Steel Door Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435615 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Steel Door Market Size

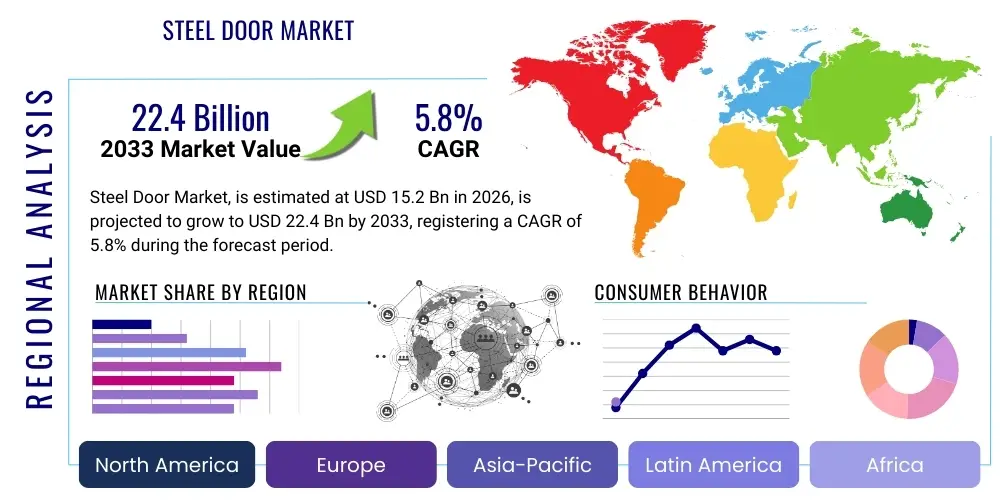

The Steel Door Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 22.4 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating global demands for enhanced security solutions in residential, commercial, and industrial infrastructure, coupled with stringent building codes mandating fire-rated and highly durable entrance systems. Furthermore, the increasing pace of urbanization and the subsequent large-scale infrastructure projects across emerging economies contribute significantly to this optimistic market valuation, solidifying steel doors as a staple in modern construction due to their inherent strength and longevity.

Steel Door Market introduction

The Steel Door Market encompasses the manufacturing, distribution, and installation of doors primarily constructed from steel or steel components, utilized across various sectors for enhanced durability, security, and fire resistance. These products range from standard hinged doors to highly specialized fire-rated, ballistic, and access-controlled security doors, serving crucial functions in both protective and aesthetic applications. Steel doors offer superior structural integrity compared to wood or fiberglass alternatives, making them highly desirable in commercial facilities, industrial complexes, and high-density residential areas where security and maintenance longevity are paramount concerns. Key applications include external entries for commercial buildings, internal fire separation barriers in hospitals and educational institutions, and heavy-duty doors in manufacturing plants and warehouses.

The primary benefits driving market adoption include unparalleled resistance to forced entry, low maintenance requirements, and excellent thermal and acoustic insulation properties when fitted with appropriate cores and seals. Moreover, steel doors are highly customizable, allowing them to meet diverse architectural specifications and regulatory compliance needs, especially concerning life safety and fire prevention standards. The inherent material properties of steel, such as its strength-to-weight ratio and recyclability, also contribute to its appeal in a global market increasingly focused on sustainable and long-lasting building materials. This confluence of security, durability, and regulatory compliance is fueling steady growth across developed and developing construction markets.

Driving factors for the Steel Door Market growth are multifaceted, centering on the rapid increase in global construction spending, particularly on commercial and institutional infrastructure projects. Intensifying security threats globally necessitate the adoption of robust perimeter protection, positioning steel security doors as essential components. Additionally, stricter governmental regulations concerning fire safety and building envelope performance, especially in Europe and North America, mandate the use of certified fire-rated steel doors. Furthermore, continuous product innovation, including the integration of smart access control technologies and advanced corrosion-resistant coatings, enhances the functionality and extends the lifecycle of these products, maintaining their competitive edge over alternative materials.

Steel Door Market Executive Summary

The global Steel Door Market demonstrates strong momentum, underpinned by favorable business trends such as escalating commercial real estate development and substantial governmental investment in public infrastructure modernization. Key business trends indicate a shift towards customized, high-performance doors featuring advanced security integrations like biometric readers and smart locks, moving beyond basic functionality to integrated solutions. Manufacturers are focusing on lean manufacturing techniques and automating processes to counteract rising raw material costs, ensuring competitive pricing and maintaining profit margins in a highly fragmented competitive landscape. Furthermore, strategic mergers and acquisitions are observed as major players consolidate their positions and expand their geographical footprints, particularly targeting rapidly industrializing regions.

Regionally, the Asia Pacific (APAC) continues to lead the market, primarily fueled by massive infrastructural growth, rapid urbanization rates, and large-scale industrialization in countries like China and India, where regulatory frameworks are progressively adopting international safety standards. North America and Europe, while mature markets, exhibit consistent growth driven by replacement cycles, remodeling activities, and the mandatory adoption of highly specialized, energy-efficient, and fire-resistant steel doors required by increasingly strict building codes. Emerging markets in Latin America and the Middle East & Africa (MEA) are showing promising trajectory due to diversification efforts in their economies and significant investments in hospitality and residential construction sectors.

Segmentation trends highlight the security steel door segment as the fastest-growing category, reflecting the global priority given to asset and personnel protection. By mechanism, hinged doors retain the largest market share due to their widespread utility and cost-effectiveness, although sliding and folding steel doors are gaining traction in industrial and large commercial applications requiring wide openings. End-use segmentation confirms that the commercial sector, including offices, retail spaces, and public facilities, remains the dominant revenue generator, consistently requiring large volumes of certified, durable, and aesthetically appealing steel entry systems to ensure regulatory compliance and operational security.

AI Impact Analysis on Steel Door Market

Common user questions regarding AI's influence on the Steel Door Market often revolve around two central themes: how AI enhances product functionality (e.g., security and smart features) and how AI transforms manufacturing and supply chain efficiency. Users frequently ask about the integration of AI for predictive maintenance in automated door systems, the use of computer vision and machine learning for advanced access control and intrusion detection, and the role of AI in optimizing complex custom door designs and minimizing waste during fabrication. The collective expectation is that AI will shift the steel door from a passive physical barrier to an active, intelligent component of a comprehensive building security and management ecosystem, improving both operational lifespan and overall security responsiveness.

AI's primary impact on the steel door market is the evolution of the product itself into a smart security asset. By embedding AI algorithms within the door system's hardware, manufacturers can offer highly sophisticated access management solutions that learn usage patterns, detect anomalies, and provide real-time security alerts far surpassing traditional electronic locks. For example, AI-powered systems can distinguish authorized personnel based on subtle biometric nuances or movement patterns, enhancing security protocols. This shift allows steel doors to become critical nodes in centralized building management systems (BMS), providing data necessary for optimizing facility usage and enhancing energy efficiency through intelligent climate control integration based on entry/exit flows.

Furthermore, AI significantly revolutionizes the manufacturing process (Industry 4.0 adoption). Machine learning models are being utilized to optimize steel cutting, welding, and assembly lines, reducing material scrap rates and improving dimensional accuracy, which is critical for fire-rated door compliance. Predictive analytics ensures that manufacturing equipment maintenance is performed proactively, minimizing downtime and increasing production throughput. In the supply chain, AI algorithms forecast demand fluctuations based on construction market indicators, optimizing inventory levels of specialized materials like galvanized steel and high-density cores, thereby shortening lead times for customized orders and improving overall logistical efficiency across the global distribution network.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast failure points in electromechanical components (e.g., automated closers, locking mechanisms).

- Advanced Access Control: Implementing machine learning for biometric verification and anomaly detection in security protocols.

- Optimized Manufacturing and Design: AI algorithms streamline CAD/CAM processes, ensuring material efficiency and precision fabrication for complex fire-rated specifications.

- Intelligent Security Monitoring: Real-time threat assessment and response generation by integrating door sensor data with broader building security systems.

- Supply Chain Forecasting: Utilizing large datasets to predict fluctuations in steel prices and demand, optimizing procurement and inventory management.

- Enhanced Corrosion Prediction: Machine learning models analyzing environmental data (humidity, temperature) to optimize anti-corrosion coating strategies for longevity.

DRO & Impact Forces Of Steel Door Market

The market dynamics are governed by several powerful forces: high security and regulatory compliance requirements act as key drivers, compelling widespread adoption of certified steel doors in both new construction and renovation projects globally. Conversely, significant volatility in the prices of raw materials, specifically steel and iron ore, poses a persistent restraint on manufacturers’ profit margins and challenges pricing stability for end-users. The major opportunity lies in the burgeoning market for smart and integrated steel door systems that incorporate IoT technology, biometric access, and advanced building automation compatibility, appealing to high-end commercial and institutional sectors. These market forces collectively dictate pricing strategies, innovation priorities, and competitive intensity across geographical regions, defining the future trajectory of the steel door industry's penetration and expansion.

Key drivers include the global increase in non-residential construction activities, particularly in healthcare, education, and hospitality sectors, all of which require highly durable and safety-compliant entry solutions. The stringent enforcement of international fire and building codes, such as NFPA standards and European EN standards, mandates the use of certified fire-rated steel doors in public access areas, serving as a non-negotiable growth catalyst. Furthermore, the rising awareness among property owners regarding the long-term cost-benefit analysis of choosing high-durability steel over alternative materials that require frequent replacement is significantly driving procurement decisions, especially for exterior applications exposed to harsh weather conditions and high usage frequency.

However, the market faces significant restraints, chiefly the aforementioned fluctuating costs and supply chain disruptions affecting steel, aluminum, and specialized core materials (like mineral wool or honeycomb structures). The energy-intensive nature of steel manufacturing also subjects producers to volatile utility costs, further pressurizing operational budgets. Another restraint is the perceived aesthetic limitation of traditional steel doors compared to custom wood or composite materials in luxury residential segments, requiring continuous innovation in finishes and architectural treatments to maintain market relevance in these niche sectors. The complexity of installation and the need for specialized labor to correctly fit certified fire and security doors also present logistical and cost barriers in less developed regions.

Opportunities abound in leveraging digitalization and sustainability trends. The shift towards "green building" certification programs, such as LEED, creates a high demand for steel doors made from recycled content and those optimized for superior thermal performance (energy efficiency). The digitalization opportunity involves integrating steel doors with advanced sensor technology and sophisticated locking mechanisms, transforming them into smart building components. Furthermore, expanding into high-growth, underserved industrial segments, such as data centers and infrastructure for renewable energy production, where high security and extreme durability are essential, represents substantial avenues for future revenue generation and specialized product line development.

Segmentation Analysis

The Steel Door Market is fundamentally segmented based on factors critical to performance, application, and material specification, allowing for a detailed examination of demand drivers within distinct vertical markets. Segmentation by mechanism (Hinged, Sliding, Folding) reflects different operational requirements, while segmentation by application (Fire-Rated, Security, Industrial) highlights specialized functionalities crucial for regulatory compliance and threat mitigation. Analyzing the market across these dimensions reveals that demand is increasingly skewed toward high-performance solutions, particularly fire-rated and security doors, driven by enhanced safety legislation and the persistent need to protect valuable assets and personnel across the globe. Understanding these segments is key for manufacturers to tailor product development and marketing efforts efficiently.

The segmentation by end-use (Residential, Commercial, Industrial) dictates the volume, complexity, and aesthetic requirements of the doors. The commercial sector consistently drives the highest value due to the sheer scale of modern office buildings, retail complexes, and public facilities requiring numerous certified doors. The industrial sector, characterized by harsh environments and heavy usage, demands highly durable, corrosion-resistant steel doors, often customized for specific operational clearances or blast resistance. Conversely, the residential segment, while smaller in value, is increasingly adopting premium steel doors for external security due to rising consumer awareness regarding home protection and durability benefits.

Further granularity in segmentation involves material composition, such as galvanized steel versus stainless steel, reflecting varying requirements for corrosion resistance and aesthetic finish, particularly in coastal or clinical environments. The core material used (polystyrene, polyurethane, honeycomb, mineral wool) also forms a critical segmentation criterion, directly influencing the door’s insulating properties, fire rating performance, and overall weight. This sophisticated segmentation structure ensures that market participants can accurately measure growth rates and competitive positioning within specific product niches that cater to unique industry standards and consumer preferences, enabling highly targeted investment strategies and product lifecycle management.

- By Mechanism

- Hinged Doors

- Sliding Doors

- Folding Doors

- Revolving Doors (Steel Frame)

- By Application

- Fire-Rated Doors

- Security/Ballistic Doors

- Industrial Doors (High-Speed, Overhead)

- Architectural/Aesthetic Doors

- By Material Type

- Galvanized Steel Doors

- Stainless Steel Doors

- Carbon Steel Doors

- By End-Use Sector

- Commercial Buildings (Office, Retail, Hospitality)

- Residential (Multi-Family, Single-Family)

- Industrial (Manufacturing, Warehousing, Logistics)

- Institutional (Healthcare, Education, Government)

- By Core Type

- Honeycomb Core

- Polyurethane/Polystyrene Foam Core

- Mineral Wool/Rockwool Core (Fire-rated)

Value Chain Analysis For Steel Door Market

The value chain for the Steel Door Market commences with the upstream analysis involving the sourcing and processing of core raw materials, primarily steel sheets, galvanized coils, and specialized core materials such as mineral wool and composite foam. Suppliers in this phase include large-scale steel mills and chemical manufacturers, where cost fluctuations in steel heavily dictate manufacturing profitability downstream. Efficiency and technological maturity at the upstream level, particularly in producing high-grade, corrosion-resistant, and fire-resistant steel alloys, are crucial prerequisites for the quality and compliance of the final door product. Effective management of these supplier relationships, including long-term procurement contracts, is vital for mitigating supply risk and ensuring price predictability for door fabricators.

The core manufacturing stage involves fabrication, where steel sheets are cut, formed, welded, and assembled into door slabs and frames. This mid-stream activity is characterized by high capital investment in precision machinery (CNC machines, automated welding robots) and specialized labor required for complex processes like precise core insertion and applying protective coatings (e.g., powder coating or specialized paints). Quality control and certification compliance (UL, Intertek, CE) are paramount at this stage, as door performance directly impacts life safety and building integrity. Direct distribution involves manufacturers supplying large orders straight to major construction contractors or specialized institutional buyers (hospitals, military installations), offering customized solutions and comprehensive installation services.

Downstream analysis focuses on distribution and installation. The majority of steel doors move through indirect channels, utilizing specialized distributors, wholesalers, and architectural hardware suppliers who manage inventory and provide localized service, often catering to smaller contractors and renovation projects. Retail channels, such as large home improvement stores, handle standardized residential and light commercial products. Installation, often subcontracted, is a critical component of value delivery, as improper fitting can compromise the fire rating or security effectiveness of the door. The entire chain, from mill to final fitting, requires rigorous logistical planning to manage the weight and bulk of the products efficiently, making localized warehousing and streamlined transportation key competitive differentiators.

Steel Door Market Potential Customers

The potential customers for the Steel Door Market are diverse and can be broadly categorized into three primary end-user segments: Commercial, Institutional, and Residential. Commercial end-users, which represent the largest purchasing segment, include developers of office buildings, retail centers, hotels, and large infrastructure projects (airports, railway stations). These customers prioritize regulatory compliance, aesthetic uniformity, high usage durability, and increasingly, integration with sophisticated building management and access control systems. Their buying decisions are often influenced by architectural specifications, stringent safety codes, and long-term maintenance cost considerations, favoring suppliers who offer comprehensive product lines and installation certifications.

Institutional customers encompass government agencies, healthcare facilities (hospitals, clinics), and educational institutions (universities, schools). This segment places an exceptionally high emphasis on life safety and security, leading to a strong demand for specialized products such as heavy-duty fire-rated doors (often 90-minute or 180-minute ratings), ballistic doors in sensitive areas, and anti-ligature doors in psychiatric facilities. Their procurement processes are often characterized by public tenders, requiring suppliers to meet rigorous specifications, provide extended warranties, and demonstrate a track record of reliability and compliance with public sector standards, making performance metrics critical determinants of successful sales.

Residential end-users, encompassing both single-family homeowners and multi-family housing developers, constitute the third major segment. While multi-family developers often act like commercial buyers, adhering to bulk purchase and regulatory needs, single-family customers prioritize home security, thermal efficiency, and aesthetic appeal. The residential demand leans toward galvanized steel doors with decorative finishes and integrated smart locking technology, positioning the door as a key component of the overall smart home ecosystem. Therefore, successful marketing to the residential segment requires emphasizing durability, customization options, energy savings, and user-friendly features, often mediated through retail channels and local contractors specializing in home improvement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 22.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Assa Abloy, dormakaba Group, Allegion plc, Hormann Group, Special-Lite, Ceco Door, Masonite International, Pella Corporation, Therma-Tru Doors, A&L Doors, Steelcraft (Allegion), Republic Doors and Frames, Oshkosh Door Company, Curries (Assa Abloy), Door-Max Industries, Pioneer Industries, Amarr, Anderson Door & Window, Plygem, TruStile Doors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steel Door Market Key Technology Landscape

The technological landscape of the Steel Door Market is rapidly evolving, focusing on optimizing manufacturing efficiency, enhancing door performance metrics (security and fire resistance), and integrating digital capabilities. In manufacturing, the adoption of laser cutting and advanced robotic welding systems ensures high precision in fabrication, which is critical for meeting stringent international standards for fire and security certifications, minimizing human error, and achieving optimal material utilization. Furthermore, innovative surface treatment technologies, particularly cathodic electrodeposition (E-coating) and advanced powder coating systems, are becoming standard, offering superior resistance to corrosion, abrasion, and harsh environmental factors, thereby significantly extending the service life of exterior steel doors.

Product innovation is heavily concentrated on smart door technologies. This involves the seamless integration of electromechanical hardware, including magnetic locks, powered door operators, and advanced sensor arrays, with sophisticated software platforms. Biometric recognition systems (fingerprint, facial recognition) and integrated access control keypads are replacing traditional mechanical locks, offering superior security, auditing capabilities, and flexible access management. The growing trend of IoT connectivity allows steel doors to communicate with Building Management Systems (BMS), enabling centralized control over security protocols, energy consumption, and operational status monitoring across large commercial or institutional complexes, significantly enhancing facility management efficiency.

Another crucial technological advancement involves materials science related to core construction. While mineral wool remains essential for high fire ratings, manufacturers are exploring advanced composite cores that offer equivalent fire resistance combined with improved thermal insulation (U-value) and reduced weight. This advancement addresses the increasing demand for energy-efficient building envelopes mandated by green building codes globally. The development of specialized acoustic cores also caters to niche markets like recording studios, theaters, and server rooms, requiring superior sound dampening capabilities alongside inherent steel durability. These combined technological efforts are repositioning the steel door from a mere barrier to a highly functional, intelligent, and sustainable building asset.

Regional Highlights

The global steel door market exhibits distinct characteristics and growth trajectories across major geographical regions, influenced heavily by regional economic development, urbanization rates, and the stringency of local building regulations. North America, characterized by its mature construction industry and high disposable income, drives demand for high-end, certified security and fire-rated steel doors, often integrated with complex smart access control technologies. Growth in this region is sustained not just by new construction but significantly by renovation, retrofit, and replacement cycles in the aging institutional and commercial infrastructure, coupled with mandatory compliance with rigorous standards set by organizations like UL (Underwriters Laboratories) and NFPA (National Fire Protection Association).

Europe represents a technologically sophisticated market with a strong emphasis on sustainability, energy efficiency, and detailed aesthetic requirements. European demand is robust for steel doors that achieve high thermal insulation values (low U-values) to meet strict EU energy performance directives for buildings. Germany, the UK, and France are key consumers, where strict EN standards govern fire resistance (e.g., EN 1634-1). Manufacturers in this region focus heavily on innovative coatings, concealed hardware, and slim-line frame designs to blend robust security performance with modern architectural aesthetics, catering to both premium commercial properties and highly regulated public sector projects. The necessity for advanced security features in commercial and public infrastructure also continuously fuels demand.

Asia Pacific (APAC) is the primary engine of global market growth, underpinned by unprecedented urbanization and massive governmental investments in infrastructure, industrial parks, and high-rise residential projects, particularly in rapidly expanding economies like China, India, and Southeast Asian nations. The sheer volume of new construction projects ensures high-volume demand, although pricing sensitivity is often higher than in Western markets. The key focus in APAC is balancing cost-effectiveness with increasing regulatory standards, driving local manufacturers to quickly adopt efficient production technologies and seek necessary international certifications to participate in large-scale commercial and governmental tenders. This region is expected to maintain the highest CAGR throughout the forecast period due to continuing mega-city development and industrial capacity expansion.

The Middle East and Africa (MEA) region is experiencing significant market expansion, driven by large-scale hospitality, tourism, and national diversification projects, especially in the GCC countries (Saudi Arabia, UAE). These projects often adhere to international security and fire safety standards, resulting in high demand for specialized, custom-engineered steel doors (blast-resistant, high-security). Latin America shows stable growth, concentrated mainly in commercial and industrial construction in major economies like Brazil and Mexico. Across all emerging regions, the increasing awareness of security threats and the gradual harmonization of local building codes with international best practices are fundamental drivers pushing the adoption of high-quality, durable steel door systems over less secure alternatives.

- North America: Focus on high-specification, smart-integrated security doors; driven by commercial renovation and strict life safety codes (NFPA, UL).

- Europe: Emphasis on energy-efficient (thermal performance) and highly compliant fire-rated doors; governed by stringent EN standards and green building mandates.

- Asia Pacific (APAC): Highest volume growth driven by rapid urbanization, massive infrastructure projects, and increasing industrial expansion in developing nations (China, India).

- Middle East & Africa (MEA): Demand fueled by large-scale commercial and luxury development projects, requiring customized, high-security specifications often adhering to international standards.

- Latin America: Steady growth concentrated in industrial and major urban commercial construction, with a gradual shift toward certified, durable security solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steel Door Market.- Assa Abloy

- dormakaba Group

- Allegion plc

- Hormann Group

- Special-Lite

- Ceco Door

- Masonite International

- Pella Corporation

- Therma-Tru Doors

- A&L Doors

- Steelcraft (Allegion)

- Republic Doors and Frames

- Oshkosh Door Company

- Curries (Assa Abloy)

- Door-Max Industries

- Pioneer Industries

- Amarr

- Anderson Door & Window

- Plygem

- TruStile Doors

Frequently Asked Questions

Analyze common user questions about the Steel Door market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the growth of the global Steel Door Market?

Market growth is primarily driven by escalating global construction activities, particularly in the commercial and industrial sectors, alongside the imposition of more stringent international fire safety and security regulations (e.g., NFPA, EN standards) that mandate the use of certified, durable steel doors for protective purposes and life safety compliance. Furthermore, the rising adoption of smart building technologies incorporating steel doors into centralized access control systems contributes significantly to market expansion and value.

How does the segmentation by core type impact steel door performance?

The core material is critical for determining the door’s functional performance. Mineral wool or rockwool cores are essential for achieving high fire-rating compliance (up to 180 minutes). Polyurethane or polystyrene cores optimize thermal insulation and energy efficiency, vital for meeting modern green building standards, while honeycomb cores offer a cost-effective, lightweight structural filler suitable for internal, non-fire-critical applications requiring only basic durability.

Which region currently dominates the Steel Door Market in terms of market share?

The Asia Pacific (APAC) region currently dominates the Steel Door Market in terms of volume and market share. This dominance is attributed to rapid urbanization, exponential infrastructure development, and significant investment in new commercial and industrial construction projects across major economies like China and India. The high volume of construction activity in these regions far surpasses the mature replacement market demand seen in North America and Europe.

What role does technology play in modernizing steel door security?

Technology is transforming steel doors by integrating advanced security features such as biometric access control, IoT sensors, and AI-driven monitoring systems. This integration enables predictive maintenance, real-time intrusion detection, and centralized management via Building Management Systems (BMS), shifting the steel door from a passive barrier to an active, intelligent component of a comprehensive physical security ecosystem, vastly improving accountability and responsiveness.

What are the primary restraints affecting the profitability of steel door manufacturers?

The primary restraints impacting profitability are the high volatility and unpredictable fluctuation in the prices of raw materials, specifically steel and iron ore, which directly affect manufacturing costs. Additionally, the need for complex, certified fabrication processes and the increasing cost of specialized labor required for compliant installation pose significant operational and financial challenges for manufacturers operating in the highly competitive global market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager