Step Stools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431383 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Step Stools Market Size

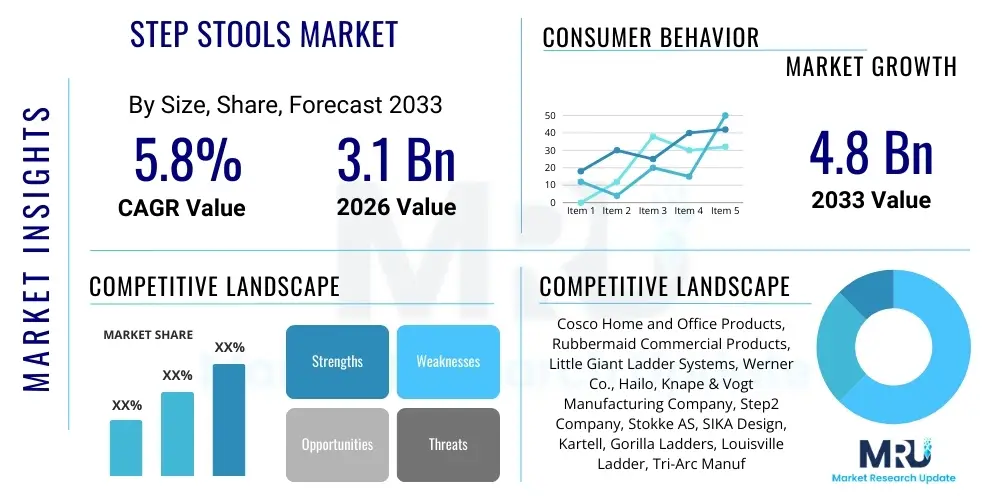

The Step Stools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Step Stools Market introduction

The Step Stools Market encompasses the global supply chain dedicated to the manufacturing, distribution, and retail of small, portable elevation aids designed for safe temporary access to heights moderately above average arm's reach. These essential utility products serve critical safety and accessibility functions across residential, commercial, and industrial settings globally. Products vary significantly based on material composition, including durable plastics, lightweight aluminum alloys, structural steel, and traditional hardwoods, each tailored to meet specific requirements regarding load capacity, resistance to environmental factors, and ergonomic portability. The fundamental necessity of these devices for reaching vertical storage or performing elevated domestic tasks ensures a perpetual and resilient baseline demand globally, which is further amplified by demographic shifts, increasing focus on vertical storage maximization, and stricter adherence to occupational safety standards in commercial environments.

Product diversity is a hallmark of this market, extending beyond basic one or two-step configurations to include highly engineered multi-functional models featuring integrated tool storage compartments, sophisticated folding technology for minimal storage footprint, and specialized non-marking feet suitable for sensitive flooring. Major applications are concentrated in the home environment, particularly kitchens, closets, and bathrooms, where safe access for children and older adults is paramount, adhering strictly to domestic safety standards enforced by regional consumer protection agencies. Furthermore, in commercial environments such as retail stockrooms, high-shelf access in libraries, and hospital maintenance areas, step stools must meet rigorous institutional procurement standards relating to industrial load ratings and essential sanitation capabilities, driving demand for specialized, certified products.

Key drivers underpinning the market’s positive outlook include the global shift towards maximizing vertical storage efficiency in shrinking urban living spaces, thereby increasing the daily reliance on safe access aids. Furthermore, the persistent growth in the geriatric population worldwide mandates safer home environments, positioning stable step stools as essential tools for maintaining independence in daily living activities, significantly reducing the risk of household falls. Regulatory mandates, particularly in developed economies, requiring certified equipment for occupational use, also significantly boost the commercial and industrial segments. Competition centers intensely on achieving the optimal balance between affordability, durability, certified load capacity, and seamless aesthetic design integration, leveraging material science advancements and patented mechanical features for market differentiation.

Step Stools Market Executive Summary

The Step Stools Market exhibits robust global business trends anchored by rising residential modernization and increasing automation in warehouse logistics, requiring specialized equipment for inventory management. The shift towards lightweight, durable materials like reinforced plastic and aerospace-grade aluminum is a prominent manufacturing trend, aimed at maximizing portability while maintaining high load capacities. Furthermore, the market is seeing consolidation among major players who are leveraging e-commerce platforms and sophisticated digital marketing strategies to reach fragmented consumer bases, particularly in developed economies. Sustainability is also becoming a key concern, driving demand for eco-friendly and sustainably sourced wood or recycled plastic step stools, aligning the industry with broader corporate social responsibility goals and consumer preference for green products.

Regionally, North America and Europe maintain dominance due to high disposable income, stringent safety regulations (ANSI, EN), and mature retail infrastructure, driving demand for premium, multi-functional step stools characterized by advanced locking mechanisms and ergonomic designs. However, the Asia Pacific region (APAC) is projected to experience the highest growth rate, fueled by rapid urbanization, increasing middle-class income, burgeoning construction activity, and the large-scale establishment of organized retail and e-commerce fulfillment centers. Emerging economies are prioritizing basic, durable, and cost-effective plastic and steel models to meet mass market volume, while developed regions focus intensely on aesthetic integration and technologically advanced safety solutions.

Segmentation trends indicate a strong consumer preference for the folding/collapsible segment owing to space constraints in modern housing and office environments, driving innovation in compact and thin storage designs. Material-wise, plastic step stools command the largest volume share due to cost-effectiveness and versatility, but aluminum and heavy-duty steel segments are growing rapidly in commercial and industrial applications due to superior strength-to-weight ratio and compliance with rigorous load-bearing certifications. The residential end-user segment remains the largest revenue generator, although the industrial/commercial segment is accelerating due to heightened corporate safety protocols, mandatory compliance, and continuous expansion in logistics and large-format retail sectors globally.

AI Impact Analysis on Step Stools Market

The intersection of AI and the Step Stools Market, while seemingly disparate, is profoundly affecting the operational efficiency, design optimization, and market forecasting aspects of the industry. Common user inquiries frequently explore the integration of AI-driven robotics in handling complex assembly tasks, such as attaching anti-slip grips or intricate folding hinges, ensuring superior product consistency and significantly reducing failure rates compared to manual labor. Users are keenly interested in how machine learning algorithms can analyze vast datasets of consumer feedback, accident reports, and structural load testing results to iteratively improve next-generation product designs, enhancing overall user safety and longevity. This predictive analysis moves product development from traditional trial-and-error to data-backed, structural optimization, ensuring materials are used efficiently and safely.

Furthermore, AI is instrumental in streamlining the supply chain, a critical function in a high-volume, low-margin market. Generative Engine Optimization (GEO) in manufacturing uses AI to simulate thousands of material configurations and stress points, identifying the most efficient use of raw materials—whether plastics, aluminum, or wood—to meet specific weight capacities at the lowest cost, improving sustainability. On the demand side, AI-powered demand forecasting integrates data from seasonal retail spikes, regional housing starts, and localized e-commerce trends to predict SKU demand with high precision. This minimizes stockouts during peak shopping periods and reduces the substantial costs associated with inventory holding and obsolescence, dramatically improving overall business profitability in a highly competitive sector.

Finally, AI influences marketing and customer engagement. Online retailers leverage AI to interpret consumer purchase patterns, matching specific step stool characteristics (e.g., aesthetics, portability, step height, folding mechanism) to individual user needs, enhancing conversion rates and customer satisfaction. While the product itself is physical and non-digital, its route to market, its engineering pedigree, and its commercial success are increasingly reliant on robust data processing and algorithmic optimization. This technological sophistication hidden beneath a simple household item allows manufacturers to maintain high safety standards while aggressively controlling manufacturing and distribution costs, ultimately benefiting the consumer through better value proposition.

- AI-enabled computer vision systems used in quality control to instantaneously detect microscopic flaws in welds or plastic injection points, ensuring zero-defect products and certified structural integrity.

- Predictive maintenance analytics applied to manufacturing equipment, minimizing unexpected downtime and ensuring the consistent, high-tolerance output of components required for complex step stool assemblies.

- Utilization of machine learning for optimized material cutting (e.g., wood or aluminum tubing) to maximize yield and reduce scrap waste, thereby improving sustainability metrics and reducing raw material expenditure.

- AI algorithms refining e-commerce search results and product categorization for step stools based on inferred user intent (e.g., prioritizing anti-slip features and safety ratings for searches related to 'kitchen access for elderly').

- Integration of robotics in the assembly of folding mechanisms, improving component fitting precision and reducing the manual labor and margin of error involved in handling complex, high-tolerance components.

- AI-driven analysis of regional climate data informing material selection to ensure resistance to specific environmental factors like humidity or extreme temperature fluctuations (e.g., rust prevention).

DRO & Impact Forces Of Step Stools Market

The Step Stools Market is shaped by powerful Drivers and significant opportunities, counterbalanced by persistent Restraints, collectively defining the Impact Forces that govern market growth trajectories. A primary Driver is the compelling need for domestic safety enhancement, driven by rising health awareness and preventative measures against household injuries, particularly among the rapidly growing demographic of older adults and households with young children. This is structurally supported by the continuous need for reaching elevated surfaces in modern storage-intensive homes and commercial facilities. The concurrent global expansion of sophisticated logistics and warehousing operations, demanding standardized and highly certified access equipment for staff safety and efficiency, provides a robust, secular growth stimulant for the heavy-duty industrial segment of the market.

Restraints primarily revolve around the inherent challenge of product differentiation in a largely commodity market, leading to aggressive pricing strategies and intense competition, especially in mass-market segments dominated by plastic models from unorganized players in Asia. The extended product lifecycle—where a durable, high-quality step stool might not require replacement for decades—also places a continuous damper on cyclical market growth, compelling manufacturers to focus on capturing first-time buyers or those undergoing major home renovations. Furthermore, raw material price volatility, particularly for petroleum-based plastics and aluminum, poses a persistent threat to profit margins, forcing companies to adopt strategic sourcing and efficient production methodologies to absorb fluctuating global commodity costs.

Opportunities for expansion are centered on specialization, sustainability, and geographical penetration. The market stands to benefit significantly from developing highly specialized ergonomic stools targeting niche occupational fields, such as non-magnetic composite stools for MRI environments in the medical sector or highly durable, non-conductive fiberglass steps for electrical maintenance and utilities. Geographically, the massive, untapped consumer base in rapidly urbanizing regions of Asia, Africa, and Latin America offers extensive volume growth potential, contingent on establishing efficient local manufacturing and distribution networks capable of delivering compliant products at regionally competitive prices. Furthermore, developing step stools integrated with sustainable and recycled materials represents a high-impact opportunity to meet evolving consumer expectations and achieve environmental market leadership.

Segmentation Analysis

The complex structure of the Step Stools Market necessitates granular segmentation based on functional attributes, material composition, and intended operational environment to accurately gauge demand and competitive standing. Segmentation allows stakeholders to target specific niche markets, optimizing product portfolios to align with regional consumer behaviors and procurement mandates. Material segmentation is foundational, influencing everything from cost and portability to maximum load capacity and environmental footprint. Plastic stools appeal to budget-conscious and residential users seeking lightweight utility and ease of cleaning, while metal stools (aluminum and steel) are essential for commercial and industrial users where high certification standards, extreme durability, and compliance with rigorous load tests are non-negotiable requirements, demonstrating a fundamental divergence in required product attributes.

The classification by type, particularly separating folding/collapsible models from fixed structures, reflects core consumer needs for storage efficiency in modern, space-constrained settings. Folding stools are market drivers in urban environments and multi-functional workspaces, emphasizing proprietary mechanisms that are safe, quick to deploy, and minimize thickness when stored. Conversely, fixed step stools, often built from heavy-gauge steel or highly stable wood, are preferred in highly stable environments like institutional libraries, hospitals, or manufacturing floor access points where permanent stability, high weight bearing, and robust design are prioritized over mobility. Multi-functional stools, which blur the line between utility seating and climbing aid, represent a high-growth hybrid category targeting modern, adaptable living spaces, often integrating storage or aesthetic design elements.

End-user analysis further defines the market landscape, distinguishing the high-volume, highly fragmented residential sales from the consolidated, specification-driven procurement in the industrial and commercial segments. Residential purchasing is influenced heavily by aesthetic trends, retail visibility, and brand trustworthiness related to safety, whereas commercial and industrial purchases are dictated by B2B relationships, adherence to strict safety compliance audits (such as conformance to regional occupational safety standards), and total cost of ownership (TCO) based on expected lifespan and minimal maintenance requirements. Understanding the unique logistical requirements of each distribution channel—from direct e-commerce fulfillment requiring compact packaging to bulk industrial supply contracts demanding palletized delivery—is crucial for maximizing global market penetration and optimizing inventory flow across disparate geographic regions, ensuring the right product reaches the right consumer channel efficiently.

- By Material: Plastic (Polypropylene, High-Density Polyethylene, often recycled), Metal (Aluminum Alloys, Structural Steel, Stainless Steel), Wood (Hardwood, Engineered Wood, bamboo), Fiber/Composite Materials (e.g., fiberglass reinforced plastic for non-conductivity).

- By Type: Folding/Collapsible Step Stools (Single-fold, Multi-hinge, Telescopic), Fixed/Standard Step Stools (Non-folding platforms, permanent fixtures), Multi-functional Step Stools (Stool-chairs, Storage integrated, wheeled kick stools).

- By Step Count: One-Step Stools (Low profile aids, common in bathrooms), Two-Step Stools (The most common residential and utility model), Three-Step Stools (Intermediate height access, often foldable), Multi-Step Ladders/Stools (Heavy-duty industrial steps, usually platforms).

- By Load Capacity: Light Duty (Residential use, typically up to 200 lbs/90 kg), Medium Duty (Commercial use, 200-300 lbs/90-136 kg), Heavy Duty/Industrial Grade (Industrial use, 300 lbs and above, certified to ANSI Type IA/IAA or EN 131 standards).

- By End-User: Residential (Kitchen, Bathroom, Closet, Garage, Home Office/Library), Commercial (Office Spaces, Libraries, Retail Stockrooms, Hospitality, Fitness Centers), Industrial (Warehouse, Logistics Centers, Manufacturing Facilities, Healthcare Institutions, Aviation Maintenance).

- By Distribution Channel: Online Retail (E-commerce platforms, Direct-to-Consumer via manufacturer websites), Hypermarkets/Supermarkets (Mass Retailers offering high volume), Specialty Stores (Home Improvement Stores, Hardware Stores), Direct Sales/Industrial Suppliers (B2B specialized procurement channels).

Value Chain Analysis For Step Stools Market

The Step Stools market value chain is initiated by rigorous Upstream activities focused on securing high-quality, cost-effective raw materials. For metal step stools, this involves global sourcing of precision-extruded aluminum profiles and high-gauge steel tubing, where suppliers' adherence to critical material strength specifications, dimensional accuracy, and corrosion resistance treatments is vital for achieving final safety certification. For plastic models, the procurement of specific polymer grades (e.g., high-impact resistant, often involving recycled content) dictates the final product's rigidity, load limit, and compliance with non-toxic material regulations. Upstream excellence is characterized by managing complex international logistics and leveraging economies of scale in material procurement to strategically mitigate the volatile impact of global commodity price fluctuations, which frequently compress the slender margins typical in this price-sensitive industry.

The Midstream phase centers on sophisticated manufacturing and assembly processes. This stage involves complex activities such as tool and die creation for high-precision plastic injection molding, specialized robotic welding for metal frames, and advanced wood joining techniques utilizing engineered components. Differentiation often occurs here through proprietary mechanical engineering, especially concerning the development and refinement of folding hinge design, safe locking mechanisms, and the integrated application of certified anti-slip components. Manufacturers must invest heavily in automated quality assurance systems, often utilizing robotics and non-destructive sensor technology, to ensure every finished unit adheres rigorously to stringent international safety standards (e.g., structural load testing, stability parameters) before final packaging. Efficient inventory management of finished goods, optimizing storage based on size, seasonality, and regional demand volatility, is also critical at this operational core.

Downstream activities involve effective distribution, strategic marketing, and final sales channels, culminating in the delivery to the end-user. The distribution network is complex and multi-faceted, integrating Direct (industrial contracts, large facility installations requiring custom or bulk orders) and Indirect channels (retail). Indirect distribution overwhelmingly dominates the residential segment, relying heavily on hypermarkets (due to their bulk purchasing power and broad physical reach) and the explosive growth of Online Retail, which specifically demands robust, secure, and compact packaging suitable for individual shipment via parcel carriers. Effective marketing in the downstream segment focuses heavily on AEO and GEO strategies, emphasizing transparent safety ratings, positive consumer reviews, and clear visual demonstrations of unique features like one-touch folding or certified heavy-duty capacity, ensuring products are highly discoverable and competitive across varied global marketplaces.

Step Stools Market Potential Customers

The customer base for step stools is segmented into three broad, influential categories: Residential, Commercial, and Industrial, each with distinct purchasing motivations, product requirements, and channel preferences. The Residential segment represents the largest volume market, driven fundamentally by household access needs and family demographics. This segment includes young families who require stable, low-height stools for toddlers to achieve independence (e.g., reaching sinks, assisting with toilet training), older adults who critically need robust, stable aids to mitigate fall risks when accessing high cabinets, and general homeowners engaged in routine high-shelf maintenance or home organization projects. Residential customers are heavily influenced by competitive retail price points, aesthetic compatibility with home décor, verifiable safety features, and ease of storage, making recognizable brand reputation and optimal retail placement key conversion factors.

Commercial customers constitute institutions and businesses where step stools are necessary utility items for staff efficiency and inventory management. This category includes large retail stores (for high-volume inventory stocking and display setup), academic libraries (for stack access), educational institutions, and traditional office environments. Procurement for these entities emphasizes long-term durability, ease of sanitation (a critical requirement in healthcare and food service settings), and the ability to source large volumes at competitive, fixed bulk pricing. The key characteristic of commercial procurement is the preference for standardized, reliable models that can be easily replaced, maintained, and deployed across multiple enterprise locations, typically favoring high-quality, medium-duty plastic or robust steel designs that offer consistent, compliant performance.

The Industrial segment demands the most specialized and high-specification products, characterized by requirements for extreme durability, maximum load capacity, and rigorous compliance with strict occupational health and safety regulations, such as OSHA or regional equivalents. Key industrial end-users include third-party logistics (3PL) providers, dedicated corporate warehouses, complex manufacturing assembly lines, and specialized maintenance sectors (e.g., aerospace, heavy machinery repair). These customers require heavy-duty metal (often specialized aluminum for lightweight strength or heavy-gauge steel for maximum load), multi-step platforms with integrated anti-fatigue mats, sometimes safety railings, and features that actively prevent accidental collapse under high operational stress. Purchasing decisions are based solely on certified performance, quantifiable total cost of ownership (TCO), and supplier reliability for consistent, compliant industrial equipment designed for continuous, harsh use environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cosco Home and Office Products, Rubbermaid Commercial Products, Little Giant Ladder Systems, Werner Co., Hailo, Knape & Vogt Manufacturing Company, Step2 Company, Stokke AS, SIKA Design, Kartell, Gorilla Ladders, Louisville Ladder, Tri-Arc Manufacturing, Zhejiang Kangqian Industry & Trade Co., Ltd., Zarges GmbH, Foppapedretti S.p.A., Telesteps, Hasegawa Kogyo Co., Ltd., Alera, Safco Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Step Stools Market Key Technology Landscape

The Step Stools Market, despite its seemingly simple construct, is deeply reliant on advanced material science and precision mechanical engineering to ensure compliance with global safety benchmarks and consumer expectations for longevity and utility. A central technological focus lies in the development of lightweight, high-strength composite materials and specialized aluminum alloys, often derived from aerospace engineering, which allows manufacturers to produce step stools that are significantly lighter than traditional steel but maintain or exceed rigorous industrial load ratings. This focus on optimizing the strength-to-weight ratio is crucial for enhancing user portability while simultaneously minimizing the risk of structural failure under maximum certified load. Furthermore, the use of sophisticated Computer-Aided Design (CAD) and Finite Element Analysis (FEA) software allows engineers to simulate thousands of real-world stress and strain scenarios, optimizing structural geometry to eliminate latent weak points and ensuring full compliance with demanding American National Standards Institute (ANSI) and European Norm (EN) standards before any physical prototyping commences, substantially reducing time-to-market for complex models.

A second pivotal area is the proprietary technology embedded within advanced folding mechanisms and safety locking systems. Modern collapsible step stools utilize highly engineered spring-loaded, gravity-assisted, or hydraulic mechanisms that ensure deployment is intuitive, requiring minimal physical effort, and crucially, that the locking mechanism is automatic and fail-safe upon full extension. Patented visual and auditory indicators, such as clearly marked ‘click-to-lock’ features, are essential safety technologies that prevent accidental use of partially deployed stools, significantly reducing the risk of collapse-related injuries, which are major liability concerns for manufacturers. Manufacturers continuously invest heavily in securing these specific mechanical patents, as they represent a core competitive differentiator and a fundamental reassurance of superior product quality and safety to both consumers and corporate procurement officers.

Finally, surface contact technology and anti-slip innovation form the third indispensable technological pillar. This includes the strategic formulation of specialized, highly durable Thermoplastic Elastomer (TPE) compounds used for foot caps and step treads, designed to provide maximum coefficient of friction and superior traction across diverse, potentially slippery flooring types (e.g., wet tile, polished concrete, industrial grating) without leaving unsightly marks or scuffing delicate surfaces. Furthermore, some high-end industrial models incorporate sensor technology, such as integrated pressure mats or radio-frequency identification (RFID) tags, which communicate stability status, load proximity, or inventory location to a central safety and asset management system, effectively integrating the step stool into a larger framework of occupational safety infrastructure. This continuous refinement in stability, material science, and safety technologies is key to maintaining market viability against increasingly stringent legal liability standards globally and differentiating premium products from low-cost alternatives.

Regional Highlights

- North America: North America, particularly the United States, commands a significant revenue share in the Step Stools Market, driven by high consumer purchasing power, extensive home ownership, and a strong regulatory framework enforced by bodies like OSHA for commercial equipment and CPSC for consumer products. The market here favors robust, multi-step aluminum and fiberglass stools, often demanded by the thriving DIY, construction, and large retail sectors. Manufacturers strategically focus on premium features, extended warranties, and certified high load capacities (ANSI ratings) to justify higher average selling prices. E-commerce penetration is exceptionally high, requiring manufacturers to maintain strong logistical partnerships for efficient, safety-compliant last-mile delivery directly to consumers and businesses.

- Europe: The European market is characterized by a high degree of segmentation based on material preference, with a noticeable aesthetic divergence between regions. Western European countries exhibit strong demand for highly stylized designer wooden and functional plastic step stools that integrate seamlessly as utility items and auxiliary furniture pieces (a strong influence from Scandinavian design). Compliance with the stringent CE marking and EN safety standards is mandatory across all segments, prioritizing certified non-toxic materials, mechanical reliability, and environmental sustainability. Eastern Europe is experiencing accelerating growth driven by infrastructure investment and rising commercial safety awareness, favoring slightly more cost-effective, high-volume steel and plastic solutions for rapidly professionalizing industrial procurement sectors.

- Asia Pacific (APAC): The APAC region is poised for explosive growth, fueled by crucial demographic shifts—namely, massive urbanization leading to smaller living spaces requiring folding stools—and unparalleled expansion in the logistics and manufacturing sectors. China and India are the pivotal volume markets, where local manufacturers dominate with affordable plastic and steel residential models. However, the rapidly professionalizing logistics sector, supported by global trade and e-commerce giants, is increasingly demanding high-quality, certified industrial-grade aluminum steps and platforms to enhance employee safety and operational efficiency within burgeoning regional fulfillment centers, marking a significant premiumization trend in B2B sales.

- Latin America (LATAM): Market expansion in LATAM is closely linked to macro-economic stability and the steady development of organized retail chains and industrial infrastructure. Brazil and Mexico are the largest contributors, where consumers prioritize value for money and basic utility. There is a noticeable split between high-cost, imported, highly certified products utilized by multinational commercial operations and lower-cost, locally produced plastic items serving the mass residential market. The primary challenge in this region remains establishing consistent, reliable distribution networks capable of efficiently reaching diverse geographical areas while navigating complex import regulations.

- Middle East and Africa (MEA): Growth in the MEA region is often episodic and concentrated, largely spurred by massive governmental investment in commercial construction, hospitality, and retail infrastructure in the GCC countries (Saudi Arabia, UAE, Qatar). These large-scale projects drive intense, specific demand for heavy-duty, internationally certified industrial access equipment designed to withstand hot, arid environments. African markets are highly fragmented, showing slower overall adoption rates, but offer significant untapped potential for basic utility plastic step stools as household disposable incomes gradually increase and modern retail penetration improves across major urban and coastal centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Step Stools Market.- Cosco Home and Office Products

- Rubbermaid Commercial Products

- Little Giant Ladder Systems

- Werner Co.

- Hailo

- Knape & Vogt Manufacturing Company

- Step2 Company

- Stokke AS

- SIKA Design

- Kartell

- Gorilla Ladders

- Louisville Ladder

- Tri-Arc Manufacturing

- Zhejiang Kangqian Industry & Trade Co., Ltd.

- Zarges GmbH

- Foppapedretti S.p.A.

- Telesteps

- Hasegawa Kogyo Co., Ltd.

- Alera

- Safco Products

Frequently Asked Questions

Analyze common user questions about the Step Stools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Step Stools Market?

The Step Stools Market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period spanning 2026 to 2033, driven primarily by favorable demographic shifts, including the aging population, and improved occupational safety regulations globally.

Which material segment currently dominates the Step Stools Market?

The plastic segment currently dominates the market by volume due to its cost-effectiveness, lightweight nature, and versatility in design, making it highly popular in high-volume residential and light commercial utility applications worldwide.

What are the primary factors driving the demand for step stools?

Key drivers include the global increase in the aging population requiring mobility aids, stringent occupational safety mandates in commercial sectors (e.g., warehouses), and rising consumer focus on domestic safety, particularly for accessing vertical storage in urban homes.

How is the industrial segment influencing market expansion?

The industrial segment, encompassing warehousing and logistics, is rapidly driving demand for specialized, heavy-duty metal step stools and certified work platforms that comply with high ANSI/OSHA safety standards, requiring superior load capacity and extended operational durability for continuous, rigorous use.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate due to fast-paced urbanization, rapidly expanding organized retail chains and e-commerce infrastructure, and increasing middle-class disposable incomes across major economies like China and India.

What technological innovations are defining modern step stool design?

Modern step stool design is defined by proprietary safety locking mechanisms (e.g., certified click-to-lock systems), the utilization of advanced lightweight aluminum alloys, specialized anti-slip Thermoplastic Elastomer (TPE) compounds for superior floor traction, and precision engineering for structural integrity.

What role does sustainability play in product development?

Sustainability is becoming a critical differentiating factor, driving manufacturers to increasingly utilize recycled plastics, sustainably sourced woods, and optimize material efficiency through AI-driven design processes, targeting environmentally conscious consumers and achieving corporate green mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager