Steel Scrap Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431868 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Steel Scrap Market Size

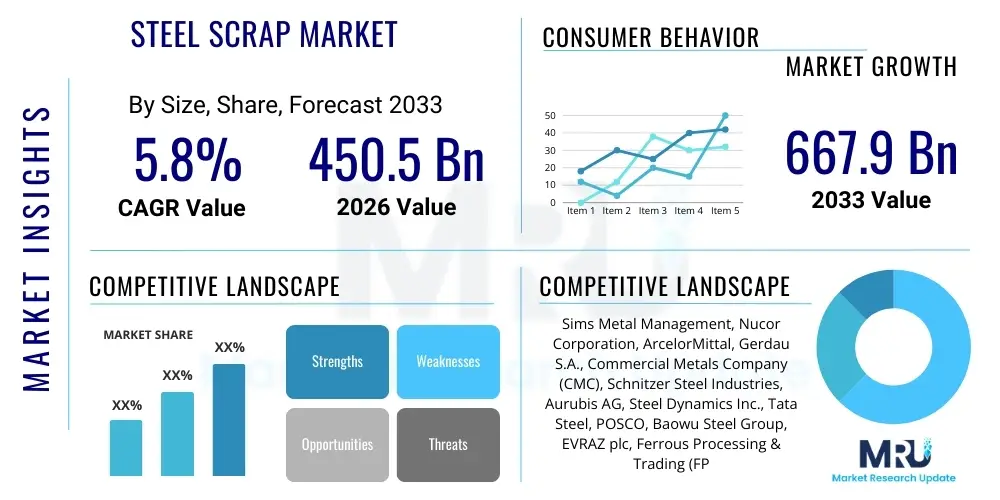

The Steel Scrap Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 billion in 2026 and is projected to reach USD 667.9 billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the global steel industry’s intensifying focus on sustainable production methods, driven by stringent environmental regulations and the accelerating transition toward Electric Arc Furnace (EAF) technology, which utilizes steel scrap as its primary feedstock.

Steel Scrap Market introduction

The Steel Scrap Market encompasses the collection, processing, and sale of discarded ferrous materials destined for recycling into new steel products. Steel scrap, essentially recycled steel, serves as a crucial, environmentally beneficial, and economically viable raw material for steelmaking, significantly reducing reliance on primary raw materials like iron ore and coal, thereby lowering carbon emissions. The product is categorized based on its source, physical characteristics, and composition, spanning from high-grade industrial prompt scrap to obsolete scrap derived from old structures and consumer goods. Major applications predominantly revolve around Electric Arc Furnaces (EAFs), which are inherently designed to operate using 100% scrap input, though scrap is also utilized as a cooling agent in Basic Oxygen Furnaces (BOFs) and in various foundry applications for specialized casting.

The primary benefits of utilizing steel scrap include substantial energy savings (estimated to be around 75% compared to producing steel from virgin resources), reduction in landfill waste, and significant mitigation of greenhouse gas emissions. The market is witnessing transformative growth driven by several interconnected factors, including global mandates favoring circular economy principles, the escalating cost and geopolitical complexity associated with primary metallurgical inputs, and unprecedented infrastructure development across emerging economies requiring sustainable steel sources. Furthermore, technological advancements in scrap sorting and processing, such as advanced sensor technologies and automation, are enhancing the quality and recovery rates, making recycled steel an increasingly competitive and reliable material supply for high-specification steel production.

Market expansion is also intrinsically linked to the longevity of manufactured steel products; as the global inventory of steel structures and goods matures, the availability of obsolete scrap increases. This structural growth, combined with rapid industrialization generating significant volumes of prompt scrap, ensures a steady supply stream. Regulatory shifts, particularly in major consuming regions like the EU and North America, are actively promoting the adoption of scrap-intensive production routes over traditional integrated steel mills, solidifying steel scrap’s foundational role in achieving the industry’s net-zero transition goals. The economic imperative to manage input costs effectively further reinforces the preference for recycled materials over volatile virgin commodity markets.

Steel Scrap Market Executive Summary

The Steel Scrap Market is currently defined by robust business trends characterized by a foundational shift in steel production methods globally, emphasizing the EAF route over traditional integrated processes. Key business dynamics include consolidation among major scrap processors to ensure quality control and optimize logistics, alongside growing contractual agreements between large suppliers and major steel mills to stabilize pricing and guarantee supply chains. Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China and India, is emerging as the dominant market for consumption, driven by massive domestic infrastructure projects and, notably in China, a substantial relaxation of scrap import restrictions aimed at decarbonizing its massive steel sector. This pivot is altering established global trade flows, traditionally directed towards Turkey and Southeast Asia.

Segment-wise, the Shredded Scrap segment (ISRI 210-211) continues to command significant volume due to its consistent density and suitability for EAF operations, while the trend towards high-specification steel production is boosting demand for premium grades like Plate and Structural Scrap (P&S). Technology trends focus heavily on enhancing the purity of obsolete scrap through advanced sorting mechanisms, crucial for producing higher quality flat steel products. The overall market narrative is strongly influenced by environmental, social, and governance (ESG) factors, compelling steel manufacturers to prioritize scrap usage as a verifiable metric of sustainability, thereby embedding its importance across all strategic planning horizons for the global steel industry.

Furthermore, the executive overview highlights persistent market volatility driven by fluctuating energy costs (critical for EAF operations) and unpredictable global shipping rates, impacting the economics of cross-border scrap trade. Despite these challenges, the long-term outlook remains overwhelmingly positive, underpinned by supportive governmental policies, carbon pricing mechanisms, and continuous innovation in material handling and recycling infrastructure. The successful integration of digital platforms for transparent trading and real-time inventory management is further streamlining the supply chain, ensuring that the Steel Scrap Market remains an indispensable pillar of the future low-carbon economy.

AI Impact Analysis on Steel Scrap Market

Common user questions regarding AI's impact on the Steel Scrap Market typically center on how technology can solve the industry's perennial challenges: inconsistent quality, volatile pricing, and complex logistics. Users frequently inquire about the efficacy of AI-driven sorting systems in separating contaminants, the accuracy of predictive models for scrap prices based on macroeconomic indicators, and the optimization of collection routes and processing throughput. The key thematic summary reveals that stakeholders anticipate AI will fundamentally enhance operational efficiency and profitability by improving material purity, mitigating financial risk through better forecasting, and enabling truly circular supply chain management, thereby ensuring higher utilization rates of post-consumer scrap for critical industrial processes.

- AI-driven sensor technology, such as LIBS (Laser-Induced Breakdown Spectroscopy) and advanced computer vision, dramatically improves the purity and homogeneity of sorted scrap, increasing its value for high-specification steelmaking.

- Machine learning algorithms enhance predictive pricing models by analyzing real-time trade data, energy costs, freight rates, and global infrastructure project announcements, offering scrap processors and consumers vital hedging tools.

- AI optimizes complex logistics and collection routes for obsolete scrap, reducing transportation costs, lowering carbon emissions associated with collection, and improving inventory visibility across fragmented supply networks.

- Predictive maintenance analytics applied to large-scale processing equipment (shredders, balers, shears) minimizes downtime, maximizing plant throughput and operational reliability.

- AI supports compliance and reporting by automating the tracking and certification of recycled content, essential for meeting increasingly stringent global green procurement standards and carbon border adjustments.

DRO & Impact Forces Of Steel Scrap Market

The dynamics of the Steel Scrap Market are shaped by a confluence of accelerating drivers, structural restraints, and critical technological opportunities, all interacting to exert significant influence on pricing and trade flows. A primary driver is the pervasive global commitment to decarbonization, pushing the steel industry rapidly toward EAF technology, which intrinsically mandates high volumes of scrap. This environmental imperative is coupled with economic advantages, as recycled steel requires substantially less energy, leading to lower operating costs for producers in regions with high energy tariffs. Conversely, a major structural restraint is the inherent complexity and high operational cost of collecting, cleaning, and processing obsolete scrap, which often contains problematic contaminants, leading to quality concerns in end-use applications and imposing high capital expenditures on sorting technology.

The principal opportunity lies in the widespread implementation of advanced sorting technologies, notably AI and sensor-based systems, which can unlock access to lower-grade obsolete scrap reservoirs that were previously uneconomical or unsuitable for recycling. These technological leaps are set to expand the accessible material base and further improve the quality consistency required by premium steel producers. Impact forces include intense commodity price volatility, directly linked to swings in global steel demand and shifts in trade policies (such as the imposition or removal of export tariffs), which dramatically affect regional supply-demand balances and create significant risk for both suppliers and consumers in managing long-term contracts. Geopolitical events also exert profound impact, particularly on established maritime shipping routes essential for the bulk movement of processed ferrous material between continents, thereby influencing landed costs and supply certainty across regions.

Segmentation Analysis

The Steel Scrap Market is critically segmented based on criteria essential for determining material suitability, pricing, and end-use application quality. Segmentation by type differentiates between Ferrous scrap, derived primarily from steel and iron products, and Non-Ferrous scrap, which includes valuable materials such as aluminum, copper, and zinc often recovered alongside steel. Segmentation by source is vital for purity assessment, distinguishing between high-grade, clean Prompt (industrial/new) scrap and more heterogeneous Obsolete (post-consumer/old) scrap. End-user segmentation highlights the market concentration in Electric Arc Furnaces (EAFs), which are the dominant consumption route, compared to smaller volumes used in induction furnaces and foundries. Understanding these segments is paramount for market players to effectively manage their logistics, processing capabilities, and risk profiles in response to varying demand characteristics across different steelmaking techniques and geographies.

- By Type:

- Ferrous Scrap

- Non-Ferrous Scrap

- By Source:

- Prompt Scrap (Industrial or New Scrap)

- Obsolete Scrap (Post-Consumer or Old Scrap)

- Home Scrap (Revert Scrap)

- By End-User:

- Electric Arc Furnace (EAF)

- Induction Furnace

- Basic Oxygen Furnace (BOF)

- Foundry

- By Processing Grade (ISRI Standard):

- Heavy Melting Steel (HMS)

- Shredded Scrap

- Plate and Structural (P&S) Scrap

- Busheling Scrap

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Steel Scrap Market

The steel scrap value chain begins with upstream activities focused on material sourcing, encompassing the collection of prompt scrap from manufacturing facilities and the dismantling of obsolete structures (cars, buildings, machinery) to acquire post-consumer material. This initial phase involves a highly fragmented network of smaller collectors, dismantlers, and specialized wrecking yards. Efficient sourcing is crucial, as the quality and concentration of materials significantly impact subsequent processing costs. Midstream operations are dominated by large scrap processors who employ capital-intensive equipment like shredders, balers, shears, and increasingly sophisticated sorting technologies to transform raw material into standardized grades (based on ISRI specifications) suitable for steel mill consumption. These processors act as the critical link, ensuring material purity and density for optimal furnace operation.

Downstream activities involve the distribution channel, which is bifurcated between direct long-term contracts and indirect brokerage/trading platforms. Major steel manufacturers often engage in direct supply agreements with large, integrated scrap processors to secure guaranteed volumes and specific quality specifications, thereby minimizing price volatility risk. The indirect channel relies on commodity traders, agents, and increasingly, digital marketplaces (exchange-based trading), which facilitate global trade, particularly for export volumes moving from surplus regions (like North America and Europe) to deficit regions (like Turkey and parts of Asia). Logistics, heavily dependent on rail and maritime shipping, represents a substantial cost component in the downstream chain, dictating the feasibility of intercontinental trade flows and regional price arbitrage opportunities.

The overall efficiency of the value chain is increasingly reliant on digitalization for inventory tracking, quality verification, and transparent transaction execution. The shift towards circularity has heightened the importance of regulatory compliance and verifiable sustainability claims throughout the chain. Steel mills prioritize suppliers who can demonstrate robust environmental and ethical sourcing practices, further institutionalizing the need for high levels of accountability and traceability from the initial collection point through to the final processing stage. This complex interplay of collection efficiency, technological processing capability, and logistical optimization defines profitability within the Steel Scrap Market.

Steel Scrap Market Potential Customers

The primary end-users and buyers of processed steel scrap are the large-scale integrated steel producers, predominantly those operating Electric Arc Furnaces (EAFs). EAF mills, often referred to as mini-mills, rely on steel scrap for up to 100% of their metallic input, making them the cornerstone of market demand. The growth and geographical distribution of EAF capacity directly dictate global scrap consumption patterns. These customers require high-quality, dense, and chemically consistent scrap grades, such as shredded scrap (210-211) and Plate and Structural (P&S), to optimize melting times and ensure the metallurgical properties of the final product meet stringent industry standards.

Secondary but highly significant customers include specialized foundries and casting operations. Foundries, which produce cast iron and custom steel components, have specific requirements for material size and chemical composition, often preferring high-purity grades like busheling scrap or low-residual plate materials to minimize defects in their intricate molds. Although these buyers account for a smaller volume compared to EAFs, they often pay premium prices for highly sorted, specialized grades. Furthermore, traditional integrated mills utilizing the Basic Oxygen Furnace (BOF) process also serve as customers, using scrap as a coolant medium to control the temperature during the exothermic reaction of refining liquid hot metal. While BOFs are less scrap-intensive, their large production scale translates into substantial, sustained demand for lower-cost scrap grades.

Finally, a growing segment of potential customers includes specialized metal refiners and alloy producers who purchase specific non-ferrous components (like stainless steel scrap containing chromium and nickel) that are recovered during the primary steel scrap processing operation. These buyers are critical in ensuring the complete loop closure for multi-material products. The purchasing decisions of all these customer groups are heavily influenced by prevailing prices of competing inputs (e.g., direct reduced iron or pig iron), energy costs, and the need to meet regulatory mandates related to recycled content in their manufactured goods, making scrap sourcing a strategic procurement priority.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 billion |

| Market Forecast in 2033 | USD 667.9 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sims Metal Management, Nucor Corporation, ArcelorMittal, Gerdau S.A., Commercial Metals Company (CMC), Schnitzer Steel Industries, Aurubis AG, Steel Dynamics Inc., Tata Steel, POSCO, Baowu Steel Group, EVRAZ plc, Ferrous Processing & Trading (FPT), MetalX, ELG Haniel GmbH, SA Recycling, OmniSource Corporation, Triple M Metals, Cozzi Recycling, Harsco Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steel Scrap Market Key Technology Landscape

The technological evolution within the steel scrap market is primarily directed toward solving the challenges of material purity, maximizing recovery, and enhancing logistical efficiency. A critical technology is the use of advanced sensor-based sorting systems, notably Laser-Induced Breakdown Spectroscopy (LIBS) and X-ray Fluorescence (XRF). LIBS is transformative as it allows for rapid, non-contact elemental analysis of individual scrap pieces on conveyor belts, enabling the highly accurate separation of different steel alloys and the removal of residual tramp elements (like copper and tin) that severely degrade the quality of recycled steel. This ability to produce ultra-clean, low-residual scrap is essential for meeting the demands of high-specification flat steel producers, marking a significant departure from manual or basic magnetic sorting techniques.

Furthermore, automation and heavy machinery technology continue to evolve, with increasingly powerful and energy-efficient shredders, shears, and balers being deployed. Modern shredding plants integrate complex air classification and magnetic separation systems to recover non-ferrous metals and minimize waste. The trend is towards larger, modular processing facilities that can handle higher volumes with reduced operational costs per ton. Robotics and advanced vision systems are also being integrated, particularly in quality control and material handling within processing yards, contributing to safer operations and more consistent output purity. This infrastructural investment is driving market consolidation as smaller players struggle to meet the capital requirements necessary for adopting cutting-edge processing technology.

Finally, digitalization platforms and logistics software represent a crucial layer in the technology landscape. These tools utilize telematics and predictive analytics to optimize the entire reverse supply chain, from coordinating scrap collection from disparate sources to scheduling bulk shipments to mills. Blockchain technology is emerging as a method for enhancing traceability and verifying the provenance of recycled materials, addressing the growing need for authenticated sustainability reporting. These digital solutions improve supply chain transparency, reduce transaction costs, and enable real-time price discovery, mitigating the traditional volatility associated with physically traded bulk commodities and integrating the fragmented network of collectors and processors more effectively into the global market structure.

Regional Highlights

- North America (NA): North America is characterized by robust domestic demand, primarily driven by large, highly efficient EAF operators, particularly in the United States, which has aggressively expanded its EAF capacity in recent years. The U.S. remains a net exporter of high-quality ferrous scrap due to its mature collection infrastructure and substantial domestic availability, often shipping surplus material to key import markets like Turkey and Mexico. The regulatory environment in NA strongly favors domestic recycling, and technological adoption, especially in advanced sensor sorting, is high among leading processors. The region benefits from a consistent supply of prompt scrap from the automotive and manufacturing sectors, supporting its position as a global quality leader.

- Europe: The European market is intrinsically linked to the European Green Deal and stringent decarbonization targets. Steel producers in the EU are under intense pressure to switch from BOF to EAF routes, dramatically increasing internal demand for scrap. Europe possesses an excellent collection and processing infrastructure, leading to high recycling rates. However, regulatory movements like the potential imposition of restrictions on scrap exports to prioritize domestic supply for green steel initiatives are major market influencers. Furthermore, the region is pioneering projects involving the combination of steel scrap with hydrogen-reduced direct reduced iron (H-DRI), solidifying scrap's role in the most advanced sustainable steelmaking processes.

- Asia Pacific (APAC): APAC is the largest and fastest-growing consumption hub, driven by the sheer scale of steel production in China, India, Japan, and South Korea. Historically, China relied on domestic scrap, but following the relaxation of import restrictions (re-labeling high-quality scrap as a resource rather than waste), import demand has surged dramatically, fundamentally restructuring global trade flows. India's rapidly expanding steel sector, fueled by massive infrastructure investment, is also creating enormous domestic scrap demand, although its collection infrastructure is still maturing. The challenge in APAC lies in managing the diverse quality standards and the logistics required to move scrap efficiently across large, often congested, and geographically dispersed markets.

- Latin America (LATAM) and Middle East & Africa (MEA): LATAM markets, led by Brazil and Mexico, are seeing steady growth, primarily focused on internal consumption driven by regional construction and manufacturing. These markets are typically characterized by a mix of domestic collection and strategic imports, particularly in Mexico which relies heavily on U.S. scrap for its large EAF base. MEA, particularly the GCC countries, is investing heavily in EAF capacity, often linked to inexpensive natural gas for DRI production, but scrap is increasingly vital as they diversify their input mix. Turkey remains the single most critical importing market globally, with its currency volatility and geopolitical factors having an outsized influence on global scrap pricing benchmarks (CFR Turkey).

Expanding on North American dynamics, the region's strength is not just in supply volume but in the maturity of its regulatory and technological framework. The integration of steel scrap brokers with large financial institutions also provides a sophisticated hedging market, allowing major mill operators like Nucor and SDI to manage price risks more effectively than their counterparts in less developed markets. This stability, coupled with strategic acquisitions of regional processors, secures long-term feedstock supply, which is a key competitive advantage for the regional steel industry. The emphasis on high-density materials like #1 Heavy Melt and Shredded scrap ensures that the final product quality meets the exacting standards required for sophisticated applications like structural beams and automotive components produced domestically.

In Europe, the political environment is a primary market driver. The EU’s Emission Trading System (ETS) makes the use of scrap financially advantageous due to the lower associated carbon footprint, directly impacting steel mill profitability models. This regulatory push encourages investments not only in new EAF capacity but also in upgrading existing infrastructure to handle greater volumes of diverse scrap types. Furthermore, transboundary movements of waste and scrap are subject to complex regulations, which necessitates higher administrative compliance but ultimately supports a cleaner, more controlled material flow across member states. The collaborative research efforts between EU member states on end-of-life vehicle (ELV) recycling further highlight the strategic importance of maximizing high-purity scrap recovery.

The APAC region’s trajectory is dominated by urbanization and industrial expansion. China’s return to the import market has been slow but influential, prioritizing high-quality shredded and HMS materials to substitute expensive imported iron ore and comply with environmental targets. India's rapid infrastructure build-out is creating dual demand: immediate need for construction steel and future creation of massive scrap reserves. Challenges in this region include a highly dispersed and often informal collection network in developing nations, leading to inconsistent quality and higher processing costs compared to North America and Europe. Investment in mechanized sorting and centralized processing facilities is crucial for APAC to fulfill its domestic demand requirements efficiently without excessive reliance on imports in the long term.

The LATAM and MEA regions demonstrate highly specific market behaviors. LATAM often sees price volatility linked closely to U.S. export parity, given the reliance on North American supply streams. Local collection infrastructure is developing but constrained by economic instability in several key countries. In the Middle East, particularly Saudi Arabia and the UAE, the strategic coupling of steel production with regional construction booms, combined with the availability of competitive energy prices for EAF operation, makes scrap a strategic input. However, the reliance on high-volume shipping routes through the Suez Canal and surrounding maritime areas subjects MEA’s imported scrap supply to geopolitical risks, necessitating robust supply chain resilience planning by regional steel producers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steel Scrap Market.- Sims Metal Management

- Nucor Corporation

- ArcelorMittal

- Gerdau S.A.

- Commercial Metals Company (CMC)

- Schnitzer Steel Industries

- Aurubis AG

- Steel Dynamics Inc. (SDI)

- Tata Steel

- POSCO

- Baowu Steel Group

- EVRAZ plc

- Ferrous Processing & Trading (FPT)

- MetalX

- ELG Haniel GmbH

- SA Recycling

- OmniSource Corporation

- Triple M Metals

- Cozzi Recycling

- Harsco Corporation

Frequently Asked Questions

Analyze common user questions about the Steel Scrap market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Steel Scrap Market?

The primary driver is the accelerating global shift towards sustainable steel production, specifically the increasing adoption and capacity expansion of Electric Arc Furnace (EAF) technology, which uses steel scrap as its main feedstock, fulfilling environmental mandates and reducing energy consumption compared to traditional methods.

How does the segmentation by 'Source' affect the price of steel scrap?

Scrap source significantly affects pricing due to purity. Prompt (new industrial) scrap is generally cleaner, commands a higher price, and is preferred for high-quality steel. Obsolete (old post-consumer) scrap is cheaper but requires more intensive processing to remove contaminants, leading to variable pricing based on its residual element content.

Which region dominates the consumption of steel scrap globally?

The Asia Pacific (APAC) region, driven primarily by massive steel production in China and India, dominates global steel scrap consumption. This demand is fueled by unprecedented urbanization, infrastructure projects, and the need for sustainable material inputs in regional steel mills.

What is the role of AI in improving the quality of steel scrap?

AI is crucial in enhancing scrap quality through sensor-based sorting systems, such as LIBS (Laser-Induced Breakdown Spectroscopy). These technologies use AI algorithms to rapidly identify and separate different metal alloys and tramp elements, ensuring the delivery of high-purity, consistent material grades required by sophisticated steel manufacturers.

What are the main logistical constraints impacting the global trade of steel scrap?

Key logistical constraints include volatile maritime freight rates, which significantly impact intercontinental trade viability (e.g., U.S. exports to Turkey), and the necessity for sophisticated, multi-modal transportation networks (rail and truck) to collect and move bulk scrap from often geographically dispersed collection points to centralized processing facilities and ports.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager