Steam Chemical Indicator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434913 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Steam Chemical Indicator Market Size

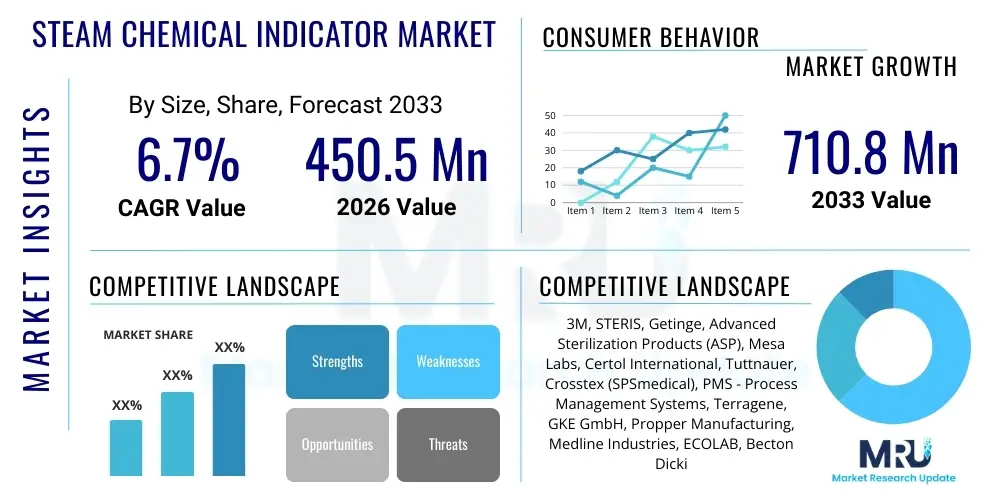

The Steam Chemical Indicator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.8 Million by the end of the forecast period in 2033.

Steam Chemical Indicator Market introduction

The Steam Chemical Indicator Market encompasses products essential for monitoring sterilization processes, primarily in healthcare and life sciences sectors. Steam chemical indicators are physical tools designed to react to one or more critical variables required for effective steam sterilization, such as time, temperature, and saturated steam presence. These indicators provide immediate visual confirmation that the items being processed have been exposed to the required sterilization conditions, thereby mitigating the risk of hospital-acquired infections (HAIs) and ensuring patient safety. Their primary function is to verify the successful penetration of steam into packaging and throughout the sterilization load, acting as a critical component of quality assurance systems in medical device reprocessing.

The core products within this market include various classes of indicators, ranging from simple exposure indicators (Class 1) used on the outside of packages, to highly sophisticated emulating indicators (Class 6) that react to all three critical variables of a specific sterilization cycle. Major applications span across hospitals, surgical centers, dental clinics, and medical device manufacturing facilities, where adherence to stringent regulatory standards like those set by the FDA and ISO is mandatory. The continuous rise in surgical procedures globally, coupled with increasing awareness regarding the hazards of improperly sterilized equipment, drives the perpetual demand for reliable chemical indicators.

Key benefits derived from the adoption of steam chemical indicators include enhanced patient safety protocols, reduced instances of surgical site infections, and streamlined quality control processes within central sterile supply departments (CSSDs). Furthermore, these indicators offer a cost-effective, immediate method for documenting sterilization efficacy, complementing the more complex and time-consuming biological indicator testing. Driving factors for market expansion include the global push for standardized infection prevention practices, technological advancements leading to more precise and integrated indicator designs, and the expanding volume of disposable and reusable medical instruments requiring high-level sterilization verification.

Steam Chemical Indicator Market Executive Summary

The Steam Chemical Indicator Market is characterized by robust regulatory oversight and continuous innovation aimed at improving indicator accuracy and ease of interpretation. Current business trends indicate a strong shift towards advanced integrating and emulating indicators (Class 5 and 6), which offer superior performance characteristics by monitoring multiple sterilization parameters simultaneously, thus providing a higher level of assurance compared to earlier classes. Consolidation among major players, particularly through strategic mergers and acquisitions, is shaping the competitive landscape, allowing large corporations to offer comprehensive sterilization monitoring solutions that bundle chemical indicators with sterilization equipment and biological monitoring tools. Furthermore, there is an increasing emphasis on environmentally friendly and non-toxic indicator formulations, responding to sustainability initiatives within the healthcare sector.

Regionally, North America and Europe currently dominate the market due to established healthcare infrastructures, stringent mandatory sterilization guidelines, and high expenditure on infection control measures. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly expanding healthcare access, increasing governmental focus on hospital sanitation standards, and the establishment of new large-scale medical facilities in countries like China and India. Latin America and the Middle East & Africa (MEA) are also exhibiting steady growth, driven by growing awareness and investment in modern sterilization protocols, often facilitated by international aid and regulatory harmonization efforts.

Segment trends highlight the dominance of hospitals as the primary end-user segment, given the high volume of surgical and medical procedures conducted daily. Within the product type segment, Integrating Indicators (Class 5) are gaining significant traction, favored for their ability to correlate performance closely with the inactivation kinetics of biological indicators, offering a pragmatic balance between cost, speed, and reliability. Technology-wise, sophisticated ink-based and moving-front indicators that provide clear, irreversible color changes are preferred over older, less reliable methods, emphasizing the demand for unambiguous result interpretation in time-sensitive clinical environments.

AI Impact Analysis on Steam Chemical Indicator Market

Common user inquiries regarding AI in the Steam Chemical Indicator market center on how artificial intelligence can enhance the interpretation of indicator results, automate compliance reporting, and predict sterilization failures before they occur. Users frequently ask if AI systems can be integrated with digital documentation platforms in Central Sterile Supply Departments (CSSDs) to eliminate human error associated with visual inspection of color change indicators. Key themes emerging from these questions include the potential for AI-powered image recognition to verify the pass/fail status of complex indicators (like Class 6), the capability of machine learning algorithms to analyze sterilization cycle data (time, temperature, pressure) and correlate it instantly with indicator performance, and the expectation that AI will ultimately streamline regulatory compliance audits by creating immutable, verifiable digital records of every sterilization cycle and its corresponding chemical indicator result.

The integration of AI, particularly computer vision and machine learning (ML), is expected to significantly enhance the reliability and efficiency of sterilization monitoring. While the indicators themselves remain physical tools reacting chemically to steam conditions, AI focuses on the downstream data processing and verification stages. AI systems can be deployed through digital readers or integrated documentation software to automatically capture images of the used chemical indicators, analyze the color change pattern against pre-defined success criteria, and generate immediate digital verification. This minimizes the risk of human fatigue or subjective misinterpretation, especially in high-volume settings where hundreds of indicators are processed daily. Furthermore, ML algorithms can analyze patterns of indicator failure across various sterilizers, identifying predictive maintenance needs or procedural deviations within the CSSD.

Ultimately, the impact of AI is transformative in making the sterilization monitoring workflow smarter, faster, and more auditable. By automating the documentation process and providing data-driven insights, AI moves the market beyond simple visual checks toward a comprehensive quality assurance ecosystem. This integration will likely drive demand for indicators designed with specific markers or patterns optimized for machine readability, bridging the gap between physical chemistry and digital verification systems, thereby reinforcing the overall safety chain within healthcare facilities.

- AI enhances visual result verification through computer vision and image recognition, reducing human error.

- Machine learning algorithms correlate sterilization cycle parameters with indicator performance for predictive failure analysis.

- AI automates digital documentation and compliance reporting, improving auditability for regulatory bodies.

- Integration with CSSD management systems streamlines workflow and provides real-time quality control feedback.

- Future indicator designs may incorporate AI-optimized features for improved automated data capture.

DRO & Impact Forces Of Steam Chemical Indicator Market

The market dynamics are defined by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the momentum and trajectory of the Steam Chemical Indicator Market. The overarching force driving demand is the mandatory requirement for effective infection control in healthcare settings globally. Stringent regulatory frameworks, such as those imposed by the FDA in the US and similar bodies internationally, necessitate the use of highly reliable chemical indicators for routine monitoring of sterilization equipment. This regulatory pressure, combined with heightened public and professional awareness regarding Hospital-Acquired Infections (HAIs), ensures sustained market buoyancy. Furthermore, the increasing volume and complexity of surgical procedures, often involving highly specialized instruments requiring validated sterilization, continually fuel the need for advanced monitoring solutions like Class 5 and Class 6 indicators.

However, the market faces significant Restraints that temper growth. One major constraint is the continuous pressure on healthcare budgets, leading organizations to seek lower-cost alternatives, sometimes favoring less expensive indicator classes over more robust integrating or emulating types. A substantial competitive restraint comes from Biological Indicators (BIs), which, while more expensive and slower, are considered the gold standard for sterilization efficacy testing; this limits the maximum permissible reliance on chemical indicators alone. Moreover, the lack of standardized training and interpretation protocols in resource-constrained regions can lead to misuse or misreading of chemical indicator results, reducing their perceived reliability and effectiveness, necessitating ongoing educational efforts by manufacturers.

Opportunities for market expansion are primarily centered on technological innovation and geographic penetration. The development of advanced indicators featuring integrated diagnostics, clearer end-point transitions, and compatibility with automated documentation systems presents a significant growth avenue. The untapped potential in emerging economies, where healthcare infrastructure is rapidly developing, represents a massive opportunity. As these regions adopt international sterilization standards, the demand for affordable and reliable chemical indicators will surge. Furthermore, the increasing trend toward the outsourcing of sterilization services (Sterilization as a Service) offers new distribution channels for manufacturers and promotes the standardized, high-volume use of chemical indicators.

Segmentation Analysis

The Steam Chemical Indicator Market is primarily segmented based on the mechanism of operation, the intended environment of use, the specific class designation, and the ultimate end-user facility. This granular segmentation allows market participants to tailor product offerings to specific regulatory and operational needs. Segmentation by class (e.g., Class 1 through Class 6) is particularly crucial as it dictates the level of assurance provided, directly impacting purchasing decisions in highly regulated environments like operating theaters and sterile processing departments. Understanding these segments is vital for analyzing market share distribution, identifying high-growth product categories, and formulating targeted marketing strategies that address the varying compliance requirements across global markets.

The market segments reflect the spectrum of sterilization assurance demanded by different healthcare and manufacturing entities. Hospitals often utilize a blend of indicators, typically Class 1 for external package monitoring, and Class 5 or Class 6 for internal load monitoring. Conversely, smaller clinics or dental practices may rely heavily on simpler, cost-effective indicators supplemented by routine biological monitoring. Technological segmentation highlights the shift towards precise, advanced indicators that offer rapid, conclusive results, moving away from older, less sensitive chemistries. The growth in the medical device manufacturing segment, driven by global demand for sterile implants and instruments, requires high-volume use of process challenge devices incorporating chemical indicators to validate industrial sterilization cycles, presenting a distinct revenue stream for manufacturers.

- By Product Class:

- Class 1 (Process Indicators)

- Class 2 (Specific Test Indicators)

- Class 3 (Single-Variable Indicators)

- Class 4 (Multi-Variable Indicators)

- Class 5 (Integrating Indicators)

- Class 6 (Emulating Indicators)

- By Technology:

- Ink-based Indicators

- Moving Front Indicators

- Paper-based Indicators

- By Application:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Medical Device Manufacturing

- Pharmaceutical and Biotechnology Companies

- Dental Clinics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Steam Chemical Indicator Market

The value chain for the Steam Chemical Indicator Market begins with the sourcing of specialized raw materials, primarily involving high-purity chemical compounds, specialized ink formulations that react predictably to heat and moisture, and high-quality substrate materials (paper or polymer films). Upstream activities are critical, focusing on maintaining supply chain integrity and ensuring the consistent quality of these chemically sensitive components, as any variability in raw materials directly impacts the indicator's accuracy and shelf life. Key upstream suppliers include specialty chemical manufacturers and advanced printing material producers. Manufacturers then engage in the complex process of formulation, coating, and printing these materials onto indicator strips or cards, requiring precision engineering and adherence to ISO 11140 standards to ensure reliable performance across various sterilization cycles.

Midstream activities involve the manufacturing, quality assurance, and packaging of the finished chemical indicator products. This stage requires rigorous testing and certification (often by third-party bodies) to validate the product's claims regarding Class designation and performance parameters. Distribution then moves through two primary channels: direct sales to large hospital systems, medical device Original Equipment Manufacturers (OEMs), and group purchasing organizations (GPOs), and indirect sales via specialized medical supply distributors. The indirect distribution network often handles smaller accounts, such as individual clinics and dental offices, providing crucial logistical support and localized inventory management, especially in fragmented regional markets.

Downstream analysis focuses on the end-users and the service providers who utilize the indicators. Hospitals (CSSDs), ASCs, and manufacturing facilities represent the points of consumption. The final segment of the value chain involves regulatory oversight, post-market surveillance, and customer support, ensuring that products are used correctly and that any deviations in performance are promptly investigated and reported. Effective collaboration between manufacturers and distributors, coupled with robust customer education, is paramount for maintaining product efficacy and trust within the healthcare ecosystem.

Steam Chemical Indicator Market Potential Customers

The primary customers and end-users of steam chemical indicators are institutions and companies where patient safety, regulatory compliance, and high-level sterile assurance are non-negotiable operational requirements. The largest purchasing segment comprises hospitals, particularly their Central Sterile Supply Departments (CSSDs), which are responsible for cleaning, disinfecting, and sterilizing all reusable surgical instruments and medical devices. These facilities consume the highest volume of indicators daily, utilizing a full range of classes for load monitoring, pack monitoring, and routine sterilizer performance checks (e.g., Bowie-Dick tests, which often utilize Class 2 indicators).

A rapidly growing customer base includes Ambulatory Surgical Centers (ASCs) and specialized clinics (e.g., ophthalmology, orthopedics) that perform high-volume, minimally invasive procedures. While smaller than hospitals, ASCs are increasingly adopting stringent sterilization protocols, mirroring hospital standards, driving demand for reliable Class 5 and 6 indicators. Furthermore, medical device manufacturers represent a crucial customer segment, utilizing chemical indicators extensively during the validation and routine monitoring of their large-scale industrial sterilization processes to ensure that sterile packaging integrity and product sterility are maintained before market release. Dental practices also form a significant, though often geographically fragmented, customer group, utilizing indicators to verify the efficacy of their smaller steam sterilizers (autoclaves) used for dental instruments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.8 Million |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, STERIS, Getinge, Advanced Sterilization Products (ASP), Mesa Labs, Certol International, Tuttnauer, Crosstex (SPSmedical), PMS - Process Management Systems, Terragene, GKE GmbH, Propper Manufacturing, Medline Industries, ECOLAB, Becton Dickinson (BD), SAKURA FINETEK JAPAN, RRS, ZD Medical, US Endoscopy, Hu-Friedy Mfg. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steam Chemical Indicator Market Key Technology Landscape

The technology landscape of steam chemical indicators is rooted in precision chemical engineering and advanced material science, focusing on creating irreversible and clearly discernible color changes upon exposure to specific sterilization parameters. The fundamental technologies include specialized, non-toxic chemical inks and formulations that contain reactive elements, such as pH-sensitive dyes or heat-sensitive compounds, which undergo a defined chemical transformation when exposed to saturated steam at the correct temperature for the required duration. A crucial technological advancement is the shift from simple single-variable indicators (Class 3) to sophisticated integrating (Class 5) and emulating (Class 6) technologies. Class 5 indicators, for example, use formulations designed to monitor multiple critical parameters (time and temperature) and correlate performance with the kill time of biological indicators, offering a higher safety margin and predictive capability.

Another major technological development involves the Moving Front Indicator technology. In this system, a specially formulated chemical pellet melts and migrates along a paper wick when exposed to heat. The speed and extent of this migration are highly dependent on the correct combination of steam saturation, temperature, and exposure time. This provides a dynamic, easily interpretable visual result that confirms successful exposure to all necessary variables. Furthermore, innovation is focused on improving the substrate materials, ensuring that the indicator remains stable, legible, and resistant to degradation within the moist, high-temperature sterilization environment, which is vital for maintaining the integrity of the indicator until it is read and archived for documentation purposes.

The future technological trajectory involves greater integration with digital systems. Manufacturers are designing indicators and accompanying reading devices that facilitate automated scanning and data logging. This shift from manual visual inspection to digital verification requires indicators with enhanced readability features, potentially utilizing QR codes or specific patterns that are easily recognized by machine vision systems. This convergence of physical chemistry and digital documentation is pivotal for enhancing compliance, reducing human error, and achieving optimal operational efficiency in high-throughput sterile processing environments worldwide.

Regional Highlights

The global Steam Chemical Indicator Market exhibits distinct regional consumption patterns dictated by regulatory enforcement, healthcare maturity, and sterilization expenditure.

- North America (NA): Dominates the market share due to stringent sterilization protocols mandated by the FDA and CDC. High healthcare spending, advanced medical infrastructure (especially in the US and Canada), and widespread adoption of Class 5 and Class 6 indicators drive sustained high demand. Key market activities include product consolidation and the push for digital documentation integration within CSSDs.

- Europe: Represents the second-largest market, strongly influenced by ISO standards and national health mandates (e.g., NHS in the UK, centralized health systems in Germany). Emphasis is placed on environmental sustainability, driving demand for non-toxic and eco-friendly indicator formulations. Germany, France, and the UK are key contributors to market revenue, focusing heavily on quality assurance in device reprocessing.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. This accelerated growth is fueled by increasing foreign direct investment in healthcare infrastructure, rising awareness about infection control, and the rapid adoption of Western sterilization standards in populous nations like China, India, and Japan. The need for cost-effective, high-volume sterilization monitoring solutions is a key regional driver.

- Latin America (LATAM): Exhibits steady growth driven by modernization of hospital facilities and increasing governmental efforts to improve public health standards. Brazil and Mexico are leading the regional adoption, often importing advanced indicator technologies to meet growing surgical demands.

- Middle East & Africa (MEA): Currently the smallest but fastest-growing segment in terms of infrastructural investment. Growth is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to large-scale development of medical cities and reliance on international healthcare accreditation standards, which necessitate the use of advanced sterilization indicators.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steam Chemical Indicator Market.- 3M

- STERIS

- Getinge

- Advanced Sterilization Products (ASP)

- Mesa Labs

- Certol International

- Tuttnauer

- Crosstex (SPSmedical)

- PMS - Process Management Systems

- Terragene

- GKE GmbH

- Propper Manufacturing

- Medline Industries

- ECOLAB

- Becton Dickinson (BD)

- SAKURA FINETEK JAPAN

- RRS

- ZD Medical

- US Endoscopy

- Hu-Friedy Mfg.

Frequently Asked Questions

What is the primary difference between Class 5 (Integrating) and Class 6 (Emulating) Steam Chemical Indicators?

Class 5 Integrating Indicators react to all three critical variables (time, temperature, saturated steam) and are designed to correlate with the performance of biological indicators (BIs) over a range of sterilization cycles. Class 6 Emulating Indicators, conversely, are cycle-specific; they react to all critical variables only at the specific stated values of a designated sterilization cycle (e.g., 134°C for 3.5 minutes), offering the highest level of assurance for that precise cycle type.

How do global regulatory standards influence the purchasing decisions of chemical indicators?

Global regulatory bodies, such as the FDA, ISO (specifically ISO 11140), and national health authorities, mandate specific levels of sterilization monitoring for medical devices. Compliance requires utilizing indicators that meet these specified standards (e.g., the use of Class 5 or Class 6 indicators for internal pack monitoring), forcing healthcare facilities to prioritize reliability and certification over lower cost, thereby boosting demand for premium, regulated products.

What are the key drivers for market growth in the Asia Pacific region?

The key drivers in APAC include rapid healthcare infrastructure development, increasing governmental spending on public health and infection control programs, and the adoption of international accreditation standards by new hospitals. The rise in medical tourism and the expansion of the indigenous medical device manufacturing sector also necessitate robust, standardized sterilization monitoring tools.

Is the market moving towards digital verification and away from manual interpretation of indicators?

Yes, the market is experiencing a significant shift towards digital verification. While the physical chemical indicator remains essential, manufacturers are developing integrated solutions using computer vision, automated scanners, and specialized software to capture, interpret, and digitally archive indicator results. This trend minimizes human error, improves workflow efficiency in CSSDs, and enhances compliance traceability.

What role does the 'Moving Front' technology play in indicator performance?

Moving Front technology utilizes a chemical ink or pellet that migrates along a strip over time when exposed to the correct sterilization conditions. This technology is preferred in certain applications, such as Bowie-Dick tests, because it provides a clear, quantitative, and dynamic confirmation that the sterilizing agent has penetrated uniformly over the required duration and temperature, ensuring comprehensive verification of sterilizer efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager