Steam Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435444 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Steam Valve Market Size

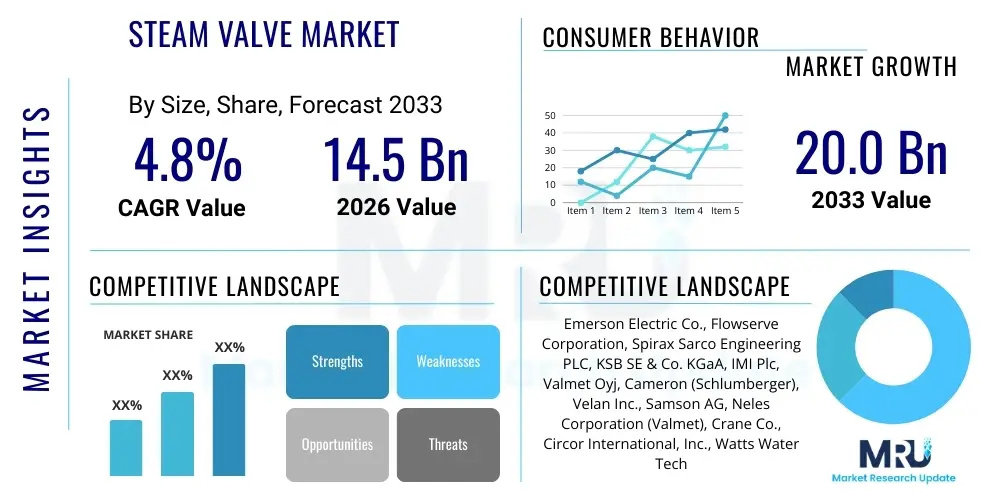

The Steam Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 14.5 billion in 2026 and is projected to reach USD 20.0 billion by the end of the forecast period in 2033.

Steam Valve Market introduction

The Steam Valve Market encompasses the production, distribution, and consumption of various valve types designed specifically to control, isolate, or regulate the flow of steam, hot water, and condensate in industrial and commercial applications. These essential components are critical for maintaining safety, efficiency, and operational control within high-pressure and high-temperature environments. Steam valves, including globe, gate, ball, check, diaphragm, and specialized control valves, are manufactured using robust materials such as cast iron, forged steel, and various alloys suitable for resisting thermal stress and corrosion inherent in steam systems. The primary function involves managing flow rates, preventing backflow, and enabling system isolation for maintenance or emergency shutdowns, thereby safeguarding personnel and infrastructure.

Major applications driving the demand for steam valves include power generation, particularly in thermal and nuclear power plants where precise steam management is paramount for turbine operation and overall energy conversion efficiency. Furthermore, the chemical and petrochemical industries rely extensively on specialized valves to manage superheated steam used in process heating, distillation, and polymerization. The heating, ventilation, and air conditioning (HVAC) sector, food and beverage processing, and pharmaceuticals also represent significant end-users, requiring reliable steam control for sterilization, cooking, and environmental conditioning. The robust and reliable operation of steam valves directly correlates with the overall uptime and energy efficiency of these industrial processes.

Key benefits associated with modern steam valves include enhanced energy conservation through reduced leakage and precise flow control, improved operational safety via rapid shut-off capabilities, and reduced maintenance costs due to durable construction materials and advanced sealing technologies. The market is propelled by factors such as the expansion of industrial infrastructure in emerging economies, the necessity for replacing aging valve systems in mature markets to comply with stringent safety regulations, and the increasing adoption of smart valves integrated with Industrial Internet of Things (IIoT) frameworks for predictive maintenance and remote monitoring. These driving forces highlight the shift toward more sophisticated, automation-ready valve solutions capable of optimizing complex steam circuits.

Steam Valve Market Executive Summary

The global Steam Valve Market is characterized by steady growth, primarily fueled by the accelerating investment in power generation infrastructure, particularly combined heat and power (CHP) facilities, and the rapid expansion of the chemical processing sector across Asia Pacific. Business trends indicate a strong move toward the digitalization of valve technology, with manufacturers focusing on integrating sensors and actuators into standard valve designs to offer enhanced diagnostic capabilities and remote operation features. Mergers and acquisitions remain a crucial strategy for market leaders seeking to consolidate technological expertise, expand geographic footprints, and broaden their product portfolios to include specialized high-pressure and high-temperature solutions required by the upstream oil and gas industry and ultra-supercritical power plants. Furthermore, sustainability mandates are prompting the development of low-emission and fugitive-emission-reducing valve solutions, influencing procurement decisions, particularly in Europe and North America.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market due to massive industrialization projects in China, India, and Southeast Asia, coupled with significant investments in new coal-fired and gas-fired power generation capacity. North America and Europe, while mature, exhibit demand driven by replacement cycles, regulatory compliance requiring higher integrity valves, and the adoption of advanced materials to extend operational lifespan. The Middle East and Africa (MEA) market is closely tied to volatile investments in the oil and gas sector, requiring extremely robust, corrosion-resistant valves for demanding process environments. Latin America’s growth is moderate, often linked to infrastructure projects and commodity processing industries.

Segmentation trends highlight the increasing dominance of control valves, which offer modulating capabilities essential for optimizing complex industrial processes, over simple isolation valves. In terms of material, specialized alloy steels are gaining traction over traditional carbon steel, particularly in applications exposed to high-sulfur or corrosive condensate environments, due to their superior longevity and resistance. The end-user segment is increasingly favoring multi-turn valves (like globe and gate valves) for precise flow regulation in power and chemicals, while the demand for quarter-turn valves (ball and butterfly) remains strong in general utility and quick shut-off applications. The market is moving towards standardized communication protocols for smart valves, facilitating easier integration into plant-wide Distributed Control Systems (DCS).

AI Impact Analysis on Steam Valve Market

Common user questions regarding AI's impact on the Steam Valve Market frequently revolve around how artificial intelligence can prevent valve failure, optimize maintenance schedules, and improve energy efficiency in steam networks. Users are primarily concerned with the transition cost associated with installing smart, AI-compatible valves and the reliability of predictive algorithms in critical, high-pressure environments. The key themes summarized from this analysis indicate a strong expectation that AI will revolutionize valve asset management by shifting from time-based maintenance to condition-based, predictive maintenance (PdM). Users anticipate AI processing sensor data (vibration, temperature, pressure changes) to detect early anomalies, such as leakage or actuator degradation, significantly before traditional methods, thereby minimizing unplanned downtime and maximizing the operational lifespan of expensive valve assets. Furthermore, there is interest in using AI for optimizing steam system architecture and modulating control valve performance in real-time to maintain peak thermal efficiency.

- AI facilitates real-time condition monitoring and fault detection in valve actuators and seals.

- Predictive maintenance (PdM) algorithms minimize unplanned shutdowns by accurately forecasting time-to-failure based on operational data.

- Optimization of control valve modulation and response times for enhanced energy efficiency across steam loops.

- Integration of machine learning models with IIoT sensors embedded in smart valves for improved data fidelity and trend analysis.

- Automation of diagnostic reporting and compliance checks, reducing manual inspection labor.

- Enhanced safety protocols by using AI to analyze pressure transients and rapidly execute emergency shut-off procedures.

- Supply chain optimization for replacement parts based on predicted failure rates across large installed bases.

- Development of self-calibrating and self-adjusting steam trap technologies utilizing AI feedback loops.

DRO & Impact Forces Of Steam Valve Market

The dynamics of the Steam Valve Market are primarily influenced by robust industrial expansion, stringent regulatory requirements, and the continuous push for operational efficiency. Drivers include the global capacity additions in power generation, particularly the construction of high-efficiency ultra-supercritical coal power plants and combined cycle gas turbines, which necessitate high-integrity steam valves capable of handling extreme temperatures and pressures. Restraints, however, manifest as high initial capital expenditure associated with sophisticated, alloy-based steam valves and the volatility in raw material prices, notably steel and nickel, which impacts manufacturing costs. Furthermore, the specialized skill set required for the installation, commissioning, and maintenance of advanced smart valves poses a challenge in certain geographical markets.

Opportunities are significant, particularly in the retrofit and replacement market, as thousands of kilometers of aging steam piping and associated valves in mature industrial economies reach the end of their operational life, demanding modern, energy-efficient replacements. The growing focus on decarbonization and energy efficiency standards worldwide drives the opportunity for manufacturers offering advanced low-leakage valves and smart steam trap management systems. The adoption of IIoT and digitalization in plant operations presents a unique avenue for integrating valves into predictive maintenance ecosystems, generating new revenue streams through software and service offerings rather than just hardware sales. This focus on digitalization serves as a major force shaping the competitive landscape.

Impact forces acting upon the market include technological advancements, such as the development of specialized materials (e.g., ceramics and advanced alloys) that extend valve life in harsh environments, and the economic fluctuation in key end-user sectors like oil and gas, where capital expenditure cycles directly dictate project initiation and valve procurement volume. The rising regulatory environment, demanding low fugitive emissions (e.g., ISO 15848-1 compliance), is a critical non-negotiable force, compelling all market participants to invest heavily in sealing technology and quality assurance. The cumulative effect of these forces suggests a sustained, albeit technologically demanding, growth path for high-performance steam valve solutions.

Segmentation Analysis

The Steam Valve Market is meticulously segmented based on the mechanism of operation (Type), the material used for construction (Material), the pressure and temperature range (Size/Rating), and the final application or industry (End-User). This multi-dimensional segmentation allows for precise market analysis, reflecting the specialized requirements inherent in managing steam across diverse industrial environments, ranging from pharmaceutical clean steam systems to heavy-duty power plant main steam lines. The complexity of steam handling mandates segmentation, as a valve suitable for low-pressure heating applications cannot be utilized in ultra-high-pressure boiler feedwater circuits. Understanding these segments is crucial for manufacturers to tailor their R&D and marketing strategies effectively.

By Type, the market is broadly divided into multi-turn valves (offering precise throttling and isolation, like globe and gate valves) and quarter-turn valves (used primarily for quick, tight shut-off, such as ball and butterfly valves). The control valve segment, which includes highly automated, pneumatic, or electric actuator-driven valves, is showing the fastest growth due to the push for process automation and optimization in chemical and power sectors. Materials segmentation is dominated by carbon steel for general industrial use, but high-alloy steels and specialized materials are becoming increasingly critical for severe service conditions where resistance to flashing, erosion, and high-temperature creep is essential, particularly for main steam isolation valves (MSIVs) and high-pressure bypass valves.

- Type:

- Globe Valves (Throttling and Flow Regulation)

- Gate Valves (Isolation and On/Off Service)

- Ball Valves (Quick Shut-off and Utility)

- Butterfly Valves (Large Diameter, Low Pressure)

- Check Valves (Prevent Backflow)

- Control Valves (Automated Modulation)

- Safety and Relief Valves (Pressure Protection)

- Steam Traps (Condensate Removal)

- Material:

- Cast Iron

- Cast Steel (Carbon Steel, Low Alloy Steel)

- Forged Steel (High Pressure/Temperature Applications)

- Stainless Steel and High Alloy Steels (Corrosion Resistance)

- Other Materials (Bronze, Specialty Alloys for nuclear/extreme service)

- End-User Industry:

- Power Generation (Thermal, Nuclear, Combined Cycle)

- Oil and Gas (Upstream, Midstream, Downstream Refining)

- Chemical and Petrochemical Processing

- HVAC and District Heating

- Pharmaceuticals and Biotechnology

- Food and Beverage Processing

- Pulp and Paper

- Size and Pressure Class:

- Small Bore (DN 10 to DN 50)

- Medium Bore (DN 65 to DN 300)

- Large Bore (DN > 300)

- ASME Class 150 to Class 2500+

Value Chain Analysis For Steam Valve Market

The Steam Valve Market value chain begins with the procurement of raw materials, primarily specialized metallic alloys, steel, and advanced sealing materials such as PTFE, graphite, and various elastomers. Upstream analysis focuses on suppliers of these high-quality materials, whose costs and availability significantly influence the final manufacturing price. Critical factors at this stage include sourcing standardized, certified materials that meet stringent industry specifications (e.g., NACE, ASTM) and managing volatility in global metal markets. Efficiency in casting, forging, and machining operations forms the core manufacturing process, requiring high capital investment in sophisticated Computer Numerical Control (CNC) equipment to achieve the precision necessary for high-integrity sealing surfaces and complex geometries required by high-pressure steam applications.

Midstream activities involve the actual valve assembly, integration of actuators (pneumatic, electric, hydraulic), and rigorous testing, including hydrostatic pressure tests, shell integrity checks, and fugitive emission testing mandated by environmental regulations. This stage adds significant value through quality assurance and certification processes specific to sectors like nuclear power or harsh chemical environments. Distribution channels are varied: Direct sales are common for large, complex, and highly customized valves sold to major EPC (Engineering, Procurement, and Construction) firms for greenfield power projects, allowing for close technical collaboration and negotiation. This is typical for control valves and critical isolation valves.

Indirect distribution relies heavily on a global network of specialized distributors, stocking agents, and representatives, particularly for standardized or frequently replaced utility steam valves, such as common globe valves or steam traps. These channels provide localized inventory, rapid delivery, and crucial after-sales support and maintenance services to smaller industrial end-users. Downstream analysis focuses on the end-user interaction, emphasizing installation support, maintenance training, and the provision of genuine spare parts. The lifecycle service offerings, including valve repair, refurbishment, and calibration, represent a growing and highly profitable segment of the downstream value chain, ensuring long-term customer retention and maximizing the operational life of the installed base.

Steam Valve Market Potential Customers

The primary consumers and end-users of steam valves are vast industrial complexes where steam is utilized as a vital medium for energy transfer, process heating, sterilization, or mechanical power generation. The largest segment is the Power Generation sector, specifically thermal power plants (coal, gas, oil), nuclear facilities, and biomass/waste-to-energy plants. These facilities require extensive arrays of high-pressure boiler feed pump valves, turbine bypass valves, main steam stop valves, and safety relief valves, all demanding the highest integrity and reliability due to the critical nature of the operations and extreme service conditions (up to 600°C and 300 bar).

Another crucial customer base lies within the Hydrocarbon Processing Industry (HPI), encompassing oil and gas extraction, refining, and petrochemical production. Refineries utilize large volumes of steam for stripping, heating, and catalyst regeneration, requiring valves resistant to coking, high temperatures, and corrosive elements often present in process steam. The Chemical Processing Industry (CPI) also represents a significant buyer, needing specialized valves for batch processing and continuous flow chemical synthesis, often focusing on sterile, clean-in-place (CIP) compatible, or highly corrosion-resistant valves, particularly in the production of bulk chemicals and fertilizers. The procurement cycles in these industries are closely tied to global commodity prices and capital investment decisions for new facilities or major maintenance turnarounds.

Furthermore, the manufacturing sectors, including Food and Beverage (using culinary steam for cooking and sterilization), Pharmaceuticals (requiring ultra-clean, validated stainless steel valves for sterile steam), and Pulp and Paper (demanding robust valves to handle harsh process conditions), constitute reliable, continuous demand streams. District heating networks and large commercial complexes requiring extensive HVAC systems also purchase medium-to-low pressure utility steam valves and specialized steam traps to manage condensate return, underscoring the widespread applicability of these products beyond heavy industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Flowserve Corporation, Spirax Sarco Engineering PLC, KSB SE & Co. KGaA, IMI Plc, Valmet Oyj, Cameron (Schlumberger), Velan Inc., Samson AG, Neles Corporation (Valmet), Crane Co., Circor International, Inc., Watts Water Technologies, Inc., ARI-Armaturen GmbH, Parker Hannifin Corporation, GE Steam Power, Baker Hughes Company, Curtiss-Wright Corporation, Metso Outotec, KITZ Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steam Valve Market Key Technology Landscape

The technology landscape within the Steam Valve Market is rapidly evolving, driven primarily by the need for enhanced safety, improved energy efficiency, and seamless integration into modern industrial control systems. A crucial area of development is advanced sealing technology, aimed at achieving ultra-low fugitive emissions. Manufacturers are extensively utilizing live-loaded packing systems, high-density graphite packing, and bellow seals to comply with increasingly stringent environmental standards suchases of the ISO 15848-1 standard and the EPA's stricter regulations concerning volatile organic compounds (VOCs). The continuous innovation in material science is also paramount, focusing on developing specialized high-temperature and high-pressure alloys, such as chromium-molybdenum (CrMo) steels for boiler applications and sophisticated ceramics for severely erosive or flashing steam services, extending the mean time between failures (MTBF) significantly.

Another transformative technology is the integration of Industrial Internet of Things (IIoT) capabilities into steam valve assets. This involves equipping valves with smart positioners, acoustic sensors, temperature probes, and vibration monitoring devices that continuously transmit real-time operational data. These smart valves enable highly accurate remote diagnostics, condition-based monitoring, and performance optimization. For instance, smart steam traps equipped with IIoT sensors can instantly detect steam loss or condensate backup, allowing for immediate corrective action and substantial energy savings. This move toward 'Valve 4.0' is changing the market from a component-supply business to a solution-oriented service model, where data analysis and software platforms are central to the offering.

The third critical technological trend involves modular design and additive manufacturing (3D printing) for complex internal components. Modular design allows for easier field maintenance, quicker replacement of wear parts, and lower inventory holding costs for end-users. Additive manufacturing, although still niche, is being explored for creating lightweight, complex flow-path geometries that reduce pressure drop and improve flow characteristics, particularly in specialized control valve trims and bespoke high-performance components. Furthermore, the development of sophisticated diagnostic software that interfaces directly with Distributed Control Systems (DCS) or Supervisory Control and Data Acquisition (SCADA) systems is becoming standard, ensuring operational efficiency and regulatory compliance through automated documentation and performance tracking.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by massive infrastructure spending, rapid industrialization, and high capacity additions in the power generation and heavy manufacturing sectors, particularly in China and India. The demand is high for both standardized utility valves and specialized high-pressure/high-temperature valves for newly commissioned ultra-supercritical power plants and large-scale petrochemical complexes. Government initiatives to improve energy efficiency in existing industrial clusters also spur significant retrofit and upgrade activity, especially concerning steam trap management systems.

- North America: The North American market is characterized by a strong emphasis on regulatory compliance, particularly related to fugitive emissions and operational safety in the oil and gas and refining industries. Demand is largely fueled by the replacement of aging infrastructure and the modernization of existing plants. The adoption rate of smart, IIoT-enabled steam valves for predictive maintenance applications is highest in this region, driven by the need to minimize downtime in high-cost operational environments. Investment in natural gas processing and LNG liquefaction facilities also sustains demand for high-integrity, severe-service valves.

- Europe: Europe exhibits mature market dynamics, with growth propelled by stringent environmental regulations and the region’s ambitious decarbonization targets. There is a strong focus on high-efficiency district heating networks and combined heat and power (CHP) systems, requiring precise control valves and robust isolation technology. European manufacturers lead in the development of low-emission valve technology and the use of certified materials, reflecting a market where technical performance and environmental compliance often outweigh initial cost considerations. Retrofitting industrial boilers to meet new efficiency benchmarks also provides consistent demand.

- Middle East and Africa (MEA): The MEA market growth is intrinsically linked to fluctuations in global oil and gas prices, as major capital expenditure projects in extraction, refining, and desalination drive steam valve procurement. The region requires valves built to withstand extreme temperatures, harsh desert environments, and highly corrosive media. Large power and water desalination projects, especially in the GCC countries, necessitate large volumes of high-class utility and safety valves, favoring suppliers with strong local support and inventory capabilities.

- Latin America: This region shows moderate growth, primarily dependent on specific commodity markets such as mining, agriculture processing, and existing infrastructure upgrades. Economic instability in several key countries occasionally hampers large-scale industrial investment, leading to a focus on essential maintenance, repair, and overhaul (MRO) activities. Brazil and Mexico remain the largest markets, driven by their respective petrochemical and manufacturing bases, necessitating reliable, cost-effective steam control solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steam Valve Market.- Emerson Electric Co.

- Flowserve Corporation

- Spirax Sarco Engineering PLC

- KSB SE & Co. KGaA

- IMI Plc

- Valmet Oyj

- Cameron (Schlumberger)

- Velan Inc.

- Samson AG

- Neles Corporation (Valmet)

- Crane Co.

- Circor International, Inc.

- Watts Water Technologies, Inc.

- ARI-Armaturen GmbH

- Parker Hannifin Corporation

- GE Steam Power

- Baker Hughes Company

- Curtiss-Wright Corporation

- Metso Outotec

- KITZ Corporation

- ASCO Valve Inc. (Emerson)

- Danfoss A/S

- Yokogawa Electric Corporation

- Rotork Plc

- TLV Co., Ltd.

- Swagelok Company

- Schlumberger Limited

- WIKA Group

- Honeywell International Inc.

- Alfa Laval AB

- Weir Group PLC

- ClydeUnion Pumps (SPX Flow)

- ITT Inc.

- Dresser Consolidated (Baker Hughes)

- Richards Industries

- Leslie Controls Inc.

- Conbraco Industries (Apollo Valves)

- Habonim Industrial Valves & Actuators

- AVK Holding A/S

- Xomox Corporation

- Gemini Valve, Inc.

- Bray International, Inc.

- DeZURIK, Inc.

- Mokveld Valves B.V.

- Orion Valves

- Farris Engineering (Curtiss-Wright)

- Persta Valve GmbH

- Babcock & Wilcox Enterprises, Inc.

- Copes-Vulcan (ClydeUnion Pumps)

- AUMA Riester GmbH & Co. KG

- Gestra AG (Spirax Sarco)

- Armstrong International, Inc.

- Keystone Valve (Pentair)

- Nibco Inc.

- GF Piping Systems

- Zwick Armaturen GmbH

- Neway Valve (Suzhou) Co., Ltd.

- Oventrop GmbH & Co. KG

- Cla-Val Co.

- Shandong Yize Valve Co., Ltd.

- Shanghai Hualian Valve Co., Ltd.

- Beijing Valve General Factory Co., Ltd.

- Taiwan Valve Co., Ltd.

- Somas Instrument AB

- ACV Manufacturing

- Axelrod & Associates

- Badger Meter, Inc.

- Cash Valve (Ametek)

- Clark-Reliance Corporation

- Durabla Manufacturing

- Essco-Collins Engineering

- Fluid Controls & Components

- Garlock Sealing Technologies

- Griswold Controls

- Henry Pratt Company

- Jordan Valve

- Lunkenheimer Valve Company

- Magnatrol Valve Corp.

- Maverick Valve & Controls

- Milwaukee Valve Company

- Mueller Co.

- NIBCO INC.

- Parker Fluid Control Division

- Precision Flow Control

- Protectoseal Company

- Reotemp Instruments

- Richards Industrials

- Rolls-Royce plc

- Sealweld Corporation

- Servomex Group Ltd.

- SilcoTek Corporation

- Snap-tite Hose, Inc.

- Sterling Fluid Systems

- Sunbelt Supply Co.

- Tayler Valve Co.

- Techno-Controls Inc.

- United Controls International

- Valvco Valve & Controls

- Velan Valve Corporation

- Victaulic Company

- Vogelsang GmbH & Co. KG

- Warren Controls, Inc.

- Watson-Marlow Fluid Technology Group

- Wedge Products, Inc.

- Westad Industri AS

- Wouter Witzel Eurovalve B.V.

- Zurn Industries, LLC

- Rotork Controls India Pvt. Ltd.

- Xiamen Powerlong Industrial Co., Ltd.

- Beijing Shuanglong Valve Co., Ltd.

- Tianjin Greatwall Valve Co., Ltd.

- Shanghai Valve Factory Co., Ltd.

- Chengdu Chenggong Valve Co., Ltd.

- Zhejiang Sanfang Control Valve Co., Ltd.

- Sichuan Zigong Industrial Co., Ltd.

- Jiangsu Shunfeng Valve Co., Ltd.

- Yongjia County Valve Factory

- Changzhou Huayang Valve Co., Ltd.

- Wenzhou Sanlian Valve Co., Ltd.

- Suzhou Valve Factory Co., Ltd.

- Dalian Dema Valve Manufacturing Co., Ltd.

- Wuxi Valve Factory Co., Ltd.

- Anhui Tongda Valve Co., Ltd.

- Fujian Valve Co., Ltd.

- Hebei Haiyuan Valve Manufacturing Co., Ltd.

- Hunan Huaguang Valve Co., Ltd.

- Jilin Valve Factory Co., Ltd.

- Lanzhou High Pressure Valve Co., Ltd.

- Nanjing Valve Factory Co., Ltd.

- Qingdao Valve Factory Co., Ltd.

- Shaanxi Valve Factory Co., Ltd.

- Shenyang Valve Factory Co., Ltd.

- Tianjin Valve Factory Co., Ltd.

- Wuhan Valve Factory Co., Ltd.

- Xi'an Valve Factory Co., Ltd.

- Zhejiang Lishui Valve Factory Co., Ltd.

- Zibo Valve Factory Co., Ltd.

- Chongqing Valve Factory Co., Ltd.

- Guangzhou Valve Factory Co., Ltd.

- Jinan Valve Factory Co., Ltd.

- Nantong Valve Factory Co., Ltd.

- Suzhou Valve & Piping Systems Co., Ltd.

- Wenzhou Valve Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Steam Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Steam Valve Market?

The market growth is primarily driven by global infrastructure expansion, especially in the Asia Pacific power generation and heavy industry sectors, coupled with stringent environmental regulations worldwide demanding low-fugitive emission valves. Additionally, the necessity to replace aging steam infrastructure in developed economies and the increasing adoption of smart valves for enhanced efficiency contribute significantly to market expansion.

How is the adoption of IIoT technology impacting the efficiency of steam valves?

IIoT technology significantly enhances steam valve efficiency by enabling real-time condition monitoring, remote diagnostics, and predictive maintenance (PdM). Smart valves equipped with sensors can detect anomalies such as leakage or actuator wear immediately, allowing maintenance to be scheduled proactively, thereby minimizing unplanned downtime and maximizing energy conservation by ensuring optimal steam flow control and condensate management.

Which end-user industry segment holds the largest share in the Steam Valve Market?

The Power Generation industry, encompassing thermal (coal, gas), nuclear, and combined cycle plants, currently holds the largest market share. This sector requires the highest volume of specialized, high-pressure, and high-temperature steam valves, including crucial main steam stop valves and turbine bypass valves, necessary for safe and efficient energy production.

What are the critical material innovations influencing steam valve performance?

Critical material innovations focus on enhancing resistance to thermal cycling, corrosion, and erosion. These include the use of advanced forged alloy steels (like CrMo steels) for extreme service conditions, specialized high-density graphite for improved sealing in low-emission packing systems, and the application of ceramics for trim components in severe flashing or high-velocity steam throttling applications to extend operational life.

What are the key differences between isolation valves and control valves in steam systems?

Isolation valves, such as gate or ball valves, are designed for tight shut-off to stop or start the flow completely, typically used for maintenance or safety isolation. Control valves, such as globe valves with modulating actuators, are designed to regulate the flow rate continuously and accurately based on an external signal, ensuring precise control over process parameters like temperature and pressure within the steam system, thereby optimizing process efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager