Sterile Injectables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431587 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Sterile Injectables Market Size

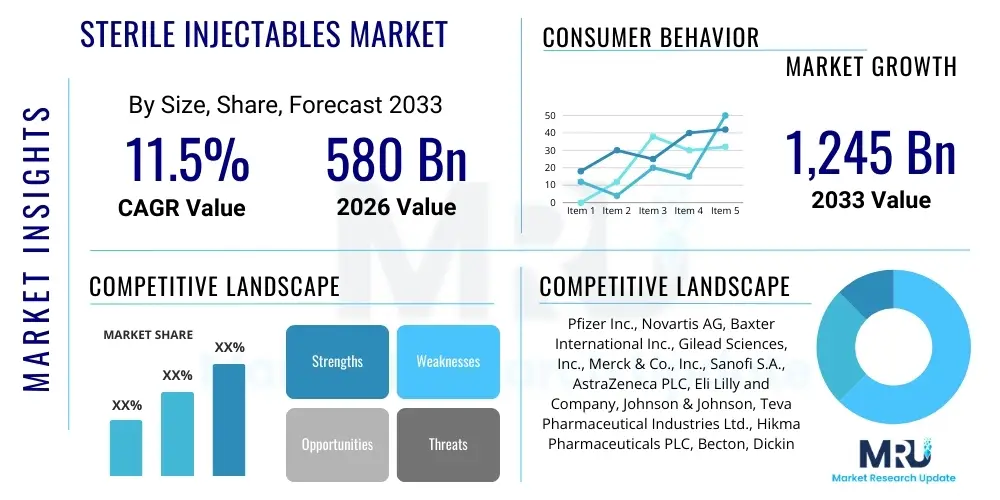

The Sterile Injectables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 580 Billion in 2026 and is projected to reach USD 1,245 Billion by the end of the forecast period in 2033. This robust expansion is predominantly fueled by the increasing prevalence of chronic diseases requiring sophisticated biological therapies, alongside significant advancements in aseptic manufacturing techniques that ensure drug safety and efficacy. The shift towards large molecule drugs, which are typically administered via injection, further solidifies the market's high growth trajectory, demanding greater capacity and technological investment in sterile formulation and fill-finish capabilities.

Sterile Injectables Market introduction

The Sterile Injectables Market encompasses a broad category of pharmaceutical products designed for parenteral administration, which must be free from viable microorganisms, ensuring patient safety and preventing severe adverse reactions such as systemic infections. These formulations include solutions, suspensions, and emulsions delivered through intravenous, intramuscular, subcutaneous, or intra-articular routes. Key product types range from vaccines and small molecule generics to complex large molecule biologics like monoclonal antibodies and sophisticated peptide therapies. Major applications span critical areas such as oncology, infectious diseases, autoimmune disorders, and diabetes management, where rapid and complete bioavailability is essential. The core benefit of sterile injectables lies in bypassing the gastrointestinal tract, ensuring high efficacy and reliability, particularly for drugs with poor oral absorption or those requiring immediate systemic effects.

Market growth is predominantly driven by the escalating global burden of chronic diseases, necessitating long-term, high-compliance injectable treatments. Furthermore, the robust pipeline of biopharmaceuticals, which are almost exclusively administered parenterally, significantly boosts demand for sterile manufacturing services. Technological drivers include advancements in pre-filled syringes (PFS) and auto-injectors, which enhance patient convenience, adherence, and safety by minimizing handling errors. The critical importance of regulatory compliance, particularly concerning Current Good Manufacturing Practices (cGMP) and aseptic processing standards, defines the operational landscape, requiring substantial capital investment and stringent quality control protocols throughout the supply chain.

Sterile Injectables Market Executive Summary

The Sterile Injectables Market is characterized by intense regulatory scrutiny, rapid technological adoption in aseptic processing, and a strategic pivot toward complex biological formulations. Business trends indicate strong merger and acquisition activity focused on acquiring specialized fill-finish capacities and enhancing cold chain logistics, crucial for sensitive biological products. The shift from glass vials to pre-filled syringes and cartridge systems is a major operational trend, streamlining drug delivery and reducing medication errors in clinical settings. Furthermore, pharmaceutical companies are increasingly outsourcing sterile manufacturing to Contract Manufacturing Organizations (CMOs) to manage high fixed costs and ensure compliance with diverse international standards, driving growth in the CDMO segment.

Regional trends highlight North America and Europe as established leaders, primarily due to advanced healthcare infrastructure, high research and development expenditure, and stringent regulatory environments that foster high-quality production. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by expanding access to healthcare, rising government investments in public health programs, and the growth of local pharmaceutical manufacturing capabilities targeting both domestic consumption and global export. Latin America and the Middle East & Africa (MEA) represent nascent markets, heavily reliant on imported generics but showing potential due to increasing chronic disease burdens.

Segment trends emphasize the rapid expansion of the Biologics segment, particularly monoclonal antibodies, dominating market value due to their high cost and efficacy in specialized treatments. By formulation, lyophilized products are gaining traction for preserving sensitive large molecules, while pre-filled syringes are dominating the volume aspect due to superior patient convenience. Application-wise, oncology and infectious disease treatments remain the primary demand drivers, commanding significant R&D investment and subsequent commercial scale-up for injectable solutions and suspensions.

AI Impact Analysis on Sterile Injectables Market

User queries regarding AI's influence on the sterile injectables domain primarily revolve around three critical areas: enhancing quality assurance in aseptic processing, accelerating complex formulation development, and optimizing supply chain integrity, particularly for high-value biologicals. Users frequently ask how AI can identify minute contamination risks invisible to human inspection (Quality Control), if machine learning models can predict the stability and shelf-life of novel injectable formulations (R&D), and how predictive analytics can manage the complex, temperature-sensitive logistics (Supply Chain). The consensus expectation is that AI will minimize human error, significantly reduce batch rejection rates, and provide a highly controlled, data-driven manufacturing environment essential for these sensitive pharmaceutical products.

The application of Artificial Intelligence is revolutionizing the traditionally conservative field of sterile manufacturing by introducing unparalleled precision and predictive capability. In R&D, AI algorithms are speeding up the selection of optimal excipients and formulation parameters, drastically reducing the time required to develop stable, high-concentration injectable drug products. By simulating molecular interactions and predicting stability under various storage conditions, AI minimizes costly, time-consuming experimental iterations. This accelerates the transition of novel therapies, especially complex personalized medicines, from discovery to commercial production, directly impacting market launch timelines and competitive advantage.

In the manufacturing and quality control phases, AI-powered computer vision systems are deployed to monitor high-speed fill-finish lines, identifying defects in containers, closures, and product fill volume with greater accuracy than human inspection. Furthermore, AI analytics are crucial for continuous process verification (CPV), utilizing sensor data from bioreactors and filtration systems to proactively detect deviations that could compromise sterility, enabling real-time adjustments and minimizing the risk of contamination events. This enhanced scrutiny ensures adherence to stringent regulatory standards and significantly improves yield and operational efficiency across high-volume sterile production facilities.

- AI-driven Predictive Maintenance: Minimizing unplanned downtime of critical aseptic processing equipment, ensuring continuous operational flow.

- Automated Visual Inspection (AVI): Utilizing deep learning algorithms for superior detection of particulates and container defects in vials and syringes, reducing human inspection variability.

- Formulation Optimization: Machine learning models predicting optimal pH, buffer selection, and concentration stability for complex biological injectables.

- Supply Chain Risk Mitigation: AI analytics optimizing cold chain logistics, predicting temperature excursions, and ensuring timely delivery of temperature-sensitive sterile products.

- Enhanced Regulatory Compliance: Using AI for continuous monitoring and automated documentation generation, facilitating quicker audit responses and approval processes.

DRO & Impact Forces Of Sterile Injectables Market

The Sterile Injectables market dynamics are shaped by powerful drivers such as the escalating global prevalence of chronic diseases and the surging demand for biological drugs, counterbalanced by stringent regulatory restraints and high manufacturing complexity. Opportunities arise primarily from advancements in drug delivery systems like pre-filled syringes and the untapped potential of emerging markets. The combined effect of these factors creates significant impact forces that necessitate continuous technological upgrades, substantial capital investment, and meticulous adherence to global quality standards to maintain market competitiveness and ensure patient safety.

Key drivers include the aging global population, which correlates strongly with an increased incidence of age-related conditions requiring injectable therapies (e.g., cancer, diabetes, cardiovascular diseases). The transition in the pharmaceutical pipeline towards complex, high-potency biologics—such as biosimilars and cell and gene therapies—further necessitates sterile parenteral administration, thereby expanding the core market. Restraints are primarily tied to the high initial investment required for constructing and validating aseptic manufacturing facilities, the immense cost associated with maintaining cGMP compliance, and the lengthy, rigorous regulatory approval pathways that can delay market entry for novel injectables. Furthermore, product recalls due to sterility breaches pose a continuous operational and financial threat.

Opportunities for growth are abundant, particularly in the development and commercialization of advanced drug delivery devices, including needle-free injectors and patch pumps, which enhance patient compliance and convenience in home-care settings. Geographical expansion into high-growth markets like China, India, and Brazil, where generic sterile injectables demand is soaring, offers significant revenue potential. The ongoing trend of pharmaceutical companies divesting manufacturing assets creates strategic opportunities for specialized Contract Development and Manufacturing Organizations (CDMOs) to capture substantial market share by providing flexible, scalable, and compliant production services tailored to diverse product requirements.

Segmentation Analysis

The Sterile Injectables Market segmentation provides critical insights into specific demand patterns and areas of technological focus within the industry. The market is broadly segmented based on Product Type, ranging from small molecule generics that dominate volume to high-value biologics that capture the majority of the revenue. Further segmentation by Packaging Type—vials, ampoules, and pre-filled syringes—reflects evolving delivery preferences, with pre-filled syringes demonstrating the highest growth due to enhanced safety features. Application areas such as oncology and autoimmune diseases represent the therapeutic focus, while end-users, including hospitals and ambulatory care centers, define the primary channels of consumption and administration for these life-saving treatments.

- Product Type

- Small Molecule Injectables

- Large Molecule Injectables (Biologics)

- Monoclonal Antibodies (mAbs)

- Immunoglobulins

- Insulin

- Vaccines

- Peptides

- Drug Type

- Generics

- Branded Drugs

- Biosimilars

- Formulation Type

- Lyophilized Powder

- Liquid Solutions & Suspensions

- Packaging Type

- Vials

- Ampoules

- Pre-filled Syringes (PFS)

- Cartridges

- Application

- Oncology

- Infectious Diseases

- Autoimmune Disorders

- Diabetes

- Cardiovascular Diseases

- Others (e.g., Pain Management, CNS Disorders)

- End-User

- Hospitals

- Ambulatory Surgery Centers

- Clinics

- Home Care Settings

Value Chain Analysis For Sterile Injectables Market

The value chain for the Sterile Injectables Market is exceptionally complex, highly regulated, and capital-intensive, starting with the upstream sourcing of high-purity Active Pharmaceutical Ingredients (APIs) and specialized excipients necessary for formulation stability. Upstream analysis involves rigorous quality assessment of raw material suppliers, as contamination risks at this stage can compromise the entire production batch. This segment also includes the manufacture of primary packaging materials—such as pharmaceutical-grade glass vials, specialized polymer syringes, and stoppers—which must meet stringent sterility and inertness requirements to prevent drug-product interaction or leachables.

The midstream process, dominated by highly specialized CMOs and integrated pharmaceutical facilities, involves formulation, aseptic processing, and fill-finish operations. This is the most crucial stage where sterility assurance is paramount, often employing advanced technologies like Restricted Access Barrier Systems (RABS) or isolators to minimize human intervention. Robust quality control (QC) testing, including sterility tests and particle analysis, is mandatory before the product moves to secondary packaging and labeling. Failures at this stage result in massive financial losses, reinforcing the need for continuous technological investment in automation and environmental monitoring.

Downstream analysis focuses on distribution and end-user delivery, heavily reliant on highly compliant cold chain logistics, especially for temperature-sensitive biologics. The distribution channel involves both direct sales to large hospital systems and indirect distribution through wholesalers and specialized pharmaceutical distributors, ensuring integrity is maintained from the manufacturing site to the patient. Potential customers, including institutional buyers like hospitals and retail pharmacies, demand reliability, competitive pricing, and certified quality, making streamlined, traceable, and validated distribution networks essential for sustaining market penetration and preventing counterfeiting.

Sterile Injectables Market Potential Customers

Potential customers and end-users of sterile injectables are diverse but primarily center around centralized healthcare delivery systems where parenteral administration is routinely practiced. Hospitals, particularly large tertiary and quaternary care centers with high volumes of critical care, surgery, and oncology services, represent the largest customer base. These institutions procure large quantities of both generic and branded injectables for immediate patient use in controlled environments. The critical need for reliable supply and stringent inventory management makes hospitals a high-volume, highly scrutinized segment of the customer market.

Ambulatory Surgery Centers (ASCs) and specialized clinics, such as chemotherapy infusion centers and dialysis facilities, form another vital customer segment. These centers require a steady supply of specific injectable therapies, often relying on user-friendly packaging types like pre-filled syringes that streamline workflow and minimize medication preparation time. The increasing shift of complex procedures and long-term care administration to these outpatient settings is rapidly expanding their purchasing power and influence on product packaging trends.

Finally, the growing trend toward home healthcare and self-administration represents a significant evolving customer segment. Patients managing chronic conditions like diabetes or multiple sclerosis are increasingly utilizing auto-injectors and smart drug delivery devices in their homes. While purchasing is often mediated through retail pharmacies or specialized distributors, the underlying demand is driven by individual patient needs for convenience, ease of use, and effective management of their therapy outside of a clinical setting, pushing manufacturers to innovate rapidly in device technology and patient education materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Billion |

| Market Forecast in 2033 | USD 1,245 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer Inc., Novartis AG, Baxter International Inc., Gilead Sciences, Inc., Merck & Co., Inc., Sanofi S.A., AstraZeneca PLC, Eli Lilly and Company, Johnson & Johnson, Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Becton, Dickinson and Company (BD), Gerresheimer AG, West Pharmaceutical Services, Inc., Catalent, Inc., Vetter Pharma-Fertigung GmbH & Co. KG, Recipharm AB, Lonza Group AG, Samsung Biologics, Thermo Fisher Scientific (Patheon). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sterile Injectables Market Key Technology Landscape

The technological landscape of the Sterile Injectables Market is defined by continuous innovation aimed at maximizing sterility assurance, enhancing formulation stability, and improving user convenience. Central to manufacturing is Aseptic Processing Technology, which has evolved from conventional cleanrooms to highly isolated environments utilizing Restricted Access Barrier Systems (RABS) and full Isolator technology. These systems drastically reduce human contact with the drug product during the critical filling process, minimizing airborne particulate and microbial contamination risks, which is vital for meeting regulatory mandates like Annex 1 in Europe and stringent FDA standards in the US. Furthermore, advanced Vaporized Hydrogen Peroxide (VHP) decontamination systems are standard for rapid and effective sterilization of isolator interiors.

In drug product delivery, the market is rapidly adopting advanced Primary Packaging Solutions. Pre-filled Syringes (PFS) represent a major technological shift, moving away from multi-dose vials to single-use, ready-to-administer formats. This innovation not only improves dosing accuracy and reduces the risk of contamination during preparation but also facilitates the development of user-friendly devices such as autoinjectors and wearable patch pumps. Materials science plays a crucial role, with the development of high-quality glass and cyclic olefin copolymer (COC/COP) plastics offering superior barrier properties and reduced interaction with sensitive large molecule drugs, thus maintaining long-term stability.

Moreover, the integration of Process Analytical Technology (PAT) is becoming foundational for achieving real-time quality control throughout the manufacturing lifecycle. PAT tools, including spectroscopic methods (e.g., Near-Infrared Spectroscopy) and advanced sensors, monitor critical quality attributes (CQAs) continuously, enabling manufacturers to adjust parameters instantly and ensure batch consistency. This data-driven approach, often augmented by AI for predictive quality assurance, is key to achieving continuous manufacturing protocols and moving away from traditional, resource-intensive batch testing, significantly boosting efficiency and regulatory compliance in high-volume production environments.

Regional Highlights

Regional dynamics play a crucial role in shaping the Sterile Injectables Market, reflecting differences in healthcare spending, regulatory strictness, and technological maturity.

- North America: Dominates the global market share, driven by high pharmaceutical R&D investment, the rapid adoption of high-cost biological drugs (especially in oncology and immunology), and the presence of major biopharmaceutical companies. The region benefits from cutting-edge manufacturing technologies and a demanding regulatory framework (FDA) that necessitates high-quality, complex sterile products. The focus here is on novel drug formulation and sophisticated delivery devices like autoinjectors.

- Europe: Represents the second-largest market, characterized by stringent quality standards enforced by the European Medicines Agency (EMA) and local national health bodies. Growth is supported by a strong biosimilars market and significant capacity expansion by Contract Development and Manufacturing Organizations (CDMOs). The implementation of revised GMP Annex 1 standards for sterile manufacturing is driving modernization and investment in isolator technology across the continent.

- Asia Pacific (APAC): Projected to be the fastest-growing region during the forecast period. This growth is fueled by increasing government focus on healthcare access, a massive patient pool suffering from chronic diseases, and the emergence of India and China as global hubs for generic sterile injectable manufacturing and biosimilar production. Favorable government policies and lower operational costs attract significant foreign direct investment into manufacturing infrastructure.

- Latin America (LATAM): A moderately growing market characterized by reliance on imported finished products, particularly branded and high-tech biologics. Brazil and Mexico are the largest regional contributors, driven by government health programs and an expanding private healthcare sector. Opportunities exist for generic manufacturers seeking to address unmet patient needs, though currency fluctuations and regulatory variability pose challenges.

- Middle East and Africa (MEA): A nascent market with high demand for anti-infectives and vaccines, often procured through international aid organizations or centralized government purchasing. The Gulf Cooperation Council (GCC) countries show higher spending on specialized care and local manufacturing initiatives aimed at reducing import dependency, particularly in technologically advanced areas like oncology injectables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sterile Injectables Market.- Pfizer Inc.

- Novartis AG

- Baxter International Inc.

- Gilead Sciences, Inc.

- Merck & Co., Inc.

- Sanofi S.A.

- AstraZeneca PLC

- Eli Lilly and Company

- Johnson & Johnson

- Teva Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Becton, Dickinson and Company (BD)

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- Catalent, Inc.

- Vetter Pharma-Fertigung GmbH & Co. KG

- Recipharm AB

- Lonza Group AG

- Samsung Biologics

- Thermo Fisher Scientific (Patheon)

Frequently Asked Questions

Analyze common user questions about the Sterile Injectables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Sterile Injectables Market?

Market growth is primarily driven by the escalating global incidence of chronic diseases (such as cancer and diabetes), the increasing prevalence of biological drugs (which must be injected), and continuous advancements in user-friendly drug delivery systems like pre-filled syringes and auto-injectors.

How do regulatory requirements impact the manufacturing of sterile injectables?

Regulatory requirements, particularly cGMP standards set by the FDA and EMA (like Annex 1), impose stringent controls on aseptic processing. Compliance necessitates high capital expenditure on advanced technologies (Isolators, RABS) and meticulous quality control protocols, acting as both a barrier to entry and a driver for technological innovation.

Which packaging type is exhibiting the fastest growth in the Sterile Injectables Market?

Pre-filled Syringes (PFS) are experiencing the fastest growth. PFS offer significant advantages in terms of reduced risk of contamination during administration, improved dosage accuracy, and enhanced patient convenience for self-injection, making them preferred for biologics and chronic disease management.

What role do Contract Manufacturing Organizations (CMOs) play in this market?

CMOs, or CDMOs, play a critical role by offering specialized, scalable manufacturing services that major pharmaceutical companies often outsource. They help manage the high cost and complexity of maintaining compliant aseptic fill-finish capacity, particularly for specialized or niche injectable products, accelerating speed to market.

How is Artificial Intelligence (AI) being utilized in sterile injectable production?

AI is used extensively in quality assurance (Automated Visual Inspection), R&D (predicting optimal formulation stability), and continuous monitoring (Process Analytical Technology). AI minimizes human error, detects contamination risks early, and optimizes complex manufacturing logistics, leading to higher yield and better compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager