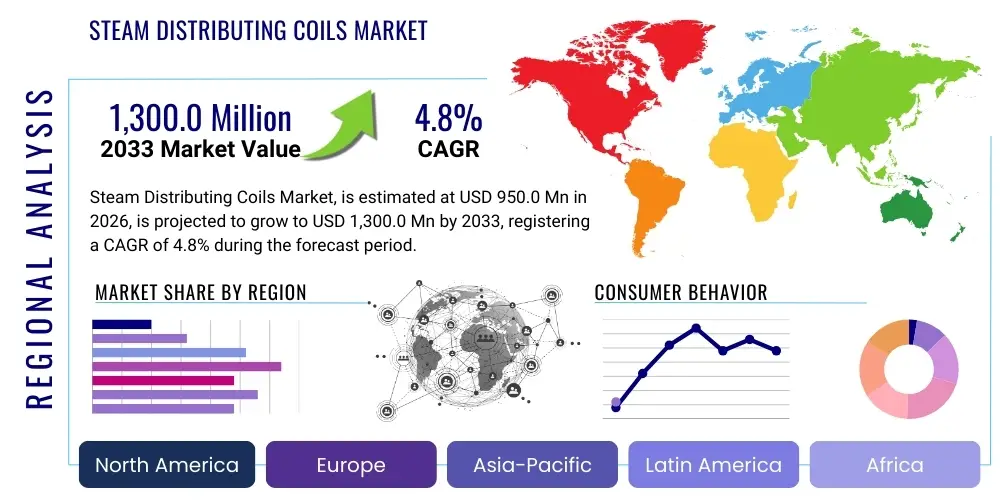

Steam Distributing Coils Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436489 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Steam Distributing Coils Market Size

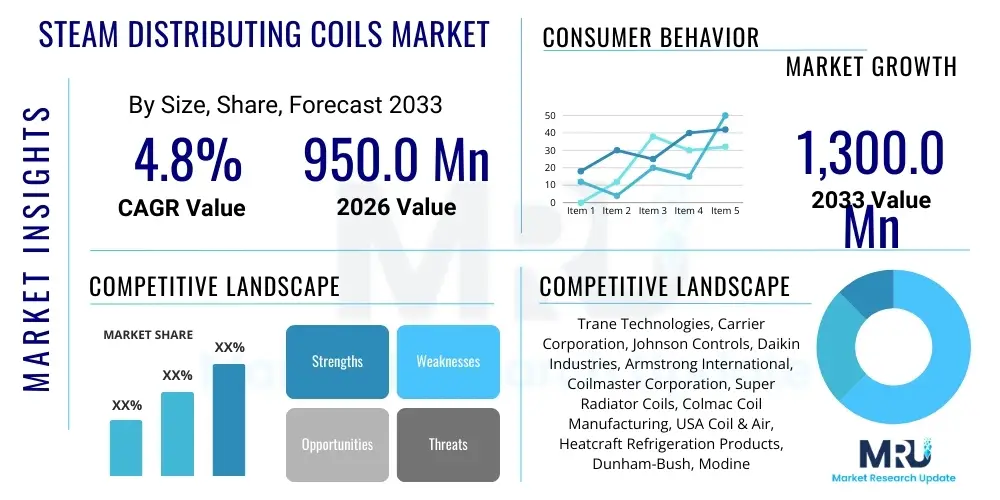

The Steam Distributing Coils Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 950.0 Million in 2026 and is projected to reach USD 1,300.0 Million by the end of the forecast period in 2033.

Steam Distributing Coils Market introduction

Steam distributing coils, also frequently referred to as steam coils or non-freeze steam coils, are essential heat transfer devices utilized primarily in Heating, Ventilation, and Air Conditioning (HVAC) systems and various industrial heating applications. These coils are specifically designed to distribute low-pressure steam uniformly across the coil face, mitigating issues related to uneven temperature distribution and, critically, preventing coil freeze-up in cold air streams. The design typically incorporates an inner steam distribution tube with small orifices centered within a larger outer coil tube, ensuring that condensate is effectively managed and steam flow is optimized for maximum heat output and longevity of the system.

The primary applications of steam distributing coils span commercial, industrial, and institutional sectors, playing a crucial role in air preheating, comfort heating, humidification control, and process drying. Major applications include use in large air handling units (AHUs), pharmaceutical manufacturing facilities requiring stringent temperature control, pulp and paper industries, and specialized environmental chambers. The inherent benefits of these coils, such as superior heat transfer efficiency, robust construction capable of handling fluctuating steam conditions, and the ability to operate reliably in sub-freezing conditions, drive their sustained demand across modernized infrastructure projects.

Market growth is predominantly driven by stringent energy efficiency mandates imposed globally, accelerating demand for high-performance HVAC components that minimize steam waste and optimize thermal output. Furthermore, rapid industrialization and expansion of commercial infrastructure, particularly in the Asia Pacific region, necessitate the integration of sophisticated climate control and air treatment systems where reliable steam distribution is paramount. The continuous replacement cycles of aging HVAC infrastructure in developed economies, coupled with technological advancements in coil material and design, further cement the market's positive trajectory.

Steam Distributing Coils Market Executive Summary

The global Steam Distributing Coils Market is defined by steady expansion, propelled by significant business trends focusing on sustainable manufacturing practices and the integration of smart building technologies. Manufacturers are increasingly prioritizing materials science, particularly the use of advanced stainless steel and corrosion-resistant alloys, to enhance coil durability and extend product lifecycles, addressing the high maintenance costs associated with traditional copper/aluminum coils in demanding industrial environments. Strategic partnerships between coil manufacturers and large-scale HVAC system integrators are shaping the distribution landscape, ensuring optimized component installation and performance guarantees, thereby strengthening market concentration among established players.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in new construction, data centers, and specialized manufacturing hubs (e.g., semiconductor and electric vehicle production), all of which require precise climate control dependent on efficient steam systems. North America and Europe demonstrate mature market characteristics, emphasizing retrofit projects and the adoption of high-efficiency models compliant with stringent local energy codes. Segment trends highlight a growing preference for non-freeze coil designs due to increased operational reliability and reduced risk of costly downtime, especially in regions prone to severe winter weather. The industrial sector remains the largest consumer segment, driven by continuous demand from the chemical, food and beverage, and automotive industries for reliable process heating solutions.

The competitive landscape is moderately fragmented, with specialized coil fabricators competing alongside integrated HVAC solution providers. Key challenges include managing volatile raw material costs, particularly copper and steel, and addressing the technical complexity of integrating coils into highly customized, modern AHU designs. Overall, the market's stability is underpinned by its essential role within critical infrastructure, with future growth contingent on ongoing modernization efforts and adherence to global sustainability standards.

AI Impact Analysis on Steam Distributing Coils Market

User queries regarding AI's influence on the Steam Distributing Coils Market typically revolve around predictive maintenance, optimization of system performance, and automated quality control during manufacturing. Users frequently ask if AI can anticipate coil failures before they occur, how machine learning algorithms can adjust steam flow rates in real-time based on fluctuating environmental conditions, and whether AI-driven design tools can optimize heat exchanger geometry for specific applications. The underlying concerns often relate to the integration cost of such sophisticated monitoring systems into legacy HVAC infrastructure and the cybersecurity risks associated with network-connected industrial components. Users expect AI to translate into tangible operational savings by minimizing energy consumption and dramatically reducing unexpected system downtime, thereby justifying the initial investment in smart coil technology and sensors.

- AI-driven Predictive Maintenance: Utilizing sensor data (temperature, pressure, vibration) to forecast potential coil scaling, corrosion, or freezing issues, scheduling maintenance proactively.

- Optimized Operational Efficiency: Machine learning algorithms dynamically adjust steam valve positions and coil bypass dampers based on occupancy patterns and real-time thermal load, minimizing steam wastage.

- Generative Design and Simulation: AI tools accelerate the development of highly efficient, application-specific coil geometries, reducing prototyping time and material usage.

- Automated Quality Inspection: Vision systems and AI models inspect brazing, tube spacing, and fin quality during manufacturing, ensuring zero-defect output.

- Smart Inventory Management: AI predicts demand fluctuations for replacement coils based on historical climate data and regional infrastructure age, optimizing supply chains.

DRO & Impact Forces Of Steam Distributing Coils Market

The dynamics of the Steam Distributing Coils Market are governed by a complex interplay of inherent growth drivers (D), market restraints (R), emerging opportunities (O), and potent environmental and competitive impact forces. The primary drivers include global infrastructural development, particularly the expansion of high-tech manufacturing, pharmaceutical, and data center industries, all requiring robust and precise humidity and temperature control facilitated by steam systems. Conversely, the market faces restraints such rooted in the high capital expenditure required for installing new steam infrastructure and the inherent risks associated with coil freezing and corrosion, which necessitate frequent maintenance and replacement. Opportunities abound in technological refinement, focusing on developing corrosion-resistant materials and incorporating smart sensors for real-time monitoring and energy optimization.

Drivers: A significant driver is the mandatory upgrade cycle of aging HVAC systems in developed economies, which often replace inefficient, older coils with modern, non-freeze distributing units that comply with current thermal efficiency standards. Furthermore, the global push towards maintaining stringent indoor air quality (IAQ) and comfort levels in commercial and institutional settings, such as hospitals and schools, ensures a continuous baseline demand for reliable heating components. The expansion of centralized district heating systems in urban areas, which often rely on large-scale steam distribution networks, further contributes to market growth. The robustness and high energy density of steam systems, particularly compared to hot water, remain advantageous in large industrial applications.

Restraints: One critical restraint is the fluctuating cost and price volatility of key raw materials, predominantly copper, steel, and aluminum, which directly impact manufacturing costs and final product pricing. Technical challenges related to steam system integration, particularly managing condensate removal efficiently to prevent water hammer and premature coil failure, also pose operational barriers. Additionally, the increasing preference for alternative, non-steam based heating solutions, such as high-efficiency electric heat pumps and direct-fired burners in smaller commercial applications, provides a competitive restraint that limits market penetration in certain segments. The requirement for specialized expertise in steam system design and maintenance acts as a subtle hurdle for widespread adoption in developing regions.

Opportunity: The market presents substantial opportunities in retrofitting existing industrial boilers and heat exchangers with advanced, micro-channel steam distributing coil designs that offer enhanced heat transfer within a smaller footprint, thereby maximizing space efficiency. Expansion into emerging markets, where rapid industrialization is underway and infrastructure investment is high, offers substantial untapped potential. Furthermore, the development of coils specifically engineered for use with low-grade, recovered waste heat steam provides a niche but growing sustainable segment. The integration of IoT (Internet of Things) capabilities into coils, enabling remote diagnostics and preventative maintenance alerts, represents a high-value opportunity for manufacturers seeking to differentiate their products through service-based offerings.

Impact Forces: The primary impact forces shaping the market include strict governmental regulations regarding energy consumption and carbon emissions, compelling end-users to adopt the most efficient steam distribution technologies available. Competitive rivalry is high, particularly among specialized OEM manufacturers who innovate rapidly in material science and thermal design to gain market share. Supply chain disruptions, exacerbated by global geopolitical events, influence the delivery times and pricing of finished coils. Technological evolution, particularly the refinement of manufacturing processes like laser welding and advanced finning techniques, constantly exerts pressure on established production methods, requiring continuous capital investment to remain competitive. Finally, end-user demand for customized, robust, and reliable coils that guarantee low operational risk heavily influences purchasing decisions across all segments.

Segmentation Analysis

The Steam Distributing Coils Market is comprehensively segmented based on several key criteria including the design type, the material composition, the specific application, and the ultimate end-user industry. This granular segmentation allows market stakeholders to identify niche high-growth areas and tailor product offerings to meet precise performance requirements across diverse operational environments. Design segmentation, for instance, focuses on differentiation between standard distribution coils, often used in less critical environments, and specialized non-freeze designs, which command a premium due to their critical role in preventing damage during freezing weather conditions. Material segmentation reflects the trade-offs between cost (copper/aluminum) and durability/corrosion resistance (stainless steel) in various industrial settings.

By Type, the market is primarily divided into models featuring inner distribution tubes to ensure even steam flow and effective condensate management, and simpler direct steam coils used where freeze protection is not a primary concern. The distinction between these types is critical, as non-freeze coils often employ staggered tube layouts and internal feed tubes designed to maintain steam pressure throughout the coil length, preventing the formation of stagnant water pockets susceptible to freezing. The application segment analysis reveals that while general HVAC remains a stable foundation, specialized industrial process heating segments, particularly those involving high-humidity or corrosive air streams, are driving demand for premium, custom-engineered coils.

Geographically, market segmentation underscores the crucial role of regional climate conditions in product demand. Regions like North America, Northern Europe, and specific parts of Asia that experience prolonged periods of sub-zero temperatures exhibit higher demand for heavy-duty, robustly tested non-freeze steam distributing coils. Conversely, warmer climates focus demand on corrosion resistance and efficient thermal output for industrial cooling pre-treatment applications. Understanding these segment dynamics is essential for strategic planning, pricing, and distribution channel optimization.

- By Type:

- Standard Distribution Coils (Single Tube)

- Non-Freeze Distribution Coils (Inner Distributing Tube)

- Separating Tube Coils

- By Material:

- Copper Tubes and Aluminum Fins

- Stainless Steel Tubes and Fins

- Carbon Steel

- Special Alloys (e.g., Cupro-Nickel)

- By Application:

- HVAC and Air Handling Units (AHUs)

- Industrial Process Heating and Drying

- Air Preheating and Tempering

- Boiler Feedwater Preheating

- By End-User:

- Commercial Buildings (Offices, Retail)

- Industrial Facilities (Manufacturing, Chemical, Automotive)

- Institutional (Hospitals, Universities, Government Facilities)

- Utilities and Power Generation

Value Chain Analysis For Steam Distributing Coils Market

The value chain for the Steam Distributing Coils Market begins with the Upstream Analysis, centered on the sourcing and processing of essential raw materials, primarily copper, stainless steel, and aluminum. This stage is dominated by large metal suppliers and processors whose pricing and quality significantly dictate the final manufacturing cost. Key activities here involve refining, extrusion, and preparation of specialized tubing and fin stock. Manufacturers often maintain long-term contracts with these suppliers to mitigate price volatility, a critical factor given that material costs constitute a substantial portion of the coil’s total production expense. Efficiency in this upstream segment depends heavily on global commodity market stability and logistical capabilities.

The core Manufacturing and Assembly stage follows, involving specialized processes such as tube expansion, fin stamping, brazing, and casing fabrication. This stage requires high precision engineering, particularly for non-freeze designs, to ensure perfect sealing and uniform heat transfer characteristics. Quality control (QC) testing, including pressure testing and leak detection, is integral. Companies invest significantly in automated machinery and proprietary design software to optimize thermal performance and customization. The final product is then prepared for distribution.

Downstream Analysis and Distribution Channel segmentation reveal two primary routes: Direct Sales and Indirect Sales. Direct sales are common for large, highly customized industrial coils, where manufacturers work closely with engineering consultants (EPCs) or end-users (e.g., large pharmaceutical plants) to integrate the coil into complex systems. Indirect sales, which cover the bulk of standardized coil distribution, rely on a network of HVAC wholesalers, authorized distributors, and original equipment manufacturers (OEMs) who integrate the coils into larger air handling units. The effectiveness of the distribution network is crucial for providing timely replacements and maintenance components, especially in the retrofit market. Technical support and after-sales service provided through these channels are key differentiators in competitive tendering.

Steam Distributing Coils Market Potential Customers

Potential customers and primary buyers of steam distributing coils span a wide array of sectors, driven by the need for reliable, large-scale thermal management and humidity control. The most significant end-users are facility managers and chief engineers within large Commercial Buildings, including high-rise offices, shopping centers, and transportation hubs, who require consistent comfort heating within stringent energy budget constraints. These buyers prioritize product longevity, ease of maintenance, and compatibility with existing centralized HVAC infrastructure. Another critical segment includes Institutional buyers, such as public and private universities, large healthcare systems, and governmental complexes, where non-stop operation and superior indoor air quality are non-negotiable requirements, leading them to favor robust, highly reliable non-freeze coil designs.

The Industrial segment represents the highest volume and value potential, encompassing manufacturing sectors like Automotive, Pulp and Paper, Chemical Processing, and Food & Beverage. In these environments, steam distributing coils are not merely for comfort but are integrated into core processes like drying, curing, sterilization, and preheating makeup air, meaning failure results in critical production downtime. These customers often seek highly customized coils made from corrosion-resistant materials (e.g., stainless steel or special alloys) capable of withstanding extreme temperature fluctuations and aggressive air streams. Finally, Original Equipment Manufacturers (OEMs) who build large Air Handling Units (AHUs) represent a major buying group, purchasing coils in bulk as components for integration into complete, custom-built systems sold under their brand names. These OEMs demand consistent quality, high thermal performance certifications, and reliable supply chain logistics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950.0 Million |

| Market Forecast in 2033 | USD 1,300.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trane Technologies, Carrier Corporation, Johnson Controls, Daikin Industries, Armstrong International, Coilmaster Corporation, Super Radiator Coils, Colmac Coil Manufacturing, USA Coil & Air, Heatcraft Refrigeration Products, Dunham-Bush, Modine Manufacturing, Aerofin Corporation, Coil Co., LLC, Nationwide Coils, York (Johnson Controls), Lennox International, Rheem Manufacturing, Swegon Group, SEMCO LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steam Distributing Coils Market Key Technology Landscape

The technological landscape of the Steam Distributing Coils Market is primarily focused on enhancing thermal efficiency, improving corrosion resistance, and incorporating smart monitoring capabilities. A cornerstone technology is the advanced manufacturing technique utilized in creating the inner distribution tube system, which ensures steam uniformity. Precision manufacturing methods, such as Orbital Welding and advanced CNC machining for fin stamping and tube bending, are crucial for minimizing thermal resistance and ensuring the structural integrity required to handle high-pressure steam and extreme temperature differentials. Furthermore, manufacturers are increasingly leveraging Computational Fluid Dynamics (CFD) software to simulate steam flow and heat transfer patterns, allowing for optimized coil geometry and minimizing potential zones of condensate pooling which lead to freezing or corrosion.

Material innovation is a significant area of technological advancement. While copper remains prevalent for its high conductivity, the market is shifting towards specialized stainless steel and duplex alloys, particularly for non-freeze applications in harsh industrial environments like marine facilities or chemical processing plants. These materials offer superior resistance to corrosive condensate and are critical for extending the coil's operational life. Another key technology involves specialized coatings, such as hydrophobic or anti-microbial treatments, applied to the coil fins to improve heat rejection efficiency, reduce scaling, and enhance indoor air quality by inhibiting bacterial growth on the heat exchange surface.

The integration of IoT and sensor technology represents the cutting edge of innovation. Modern steam distributing coils are being equipped with wireless temperature, pressure, and vibration sensors that feed data into building management systems (BMS). This allows for sophisticated diagnostics, remote performance tuning, and the implementation of predictive maintenance routines, moving away from reactive repair models. This smart coil technology enhances the coil's perceived value by guaranteeing operational reliability and contributing to overall building energy efficiency targets, aligning the product with the broader smart infrastructure and Industry 4.0 trends.

Regional Highlights

Regional dynamics heavily influence the demand, product mix, and regulatory environment for steam distributing coils across the globe. Each major region possesses unique market characteristics driven by climate, industrial base, and regulatory mandates.

- Asia Pacific (APAC): This is the fastest-growing market, driven by massive investments in greenfield manufacturing (especially automotive and electronics), pharmaceutical cleanrooms, and commercial real estate development in countries like China, India, and Southeast Asia. The focus is often on rapid scalability and cost-effective solutions, though demand for high-end stainless steel coils is surging in high-tech industrial parks due to stringent process control requirements.

- North America: Characterized by a mature market heavily influenced by energy efficiency standards and replacement cycles. Demand is highest for non-freeze coils due to severe winter climates. The market emphasizes high-quality, long-life products, with significant procurement driven by the institutional sector (universities, hospitals) and the retrofit of existing commercial HVAC systems to meet net-zero targets.

- Europe: The market is stable, prioritizing regulatory compliance with strict environmental and energy performance directives (e.g., EU F-Gas Regulation impact on refrigerants, indirectly promoting steam for certain thermal duties). Western European countries focus on premium, custom-engineered coils with low lifecycle costs and high material durability. Central and Eastern Europe are seeing increased demand driven by industrial modernization and infrastructure development.

- Latin America: This region presents moderate growth, often concentrated in industrial centers like Brazil and Mexico (mining, petrochemicals, automotive). Market activity is closely tied to economic stability and foreign investment in manufacturing. Price sensitivity is higher, but there is growing recognition of the value of robust, long-lasting steam coils to avoid operational downtime.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) states due to massive infrastructure projects, data center construction, and expanding commercial hospitality sectors. While steam heating is less critical for comfort, coils are essential for process heating, air humidification, and preheating applications, particularly in oil and gas facilities, where robust, corrosion-resistant materials are mandated.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steam Distributing Coils Market.- Trane Technologies

- Carrier Corporation

- Johnson Controls

- Daikin Industries

- Armstrong International

- Coilmaster Corporation

- Super Radiator Coils

- Colmac Coil Manufacturing

- USA Coil & Air

- Heatcraft Refrigeration Products

- Dunham-Bush

- Modine Manufacturing

- Aerofin Corporation

- Coil Co., LLC

- Nationwide Coils

- York (Johnson Controls)

- Lennox International

- Rheem Manufacturing

- Swegon Group

- SEMCO LLC

Frequently Asked Questions

Analyze common user questions about the Steam Distributing Coils market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a steam distributing coil over a standard steam coil?

The primary advantage is effective freeze protection and even heat distribution. Distributing coils incorporate an inner distribution tube that ensures steam is spread uniformly across the coil face, maintaining pressure and temperature in the outer tubes, thereby preventing stagnant condensate pockets that are highly susceptible to freezing damage in cold airstreams.

Which end-user segment is currently driving the highest demand for specialized stainless steel steam coils?

The Industrial Facilities segment, specifically pharmaceutical, chemical processing, and food & beverage manufacturing, drives the highest demand for specialized stainless steel coils. These industries require superior corrosion resistance and sanitation capabilities that traditional copper/aluminum coils cannot provide, especially when handling corrosive condensate or stringent cleaning protocols.

How do energy efficiency regulations impact the design and adoption of new steam distributing coils?

Energy efficiency regulations, such as those governing HVAC performance, compel manufacturers to design coils with maximized heat transfer surfaces, optimized fin density, and minimized pressure drop. This drives the adoption of advanced materials and micro-channel designs to ensure high thermal output while minimizing steam usage and complying with stringent operational efficiency metrics.

What are the key risks associated with steam coil failure and how can predictive maintenance address them?

Key risks include coil freezing, corrosion leading to leaks, and water hammer damage. Predictive maintenance systems using IoT sensors monitor internal pressure and temperature fluctuations in real-time. By analyzing this data using AI, facility managers can identify early signs of condensate pooling or excessive vibration, allowing for intervention before catastrophic failure and costly downtime occurs.

Which region is expected to exhibit the highest Compound Annual Growth Rate (CAGR) in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR. This growth is directly attributable to rapid industrialization, large-scale commercial infrastructure development, and increasing foreign direct investment in manufacturing sectors across major developing economies such as China, India, and Southeast Asia, requiring new, high-efficiency steam systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager