Steel Sheet Piling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431661 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Steel Sheet Piling Market Size

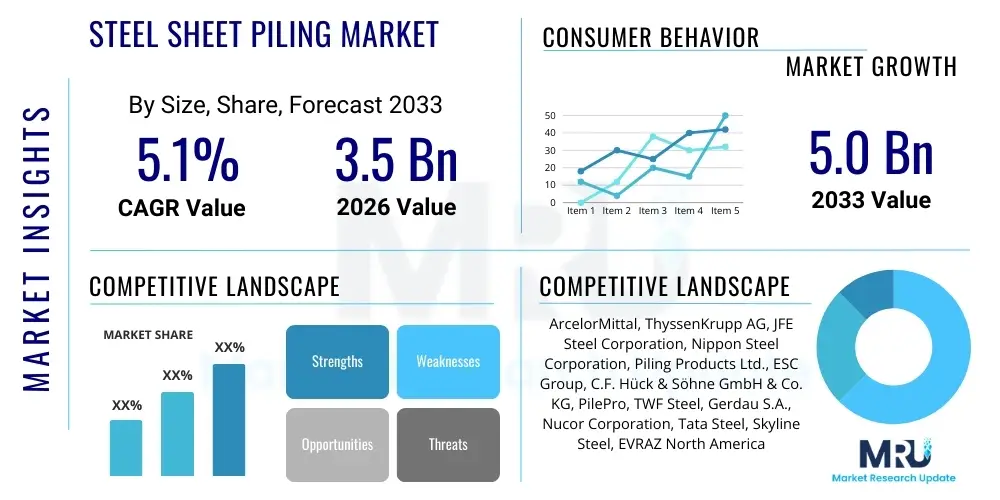

The Steel Sheet Piling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Steel Sheet Piling Market introduction

The Steel Sheet Piling Market is fundamentally driven by global infrastructure development, particularly within the marine, transportation, and urban construction sectors. Steel sheet piles are specialized rolled steel sections engineered with interlocking edges, forming continuous structural barriers used primarily for earth retention, excavation support, and groundwater control. These structures are crucial for building deep foundations, constructing cofferdams, stabilizing embankments, and reinforcing waterfront structures such as jetties, quays, and bulkheads. The inherent strength, durability, and reusability of steel, combined with advanced manufacturing techniques, position steel sheet piling as a preferred solution over conventional materials like concrete or timber in demanding civil engineering projects across the globe.

Product descriptions typically categorize sheet piles based on their cross-sectional shape, including Z-sections, U-sections, and flat sections, with Z-sections being the most common due to their high strength-to-weight ratio and efficiency in retaining walls. Major applications span coastal protection against rising sea levels, construction of port facilities to support global trade, and extensive infrastructure works like bridge abutments and underground tunnels. The versatility of these piles allows them to be used in both temporary structures, such as temporary excavation supports, and permanent installations requiring decades of performance in aggressive environments like saline or contaminated soils. Key driving factors include rapid urbanization in emerging economies necessitating advanced flood control and transportation networks, alongside substantial governmental investments in modernizing aging infrastructure in developed nations.

Benefits derived from using steel sheet piling are multifaceted, encompassing ease of installation, immediate load-bearing capacity, and high resistance to driving stresses. Furthermore, the material’s recyclability strongly supports circular economy principles within the construction industry. Driving factors that substantially influence market trajectory include increased global shipping volumes demanding expanded and resilient port infrastructure, stricter environmental regulations pushing for minimized construction footprints, and critical public and private sector funding directed towards resilience projects related to climate change adaptation, especially seawalls and storm surge barriers. The continuous refinement of locking systems and steel alloys further enhances the applicability and longevity of sheet piling solutions in increasingly complex geotechnical challenges worldwide.

Steel Sheet Piling Market Executive Summary

The Steel Sheet Piling Market is poised for stable and robust growth, primarily influenced by accelerated business trends centered around sustainability and digitalization within the construction industry. Strategic mergers and acquisitions among major steel manufacturers and specialized piling contractors are shaping the competitive landscape, aiming to achieve supply chain integration and enhance global distribution capabilities. Furthermore, there is a pronounced shift towards high-grade, corrosion-resistant steel alloys and specialized coatings, reflecting the need for longer-lasting infrastructure assets, particularly in aggressive marine environments. Business models are increasingly incorporating rental and leasing options for temporary works, allowing construction companies to optimize capital expenditure and improve project flexibility, thereby boosting overall market activity and access, especially for smaller and medium-sized enterprises.

Regional trends indicate that the Asia Pacific (APAC) region maintains its dominance, fueled by massive governmental investment programs in transportation, energy infrastructure, and coastal defense, notably in countries like China, India, and Southeast Asian nations undergoing rapid urbanization and industrial expansion. Europe demonstrates strong momentum driven by stringent environmental standards and rehabilitation projects focused on maintaining historic waterways, ports, and flood defenses, often utilizing specialized silent piling techniques in densely populated urban centers. North America shows steady demand, primarily focused on replacing and repairing aging civil infrastructure, including extensive work on inland waterway systems, riverbank stabilization, and expansion of container terminal capacities along the coasts. The Middle East and Africa (MEA) are emerging as high-growth areas, propelled by large-scale commercial and residential development projects that require substantial foundation and earth retention works.

Segmentation trends highlight the increasing demand for Z-sections, favored for permanent retaining structures due to superior strength and ease of handling, though specialized flat sections are gaining traction in deep cofferdams and cellular structures. Based on end-user, the Ports and Harbors segment remains the largest revenue contributor, reflecting the sustained investment in global trade infrastructure. However, the rapidly expanding Infrastructure sector, encompassing bridges, tunnels, and deep basements for urban development, is projected to exhibit the highest CAGR through the forecast period. The market structure is evolving to favor suppliers capable of offering integrated solutions, including design consultation, material supply, and specialized installation equipment, indicating a convergence of product manufacturing and high-value service offerings to maximize project efficiency.

AI Impact Analysis on Steel Sheet Piling Market

Common user questions regarding AI’s influence on the steel sheet piling domain typically center on how artificial intelligence can reduce material wastage, optimize complex piling schedules, and predict structural integrity over long lifecycles. Users are keen to understand if AI can effectively process geotechnical data to minimize installation risk (e.g., encountering unforeseen subsurface conditions) and how machine learning algorithms can refine the structural design of sheet pile walls, leading to significant material cost reductions. The core expectations revolve around enhanced precision in design, automation of quality assurance during manufacturing, and improved predictive maintenance planning for permanent structures, ultimately aiming for increased project safety, efficiency, and material sustainability in foundation and marine construction projects.

- AI-driven optimization of sheet pile design geometries, minimizing steel mass while maintaining requisite structural capacity based on specific site geotechnical data.

- Machine learning algorithms predicting optimal installation sequences and driving depths, thereby reducing time delays and minimizing the risk of piling refusal or structural damage.

- Integration of AI with Building Information Modeling (BIM) platforms to simulate complex soil-structure interactions and forecast long-term settlement or deflection behavior.

- Enhanced quality control during the manufacturing process using computer vision systems to detect minute defects in steel sections and interlocks before shipment.

- Predictive maintenance schedules for existing marine structures, utilizing sensor data (e.g., corrosion rates, strain gauges) analyzed by AI to prioritize repair work and extend asset lifespan.

- Automated logistics and supply chain optimization, ensuring timely delivery of specific sheet pile lengths and sections to remote construction sites, mitigating project delays caused by material shortages.

DRO & Impact Forces Of Steel Sheet Piling Market

The Steel Sheet Piling Market's trajectory is primarily shaped by the synergy between strong drivers related to global urbanization and environmental resilience, coupled with significant restraints centered on material cost volatility and installation complexity. Opportunities are vast, particularly in leveraging advanced materials and specialized equipment to penetrate niche markets like deep-water construction and contaminated land remediation. These elements collectively generate the impact forces that dictate investment levels, technological adoption, and regional growth distribution within the market. Global infrastructure spending, particularly on coastal protection and modernized port facilities, acts as a pivotal driver, constantly pushing demand upward, while the recurring cyclicality and high cost of raw steel present persistent friction points for major contractors and government budgets, requiring sophisticated procurement strategies to manage risk and maintain profitability thresholds.

Key drivers include the imperative for climate change adaptation, which necessitates robust sea defenses and flood protection measures across vulnerable coastlines and river basins globally. Additionally, the rapid expansion of global trade demands larger, deeper ports and jetties, creating a continuous need for high-performance sheet pile retaining structures capable of withstanding heavy loads and aggressive environments. Restraints primarily involve the inherent volatility of steel commodity prices, which can significantly skew project budgets and make long-term planning challenging for fixed-price contracts. Furthermore, the high capital cost of specialized installation equipment (vibratory hammers, silent hydraulic presses) and the need for highly skilled operators, especially in complex geotechnical environments, act as barriers to entry and limit operational efficiency gains, particularly in developing regions with less established construction specializations.

Opportunities are significant in the adoption of innovative piling methods, such as press-in piling technology (silent and vibration-free), which allows for efficient installation in densely populated urban areas where noise and vibration restrictions are stringent. Furthermore, the development of high-performance steel alloys and advanced protective coatings (e.g., duplex systems, cathodic protection) opens avenues for applications requiring lifespans exceeding 100 years, appealing to large-scale public infrastructure owners seeking minimal lifecycle costs. The impact forces are thus heavily weighted toward the drivers, particularly due to essential government and utility spending in resilience and transport, compelling the industry to overcome logistical and cost restraints through technological innovation and process optimization to meet the continually increasing global demand for reliable earth retention solutions in critical civil engineering applications.

Segmentation Analysis

The Steel Sheet Piling Market is comprehensively segmented based on product type, end-user industry, and the nature of the project (temporary vs. permanent), offering a nuanced view of demand patterns and strategic market focuses. Product segmentation delineates market consumption by the pile's cross-sectional profile, directly correlating with its primary structural function, be it retaining stability (Z-sections) or creating a waterproof barrier (U-sections or flat sections in combination). End-user segmentation reveals the concentration of demand across diverse construction domains, with marine and heavy civil infrastructure consuming the majority of material, reflecting the necessity of robust foundation solutions in these sectors. Geographic segmentation remains critical, demonstrating regional divergence based on the maturity of infrastructure, prevalence of maritime activity, and local geological challenges that necessitate specific piling solutions. Understanding these segmentations is paramount for manufacturers to tailor their production lines and marketing strategies to the highest growth and profitability areas within the global construction landscape, ensuring efficient resource allocation and maximizing market penetration across varied application demands.

- By Product Type:

- Z-Sections

- U-Sections

- Flat Sections

- Straight Web Sections

- By End-User:

- Ports and Harbors (Marine Structures)

- Inland Waterways and Bridges (Transportation Infrastructure)

- Flood and Coastal Protection (Environmental Resilience)

- Civil Works (Basements, Tunnels, Excavation Support)

- Dredging and Land Reclamation

- By Application:

- Temporary Structures (Cofferdams, Temporary Earth Retention)

- Permanent Structures (Seawalls, Quay Walls, Bridge Abutments)

- By Material Grade:

- Standard Carbon Steel

- High-Grade Steel Alloys

- Corrosion-Resistant Options

Value Chain Analysis For Steel Sheet Piling Market

The value chain for the Steel Sheet Piling Market begins with the highly capital-intensive upstream segment, dominated by major integrated steel producers responsible for processing iron ore into specific high-strength steel grades suitable for rolling. This stage involves sophisticated processes to ensure the metallurgical properties meet stringent international standards required for deep driving and high load-bearing capacity, particularly focusing on yield strength and weldability. Key activities here include raw material procurement, specialized steel melting, and the initial rolling of billets. Efficiency and cost control at this upstream stage are critical, as the volatile cost of raw materials directly dictates the manufacturing cost of the final sheet pile product, requiring long-term supply agreements and hedging strategies to stabilize pricing for downstream activities.

The midstream activities focus on the specialized fabrication and rolling process, where hot-rolled steel blanks are precisely formed into specific sheet pile profiles (Z, U, flat sections) using dedicated rolling mills equipped with specialized dies to create the interlocking clutch mechanism. This phase requires high technical expertise to ensure dimensional accuracy and clutch integrity, which is vital for forming watertight and structurally continuous walls during installation. Distribution channels play a critical role, involving a combination of direct sales from manufacturers to large-scale contractors for massive infrastructure projects, and sales through specialized, often regional, distributors who maintain extensive inventory and offer logistics services for smaller or immediate project needs. Indirect distribution, leveraging established construction supply houses, ensures market reach across diverse geographical areas, complementing direct engagement with primary engineering procurement construction (EPC) firms.

The downstream segment encompasses the highly specialized installation services, where heavy machinery and expert geotechnical knowledge are paramount. Installation is typically carried out by specialized piling contractors who own or lease high-end equipment like vibratory hammers, hydraulic presses, and piling rigs. This segment includes crucial activities such as site preparation, geotechnical consultation, structural design verification, actual pile driving, and subsequent removal (for temporary works) or capping/finishing (for permanent works). Potential customers, the end-users, interact heavily with this downstream service segment, seeking not just the product but an integrated, risk-managed solution for earth retention and foundation stability. The overall efficiency of the value chain relies heavily on minimizing logistics costs associated with transporting long, heavy steel sections to often remote construction sites and ensuring timely delivery to meet rigorous construction schedules.

Steel Sheet Piling Market Potential Customers

The primary end-users and buyers of steel sheet piling are large governmental agencies and high-tier engineering procurement and construction (EPC) firms managing expansive public works and private infrastructure development projects. These customers require materials that guarantee long-term structural integrity, often specifying particular steel grades and coating systems to meet design life criteria ranging from 50 to over 100 years. The decision-making process for these buyers is heavily influenced by total cost of ownership, including initial material cost, installation efficiency, and estimated maintenance expenses over the asset's lifecycle. Key sectors include national and regional port authorities responsible for expanding and maintaining maritime trade facilities, requiring thousands of tons of sheet piles for quay walls and container stacking areas, representing a consistent and high-volume demand stream.

Another major customer segment comprises civil engineering and heavy construction companies specializing in water management and transportation infrastructure, such as bridge construction, tunnel approaches, and riverbank stabilization projects. These customers utilize sheet piling extensively for temporary earth retention systems (cofferdams) that allow safe excavation below the water table or adjacent to existing structures, demanding speed, reusability, and guaranteed material strength to protect workers and ongoing construction assets. Additionally, urban developers requiring deep basements for high-rise buildings or underground transit systems are increasingly using sheet piling for perimeter support in complex, congested city environments, often necessitating noise- and vibration-controlled installation methods, influencing their supplier selection criteria towards those offering specialized equipment and services.

Lastly, governmental bodies and utility companies involved in flood control, environmental remediation, and coastal resilience projects form a critical segment of potential customers. Agencies responsible for coastline protection (e.g., Army Corps of Engineers, regional water boards) purchase sheet piling to construct permanent seawalls, flood barriers, and cutoff walls to prevent groundwater migration. For these critical public safety projects, reliability, traceability, and compliance with stringent environmental impact assessments are paramount considerations, driving demand for materials manufactured under tight quality control and offering documentation regarding environmental performance. Consequently, suppliers who offer full compliance documentation, technical support, and innovative coating solutions often secure these high-value, long-term contracts based on proven performance history and guaranteed product lifespan.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 5.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, ThyssenKrupp AG, JFE Steel Corporation, Nippon Steel Corporation, Piling Products Ltd., ESC Group, C.F. Hück & Söhne GmbH & Co. KG, PilePro, TWF Steel, Gerdau S.A., Nucor Corporation, Tata Steel, Skyline Steel, EVRAZ North America, Zekelman Industries, Meever & Meever, EMJ Metals, Shoreline Steel, TMK IPSCO, SSAB AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steel Sheet Piling Market Key Technology Landscape

The technology landscape in the Steel Sheet Piling Market is characterized by a dual focus: improving the physical characteristics of the piles themselves and enhancing the efficiency and environmental compliance of the installation process. In terms of materials, advancements center on developing high-strength, low-alloy (HSLA) steel grades that offer superior yield strength, allowing engineers to achieve the required structural performance with less material mass, thereby reducing both cost and environmental footprint. Furthermore, advanced corrosion protection technologies, including high-performance polymer coatings, hot-dip galvanization, and sophisticated duplex coating systems that combine galvanization with epoxy paints, are critical for extending the service life of permanent structures, especially in highly corrosive environments like seawater or polluted groundwater, ensuring long-term asset reliability and compliance with mandated infrastructure lifecycles.

Installation technology has seen significant evolution, particularly with the widespread adoption of press-in piling methods, often referred to as silent piling. This non-vibratory technique utilizes static weight and hydraulic force to push piles into the ground, offering immense advantages in densely built-up urban areas and near sensitive infrastructure where noise and vibration must be minimized. These technologies often integrate advanced monitoring systems that provide real-time data on driving forces, penetration rates, and geotechnical resistance, optimizing the installation process and verifying immediate structural capacity. Coupled with this is the refinement of traditional vibratory hammers, which are now often variable moment models, allowing operators to adjust eccentric weight and frequency to manage soil-specific vibration transmission, balancing speed with reduced environmental disturbance, which significantly boosts project timelines and overall operational flexibility on site.

Digital technologies, notably Building Information Modeling (BIM) and specialized structural analysis software, are transforming the design phase. BIM allows for the precise 3D modeling of the sheet pile wall interacting with surrounding subterranean utilities and structures, minimizing potential conflicts before construction begins. Advanced finite element analysis (FEA) software is now routinely used to model complex soil-structure interactions under various loading conditions, including seismic events and large hydrostatic pressures, ensuring optimal pile section selection and minimizing over-design. This computational approach guarantees structural safety while optimizing material use, representing a crucial shift from traditional empirical design methods to more reliable, data-driven engineering solutions that are integral to complex, large-scale civil projects where risk mitigation and cost efficiency are paramount concerns for owners and engineers alike.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and the fastest-growing region, driven by unparalleled levels of urbanization and massive government investment in infrastructure expansion, including ports, bridges, and extensive flood control projects in coastal areas. Countries like China, India, Vietnam, and Indonesia are undertaking continuous, large-scale maritime and industrial zone developments that require extensive earth retention and foundation solutions, ensuring sustained high demand for sheet piling materials and associated services.

- Europe: Europe is characterized by stringent environmental regulations and a focus on maintaining and upgrading aging infrastructure, particularly along historic waterways and ports. Demand is strong for specialized, low-vibration installation technologies (silent piling) due to high population density, coupled with consistent requirements for permanent corrosion protection in rehabilitation projects.

- North America: Demand is stable and substantial, primarily fueled by massive federal and state initiatives aimed at replacing and modernizing decaying infrastructure, including extensive work on inland navigation locks, dams, and deep foundation projects in metropolitan areas. The market often favors high-performance Z-sections and specialized coatings to meet stringent structural and longevity requirements mandated by governmental bodies such as the US Army Corps of Engineers.

- Middle East and Africa (MEA): This region is experiencing high growth driven by ambitious mega-projects, including new city developments, artificial islands, and significant expansion of oil and gas export terminals. Demand here is characterized by the need for large quantities of sheet piling in land reclamation and marine structure foundations, often in challenging saline and high-temperature environments, pushing requirements for advanced steel grades and robust protection systems.

- Latin America: Market growth is moderate but consistent, tied to investments in commodity export infrastructure, particularly port expansions necessary to handle increased volumes of agricultural and mineral exports. Political and economic stability fluctuations can impact major project timelines, but underlying long-term demand related to national road networks and coastal defenses remains a fundamental market driver across key economies like Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steel Sheet Piling Market.- ArcelorMittal

- ThyssenKrupp AG

- JFE Steel Corporation

- Nippon Steel Corporation

- ESC Group

- Piling Products Ltd.

- C.F. Hück & Söhne GmbH & Co. KG

- Skyline Steel

- Gerdau S.A.

- Nucor Corporation

- Tata Steel

- PilePro

- TWF Steel

- EVRAZ North America

- Zekelman Industries

- Meever & Meever

- EMJ Metals

- Shoreline Steel

- TMK IPSCO

- SSAB AB

Frequently Asked Questions

Analyze common user questions about the Steel Sheet Piling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Steel Sheet Piling Market?

The primary factor driving market growth is the massive global investment in infrastructure modernization, particularly critical coastal defense projects needed for climate change resilience and the expansion of international port facilities to support global trade volumes.

Which steel sheet pile section type is most commonly used for permanent retaining walls?

Z-sections are the most commonly specified product type for permanent retaining structures due to their high section modulus and superior strength-to-weight ratio, which efficiently manages high lateral earth and hydrostatic pressures.

How does the volatility of steel prices affect the market?

Volatile raw steel prices act as a significant restraint, increasing material costs and creating financial uncertainty for construction contractors, often necessitating risk management strategies such as hedging and establishing contingency budgets for large-scale projects.

What technological innovations are impacting the installation process?

Key innovations include the increased use of press-in or silent piling technology, which minimizes noise and vibration, making it essential for urban construction, alongside the integration of digital monitoring systems for real-time installation optimization and quality assurance.

Which region holds the largest market share for steel sheet piling?

The Asia Pacific (APAC) region currently holds the largest market share, fueled by extensive government spending on urbanization, transportation networks, and coastal protection projects across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager