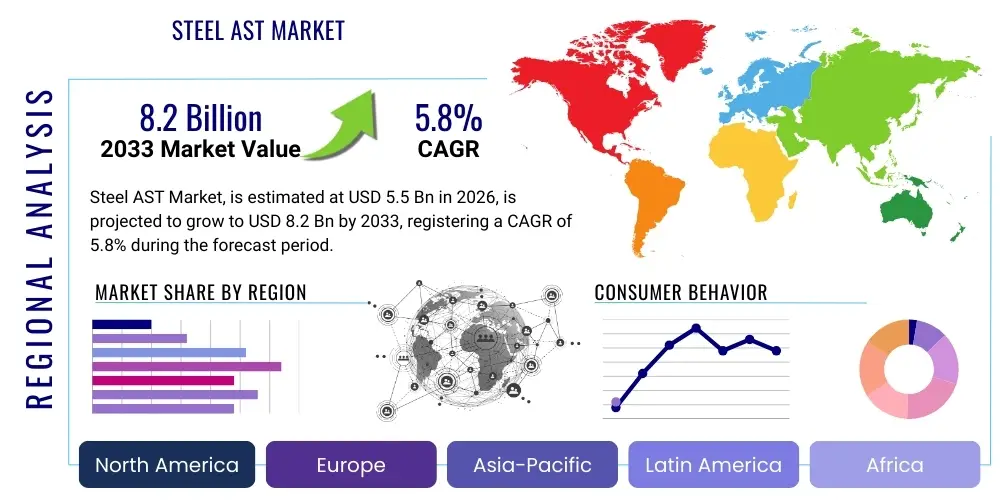

Steel AST Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436492 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Steel AST Market Size

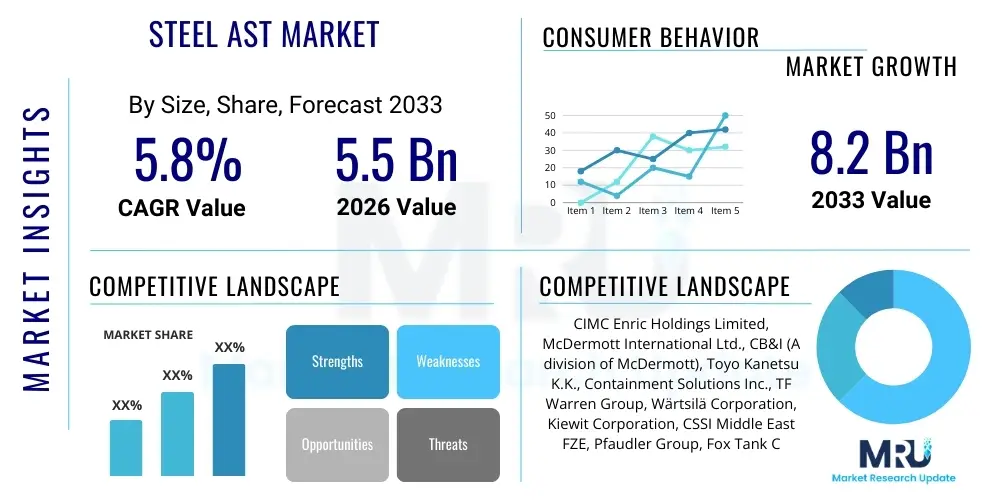

The Steel AST Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.5 Billion in 2026 and is projected to reach USD 8.2 Billion by the end of the forecast period in 2033.

Steel AST Market introduction

The Steel Aboveground Storage Tank (AST) market encompasses the design, fabrication, installation, and maintenance of large steel containment vessels used primarily for storing liquids and gases across various industrial sectors. These tanks are critical components in infrastructure supporting the energy, chemical, water treatment, and petrochemical industries. Products range from standard fixed-roof tanks for non-volatile liquids to sophisticated floating-roof tanks designed for volatile hydrocarbons, ensuring minimal vapor loss and enhanced safety. The demand for steel ASTs is fundamentally driven by the continuous need for reliable bulk storage facilities to manage supply chain logistics, ensure operational continuity, and accommodate fluctuations in global commodity production and consumption.

Major applications of steel ASTs include the storage of crude oil, refined petroleum products (gasoline, diesel, jet fuel), natural gas liquids (NGLs), specialized chemicals, hazardous waste materials, and large volumes of potable and process water. The inherent strength and durability of steel, coupled with advancements in welding technology and corrosion protection, make steel the preferred material for high-capacity, long-life storage solutions conforming to stringent international standards such as API 650 and API 620. Benefits derived from utilizing robust steel ASTs include superior structural integrity, resistance to seismic activity, efficient management of thermal expansion, and a proven track record of safe containment, which are essential factors given the often volatile or environmentally sensitive nature of stored substances.

Driving factors contributing to the market expansion include the global resurgence in oil and gas exploration, particularly in regions requiring new downstream refining and terminal capacity, and massive investment in national strategic petroleum reserves (SPRs). Furthermore, the expanding chemical manufacturing sector, especially in Asia Pacific, necessitates substantial investments in chemical storage infrastructure. Urbanization and industrial water management needs also spur demand for large-scale water storage tanks, while the increasing adoption of LNG and LPG globally fuels the need for cryogenic and high-pressure steel vessels tailored for specific gas storage applications, cementing the market's trajectory.

Steel AST Market Executive Summary

The global Steel AST market is characterized by robust capital expenditure driven by energy security mandates and infrastructure modernization cycles. Business trends highlight a significant focus on digitalization, specifically integrating Structural Health Monitoring (SHM) systems and advanced non-destructive testing (NDT) techniques to extend asset life and reduce unscheduled downtime. Companies are increasingly adopting modular construction techniques to accelerate project timelines and minimize on-site risks. Strategic partnerships between EPC (Engineering, Procurement, and Construction) firms and specialized tank fabricators are becoming commonplace to manage complex, large-scale storage terminal projects effectively. Cost pressures arising from fluctuating steel prices remain a constraint, pushing manufacturers toward optimized design methodologies and supply chain hedging strategies.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by burgeoning chemical production bases in China and India and intensive development of oil and gas import/export infrastructure across Southeast Asia. North America continues to represent a mature but significant market, with demand primarily stemming from the modernization of aging storage facilities, increased crude oil exports, and the expansion of midstream pipeline systems requiring large buffer storage capacity. Europe, while slower, focuses heavily on stringent environmental compliance, driving demand for double-walled and secondary containment ASTs. The Middle East remains crucial due to ongoing strategic investments in refining and petrochemical capacity expansion programs.

Segment trends demonstrate a strong shift toward higher capacity tanks (above 50,000 cubic meters), particularly in the crude oil and LNG storage sectors, reflecting the economies of scale sought by major operators. The internal floating roof (IFR) and external floating roof (EFR) tank segments are exhibiting steady growth due to regulatory mandates aimed at reducing volatile organic compound (VOC) emissions during hydrocarbon storage. Moreover, the demand for specialized, corrosion-resistant alloy steels is increasing within the chemical processing segment, where tanks must handle highly aggressive or high-temperature media. This specialization requires manufacturers to invest continuously in advanced materials science and coating technologies to ensure long-term integrity and safety.

AI Impact Analysis on Steel AST Market

Common user inquiries regarding AI's influence on the Steel AST market center predominantly on three areas: optimizing operational safety, minimizing maintenance costs, and accelerating project schedules. Users frequently question how AI and Machine Learning (ML) can predict tank failures, estimate the remaining useful life (RUL) of aging assets, and automate complex inspection processes. Key themes emerging from these concerns include the reliability of AI-driven defect detection in complex welding structures, the integration challenges of large data sets from historical maintenance records and sensor inputs, and the potential for AI to dynamically optimize tank filling and emptying schedules to maximize energy efficiency. Overall, users expect AI to transition the market from reactive maintenance models to highly proactive, predictive asset management frameworks.

- AI-driven Predictive Maintenance (PdM): Algorithms analyze vibration, temperature, and corrosion sensor data to forecast potential failures, optimizing inspection schedules and minimizing unscheduled downtime.

- Automated Visual Inspection: Integration of AI-powered computer vision systems with drones and robotic crawlers for non-contact inspection of tank shells and roofs, drastically reducing inspection time and improving defect detection accuracy.

- Optimized Design and Fabrication: ML models simulate material stresses, fluid dynamics, and seismic resistance during the design phase, leading to more efficient material usage and optimized structural integrity according to API standards.

- Supply Chain and Inventory Management: AI algorithms predict steel demand fluctuations and optimize raw material procurement, hedging against price volatility and ensuring timely project completion.

- Safety and Risk Management: AI models process environmental data and historical incident patterns to dynamically assess operational risks, particularly concerning volatile organic compound (VOC) leakage detection and fire prevention protocols.

- Digital Twin Implementation: Creation of high-fidelity virtual models of ASTs, powered by real-time sensor data and AI, allowing operators to simulate various operational and stress scenarios before deployment or maintenance.

DRO & Impact Forces Of Steel AST Market

The Steel AST market is primarily driven by the expanding global energy infrastructure, the robust growth of the downstream chemical and petrochemical industries, and the mandated replacement or refurbishment of aging tank infrastructure that no longer meets modern safety and environmental standards. However, the market faces significant restraints, notably the high volatility of raw material prices, specifically steel and specialized alloys, which introduces substantial cost and timeline uncertainty for large-scale construction projects. Furthermore, extremely stringent environmental regulations, particularly regarding secondary containment systems and fugitive emissions control (e.g., VOC reduction), require significant capital investment in advanced floating roof designs and seals. Opportunities lie in the rapidly developing global liquefied natural gas (LNG) infrastructure, the shift toward storing biofuels and hydrogen derivatives, and the increasing adoption of advanced structural health monitoring technologies that enhance the value proposition of new AST installations.

Impact forces within the market are predominantly high, driven by technological advancements in materials science and fabrication techniques that seek to improve longevity and operational safety. Regulatory compliance represents a pervasive external force; adherence to updated standards from bodies like the American Petroleum Institute (API), the European Norms (EN), and local environmental protection agencies dictates design specifications, construction methods, and inspection frequencies. Economic volatility and geopolitical factors, particularly relating to oil price stability and major infrastructure project funding in emerging economies, exert a medium to high influence on investment cycles. Competitive intensity remains elevated among global fabricators and local specialized firms, forcing continuous improvement in project execution efficiency and quality assurance to secure market share in high-value tenders.

Segmentation Analysis

The Steel AST market is segmented based on product type, capacity, application, and geographic region, reflecting the diverse requirements of the end-user industries. Analyzing these segments provides strategic insights into market hotspots and technological preferences. Product type segmentation distinguishes between fixed cone roof tanks, suitable for low volatility liquids like water and heavy oils, and the more technically demanding floating roof tanks (internal and external), which are essential for storing high-volatility products like gasoline and crude oil to minimize evaporation losses and meet strict environmental mandates. Capacity segmentation defines the scale of demand, with large-capacity tanks (over 100,000 cubic meters) being crucial for strategic reserves and export terminals, while smaller tanks serve local distribution and specific industrial processes.

Application segmentation reveals that the Oil and Gas sector remains the dominant segment due to the inherent need for massive storage capacity across upstream, midstream, and downstream operations, including refineries and major bulk terminals. The chemical and petrochemical segment is growing rapidly, driven by industrial output and requiring tanks built from specialized steels to handle corrosive or high-temperature media. Geographic segmentation highlights the disparity in growth rates, with mature markets focusing on replacement and upgrades, and developing markets experiencing greenfield construction surges. Understanding these segment dynamics is critical for manufacturers tailoring their offerings, whether focusing on standardized API 650 tanks for commodity storage or highly customized, specialized tanks conforming to API 620 for low-temperature or high-pressure applications.

- By Product Type:

- Fixed Cone Roof Tanks

- External Floating Roof Tanks (EFRT)

- Internal Floating Roof Tanks (IFRT)

- Dome Roof Tanks

- Floating Roof Tanks (General)

- LPG/LNG Cryogenic Tanks

- By Capacity:

- Small (Up to 10,000 cubic meters)

- Medium (10,001 to 50,000 cubic meters)

- Large (Above 50,000 cubic meters)

- By Application/End-User:

- Oil and Gas (Crude Oil, Refined Products)

- Chemical and Petrochemical

- Water and Wastewater Treatment

- Power Generation (Fuel Storage)

- Mining and Metals

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Steel AST Market

The Steel AST market value chain is characterized by a high degree of integration between specialized material suppliers and complex engineering services. Upstream activities are dominated by primary steel manufacturers supplying plate steel and specialized alloys (e.g., carbon steel, stainless steel, high-tensile steel) that meet industry specifications regarding strength, thickness, and weldability. Pricing and availability of these raw materials significantly influence the final product cost and project feasibility. Midstream operations involve the core activities of detailed engineering design, fabrication (cutting, rolling, welding of plate segments), and modular construction preparation. This stage requires specialized EPC contractors and tank fabricators who possess expertise in adhering to rigorous codes like API 650 and employing advanced manufacturing technologies such as automated welding systems.

Downstream activities encompass on-site installation, including foundation preparation, shell erection, hydrotesting, and the application of internal and external coatings for corrosion protection. This phase often involves specialized labor and adherence to strict safety protocols. The distribution channel is predominantly direct, especially for large, custom-engineered projects, where the end-user or asset owner contracts directly with a primary EPC firm or tank specialist. For standardized, smaller-capacity tanks, there may be involvement of industrial distributors or regional supply houses. After installation, the value chain extends to aftermarket services, including routine maintenance, inspection (NDT), repair, and eventual decommissioning or modernization of the tanks, which generates steady revenue for specialized service providers.

The interaction between the direct and indirect channels is primarily defined by project size and complexity. Direct engagement ensures strict quality control and customization required for critical infrastructure, while indirect channels provide faster delivery and cost-efficiency for generic or non-critical storage needs. Efficient management across the value chain, particularly the seamless integration between design engineering and on-site construction, is paramount for profitability. Disruptions in the supply of high-quality steel plates or specialized lining materials can halt projects, underscoring the necessity for robust procurement strategies and strong supplier relationships throughout the ecosystem.

Steel AST Market Potential Customers

The primary customers for steel ASTs are large-scale industrial operators and government entities requiring high-volume storage facilities for strategic or operational purposes. The most significant customer segment is the Oil and Gas industry, including national oil companies (NOCs), independent oil producers, and midstream pipeline and terminal operators who require massive storage facilities for crude handling, fractionation, and product blending. Refinery operators are perpetual buyers, needing tanks for various stages of processing inputs and final product storage. Similarly, large petrochemical complexes are major customers, utilizing ASTs for feedstock, intermediate chemicals, and finished products, often demanding tanks resistant to highly corrosive substances.

Beyond the energy sector, governmental agencies often commission large ASTs for national strategic petroleum reserves (SPR) to ensure national energy security, representing multi-billion dollar project opportunities. Municipal water authorities and industrial plants (e.g., power generation facilities requiring fuel oil storage, pulp and paper mills needing chemical storage) form another critical customer base, particularly for standardized water and non-hazardous chemical tanks. The evolving LNG market presents an emerging, high-value customer group consisting of liquefaction and regasification terminal operators who require specialized, double-walled cryogenic steel ASTs, representing significant technical challenges and investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 8.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CIMC Enric Holdings Limited, McDermott International Ltd., CB&I (A division of McDermott), Toyo Kanetsu K.K., Containment Solutions Inc., TF Warren Group, Wärtsilä Corporation, Kiewit Corporation, CSSI Middle East FZE, Pfaudler Group, Fox Tank Co., ZCL Composites (part of Shawcor), NOV Inc., Tuff Tank Inc., Motherwell Bridge, Fisher Tank Company, BELFAB, Tank Connection, CST Industries Inc., Gulf Coast Fabrication. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steel AST Market Key Technology Landscape

The Steel AST market is witnessing continuous technological evolution focused on improving structural integrity, minimizing environmental impact, and reducing the total cost of ownership (TCO). Advanced welding techniques are pivotal, shifting from traditional manual processes to automated and robotic welding systems, which ensure higher quality welds, reduce the risk of human error, and accelerate fabrication schedules, particularly crucial for large diameter tanks and specialized alloy construction. Another critical technological advancement involves the deployment of sophisticated corrosion prevention systems, including highly durable, multi-layer coating and lining materials (e.g., glass flake epoxy, zinc silicate primers) optimized for specific chemical resistance and high-temperature environments, significantly extending the service life of the tank assets.

In terms of operational technology, Structural Health Monitoring (SHM) systems are rapidly becoming standard installations. These systems integrate various sensors (acoustic emission, ultrasonic testing, fiber optics, strain gauges) to provide real-time data on the tank's physical condition, internal pressure, and potential corrosion hotspots. The data generated by these SHM systems feeds into predictive maintenance algorithms, allowing operators to move away from time-based inspection regimes to condition-based monitoring, optimizing resource deployment. Furthermore, the use of drones and robotic crawlers equipped with high-resolution cameras and advanced NDT equipment (e.g., Magnetic Flux Leakage—MFL) enables rapid and safe inspection of tank internals and externals, reducing the need for manned entry and decreasing inspection turnaround time.

Future technology is heavily leaning toward material science innovation and modularization. The development and incorporation of specialized high-strength low-alloy (HSLA) steels allow for thinner shell plates without compromising structural strength, potentially reducing material costs and erection time. Modular construction, where large tank sections are fabricated off-site under controlled conditions and transported for assembly, is increasingly adopted globally, enhancing quality control and safety during the construction phase. The integration of Building Information Modeling (BIM) and digital twin technology during the design and lifecycle management phases provides a comprehensive virtual representation of the asset, optimizing modifications, and training procedures, thereby institutionalizing best practices in tank operation and maintenance.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to dominate the market share and exhibit the highest growth rate, driven by rapid industrialization, massive investments in petrochemical complexes in China and India, and the expansion of LNG import terminals across South Korea and Southeast Asia. The region’s focus on building strategic energy reserves and upgrading older infrastructure to meet stringent pollution control norms fuels high demand for new floating roof and specialty tanks.

- North America: This region represents a mature yet high-value market. Growth is primarily sustained by the need to replace or modernize an extensive existing base of aging infrastructure in the US and Canada, particularly in the oil and gas midstream sector (storage hubs like Cushing, Oklahoma). Increased crude oil and NGL production necessitates the construction of new large-capacity terminals tailored for export operations, strictly adhering to API and regulatory standards.

- Europe: Characterized by stringent environmental and safety regulations, the European market drives demand for high-specification tanks, including double-walled vessels and advanced secondary containment solutions. Investment is concentrated on modernizing existing refineries, expanding biofuel storage facilities, and developing dedicated LNG import capacity in countries aiming to reduce reliance on piped gas sources.

- Middle East and Africa (MEA): The MEA region is central to global crude oil and refined product exports, leading to constant infrastructure investment. Major national oil companies are undertaking multi-billion dollar projects to expand refinery capacity and strategic storage terminals, making this region a significant hub for large-scale, customized AST fabrication projects.

- Latin America (LATAM): Market growth in LATAM is variable but significant, driven by energy sector liberalization and renewed investments in upstream and downstream facilities, particularly in Brazil and Mexico. The increasing demand for refined products and the need to improve logistical efficiency contribute to steady project opportunities, often involving large international EPC firms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steel AST Market.- CIMC Enric Holdings Limited

- McDermott International Ltd.

- CB&I (A division of McDermott)

- Toyo Kanetsu K.K.

- Containment Solutions Inc.

- TF Warren Group

- Wärtsilä Corporation

- Kiewit Corporation

- CSSI Middle East FZE

- Pfaudler Group

- Fox Tank Co.

- ZCL Composites (part of Shawcor)

- NOV Inc.

- Tuff Tank Inc.

- Motherwell Bridge

- Fisher Tank Company

- BELFAB

- Tank Connection

- CST Industries Inc.

- Gulf Coast Fabrication

Frequently Asked Questions

Analyze common user questions about the Steel AST market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Steel AST Market?

The primary driver is the extensive global investment in energy infrastructure, particularly the expansion of midstream oil and gas handling terminals and the construction of new petrochemical and LNG facilities in emerging economies, alongside mandatory replacement cycles for aging assets in mature markets.

Which type of steel storage tank is most effective for storing volatile liquids?

Floating Roof Tanks (both Internal Floating Roof Tanks—IFRT, and External Floating Roof Tanks—EFRT) are considered most effective for volatile liquids like gasoline and crude oil, as they minimize the vapor space, significantly reducing evaporation losses and volatile organic compound (VOC) emissions in compliance with environmental mandates.

How do volatile steel prices impact the profitability of AST manufacturers?

Volatile steel prices constitute a major constraint as raw materials account for a significant portion of the total project cost. Fluctuations necessitate robust hedging strategies, sophisticated procurement planning, and price escalation clauses in contracts to maintain manufacturer profitability and manage project risk.

What role does digitalization play in the maintenance of Steel AST assets?

Digitalization plays a critical role through the implementation of Structural Health Monitoring (SHM) systems and AI-driven Predictive Maintenance (PdM). These technologies utilize real-time sensor data to forecast corrosion rates and potential failures, optimizing inspection schedules, improving asset safety, and reducing unnecessary downtime.

Which geographical region is expected to demonstrate the highest growth in the Steel AST market?

The Asia Pacific (APAC) region, specifically driven by major industrial and energy projects in countries like China, India, and Indonesia, is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrial expansion, urbanization, and critical infrastructure development programs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager