Stoma & Ostomy Care Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435312 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Stoma & Ostomy Care Market Size

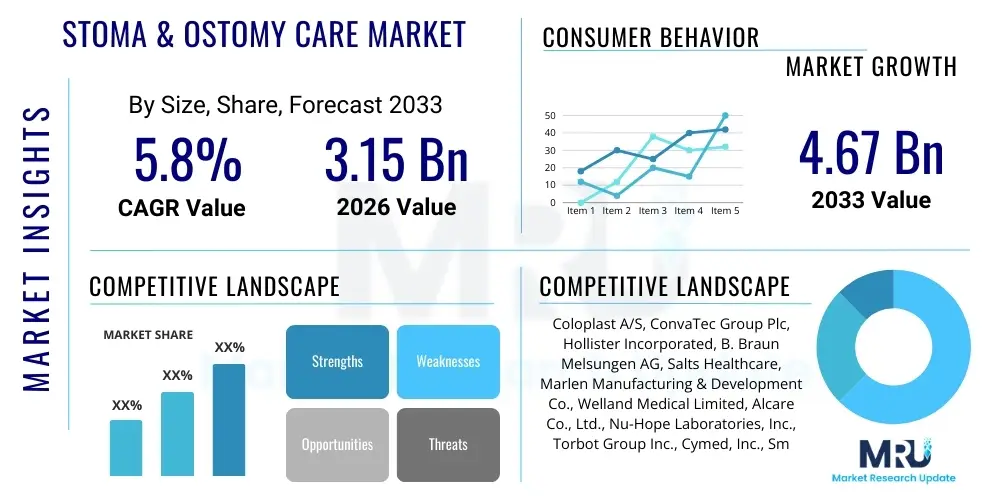

The Stoma & Ostomy Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.15 Billion in 2026 and is projected to reach USD 4.67 Billion by the end of the forecast period in 2033.

Stoma & Ostomy Care Market introduction

The Stoma and Ostomy Care Market encompasses a specialized range of medical devices and supplies designed to manage the physiological needs of patients who have undergone ostomy procedures, such as colostomy, ileostomy, or urostomy. These products primarily facilitate the collection of bodily waste outside the body through an artificially created opening (stoma). Core product offerings include sophisticated ostomy pouches (bags), skin barriers (wafers or flanges), and various accessories like belts, adhesives, and deodorants, all engineered to ensure maximum security, comfort, and discretion for the user. The primary goal of these devices is to improve the quality of life for individuals living with an ostomy by preventing leakage, protecting peristomal skin integrity, and enabling participation in daily activities without constant concern.

The increasing prevalence of chronic diseases such as colorectal cancer, bladder cancer, and Inflammatory Bowel Disease (IBD), particularly Crohn’s disease and ulcerative colitis, serves as a fundamental driving factor for market expansion. Ostomy surgery often becomes a necessary, life-saving intervention when conventional treatments fail or are insufficient to manage these severe conditions. Furthermore, advancements in surgical techniques, leading to higher ostomy procedure rates globally, coupled with a growing geriatric population, which is inherently more susceptible to these chronic conditions, are significantly fueling product demand. The market is also benefiting from continuous innovation focused on developing highly flexible, durable, and technologically advanced products, such as extended-wear barriers and discreet pouching systems, which meet the evolving needs for better skin health and patient compliance.

Major applications of ostomy care products are segmented based on the surgical procedure performed, including colostomy care, which addresses waste from the colon; ileostomy care, managing output from the small intestine; and urostomy care, dedicated to urine diversion. The benefits provided by these products extend beyond mere waste collection; they include psychological comfort, normalization of social interactions, and a substantial reduction in infection risks associated with traditional, less secure methods. The driving forces are intrinsically linked to healthcare infrastructure improvements, increased global awareness about ostomy management, and robust research and development efforts by key market players aimed at enhancing product efficacy, wear time, and overall user experience.

Stoma & Ostomy Care Market Executive Summary

The Stoma & Ostomy Care Market is characterized by steady growth driven by demographic shifts, escalating prevalence of chronic gastrointestinal and urinary disorders, and sustained technological innovation in material science and device design. Current business trends indicate a strong move toward two-piece pouching systems due to their flexibility and ease of maintenance, alongside robust demand for specialized accessories, including barrier rings and seals, crucial for managing complex stoma contours and ensuring skin protection. Furthermore, the industry is witnessing increased merger and acquisition activities, allowing large multinational corporations to consolidate market share, expand geographical presence, and integrate specialized material technologies, particularly in advanced hydrocolloids and anti-leakage systems. Value-based care models are increasingly influencing procurement decisions, favoring products that reduce hospitalization rates due to peristomal complications, thus elevating the importance of quality over just cost.

Regionally, North America maintains the leading position in the global market, primarily due to established, comprehensive reimbursement policies, high healthcare expenditure, and a significantly higher adoption rate of advanced ostomy products among both healthcare providers and patients. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period, fueled by rapidly improving healthcare infrastructure in emerging economies like China and India, increasing public awareness about ostomy management, and a massive, aging population base susceptible to relevant chronic diseases. European markets remain mature, focusing heavily on sustainability and quality standards (e.g., MDR compliance), driving demand for innovative, high-performance materials designed for extended wear and environmental considerations.

Segment trends highlight the dominance of the pouching systems segment, which is further bifurcated into one-piece and two-piece categories, with the two-piece systems gaining traction due to user preference for interchangeability and easier application. Among end-users, the home care settings segment is exhibiting the most aggressive growth, largely attributable to global shifts toward patient self-management and the successful transition of post-operative care from hospitals to less intensive settings, supported by tailored product designs optimized for ease of use by non-professionals. The underlying market dynamic emphasizes continuous improvement in barrier technology—specifically focusing on moisture handling, pH balance, and hypoallergenic formulations—to address the pervasive issue of peristomal skin complications, which represents a significant economic burden on healthcare systems globally.

AI Impact Analysis on Stoma & Ostomy Care Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Stoma & Ostomy Care Market frequently center on themes of predictive failure, personalized monitoring, and enhanced patient adherence. Common concerns revolve around how AI can minimize catastrophic leakage events, which severely impact quality of life, and whether machine learning algorithms can analyze stoma output characteristics (volume, consistency) to provide timely warnings about patient health deterioration, such as dehydration or blockage. Users are also highly interested in AI-driven diagnostic tools capable of accurately assessing and grading peristomal skin complications, minimizing reliance solely on subjective human observation. Expectations are focused on the integration of AI with smart ostomy devices—often involving embedded sensors and wireless communication—to automate data capture and generate actionable insights for both patients managing their condition at home and clinicians overseeing complex cases remotely. The overarching demand is for AI to transform passive care devices into active, intelligent management tools.

- AI-powered predictive analytics can forecast ostomy pouch wear time failure or risk of leakage based on historical usage patterns, activity levels, and environmental factors, enhancing security for users.

- Machine learning algorithms enable the automated analysis of output sensors within smart pouches, identifying deviations in effluent characteristics that may signal early complications like stoma blockage, dehydration, or infection.

- AI platforms facilitate personalized care management by recommending optimal product types (barriers, seals) and wear schedules tailored to individual patient anatomy, skin type, and lifestyle through pattern recognition.

- Natural Language Processing (NLP) is being utilized in telehealth applications and patient support forums to analyze user feedback and common issues, rapidly identifying product defects or gaps in patient education materials.

- Computer vision and image analysis, integrated into mobile applications, allow patients or caregivers to photograph the peristomal skin, with AI instantaneously grading the severity of dermatitis or ulceration, guiding prompt intervention.

- Optimization of inventory management and supply chain logistics using AI ensures that patients receive correctly sized and specified supplies precisely when needed, reducing waste and patient anxiety related to shortages.

DRO & Impact Forces Of Stoma & Ostomy Care Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. Key drivers include the exponential increase in the global elderly population, a demographic highly vulnerable to conditions requiring ostomy; the rising incidence of debilitating gastrointestinal diseases, such as colorectal cancer and IBD, necessitating surgical interventions; and continuous governmental and private investment in chronic disease management infrastructure, ensuring broader access to specialized care products. However, the market faces constraints, primarily high product costs, particularly for advanced or specialized systems, which pose significant financial barriers in developing regions or for patients lacking robust insurance coverage. Additionally, a pervasive lack of trained stoma care nurses and standardized education programs globally acts as a substantial restraint, potentially leading to increased complication rates and poor patient compliance, thereby limiting product uptake and effectiveness.

Opportunities for market growth are abundant, notably stemming from the untapped potential of emerging economies where ostomy product penetration remains low but is rapidly expanding alongside economic development and improved healthcare access. Furthermore, the strategic shift towards smart ostomy care—integrating IoT sensors and digital connectivity for remote monitoring and data collection—presents a major avenue for innovation, promising enhanced patient outcomes and increased market premium. The focus on developing advanced barrier materials that offer superior moisture management and better adherence to complex abdominal shapes represents a constant technological opportunity, directly addressing the most critical patient need: preventing leakage and protecting peristomal skin integrity. These innovations also align with the trend toward minimizing the environmental footprint of disposable medical devices, driving interest in more sustainable material compositions.

The core impact forces shaping the market direction are demographic shifts and technological advancement. Demographic shifts, particularly the aging population, ensure sustained, long-term demand regardless of short-term economic fluctuations. Concurrently, technological advancement in skin barrier composition (e.g., ceramic-infused hydrocolloids) and digital integration (smart monitoring systems) acts as a powerful transformative force, segmenting the market into basic and premium/advanced care solutions. Regulatory landscapes, particularly those related to product approval timelines and clinical evidence requirements, also exert a moderate impact force, influencing market entry and innovation cycles for new device manufacturers. The combined effect of these forces suggests a future market characterized by premiumization, driven by necessity and quality-of-life improvements, alongside geographical expansion into currently underserved populations.

Segmentation Analysis

The Stoma & Ostomy Care Market is intricately segmented across various dimensions, including product type, application, and end-user, reflecting the diverse clinical needs and usage environments of ostomy patients worldwide. The fundamental segmentation is by product, distinguishing between Pouching Systems (one-piece, two-piece), Accessories (seals, rings, belts, powders, deodorants, cleansers), and Irrigators. This structure allows manufacturers to cater specifically to patients requiring varying levels of dexterity, wear time, and specific complication management solutions. Pouching systems typically dominate revenue generation, but the accessories segment is experiencing accelerated growth as patients become more aware of the importance of prophylactic skin protection and advanced complication management beyond basic waste collection. Effective market analysis requires understanding the substitutability and complementarity between these segments, recognizing that most patients use a combination of products tailored to their unique stoma characteristics and lifestyle demands.

Application-based segmentation is critical, separating products optimized for Colostomy, Ileostomy, and Urostomy care, as the effluent consistency and chemical properties vary significantly across these surgical procedures, necessitating distinct product material compositions. For instance, urostomy bags require specialized anti-reflux valves and stronger, non-degradable materials due to the liquid nature of the output, while ileostomy care often demands products with enhanced absorption capabilities to manage highly enzymatic output that aggressively attacks the skin. These clinical distinctions necessitate specialized product development, contributing to the diversity of the supply chain. Moreover, the End-User analysis, categorizing utilization across Hospitals, Ambulatory Surgical Centers (ASCs), and Home Care Settings, underscores the shift in the care paradigm. While hospitals are crucial for initial post-operative stabilization and product fitting, the overwhelming majority of ongoing consumption occurs in the highly decentralized home care setting, making patient education and user-friendliness paramount design considerations.

The segmentation structure not only helps in defining target markets for specific products but also informs strategic pricing and distribution channel planning. For example, high-volume, basic ostomy care products are widely distributed through retail pharmacies and online channels to the home care segment, while specialized or high-end products, such as those used for complex prolapses or challenging skin conditions, often involve direct sales or specialized medical supply distributors working closely with certified stoma nurses in clinical environments. This complex segmentation highlights the market's maturity and its responsiveness to nuanced clinical and lifestyle requirements. Ongoing research focuses on cross-segment innovations, such as developing universal barriers that perform optimally across all three application types (colostomy, ileostomy, urostomy), aiming to simplify inventory and procurement processes for healthcare providers.

- Product Type:

- Pouching Systems (One-Piece Systems, Two-Piece Systems)

- Accessories (Skin Barriers, Seals, Rings, Pastes, Adhesives, Deodorants, Belts)

- Irrigation Systems

- Application:

- Colostomy Care

- Ileostomy Care

- Urostomy Care

- End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Stoma & Ostomy Care Market

The value chain for the Stoma & Ostomy Care Market begins with the upstream activities centered on raw material procurement, focusing heavily on specialized chemical components, polymers, and advanced hydrocolloids. Key raw materials include synthetic rubbers (like polyisobutylene), specialized elastomers, hydrocolloid materials (such as pectin and gelatin), and various plastics used for pouch construction (e.g., EVA, PVC). Suppliers in this upstream segment must adhere to stringent medical-grade quality standards and biocompatibility regulations, ensuring the final product is safe for prolonged contact with sensitive peristomal skin. Research and Development (R&D) is deeply integrated into the upstream stage, focusing on material science innovations that enhance barrier wear time, improve adherence in humid conditions, and reduce the risk of allergic reactions, making material innovation a critical determinant of competitive advantage.

Manufacturing and assembly form the core midstream segment, where raw materials are converted into finished ostomy systems. This stage involves sophisticated manufacturing processes, including precision molding, adhesive layer integration, and sterile packaging. Market leaders often maintain geographically diverse manufacturing facilities to mitigate supply chain risks and comply with regional regulatory mandates, such as the EU’s Medical Device Regulation (MDR). Quality control and assurance are paramount here, as defects in seals or barrier integrity can lead to severe patient complications. The efficiency of production, particularly automating assembly processes for one-piece and two-piece systems, is crucial for cost optimization in this high-volume, necessity-driven market.

The downstream segment focuses on distribution channels and end-user delivery. The channel structure is typically bifurcated into direct and indirect routes. Direct sales often target large institutional buyers like hospital networks, government health systems, and specialized stoma clinics, facilitating technical training and complex product customization. Indirect distribution relies heavily on specialized Durable Medical Equipment (DME) suppliers, online pharmacies, and major retail chains, particularly for delivering products to the rapidly growing home care segment. Due to the chronic nature of ostomy care, a robust, reliable logistics network capable of handling repeat prescriptions and ensuring timely delivery of life-essential supplies is non-negotiable. Furthermore, extensive patient education and clinical support provided by manufacturer-sponsored Stoma Care Nurses (SCNs) often acts as a crucial differentiator in the downstream value offering.

Stoma & Ostomy Care Market Potential Customers

The primary consumers and end-users of Stoma & Ostomy Care products are individuals who have undergone life-altering surgical procedures resulting in a stoma (colostomy, ileostomy, or urostomy). This patient population forms the baseline of consistent demand, requiring continuous, often lifelong, supply of specialized pouches, barriers, and accessories to manage waste output safely and maintain dignity. These patients are highly dependent on product quality, demanding systems that offer security against leaks, maintain peristomal skin health, and provide discreet wearability to minimize psychological impact and allow for a return to normal social and professional activities. Their purchasing decisions, while often mediated by insurance or government programs, are heavily influenced by the advice of clinical specialists, particularly certified Stoma Care Nurses (SCNs), making the clinician a critical gatekeeper.

Institutional customers constitute another major segment. Hospitals, particularly those specializing in oncology, gastroenterology, and colorectal surgery, are the initial point of contact where product decisions are made for post-operative care and patient training. Hospitals purchase in large volumes for immediate use and discharge kits, prioritizing reliability, institutional contracts, and ease of use for their clinical staff. Ambulatory Surgical Centers (ASCs), increasingly performing minor ostomy revisions or related procedures, also represent potential buyers, albeit on a smaller scale than major hospital systems. These institutional settings require reliable supply chains and comprehensive technical support from manufacturers to ensure seamless integration of products into their patient care protocols and inventory systems.

The most rapidly growing customer segment is the Home Care Setting. This includes both formal home health agencies that manage nursing care and the patients themselves managing their conditions independently. The shift toward managing chronic care in the home environment, supported by telehealth and enhanced education, positions the patient as the final decision-maker regarding comfort and performance. Manufacturers must appeal to this segment through user-friendly designs, clear instructions, and readily available direct-to-consumer logistics channels. Furthermore, third-party payers, including national health services, private insurance companies, and governmental reimbursement bodies (like Medicare/Medicaid), are indirect but crucial customers. They ultimately determine the eligibility and affordability of products, making evidence of clinical efficacy and cost-effectiveness paramount for market access and sustained sales volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.15 Billion |

| Market Forecast in 2033 | USD 4.67 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coloplast A/S, ConvaTec Group Plc, Hollister Incorporated, B. Braun Melsungen AG, Salts Healthcare, Marlen Manufacturing & Development Co., Welland Medical Limited, Alcare Co., Ltd., Nu-Hope Laboratories, Inc., Torbot Group Inc., Cymed, Inc., Smith & Nephew plc, Flexicare Medical Ltd., Medicare Systems, Perma-Type Manufacturing, Inc., 3M Company, Scapa Group plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stoma & Ostomy Care Market Key Technology Landscape

Technological advancements in the Stoma & Ostomy Care market are primarily focused on optimizing the interface between the device and the human body, specifically improving the adhesive mechanism and the materials used for the skin barrier. The most critical area of innovation lies in hydrocolloid technology. Modern hydrocolloid formulations are designed to be highly absorbent, managing moisture effectively to maintain an optimal pH balance on the peristomal skin, thereby minimizing the risk of maceration, infection, and skin breakdown—the leading cause of discomfort and product failure. Continuous research is yielding extended-wear barriers, which utilize complex matrix structures and often incorporate synthetic polymers and specialized natural ingredients (like pectin or carboxymethylcellulose) to provide multi-day security, a significant improvement in quality of life for patients. Furthermore, customized barrier shapes and convex/concave designs are leveraging advanced molding technologies to better accommodate atypical abdominal contours and recessed stomas, ensuring a secure seal even during physical activity.

Beyond material science, the market is rapidly integrating digital technologies, marking the emergence of "smart ostomy care." This trend involves embedding sensors into ostomy pouches or within the accompanying accessory systems. These smart devices are capable of monitoring crucial operational parameters, such as the fill level of the pouch, the composition and volume of the output (effluent), and the wear time integrity of the skin barrier. Data captured by these sensors is transmitted wirelessly, often via Bluetooth, to a connected smartphone application or cloud-based monitoring platform. This allows patients to receive timely alerts regarding necessary changes or potential health complications like sudden output changes that could indicate blockage or dehydration, thus facilitating proactive self-management and reducing emergency medical visits.

Further technological differentiation is observed in anti-leakage and filtration systems. High-performance filters, utilizing activated charcoal and advanced membrane technology, are engineered to neutralize odors effectively while allowing gas to escape slowly, preventing pouch ballooning—a major source of patient anxiety and embarrassment. In urostomy care, integrated anti-reflux valves have been perfected to prevent urine backflow onto the stoma, safeguarding against urinary tract infections. Looking forward, the application of 3D printing technology holds immense potential for creating truly customized, patient-specific stoma barriers that perfectly match individual anatomy, moving beyond standardized sizes and potentially revolutionizing the fit and comfort for patients with challenging stoma placements. These combined technological efforts are driving the market toward highly customized, digitally supported, and complication-resistant ostomy solutions.

Regional Highlights

The global Stoma & Ostomy Care Market exhibits significant regional disparities in terms of maturity, product adoption rates, and growth trajectory, largely influenced by healthcare infrastructure quality, disease prevalence, and reimbursement policies.

- North America: This region holds the largest market share, characterized by high disposable incomes, extensive healthcare spending, and well-established reimbursement systems (Medicare, private insurance) that ensure patient access to premium and technologically advanced ostomy products. The U.S. is the primary driver, benefitting from a high prevalence of IBD, a sophisticated network of specialized stoma care nurses, and robust adoption of the latest innovations, including smart ostomy devices and extended-wear hydrocolloid barriers. Market competition is fierce, driving continuous product quality improvements and robust patient support programs.

- Europe: Representing the second-largest market, Europe is marked by stable growth and high standardization, heavily influenced by regulatory bodies like the European Medicines Agency (EMA) and the implementation of the Medical Device Regulation (MDR). Western European countries (Germany, UK, France) dominate consumption, benefiting from universal healthcare access and high levels of patient education. The focus here is balanced between cost-effectiveness for national health services and the adoption of clinically proven, high-quality systems, often driving the demand for sustainable and environmentally conscious product design.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by the massive, rapidly aging population in countries like Japan and China, coupled with drastic improvements in healthcare access and spending in emerging economies (India, Southeast Asia). While basic, lower-cost products currently dominate parts of the region, rising medical tourism, increasing awareness of proper ostomy care techniques, and the growing incidence of lifestyle-related chronic diseases are swiftly increasing the demand for advanced, premium products and accessories. Investment in local manufacturing and supply chains is key to unlocking this region’s full market potential.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently contribute a smaller but growing share, often facing challenges related to economic volatility and underdeveloped infrastructure, which limits patient access outside major metropolitan areas. However, targeted governmental health initiatives, increasing foreign direct investment in private healthcare facilities, and efforts by NGOs to improve specialized surgical care are gradually increasing the market penetration of imported ostomy supplies. Demand is highly price-sensitive, emphasizing the need for cost-effective, durable product solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stoma & Ostomy Care Market.- Coloplast A/S

- ConvaTec Group Plc

- Hollister Incorporated

- B. Braun Melsungen AG

- Salts Healthcare

- Marlen Manufacturing & Development Co.

- Welland Medical Limited

- Alcare Co., Ltd.

- Nu-Hope Laboratories, Inc.

- Torbot Group Inc.

- Cymed, Inc.

- Smith & Nephew plc

- Flexicare Medical Ltd.

- Medicare Systems

- Perma-Type Manufacturing, Inc.

- 3M Company

- Scapa Group plc

- Kimberly-Clark Corporation (through specific divisions)

- Hydrofera, LLC

- Péters Surgical

Frequently Asked Questions

Analyze common user questions about the Stoma & Ostomy Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Stoma & Ostomy Care Market?

Market growth is predominantly driven by the accelerating global prevalence of chronic digestive and urinary diseases, such as Inflammatory Bowel Disease (IBD) and colorectal cancer, which frequently necessitate ostomy procedures. Additionally, the increasing global geriatric population and continuous technological improvements in specialized skin barrier materials enhance product performance and patient compliance, thereby expanding overall market adoption and consistent demand.

Which segment of Stoma & Ostomy Care products is expected to experience the highest growth rate?

The accessories segment, including specialized barrier seals, rings, and pastes, is anticipated to show the highest growth rate. This acceleration is due to heightened awareness among patients and clinicians regarding the critical importance of prophylactic peristomal skin protection and the rising use of complex product combinations tailored for superior adhesion and extended wear time, particularly in home care settings.

How is technological innovation impacting the security and comfort of ostomy care devices?

Technological innovation is focused on developing advanced hydrocolloid barriers that offer superior moisture management and extended adherence, drastically reducing leakage events. Furthermore, the integration of IoT and sensor technology into "smart pouches" allows for real-time monitoring of effluent levels and potential complications, offering unprecedented security and proactive care management for users.

Which geographical region is currently leading the global Stoma & Ostomy Care Market, and why?

North America currently leads the global market in terms of revenue share. This dominance is attributed to high healthcare expenditure, established and comprehensive medical reimbursement frameworks, high prevalence rates of chronic conditions requiring ostomy surgery, and the rapid adoption of premium, advanced ostomy care products and digital monitoring solutions.

What are the main challenges restraining the growth of the Stoma & Ostomy Care Market?

Key restraints include the relatively high cost of advanced ostomy devices, which can limit access for underserved populations, particularly in developing economies without robust reimbursement. Additionally, the global shortage and uneven distribution of specialized Stoma Care Nurses (SCNs) hinder proper post-operative education and care management, potentially leading to increased complication rates and poor product utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager