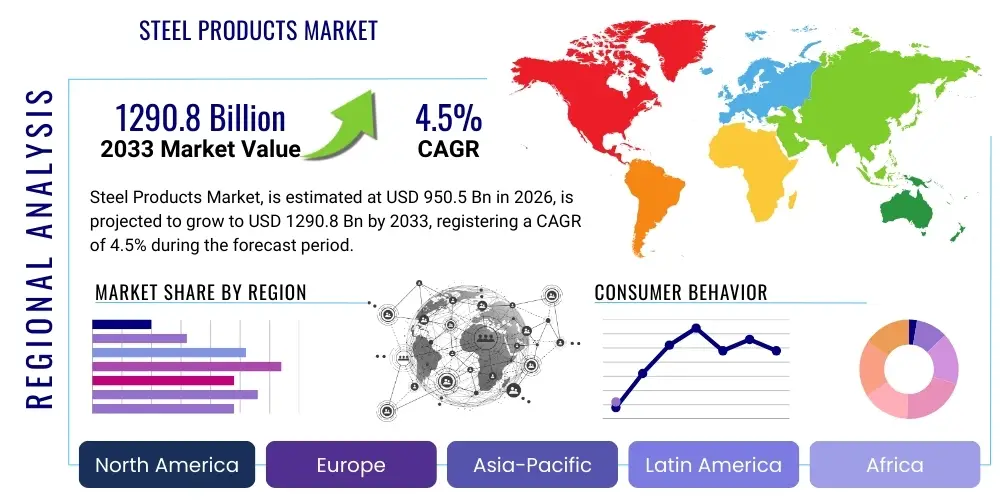

Steel Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436423 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Steel Products Market Size

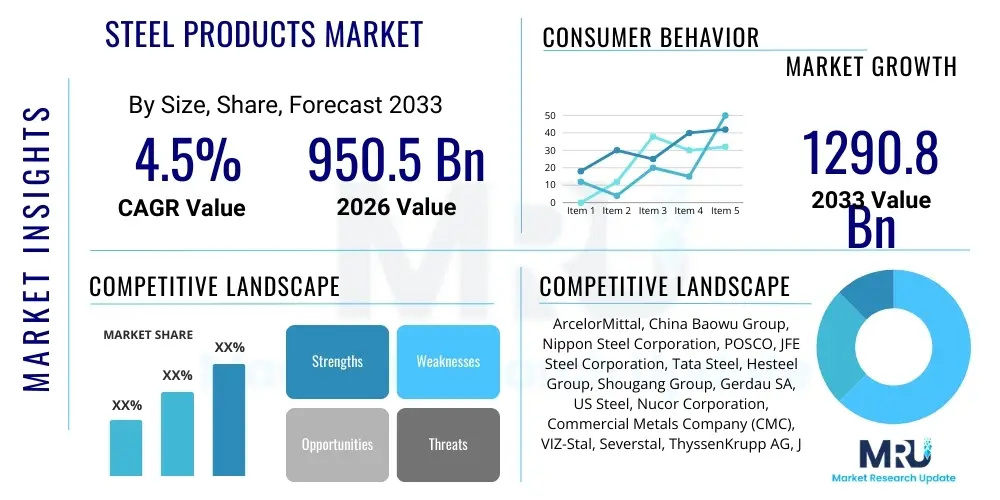

The Steel Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 950.5 Billion in 2026 and is projected to reach USD 1290.8 Billion by the end of the forecast period in 2033.

Steel Products Market introduction

The Steel Products Market encompasses the manufacturing, distribution, and trade of various steel forms crucial for global industrial and construction activities. This market includes primary steel products such as plates, sheets, bars, pipes, tubes, and structural steel, which are fundamental inputs for sectors ranging from automotive and infrastructure to energy and consumer goods manufacturing. The inherent properties of steel—high tensile strength, durability, and recyclability—ensure its sustained demand globally, acting as a barometer for overall economic health and industrial expansion. The modern market is characterized by increasing specialization, focusing on high-grade, specialized steel alloys engineered for demanding applications like high-pressure pipelines or lightweight automotive structures, driven by stringent regulatory requirements and the need for efficiency.

Major applications of steel products are predominantly found in large-scale infrastructure projects, residential and commercial construction, and transportation equipment production. In construction, structural steel provides the backbone for skyscrapers and bridges, valued for its speed of erection and resilience. The automotive sector relies heavily on high-strength low-alloy (HSLA) steel and advanced high-strength steel (AHSS) to meet safety standards while minimizing vehicle weight, crucial for fuel efficiency and electric vehicle (EV) battery housing. Furthermore, the energy sector uses specialized steel for drilling, pipelines, and renewable energy infrastructure, including wind turbine towers and solar panel mounts, requiring materials resistant to corrosion and extreme temperatures.

The market’s enduring growth is underpinned by several key benefits and driving factors. Benefits include steel’s infinite recyclability, supporting circular economy initiatives, and its cost-effectiveness compared to alternative materials like aluminum or advanced composites in high-volume applications. Key driving factors include rapid urbanization in developing economies, necessitating massive infrastructure investment; global efforts toward energy transition, requiring significant steel tonnage for renewable energy projects; and continuous innovation in manufacturing processes that lower production costs and environmental footprint. Policy support for local manufacturing and defense spending also contribute significantly to specific high-value segments of the steel product market, ensuring sustained investment in capacity and technological upgrades across major producing regions.

Steel Products Market Executive Summary

The Steel Products Market demonstrates resilience driven by robust construction activity, particularly in Asia Pacific, and a steady rebound in automotive production globally, particularly focusing on electric vehicle (EV) platforms which require specialized lightweight steel grades. Business trends are increasingly shifting towards sustainable steel production methods, such as utilizing electric arc furnaces (EAFs) over traditional blast furnaces, to reduce carbon emissions and align with global decarbonization goals. Furthermore, consolidation remains a significant feature of the market landscape, with large integrated producers acquiring smaller, specialized mills to gain technological expertise, secure raw material supplies, and optimize distribution networks. Supply chain volatility, influenced by geopolitical events and fluctuating iron ore and coking coal prices, necessitates strategic hedging and long-term procurement contracts for major stakeholders, placing a premium on vertically integrated operations and efficient inventory management.

Regional trends highlight Asia Pacific, led by China and India, as the undisputed epicenter of steel consumption and production, driven by massive domestic infrastructure build-out and rapid industrialization. North America and Europe, while slower in tonnage growth, focus intensively on high-value, niche steel products like specialized stainless steel and tool steel, prioritizing technological superiority and process efficiency. Regulatory pressures in Western markets, such as the European Union’s Carbon Border Adjustment Mechanism (CBAM), are forcing localized producers and importers alike to invest heavily in low-carbon steel technologies, reshaping trade flows and creating a competitive advantage for green steel pioneers. Conversely, emerging markets in Latin America and the Middle East are experiencing growth fueled by oil and gas infrastructure expansion and government spending on national development visions, albeit subject to localized economic instability and currency fluctuations.

Segmentation trends indicate accelerating demand for flat steel products, essential for auto manufacturing and white goods, outpacing long steel products used primarily in traditional construction, although infrastructure spending ensures consistent long product demand. Within product types, high-strength steel grades and corrosion-resistant alloys are experiencing premium growth rates due to stringent performance requirements in critical applications. From an end-user perspective, the Construction segment maintains the largest market share, but the Automotive and Transportation segment is projected to exhibit the highest CAGR, primarily due to the transition to EV manufacturing which requires specialized, lighter, and safer steel components. The strategic shift towards circular economy models also boosts the segment related to recycled steel and scrap processing, influencing raw material costs and overall production sustainability metrics.

AI Impact Analysis on Steel Products Market

User inquiries regarding Artificial Intelligence (AI) in the Steel Products Market commonly focus on how AI can enhance operational efficiency, reduce energy consumption, and ensure consistent product quality in complex manufacturing environments. Key themes revolve around the feasibility and cost-effectiveness of implementing machine learning models for predictive maintenance (PM), optimizing furnace operations, and streamlining supply chain logistics. Users are also concerned about the required data infrastructure and the need for specialized skills to manage AI-driven systems. Expectations center on AI's ability to minimize waste, improve yield rates in hot rolling mills, and provide real-time decision support for complex alloying processes, moving the industry toward 'smart steel' manufacturing. Furthermore, there is significant interest in how AI can aid in decarbonization efforts by optimizing energy use and raw material input blending to achieve lower carbon intensity production.

The integration of AI into steel production offers unprecedented opportunities for process optimization. Traditional steel manufacturing involves high temperatures, complex chemical reactions, and inherent variability in raw materials. AI and machine learning algorithms can analyze vast datasets—including sensor data from furnaces, rolling mills, and casting processes—to identify subtle correlations and predict potential failures or deviations in quality well before human operators can detect them. For instance, predictive models can forecast the optimal timing for refractory maintenance or precisely adjust oxygen blowing rates in Basic Oxygen Furnaces (BOF) to maximize yield and minimize energy usage, resulting in substantial operational savings and enhanced safety standards across the facility.

Beyond the core manufacturing processes, AI significantly impacts the supply chain and commercial aspects of the steel market. Demand forecasting, inventory management, and logistics planning are radically improved through AI-driven analytics, which can process real-time market data, geopolitical risk factors, and transportation constraints to optimize delivery schedules and minimize warehousing costs. Furthermore, AI is being utilized in material science R&D, accelerating the discovery and formulation of new advanced steel alloys with specific properties required for cutting-edge applications, such as high-temperature tolerance for aerospace or improved corrosion resistance for offshore wind farms. This technological integration is transforming steel manufacturing from a traditional heavy industry into a highly data-intensive, precision engineering sector.

- AI optimizes furnace energy consumption by predicting optimal operating parameters in real time.

- Machine learning algorithms enhance quality control by identifying microscopic defects in steel sheets during production.

- Predictive maintenance schedules, powered by AI, reduce unplanned downtime of critical machinery like rolling mills.

- AI-driven supply chain management improves raw material procurement (iron ore, scrap) and logistics efficiency.

- Generative AI assists in accelerating the R&D cycle for novel high-performance steel alloys and material properties.

- Computer vision and AI systems are used for automated slab inspection and tracking throughout the mill.

- AI models support decarbonization efforts by optimizing the blending of raw materials and minimizing carbon intensity.

DRO & Impact Forces Of Steel Products Market

The Steel Products Market is characterized by a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively determine its trajectory and competitive landscape. The primary Driver remains the accelerating global demand for infrastructure, particularly in emerging economies undergoing rapid urbanization and industrialization, requiring massive tonnages of structural and long steel products. This is coupled with the ongoing technological shift in the automotive sector towards electric vehicles (EVs), which necessitates new generations of lightweight and ultra-high-strength steel (UHSS) for battery protection and structural integrity, sustaining high-value demand. Furthermore, increasing government mandates for local content in critical infrastructure projects and defense sectors provide stable demand streams, shielding domestic producers from some external volatility. These drivers are amplified by powerful impact forces related to environmental performance and technological capability, pushing companies to invest heavily in green production methods and smart factory technologies.

Conversely, the market faces significant Restraints that temper growth projections and increase operational complexity. High volatility in raw material costs, primarily iron ore, coking coal, and energy prices, exerts constant pressure on profit margins, especially for non-integrated producers. Overcapacity in certain geographic regions, particularly in China, continues to challenge global pricing stability and leads to trade disputes, resulting in increased tariffs and market access barriers. Additionally, the steel industry is one of the largest emitters of greenhouse gases; therefore, increasing global regulatory scrutiny and the cost associated with mandated decarbonization efforts (such as carbon taxes or transition to hydrogen-based production) represent a substantial financial and operational restraint, requiring massive capital expenditure for technological overhaul and potentially increasing the end-user cost of steel.

Opportunities for growth are concentrated in specialized and sustainable steel segments. The development and commercialization of ‘Green Steel’—steel produced with near-zero carbon emissions, often utilizing hydrogen or renewable electricity—presents a major opportunity to capture premium pricing and satisfy the strict procurement standards of environmentally conscious multinational corporations. The growth of additive manufacturing (3D printing) using specialized steel powders opens niche but highly profitable markets for complex component production. Moreover, expanding steel recycling infrastructure and enhancing scrap processing efficiency offers a reliable and sustainable raw material source, reducing reliance on primary production. The dynamic balance of these DRO forces means that market participants who successfully navigate raw material price risk while proactively investing in decarbonization and high-performance product innovation are best positioned for long-term sustainable growth and market leadership.

Segmentation Analysis

The Steel Products Market is comprehensively segmented based on product type, end-use application, and processing method, providing a detailed view of demand dynamics across various industrial sectors. The segmentation highlights the divergence in growth rates between high-volume, standard-grade steel used in general construction and specialized, advanced steel alloys demanded by the automotive, aerospace, and energy sectors. Understanding these segments is critical for producers to tailor their product mix, optimize manufacturing routes (BOF vs. EAF), and strategically target investment towards areas offering superior margins, such as high-strength low-alloy (HSLA) sheets or corrosion-resistant stainless steel tubes, which typically command higher prices and are less susceptible to commodity price volatility than basic long products.

- By Product Type:

- Flat Products (Sheets, Plates, Coils, Strips)

- Long Products (Rebars, Wire Rods, Sections, Rails)

- Tubular Products (Seamless Pipes, Welded Pipes)

- Steel Powders

- By Material Type:

- Carbon Steel

- Stainless Steel

- Alloy Steel (Tool Steel, HSLA Steel, AHSS)

- By Process:

- Basic Oxygen Furnace (BOF)

- Electric Arc Furnace (EAF)

- Open Hearth Furnace (OHF)

- By End-Use Application:

- Construction and Infrastructure (Residential, Commercial, Civil)

- Automotive and Transportation (Vehicles, Rail, Aerospace)

- Mechanical Equipment and Machinery

- Energy and Power Generation (Oil & Gas, Renewables)

- Consumer Appliances (White Goods)

- Packaging

Value Chain Analysis For Steel Products Market

The steel product value chain is a complex, capital-intensive process that begins with upstream activities involving the extraction and processing of raw materials. Upstream analysis focuses heavily on the procurement of iron ore, coking coal, scrap metal, and ferroalloys. The cost and quality of these inputs significantly dictate the final price and sustainability credentials of the steel produced. Suppliers of high-grade iron ore (e.g., BHP, Rio Tinto) hold considerable power, especially when combined with volatile logistics costs. Producers utilizing the Basic Oxygen Furnace (BOF) route are highly exposed to iron ore and coal price fluctuations, while those relying on the Electric Arc Furnace (EAF) route are more sensitive to the price and availability of quality ferrous scrap. Efficient upstream risk management, often achieved through long-term supply contracts or captive mining operations, is crucial for maintaining competitive stability and ensuring continuous production.

Midstream activities involve the highly technical and energy-intensive production process itself, including smelting, refining, casting (e.g., continuous casting), and finishing (hot rolling, cold rolling). This stage is characterized by immense economies of scale and significant capital requirements for modernization and decarbonization technologies. Efficiency gains at this stage, achieved through advanced manufacturing techniques, automation, and AI-driven process control, directly translate into cost advantages and improved product quality (e.g., tighter dimensional tolerances or superior surface finish). Technological innovation in the midstream, such as transitioning to hydrogen-direct reduction of iron (H-DRI), is now defining future competitiveness, though adoption requires large, upfront investments and access to green hydrogen infrastructure.

Downstream activities center on distribution, sales, and end-user application. Distribution channels are bifurcated into direct sales to large, strategic end-users (e.g., major automotive manufacturers or infrastructure consortiums) and indirect sales through steel service centers, distributors, and traders. Steel service centers play a vital role in cutting, slitting, and processing steel products to meet precise end-user specifications, adding value and optimizing inventory management for smaller buyers. Direct sales often involve long-term relationship management and technical collaboration on specialized steel grades, offering stability and higher margins. The profitability of the downstream segment relies heavily on effective inventory management, credit risk assessment, and minimizing logistical costs associated with the heavy nature of steel products, utilizing multimodal transport solutions.

Steel Products Market Potential Customers

The primary customers and end-users of steel products are broadly categorized into heavy industries that rely on steel as a core structural or functional material. The Construction and Infrastructure sector stands as the largest consumer globally, encompassing national governments and private developers requiring rebars, structural sections, and plates for civil engineering projects like bridges, highways, dams, and urbanization efforts, including residential and commercial buildings. These customers prioritize reliability, compliance with international building codes, and large-volume supply capabilities. The long-term durability and structural performance of steel products are paramount in this sector, making it a foundation of stable, albeit cyclically sensitive, demand for steel manufacturers worldwide.

Another major buying segment is the Automotive and Transportation industry. Modern automakers, including traditional Original Equipment Manufacturers (OEMs) and new Electric Vehicle (EV) startups, demand highly specialized steel grades, such as advanced high-strength steel (AHSS) and ultra-high-strength steel (UHSS). These materials are critical for ensuring passenger safety (crash performance) while simultaneously achieving vehicle lightweighting requirements necessary for improved fuel economy and extending EV battery range. Customers in this segment require stringent quality control, reliable just-in-time delivery schedules, and technical support in developing customized steel solutions, leading to deep, collaborative relationships between steel producers and automotive supply chains globally.

Furthermore, the Mechanical Equipment and Energy sectors represent high-value customer bases requiring specialized steel alloys for demanding environments. Customers include manufacturers of heavy machinery (e.g., mining equipment, agricultural machinery), industrial automation systems, and crucial components for oil and gas exploration (pipes, casings) and renewable energy infrastructure (wind turbine shafts, solar trackers). These buyers prioritize material resistance to extreme temperatures, high pressure, corrosion, and wear. Stainless steel and specific alloy steels are critical here, where failure is not an option. The procurement decisions in these segments are often driven by regulatory compliance, certified quality standards (e.g., API standards), and total cost of ownership rather than just upfront price per tonne.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950.5 Billion |

| Market Forecast in 2033 | USD 1290.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, China Baowu Group, Nippon Steel Corporation, POSCO, JFE Steel Corporation, Tata Steel, Hesteel Group, Shougang Group, Gerdau SA, US Steel, Nucor Corporation, Commercial Metals Company (CMC), VIZ-Stal, Severstal, ThyssenKrupp AG, JSW Steel, SAIL (Steel Authority of India Ltd), Hyundai Steel, Outokumpu, Aperam. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steel Products Market Key Technology Landscape

The Steel Products Market is undergoing a profound technological transformation driven by twin mandates: achieving superior product performance and drastically reducing the industry's significant carbon footprint. The primary focus of technological innovation is centered on process optimization and material science advancements. In production, digitalization and the implementation of Industry 4.0 principles, including pervasive sensor deployment, real-time data analytics, and machine learning, are becoming standard. These technologies enable precise control over temperature and chemical composition during melting and casting, ensuring tighter tolerances, reduced variability, and maximized energy efficiency across the entire mill operation. Continuous casting improvements, such as thinner slab casting, reduce subsequent rolling requirements and energy consumption, further enhancing operational efficiency and lowering costs.

The most impactful technological shift revolves around decarbonization. Traditional methods utilizing coking coal are being challenged by innovative, low-carbon steelmaking routes. Key among these is the increased adoption of Electric Arc Furnaces (EAFs), which use recycled scrap steel and electricity, offering significantly lower emissions compared to Basic Oxygen Furnaces (BOFs). However, the future of primary steel production lies in hydrogen-based direct reduction (H-DRI) technology, where natural gas or coking coal reductants are replaced entirely or partially by green hydrogen. This technology, currently piloted by major European producers like SSAB and Salzgitter, promises near-zero CO2 emissions, fundamentally changing the feedstock requirements and demanding vast infrastructure investments in green hydrogen production and storage.

Beyond process technologies, material science innovation is crucial, particularly in developing Advanced High-Strength Steel (AHSS) and Ultra-High-Strength Steel (UHSS) tailored for the automotive and aerospace industries. These advanced steels feature complex microstructures, achieved through specialized heat treatments and alloying elements, offering unprecedented strength-to-weight ratios. Furthermore, coating technologies, such as advanced galvanizing and specialized polymer coatings, are critical for enhancing corrosion resistance and extending the lifespan of steel products, particularly in harsh marine, infrastructure, and oil and gas environments. The adoption of additive manufacturing (3D printing) using specialized steel powders is also beginning to create niche markets for complex, customized steel components previously impossible to manufacture using conventional forging or casting techniques, pushing the boundaries of material applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for both production and consumption of steel products, accounting for over 60% of the world’s output. This dominance is led by China, which is the single largest producer and consumer, driven by extensive investment in housing, transportation, and industrial infrastructure. India is emerging as the fastest-growing major market, benefiting from government initiatives focused on infrastructure creation, urbanization, and manufacturing self-sufficiency (Make in India). Regional growth is sustained by low production costs relative to Western markets, though environmental regulations are rapidly tightening, compelling modernization efforts across major manufacturing hubs. The region focuses heavily on volume production of both long and flat products, although specialized alloy production is also increasing rapidly to support sophisticated electronics and automotive industries in Japan and South Korea.

- Europe: The European steel market is mature, characterized by high regulatory standards, intense competition, and a strong focus on decarbonization. The region leads in the development and adoption of 'Green Steel' initiatives, leveraging technologies like hydrogen-DRI and increased EAF utilization. Demand is concentrated in high-value segments, including specialized stainless steel, tool steel, and AHSS for premium automotive manufacturing and industrial machinery. The EU's Carbon Border Adjustment Mechanism (CBAM) is a defining policy, forcing both domestic producers and importers to adhere to strict emissions standards, significantly impacting trade dynamics and encouraging technological investment to maintain regional competitiveness and strategic autonomy in essential industrial materials.

- North America: The North American market is highly integrated and technologically advanced, with the US being a major consumer driven by residential construction, energy infrastructure, and a rebounding automotive sector, particularly focusing on light truck and SUV production. The region is characterized by high reliance on Electric Arc Furnace (EAF) production, making scrap availability a critical factor. Policy stimuli, such as the Infrastructure Investment and Jobs Act (IIJA), guarantee substantial long-term demand for structural steel and other long products. Canadian and Mexican markets are closely tied to the US through continental trade agreements, focusing on providing high-quality inputs for regional manufacturing supply chains, including pipelines and construction projects in resource extraction sectors.

- Latin America (LATAM): The LATAM steel market shows sporadic growth influenced heavily by commodity cycles and localized economic stability, with Brazil and Mexico as the largest producers and consumers. Demand is tied primarily to residential construction, oil and gas infrastructure, and large-scale mining operations, which require specialized wear-resistant steel. Brazil, with its abundant iron ore reserves, maintains strong export capabilities. However, market volatility, high inflation rates, and complex domestic regulatory environments often challenge investment in capacity expansion and technological upgrades necessary for international competitiveness outside of basic steel grades.

- Middle East and Africa (MEA): The MEA region is witnessing significant steel demand, particularly in the Gulf Cooperation Council (GCC) countries, fueled by massive government-led diversification projects (e.g., NEOM in Saudi Arabia) and energy infrastructure modernization. These projects necessitate large volumes of structural steel, rebar, and specialized piping for oil, gas, and water distribution. Africa represents a vast, largely underdeveloped market with high future growth potential, driven by infrastructure gaps and rising urbanization, though investment is often constrained by political instability and lack of robust local supply chains, leading to heavy reliance on imported finished steel products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steel Products Market.- ArcelorMittal

- China Baowu Group

- Nippon Steel Corporation

- POSCO

- JFE Steel Corporation

- Tata Steel

- Hesteel Group

- Shougang Group

- Gerdau SA

- US Steel

- Nucor Corporation

- Commercial Metals Company (CMC)

- VIZ-Stal

- Severstal

- ThyssenKrupp AG

- JSW Steel

- SAIL (Steel Authority of India Ltd)

- Hyundai Steel

- Outokumpu

- Aperam

Frequently Asked Questions

Analyze common user questions about the Steel Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for specialized Advanced High-Strength Steel (AHSS)?

The primary driver for AHSS is the global automotive industry's requirement to achieve vehicle lightweighting for better fuel efficiency and extended battery range in electric vehicles, alongside stringent safety regulations that necessitate materials offering superior crash energy absorption without excessive weight increase. AHSS allows manufacturers to maintain structural integrity while reducing material thickness, directly contributing to compliance and performance optimization in modern vehicle design and production.

How are environmental regulations impacting the global competitive landscape of steel production?

Environmental regulations, particularly carbon pricing mechanisms like the EU’s Carbon Border Adjustment Mechanism (CBAM), are fundamentally reshaping global competition by penalizing high-carbon production methods. This creates a significant competitive advantage for producers investing in low-carbon technologies (Green Steel, Hydrogen-DRI, EAF utilization), driving capital expenditure towards sustainability and potentially leading to trade shifts favoring regions with cleaner energy sources and advanced processing capabilities.

Which geographic region is expected to show the highest growth rate for steel products, and why?

Asia Pacific (APAC), particularly driven by India and Southeast Asian nations, is projected to exhibit the highest sustained growth rate. This growth is fueled by massive urbanization, large-scale public and private investment in infrastructure (highways, ports, renewable energy), and the expansion of domestic manufacturing bases. While China’s growth is stabilizing, the cumulative demand from India and other developing APAC countries ensures the region remains the dominant driver of global steel consumption volume growth throughout the forecast period.

What are the main challenges related to raw material procurement in the current steel market?

The main challenges involve extreme price volatility and supply chain security for key inputs, specifically iron ore, coking coal, and energy (natural gas/electricity). Geopolitical tensions, resource nationalism, and logistics bottlenecks contribute to price uncertainty, forcing steel manufacturers to engage in sophisticated hedging strategies, secure long-term contracts, or accelerate the shift towards scrap-based EAF production to mitigate dependency on volatile primary raw materials.

How is digitalization and AI transforming traditional steel manufacturing processes?

Digitalization and AI are transforming steel manufacturing by enabling real-time process optimization, drastically improving operational efficiency, and enhancing product quality control. AI systems are used for predictive maintenance, minimizing unplanned downtime in rolling mills, optimizing raw material blending for cost and quality, and controlling furnace parameters to reduce energy consumption and emissions. This transition facilitates the shift towards highly automated, data-driven 'smart factories' capable of producing steel with greater precision and sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager