Steviol Glycoside Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437148 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Steviol Glycoside Market Size

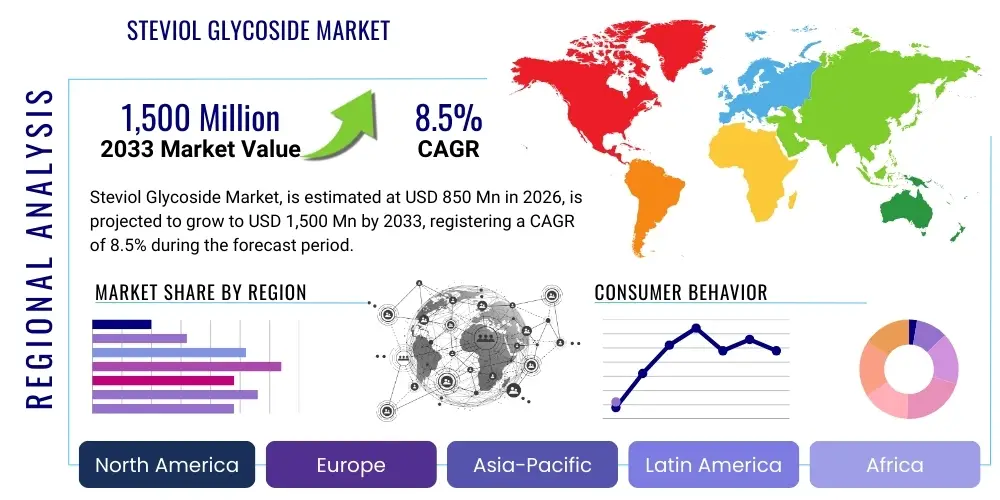

The Steviol Glycoside Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,500 Million by the end of the forecast period in 2033.

Steviol Glycoside Market introduction

The Steviol Glycoside Market encompasses the global trade of natural sweeteners derived from the leaves of the Stevia rebaudiana plant. These compounds are non-caloric, high-intensity sweeteners that are increasingly utilized as healthier alternatives to sugar and artificial sweeteners like aspartame and sucralose. Steviol glycosides, primarily Rebaudioside A (Reb A) and the more sought-after Rebaudioside M (Reb M) and D (Reb D), are crucial ingredients in the food and beverage industry, driven by escalating consumer demand for clean-label, natural products that support weight management and address chronic conditions such as diabetes. The product’s versatility allows its incorporation across diverse applications, ranging from carbonated soft drinks and fruit juices to dairy products, baked goods, and dietary supplements, positioning it as a fundamental component in the global shift towards health-conscious eating habits.

Major applications of steviol glycosides span the entire spectrum of consumable goods where sweetness is desired without the associated caloric load of sucrose. Beverages constitute the largest application segment, where manufacturers are constantly reformulating products to comply with sugar taxes and evolving nutritional guidelines imposed by regulatory bodies worldwide. The benefits of steviol glycosides include their natural origin, high potency (often 200 to 300 times sweeter than sugar), and relatively stable thermal properties, making them suitable for processing. Furthermore, continuous advancements in extraction and purification technologies, particularly the development of enzyme-modified stevia and fermentation techniques, have significantly reduced the lingering bitter aftertaste traditionally associated with early generations of stevia extracts, thereby enhancing consumer acceptance and driving market penetration.

The primary driving factors sustaining the market's robust growth are twofold: stringent governmental regulations aimed at curbing excessive sugar consumption and a pervasive consumer focus on preventative health and wellness. The rise in obesity and diabetes rates globally necessitates immediate effective sugar reduction strategies, making stevia an indispensable tool for food and beverage companies. Additionally, the move away from artificial ingredients has solidified stevia’s position as the leading natural, plant-derived sweetening solution. Ongoing research focusing on developing steviol glycosides that possess a superior taste profile, mirroring that of sugar, ensures continued innovation and expansion into new product categories previously resistant to high-intensity sweeteners.

Steviol Glycoside Market Executive Summary

The Steviol Glycoside Market is characterized by intense competitive dynamics driven by innovation in taste profile and sourcing efficiency. Current business trends indicate a critical shift towards biosynthetic production methods, such as fermentation and enzymatic conversion, to secure high-purity Reb M and Reb D, which offer superior taste quality compared to the more abundant Reb A. This strategy addresses supply chain volatility associated with agricultural sourcing and enables manufacturers to achieve greater economies of scale and consistency. Key market players are heavily investing in vertical integration, controlling the entire process from stevia leaf cultivation to final glycoside extraction or fermentation, thereby ensuring compliance with stringent quality and sustainability standards increasingly demanded by large multinational food corporations seeking stable, reliable ingredient sourcing.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily due to the established history of stevia cultivation in countries like China and regulatory approvals expanding its use across emerging economies such as India and Southeast Asia. North America and Europe, however, represent the highest revenue-generating regions, propelled by high consumer awareness, widespread clean-label adoption, and aggressive sugar reduction mandates. European Union regulations favoring natural, sustainable ingredients further bolster market uptake, while the prevalence of lifestyle diseases in North America accelerates the switch from traditional caloric sweeteners. Manufacturers are focusing marketing and distribution efforts in these regions, emphasizing the natural positioning of the product to capture the premium segment of the non-caloric sweetener category.

Segment trends underscore the dominance of the powder form, preferred for its ease of handling and high concentration, making it ideal for industrial-scale food production. However, the liquid form is gaining traction in the consumer retail segment for direct use in home beverages. Crucially, in terms of compound type, there is a pronounced pivot away from legacy stevioside and basic Reb A towards next-generation minor glycosides, specifically Reb M and Reb D. These compounds command premium pricing due to their sugar-like taste and are increasingly necessary for formulating successful zero-sugar versions of historically sugar-intensive products, particularly premium carbonated soft drinks and high-end dairy alternatives. This shift is fueling R&D expenditure directed towards fermentation technology, which promises a sustainable and cost-effective pathway to high-purity minor glycosides.

AI Impact Analysis on Steviol Glycoside Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Steviol Glycoside market frequently center on three main areas: optimizing raw material cultivation, enhancing molecular structure predictability for improved taste, and streamlining complex supply chains. Users are keenly interested in how machine learning can analyze environmental data (soil moisture, nutrient levels, weather patterns) to maximize the yield and Reb M content within stevia leaves, minimizing resource waste and increasing agricultural efficiency. Furthermore, there is significant interest in AI's role in computational chemistry, specifically in predicting the interaction of various steviol glycosides with flavor receptors, thereby accelerating the formulation of novel blends that eliminate bitterness and achieve the desired sugar-like taste profile, an essential technological hurdle for market expansion. Finally, businesses are exploring AI-driven logistics platforms to manage the global supply chain, which includes sourcing from diverse agricultural regions, managing enzymatic conversion processes, and optimizing inventory based on real-time global demand forecasts, ensuring stability and cost efficiency in a sensitive ingredient market.

- AI-driven precision agriculture optimization for maximizing steviol glycoside yield and purity (e.g., Reb M content) in stevia leaves.

- Machine learning algorithms utilized in computational chemistry to rapidly screen and predict optimal steviol glycoside blends for superior taste profiles and bitterness mitigation.

- Predictive demand forecasting and inventory management through AI platforms to stabilize global supply chains and manage price volatility.

- Automation of complex extraction and purification processes, improving efficiency and reducing variability in the final ingredient quality.

- Utilization of AI in regulatory compliance and tracing the origin of natural ingredients to ensure sustainability and clean-label adherence.

DRO & Impact Forces Of Steviol Glycoside Market

The trajectory of the Steviol Glycoside Market is governed by a compelling mix of growth stimulants, inherent limitations, and prospective expansion pathways. Drivers primarily include the global public health initiative focused on reducing sugar consumption, supported by government implementation of sugar taxes and mandatory labeling requirements. These external pressures compel multinational food and beverage companies to adopt high-intensity, non-caloric alternatives like steviol glycosides. Coupled with this is the continuous and accelerating consumer preference for natural, plant-derived ingredients, aligning perfectly with the clean-label movement. The continuous technological breakthroughs in enzymatic bioconversion and fermentation techniques represent a significant opportunity, promising to deliver commercial quantities of superior-tasting minor glycosides (Reb M and Reb D) at competitive prices, thereby overcoming the long-standing hurdle of the metallic or bitter aftertaste associated with earlier stevia generations.

Despite strong drivers, the market faces notable restraints. The most significant historical constraint has been the inherent difficulty and high cost associated with extracting and purifying the highest quality glycosides (Reb M) from the natural leaf, where they occur in minimal concentrations. This supply constraint historically led to higher prices compared to artificial sweeteners, limiting broader adoption. Furthermore, sensory issues remain a challenge; while significant improvements have been made, achieving a complete sugar-like taste profile across all application matrices (especially dairy and acidic beverages) still requires complex blending and formulation expertise. Regulatory complexities also vary by region; although generally approved, minor differences in permissible usage levels and approved sources require meticulous compliance planning for global manufacturers, occasionally slowing down new product introductions.

Opportunities for market expansion are vast, centering on integrating steviol glycosides into entirely new product categories, particularly in pharmaceutical excipients, personal care products, and pet food, beyond the traditional scope of beverages and confectionery. The development of next-generation sweetness platforms utilizing advanced biotechnology, such as engineered yeast strains for high-yield Reb M production, promises to democratize access to premium stevia compounds, making them accessible even in cost-sensitive emerging markets. Additionally, strategic partnerships between stevia producers and major food technology companies focused on ingredient optimization and novel texture agents will further accelerate the market penetration, establishing steviol glycosides as the gold standard for natural, zero-calorie sweetness worldwide. The overall impact forces are strongly positive, favoring long-term, sustained growth catalyzed by technological refinement and shifting public health priorities.

Segmentation Analysis

The Steviol Glycoside market is comprehensively segmented based on its source of production, physical form, specific compound type, and diverse end-use applications. Understanding these segments is crucial for market participants to tailor their investment strategies, focusing R&D efforts on high-growth areas such as enzymatic and fermentation-derived Reb M. The segmentation analysis reflects the market's evolution from relying solely on traditional leaf extraction to adopting advanced biotechnological methods, providing superior taste and addressing supply chain inconsistencies. The beverage application segment remains the largest consumer, but significant potential lies in expanding usage within specialized food categories like clinical nutrition and sports supplements, reflecting the ingredient’s health benefits and suitability for high-performance dietary requirements.

- By Source

- Stevia Leaf Extract (Traditional Extraction)

- Enzymatic Bioconversion

- Fermentation (Biosynthesis)

- By Form

- Powder

- Liquid

- By Compound Type

- Rebaudioside A (Reb A)

- Rebaudioside M (Reb M)

- Rebaudioside D (Reb D)

- Stevioside

- Others (e.g., Reb C, Reb F)

- By Application

- Beverages

- Carbonated Soft Drinks (CSD)

- Juices and Nectars

- Tea and Coffee

- Energy and Sports Drinks

- Food

- Dairy and Frozen Desserts

- Confectionery and Gums

- Bakery Products

- Tabletop Sweeteners

- Pharmaceuticals and Dietary Supplements

- Others (Personal Care, Animal Feed)

- Beverages

Value Chain Analysis For Steviol Glycoside Market

The value chain for the Steviol Glycoside Market begins with extensive upstream activities centered around raw material cultivation and harvesting. This phase involves meticulous agricultural planning, including selecting high-yield stevia varieties, ensuring sustainable farming practices, and managing the drying and baling of the leaves. Key upstream players include specialized agricultural companies and large ingredient suppliers engaged in contract farming across regions like China, Paraguay, and parts of the US. Efficiency in this stage dictates the initial purity and concentration of desired glycosides, heavily influencing the subsequent extraction costs. As the market pivots towards fermentation, the upstream focus increasingly includes R&D in customized yeast strains and microbial engineering, shifting reliance partly away from agricultural volatility towards biotechnological control.

Midstream processing involves the complex industrial steps of extraction, purification, and refinement. Traditional methods utilize water or alcohol-based extraction to separate the steviol glycosides from the dried leaf matter, followed by crystallization, filtration, and chromatography to isolate specific compounds (like Reb A, M, or D) to the required purity levels (often 95% or higher). The adoption of enzymatic bioconversion and biosynthesis techniques has introduced a highly efficient parallel midstream process, where major ingredient manufacturers convert less desirable Reb A into superior Reb M or produce Reb M directly via fermentation. These technologies are capital-intensive but critical for achieving the high purity and premium taste profiles demanded by leading food and beverage corporations. Quality control and assurance are paramount in this stage to maintain regulatory compliance.

The downstream segment encompasses the distribution channel and the final application phase. Distribution is complex, involving both direct sales to major multinational food and beverage corporations (direct channel) and indirect sales through specialized global ingredient distributors and brokers (indirect channel) who cater to smaller regional manufacturers. Direct channels are preferred for high-volume, long-term contracts where technical support and customized blending solutions are required. The end-users—beverage manufacturers, food processors, and pharmaceutical companies—then integrate the steviol glycosides into their final products, often requiring specialized formulation expertise to manage potential taste interactions and solubility issues, confirming the ingredient's journey from cultivation or fermentation to consumer consumption.

Steviol Glycoside Market Potential Customers

The primary customers for steviol glycosides are large-scale industrial food and beverage manufacturers seeking cost-effective, high-intensity, zero-calorie sweetening solutions to meet shifting consumer demands and regulatory pressures. The beverage sector, encompassing major players in soft drinks, ready-to-drink teas, dairy alternatives, and sports nutrition, represents the most significant end-user base due to the immediate need for high-volume sugar reduction without sacrificing taste. These customers value natural sourcing, stable supply, high purity (especially Reb M/D), and regulatory assurance. They often engage in multi-year supply contracts and demand significant technical collaboration to integrate the sweetener seamlessly into their complex matrices, focusing heavily on achieving parity with the full-sugar taste experience.

Secondary, yet rapidly expanding, customer segments include manufacturers in the dietary supplements and pharmaceutical industries. Pharmaceutical companies utilize steviol glycosides as non-caloric masking agents for bitter active pharmaceutical ingredients (APIs), particularly in pediatric medications and specialized over-the-counter formulations. Dietary supplement and functional food producers incorporate stevia not just for sweetness, but also for its natural, health-promoting image, often utilizing it in protein powders, meal replacement bars, and functional beverages marketed towards fitness-conscious and health-aware consumers. These customers prioritize certifications, specific non-GMO status, and often require unique delivery forms, such as liquid drops or highly soluble granule powders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,500 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pure Circle, Ingredion Incorporated, Cargill, Tate & Lyle, GLG Life Tech, S&W Seed Co., Haotian Pharm, ADM, Sunwin Stevia International, Zhucheng Dongxiao Biotechnology, Layn Corp, Daepyung Co., Merck KGaA, Foodchem International, Beijing Vistapon Biotech, DSM Nutritional Products, SweeGen, Stevia Leaf Holdings, Morita Kagaku Kogyo, Hunan Huacheng Biotech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steviol Glycoside Market Key Technology Landscape

The technological landscape of the Steviol Glycoside Market is rapidly evolving, moving beyond conventional water or alcohol-based extraction toward sophisticated biotechnology aimed at enhancing taste quality and ensuring supply stability. The primary technological focus centers on two key areas: improving the efficiency of minor glycoside isolation from the leaf and, more critically, developing alternative biosynthesis pathways. Traditional extraction methods involve multiple chromatography steps which are resource-intensive and costly, especially for high-purity Reb M which occurs naturally at less than 1% concentration in the stevia leaf. Therefore, continuous process optimization, including supercritical fluid extraction and advanced membrane separation, is crucial for reducing processing time and environmental footprint in agricultural sourcing methods.

The most transformative technology driving the market is the industrial-scale deployment of enzymatic bioconversion and fermentation. Enzymatic bioconversion uses specific enzymes to convert readily available, less desired steviol glycosides (like Reb A) into premium ones (like Reb M), significantly enhancing the yield of the superior-tasting compound. Fermentation, or biosynthesis, represents the cutting edge; this process utilizes engineered yeast or other microorganisms to directly produce Reb M from a simple sugar feedstock, completely bypassing the need for stevia cultivation. This biotechnological approach offers unparalleled purity, scalability, and consistency, effectively decoupling production from agricultural constraints and positioning manufacturers to meet the massive demand for sugar-like, zero-calorie ingredients at a competitive price point, solidifying the long-term viability of steviol glycosides against artificial alternatives.

Regional Highlights

- North America: Dominates the market share driven by high consumer awareness regarding sugar reduction and proactive industry reformulation efforts. The region, particularly the United States, sees strong adoption of Reb M in flagship beverage brands and continuous innovation in tabletop sweeteners. The robust regulatory framework and high disposable incomes support premium pricing for natural, non-GMO stevia products.

- Europe: Characterized by stringent clean-label and natural ingredient preferences, Europe shows rapid growth. Regulatory clarity from the European Food Safety Authority (EFSA) regarding various steviol glycosides supports market expansion. High taxation on sugary drinks across several EU nations provides a substantial economic incentive for manufacturers to adopt high-intensity natural sweeteners.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR due to established stevia cultivation (China, India) and increasing health consciousness among the vast consumer base. Expanding middle-class populations, coupled with the rising incidence of diet-related diseases, drive the adoption of stevia in traditional Asian food and beverage formulations. China is a major producer and consumer, influencing global supply dynamics.

- Latin America: Experiences rapid uptake, especially in Brazil and Mexico, due to regulatory changes and increasing obesity rates. Stevia is often marketed emphasizing its plant-based, South American origin, appealing to regional preference for natural ingredients. Market growth is closely tied to the expansion of multinational food and beverage companies operating within the region.

- Middle East and Africa (MEA): Represents an emerging market with gradual adoption. Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, fueled by rising health awareness and governmental initiatives to reduce diabetes prevalence. The market requires careful navigation of local import regulations and religious dietary requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steviol Glycoside Market.- Pure Circle

- Ingredion Incorporated

- Cargill

- Tate & Lyle

- GLG Life Tech

- S&W Seed Co.

- Haotian Pharm

- ADM

- Sunwin Stevia International

- Zhucheng Dongxiao Biotechnology

- Layn Corp

- Daepyung Co.

- Merck KGaA

- Foodchem International

- Beijing Vistapon Biotech

- DSM Nutritional Products

- SweeGen

- Stevia Leaf Holdings

- Morita Kagaku Kogyo

- Hunan Huacheng Biotech

Frequently Asked Questions

Analyze common user questions about the Steviol Glycoside market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Steviol Glycoside Market?

The primary market driver is the global effort to reduce sugar consumption, backed by government mandates (like sugar taxes) and robust consumer preference for natural, non-caloric, clean-label sweeteners as alternatives to artificial options.

Which Steviol Glycoside compound offers the best sugar-like taste profile?

Rebaudioside M (Reb M) is widely regarded as the steviol glycoside with the taste profile closest to traditional sugar, exhibiting minimal bitterness or off-notes compared to older compounds like Reb A or Stevioside.

How is biotechnology influencing the supply chain of high-purity Steviol Glycosides?

Biotechnology, particularly precision fermentation, allows manufacturers to produce high-purity Reb M and Reb D sustainably and at scale, reducing reliance on volatile agricultural supply chains and overcoming the cost barrier associated with low natural leaf concentrations.

Which geographical region holds the largest market share for Steviol Glycosides?

North America currently holds the largest revenue share in the Steviol Glycoside Market due to early adoption, high health awareness, and widespread integration of the ingredient by major multinational food and beverage companies.

What are the main application segments driving demand for Stevia sweeteners?

The Beverages segment (including CSDs, juices, and sports drinks) remains the largest consumer, closely followed by the Food sector, specifically tabletop sweeteners, confectionery, and dairy products, all focused on caloric reduction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager