Sterile Nasal Spray Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433864 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Sterile Nasal Spray Pump Market Size

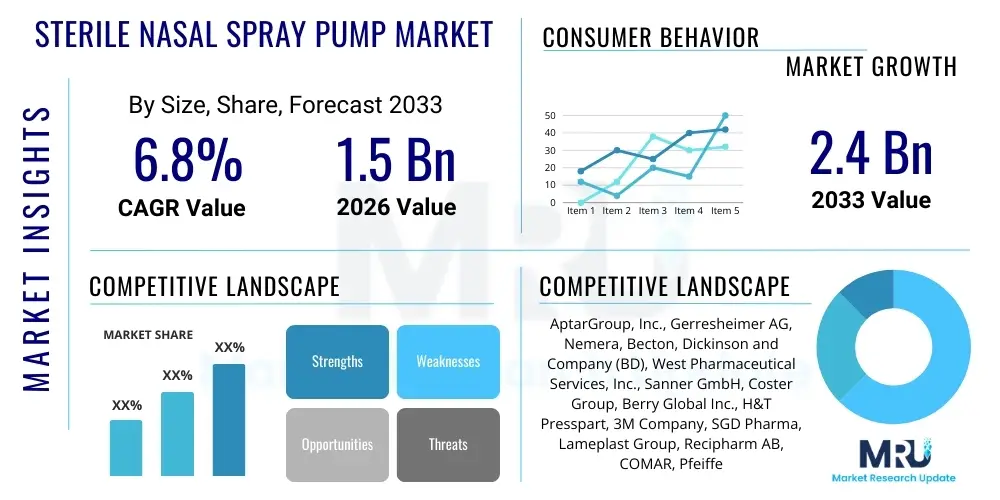

The Sterile Nasal Spray Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Sterile Nasal Spray Pump Market introduction

The Sterile Nasal Spray Pump Market is defined by the development, manufacturing, and global supply of sophisticated primary packaging systems engineered to deliver liquid pharmaceutical formulations directly into the nasal cavity while rigorously maintaining the aseptic state of the drug product throughout its use cycle. These drug-device combination products are indispensable for modern medicine, serving critical roles in the administration of treatments for chronic respiratory conditions, emergent nasal vaccines, and highly sensitive neurological medications. The core value proposition of a sterile nasal pump stems from its ability to ensure dose accuracy, provide consistent spray characteristics (plume geometry and droplet size), and, crucially, prevent external microbial ingress, often eliminating the reliance on chemical preservatives which can irritate sensitive nasal linings. Consequently, pharmaceutical companies operating under strict cGMP guidelines view the choice of a sterile pump supplier as a strategic decision impacting both clinical trial outcomes and regulatory approval success, particularly in markets governed by organizations such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

The evolution of sterile nasal spray pump technology has been heavily influenced by the increasing complexity of pharmaceutical formulations, especially the rise of biologics and high-potency molecules which require highly precise delivery and material compatibility. Unlike traditional non-sterile delivery devices, sterile pumps are often assembled in certified ISO 7 or ISO 8 cleanrooms and sometimes incorporate advanced mechanisms, such as tip-seal or valve-in-piston designs, specifically designed to function as an impermeable microbial barrier. These technical prerequisites necessitate significant investment in specialized tooling, automation, and continuous process validation to ensure that manufacturing scale-up does not compromise the critical quality attributes (CQAs) of the final drug product. Furthermore, the market is seeing a sustained migration toward unit-dose and bi-dose systems, particularly for products with short stability profiles or those requiring highly controlled dosing regimens, emphasizing the market's trajectory towards safety and precision.

Market expansion is robustly supported by several macro-environmental factors, including the global rise in environmental allergies, urban pollution exacerbating chronic rhinosinusitis, and the urgent need for non-invasive delivery methods for large molecule pharmaceuticals. The convenience and enhanced bioavailability offered by nasal delivery, bypassing the gastrointestinal tract and first-pass metabolism, positions sterile pumps as the delivery system of choice for therapeutics where rapid systemic absorption is required, such as migraine relief or emergency treatments. The continuous efforts by market leaders to innovate proprietary mechanisms that offer superior tactile feedback, easier actuation force, and integrated electronic features, such as Bluetooth connectivity for monitoring patient adherence in clinical settings, further cement the strategic importance of this specialized segment within the broader pharmaceutical packaging industry, ensuring sustained long-term growth.

Sterile Nasal Spray Pump Market Executive Summary

The Sterile Nasal Spray Pump Market is characterized by intense technological competition and strict adherence to global pharmaceutical quality standards, driving continuous innovation in preservation-free delivery systems. Business trends highlight a consolidation among specialized pump manufacturers, with market leaders strategically acquiring smaller, innovative firms to gain access to proprietary sealing technologies and expanding their sterile manufacturing footprint globally, particularly targeting fast-growing markets in Asia. Pharmaceutical clients are demanding highly customizable solutions, requiring pump manufacturers to offer flexible production capabilities that can handle diverse viscosity ranges and fill volumes, supporting personalized medicine initiatives. Emphasis on full lifecycle support, including regulatory documentation (DMF/MAF preparation), testing protocols, and robust change control management, is becoming a key differentiator in vendor selection, moving away from simple commodity supply to high-value strategic partnerships.

Regionally, the market maintains a tripartite leadership structure. North America commands the highest revenue share due to well-established regulatory pathways that incentivize high-quality, complex sterile devices, alongside high levels of managed care funding for chronic respiratory diseases. Europe is a strong second, distinguished by its early adoption of sustainable practices and preference for preservative-free devices, often driven by proactive regulatory guidance from bodies like the EMA. Asia Pacific, although currently smaller in value, is the fastest-growing region. This explosive growth is fueled by massive increases in local pharmaceutical production, improving healthcare access, and the construction of numerous new sterile manufacturing facilities in key economies like India, China, and South Korea, eager to meet both domestic and export demands for sterile drug products.

Segmental dynamics underscore the transition towards enhanced functionality. The Tip-Seal (or closed system) technology segment is witnessing the most rapid growth, reflecting the industry-wide effort to minimize chemical excipients. By material, specialized medical-grade plastics (Cyclic Olefin Copolymers/Polymers or COP/COC) are gaining traction over standard HDPE/PP, particularly for biologic drugs that are susceptible to pH changes or chemical interaction, offering better barrier properties and leachables profiles. Application-wise, while allergic rhinitis remains the volume mainstay, the CNS drug delivery segment—utilizing the nose-to-brain pathway for rapid, non-invasive treatment of neurological conditions—represents the highest value opportunity for high-precision, low-dose sterile pumps, necessitating investments in systems that can guarantee micro-liter level accuracy and spray consistency regardless of orientation.

AI Impact Analysis on Sterile Nasal Spray Pump Market

User inquiries concerning the integration of Artificial Intelligence within the sterile nasal spray pump domain frequently revolve around how predictive modeling can ensure sterility compliance and optimize the delicate assembly processes. Users often question the practicality of deploying AI/ML for real-time monitoring of cleanroom environments, seeking guarantees that advanced analytics can detect contamination risks far sooner and more reliably than traditional static monitoring systems. A significant interest area is the application of ML in optimizing the physical characteristics of the pump itself—specifically, simulating and validating complex spray patterns and dose accuracy under various patient usage conditions (e.g., different actuation forces or angles), which traditionally requires expensive, time-consuming physical testing cycles. Furthermore, users expect AI to streamline the massive regulatory documentation process by automatically flagging potential compliance risks and generating optimized validation protocols, reducing time-to-market for novel drug-device combinations.

- AI-driven Predictive Maintenance: Minimizing downtime of complex cleanroom machinery, ensuring continuous, sterile production runs and reducing the risk of contamination from mechanical failure.

- Quality Control Automation: Utilizing computer vision and deep learning models to inspect pump components for micro-defects, burrs, or particulates in real-time within the assembly line, ensuring ultra-high component quality before sterile packaging.

- Supply Chain Optimization: ML algorithms forecasting highly variable demand for specific pump types (e.g., preservative-free systems required for specific regulatory submissions) to manage specialized material procurement and inventory efficiently, mitigating supply chain bottlenecks.

- Formulation Compatibility Modeling: Simulating drug-device interaction parameters, including predicting potential polymer degradation, leaching profiles, and stability issues across varying temperature and humidity conditions, significantly accelerating the research and development phase of new nasal formulations.

- Cleanroom Environmental Monitoring: Real-time sensor data analysis integrating inputs like airflow, pressure differentials, temperature, and particle counts to predict and prevent potential breaches of sterility, moving quality assurance from reactive testing to proactive risk management.

DRO & Impact Forces Of Sterile Nasal Spray Pump Market

The Sterile Nasal Spray Pump Market's expansion is fundamentally driven by two compelling forces: the rising global burden of chronic upper respiratory tract disorders, necessitating consistent and reliable drug administration, and the pharmaceutical industry’s aggressive pursuit of non-invasive systemic delivery methods, particularly for high-value biological drugs. Specifically, the growing adoption of nasal-delivered vaccines, requiring impeccably sterile and stable unit-dose platforms, acts as a potent accelerator for market demand. Strategic opportunities are abundant in emerging therapeutic areas, such as the nasal delivery of insulin, hormones, and highly targeted neuro-therapeutics, which leverage the rapid absorption capabilities of the nasal mucosa, thereby commanding a premium for high-precision, sterile pump technology. Manufacturers who successfully integrate dose-counting technology with high-barrier, preservative-free mechanisms are best positioned to capitalize on these high-growth segments, particularly in regulated Western markets.

Conversely, significant restraints pose challenges to the market's trajectory. The most pronounced obstacle is the exceedingly high capital expenditure required to design, construct, and maintain manufacturing facilities that comply with global aseptic processing standards (e.g., ISO Class 7/8). Furthermore, the regulatory pathway for drug-device combination products is arduous, requiring extensive data submission, long lead times for approval, and complex post-market surveillance, which disincentivizes smaller players. The constant need for material validation to ensure zero interaction between the drug formulation and the polymer components (leaching and extractables risk) adds layers of technical complexity and cost, acting as a crucial drag on overall production efficiency and speed to market, especially for sensitive biologic formulations.

The overarching impact forces shaping competition are the intensifying regulatory environment and the rapid pace of technological obsolescence. Regulators worldwide are tightening standards for drug product sterility, particularly for multi-dose applications, making proprietary, certified sterile systems (like tip-seal) an industry necessity rather than a premium feature. This environmental pressure forces continuous R&D investment into advanced materials and precision micro-molding techniques. Competitive dynamics are also heavily influenced by intellectual property battles over unique pump mechanisms that guarantee superior spray performance and long-term functionality. Only companies capable of scalable, cost-effective sterile production while simultaneously maintaining a robust patent portfolio and mastering the regulatory submission process can exert strong influence on pricing and market share, defining a landscape where quality and proprietary technology are paramount determinants of success.

Segmentation Analysis

The analysis of the Sterile Nasal Spray Pump Market through various segmentation lenses reveals deep market specialization and distinct consumer preferences driven by therapeutic needs and regulatory requirements. Segmentation by Pump Technology, particularly the distinction between standard Metered-Dose Pumps and advanced Tip-Seal Pumps, is crucial as it directly correlates with the ability to support preservative-free formulations—a non-negotiable requirement for many new drug approvals. The technological sophistication level often determines the cost structure and the suitability of the pump for high-value versus commodity drug applications. Understanding these differences allows stakeholders to strategically focus their investments, targeting either high-volume generics with standard metered systems or complex biologics requiring superior barrier protection and dose control offered by Tip-Seal mechanisms.

Further granularity is achieved by segmenting based on Application and Material. The Application segmentation clearly defines where the market growth pockets lie; while traditional allergy treatments provide the volume base, the fastest-growing and highest-value segments are increasingly found in CNS therapies and vaccine delivery, sectors that demand pumps engineered for extremely small, highly accurate dosing volumes (micro-dosing). Material segmentation reflects pharmaceutical compatibility requirements; for instance, COC/COP polymers are increasingly specified over basic plastics for biologics to minimize extractable impurities that could destabilize sensitive proteins. The strategic convergence of high-precision technology, advanced material science, and regulatory compliance is what defines successful participation across these differentiated market segments, emphasizing quality and customization over mass production simplicity.

- By Dosage Form:

- Metered-Dose Pumps (Multi-dose systems for standard treatments)

- Unit-Dose Pumps (Single application systems, crucial for vaccines and emergency medicine)

- Bi-Dose Pumps (Controlled two-stage delivery systems)

- By Pump Technology/Mechanism:

- Tip-Seal Pumps (Preservative-free closed systems, highest growth area)

- Airless/Piston Pumps (Utilized for specific formulation viscosities)

- Bag-on-Valve (BOV) Systems (Primarily used for specialized aerosol formulations)

- By Material:

- Plastics (Polypropylene [PP], High-Density Polyethylene [HDPE], Low-Density Polyethylene [LDPE])

- Advanced Polymers (Cyclic Olefin Copolymers [COC], Cyclic Olefin Polymers [COP])

- Elastomers (Bromobutyl/Chlorobutyl rubber components for sealing)

- By Application:

- Allergic Rhinitis and Sinusitis Treatment (Volume driver: Corticosteroids, Antihistamines)

- Pain Management (Opioids, Migraine relief, rapid absorption required)

- Vaccines (Influenza, potential viral vaccines, high sterility mandate)

- Central Nervous System (CNS) Disorders (High-value segment: Nose-to-brain delivery)

- Others (e.g., Saline solutions, Hormone replacement therapies)

- By End User:

- Large Pharmaceutical Companies

- Specialty Biotechnology Firms

- Contract Development and Manufacturing Organizations (CDMOs)

- Compounding and Hospital Pharmacies

Value Chain Analysis For Sterile Nasal Spray Pump Market

The value chain commences with highly scrutinized upstream operations, dominated by the procurement and stringent quality testing of raw materials. Given the sterile and high-precision nature of the final product, only certified medical-grade polymers, such as high-purity polypropylene or specialty elastomers with documented low-extractable profiles, are acceptable. Suppliers must provide extensive testing documentation proving biocompatibility and chemical inertness. Following material procurement, primary manufacturing involves complex injection molding and micro-molding processes conducted within temperature and particle-controlled environments to fabricate the intricate components of the pump (e.g., piston, valve housing, actuator). This upstream segment is characterized by high capital costs for precision tooling and automated machinery, creating a landscape dominated by specialized component molders capable of maintaining extremely tight dimensional tolerances essential for accurate dose delivery.

The midstream is the most critical and value-additive stage: sterile assembly. Components, often having undergone validated terminal sterilization (such as gamma irradiation), are transported and assembled within ISO Class 7 or Class 8 cleanrooms using highly automated, robotic assembly lines to minimize human contact and contamination risk. This stage includes integrating proprietary features like tip-seals and dose counters, which differentiate the final product. Quality assurance and control are paramount here, involving continuous environmental monitoring and in-process testing for dose consistency and spray characteristics. The successful execution of sterile assembly transforms individual components into a validated drug delivery system, justifying the significant markup and reflecting the high technical complexity and regulatory risk involved.

Downstream distribution focuses almost entirely on direct engagement with the end-user pharmaceutical companies. The distribution channel is characterized by complex logistical requirements, ensuring the sterility and integrity of the bulk-shipped pump systems until they reach the client's aseptic filling lines. Direct sales teams are crucial, as they must provide deep technical support, assisting clients with regulatory submissions (e.g., providing comprehensive Device Master Files and validation summaries) and coordinating highly synchronized just-in-time deliveries to meet continuous manufacturing schedules. Indirect channels, while less common for high-volume sterile pumps, exist for smaller generic firms or regional markets, involving specialized packaging distributors who must strictly maintain chain of custody documentation to guarantee product quality and regulatory compliance throughout the final distribution leg.

Sterile Nasal Spray Pump Market Potential Customers

The primary customer base for sterile nasal spray pumps consists of global pharmaceutical giants and innovative biotechnology firms, driven by the imperative to deliver advanced, patient-safe medications via the intranasal route. These clients require not just a container but a certified drug delivery system that meets rigorous standards for sterility, dose accuracy, and material compatibility. Specific purchasing decisions are often made by cross-functional teams comprising R&D scientists (focused on drug stability), packaging engineers (focused on compatibility and assembly efficiency), and regulatory affairs specialists (focused on ease of submission and compliance). Critical to securing these high-value accounts is the vendor's ability to demonstrate consistent quality at immense scale, global regulatory acceptance across major markets (US, EU, Japan), and technical expertise in integrating the pump system into high-speed, automated aseptic filling operations, minimizing client validation time.

Beyond traditional pharma, a rapidly expanding customer segment includes Contract Development and Manufacturing Organizations (CDMOs) specializing in sterile injectable and nasal dose filling. These CDMOs serve a multitude of smaller biotech and virtual pharmaceutical companies that outsource their manufacturing needs. As CDMOs seek to offer comprehensive services, they become high-volume purchasers of certified sterile pumps, relying on a few trusted vendors to provide diverse options that accommodate various drug viscosities and delivery requirements for their varied client portfolio. Furthermore, government health organizations and non-profit global health initiatives are increasingly seeking sterile, reliable nasal pump systems for mass vaccination campaigns or large-scale humanitarian distribution of essential medications, prioritizing robust designs that maintain integrity under challenging logistical conditions, emphasizing unit-dose or bi-dose options for enhanced field safety and efficacy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AptarGroup, Inc., Gerresheimer AG, Nemera, Becton, Dickinson and Company (BD), West Pharmaceutical Services, Inc., Sanner GmbH, Coster Group, Berry Global Inc., H&T Presspart, 3M Company, SGD Pharma, Lameplast Group, Recipharm AB, COMAR, Pfeiffer Vacuum, Rieke Packaging Systems, DispenPak, Neopac, Unicep, Shandong Medicinal Glass Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sterile Nasal Spray Pump Market Key Technology Landscape

The technological evolution within the sterile nasal spray pump market is primarily defined by the pursuit of absolute microbial integrity and pharmaceutical compatibility. The pioneering advancement is the development and widespread adoption of active microbial barrier systems, most prominently embodied in Tip-Seal technology. This mechanism utilizes a specialized sealing system at the actuator opening that closes immediately upon actuation, physically blocking ambient air, debris, and microorganisms from entering the drug reservoir upon the piston’s return stroke. This closed system approach effectively addresses regulatory and consumer demand for preservative-free formulations, significantly broadening the therapeutic window for sensitive drugs previously hindered by compatibility issues with traditional preservatives like benzalkonium chloride (BAC), necessitating specialized molding and material verification processes.

Precision dosing technology represents another crucial technological pillar. Modern sterile pumps are engineered to deliver volumes with extremely low coefficients of variation (CV), often below 3-5%, which is critical for potent drugs where even micro-liter discrepancies can affect patient outcomes or safety. This precision requires sophisticated micro-molding of internal components and the integration of highly sensitive mechanical or electronic dose counters. Electronic dose counters, in particular, are emerging as a high-value feature, offering not only dose tracking but also potential connectivity for monitoring patient adherence, collecting real-world usage data for clinical trials, and improving overall medication compliance management, positioning these smart devices at the forefront of pharmaceutical packaging innovation.

Furthermore, the utilization of advanced material science is fundamental to maintaining sterility and drug stability. Manufacturers are heavily investing in high-purity, inert polymer solutions, such as Cyclic Olefin Copolymers (COC) and Cyclic Olefin Polymers (COP), which possess superior gas barrier properties and minimal extractables/leachables compared to standard commodity plastics. This material selection is vital for ensuring the long-term integrity and efficacy of complex drug molecules, including proteins and peptides, which are highly sensitive to chemical interaction with packaging components. Coupled with optimized gamma sterilization protocols that minimize polymer degradation, these material innovations ensure that the pump remains a reliable, non-reactive component of the complex drug delivery system over the entire mandated shelf life.

Regional Highlights

The global market for Sterile Nasal Spray Pumps demonstrates heterogeneous growth patterns shaped by economic development, regulatory stringency, and public health priorities across key regions.

- North America: This region maintains its dominant position, largely due to a mature pharmaceutical R&D ecosystem and substantial public and private healthcare expenditure. The market is defined by high demand for complex, patented preservative-free systems and advanced dose counters. Stringent FDA requirements for sterility validation and combination product approval encourage technological leadership among manufacturers operating here, focusing heavily on chronic disease management and proprietary CNS therapeutics.

- Europe: Characterized by stringent, harmonization-focused regulatory bodies (EMA) and a strong emphasis on environmental and patient safety standards. Western European countries, particularly Germany and Switzerland, are hubs for high-precision manufacturing and innovation in sterile pump mechanics. The European preference for minimal excipients in medicinal products strongly drives the demand for specialized tip-seal and unit-dose technologies, ensuring high-quality, long-term multi-dose safety.

- Asia Pacific (APAC): The fastest accelerating regional market, driven by the massive expansion of local pharmaceutical manufacturing bases, rising incidence of respiratory illnesses due to urbanization and pollution, and increasing access to advanced drug delivery systems. China, Japan, and India are key drivers, with substantial investment flowing into establishing certified cleanroom manufacturing capabilities to satisfy burgeoning domestic demand and establish export dominance in the global generics market.

- Latin America: Exhibiting steady growth, the market is primarily focused on serving mass-market allergy and cold treatments. Improvements in regulatory frameworks and economic stability across key countries like Brazil and Mexico are leading to a gradual shift from non-sterile to certified sterile pump adoption, though cost remains a significant purchasing factor compared to North America and Europe.

- Middle East and Africa (MEA): This region represents an emergent market, with growth concentrated in wealthier Gulf Cooperation Council (GCC) nations (UAE, Saudi Arabia) which are heavily investing in modernizing their domestic healthcare and pharmaceutical sectors. The demand is currently focused on high-quality imported devices for specialized treatments and addressing endemic health issues, requiring reliable sterile systems that perform effectively under challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sterile Nasal Spray Pump Market.- AptarGroup, Inc.

- Gerresheimer AG

- Nemera

- Becton, Dickinson and Company (BD)

- West Pharmaceutical Services, Inc.

- Sanner GmbH

- Coster Group

- Berry Global Inc.

- H&T Presspart

- 3M Company

- SGD Pharma

- Lameplast Group

- Recipharm AB

- COMAR

- Pfeiffer Vacuum

- Rieke Packaging Systems

- DispenPak

- Neopac

- Unicep

- Shandong Medicinal Glass Co.

Frequently Asked Questions

Analyze common user questions about the Sterile Nasal Spray Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard and sterile nasal spray pumps?

The primary difference lies in the manufacturing and design guarantees. Sterile pumps are assembled and often sterilized in certified cleanroom environments (e.g., ISO 7/8) and utilize advanced mechanisms (like tip-seal technology) to prevent microbial contamination and atmospheric suck-back into the reservoir after actuation, thus ensuring the multi-dose contents remain aseptic throughout the product's shelf life, often allowing for preservative-free drug formulations.

Why is preservative-free technology a major trend in this market?

Preservative-free technology, primarily enabled by tip-seal pumps, is a major trend because it eliminates patient exposure to chemical preservatives (like benzalkonium chloride) linked to irritation and potential long-term damage to the nasal mucosa. Regulatory bodies and healthcare providers favor these systems, especially for chronic use drugs and pediatric patients, driving pharmaceutical manufacturers to adopt these advanced sterile delivery solutions.

Which application segment drives the highest demand for sterile nasal spray pumps?

The Allergic Rhinitis and Sinusitis Treatment segment currently drives the highest volume demand. This segment includes widely used nasal corticosteroids and antihistamines, many of which are multi-dose formulations requiring certified sterile delivery to maintain efficacy and safety over extended periods of patient use, particularly in North America and Europe, forming the foundational market volume.

How does stringent regulation impact the competitive landscape?

Stringent regulatory requirements (e.g., FDA, EMA mandates for sterility and dose accuracy) heighten the barrier to entry, favoring large, established manufacturers who possess the necessary cleanroom infrastructure, quality management systems (ISO 13485), and intellectual property in proprietary pump mechanisms. This regulatory pressure promotes continuous R&D investment in high-precision, reliable sterile components, consolidating market power among compliance leaders.

What role does Artificial Intelligence play in optimizing pump manufacturing?

AI primarily enhances optimization by integrating predictive maintenance in cleanrooms, reducing machine downtime crucial for aseptic assembly. Furthermore, AI-driven computer vision systems are employed for real-time quality control, inspecting microscopic defects and particulate matter on components, significantly lowering the risk of sterility failure and improving overall batch consistency far beyond traditional manual inspection methods, ensuring process optimization and regulatory adherence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager