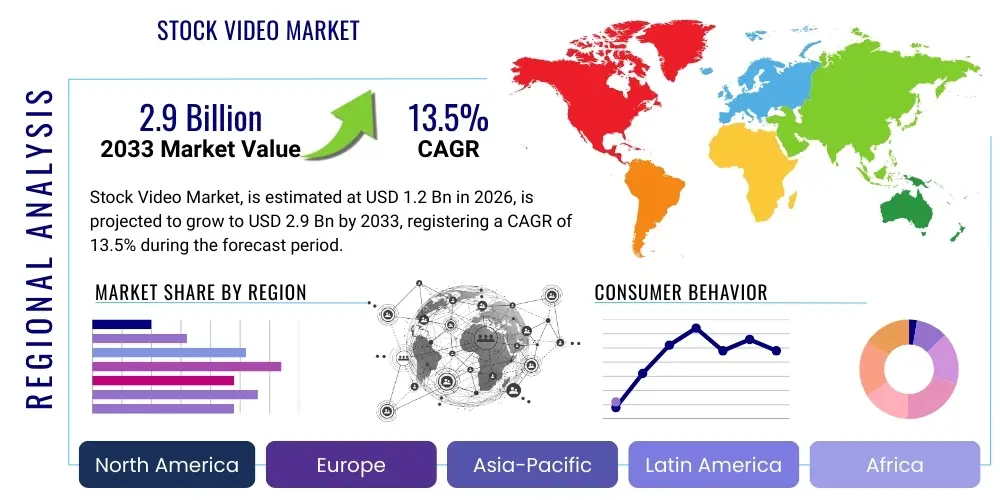

Stock Video Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438214 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Stock Video Market Size

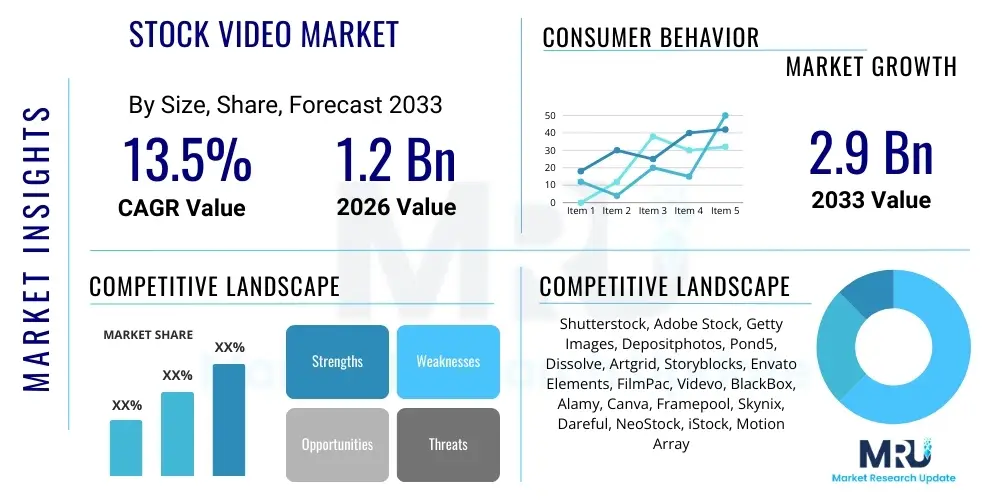

The Stock Video Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.9 Billion by the end of the forecast period in 2033.

Stock Video Market introduction

The Stock Video Market encompasses the supply and demand ecosystem for pre-shot, licensed video footage used primarily for commercial, educational, and entertainment purposes. This footage, often categorized by resolution, subject matter, and usage rights (royalty-free or rights-managed), serves as a fundamental resource for content creators, marketing agencies, production houses, and internal corporate communication departments seeking high-quality visual assets without the time and expense associated with bespoke filming. The product description ranges from high-definition (HD) clips to ultra-high-definition (4K and 8K) cinematic footage, often incorporating specialized elements like drone videography, time-lapses, and motion graphics templates. Standardization of file formats and efficient digital delivery platforms are crucial components defining the infrastructure of this market, allowing for seamless integration into diverse editing workflows globally.

Major applications of stock video span digital marketing campaigns, including social media advertisements and website headers, broadcast media for news and documentary segments, corporate training videos, and motion picture production needing establishing shots or B-roll footage. The inherent benefit of utilizing stock video lies in its cost-effectiveness, immediate availability, and the ability to access footage that would otherwise be geographically or logistically impractical to capture. It democratizes high-production value, enabling smaller entities and individual creators to compete visually with larger, resource-heavy organizations. Furthermore, the extensive searchable libraries provided by major platforms offer unparalleled flexibility in sourcing specific visual narratives tailored to niche audience requirements.

Driving factors propelling the market growth are intrinsically linked to the global proliferation of digital content consumption and the 'video-first' paradigm adopted across online platforms. The increasing demand for engaging content across platforms like YouTube, TikTok, and corporate Learning Management Systems (LMS) necessitates a constant supply of fresh, high-quality video clips. Technological advancements, particularly the widespread adoption of 4K and 8K cameras and sophisticated editing software, have elevated the quality standards of stock video offerings, making them virtually indistinguishable from custom-shot footage. Additionally, the shift towards subscription-based licensing models, offering predictable access and volume, further incentivizes high-volume content producers to rely heavily on stock footage libraries, ensuring sustained market momentum.

Stock Video Market Executive Summary

The Stock Video Market is experiencing robust expansion driven primarily by foundational business trends such as the escalating need for visual content marketing and the shift towards scalable subscription licensing models. Key business trends indicate a strong focus on library diversification, particularly in specialized niches such as Abstract 3D, authentic lifestyle shots, and niche vertical industries like healthcare and finance, which currently lack extensive realistic representation. Competitive pressures are intensifying as leading agencies invest heavily in AI-powered search and recommendation engines to enhance user experience and reduce asset discovery time, positioning platform efficiency as a primary differentiator. Furthermore, the integration of Non-Fungible Tokens (NFTs) and blockchain technology is starting to explore novel licensing and intellectual property management frameworks, though this remains an emerging, rather than dominant, trend.

Regionally, North America and Europe remain the largest revenue contributors due to high digital content penetration and significant advertising expenditure, characterized by mature and sophisticated media production ecosystems. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the rapid expansion of digital economies, particularly in China and India, coupled with massive growth in mobile video consumption and the rise of local production studios catering to regional dialects and cultural narratives. Emerging markets in Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a smaller base, primarily driven by increasing internet connectivity and the subsequent adoption of social media and e-learning platforms which require substantial visual assets.

Segment trends reveal a pronounced shift in preference towards royalty-free licensing models, valued for their simplicity and flexibility, especially among small and medium-sized enterprises (SMEs) and individual creators. Technologically, the 4K and above resolution segment commands a growing premium due to its suitability for large-format displays and high-end cinematic projects, overshadowing the standard HD segment. Based on end-user, the Media & Entertainment segment, inclusive of large-scale production houses and advertising firms, continues to dominate consumption volume, yet the Corporate/Enterprise segment, driven by internal communication, training, and B2B marketing, is demonstrating the fastest rate of uptake, signifying a structural shift in how businesses utilize visual communication resources internally.

AI Impact Analysis on Stock Video Market

Common user questions regarding AI's impact on the Stock Video Market frequently revolve around intellectual property, the threat to traditional cinematographers, the efficiency gains in post-production workflows, and the eventual saturation of AI-generated content. Users are primarily concerned with whether AI tools, particularly generative models (text-to-video), will devalue existing human-shot libraries and if the metadata generated by AI is reliable enough for precise search queries. Expectations center on AI significantly accelerating the asset discovery process, improving personalization for license recommendations, and automatically tagging complex video elements, thus enhancing the platform's utility. The key themes summarized highlight a tension between AI as an efficiency tool (for search, indexing, and quality control) and AI as a competitive threat (for content creation itself), necessitating new guidelines for distinguishing between human and machine-created content and addressing potential legal liabilities associated with synthetic media generation.

The immediate practical impact of AI is observed in refining backend operations and user experience. Machine learning algorithms are crucial for sophisticated content moderation, identifying inappropriate or repetitive submissions, and ensuring quality consistency across vast libraries. Furthermore, generative AI tools are beginning to produce simple, customizable templates and short abstract clips, which serves niche demands where authenticity is less critical than immediate availability and low production cost. This integration allows platforms to offer value-added services such as automatic color correction suggestions, intelligent cropping for different social media aspect ratios, and instant background replacement, substantially lowering the barrier for entry for less technically proficient users attempting professional-grade results.

Looking forward, the transformative potential of AI lies in personalized content synthesis. Instead of merely searching for pre-existing clips, users will increasingly utilize AI to generate bespoke footage based on highly specific textual prompts, fundamentally challenging the traditional stock model reliant solely on pre-captured footage. While genuine, authentic human interaction and complex emotional narratives will likely remain the domain of human cinematographers for the foreseeable future, basic landscape, environment, and object visualization tasks are rapidly becoming automated. This creates an imperative for traditional stock video providers to evolve their offerings, perhaps focusing more on hyper-authentic, narrative-driven collections that AI currently struggles to replicate convincingly, or by integrating AI generative tools directly into their platforms as a service offering.

- AI-driven metadata generation and semantic search optimization, significantly improving content discoverability.

- Implementation of deep learning models for quality control and automated rejection of low-resolution or technically flawed submissions.

- Emergence of generative AI tools creating customizable stock footage, particularly for abstract visuals and basic environmental scenes.

- Increased risk of market saturation in generic video categories due to high-volume AI output, potentially depressing pricing for baseline clips.

- Development of AI-powered tools for post-production enhancement, including automatic stabilization, upscaling, and object tracking within licensed clips.

- Need for new licensing frameworks and ethical guidelines to address ownership and copyright of AI-generated and synthetic media.

- Improved personalization engines recommending clips based on the user's editing style, previous purchases, and project context.

DRO & Impact Forces Of Stock Video Market

The Stock Video Market is dynamically shaped by a critical balance of Drivers, Restraints, and Opportunities, which collectively influence the competitive landscape and profitability structure—the Impact Forces. Primary drivers include the global mandate for video content across all digital platforms and the continuous improvements in camera and processing technology that make professional-grade submissions widely accessible. However, the market faces significant restraints, chiefly concerning stringent intellectual property (IP) and copyright regulations, alongside the potential market disruption and ethical debates stemming from AI-generated video content that may dilute the value of human-shot libraries. Opportunities arise mainly from expanding into highly specialized vertical markets and integrating new technologies like VR/AR footage, offering unique value propositions. These dynamics result in intense Impact Forces, particularly the high bargaining power of buyers (due to numerous platform choices) and intense rivalry among existing competitors, necessitating continuous innovation in pricing, library depth, and technological utility.

A detailed examination of the Drivers reveals that the rise of high-bandwidth internet infrastructure globally has made the distribution of large 4K and 8K files seamless, thus supporting the market shift towards ultra-high-definition content. Furthermore, the increasing professionalism of content creators across social media platforms means the demand for cinematic quality footage, even for short-form content, is continually escalating. Restraints are often managerial and legal; maintaining the legal integrity of millions of assets requires sophisticated licensing tracking systems, especially when dealing with international rights and likeness releases. The sheer volume of content now available can also become a restraint, leading to content shock for buyers who struggle to find relevant clips without highly efficient search tools, thus highlighting the operational challenge of effective curation.

Opportunities are clearly visible in the transition to more immersive formats. The demand for 360-degree video, virtual reality (VR) footage, and augmented reality (AR) overlay assets presents a premium market segment yet to be fully capitalized by all providers. Developing hyper-local and culturally specific content is another significant opportunity, as generic Western-centric footage often fails to resonate in rapidly growing APAC and MEA markets. Analyzing the Impact Forces through the lens of Porter's Five Forces highlights that the threat of substitutes is high, given the emergence of generative AI and the possibility of companies filming their own low-cost footage. The threat of new entrants, while mitigated by the massive capital required for library acquisition and technological infrastructure, is constantly renewed by small, niche platforms focusing on specific aesthetics or themes. Profitability hinges on achieving scale and maintaining technological superiority in search and delivery mechanisms.

- Drivers:

- Explosion in demand for digital video content across marketing, education, and entertainment sectors.

- Advancements in digital cinema technology, enabling higher quality 4K and 8K submissions.

- Increased adoption of subscription-based licensing models, ensuring recurring revenue and accessibility for high-volume users.

- Global expansion of high-speed internet and mobile video consumption.

- Restraints:

- Complexities associated with global intellectual property rights and model/property releases.

- Potential devaluation of existing content libraries due to the rapid proliferation of generative AI video.

- Market saturation in common or generic subject categories leading to price pressure.

- High operational costs associated with archiving, managing, and curating massive high-resolution video libraries.

- Opportunities:

- Expansion into specialized, high-growth niches such as drone footage, medical visualizations, and immersive VR/AR content.

- Customized content solutions utilizing hybrid AI-human workflows for enterprise clients.

- Geographic market penetration into underserved regions in Asia Pacific and Africa seeking localized content.

- Development of blockchain-enabled platforms for transparent licensing and artist compensation.

- Impact Forces:

- High Rivalry: Intense competition driven by key players aggressively expanding library size and offering competitive subscription tiers.

- High Bargaining Power of Buyers: Users have multiple high-quality platform options, forcing competitive pricing and robust service offerings.

- Medium Threat of New Entrants: High barrier to entry in terms of library scale and technology, but reduced by niche providers and AI tools.

- Medium to High Threat of Substitutes: Custom filming (internal production) and generative AI video pose credible alternatives to traditional stock libraries.

- Medium Bargaining Power of Suppliers (Contributors): While individual contributors have low power, established, high-quality contributors and acquisition studios maintain moderate leverage.

Segmentation Analysis

Segmentation analysis of the Stock Video Market provides a crucial framework for understanding diverse user requirements and optimizing service delivery. The market is primarily segmented based on Licensing Model (Royalty-Free vs. Rights-Managed), Resolution (HD, 4K, 8K), Application (Marketing/Advertising, Media & Entertainment, Corporate), and End-User (Enterprise, SME, Individual Creator). This granular classification allows providers to tailor pricing strategies and content acquisition efforts to maximize profitability within specific user cohorts. For instance, Enterprise clients typically require Rights-Managed licensing for higher-risk commercial projects, justifying premium pricing, while Individual Creators predominantly seek the flexibility and affordability offered by Royalty-Free, often accessed via monthly subscription plans. The differentiation in resolution is directly correlated with the end application, where broadcast media demands 4K and 8K, and digital marketing remains largely satisfied with high-quality HD footage.

The segmentation by content type is increasingly important as platforms strive to move beyond generic clips. Content segments include People & Lifestyle, Nature & Landscapes, Technology & Science, and Abstract/Motion Graphics. Providers are strategically focusing on underserved segments, such as highly authentic, non-staged footage—often referred to as 'Real Life' stock—which commands better engagement rates in contemporary digital marketing. The growth trajectory for motion graphics and animated templates is also notable, driven by the demand for quick, professional-looking intros, lower thirds, and data visualization elements that require minimal video editing skill on the user's part.

Furthermore, geographic segmentation is vital for adjusting content acquisition priorities to reflect regional consumer preferences and cultural sensitivities, ensuring library relevance across diverse international markets. The overall market strategy must harmonize these segmentations. For example, a focus on the APAC market necessitates acquiring significant volumes of 4K footage related to local customs, urban environments, and business scenarios, delivered under a Royalty-Free model suitable for the region's burgeoning digital economy, contrasting sharply with the needs of a European broadcast media client requiring Rights-Managed archival footage.

- By Licensing Model:

- Royalty-Free (RF)

- Rights-Managed (RM)

- By Resolution:

- High Definition (HD)

- 4K (Ultra HD)

- 8K and Beyond

- By Application/Usage:

- Marketing and Advertising (Digital Ads, Social Media)

- Media and Entertainment (Film, Television, Documentary)

- Corporate and Enterprise Communication (Training, Internal Videos)

- Educational Content and E-learning

- By End-User:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- Individual Content Creators (Freelancers, YouTubers)

- Academic and Government Institutions

- By Content Type:

- People and Lifestyle

- Business and Finance

- Nature, Wildlife, and Travel

- Technology and Science

- Abstract and Motion Graphics

Value Chain Analysis For Stock Video Market

The Value Chain of the Stock Video Market is fundamentally divided into three primary stages: Upstream (Content Creation and Acquisition), Midstream (Platform Hosting and Management), and Downstream (Distribution and Consumption). Upstream analysis involves the core activities of content generation, which includes independent cinematographers, specialized production agencies, and increasingly, AI-driven synthesis tools, who act as suppliers. The critical factors at this stage are the technical quality, thematic relevance, and legal clearance (model and property releases) of the footage. Companies focus on establishing strong contributor networks and implementing sophisticated vetting processes to ensure the library's integrity and quality, often utilizing exclusive contracts for premium collections to secure unique assets.

Midstream activities are characterized by the sophisticated technological infrastructure required to ingest, index, and manage vast quantities of high-resolution video files. This stage includes comprehensive metadata tagging—often enhanced by AI for semantic search—quality assurance, archival storage (typically cloud-based), and platform development. The distribution channel analysis shows a strong dominance of direct online marketplaces owned by major platform providers (e.g., Shutterstock, Adobe Stock). These direct channels leverage proprietary search algorithms and recommendation engines to connect buyers directly with assets. Indirect distribution, though less common, involves partnerships with smaller local resellers or integration into third-party creative suite applications, but the digital nature of the product heavily favors the direct-to-consumer model for efficiency and immediate licensing.

Downstream analysis focuses on the end-user interaction, licensing models, and integration of the assets into professional workflows. Success at this stage relies heavily on providing flexible licensing options (Royalty-Free being the primary preference) and ensuring seamless compatibility with industry-standard editing software. The integration of licensing platforms via Application Programming Interfaces (APIs) directly into editing tools enhances user stickiness and streamlines the final consumption process. The core value derived downstream is the reduction in production time and cost for the end-user, emphasizing the efficiency and immediacy offered by the robust value chain structure, which must be constantly monitored for legal compliance and ease of use.

Stock Video Market Potential Customers

The potential customers for the Stock Video Market are highly diversified, encompassing professional entities and individual consumers whose core function involves visual communication. The largest segment remains the Media & Entertainment industry, including television broadcasters, documentary makers, independent film production houses, and increasingly, specialized streaming platform content creators. These buyers require high-fidelity, often cinematic-grade footage for B-roll, establishing shots, and historical context, frequently operating under tight production schedules which necessitate immediate asset availability. Their purchasing behavior is often characterized by the need for premium, rights-managed content or high-volume subscription access for their entire production team, making them high-value, recurring customers.

A rapidly expanding customer base is the Corporate/Enterprise sector, spanning marketing departments, Human Resources (HR) for training modules, and Public Relations (PR) teams. Companies across finance, technology, and manufacturing rely on stock video to create internal communications, product tutorials, B2B marketing videos, and corporate social responsibility (CSR) reports. Unlike media professionals, corporate buyers often prioritize business-appropriate content, clean aesthetics, and clear model releases for commercial use. Their demand profile tends towards high-volume, lower-per-clip usage, making them ideal candidates for enterprise-level unlimited subscription plans, where predictable cost is a key driver.

Finally, the vast cohort of Small and Medium-sized Enterprises (SMEs) and Individual Content Creators (ICC), such as social media influencers, freelancers, small digital agencies, and e-learning developers, constitute the volume driver of the market. These customers are highly sensitive to price and primarily seek simplicity and breadth of choice, favoring Royalty-Free micro-stock models. Their purchasing decisions are highly influenced by factors such as low-cost subscriptions or credit packs, ease of search, and integration with user-friendly online video editors. Serving this segment requires maximizing accessibility and minimizing the complexity of the licensing process, which is why platforms often dedicate specific, high-volume, lower-price collections to this demographic.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.9 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shutterstock, Adobe Stock, Getty Images, Depositphotos, Pond5, Dissolve, Artgrid, Storyblocks, Envato Elements, FilmPac, Videvo, BlackBox, Alamy, Canva, Framepool, Skynix, Dareful, NeoStock, iStock, Motion Array |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stock Video Market Key Technology Landscape

The technological landscape of the Stock Video Market is dominated by advancements in video acquisition, high-efficiency compression, cloud-based storage, and sophisticated search algorithms. Modern content acquisition increasingly relies on professional-grade digital cinema cameras capable of recording in resolutions up to 8K, utilizing advanced codecs such as HEVC (H.265) and ProRes to maintain quality while managing file size complexity. The backbone of distribution is highly scalable cloud infrastructure (AWS, Azure, GCP) which manages petabytes of data, offering redundancy and fast global delivery through Content Delivery Networks (CDNs). Effective asset management requires specialized Digital Asset Management (DAM) systems capable of handling deep metadata, version control, and complex licensing restrictions, ensuring the legal integrity of transactions.

Crucially, the user-facing technology is focused heavily on improving discoverability and workflow integration. Search functionality has moved beyond simple keyword matching to semantic search, utilizing Natural Language Processing (NLP) and machine learning to understand the contextual and emotional intent of a user's query, significantly reducing the time required to find the perfect clip. Technologies such as computer vision and object recognition are employed to automatically tag footage with hundreds of descriptive terms, ensuring accurate indexing even for abstract or highly specific content that human taggers might miss. Furthermore, APIs are essential, enabling seamless integration of stock video libraries directly into popular video editing software (e.g., Adobe Premiere Pro) and corporate DAM systems, turning the asset search from a platform-hopping task into an intrinsic part of the professional workflow.

The emerging technological frontier is centered on Artificial Intelligence and blockchain. AI is rapidly advancing in generative capabilities, offering tools for automated content creation and highly efficient video manipulation (e.g., resizing, re-framing, and stylistic transfer). This necessitates platforms to invest in AI literacy and ethical governance frameworks. Blockchain technology is also being explored, primarily for transparent licensing and immutable intellectual property verification. By recording licensing agreements on a distributed ledger, platforms aim to increase trust, streamline royalty payments to contributors, and offer unparalleled proof of authenticity and usage rights, though its mainstream implementation remains exploratory in most large stock agencies.

Regional Highlights

- North America: This region holds the largest market share, characterized by high penetration of digital advertising, mature media production industries, and significant capital investment in content creation technology. The US market dictates global trends in licensing models and high-resolution content adoption. Demand is driven by major tech companies, streaming services, and a competitive digital marketing landscape that relies heavily on visual storytelling. There is a strong emphasis on technology-related and corporate lifestyle footage.

- Europe: The European market is robust and highly segmented, with strong demand from major broadcast organizations and advertising agencies. Western Europe (UK, Germany, France) dominates the regional market, focusing heavily on premium, rights-managed historical and culturally specific footage. Regulatory factors like GDPR influence data privacy practices regarding model releases, pushing providers toward stricter compliance standards and authentic, locally relevant European content.

- Asia Pacific (APAC): APAC is the fastest-growing region, propelled by rapid internet penetration, explosive mobile video consumption, and the emergence of massive local content ecosystems in China, India, and Southeast Asia. The demand here is highly localized, requiring extensive libraries covering diverse Asian cultures, urban environments, and consumer behaviors. The market is primarily driven by affordability, favoring high-volume Royalty-Free subscription models catering to local SMEs and massive social media user bases.

- Latin America (LATAM): This region is an emerging market characterized by increasing adoption of e-commerce and digital education platforms. Growth is steady, driven by the need for content reflecting Latin American identity and languages (Spanish and Portuguese). Market penetration is still lower than North America or Europe, but rising investment in local digital infrastructure promises sustained growth, particularly among corporate training and regional advertising firms.

- Middle East and Africa (MEA): The MEA market, while the smallest, presents significant untapped potential, particularly in the Gulf Cooperation Council (GCC) countries with high spending power and rapid media modernization. Demand is highly specific, requiring content adhering to local cultural norms, religious sensitivities, and unique regional business environments. Expansion of 5G networks in urban centers is expected to accelerate video consumption, boosting demand for localized stock assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stock Video Market.- Shutterstock, Inc.

- Adobe Inc. (Adobe Stock)

- Getty Images Holdings, Inc.

- Depositphotos Inc.

- Pond5, Inc.

- Dissolve Inc.

- Artgrid Ltd.

- Storyblocks (VideoBlocks)

- Envato Elements Pty Ltd.

- FilmPac

- Videvo Ltd.

- BlackBox Global Inc.

- Alamy Ltd.

- Canva Pty Ltd.

- Framepool AG

- Skynix LLC

- Dareful.com

- NeoStock

- Motion Array

- iStock (a subsidiary of Getty Images)

Frequently Asked Questions

Analyze common user questions about the Stock Video market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Royalty-Free and Rights-Managed stock video licensing?

Royalty-Free (RF) licensing allows the buyer to use the video multiple times across various projects globally after a single purchase, without needing to pay recurring royalties, though limitations on sensitive use may apply. Rights-Managed (RM) licensing requires the buyer to specify the exact usage parameters (e.g., duration, geographic region, medium) and payment is determined by these specific rights, offering exclusivity and stricter control over asset usage.

How is the growth of 4K and 8K technology impacting the market?

The increasing availability and demand for 4K and 8K resolution footage are driving premium pricing segments and requiring platforms to upgrade their storage and delivery infrastructure. High-resolution clips are essential for modern broadcast and cinema quality projects, forcing contributors to invest in higher-end equipment, thereby raising the overall quality standard expected across the stock video ecosystem.

What regulatory concerns surround the use of stock video footage?

Key regulatory concerns center on obtaining legally binding model releases (permission from identifiable people in the footage) and property releases (permission from owners of recognizable private property). Mismanagement of these releases can lead to severe legal liabilities for commercial use, making stringent compliance and transparent documentation by stock agencies paramount for minimizing user risk.

How is Artificial Intelligence (AI) influencing stock video creation and search?

AI impacts the market by dramatically improving content discoverability through semantic search and automated tagging, making massive libraries manageable. Furthermore, generative AI tools are emerging, capable of creating simple, synthetic footage based on text prompts, presenting both an opportunity for hyper-customization and a potential threat of market saturation in generic content categories.

Which geographic regions are expected to drive the highest growth rates?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) in the forecast period. This accelerated growth is primarily attributed to the rapid expansion of digital media consumption, increasing investment in localized content marketing, and the widespread adoption of mobile video platforms across densely populated markets like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager