Sterilization Pouch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434017 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sterilization Pouch Market Size

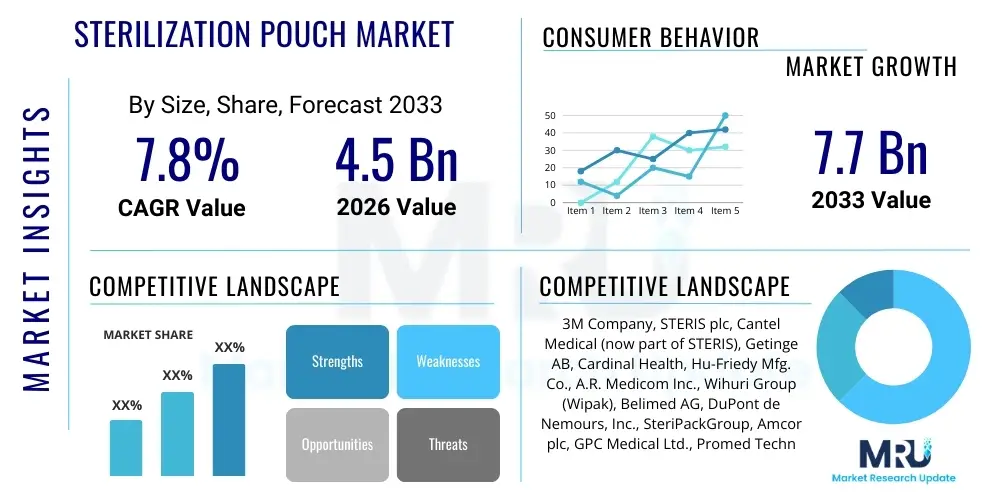

The Sterilization Pouch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Sterilization Pouch Market introduction

The Sterilization Pouch Market is intrinsically linked to global healthcare spending and the stringent regulatory environment surrounding infection prevention and control (IPC). These specialized packaging solutions are crucial for maintaining the sterility of medical devices, instruments, and supplies after processing in autoclaves or other sterilization chambers until the moment of use. They are designed using medical-grade paper, non-woven materials, or transparent film, optimized to allow the sterilization agent (such as steam, ethylene oxide (EtO), or hydrogen peroxide plasma) to penetrate while simultaneously creating a robust microbial barrier post-sterilization. The integrity of these pouches is non-negotiable, acting as the final line of defense against healthcare-associated infections (HAIs), making their adoption mandatory across hospitals, clinics, and surgical centers worldwide.

Product descriptions within this market focus heavily on material innovation and validation for specific sterilization methods. Key product attributes include strong seals, process indicators that visually confirm exposure to the sterilization cycle, and peel mechanisms that ensure aseptic presentation of the contents. The growing volume of surgical procedures, coupled with increased global awareness regarding cross-contamination risks, drives sustained demand. Furthermore, the shift toward single-use disposable medical items, particularly in ambulatory surgical centers (ASCs) and dental practices, necessitates corresponding growth in the sterilization packaging sector.

Major applications span across all environments where critical and semi-critical medical devices are reprocessed. This includes general surgery departments, dentistry, ophthalmology, and specialty clinics. The primary benefits derived from using certified sterilization pouches include enhanced patient safety through reduced infection risk, simplified instrument tracking via integrated labeling, and compliance with international standards such as ISO 11607 (Packaging for terminally sterilized medical devices). The driving factors underpinning market expansion are diverse, encompassing demographic trends such as an aging population requiring more surgical interventions, technological advancements in packaging materials offering superior barrier properties, and uncompromising global regulatory mandates compelling healthcare providers to prioritize sterilization efficacy.

Sterilization Pouch Market Executive Summary

The Sterilization Pouch Market demonstrates robust growth driven primarily by escalating volumes of complex surgical procedures and the non-negotiable imperative for strict infection control mandated by governing bodies like the FDA and the European Medicines Agency. Business trends highlight a strong emphasis on sustainability, prompting manufacturers to invest in environmentally friendly packaging materials that maintain the same high performance standards as traditional components. Consolidation through strategic mergers and acquisitions is becoming a common strategy among large players to expand geographic reach and diversify product portfolios, particularly in high-growth emerging markets. Furthermore, the integration of advanced chemical indicators directly onto the pouch material, providing immediate visual confirmation of sterilization cycle efficacy, remains a major area of competitive differentiation and technological advancement.

Regionally, North America maintains market dominance due to a highly developed healthcare infrastructure, high per capita healthcare spending, and the rigorous implementation of infection control guidelines across hospitals and ASCs. However, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding medical tourism, rapid development of hospital facilities in countries like China and India, and increasing disposable income leading to higher adoption rates of quality medical supplies. European markets show stable growth, heavily influenced by regulatory harmonization efforts and the mature adoption of steam and low-temperature sterilization methods, requiring a continuous supply of compatible pouch products.

Segmentation trends reveal that the heat-sealable pouches segment retains the largest market share due to their widespread compatibility with high-volume sterilization processes and superior sealing integrity compared to self-sealing options. By material, the medical-grade paper and plastic film combination dominates, offering an optimal balance between microbial barrier properties, visibility of contents, and cost-effectiveness. The end-user analysis confirms that hospitals remain the largest consumers, yet ambulatory surgical centers and dental clinics are registering accelerated growth, reflecting the decentralization of minor and outpatient surgical procedures, which requires dedicated sterilization capacity outside the traditional hospital setting.

AI Impact Analysis on Sterilization Pouch Market

User inquiries regarding the impact of Artificial Intelligence on the Sterilization Pouch Market often revolve around three core themes: optimization of supply chain logistics, enhancement of quality control (QC) and defect detection during manufacturing, and the role of smart inventory management systems. Users are keenly interested in whether AI-driven demand forecasting can reduce waste from expired stock, given the strict shelf-life requirements for sterilized goods. They also question the potential for AI vision systems to revolutionize the detection of minute breaches, seal inconsistencies, or material defects that could compromise the sterility barrier, thereby moving beyond manual or semi-automated inspection methods.

While AI does not directly interact with the physical sterilization process performed inside the autoclave, its influence is profoundly felt in the preparatory and post-sterilization phases. AI-powered predictive maintenance models ensure that the high-speed pouch manufacturing equipment operates optimally, minimizing downtime and guaranteeing consistent production quality necessary for compliance. Furthermore, sophisticated inventory management algorithms, often deployed in central sterile supply departments (CSSDs), utilize historical consumption data and procedure schedules to automatically calculate optimal stocking levels for various pouch sizes and types, ensuring that the correct supplies are available without leading to costly overstocking or critical shortages.

The future application of AI lies in integrating sensor data from sterilization equipment (like temperature curves, pressure data, and cycle times) with the corresponding packaging batch data. This integration allows for robust, end-to-end digital tracking of instrument reprocessing. Such systems can utilize machine learning to identify anomalous trends or patterns in batch data that might indicate a potential failure in packaging integrity, even before visual inspection, thereby providing an advanced layer of quality assurance far surpassing traditional indicator strips and manual documentation. This shift toward "smart sterilization records" is expected to be a major regulatory focus in the coming decade, further driving adoption.

- AI optimizes raw material procurement and production scheduling, reducing manufacturing lead times.

- Machine learning algorithms enhance visual inspection systems to detect micro-tears or sealing defects on pouches.

- AI-driven inventory platforms forecast demand for specific pouch sizes, minimizing CSSD stockouts and expiration waste.

- Predictive maintenance models increase the uptime and reliability of high-speed pouch sealing machinery.

- Integration of AI with RFID/barcode tracking offers enhanced digital traceability for every sterilized instrument batch.

DRO & Impact Forces Of Sterilization Pouch Market

The Sterilization Pouch Market dynamics are heavily influenced by a confluence of accelerating regulatory pressures, technological advancements in material science, and the pervasive global focus on eradicating healthcare-associated infections (HAIs). Key drivers include the mandatory implementation of reprocessing guidelines requiring validated sterile barriers for all critical instruments, the increasing number of surgical and dental procedures globally, and the consistent technological evolution of packaging materials that allow for broader compatibility across different sterilization modalities (e.g., accommodating low-temperature plasma sterilization requirements). The expansion of ambulatory surgical centers (ASCs) also serves as a critical driver, creating new, high-volume demand centers outside large hospitals.

Conversely, the market faces restraints primarily related to cost pressures and concerns about environmental sustainability. The shift toward more expensive, high-barrier, multi-layer films or specialized Tyvek-based pouches for demanding sterilization methods raises the overall consumable cost for healthcare facilities, often leading to pushback in budget-constrained regions. Furthermore, the massive volume of single-use plastic waste generated by sterilization packaging poses an increasing environmental challenge, prompting some facilities to explore reusable sterilization container systems, which, while niche, represent a competitive restraint on the disposable pouch market.

Significant opportunities exist in emerging economies where healthcare infrastructure is rapidly expanding and regulatory oversight is tightening, offering large untapped markets for standardized, certified pouches. Manufacturers also have the opportunity to innovate in the realm of smart packaging, such as embedding advanced chemical indicators or integrating NFC/RFID tags directly into the pouch structure, enhancing traceability and compliance documentation effortlessly. The increasing need for patient safety protocols acts as a powerful, permanent impact force, ensuring that regardless of economic volatility, investment in high-quality, dependable sterilization pouches remains a priority for all healthcare systems committed to modern patient care.

Segmentation Analysis

The Sterilization Pouch Market is systematically segmented based on material, product type, sterilization method, and end-user, providing a granular view of market dynamics and adoption patterns. This detailed categorization helps stakeholders identify the most profitable segments and tailor their product development and marketing strategies accordingly. The dominance of specific sterilization methods, such as steam (autoclave), directly influences the demand for compatible packaging materials, particularly those pouches using medical-grade paper which are highly permeable to steam yet function as an effective microbial barrier once the process is complete.

The most crucial segmentation lies in the product type, differentiating between self-sealing (or self-sterilization) pouches and heat-sealable pouches. Self-sealing pouches offer convenience and are particularly favored in smaller clinics, dental offices, and decentralized settings due to their ease of use, eliminating the need for specialized sealing equipment. Conversely, heat-sealable pouches dominate high-volume hospital central sterile supply departments (CSSDs) because they provide a tamper-evident, highly reliable seal essential for long-term storage and regulatory compliance, ensuring maximum integrity throughout the supply chain.

Further analysis of the end-user segment highlights a growing trend of sterilization services being outsourced to third-party sterilization facilities. While hospitals remain the cornerstone of demand, the accelerated growth of ambulatory surgical centers (ASCs) is transforming the distribution landscape. ASCs often require smaller, highly tailored orders of specific pouch sizes appropriate for instruments used in specialized outpatient procedures, leading to customization and specialization within the product offerings of pouch manufacturers to better serve these high-growth niche areas.

- By Product Type:

- Self-Sealing Pouches

- Heat-Sealable Pouches

- By Material:

- Medical-Grade Paper

- Plastic Film (Polyethylene, Polypropylene)

- Non-Woven Fabric (e.g., Tyvek)

- By Sterilization Method:

- Steam Sterilization (Autoclave)

- Ethylene Oxide (EtO) Sterilization

- Hydrogen Peroxide Gas Plasma Sterilization

- Formaldehyde Sterilization

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Dental Clinics

- Research Laboratories and Pharmaceutical Companies

Value Chain Analysis For Sterilization Pouch Market

The value chain for the Sterilization Pouch Market begins with the highly specialized upstream procurement of raw materials, primarily medical-grade paper (such as surgical kraft paper or specialty coated papers), transparent plastic films (typically multilayer laminates of PET/PE/PP for enhanced barrier properties), and chemical indicator inks. This phase is characterized by stringent quality checks, as the performance of the final product is entirely dependent on the permeability, strength, and non-toxicity of these base components. Suppliers must comply with ISO and FDA standards, making material sourcing a high-barrier entry segment within the overall value chain, often featuring long-term contractual agreements between pouch manufacturers and specialized paper/film producers.

The manufacturing and conversion phase involves high-precision automated machinery that laminates the paper and film, applies heat-seal zones, integrates the chemical indicators, and forms the final pouch structure. This stage is critical for maintaining consistent seal integrity and accurate placement of indicators. Downstream activities focus heavily on distribution, which involves complex logistics due to the global reach of the healthcare industry. Distribution channels are varied, incorporating both direct sales to large hospital systems and indirect distribution through established medical supply distributors, who manage localized inventory and handle last-mile delivery to smaller clinics and dental practices.

The distinction between direct and indirect distribution is crucial. Major global manufacturers often use direct sales models for key accounts, ensuring better control over pricing and inventory management, and fostering deeper relationships with large hospital purchasing groups. However, the indirect channel, leveraging regional or national medical product distributors, is essential for reaching the fragmented market of individual practitioners, dental offices, and smaller ASCs efficiently. This multi-channel approach ensures wide market penetration, particularly in developing markets where localized distributors possess superior logistical networks and regional regulatory expertise necessary for market access.

Sterilization Pouch Market Potential Customers

The primary consumers and end-users of sterilization pouches are institutions and entities involved in critical medical and dental reprocessing. Hospitals, particularly their Central Sterile Supply Departments (CSSDs), represent the largest volume purchasers globally. These departments manage the sterilization cycles for thousands of instruments daily, requiring a stable, high-volume supply of pouches compatible with diverse sterilization loads, sizes, and methods, making them the cornerstone customers for manufacturers.

Another rapidly expanding customer base is the network of Ambulatory Surgical Centers (ASCs). As healthcare systems globally emphasize cost containment and shift more procedures to outpatient settings, ASCs are becoming critical buyers. These centers often prioritize self-sealing pouches and specific sizes tailored to minimally invasive instruments. Dental clinics also constitute a highly important segment, characterized by frequent, smaller-volume purchases of dedicated dental sterilization pouches (often featuring built-in internal and external indicators) essential for maintaining standards during routine instrument reprocessing.

Beyond clinical settings, specialized potential customers include third-party contract sterilization facilities, which offer outsourced sterilization services for medical device manufacturers and smaller clinics, requiring bulk quantities of validation-compliant packaging. Furthermore, research laboratories and pharmaceutical companies utilize sterilization pouches for ensuring the aseptic preparation of lab tools, culture media components, and cleanroom supplies, showcasing the breadth of the market's reach beyond traditional patient care environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, STERIS plc, Cantel Medical (now part of STERIS), Getinge AB, Cardinal Health, Hu-Friedy Mfg. Co., A.R. Medicom Inc., Wihuri Group (Wipak), Belimed AG, DuPont de Nemours, Inc., SteriPackGroup, Amcor plc, GPC Medical Ltd., Promed Technologies, Baglioni Group, Healthcare Logistics Management, MIP Inc., MATACHANA GROUP, Becton, Dickinson and Company (BD), Propper Manufacturing Co. Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sterilization Pouch Market Key Technology Landscape

The technological landscape of the Sterilization Pouch Market centers not on novel product form factors but on iterative improvements in material science and indicator chemistry to enhance safety and compliance. A pivotal technology is the development of advanced multi-layer film laminates, particularly the transparent film component. These films must be strong enough to resist puncture and tearing during handling and storage, yet engineered to withstand the extreme temperatures and pressures of steam sterilization without delaminating or compromising the microbial barrier. For low-temperature sterilization methods (like hydrogen peroxide plasma), the adoption of specialized non-woven materials such as Tyvek (a registered trademark of DuPont) is mandatory, as traditional paper and plastic films cannot withstand the process, driving a premium segment based on material specialization.

Another significant technological advancement is the integration of high-quality, reliable chemical indicators (CIs). These indicators are inks printed directly onto the pouch material that change color only when exposed to specific critical parameters of a sterilization cycle (e.g., specific temperature, pressure, and time combination). The technology is moving toward Type 4, Type 5, and even Type 6 integrating indicators, offering increasingly robust assurance that the conditions necessary for sterilization were met inside the pouch. This standardization of indicator technology is crucial for minimizing human error during reprocessing and improving adherence to ANSI/AAMI ST79 guidelines.

The convergence of packaging with digital traceability represents the next frontier. Technologies such as high-resolution barcodes, two-dimensional matrix codes, and increasingly, embedded passive RFID (Radio-Frequency Identification) tags are being applied to sterilization pouches. These technologies automate the logging process in CSSDs, linking the specific sterile barrier package to the patient procedure, the instrument set inside, and the date and time of sterilization. This capability is vital for efficient recalls, streamlined inventory management, and the creation of unassailable digital audit trails required by major regulatory bodies, thereby enhancing the functional value of the pouch far beyond its basic barrier function.

Regional Highlights

Regional dynamics play a crucial role in shaping the Sterilization Pouch Market, influenced primarily by regulatory stringency, healthcare infrastructure maturity, and procedural volume. North America, encompassing the U.S. and Canada, currently holds the largest market share. This dominance is attributed to a massive procedural volume, stringent FDA and CDC infection control mandates that necessitate the highest quality sterilization packaging, and high awareness among healthcare professionals regarding sterile barrier system integrity. The widespread adoption of single-use disposables and a highly decentralized healthcare system with numerous ASCs contribute significantly to sustained high demand for both self-sealing and heat-sealable pouches.

Europe represents a mature and stable market, characterized by strict adherence to ISO and CE marking standards, especially in Germany, the UK, and France. The European market exhibits strong demand for sustainable and recyclable sterilization materials due to regional environmental policies, compelling manufacturers to develop advanced, eco-friendly paper and film combinations. Furthermore, the region is a key early adopter of advanced sterilization technologies like formaldehyde and low-temperature plasma, driving demand for specialized packaging solutions compatible with these sensitive processes.

The Asia Pacific (APAC) region is poised for the most rapid growth throughout the forecast period. This rapid acceleration is fueled by the significant investment in public and private hospital construction, the burgeoning medical tourism sector (particularly in countries like Thailand, Singapore, and India), and governmental efforts to standardize healthcare practices and infection control across rapidly developing urban centers. While price sensitivity remains a factor, the increasing regulatory oversight in countries like China and India is leading to a strong, gradual shift away from substandard packaging toward certified, high-quality sterilization pouches, offering substantial growth opportunities for global manufacturers seeking market penetration.

- North America: Dominant market share due to mature infrastructure, high procedural volumes, and stringent regulatory enforcement (FDA/CDC). Focus on high-throughput, heat-sealable pouches for large hospitals.

- Europe: Stable growth driven by ISO compliance, high adoption of advanced sterilization methods, and a strong regional focus on incorporating sustainable and recyclable packaging materials.

- Asia Pacific (APAC): Highest expected CAGR fueled by infrastructural development, increasing healthcare expenditure in China and India, and rising awareness of HAI prevention protocols. High potential for market penetration for specialized products.

- Latin America (LATAM): Moderate growth driven by improving access to basic healthcare services and increasing foreign investment in private clinics. Market characterized by price sensitivity and preference for cost-effective steam sterilization compatible pouches.

- Middle East and Africa (MEA): Emerging market driven by substantial investment in high-end hospital facilities in the GCC countries (Saudi Arabia, UAE). Demand focuses on premium, certified sterile barrier systems aligning with international quality standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sterilization Pouch Market.- 3M Company

- STERIS plc

- Cantel Medical (now part of STERIS)

- Getinge AB

- Cardinal Health

- Hu-Friedy Mfg. Co. (a subsidiary of Cantel)

- A.R. Medicom Inc.

- Wihuri Group (Wipak)

- Belimed AG

- DuPont de Nemours, Inc. (Material Supplier)

- SteriPackGroup

- Amcor plc

- GPC Medical Ltd.

- Promed Technologies

- Baglioni Group

- Healthcare Logistics Management

- MIP Inc.

- MATACHANA GROUP

- Becton, Dickinson and Company (BD)

- Propper Manufacturing Co. Inc.

Frequently Asked Questions

Analyze common user questions about the Sterilization Pouch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for sterilization pouches globally?

The primary driver is the stringent, non-negotiable regulatory environment centered around infection prevention and control (IPC) standards, such as those mandated by the CDC and ISO 11607. Increased surgical procedure volumes and the critical need to prevent healthcare-associated infections (HAIs) make sterile barrier systems mandatory consumables in all clinical settings.

How do heat-sealable pouches compare to self-sealing pouches in terms of usage?

Heat-sealable pouches offer superior seal integrity and are favored by high-volume Central Sterile Supply Departments (CSSDs) in hospitals for long-term storage and regulatory compliance, requiring a specialized sealing machine. Self-sealing pouches, offering convenience and rapid application, are predominantly used in smaller dental clinics, physician offices, and ambulatory surgical centers (ASCs) where throughput is lower.

Which sterilization methods require specialized pouch materials, and why?

Low-temperature sterilization methods, particularly hydrogen peroxide gas plasma (HPGP) and vaporized hydrogen peroxide (VHP), require specialized non-woven materials, such as Tyvek. Traditional paper-plastic pouches cannot be used because HPGP cannot adequately penetrate cellulose (paper) materials, necessitating synthetic substrates with high porosity and resistance to the plasma process.

What role does sustainability play in the future development of sterilization pouch materials?

Sustainability is a major trend. Manufacturers are increasingly focused on developing materials that are recyclable, bio-based, or minimize plastic content while strictly maintaining the microbial barrier function required by ISO 11607. This drive is accelerated by environmental pressures and regulatory demands in Europe and North America to reduce medical waste volume.

How does the integration of AI technology impact the sterile pouch supply chain?

AI primarily impacts the supply chain by optimizing inventory management and quality assurance. AI-driven predictive analytics forecast demand, reducing waste from expiration in CSSDs. Additionally, AI vision systems are being integrated into manufacturing lines to perform real-time, high-precision detection of seal defects or micro-perforations, ensuring a higher standard of product integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager