Steam Turbine MRO Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432858 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Steam Turbine MRO Market Size

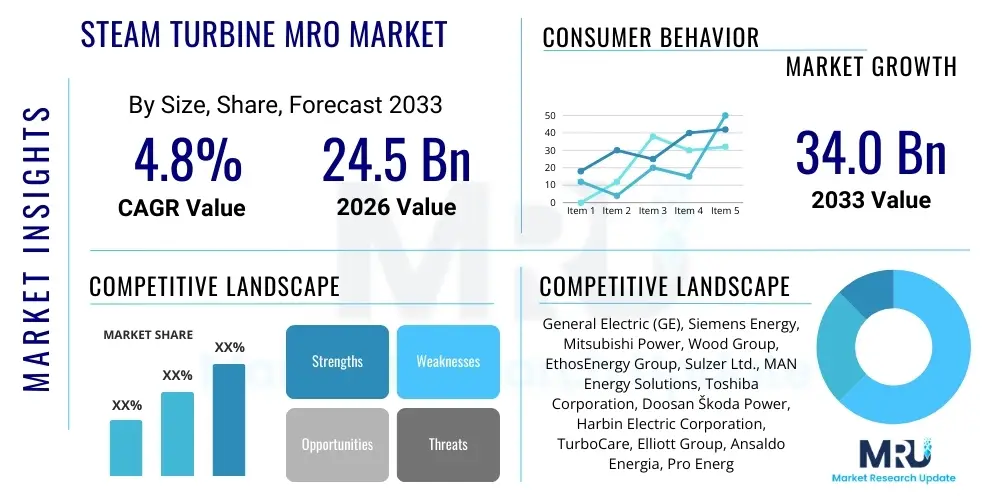

The Steam Turbine MRO Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $34.0 Billion by the end of the forecast period in 2033.

The consistent expansion of the steam turbine MRO sector is fundamentally driven by the extensive installed base of power generation assets globally, many of which are entering critical operational lifecycles requiring substantial maintenance and refurbishment. Regulatory mandates promoting operational efficiency and reducing unplanned downtime further compel utility and industrial operators to prioritize robust MRO strategies. The shift toward predictive maintenance utilizing digital twin technology and sensor-based monitoring is enhancing service quality, contributing positively to market valuation and sustained growth.

Market valuation reflects the increasing complexity of steam turbine technology, requiring specialized skills and high-precision tooling for effective maintenance, repair, and overhaul procedures. Furthermore, the decommissioning and modernization activities in developed economies, coupled with new capacity additions in emerging markets (particularly in APAC), create a cyclical demand for both routine maintenance contracts and large-scale major overhauls. This robust demand across diverse geographical and end-user segments underpins the projected market size expansion through 2033.

Steam Turbine MRO Market introduction

The Steam Turbine Maintenance, Repair, and Overhaul (MRO) market encompasses a specialized range of services designed to ensure the continuous, efficient, and reliable operation of steam turbines used primarily in power generation and heavy industrial processes. This crucial sector involves preventative maintenance schedules, complex repair work on blades and rotors, and comprehensive overhauls aimed at extending the asset life and restoring peak performance levels. The underlying necessity for MRO stems from the harsh operational environments steam turbines endure, leading to thermal fatigue, erosion, and corrosion, which necessitate expert intervention to maintain safety and efficiency standards.

Major applications for steam turbine MRO services span utility-scale power plants, including conventional thermal (coal, gas, nuclear), and concentrated solar power (CSP), as well as significant industrial applications such as oil and gas refineries, petrochemical complexes, and pulp and paper mills where turbines are utilized for process energy and combined heat and power (CHP) generation. The core benefit derived from effective MRO is the maximization of turbine availability and minimization of forced outages, which directly impacts the profitability of power producers and industrial operators. Consistent MRO is vital for compliance with strict environmental regulations regarding efficiency and emissions, preventing catastrophic failures, and ensuring long-term asset integrity.

Key driving factors accelerating this market include the global aging infrastructure of conventional power generation facilities, particularly in North America and Europe, requiring intensive life extension and modernization services. Secondly, the increasing cost of unplanned downtime places immense pressure on operators to adopt rigorous predictive maintenance regimes. Finally, technological advancements, such as the implementation of advanced materials for turbine components and the integration of digital diagnostic tools, are expanding the scope and complexity of MRO services offered by specialized providers, thereby fueling market demand.

Steam Turbine MRO Market Executive Summary

The Steam Turbine MRO market is characterized by resilient demand driven by the essential requirement for operational stability in global power and industrial sectors, reflecting a consolidated yet highly specialized vendor landscape. Key business trends indicate a significant shift toward long-term service agreements (LTSAs) and the widespread adoption of predictive maintenance techniques, leveraging advanced sensor data and analytics to optimize overhaul intervals and reduce reactive repair costs. Vendors are increasingly investing in digitalization, offering integrated MRO solutions that combine physical services with advanced diagnostics, transforming service delivery from reactive fixes to proactive asset management, thereby stabilizing recurring revenue streams.

Regionally, the Asia Pacific (APAC) dominates the market due to rapid industrialization, ongoing capacity expansion, particularly in coal and gas-fired power generation, and the necessity to service a recently installed, large fleet of assets. Conversely, mature markets in North America and Europe focus intensely on life extension programs, component upgrades (e.g., blade retrofits for efficiency improvements), and highly specialized nuclear turbine MRO. Emerging economies in the Middle East and Africa (MEA) are witnessing growth tied to major infrastructure projects and significant investments in oil and gas processing facilities, necessitating comprehensive MRO support for captive power generation units.

Segment trends reveal that the Overhaul segment, particularly major overhauls, continues to command the largest market share due to the high-value, periodic nature of these intensive services that often require full disassembly and reassembly of the turbine train. However, the Maintenance segment, specifically predictive maintenance, is projected to exhibit the highest CAGR as operators prioritize condition monitoring to minimize large, unpredictable expenses. End-user analysis shows that the Utility Power Generation sector remains the largest consumer of MRO services, dictated by sheer asset volume and strict regulatory environments concerning grid reliability.

AI Impact Analysis on Steam Turbine MRO Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming traditional maintenance scheduling, seeking validation on the cost-saving potential and improved accuracy of predictive diagnostics in the steam turbine MRO domain. Key concerns center around data privacy, the required investment in sensor infrastructure, and the ability of existing workforces to adapt to highly automated diagnostic systems. Users also express strong interest in AI’s role in optimizing parts inventory, predicting remaining useful life (RUL) of critical components like turbine blades, and automating quality control checks during complex repair processes, viewing AI as the critical factor in moving beyond time-based and cycle-based maintenance toward genuine condition-based monitoring (CBM).

- AI enhances Predictive Maintenance (PdM) models by analyzing multi-dimensional sensor data (vibration, temperature, pressure) to detect subtle anomalies indicative of impending failure with greater accuracy than traditional statistical methods.

- Machine learning algorithms optimize overhaul schedules by calculating the Remaining Useful Life (RUL) for high-stress components, maximizing operational uptime while minimizing unnecessary maintenance interventions.

- Natural Language Processing (NLP) is used to rapidly analyze vast maintenance logs, historical failure reports, and OEM manuals, assisting field technicians and accelerating troubleshooting processes.

- AI-powered diagnostic systems automate the inspection process using visual recognition on drone or camera-captured images of turbine internals, identifying cracks, corrosion, and erosion damage efficiently.

- Generative AI tools are being deployed to simulate various operational scenarios (digital twins), allowing MRO providers to test repair methodologies and component modifications virtually before implementation, drastically reducing risk.

- Optimized spare parts inventory management and supply chain logistics are achieved using ML algorithms that predict future demand based on anticipated maintenance requirements across the installed fleet.

DRO & Impact Forces Of Steam Turbine MRO Market

The dynamics of the Steam Turbine MRO market are shaped by powerful opposing forces, summarized as Drivers, Restraints, and Opportunities. The primary driver is the necessity to maintain an aging global asset base, often running beyond original design life, coupled with strict regulatory enforcement concerning grid stability and environmental performance, compelling continuous investment in upkeep. However, the market faces significant restraints, chiefly the extremely high capital expenditure required for major overhauls and the difficulty in securing highly specialized, experienced MRO personnel and proprietary component parts. These restraints are partially mitigated by substantial opportunities arising from the integration of advanced digital technologies—specifically predictive analytics and remote monitoring—which promise to drastically improve efficiency and service delivery models, opening new revenue streams for specialist providers.

The impact forces within the steam turbine MRO sector are heavily influenced by bargaining power and competitive intensity. The bargaining power of large utility and industrial end-users is significant, often leading to highly competitive long-term service agreements (LTSAs) that demand cost efficiency and performance guarantees from MRO providers. Simultaneously, the threat of new entrants is low due to the high regulatory barriers, massive capital requirements, and proprietary intellectual property held by major original equipment manufacturers (OEMs). Therefore, market growth is primarily determined by internal factors such as technological innovation in maintenance practices and external pressures related to energy policy and capacity factor demands on existing fleets.

The cyclical nature of major overhaul requirements, typically occurring every 5–8 years, ensures a baseline level of demand, but the market's true growth acceleration comes from proactive maintenance strategies. Opportunities in the life extension and modernization segment are particularly strong, especially as many countries transition energy systems, requiring flexible and optimized performance from remaining thermal assets. The continuous push for improved thermal efficiency also creates an ongoing demand for component upgrades (e.g., advanced materials for blading), which falls squarely within the specialized MRO service offering, acting as a powerful long-term growth catalyst for specialized service firms.

Segmentation Analysis

The Steam Turbine MRO market is segmented based on critical factors including service type, turbine capacity, and end-user application, providing a granular view of market dynamics and expenditure patterns across different operational domains. The segmentation by service type—Maintenance, Repair, and Overhaul—differentiates between routine preventive care, localized failure correction, and extensive, planned decommissioning and refurbishment projects, with overhaul typically representing the highest-value transaction. Analyzing these segments is essential for service providers to accurately allocate resources, manage complex scheduling, and develop targeted marketing strategies aimed at varying customer needs.

Capacity segmentation—typically categorized into small (1-150 MW), medium (151-300 MW), and large (Above 300 MW)—allows for distinguishing the specialized service requirements associated with different turbine scales. Larger, utility-scale turbines require significantly more complex logistics, heavier lifting equipment, and often mandate the involvement of OEM or highly qualified independent service providers (ISPs), driving up service costs. Conversely, smaller turbines, often found in industrial CHP applications, may be serviced more routinely by smaller regional firms, reflecting diverse price sensitivity and technical demands across the market.

The end-user classification, primarily dividing the market between Utility Power Generation and Industrial Applications (Oil & Gas, Chemicals, Manufacturing), highlights the core expenditure drivers. The utility sector remains the largest segment due to the vast installed capacity and stringent regulatory environment, emphasizing reliability. Industrial applications, while smaller in volume, often require rapid response times and specialized MRO solutions tailored to process continuity, making them a high-priority, high-margin niche for specialized service providers focused on industrial turbomachinery support.

- By Service Type:

- Maintenance (Preventive, Predictive, Condition Monitoring)

- Repair (Component Repair, Emergency Services)

- Overhaul (Major Overhaul, Minor Overhaul, Hot Gas Path Inspection)

- Retrofit and Modernization (Component Upgrades, Life Extension)

- By Capacity:

- 1 MW to 150 MW (Small and Medium Scale)

- 151 MW to 300 MW (Medium Scale)

- Above 300 MW (Large Scale/Utility Grade)

- By End-User:

- Utility Power Generation (Conventional Thermal, Nuclear, CSP)

- Industrial Applications (Oil & Gas, Chemicals & Petrochemicals, Manufacturing, Pulp & Paper)

- By Component:

- Rotor and Shaft

- Blades and Vanes

- Bearings and Seals

- Casing and Housing

- Control Systems

Value Chain Analysis For Steam Turbine MRO Market

The steam turbine MRO value chain is characterized by a high degree of integration between specialized service delivery and complex component manufacturing, starting upstream with Original Equipment Manufacturers (OEMs) and independent component suppliers. Upstream activities involve the highly technical design, fabrication, and supply of proprietary turbine parts (e.g., high-pressure blading, specialized alloys) and advanced monitoring technologies (sensors, diagnostics software). The dominance of OEMs in supplying critical, proprietary components, often under exclusivity clauses or patents, significantly influences the cost and availability of repair materials, presenting a strategic hurdle for independent service providers (ISPs).

Midstream activities are centered on the execution of MRO services itself, which includes highly specialized engineering planning, field execution (disassembly, inspection, repair), and reassembly/testing. Distribution channels in this market are predominantly direct, involving long-term service agreements (LTSAs) or specific, high-value contracts negotiated directly between the service provider (OEM or ISP) and the power plant operator or industrial facility owner. Due to the critical nature and high technical specificity of the work, indirect sales channels are minimal, though third-party logistics firms may be utilized for transporting large turbine components to and from centralized repair shops.

Downstream analysis focuses on the end-user (power utilities and industrial clients) whose primary concerns are minimizing downtime, ensuring regulatory compliance, and maximizing asset longevity. The effectiveness of the MRO service directly impacts the downstream profitability and reliability of the client. Direct communication and technical transparency are vital throughout the process. Independent service providers (ISPs) offer a key challenge to OEM dominance in the downstream segment by providing competitive, flexible, and often faster turnaround times for non-proprietary repairs, increasing competition and offering clients alternative options for major scheduled maintenance.

Steam Turbine MRO Market Potential Customers

The primary consumers of steam turbine MRO services are entities operating assets where steam is the working fluid to drive large rotating machinery, predominantly centered in the energy generation sector. The largest customer base is the Utility Power Generation sector, including both governmental and privately owned utilities that operate fossil fuel (coal and natural gas combined cycle), nuclear, and large concentrated solar power (CSP) facilities. These operators are committed to long-term maintenance contracts due to the critical nature of grid stability and the severe financial penalties associated with unplanned outages, making them highly reliable and high-value customers for comprehensive LTSA packages.

A secondary, yet rapidly expanding, customer segment is the Industrial Sector, specifically encompassing major players in Oil & Gas, Chemicals, and Petrochemicals. These industries rely heavily on steam turbines for mechanical drives (compressors, pumps) and for combined heat and power (CHP) generation to support complex industrial processes. For these customers, MRO services are crucial for maintaining continuous production flow, and maintenance requirements are often dictated less by cycles and more by process demands and internal operational schedules. This segment places a premium on rapid, effective component repair capabilities and specialized field service support.

Emerging markets in Asia Pacific and the Middle East also represent significant growth opportunities, characterized by newly installed, large-scale power plants requiring warranty-mandated or initial period maintenance services. Furthermore, independent power producers (IPPs) are increasingly potential customers; as non-integrated entities, IPPs often rely heavily on specialized ISPs for MRO services to manage costs and maximize asset performance outside of the original OEM framework, driving demand for competitive and innovative service solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $34.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric (GE), Siemens Energy, Mitsubishi Power, Wood Group, EthosEnergy Group, Sulzer Ltd., MAN Energy Solutions, Toshiba Corporation, Doosan Škoda Power, Harbin Electric Corporation, TurboCare, Elliott Group, Ansaldo Energia, Pro Energy Services, BHEL (Bharat Heavy Electricals Limited), Kawasaki Heavy Industries, Curtiss-Wright Corporation, FieldCore (GE Subsidiary), Sermatech International, Advanced Turbine Component Repair (ATCR) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steam Turbine MRO Market Key Technology Landscape

The technological landscape of the Steam Turbine MRO market is rapidly evolving, moving away from time-based maintenance toward sophisticated condition-based monitoring (CBM) enabled by advanced sensor technology and data analytics platforms. Crucial technologies include high-frequency vibration monitoring systems, acoustic emission sensors, and thermal imaging cameras, which provide real-time operational data. This massive influx of data is processed using specialized diagnostic software and proprietary algorithms to identify early signs of wear, misalignment, or component fatigue. The implementation of digital twin technology, which creates a precise virtual replica of the physical turbine, allows MRO specialists to simulate maintenance effects and optimize operational parameters without impacting live production, drastically improving planning and execution accuracy.

Additive manufacturing (3D printing) is also emerging as a transformative technology in the repair segment, particularly for fabricating small, complex, or obsolete metal components with high precision and significantly reduced lead times compared to traditional casting and machining. Specialized repair techniques, such as advanced laser cladding and thermal spray coating, are utilized to restore damaged turbine blades and rotors, extending component life and enhancing resistance to erosion and corrosion. These advanced repair methodologies reduce the necessity for complete component replacement, offering substantial cost savings and faster return-to-service rates for asset owners.

Furthermore, automation and robotics are increasingly deployed for inspections in hazardous or difficult-to-access areas within the turbine casing, minimizing human risk and improving inspection quality. Remote monitoring and diagnostic centers (RMDCs), often operated by OEMs and large ISPs, leverage secure cloud infrastructure and high-speed connectivity to provide 24/7 expert support and immediate advisory services based on continuous performance data analysis. This integrated technological framework is crucial for delivering modern, data-driven MRO contracts that guarantee specific levels of asset performance and reliability, shifting the MRO market toward performance-based service models.

Regional Highlights

The geographical distribution of the Steam Turbine MRO market reflects the global concentration of power generation assets and varying stages of infrastructure maturity, leading to distinct regional demands for MRO services.

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive capacity additions in countries like China, India, and Southeast Asia. Much of this capacity is relatively new (less than 20 years old), leading to strong demand for initial warranty services, minor maintenance, and the first major scheduled overhauls. The region benefits from lower labor costs but faces complex logistics due to geographical spread and localized regulatory environments.

- North America: This region is characterized by an aging fleet of thermal and nuclear power plants, resulting in a high demand for complex life extension projects, component modernization (especially efficiency upgrades), and specialized high-value repair services. The market here is technologically mature, with high adoption rates of predictive maintenance and AI-driven diagnostic tools.

- Europe: Europe exhibits stable, mature demand, heavily influenced by strict emissions regulations and the energy transition away from coal. MRO demand centers on maximizing the efficiency and operational flexibility of remaining gas-fired and nuclear capacity. Specialized expertise in nuclear turbine MRO and complex component retrofits drives market value.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around major oil and gas infrastructure and large utility projects in the Gulf Cooperation Council (GCC) states. The high ambient temperatures and aggressive environments necessitate specialized MRO expertise to handle unique corrosion and fouling challenges, often demanding high-specification component coatings and rapid response services.

- Latin America: This region presents moderate growth, often driven by government privatization initiatives and infrastructure investment in countries like Brazil and Mexico. The market is often price-sensitive, balancing between OEM services and cost-effective independent service providers for turbine maintenance in industrial and decentralized power generation units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steam Turbine MRO Market.- General Electric (GE)

- Siemens Energy

- Mitsubishi Power

- Wood Group

- EthosEnergy Group

- Sulzer Ltd.

- MAN Energy Solutions

- Toshiba Corporation

- Doosan Škoda Power

- Harbin Electric Corporation

- TurboCare

- Elliott Group

- Ansaldo Energia

- Pro Energy Services

- BHEL (Bharat Heavy Electricals Limited)

- Kawasaki Heavy Industries

- Curtiss-Wright Corporation

- FieldCore (GE Subsidiary)

- Sermatech International

- Advanced Turbine Component Repair (ATCR)

Frequently Asked Questions

Analyze common user questions about the Steam Turbine MRO market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between OEM and ISP services in the Steam Turbine MRO market?

Original Equipment Manufacturers (OEMs) typically offer comprehensive MRO services, leveraging proprietary technology, intellectual property, and guaranteed access to original spare parts, often commanding premium prices. Independent Service Providers (ISPs) focus on competitive pricing, faster turnaround times, and specialized repair techniques, often utilizing reverse engineering or equivalent parts, particularly for aging turbine fleets where OEM support may be expensive or phased out.

How does predictive maintenance technology impact the profitability of steam turbine operators?

Predictive maintenance (PdM) systems, utilizing AI and sensor data, allow operators to shift from fixed time-based maintenance to condition-based interventions, resulting in optimized overhaul scheduling. This transition minimizes unnecessary maintenance costs, drastically reduces the probability of catastrophic, unplanned downtime, and maximizes the operational lifespan and availability of the steam turbine asset, directly boosting profitability.

Which segmentation segment is expected to show the highest growth rate during the forecast period?

The Maintenance segment, specifically the Predictive and Condition Monitoring sub-segment within Service Type, is projected to register the highest Compound Annual Growth Rate (CAGR). This growth is driven by the industry-wide push for digitalization, remote monitoring, and proactive asset management strategies aimed at reducing reliance on expensive, scheduled major overhauls and emergency repairs.

What are the major challenges currently facing the Steam Turbine MRO market?

Key challenges include the high upfront capital expenditure required for major overhauls, the increasing complexity and high cost of proprietary components, and, critically, the severe global shortage of highly specialized, experienced technical personnel and field engineers capable of performing complex turbine repair and modernization work.

What is the role of digital twin technology in modern Steam Turbine MRO?

Digital twin technology creates a high-fidelity virtual model of a physical steam turbine, allowing MRO providers to run complex simulations regarding component wear, stress analysis, and performance degradation. This capability is essential for accurately planning and testing repair and retrofit scenarios before implementing them on the actual asset, ensuring optimal maintenance outcomes and minimizing operational risk during execution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager