Sterile Endotracheal Tube Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431629 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sterile Endotracheal Tube Market Size

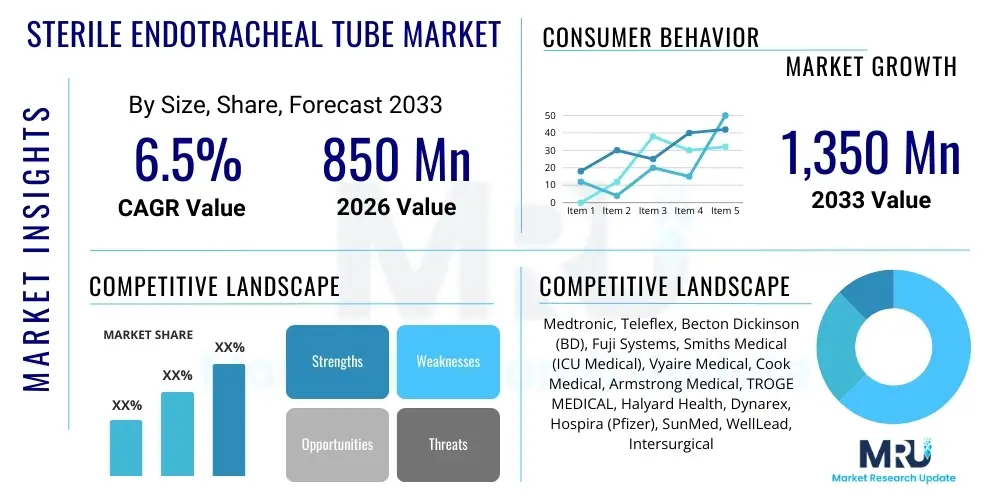

The Sterile Endotracheal Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Sterile Endotracheal Tube Market introduction

The Sterile Endotracheal Tube (ETT) Market encompasses the sales and distribution of single-use medical devices essential for airway management during surgical procedures, critical care interventions, and emergency medical settings. These tubes are meticulously sterilized to prevent healthcare-associated infections (HAIs), particularly ventilator-associated pneumonia (VAP), representing a significant advancement over reusable or non-sterile alternatives. The primary product function is to maintain a patent airway and ensure adequate ventilation and oxygenation for patients requiring mechanical support. The demand for these sterile devices is intrinsically linked to the rising volume of complex surgeries, the increasing prevalence of chronic respiratory diseases, and stringent global infection control protocols mandated by health organizations. The market focuses heavily on innovation related to cuff design, material biocompatibility, and integration of features that minimize tracheal injury and facilitate successful intubation.

Sterile ETTs are typically manufactured from high-grade materials like Polyvinyl Chloride (PVC) or silicone, offering flexibility and structural integrity. Key applications include general anesthesia, intensive care unit (ICU) ventilation support, and emergency rescue operations. The fundamental benefit of using pre-sterilized tubes is the elimination of cross-contamination risk, leading to superior patient safety outcomes and reducing the economic burden associated with treating secondary infections. The driving factors behind market expansion are multifaceted, including demographic shifts leading to a larger geriatric population susceptible to respiratory illnesses, technological advancements in material science such as tubes with antimicrobial coatings or built-in suction lumens, and the continuous global emphasis on optimizing operational efficiency and sterility assurance in hospital environments. Furthermore, regulatory bodies in developed regions are increasingly favoring single-use sterile devices over reusable counterparts to maintain the highest standards of patient care.

The product portfolio within this market includes specialized tubes such as reinforced ETTs for neurosurgical procedures, pre-formed tubes for oral and nasal applications, and tubes designed specifically for pediatric and neonatal patients, reflecting the necessity for precise sizing and material safety across all age groups. Manufacturers are focusing on developing products that incorporate features like subglottic secretion drainage capabilities, which are clinically proven to reduce the incidence of VAP. The complexity of modern medical procedures often requires specialized airway tools, bolstering the demand for innovative, sterile solutions that can adapt to challenging patient anatomies or prolonged intubation periods. This constant need for enhanced safety, combined with the expanding global healthcare infrastructure, solidifies the market's robust growth trajectory over the forecast period.

Sterile Endotracheal Tube Market Executive Summary

The Sterile Endotracheal Tube Market demonstrates resilient business trends driven primarily by the acute focus on patient safety and infection prevention in post-pandemic healthcare settings. Key business developments involve consolidation among major players to achieve economies of scale and significant investment in automated sterilization and packaging technologies to ensure product integrity and high-volume output. There is a discernible trend toward the adoption of sophisticated cuff pressure management systems integrated within the ETT setup to prevent both tracheal injury from over-inflation and leakage from under-inflation. Furthermore, sustainability is emerging as a critical trend, prompting research into bio-based or more easily recyclable materials for single-use devices, balancing sterility requirements with environmental responsibility. The market is competitive, characterized by frequent product launches featuring enhanced safety features, such as tubes with visual indicators for correct placement and radio-opaque lines for imaging verification.

Regionally, North America maintains the dominant market share due to its established healthcare infrastructure, high per capita healthcare spending, widespread adoption of advanced respiratory care technologies, and strict adherence to infection control guidelines. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapidly expanding medical tourism, increasing government initiatives to modernize public health systems, and the vast, untapped patient pool requiring surgical and critical care. Countries like China and India are witnessing significant investments in new hospitals and critical care units, directly translating into higher consumption of sterile airway management tools. European growth remains stable, anchored by established reimbursement policies and continuous integration of high-standard medical devices, though regulatory harmonization efforts within the EU may streamline market entry for innovative products.

Segmentation trends indicate that the Cuffed Endotracheal Tube segment holds the largest market share owing to its necessity in general anesthesia and prolonged ventilation, where preventing aspiration is paramount. However, the specialized segments, particularly those focusing on neonatal/pediatric tubes and tubes with integrated subglottic secretion drainage (SSD) systems, are experiencing accelerated growth due to clinical evidence highlighting their utility in reducing VAP incidence. Hospitals remain the largest end-user segment due to their high volume of surgeries and critical care admissions. Conversely, Ambulatory Surgical Centers (ASCs) represent a high-growth end-user segment as simple surgical procedures increasingly shift out of traditional hospital settings, driving demand for cost-effective, sterile, single-use airway management products suitable for rapid turnover environments. Material science segmentation sees PVC dominating due to cost and flexibility, but silicone is gaining traction in niche applications requiring enhanced biocompatibility for long-term intubation.

AI Impact Analysis on Sterile Endotracheal Tube Market

Common user questions regarding AI's impact on the Sterile Endotracheal Tube Market revolve primarily around improving intubation accuracy, enhancing patient safety during ventilation, and optimizing supply chain logistics for sterile products. Users are keen to know if AI can predict difficult airways more reliably than traditional scoring systems, thereby ensuring the selection of the correct tube size and type on the first attempt. Another major concern focuses on using AI for real-time monitoring of ventilation parameters and ETT positioning, reducing risks like accidental extubation or ventilator-associated complications. Furthermore, users inquire about AI's role in inventory management, ensuring the timely and sterile supply of these critical, single-use devices, especially in high-demand environments like ICUs or during pandemics. The overarching themes reflect a desire for AI to increase procedural success rates, minimize complications associated with mechanical ventilation, and improve the operational efficiency of sterile supply chains.

- AI-Powered Pre-Procedural Risk Assessment: Utilization of machine learning algorithms to analyze patient radiological images and electronic health records (EHR) to predict difficult intubation scenarios, aiding anesthesiologists in selecting optimal sterile tube geometry and size, thus reducing procedural time and failure rates.

- Real-Time Position and Depth Monitoring: Integration of AI with imaging and continuous physiological monitoring systems to track the sterile ETT tip position in real-time, issuing immediate alerts if displacement occurs, which is crucial for preventing critical errors and subsequent complications.

- Optimized Cuff Pressure Management: AI systems analyzing respiratory mechanics (compliance, resistance) and blood pressure fluctuations to dynamically adjust cuff pressure of the sterile ETT, minimizing tracheal wall damage while ensuring adequate sealing against aspiration.

- Demand Forecasting and Supply Chain Optimization: Applying predictive analytics to forecast the consumption of specific sterile ETT variants (e.g., pediatric, reinforced, SSD tubes) based on surgical schedules and ICU admission rates, ensuring zero stock-outs and reducing excess inventory waste across hospital networks.

- Enhanced Training and Simulation: AI-driven high-fidelity simulation platforms providing objective feedback on intubation technique using sterile equipment, improving the skill acquisition curve for medical residents and reducing patient risk during live procedures.

- Predictive Maintenance for Ventilators: While not directly on the tube, AI improving the reliability of the connected ventilation system, ensuring the sterile ETT functions within a perfectly calibrated, safe environment.

- Automated Quality Control in Manufacturing: AI-vision systems used during the sterilization and packaging phase of ETT production to detect microscopic defects or packaging breaches, guaranteeing the integrity of the sterile barrier before distribution.

DRO & Impact Forces Of Sterile Endotracheal Tube Market

The Sterile Endotracheal Tube Market is powerfully influenced by regulatory mandates emphasizing infection control and the continuous expansion of global surgical volumes. The primary drivers include the escalating global prevalence of chronic respiratory disorders, such as Chronic Obstructive Pulmonary Disease (COPD) and asthma, which necessitate intubation during acute exacerbations, alongside the increasing number of invasive procedures across diverse medical specialties. Furthermore, the mandatory adoption of single-use, sterile devices to mitigate the risk of cross-contamination, especially VAP, acts as a significant market propellant. However, the market faces considerable restraints, notably the high cost associated with advanced sterile tubes (like those with SSD ports or specialized coatings) compared to standard non-sterile or less sophisticated alternatives, posing adoption challenges in low and middle-income countries. Supply chain volatility, particularly concerning raw materials like medical-grade PVC and silicone, exacerbated by geopolitical instability, also restricts steady growth. The market finds substantial opportunities in the rapid technological advancements focusing on smart ETTs incorporating fiber optics or integrated sensors for enhanced monitoring, and expansion into emerging economies where healthcare infrastructure is rapidly developing and standards are rising.

The market is subjected to several critical impact forces. The threat of substitutes is relatively low, as ETTs are the gold standard for long-term mechanical ventilation and general anesthesia, though alternatives like laryngeal masks (LMAs) pose a threat in short-duration surgeries. However, the bargaining power of buyers, primarily large hospital procurement groups and government health systems, is high, demanding competitive pricing and bundled deals, which pressures manufacturers' margins. Regulatory stringentness, driven by bodies like the FDA and EMA, acts as a dual force: it drives demand for high-quality sterile products (Driver) but simultaneously increases the compliance cost and time-to-market for new innovations (Restraint). Innovation in material science, focusing on reducing biofilm formation and enhancing biocompatibility, is a major positive force, enhancing product efficacy and justifying higher pricing. The ongoing global trend toward aging populations, which require more frequent critical care interventions, provides sustained, long-term positive market momentum.

The impact forces also include intensifying competition among existing players, leading to price wars in saturated segments and aggressive mergers and acquisitions to capture specialized technology or regional market presence. Furthermore, the transition towards environmentally conscious practices imposes new technological demands on manufacturers to develop biodegradable or easier-to-recycle sterile packaging and tube materials without compromising sterility assurance. This operational complexity, coupled with the necessity for consistent global sterilization validation (e.g., Ethylene Oxide or Gamma Irradiation), necessitates significant capital investment, further elevating the barriers to entry for smaller manufacturers. Opportunities also emerge from the increased use of telemedicine and remote patient monitoring, indirectly influencing the demand for robust, reliable sterile ETTs used in stabilized patients transferred to specialized care facilities. The synthesis of these dynamic drivers, restraints, and competitive forces dictates the trajectory of innovation and commercial success in the Sterile Endotracheal Tube Market, favoring companies that can achieve cost-efficiency alongside certified sterility and clinical superiority.

Segmentation Analysis

The Sterile Endotracheal Tube Market is highly segmented based on product type, material, application, and end-user, reflecting the diverse clinical needs associated with airway management. The segmentation by product type, primarily Cuffed vs. Uncuffed, is fundamental, as cuffed tubes are standard for preventing aspiration in adults and ensuring positive pressure ventilation efficiency, making them the largest and fastest-growing segment in absolute terms. Uncuffed tubes remain critical for pediatric and neonatal patients due where the cricoid cartilage forms a natural seal, though miniaturized cuffed tubes are also gaining traction in this niche. Material segmentation distinguishes tubes based on manufacturing material, with medical-grade PVC dominating due to its cost-effectiveness and excellent thermolability (softening at body temperature), while silicone is preferred for specific long-term intubation cases due to its superior biocompatibility and reduced reaction risk. The careful consideration of these segments allows manufacturers to target specific clinical environments and regulatory requirements effectively.

Application-wise, the market is segmented into Anesthesia, Emergency Medicine, and Critical Care/ICU. The Anesthesia segment holds the majority share due to the sheer volume of elective and emergency surgeries requiring general anesthesia. However, the Critical Care/ICU segment is experiencing rapid growth, driven by the increasing severity of patient conditions and the prolonged use of mechanical ventilation, which necessitates specialized, high-quality sterile ETTs, often featuring SSD capabilities to actively mitigate VAP risk. The Emergency Medicine segment, encompassing pre-hospital care and trauma centers, relies heavily on ready-to-use, sterile, durable tubes suitable for rapid deployment under varied conditions. End-user segmentation focuses on where the product is consumed, distinguishing between Hospitals (public and private), Ambulatory Surgical Centers (ASCs), and Specialty Clinics. Hospitals represent the primary consumer base due to the complex critical care units and vast surgical suites, dictating purchasing power and volume demand.

Emerging segments within the product category include specialty tubes like reinforced ETTs, designed for stability during procedures where the patient's neck position changes frequently (e.g., neurosurgery or orthopedics), and tubes incorporating advanced visualization or monitoring technologies. The trend towards integrating multiple functions into a single sterile device—such as suction lumens and temperature sensing—is shaping future segmentation. Furthermore, the shift towards environmentally sustainable sterile packaging solutions and the development of tubes with reduced phthalate content to meet stricter European Union chemical safety standards are creating new sub-segments focused on biocompatibility and environmental stewardship. Strategic market players are diversifying their portfolios across these segments to capitalize on niche high-growth areas while maintaining their foothold in high-volume general anesthesia applications.

- Segmentation by Product Type:

- Cuffed Endotracheal Tubes

- Uncuffed Endotracheal Tubes

- Reinforced Endotracheal Tubes (Flexible/Armored)

- Preformed Endotracheal Tubes (Oral/Nasal)

- Specialized Tubes (e.g., Subglottic Suction Drainage ETTs, Double Lumen Tubes)

- Segmentation by Material:

- Polyvinyl Chloride (PVC)

- Silicone

- Other Advanced Biocompatible Materials

- Segmentation by Application:

- Anesthesia Procedures

- Critical Care and Intensive Care Units (ICU)

- Emergency and Trauma Care

- Segmentation by End-User:

- Hospitals (Public and Private)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Diagnostics Centers

- Emergency Medical Services (EMS)

Value Chain Analysis For Sterile Endotracheal Tube Market

The value chain for the Sterile Endotracheal Tube Market begins with the upstream segment, which involves the sourcing and processing of specialized raw materials, primarily medical- grade polymers such as PVC, silicone, and various plasticizers necessary for cuff and tube construction. This phase is highly dependent on petrochemical derivatives, making it susceptible to volatility in global oil and polymer prices. Key suppliers in the upstream segment must adhere to strict purity standards and biocompatibility certifications (USP Class VI). Manufacturing involves high-precision extrusion, molding, and assembly processes, often performed in ISO-certified cleanrooms. A crucial step is the terminal sterilization process, typically utilizing Ethylene Oxide (EtO) or radiation sterilization, which necessitates rigorous validation and quality control to maintain sterility assurance levels (SAL) mandated by regulatory bodies globally. Efficiency in manufacturing focuses on automating assembly and sterilization to reduce contamination risk and per-unit costs, creating a competitive advantage.

The midstream activities center around distribution and logistics. Due to the critical nature and single-use requirement of these sterile products, maintaining the sterile barrier through robust packaging is paramount. Distribution channels are complex, involving direct sales forces, third-party medical device distributors, group purchasing organizations (GPOs), and specialized logistics providers capable of handling sensitive medical supplies. The distribution model often utilizes both direct and indirect channels. Direct channels are common for high-volume sales to large hospital chains and integrated delivery networks (IDNs), allowing manufacturers greater control over pricing and inventory. Indirect channels, involving authorized dealers and regional distributors, are essential for reaching smaller clinics, ASCs, and international markets where local regulatory knowledge and established logistics infrastructure are necessary.

The downstream segment involves the ultimate consumption by end-users, primarily hospitals and critical care units. Adoption is influenced heavily by clinical evidence, physician preference, and hospital infection control policies. Procurement departments often prioritize tubes that offer advanced features proven to reduce complications (e.g., VAP rates) and comply strictly with mandated sterile packaging integrity. Post-consumption, the value chain concludes with waste management, which is increasingly regulated, necessitating proper disposal protocols for medical plastic waste. The strong link between product sterility, clinical outcome, and procurement decisions emphasizes the strategic importance of quality assurance throughout the entire value chain, from raw material selection to final patient use.

Sterile Endotracheal Tube Market Potential Customers

The primary potential customers for the Sterile Endotracheal Tube Market are healthcare institutions that perform surgical procedures or manage critically ill patients requiring prolonged ventilatory support. Hospitals, particularly large tertiary care centers and university teaching hospitals with extensive ICU capacities, represent the largest and most valuable customer segment. These facilities exhibit high purchasing volume and often adopt premium sterile ETTs featuring advanced technology like integrated suction and monitoring capabilities, driven by their stringent infection control standards and focus on minimizing patient morbidity rates, especially VAP. Procurement decisions in these environments are often centralized through GPOs, which seek long-term contracts for standardized, sterile supplies at competitive bulk pricing. The continuous turnover in operating theaters and critical care beds ensures sustained, high-volume demand.

Ambulatory Surgical Centers (ASCs) form a rapidly expanding customer segment. As healthcare delivery shifts towards outpatient settings for less complex procedures, ASCs require sterile, reliable ETTs for short-duration general anesthesia. Although ASCs use tubes for shorter periods than ICUs, their high procedure turnover rate makes them significant consumers. Their buying behavior is characterized by a strong preference for single-use efficiency and cost-effectiveness, favoring standard cuffed sterile tubes packaged for easy, rapid use. Furthermore, independent clinics and diagnostic centers that perform minor surgeries or sedated procedures also contribute to the demand, particularly for specialized oral and nasal preformed tubes required for procedures like endoscopy.

Emergency Medical Services (EMS) and trauma centers constitute another crucial customer base. ETTs are indispensable in pre-hospital emergency management and resuscitation protocols, demanding tubes that are durable, highly reliable, and sterile for rapid deployment in often uncontrolled environments. Governmental stockpiles and military medical units also serve as high-volume institutional customers, maintaining reserves of sterile ETTs for disaster preparedness and field operations. The ongoing investment in global emergency infrastructure and the standardization of advanced life support training further cement these entities as essential, long-term purchasers of sterile airway management solutions, requiring robust, standardized product supply chains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Teleflex, Becton Dickinson (BD), Fuji Systems, Smiths Medical (ICU Medical), Vyaire Medical, Cook Medical, Armstrong Medical, TROGE MEDICAL, Halyard Health, Dynarex, Hospira (Pfizer), SunMed, WellLead, Intersurgical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sterile Endotracheal Tube Market Key Technology Landscape

The technological landscape of the Sterile Endotracheal Tube Market is characterized by a continuous push for improved patient safety, enhanced monitoring capabilities, and superior infection control. A key area of innovation is in cuff technology, moving beyond traditional high-pressure, low-volume cuffs to thin-walled, high-volume, low-pressure cuffs designed to minimize pressure trauma to the tracheal mucosa while maintaining an effective seal. Further advanced designs include tapered cuffs and tubes with integrated pressure-sensing technology, providing continuous digital feedback to clinicians to maintain optimal cuff pressure, thereby directly addressing the risk of both aspiration and ischemic injury. Materials science plays a critical role, with ongoing research into polymers that resist biofilm formation and discourage bacterial adhesion, often through the incorporation of silver or other antimicrobial agents embedded within the tube matrix, thus significantly lowering the incidence of VAP—a major focus for healthcare improvement globally.

Another significant technological advancement is the integration of subglottic secretion drainage (SSD) capabilities. These specialized sterile ETTs feature an extra lumen above the cuff that allows for continuous or intermittent suctioning of contaminated secretions accumulating in the subglottic space. Clinical data consistently supports the efficacy of SSD tubes in reducing VAP rates, driving their accelerated adoption, particularly in critical care settings where patients remain intubated for extended periods. Furthermore, the incorporation of imaging technology is crucial; all modern ETTs contain radio-opaque lines to confirm placement via X-ray, but newer developments involve integrating fiber optic visualization or miniature cameras directly into the tube tip (e.g., videolaryngoscopy assistance integration) to facilitate faster and more accurate intubation, even in anatomically challenging patients, enhancing first-pass success rates.

Sterilization and packaging technology also represent a vital part of the landscape. Given the mandate for guaranteed sterility, manufacturers employ stringent terminal sterilization techniques (EtO or Gamma) and are increasingly investing in sophisticated, multi-layer sterile barrier systems (SBS) that protect the device from contamination during transport and handling. Innovations in packaging include peel-open pouches designed for aseptic presentation and environmental sustainability, minimizing the volume of non-recyclable plastic while maintaining the required shelf life and sterility integrity. The convergence of sensor technology, advanced materials, and precise manufacturing processes ensures that the sterile ETT remains a high-tech medical necessity, continually evolving to meet demanding clinical safety standards and the economic pressures of modern healthcare systems.

Regional Highlights

North America currently dominates the Sterile Endotracheal Tube Market, primarily driven by the United States. This dominance is attributable to several key factors: highly advanced healthcare infrastructure, substantial expenditure on respiratory care and critical care facilities, and the rapid adoption of specialized, high-cost sterile devices. Regulatory mandates in the US, particularly from bodies like the Centers for Disease Control and Prevention (CDC) and the Joint Commission, strongly advocate for single-use, sterile devices to adhere to strict VAP prevention guidelines, propelling the market forward. Furthermore, the presence of major global market players and sophisticated supply chain logistics ensure high product availability and rapid introduction of clinical innovations. The extensive use of mechanical ventilation in the large elderly population segment and a high volume of complex surgical procedures also solidify North America’s leading market position, although market maturity means that future growth rates, while stable, may be outpaced by developing regions.

Europe represents the second-largest market, characterized by stringent European Medicines Agency (EMA) and local country regulations ensuring high standards for medical device safety and sterility. Western European countries, including Germany, the UK, and France, are key contributors, benefiting from universal healthcare systems that provide high critical care penetration. The market in Europe is witnessing a steady shift toward premium sterile ETTs, especially those with SSD features, driven by strong clinical advocacy and public health policies aiming to reduce hospital-acquired infections. However, pricing pressure exerted by centralized health procurement bodies and varying reimbursement scenarios across different member states pose marginal challenges. Eastern Europe is gradually increasing its consumption as healthcare infrastructure modernization progresses, adopting international quality standards and purchasing sterile ETTs to replace older, reusable alternatives, thus providing medium-term growth potential.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally throughout the forecast period. This explosive growth is underpinned by massive governmental and private sector investments in building new hospitals, expanding critical care capacity, and improving surgical facilities, particularly in rapidly developing nations like China, India, South Korea, and Southeast Asian countries. Increasing public awareness regarding healthcare-associated infections, coupled with rising disposable incomes, allows for the adoption of higher-quality sterile medical consumables. While price sensitivity remains a factor, domestic manufacturers are emerging, focusing on scaling production of cost-effective, high-quality sterile ETTs that meet international standards. Furthermore, the burgeoning medical tourism industry across the region drives the need for state-of-the-art sterile equipment to maintain global competitiveness and patient safety profiles. Latin America and the Middle East & Africa (MEA) markets are displaying moderate growth, hampered slightly by fluctuating economic conditions and infrastructure gaps, but showing significant potential in countries like Brazil, Saudi Arabia, and UAE, where high-end medical facilities are rapidly expanding and importing high-quality sterile devices.

- North America: Market leader due to strict infection control standards, high healthcare expenditure, established critical care infrastructure, and the early adoption of advanced sterile tubing technologies, including integrated monitoring ETTs.

- Europe: Second-largest market, characterized by a preference for high-quality, clinically proven SSD tubes, supported by standardized regulatory oversight and robust national health systems emphasizing VAP reduction.

- Asia Pacific (APAC): Fastest-growing region, fueled by expanding healthcare infrastructure, rising surgical volumes, increased government investment in critical care, and improving access to modern, sterile medical devices across populous countries.

- Latin America (LATAM): Emerging market demonstrating strong growth potential, particularly in Brazil and Mexico, driven by increasing private sector investment in specialty hospitals and improving access to intensive care services.

- Middle East & Africa (MEA): Moderate growth attributed to healthcare modernization initiatives, particularly in Gulf Cooperation Council (GCC) countries, focusing on establishing world-class medical facilities and ensuring high sterile product standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sterile Endotracheal Tube Market.- Medtronic plc

- Teleflex Incorporated

- Becton, Dickinson and Company (BD)

- Smiths Medical (an ICU Medical Company)

- Vyaire Medical, Inc.

- Fuji Systems Corporation

- Cook Medical LLC

- Armstrong Medical Ltd.

- TROGE MEDICAL GmbH

- Halyard Health, Inc. (now part of Owens & Minor)

- Dynarex Corporation

- SunMed LLC

- WellLead Medical Products Co., Ltd.

- Intersurgical Ltd.

- ConvaTec Group plc

- Merit Medical Systems, Inc.

- Pennine Healthcare

- Drive DeVilbiss International

- Fisher & Paykel Healthcare Corporation Limited

- Ambu A/S

Frequently Asked Questions

Analyze common user questions about the Sterile Endotracheal Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Sterile Endotracheal Tube Market?

The primary driver is the global imperative to reduce Healthcare-Associated Infections (HAIs), particularly Ventilator-Associated Pneumonia (VAP). The shift from reusable to guaranteed single-use sterile ETTs is mandated by increasingly stringent infection control guidelines worldwide, ensuring patient safety and minimizing cross-contamination risks during critical care and surgery.

How does the Subglottic Secretion Drainage (SSD) feature impact market segmentation?

The SSD feature significantly drives the premium segment of the market, especially within critical care applications. SSD tubes are clinically proven to actively remove contaminated secretions, resulting in lower VAP rates, justifying their higher cost and leading to accelerated adoption by major hospitals focused on quality metrics and improved patient outcomes.

Which geographical region is expected to show the highest growth rate, and why?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is primarily fueled by massive infrastructure development in countries like China and India, expanding critical care capacity, increasing medical tourism, and rising adherence to international quality standards for sterile medical devices.

What is the role of AI in improving ETT utilization and safety?

AI's role centers on enhancing procedural safety and monitoring. AI algorithms analyze patient data to predict difficult airways, guide optimal tube selection, and provide real-time, dynamic adjustments to ETT cuff pressure, thereby minimizing the risk of tracheal injury and ensuring precise ventilation during mechanical support.

What materials are most commonly used for manufacturing sterile endotracheal tubes?

Medical-grade Polyvinyl Chloride (PVC) is the most common material due to its flexibility, cost-efficiency, and thermolability (softening at body temperature). Silicone is also used, particularly in specialized applications or for patients requiring long-term intubation, owing to its superior biocompatibility and reduced tissue reaction profile.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager