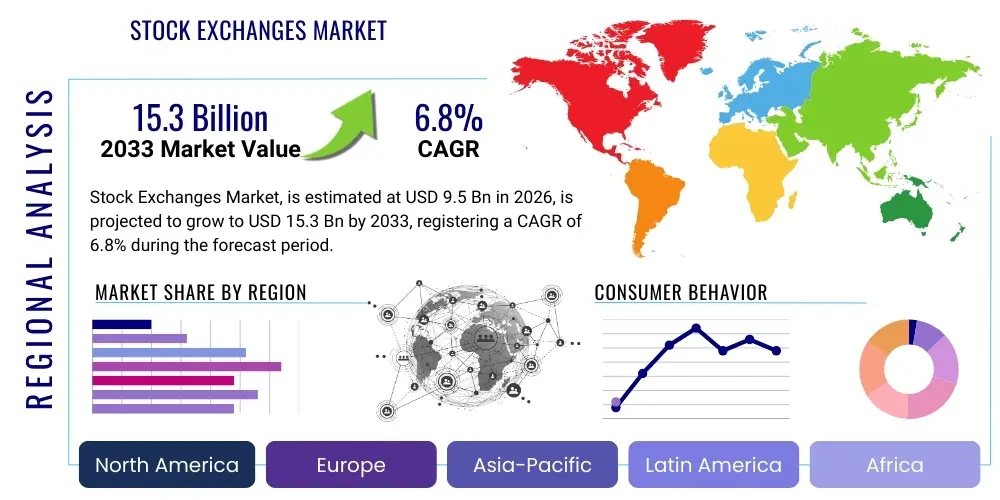

Stock Exchanges Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435367 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Stock Exchanges Market Size

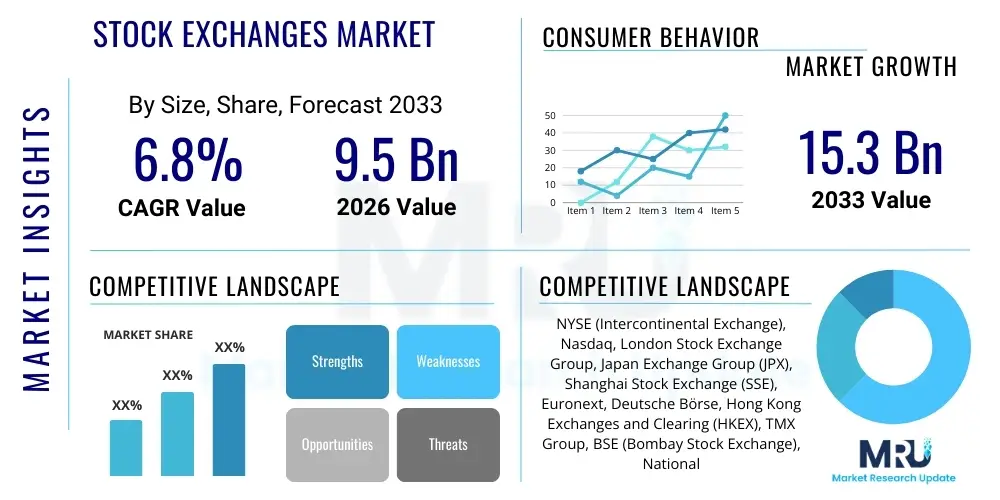

The Stock Exchanges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.5 billion in 2026 and is projected to reach USD 15.3 billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating global digitalization of financial transactions, the increasing participation of retail investors facilitated by low-cost brokerage platforms, and the continuous demand for capital formation by growing enterprises worldwide.

The valuation reflects the consolidated trading revenues, listing fees, market data service provision, and post-trade activities handled by major exchanges globally. While traditionally dominated by established exchanges in North America and Europe, the growth rate acceleration is increasingly attributed to emerging economies in the Asia-Pacific region, where capital markets are maturing rapidly and attracting significant foreign institutional investment. Moreover, the integration of advanced technologies like blockchain for settlement and artificial intelligence for market surveillance further enhances the operational efficiency and attractiveness of regulated exchange platforms.

Market size calculation also incorporates the value generated by niche trading platforms focusing on specific asset classes such as commodities and specialized derivatives, reflecting a shift towards diversified trading products tailored to complex risk management strategies. The geopolitical stability and regulatory landscape remain crucial determinants influencing trading volumes and listing activity, especially for large Initial Public Offerings (IPOs) that significantly contribute to the exchange's transaction fees and visibility within the global financial architecture.

Stock Exchanges Market introduction

The Stock Exchanges Market encompasses the platforms and infrastructure facilitating the issuance, buying, and selling of securities, derivatives, and other financial instruments. These regulated entities serve as central meeting places for investors seeking to deploy capital and corporations seeking to raise capital, playing a fundamental role in global economic growth and stability. The core product offering includes equity trading, bond trading, derivatives exchanges, market data services, and clearing and settlement services. Major applications span corporate fundraising (IPOs, secondary offerings), asset diversification for institutional funds, price discovery, and systematic risk management for various financial participants.

Key benefits derived from well-functioning stock exchanges include enhanced market liquidity, efficient capital allocation, transparency in pricing, and stringent regulatory oversight that protects investors. The establishment of secure and technologically advanced trading environments minimizes transaction costs and execution latency, which are critical performance indicators for high-frequency trading firms and institutional investors. Furthermore, exchanges often drive innovation in financial technology, adopting cutting-edge solutions to manage massive data volumes and ensure instantaneous trade execution across geographically dispersed market participants.

The primary driving factors propelling market expansion include the globalization of capital flows, encouraging cross-border listings and trading; the digitization of brokerage services, making investment accessible to a wider demographic; and supportive government policies aimed at deepening local capital markets. Additionally, the proliferation of specialized Exchange Traded Funds (ETFs) and complex financial products necessitates robust, regulated exchange infrastructure capable of handling increasing complexity and volume, ensuring continuous market efficiency and maintaining investor confidence amidst economic volatility.

Stock Exchanges Market Executive Summary

The Stock Exchanges Market demonstrates resilient growth driven by accelerated technological integration and evolving global regulatory frameworks designed to promote transparency and stability. Key business trends indicate a strong move towards diversification beyond traditional listing fees, with market data sales, index licensing, and technological service provision becoming increasingly significant revenue streams. Exchange groups are actively engaging in vertical integration, consolidating clearing, settlement, and data analytics capabilities to offer comprehensive end-to-end solutions, enhancing profitability and control over the trading lifecycle. Strategic mergers and acquisitions among regional exchanges are also a defining trend, aiming to achieve economies of scale and cross-list capabilities necessary to compete with global mega-exchanges.

Regionally, the Asia Pacific (APAC) market is anticipated to record the highest growth rates, fueled by burgeoning middle-class wealth, regulatory reforms opening up markets like India and China to international investment, and the rise of local tech giants seeking large-scale listings. North America and Europe, while representing mature markets, maintain dominance in terms of overall trading value and sophistication, specifically in complex derivatives and high-frequency trading. These regions are focusing on upgrading legacy infrastructure to support ultra-low latency trading and implementing robust cybersecurity measures to protect critical financial infrastructure from sophisticated threats.

Segment trends highlight the shift towards electronic trading dominating operational models, rendering open outcry nearly obsolete across major exchanges. Derivatives trading, particularly in sophisticated structured products and commodities, is exhibiting significant growth volatility, linked directly to global commodity cycles and inflation expectations. From an end-user perspective, the retail investor segment has experienced explosive growth following the proliferation of fractional share ownership and commission-free trading, demanding more user-friendly interfaces and educational resources from both exchanges and brokerage firms, further stimulating market activity across all segments.

AI Impact Analysis on Stock Exchanges Market

User inquiries regarding Artificial Intelligence (AI) in the Stock Exchanges Market predominantly center on its role in market integrity, trading efficiency, and revenue generation opportunities. Common questions address how AI enhances regulatory compliance, specifically querying AI's ability to detect sophisticated insider trading or market manipulation in real-time. Users also express high expectations regarding the use of AI and machine learning (ML) to process vast amounts of unstructured data (news, social media sentiment) for superior market intelligence and automated trading strategies. There is palpable anticipation concerning AI’s potential to dramatically reduce operational costs for exchanges through automation of back-office functions and its contribution to creating novel, high-value data products for institutional clients, summarizing key themes of efficiency, risk management, and data monetization.

The integration of AI is fundamentally reshaping the core functions of stock exchanges, transitioning them from simple transaction platforms to intelligent data aggregators and risk monitors. AI algorithms are now critical in enhancing liquidity by optimizing order matching and propagation mechanisms, ensuring fairer and more efficient execution for all participants. Furthermore, AI-powered predictive maintenance models are being deployed to minimize system downtime, a crucial element for exchanges where milliseconds can translate into billions in potential losses or missed opportunities. This systemic reliance on ML models necessitates continuous investment in high-performance computing infrastructure and specialized data science talent within exchange organizations.

Concerns often revolve around algorithmic biases and the ethical implications of using deep learning models in price discovery, particularly how these systems might amplify volatility or inadvertently favor specific trading styles. Therefore, exchanges are increasingly focused on explainable AI (XAI) to ensure transparency and accountability in their automated surveillance and risk management tools. The effective deployment of AI technologies is positioned not only as a competitive necessity but also as a regulatory imperative to maintain fair, orderly, and resilient financial markets in an increasingly complex and interconnected global environment.

- Real-time market surveillance and fraud detection enhanced by ML anomaly recognition.

- Algorithmic trading optimization leading to increased market liquidity and reduced slippage.

- Automation of post-trade processing, clearing, and settlement through intelligent systems.

- Creation of sophisticated, high-value market data products and predictive analytics services.

- Improved operational efficiency and reduced latency through AI-driven network management.

- Enhanced cybersecurity posture using AI to detect and neutralize advanced persistent threats.

DRO & Impact Forces Of Stock Exchanges Market

The Stock Exchanges Market is primarily driven by the deepening globalization of finance, the widespread adoption of digital brokerage services, and the continual need for corporations to access public capital markets for expansion and innovation. Restraints include stringent and often fragmented regulatory burdens across different jurisdictions, high capital expenditure requirements for maintaining state-of-the-art low-latency technology infrastructure, and significant vulnerability to cybersecurity threats which mandate continuous, costly investment in defense mechanisms. Opportunities are abundant in areas such as blockchain adoption for streamlining post-trade processes, expansion into emerging markets, and the monetization of proprietary market data using advanced AI analytics, creating new revenue streams.

Impact forces currently shaping the market are the accelerating pace of technological innovation, particularly in AI and quantum computing potentially affecting execution speed, and the growing influence of retail investors whose collective market participation significantly affects trading volumes and market psychology. Regulatory changes, such as the implementation of MiFID II in Europe or new listing standards globally, exert immediate and powerful influence over operational models and market access. Furthermore, geopolitical risks and macroeconomic instability directly impact investor confidence, leading to cyclical fluctuations in IPO activity and trading turnover, thereby influencing exchange revenues.

The critical balance exchanges must manage involves maximizing operational efficiency through automation while rigorously adhering to global standards for market integrity and data security. The continuous development of new derivative and specialized asset classes (e.g., carbon credits, digital assets) represents a substantial opportunity, providing diversification and attracting specialized institutional capital. However, the inherent systemic risk associated with highly interconnected global markets means that regional economic shocks can rapidly propagate, necessitating robust risk management and capital buffers across the exchange ecosystem.

Segmentation Analysis

The Stock Exchanges Market is comprehensively segmented based on the type of trading activity supported, the operational model employed, and the primary end-user demographic served. This layered segmentation allows for a granular understanding of revenue drivers and competitive landscapes across different financial product categories and investor profiles. Analysis across these segments reveals varying growth trajectories, with high-growth potential identified particularly within the derivatives and specialized commodity trading segments, often correlating with geopolitical and economic volatility that increases hedging demand.

Segmentation by type of trading activity (e.g., Equities, Bonds, Derivatives) is crucial because each product category is governed by distinct regulatory regimes, trading protocols, and pricing sensitivities, impacting the revenue structure of the exchange. For instance, equity trading typically generates substantial listing fees and lower margin trading revenue compared to high-volume, low-margin transactions characteristic of fixed income products. Operational segmentation highlights the final dominance of electronic trading platforms, which offer unmatched speed and scale necessary for modern high-frequency trading firms, effectively displacing traditional physical trading floors.

The segmentation by end-user, differentiating between Institutional Investors, Retail Investors, and Corporations, is essential for tailoring data products and access services. Institutional investors drive the vast majority of trading volume and demand sophisticated, low-latency access and customized data analytics, whereas the booming retail segment requires simplified interfaces, educational content, and mobile access. Corporations, the primary source of listing fees, require advisory services and robust market infrastructure to support capital raising activities, demonstrating the need for exchanges to manage diverse stakeholder expectations effectively.

- By Type:

- Stock Trading (Equities)

- Commodity Trading

- Derivatives (Futures, Options, Swaps)

- Bonds (Fixed Income)

- Other Specialized Securities

- By Operation:

- Electronic Trading Platforms

- Open Outcry (Residual and niche markets)

- By End-User:

- Institutional Investors (Hedge Funds, Pension Funds, Asset Managers)

- Retail Investors

- Corporations (Issuers)

Value Chain Analysis For Stock Exchanges Market

The value chain for the Stock Exchanges Market is complex and highly integrated, extending from the initial upstream activities of technology development and regulatory compliance to the final downstream delivery of trading execution, clearing, and data services to end-users. Upstream analysis focuses heavily on the procurement of cutting-edge hardware and software for trading systems, including high-speed networking equipment, cloud computing resources, and advanced algorithmic trading engines developed either internally or sourced from specialized FinTech vendors. Regulatory bodies and governing organizations also play a critical upstream role in establishing the rules and standards that define the operational boundaries of the exchange.

Midstream activities are characterized by the core functions of the exchange: listing securities, market making, order book management, and price discovery. Exchanges leverage sophisticated matching algorithms to ensure fair and rapid execution of trades. Downstream analysis focuses on post-trade activities, dominated by clearing houses and central counterparties (CCPs), which manage counterparty risk and ensure the settlement of transactions. The distribution channel is predominantly electronic and direct, with major institutional investors connecting directly via co-location services for minimal latency, while retail investors access the exchange indirectly through licensed brokerage firms that serve as intermediaries.

The shift towards vertical integration means that major exchange groups increasingly control both the trading platform (direct) and the clearing/settlement mechanism (critical infrastructure). This consolidation allows exchanges to capture a larger share of the transaction value and offer streamlined services. However, market data dissemination—another crucial downstream activity—is also a significant, high-margin revenue stream, distributed both directly to data vendors and specialized institutional subscribers and indirectly via integrated trading terminals provided by brokers, highlighting a hybrid distribution model maximizing reach and monetization.

Stock Exchanges Market Potential Customers

The primary end-users and potential customers of the Stock Exchanges Market are diverse, encompassing institutional behemoths that generate high trading volumes, rapidly growing segments of individual retail traders, and corporations seeking capital. Institutional Investors, including large asset management firms, pension funds, hedge funds, and sovereign wealth funds, represent the cornerstone of the market, demanding exceptional liquidity, robust risk management tools, and access to proprietary market data feeds necessary for sophisticated quantitative trading strategies. Their decisions regarding asset allocation and fund management directly influence market volatility and overall trading turnover.

Retail Investors constitute a rapidly expanding customer base, particularly with the democratization of trading enabled by mobile platforms, commission-free models, and the ability to trade fractional shares. This segment seeks accessible, user-friendly trading interfaces, educational content, and lower entry barriers, driving demand for simpler financial products like ETFs and index funds. Exchanges and associated brokerages are adapting by offering tailored platforms and enhanced communication strategies to serve this demographic effectively, transforming what was once an exclusive arena into a mass-market investment tool.

Finally, Corporations and Governments serve as essential customers as issuers of securities. Corporations rely on stock exchanges to execute Initial Public Offerings (IPOs), secondary offerings, and debt issuances to fund growth, mergers, and capital projects. Governments use exchanges for issuing sovereign and municipal bonds. These issuers demand transparency, fair valuation, and access to deep pools of global capital. Attracting high-quality listings is a competitive imperative for exchanges, driving innovation in listing standards and market visibility services offered to corporate clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 billion |

| Market Forecast in 2033 | USD 15.3 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NYSE (Intercontinental Exchange), Nasdaq, London Stock Exchange Group, Japan Exchange Group (JPX), Shanghai Stock Exchange (SSE), Euronext, Deutsche Börse, Hong Kong Exchanges and Clearing (HKEX), TMX Group, BSE (Bombay Stock Exchange), National Stock Exchange of India (NSE), SIX Swiss Exchange, Australian Securities Exchange (ASX), Bolsa Mexicana de Valores (BMV), Korea Exchange (KRX), Singapore Exchange (SGX), Cboe Global Markets, Moscow Exchange (MOEX), Johannesburg Stock Exchange (JSE), B3 S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stock Exchanges Market Key Technology Landscape

The technological landscape of the Stock Exchanges Market is defined by the unrelenting pursuit of speed, security, and scalability, essential requirements for handling the immense volume and velocity of modern electronic trading. The core infrastructure relies heavily on ultra-low latency trading systems, typically built on proprietary matching engines, which utilize highly optimized network protocols and co-location services to minimize the time between order submission and execution. This infrastructure is often supported by high-performance computing (HPC) clusters, enabling complex risk management calculations and market data distribution in near real-time, forming the backbone of competitive advantage for global exchanges.

A second critical technology focus is the adoption of distributed ledger technology (DLT), particularly blockchain, moving beyond theoretical discussions to pilot projects aimed at revolutionizing post-trade processes. DLT promises to significantly reduce settlement times—potentially moving to T+0—and minimize counterparty risk by creating immutable, shared records of ownership. While full implementation faces significant regulatory and interoperability hurdles, several major exchanges are actively developing DLT-based platforms for specialized asset trading and tokenized securities, indicating a fundamental shift in how ownership and transfer are managed.

Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are pervasive, utilized across market surveillance, fraud detection, and the creation of advanced data products. These technologies process petabytes of market data, news feeds, and communication patterns to identify market abuse, predict volatility, and refine algorithmic trading strategies. Cybersecurity tools, including advanced encryption, behavioral analytics, and AI-driven defense mechanisms, are also paramount, given that exchanges are critical national infrastructure and primary targets for sophisticated cyberattacks, necessitating continuous investment in protective technologies.

Regional Highlights

- North America: This region, anchored by the NYSE and Nasdaq, dominates the global market in terms of listing values, trading volumes, and technological sophistication. It serves as the primary hub for global IPOs, especially in the technology and life sciences sectors. The market is characterized by intense competition among high-frequency trading firms and a strong focus on regulatory compliance and market data monetization. The early adoption of advanced technologies like AI in surveillance and the robust ecosystem of institutional investors ensure sustained market leadership, although future growth rates may be modest compared to developing regions.

- Europe: The European market, led by the London Stock Exchange Group (LSEG), Deutsche Börse, and Euronext, is highly fragmented but sophisticated. It is heavily influenced by pan-European regulations such as MiFID II, which aims to enhance competition and transparency. Strategic focus is currently centered on post-Brexit realignment, the integration of ESG (Environmental, Social, and Governance) factors into market indices, and the development of consolidated data reporting systems across multiple countries, driving investment in unified IT platforms.

- Asia Pacific (APAC): APAC represents the fastest-growing region, driven by the economic powerhouses of China (Shanghai Stock Exchange), Japan (JPX), and India (BSE, NSE). Rapid urbanization, rising affluence, and governmental efforts to deepen local capital markets are key drivers. The region is seeing massive inflows of foreign institutional investment attracted by strong domestic corporate growth. Technology adoption is high, with exchanges in Singapore and Hong Kong pioneering digital asset and blockchain initiatives, positioning APAC as a future leader in global financial innovation.

- Latin America (LATAM): This region, centered around Brazil (B3) and Mexico (BMV), is characterized by volatility and opportunities driven by commodity trading and local regulatory reforms aimed at attracting international listings. The primary challenge is currency fluctuation and sovereign risk, but growth is fueled by increasing cross-listing activity and the modernization of legacy trading systems to align with global standards, aiming to enhance liquidity and investor trust.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, led by Saudi Arabia (Tadawul) and the UAE. Driven by large-scale privatization programs and sovereign fund investments, these markets are diversifying away from oil revenues, leading to significant corporate listings and a focus on FinTech development. The region is actively working on creating internationally competitive listing environments, often partnering with Western exchanges for technical expertise and market linkage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stock Exchanges Market.- Intercontinental Exchange, Inc. (ICE) – Owner of NYSE

- Nasdaq, Inc.

- London Stock Exchange Group (LSEG)

- Japan Exchange Group, Inc. (JPX)

- Shanghai Stock Exchange (SSE)

- Euronext N.V.

- Deutsche Börse AG

- Hong Kong Exchanges and Clearing Limited (HKEX)

- TMX Group Limited

- BSE (Bombay Stock Exchange)

- National Stock Exchange of India (NSE)

- SIX Group AG (SIX Swiss Exchange)

- Australian Securities Exchange (ASX)

- Bolsa Mexicana de Valores, S.A.B. de C.V. (BMV)

- Korea Exchange (KRX)

- Cboe Global Markets, Inc.

- Singapore Exchange Limited (SGX)

- B3 S.A. – Brasil, Bolsa, Balcão

- Moscow Exchange (MOEX)

- JSE Limited (Johannesburg Stock Exchange)

Frequently Asked Questions

Analyze common user questions about the Stock Exchanges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of market data services as a revenue stream for stock exchanges?

The accelerated growth is driven by the demand from institutional investors and algorithmic trading firms for high-speed, comprehensive, and proprietary data feeds. AI and machine learning require extensive, high-quality data to formulate trading strategies and manage risk effectively, allowing exchanges to monetize their primary output—market data—at premium rates.

How is blockchain technology currently impacting the Stock Exchanges Market?

Blockchain is primarily impacting the post-trade sphere, specifically clearing and settlement. Exchanges are exploring DLT to reduce settlement cycles (moving towards instantaneous T+0 settlement), minimize counterparty risk, and lower operational costs. While widespread equity integration is ongoing, specialized digital asset exchanges utilizing DLT are already operational.

What are the main regulatory challenges faced by global stock exchanges?

Main challenges include managing compliance across fragmented, cross-jurisdictional regulatory frameworks (e.g., MiFID II, SEC regulations), ensuring robust cybersecurity protocols, and adapting rules to govern novel asset classes like tokenized securities and complex derivatives. Exchanges must balance stringent oversight with fostering innovation and attracting international listings.

Which regional market is anticipated to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to the rapid expansion of capital markets in China and India, increasing retail participation, rising disposable income, and governmental initiatives focused on financial liberalization and deepening domestic investor bases.

What role does Artificial Intelligence play in maintaining market integrity?

AI plays a crucial role in enhancing market integrity through advanced surveillance and anomaly detection. Machine learning algorithms analyze trading patterns, communication data, and order flow in real-time, identifying complex manipulation schemes, insider trading, and potential systemic risks far more efficiently than traditional rule-based systems, thereby ensuring fairness and orderliness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager