Stone Plastic Composite (SPC) Flooring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435443 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Stone Plastic Composite (SPC) Flooring Market Size

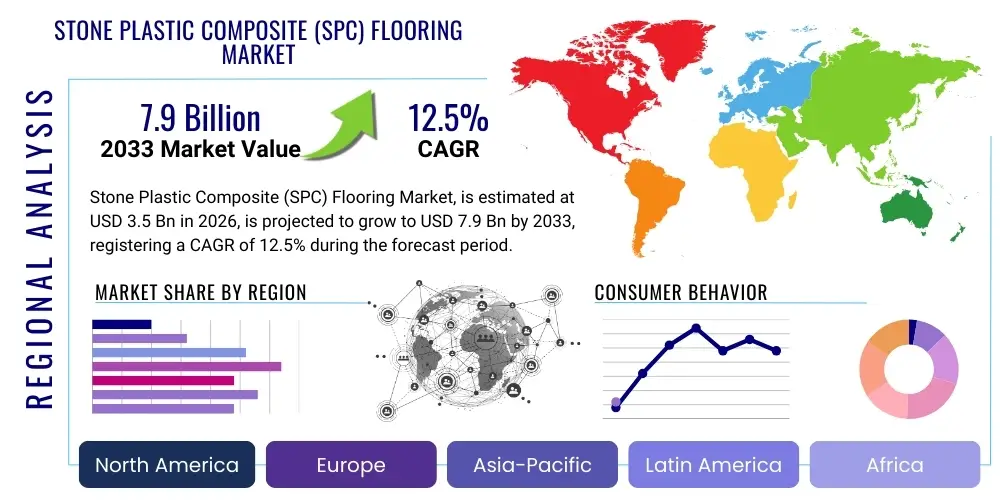

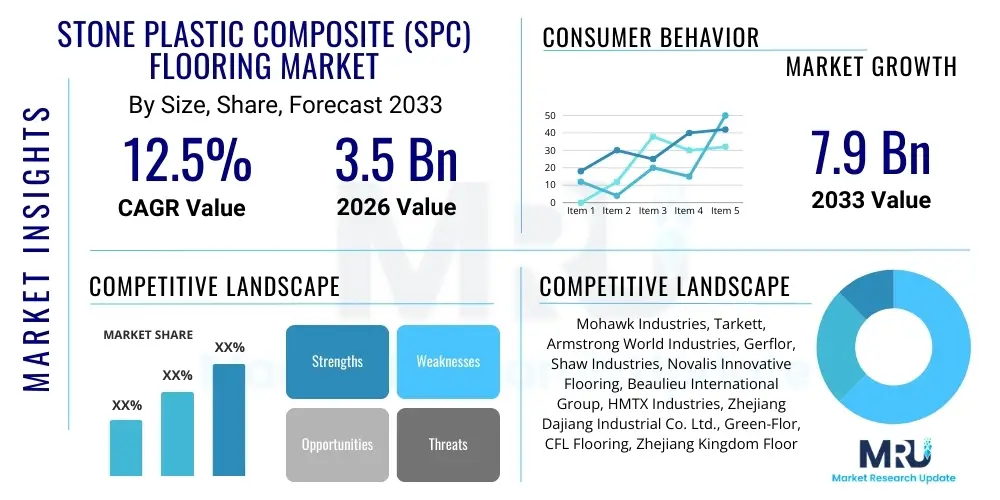

The Stone Plastic Composite (SPC) Flooring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Stone Plastic Composite (SPC) Flooring Market introduction

The Stone Plastic Composite (SPC) Flooring Market encompasses the manufacturing, distribution, and sale of rigid core luxury vinyl tiles and planks, characterized by their dense core structure primarily composed of natural pulverized limestone and polyvinyl chloride (PVC) stabilizers. This unique composition grants SPC flooring superior dimensional stability, unparalleled water resistance, and high durability, making it a preferred alternative to traditional flooring materials such as laminate, ceramic tiles, and wood plastic composite (WPC) flooring. The product is engineered to address common consumer pain points, particularly susceptibility to moisture and temperature fluctuations, thereby expanding its application scope significantly across diverse environmental conditions. Its rigid structure allows for installation over existing imperfect subfloors without extensive preparation, drastically reducing labor time and overall project costs for both commercial and residential end-users. This technological leap in flooring composition positions SPC as a key disruptor in the global flooring industry, driven by evolving consumer preferences for performance-based interior materials.

Major applications of SPC flooring span the residential sector, including single-family homes, apartments, and condominiums, and the burgeoning commercial sector, specifically high-traffic areas such as retail spaces, hospitality establishments (hotels and restaurants), healthcare facilities, and educational institutions. The market expansion is intrinsically linked to global trends in urbanization, rising disposable incomes in developing economies, and the continuous growth of the renovation and remodeling industry. SPC flooring offers aesthetic versatility, mimicking the look and feel of natural wood or stone through advanced photographic films and embossing techniques, notably Embossed In Register (EIR) technology, providing high-end visuals at a fraction of the cost of natural materials. This combination of performance characteristics and aesthetic appeal fuels its adoption across various budget points and design requirements, cementing its position as a dominant force in the resilient flooring category.

Key market driving factors include the escalating global demand for waterproof and highly durable flooring solutions, particularly in kitchens, bathrooms, and basements. Furthermore, the relative ease of installation facilitated by modern click-lock systems promotes widespread adoption in the Do-It-Yourself (DIY) segment, especially in North America and Europe. Environmental considerations also play a pivotal role; while PVC remains a component, the inclusion of limestone reduces the reliance on pure vinyl, and many manufacturers are adopting stricter standards regarding VOC emissions, aligning with regulatory pressures in developed regions. The persistent growth in construction activities worldwide, coupled with government investments in infrastructure and affordable housing projects, provides a robust platform for sustained market growth for high-performance, cost-effective flooring materials like SPC.

Stone Plastic Composite (SPC) Flooring Market Executive Summary

The Stone Plastic Composite (SPC) Flooring Market is characterized by vigorous growth, primarily fueled by technological advancements in core composition and surface aesthetics, alongside strong demand from the residential renovation sector and expansion into specialized commercial applications requiring high water resistance and low maintenance. Current business trends indicate a significant focus on supply chain resilience and vertical integration among key manufacturers, particularly in the Asia Pacific region, aiming to stabilize raw material costs (PVC resin and calcium carbonate) which have historically shown volatility. Furthermore, there is a pronounced shift towards ultra-realistic visual designs, employing superior digital printing and synchronization techniques, thereby bridging the aesthetic gap between resilient flooring and genuine hardwood or natural stone. Manufacturers are also prioritizing the development of thinner, lighter, and yet equally rigid SPC products, easing transportation and installation challenges and catering to the requirements of large-scale international projects. The competitive landscape is intensely dynamic, marked by frequent mergers, acquisitions, and strategic partnerships aimed at geographic expansion and capturing niche market segments, driving innovation in sustainable manufacturing practices.

Regional trends reveal Asia Pacific (APAC) as the undisputed global manufacturing hub, leveraging lower operational costs and established supply chains, while simultaneously emerging as a significant consumption market driven by rapid infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe, however, lead in terms of technology adoption, particularly in premium segments demanding low-VOC and aesthetically advanced products. These developed markets show a preference for click-lock systems and wide plank formats, reflecting consumer desires for quick and seamless installation. The push for sustainability is strongest in European markets, influencing stricter regulations on chemical composition and end-of-life recycling programs for SPC materials. Meanwhile, emerging markets in Latin America and the Middle East and Africa (MEA) are witnessing accelerating adoption as SPC offers a cost-effective, climate-appropriate alternative to conventional flooring in regions facing high humidity or temperature extremes.

Segmentation trends highlight the increasing dominance of the residential segment due to sustained growth in home remodeling activities and new housing starts, especially post-pandemic. Within product segmentation, thicker core layers (e.g., 5mm to 8mm) with enhanced acoustic underlayment layers are gaining traction, driven by consumer focus on noise reduction in multi-story buildings and apartment complexes. The distribution channel analysis indicates the growing influence of e-commerce and specialized online flooring retailers, supplementing traditional big-box retail stores and specialty flooring shops, enabling consumers to easily compare product specifications and receive direct-to-consumer delivery. Furthermore, the commercial sector, specifically the healthcare and education sub-segments, shows a growing demand for customized, anti-microbial surface treatments integrated into the SPC wear layer, emphasizing hygiene and long-term durability as non-negotiable purchasing criteria. This multi-faceted growth across segments ensures the robust and resilient future trajectory of the SPC flooring market.

AI Impact Analysis on Stone Plastic Composite (SPC) Flooring Market

User queries regarding the intersection of Artificial Intelligence (AI) and the SPC Flooring Market commonly revolve around improving manufacturing efficiency, enhancing product design realism, and optimizing complex supply chain logistics. Key themes include "How AI can reduce manufacturing defects in SPC production," "AI-driven design tools for custom SPC patterns," and "Predictive analytics for PVC and limestone price forecasting." Consumers also show interest in personalized AI-powered visualization tools that allow them to virtually ‘install’ different SPC patterns in their homes before purchase. The fundamental expectation is that AI integration will lead to higher quality products at stable or decreasing costs, significantly improving the industry’s speed to market for innovative designs and addressing environmental impact through optimized resource utilization. Users are concerned about the potential disruption to traditional installation and design services, yet hopeful for efficiency gains that translate into better value.

AI's role in the manufacturing process is transformative, enabling hyper-accurate quality control and predictive maintenance. In the extrusion and pressing phases, high-speed cameras coupled with machine learning algorithms can detect minute surface imperfections, alignment issues, or inconsistencies in core density far beyond human capacity, ensuring that quality standards are maintained across high-volume production runs. Predictive maintenance leverages sensor data from heavy machinery (presses, calenders) to forecast equipment failure, drastically reducing unplanned downtime, which is costly in a capital-intensive industry like flooring manufacturing. Furthermore, AI optimizes material mixing ratios, minimizing waste and ensuring maximum structural integrity of the SPC core, leading directly to reduced raw material consumption and enhanced sustainability profiles for manufacturers striving for greener operations.

Beyond the factory floor, AI significantly influences market strategy and customer engagement. AI algorithms analyze vast datasets of consumer preferences, social media trends, and regional climate data to accurately predict the popularity of specific colors, textures, and plank sizes, guiding R&D investment and inventory management. This demand forecasting capability minimizes overproduction and inventory obsolescence, leading to a leaner operational model. In logistics, AI optimizes complex global shipping routes for heavy materials, accounting for volatile fuel costs and port congestion, thereby ensuring timely delivery and managing landed costs effectively. For the end-user, AI-powered design platforms offer sophisticated visualization, utilizing augmented reality (AR) to map and project flooring designs in real-time customer environments, significantly enhancing the purchase experience and reducing return rates associated with aesthetic mismatch.

- AI-enhanced Quality Control: Real-time defect detection during lamination and pressing using computer vision, minimizing waste.

- Predictive Maintenance: Optimizing heavy machinery uptime and reducing operational expenditures (OPEX) in extrusion lines.

- Demand Forecasting: Analyzing geographical and demographic data to predict trends in colors, textures, and plank dimensions.

- Generative Design: AI tools assisting designers in creating novel, complex, and realistic wood or stone aesthetic patterns.

- Supply Chain Optimization: Utilizing machine learning for dynamic route planning and inventory management of raw materials (PVC, limestone).

- Augmented Reality (AR) Visualization: Improving customer purchase confidence through virtual installation experiences.

- Energy Consumption Modeling: AI optimizing heating and cooling cycles during the curing process to reduce manufacturing energy use.

DRO & Impact Forces Of Stone Plastic Composite (SPC) Flooring Market

The SPC Flooring Market’s trajectory is shaped by a powerful confluence of drivers and restraining factors, balanced by significant emerging opportunities, all subject to external competitive and structural impact forces. The core drivers predominantly stem from the product's innate technical superiority: its 100% waterproof nature, exceptional durability against impact and indentation, and dimensional stability that resists expansion or contraction under temperature fluctuations, attributes that resonate strongly with both residential and high-performance commercial sectors. These characteristics make SPC a superior alternative to conventional Luxury Vinyl Tile (LVT) and Wood Plastic Composite (WPC) options. The opportunity landscape is vast, particularly in penetrating underdeveloped markets in Africa and specific Asian economies where climate conditions demand highly resilient flooring, coupled with ongoing innovation in surface treatments, such as anti-scratch and anti-microbial coatings, further broadening application scope in niche areas like senior care and childcare facilities. The overall market momentum is strong, driven by modernization and consumer willingness to invest in long-term, low-maintenance home improvement solutions.

However, the market faces structural restraints, primarily concerning raw material price volatility, particularly for PVC resins, which are petroleum derivatives, subjecting manufacturing costs to global crude oil market fluctuations. Another significant constraint is the high initial capital investment required for specialized extrusion and calibration machinery necessary for rigid core production, posing high barriers to entry for smaller manufacturers. Furthermore, despite efforts to improve sustainability, the perception and challenges associated with the end-of-life recycling of PVC-based products remain a limiting factor, especially in environmentally conscious European jurisdictions where mandates favor fully recyclable or bio-based materials. The market also contends with intense competition from established, lower-cost flooring types like ceramic tiles and laminate in price-sensitive segments, requiring continuous cost engineering and product differentiation efforts to maintain market share and pricing power across global regions.

The impact forces operating on the market, derived from Porter's Five Forces analysis, indicate a moderate to high degree of rivalry among existing competitors, driven by the standardized manufacturing process and relatively low product differentiation on a fundamental level, compelling players to compete aggressively on price, logistics, and customer service. The threat of substitutes is significant, given the strong presence of established materials like polished concrete and engineered wood, forcing SPC manufacturers to continuously highlight the total cost of ownership benefits. Supplier bargaining power is considered moderate but subject to fluctuations, particularly regarding specialized additives and PVC stabilizers. Buyer bargaining power is high, especially in large commercial procurement contracts or via powerful retail chains (e.g., Home Depot, Lowe's), necessitating competitive pricing and favorable warranty terms. The impact of new entrants, while mitigated by high capital expenditure requirements, is always present due to global manufacturing capacity shifts, especially from emerging industrial nations, demanding constant vigilance and strategic adaptability from market leaders.

Segmentation Analysis

The Stone Plastic Composite (SPC) Flooring Market is intricately segmented based on core structure, thickness, application, and distribution channel, providing a refined view of market dynamics and catering to specific end-user requirements. Segmentation by application, encompassing residential and commercial uses, clearly delineates purchasing criteria, with residential users prioritizing aesthetics, DIY installation ease, and affordability, while commercial users focus on wear resistance, fire rating compliance, and anti-slip properties, dictating demand for higher quality wear layers and specific anti-microbial treatments. The most pivotal segmentation is by core thickness, which directly correlates with the product's acoustic performance, rigidity, and overall cost, guiding installers toward optimal product selection based on subfloor conditions and noise reduction mandates.

The differentiation in core structure is also crucial, categorizing products into standard SPC core and enhanced or integrated core systems, often featuring attached underlayments (IXPE or EVA foam). These integrated systems simplify installation and provide superior sound dampening characteristics, particularly valued in multi-family dwellings and office buildings, thereby commanding a higher average selling price (ASP). Thickness categories typically range from 3.5mm (light commercial/residential) up to 8mm (heavy commercial/premium residential), allowing manufacturers to tailor their portfolio to specific performance requirements. Furthermore, segmentation by surface finish, encompassing embossed (with and without EIR) and smooth textures, enables targeted marketing towards consumers seeking highly realistic wood grain or natural stone appearances.

The distribution channel breakdown is evolving rapidly, moving beyond traditional brick-and-mortar stores to capitalize on digital retail opportunities. Traditional channels, including specialty flooring retailers and professional dealer networks, continue to dominate due to the need for physical inspection and professional installation support, particularly for complex commercial projects. However, the influence of mass merchandisers and growing e-commerce platforms is undeniable, especially for standard residential products where consumers are comfortable purchasing materials sight unseen based on online reviews and standardized product specifications. Successful market players adopt an omnichannel strategy, integrating online inventory visibility with professional local installation networks to maximize reach and convenience across diverse buyer groups.

- By Product Type:

- Standard SPC Core

- Enhanced Core (with attached underlayment, e.g., IXPE/EVA)

- Rigid Composite Core (RCC)

- By Thickness:

- 3.5 mm – 4.5 mm

- 4.5 mm – 6.0 mm

- Above 6.0 mm

- By Application:

- Residential (Single-Family, Multi-Family)

- Commercial (Retail, Healthcare, Hospitality, Office Spaces, Education)

- By Distribution Channel:

- Offline (Specialty Retailers, Mass Merchandisers, Dealer Networks)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

- By Finish Type:

- Embossed in Register (EIR)

- Standard Embossed

- Smooth Finish

Value Chain Analysis For Stone Plastic Composite (SPC) Flooring Market

The Value Chain for the SPC Flooring Market is characterized by a high degree of integration potential, starting from the procurement of fundamental raw materials upstream through to the complex processes of manufacturing and finishing, culminating in downstream distribution and installation services. The upstream analysis focuses intensely on the sourcing of key components: calcium carbonate (limestone powder), which constitutes the bulk of the rigid core, PVC resins, and chemical additives (stabilizers and plasticizers). Efficiency at this stage is crucial, as the cost structure of the final product is highly sensitive to the global commodity prices of PVC and limestone mining/processing costs. Strategic partnerships with specialized chemical suppliers are vital to ensure compliance with regional health and safety standards, particularly concerning VOC and phthalate content, especially for products aimed at European and North American markets. Manufacturers often engage in long-term contracts to hedge against price volatility, securing reliable, high-quality material supply.

The core manufacturing process involves several technologically intensive stages: mixing and hot-pressing the SPC core layer, applying the decorative film layer (often photographic paper), bonding the transparent wear layer, and finally, applying specialized UV coatings for enhanced abrasion resistance. Efficiency in manufacturing relies heavily on advanced extrusion and calendering technologies to ensure uniform density and dimensional accuracy, critical for successful click-lock installations. Downstream activities involve logistics, where efficient bulk shipping of heavy flooring material is essential. Distribution channels are varied, encompassing direct sales to large commercial builders and indirect sales through a network of national distributors, specialized regional wholesalers, and consumer-facing retailers (both large-format and independent). Installation, often performed by third-party contractors, represents the final value-add activity, where the ease of the click-lock system significantly contributes to installer preference and speed of project completion.

The complexity of the distribution channel segmentation involves balancing direct and indirect sales strategies. Direct channels are commonly utilized for large commercial projects where specifications are tight and volume discounts are high, allowing the manufacturer to maintain greater control over pricing and customer service. Indirect channels, relying on distributors and retailers, facilitate market penetration into diverse geographic areas and cater to the fragmented residential renovation market. The growing importance of e-commerce platforms represents a hybrid channel; while the transaction is direct-to-consumer, the physical fulfillment often relies on established logistics and warehousing infrastructure. Successful value chain management requires robust inventory systems, swift response to shifting aesthetic trends, and continuous investment in sustainable sourcing and production to maintain a competitive edge and meet increasingly stringent global regulatory standards for construction materials.

Stone Plastic Composite (SPC) Flooring Market Potential Customers

Potential customers for Stone Plastic Composite (SPC) flooring are broadly segmented into professional buyers (B2B) and individual consumers (B2C), each driven by distinct needs and purchasing criteria. Within the B2B segment, large-scale commercial developers, general contractors, and architects specializing in high-traffic environments constitute a core customer base. These buyers are primarily interested in technical specifications such as the wear layer thickness, abrasion classification (AC ratings), compliance with fire safety codes (Class A), and long-term warranties (typically 15-25 years commercial warranties). They seek solutions for hospitality (hotels, resorts) where cleaning and moisture resistance are paramount, and healthcare settings (clinics, hospitals) which require seamless installation, low-VOC emissions, and anti-microbial surface properties to maintain hygiene standards. Their purchasing decisions are heavily influenced by the total cost of ownership (TCO), factoring in reduced installation time and minimal maintenance needs over the product lifespan.

The residential market, constituting the B2C segment, includes homeowners involved in new construction or renovation projects, as well as property managers of multi-family housing units. Homeowners prioritize aesthetics—the realism of the wood or stone look, color palettes matching current interior design trends, and the tactile feel of the surface. For this segment, the ease of DIY installation offered by the click-lock mechanism is a major draw, alongside the peace of mind provided by 100% waterproof performance, making SPC an ideal choice for high-moisture areas like kitchens, basements, and laundry rooms. Property managers and landlords value durability and resistance to tenant wear and tear, focusing on quick turnaround times for unit refurbishment and seeking products that offer optimal acoustic separation, reducing sound transmission between floors, a critical feature in competitive rental markets.

A specialized, rapidly growing customer segment is the institutional buyer, including public sector agencies, schools, universities, and government facilities. These customers often procure flooring through highly structured public tenders and procurement processes, demanding strict adherence to sustainability certifications (e.g., FloorScore, GreenGuard) and specific technical performance requirements related to slip resistance and indentation recovery. For these high-volume institutional buyers, the supplier’s capacity for consistent quality, reliability of large-scale supply chains, and adherence to social and environmental responsibility metrics are non-negotiable factors. Furthermore, the rising demand for green building materials driven by initiatives like LEED and BREEAM places customers who prioritize low-emission and sustainable products at the forefront of the market's growth trajectory, pushing manufacturers towards increased transparency in material sourcing and end-of-life planning.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mohawk Industries, Tarkett, Armstrong World Industries, Gerflor, Shaw Industries, Novalis Innovative Flooring, Beaulieu International Group, HMTX Industries, Zhejiang Dajiang Industrial Co. Ltd., Green-Flor, CFL Flooring, Zhejiang Kingdom Floor Co., Ltd., Anhui Sentai WPC, Classen Group, Faus Group, Jinka Group, Unilin Technologies, KCC Corporation, Metroflor, and Mannington Mills. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stone Plastic Composite (SPC) Flooring Market Key Technology Landscape

The technological evolution within the SPC flooring market is primarily focused on enhancing realism, improving installation efficiency, and addressing sustainability concerns through material science and manufacturing processes. A cornerstone technology driving market value is Embossed In Register (EIR) surface texturing, which synchronizes the texture of the plank surface with the underlying photographic image of the wood grain or stone pattern. This precise synchronization creates a highly realistic, three-dimensional look and feel, significantly increasing the aesthetic appeal and market competitiveness against natural materials. Further advancements include proprietary UV-cured topcoats integrated with ceramic beads or aluminum oxide micro-particles, which dramatically improve the scratch resistance and longevity of the wear layer, extending the product’s life cycle, a critical factor for commercial installations with high foot traffic. These topcoat advancements directly contribute to the product's superior performance ratings and lower maintenance requirements over time.

Installation technology remains a key area of innovation, dominated by patented click-lock systems, such as Uniclic and various 5G locking mechanisms. These systems allow for rapid, glueless, floating floor installation, significantly reducing professional labor costs and facilitating ease of use for the growing DIY consumer segment. Continuous R&D in click-lock profile design aims to increase joint strength, enhance water resistance at the seams, and simplify the angle or folding methods required for rapid assembly. Concurrent innovation in the core composition includes the optimization of the limestone content and the introduction of advanced stabilizers to ensure the core maintains absolute dimensional stability across extreme temperatures, preventing warping or gapping—a common failure point in earlier generations of vinyl flooring. This structural integrity ensures the long-term performance and aesthetic appeal of the installed floor.

Beyond core composition and surface finishing, a crucial technology trend involves acoustic dampening integration. The development and incorporation of pre-attached underlayment layers (often IXPE or EVA foam) directly bonded to the back of the SPC planks are vital for meeting stringent building codes regarding sound transmission (IIC/STC ratings) in multi-story residential and commercial structures. This integrated solution streamlines the installation process by eliminating the need for separate underlayment application, offering superior noise mitigation compared to standard LVT. Furthermore, digital printing technology is rapidly advancing, allowing for infinite design variations and reduced lead times for customized patterns, moving beyond standard wood or stone replication to encompass artistic, geometric, and proprietary design films. This combination of advanced aesthetic realism, structural stability, and efficient installation systems solidifies the technological maturity and competitiveness of SPC flooring in the global resilient flooring sector.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth: APAC stands as the largest market both in terms of production capacity and consumption growth. The region, particularly China, Vietnam, and South Korea, serves as the global manufacturing hub, benefitting from established supply chain infrastructure, economies of scale, and efficient raw material sourcing. Market growth within APAC is intensely driven by rapid urbanization, significant government investment in infrastructure, and burgeoning residential construction activity, especially in high-density urban centers where durable and waterproof flooring solutions are essential. The expanding middle class in countries like India and Indonesia fuels demand for aesthetically pleasing and affordable resilient flooring alternatives, positioning APAC to maintain its market dominance throughout the forecast period due to robust local consumption and expansive export capabilities.

- North America (NA) High Value Market: North America represents a mature, high-value market characterized by robust consumer spending power and a strong culture of home renovation and remodeling. The demand in this region is primarily focused on premium SPC products featuring thicker cores (6.0mm+), integrated acoustic underlayments, and advanced EIR finishes that closely replicate genuine hardwood. Regulatory focus on indoor air quality, driven by certifications such as FloorScore, influences product selection, promoting manufacturers who offer low-VOC products. The widespread adoption of DIY installation, supported by strong retail chains and specialized dealers, is a key driver, alongside high demand from the multifamily housing and commercial sectors (e.g., fast-casual dining and large retail environments) that require highly durable and quickly installable flooring.

- Europe’s Regulatory and Sustainability Focus: The European market is characterized by high demand for quality and stringent environmental and health regulations (e.g., REACH). Consumers and commercial specifiers prioritize sustainable sourcing, material transparency, and products free of harmful phthalates. While facing slower construction growth compared to APAC, the robust renovation segment, coupled with the need for high-performance flooring in historical buildings and multi-story dwellings (where acoustic performance is mandatory), sustains strong demand for premium SPC. Germany, France, and the UK are key markets, demanding specialized features such as superior thermal insulation and specific fire classifications, pushing manufacturers toward innovation in core composition and additive usage to comply with diverse national building standards.

- Latin America (LATAM) Emerging Opportunities: The LATAM region, though currently holding a smaller market share, presents substantial growth opportunities. Countries such as Brazil, Mexico, and Chile are experiencing increasing residential construction and commercial development. SPC flooring is highly valued here due to its resistance to moisture and high humidity, making it suitable for tropical and subtropical climates where traditional wood flooring often fails. Market penetration is accelerating as SPC offers a cost-competitive and durable alternative to ceramic tile, provided manufacturers can navigate the complex import duties and establish efficient regional distribution networks. The primary focus remains on affordability and basic performance characteristics rather than premium aesthetic features.

- Middle East and Africa (MEA) Infrastructure Demand: The MEA region’s market growth is tied directly to large-scale infrastructure projects, hospitality expansions (particularly in the Gulf Cooperation Council (GCC) states), and burgeoning residential sectors. High temperatures and, in coastal areas, extreme humidity make SPC's dimensional stability and waterproof nature exceptionally valuable. Investment in healthcare and educational facilities also drives commercial demand, often favoring products with anti-microbial treatments. Political and economic volatility can pose temporary challenges, but the long-term outlook remains positive, especially with large public works programs aiming to diversify economies away from oil dependence, leading to increased demand for robust, high-performance building materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stone Plastic Composite (SPC) Flooring Market.- Mohawk Industries

- Tarkett

- Armstrong World Industries

- Gerflor

- Shaw Industries

- Novalis Innovative Flooring

- Beaulieu International Group

- HMTX Industries

- Zhejiang Dajiang Industrial Co. Ltd.

- Green-Flor

- CFL Flooring

- Zhejiang Kingdom Floor Co., Ltd.

- Anhui Sentai WPC

- Classen Group

- Faus Group

- Jinka Group

- Unilin Technologies

- KCC Corporation

- Metroflor

- Mannington Mills

Frequently Asked Questions

Analyze common user questions about the Stone Plastic Composite (SPC) Flooring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between SPC and WPC flooring?

SPC (Stone Plastic Composite) flooring has a core made primarily of limestone powder and PVC stabilizers, making it ultra-dense, dimensionally stable, and resistant to indentation. WPC (Wood Plastic Composite) uses wood flour and foaming agents in its core, resulting in a lighter, softer feel underfoot and less resistance to extreme temperature changes, whereas SPC is superior in rigidity and resistance to expansion/contraction.

Is SPC flooring environmentally friendly or recyclable?

While SPC is generally low-VOC (Volatile Organic Compounds) and often certified by bodies like FloorScore, its primary component, PVC, complicates end-of-life recycling. However, manufacturers are increasingly using virgin PVC or highly controlled recycled content, and the high limestone content reduces the overall polymer dependence, positioning it as a greener alternative to pure vinyl products, with growing industry focus on material reclamation programs.

How does the thickness of SPC flooring impact performance and cost?

Thickness (ranging from 3.5mm to over 8mm) significantly impacts cost and performance. Thicker cores offer superior sound absorption (acoustic performance), better insulation, and increased comfort underfoot. While the wear layer thickness (measured separately) determines scratch resistance, core thickness is crucial for structural rigidity and hiding minor subfloor imperfections, resulting in premium pricing for thicker, enhanced core products.

Which regions are driving the highest growth rates for SPC flooring adoption?

Asia Pacific (APAC) leads the market in both manufacturing and consumption growth due to rapid urbanization, massive infrastructure development, and low operational costs. North America and Europe, however, show high growth in the premium segment, driven by renovation activities and demand for high-end, aesthetically advanced, and low-VOC compliant products.

What major technological advancement is currently affecting the aesthetic quality of SPC?

The key advancement is Embossed In Register (EIR) technology. EIR ensures that the texture of the plank surface aligns perfectly with the photographic print film underneath. This synchronization creates a hyper-realistic, high-definition aesthetic that mimics the look and feel of natural wood grain or stone surfaces, which is a significant factor driving consumer preference and market valuation in the premium sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stone Plastic Composite (SPC) Flooring Market Statistics 2025 Analysis By Application (Commercial Use, Residential Use), By Type (DIY Installation, Professional Installation), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Stone Plastic Composite (SPC) Flooring Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (DIY Installation, Professional Installation), By Application (Commercial Use, Residential Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager