenance, and stringent environmental compliance. A key business trend involves the transition from traditional, manually calibrated analyzers to smart, self-diagnosing sensor technologies leveraging Industrial Internet of Things (IIoT) frameworks for remote monitoring and data aggregation. This shift enhances data accuracy and reduces operational expenditure associated with manual sampling and routine maintenance. Furthermore, there is a growing demand for customized, modular SWAS solutions that offer scalability and flexibility for diverse industrial footprints, moving away from large, centralized analytical panels. The convergence of analytical data with cloud-based platforms is also defining competition, allowing vendors to offer comprehensive data management and reporting services.

Regional trends indicate that the Asia Pacific (APAC) region is the primary growth engine, predominantly driven by massive investments in new coal-fired, gas-fired, and nuclear power generation capacity, alongside rapid industrialization in countries like China, India, and Southeast Asia. These developing economies are adopting modern water chemistry standards from the outset, spurring demand for advanced SWAS installations. Conversely, mature markets in North America and Europe exhibit slower but consistent growth driven mainly by replacement cycles, modernization efforts focused on integrating analytics with existing DCS platforms, and adherence to increasingly rigorous environmental regulations concerning water discharge quality. Latin America and the Middle East and Africa (MEA) represent emerging opportunities, particularly in expanding oil and gas processing facilities and utility infrastructure requiring robust analytical control.

Segment trends highlight the dominance of the power generation sector, which remains the single largest end-user due to the critical nature of boiler feedwater quality management. Within components, online analyzers are the leading segment, with specialized sensors for pH, cation conductivity, and dissolved oxygen driving revenue, reflecting their fundamental importance in corrosion control. The market is also witnessing rapid technological advancements in sample conditioning systems aimed at improving thermal stability and flow control, ensuring the integrity of the sample delivered to the analyzers. Economically, while initial capital expenditure remains high, the proven return on investment through reduced corrosion damage and maximized uptime sustains market demand across all operational scales.

AI Impact Analysis on Steam and Water Analysis System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Steam and Water Analysis System Market frequently center on how AI can transform reactive maintenance into predictive failure prevention, optimize chemical dosing strategies, and enhance the overall reliability of analytical output. Common questions explore the feasibility of AI models detecting subtle deviations in water chemistry trends that precede major corrosion events, the capability of machine learning algorithms to compensate for sensor drift or fouling without human intervention, and the potential for deep learning to correlate SWAS data with other plant parameters (like temperature, pressure, and load) for holistic operational insights. Users are keen to understand if AI can automate the complex calibration and verification processes inherent in high-purity water analysis, thereby reducing labor costs and minimizing errors associated with manual data interpretation. The consensus expectation is that AI integration will shift SWAS from a purely monitoring function to an active diagnostic and prescriptive tool, promising significant increases in equipment uptime and analytical integrity.

- Enhanced Predictive Maintenance: AI algorithms analyze historical and real-time SWAS data to predict potential component failures (e.g., pump breakdowns, sensor drift, conditioning module issues) days or weeks in advance, optimizing maintenance scheduling.

- Optimized Chemical Dosing: Machine learning models correlate water chemistry parameters (pH, conductivity) with plant load and chemical input effectiveness, automatically adjusting corrosion inhibitor or oxygen scavenger injection rates for peak efficiency.

- Anomaly Detection and Data Validation: AI identifies subtle, non-linear anomalies in water quality profiles that traditional alarm limits might miss, signaling incipient corrosion or scaling issues, simultaneously validating sensor data integrity to filter out false alarms.

- Automated Diagnostic Reporting: AI generates sophisticated, summarized reports detailing the root cause of water chemistry excursions and recommending specific operational adjustments, significantly reducing the burden on plant chemists.

- Improved Sensor Calibration and Drift Compensation: Machine learning continuously monitors sensor performance characteristics and applies dynamic compensation algorithms, reducing the frequency of physical calibration required.

DRO & Impact Forces Of Steam and Water Analysis System Market

The Steam and Water Analysis System (SWAS) market is shaped by a powerful confluence of drivers, constraints, opportunities, and external impact forces. Key market drivers include the pervasive global need for reliable and efficient power generation, which necessitates extremely precise water quality control to prevent catastrophic boiler and turbine failures. This is structurally reinforced by stringent international and local regulatory frameworks (such as those governing environmental discharge limits and boiler feedwater quality) that mandate continuous, high-accuracy monitoring. Furthermore, the rising average age of industrial infrastructure, particularly in North America and Europe, necessitates replacement and upgrade cycles for outdated analytical equipment, driving demand for modern, digitally integrated SWAS units. The growing adoption of advanced supercritical and ultra-supercritical boilers, which operate at higher pressures and temperatures, demands tighter analytical specifications, further fueling the market.

Restraints, however, temper market expansion. The most significant is the high initial capital expenditure (CAPEX) required for sophisticated, multi-parameter SWAS installations, including the complex sample conditioning system necessary to ensure sample integrity. This high entry cost can deter small and medium-sized industrial facilities. Technical complexity also acts as a restraint; SWAS require skilled personnel for installation, calibration, and maintenance, and the global shortage of trained water chemistry specialists poses operational challenges for end-users. Additionally, competition from alternative technologies or simplified, less comprehensive monitoring solutions in less critical applications can occasionally divert investment.

Opportunities abound, primarily driven by technological advancements. The shift towards modular and pre-engineered SWAS skid packages simplifies deployment and reduces installation costs, making advanced systems more accessible. Significant potential exists in emerging economies in Asia and Latin America undergoing rapid industrialization and power sector expansion. Moreover, integrating SWAS with IIoT and cloud computing platforms for remote diagnostics and centralized data management offers substantial value proposition opportunities, particularly through subscription-based services (Software as a Service for Analytics). Key impact forces include technological evolution, specifically in micro-sensor technology and robust material science that enhances sensor longevity and accuracy in harsh environments. Global sustainability and environmental impact forces also play a role, pushing industries to optimize water usage and minimize effluent pollutants, thereby increasing the reliance on precise SWAS data for compliance and resource efficiency.

Segmentation Analysis

The Steam and Water Analysis System (SWAS) market segmentation provides a detailed structural view of the diverse offerings and end-user applications that collectively constitute the market. Segmentation is primarily based on Component, Application, and Type of Measurement. The Component segment, which is crucial for market revenue generation, includes the Sample Conditioning System (SCS), Analyzers (or sensors), and Communication & Data Acquisition Systems. The SCS is vital as it ensures the high-temperature, high-pressure sample stream is cooled and regulated to appropriate conditions before reaching the sensitive analyzers, thus guaranteeing measurement accuracy. Analyzers, which form the heart of the system, are categorized by the specific parameter they measure, such as pH, conductivity, dissolved oxygen, and sodium ion concentration. The continuous development in sensor robustness and specificity is a key driver within this segment.

The Application segment highlights the dominance of the Power Generation industry, encompassing thermal (coal, gas, oil), nuclear, and combined cycle power plants, where water chemistry control is non-negotiable for safety and efficiency. This segment dictates system specifications and reliability standards across the market. Secondary applications include large-scale industrial processes such as chemical and fertilizer manufacturing, where water is a crucial utility and product quality determinant, and the Oil & Gas sector, particularly for monitoring boiler feedwater in refineries and offshore platforms. Furthermore, the Pharmaceutical and Semiconductor industries, which demand ultrapure water (UPW) for manufacturing, represent high-value niches due to their stringent quality requirements.

- By Component:

- Sample Conditioning System (SCS)

- Analyzers/Sensors (e.g., pH, DO, Conductivity)

- Communication & Data Acquisition Systems (DCS integration)

- By Type of Measurement:

- pH Monitoring

- Cation Conductivity and Specific Conductivity

- Dissolved Oxygen (DO) Analysis

- Sodium Analysis

- Silica Analysis

- Hydrazine/Carbohydrazide Monitoring

- By Application:

- Power Generation (Thermal, Nuclear, Combined Cycle)

- Chemical and Petrochemical Industry

- Oil and Gas (Refineries, Upstream)

- Pharmaceutical and Life Sciences

- Semiconductor and Microelectronics

Value Chain Analysis For Steam and Water Analysis System Market

The value chain for the Steam and Water Analysis System (SWAS) market is vertically integrated, starting with highly specialized upstream suppliers and concluding with complex integration and aftermarket services for the end-users. Upstream activities involve the supply of critical components: analytical sensors, high-grade corrosion-resistant materials for conditioning systems (such as stainless steel alloys for sample lines and heat exchangers), and advanced electronics for data processing. Success at this stage relies heavily on intellectual property regarding sensor chemistry and manufacturing precision, with companies often outsourcing basic components but retaining core control over proprietary analytical cells. The cost and quality of specialized sensors—particularly for low-level detection of contaminants like sodium or silica—significantly influence the final system price and performance. Innovation in the upstream phase focuses on developing maintenance-free sensors and ruggedized components suitable for harsh industrial environments.

Midstream activities involve the design, assembly, and testing of the complete SWAS unit. This is often performed by Original Equipment Manufacturers (OEMs) who integrate components from various specialized suppliers onto a single skid or panel. This phase requires significant engineering expertise to design the sample flow paths, ensuring minimal lag time, thermal efficiency in cooling, and optimal pressure regulation. SWAS integration firms play a critical role in customizing standard designs to meet specific plant specifications (e.g., boiler type, regulatory standards). The distribution channel relies on a mix of direct sales forces for large, strategic accounts (like major utilities) and a network of highly specialized system integrators and distributors who handle local installation, commissioning, and maintenance contracts. Direct sales ensure deep product knowledge transfer, while integrators provide localized, quick-response service capabilities.

Downstream analysis focuses on the end-user deployment and the continuous service cycle. The major downstream buyers—power plants, chemical manufacturers, etc.—require extensive pre-sale consultation and detailed post-sale technical support, including scheduled maintenance, calibration services, and spare parts supply. This after-sales service is a high-margin segment of the value chain. Direct and indirect distribution strategies coexist: direct channels (OEM sales teams) are preferred for customized, large-scale projects, allowing for closer control over project execution and integration with existing DCS. Indirect channels (local agents, distributors) are essential for reaching dispersed industrial clients and providing routine support, capitalizing on the distributor's established local presence and rapid service capabilities. Efficiency in the downstream value chain is measured by system uptime and the speed of technical intervention.

Steam and Water Analysis System Market Potential Customers

The primary customer base for Steam and Water Analysis Systems (SWAS) is overwhelmingly concentrated in sectors where the generation or use of high-pressure, high-temperature steam is integral to the production process and where water quality directly impacts capital asset integrity and safety. The largest segment of buyers consists of utility companies operating thermal power plants, including conventional coal, natural gas, oil-fired, and nuclear power stations. These customers view SWAS not merely as an instrument but as a critical safety and asset protection system necessary to prevent multi-million dollar failures such as boiler tube ruptures or turbine blade damage caused by carryover contamination. Regulatory compliance is the central purchasing driver for this group, compelling them to invest in redundant, high-accuracy systems capable of continuous monitoring across various sample points (feedwater, boiler water, steam, condensate).

Secondary high-potential customers include the heavy industrial processing sectors, notably the petrochemical, refining, and chemical manufacturing industries. In these facilities, steam is used extensively for heating, driving pumps, and as a reactant, requiring strict control over water chemistry to maintain operational continuity and minimize chemical additive costs. Refineries, for instance, must rigorously monitor effluent quality to meet environmental discharge permits, utilizing SWAS data for process optimization. Furthermore, specialized industries requiring ultra-pure water (UPW), such as semiconductor fabrication plants and pharmaceutical manufacturing facilities, represent a niche but highly lucrative customer segment. While their operational parameters differ slightly from power plants, their demand for contaminant-free water (often measured in parts per trillion) requires extremely sensitive and reliable analytical instruments, which drives high-specification SWAS purchases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Hach Company (Danaher), Emerson Electric Co., SUEZ (Water Technologies & Solutions), Swan Analytical Instruments AG, Endress+Hauser Group, Mettler Toledo International Inc., Teledyne Analytical Instruments, Xylem Inc., Yokogawa Electric Corporation, Thermo Fisher Scientific Inc., Waltron LLC, Dr. A. Kuntze GmbH, Aqua-Chem, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steam and Water Analysis System Market Key Technology Landscape

The technological landscape of the Steam and Water Analysis System (SWAS) market is rapidly evolving, driven by the need for enhanced accuracy, reduced maintenance, and seamless digital integration. A fundamental technological advancement centers on the transition from traditional wet-chemistry analysis methods to robust, online electrochemical and optical sensors. Specifically, the development of reliable, low-maintenance sensors for critical parameters like sodium, chloride, and dissolved oxygen—often utilizing ion-selective electrode (ISE) or fluorescence technologies—has significantly improved real-time monitoring capabilities. Modern systems employ microprocessor-based controllers that manage complex calibration routines automatically and continuously perform self-diagnostics, minimizing operator intervention. Furthermore, the meticulous design of the sample conditioning system involves advanced heat exchanger technology and precise flow control mechanisms (often utilizing pressure reducing valves and cooling water control) to ensure the sample reaching the analyzer is truly representative of the process conditions, a critical technological bottleneck that requires constant innovation in material science and engineering design.

Digital connectivity and the integration of SWAS into the broader Industry 4.0 ecosystem represent the most significant contemporary technological shift. New SWAS units are invariably equipped with protocols (such as Modbus TCP/IP, Ethernet/IP, and Profibus) for direct communication with plant Distributed Control Systems (DCS) and SCADA networks. This connectivity facilitates data centralization and remote access for monitoring and troubleshooting. Beyond basic connectivity, sophisticated analytics software utilizing cloud infrastructure is becoming standard. These platforms process large volumes of historical and real-time data, enabling trend analysis, predictive maintenance alarms (often leveraging AI), and automated compliance reporting. The move towards fully integrated, modular, and sometimes containerized SWAS solutions is also a key technology trend, drastically simplifying installation and reducing commissioning time compared to custom-built field installations.

Further innovation is concentrated in improving the accuracy of measurements at ultra-low concentrations (parts per billion or even parts per trillion), crucial for preventing corrosion in advanced power cycles (like ultra-supercritical plants) and manufacturing sectors (like semiconductors). Technology developers are focusing on enhancing sensor selectivity to minimize interference from other ionic species present in the water, which requires advancements in membrane and electrolyte chemistry. Another emerging trend is the use of non-reagent-based systems, particularly for oxygen and pH measurement, which reduces the operational complexity and waste generation associated with traditional chemical titration methods. This focus on simplifying consumables and automating calibration sequences directly addresses the end-user challenge of high operational expenditure and technical skill dependency, thereby driving overall market appeal and technological maturity.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and deployment strategies within the Steam and Water Analysis System (SWAS) market, reflecting varying levels of industrialization, regulatory maturity, and power generation expansion.

- Asia Pacific (APAC): APAC represents the fastest-growing and largest regional market, driven primarily by extensive infrastructure development, particularly the continuous construction of new coal, gas, and nuclear power plants in nations like China, India, and Indonesia. Rapid industrialization across Southeast Asia, coupled with increasing governmental scrutiny over environmental discharges and boiler safety standards, mandates investment in high-quality SWAS. The region is characterized by high volume installations, often adopting the latest digital integration standards.

- North America: This region is a mature market characterized by replacement demand and technological upgrades rather than greenfield projects in the power sector. Growth is driven by the imperative to modernize aging infrastructure, integrating existing SWAS into advanced DCS and adopting IIoT capabilities for improved remote diagnostics and efficiency. Stringent EPA regulations and the high cost of unscheduled downtime in the energy sector maintain consistent demand for high-reliability systems.

- Europe: Similar to North America, Europe is a mature, high-value market focused on adherence to strict European Union directives regarding industrial emissions and water quality. Market activity is heavily influenced by the transition to combined heat and power (CHP) systems and the retirement of older thermal plants, driving demand for flexible, modular SWAS solutions optimized for varied operational loads. Innovation is focused on energy efficiency and highly accurate, low-reagent analytical technologies.

- Middle East and Africa (MEA): This region is an emerging market with significant growth potential, particularly in the Gulf Cooperation Council (GCC) countries due to massive investments in the oil & gas sector (refineries and petrochemical complexes) and desalination plants. SWAS are critical here for managing boiler feedwater in these energy-intensive facilities. Market growth is sensitive to global oil price fluctuations but shows consistent demand for robust, high-temperature tolerant systems.

- Latin America: This region presents moderate growth, driven by expansion in the petrochemical and mining sectors, alongside necessary infrastructure upgrades in Brazil, Mexico, and Chile. The market is often price-sensitive, balancing the need for quality analytical systems with budget constraints, leading to a strong presence of both major international vendors and local distributors providing maintenance services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steam and Water Analysis System Market.- ABB Ltd.

- Siemens AG

- Hach Company (Danaher Corporation)

- Emerson Electric Co.

- SUEZ (Water Technologies & Solutions)

- Swan Analytical Instruments AG

- Endress+Hauser Group

- Mettler Toledo International Inc.

- Teledyne Analytical Instruments

- Xylem Inc.

- Yokogawa Electric Corporation

- Thermo Fisher Scientific Inc.

- Waltron LLC

- Dr. A. Kuntze GmbH

- Aqua-Chem, Inc.

- Schneider Electric SE

- GE Analytical Instruments

- Chemscan, Inc.

- Custom Control Sensors, Inc.

- ATI (Analytical Technology, Inc.)

Frequently Asked Questions

Analyze common user questions about the Steam and Water Analysis System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Sample Conditioning System (SCS) in SWAS?

The primary function of the SCS is to reduce the high temperature and pressure of the industrial steam or water sample stream to levels suitable for online analyzers. This process ensures the sample reaches the sensors quickly and safely, without flashing or damaging the sensitive analytical instrumentation, thereby guaranteeing measurement accuracy and system longevity.

Which measurement parameter is most critical for detecting corrosion in high-pressure boilers?

Cation conductivity is often considered the most critical parameter, as it isolates and measures the concentration of corrosive ionic impurities (like chlorides and sulfates) remaining in the sample after ammonia or amine buffering agents have been removed. Additionally, low levels of dissolved oxygen analysis are crucial for minimizing oxygen-based pitting corrosion.

How does IIoT integration benefit the operation of Steam and Water Analysis Systems?

IIoT integration allows for centralized data collection, remote monitoring, and advanced predictive maintenance scheduling. It enables plant operators to access real-time diagnostic information, perform remote calibration checks, and utilize cloud-based analytics (often AI-driven) to optimize chemical dosing and predict potential equipment failures before they occur, maximizing system uptime.

Why is the Power Generation industry the largest end-user segment for SWAS?

The Power Generation industry requires exceptionally pure water and steam for operation in high-pressure cycles (boilers and turbines). Contaminants lead directly to corrosion, scaling, efficiency loss, and catastrophic failure. Regulatory and safety standards mandate continuous monitoring, making SWAS essential for protecting high-value assets and ensuring reliable energy output.

What major restraints hinder the broader adoption of advanced SWAS technology?

The primary restraints include the high initial capital investment required for comprehensive, multi-parameter SWAS installations, particularly the complex Sample Conditioning Systems. Additionally, the technical complexity necessitates specialized maintenance staff, posing challenges in regions with a shortage of trained water chemistry and instrumentation personnel.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager