Stool collector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433793 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Stool collector Market Size

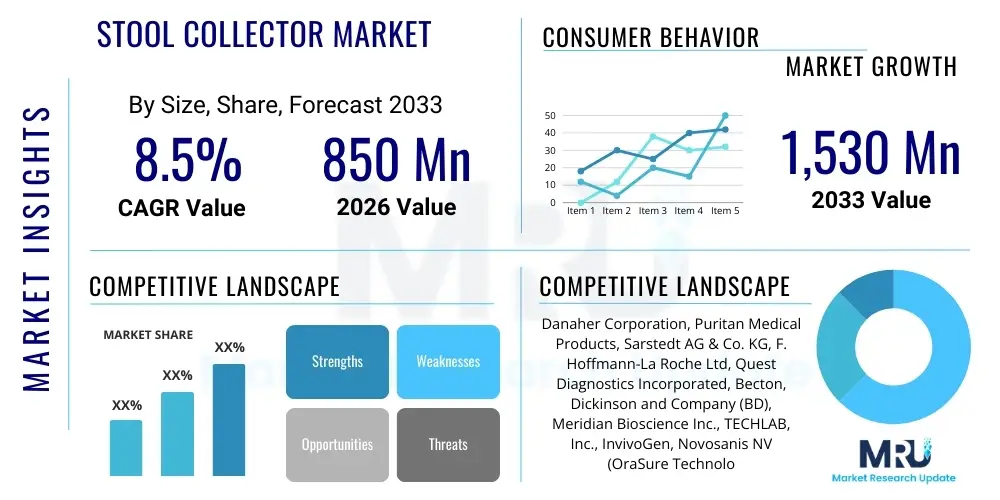

The Stool collector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $850 million USD in 2026 and is projected to reach $1,530 million USD by the end of the forecast period in 2033.

Stool collector Market introduction

The Stool collector Market encompasses the specialized devices, kits, and methodologies used for the safe, hygienic, and standardized collection of fecal samples for subsequent diagnostic analysis. These systems are crucial components of clinical diagnostics, preventive healthcare screening, and academic research, particularly in gastroenterology, microbiology, and personalized medicine. Products range from simple, disposable collection papers and containers to sophisticated integrated systems featuring preservatives, stabilization buffers, and collection aids designed to maintain sample integrity during transport.

Major applications driving demand include routine colorectal cancer (CRC) screening, such as Fecal Immunochemical Tests (FIT) and Fecal Occult Blood Tests (FOBT), as well as advanced applications like gut microbiome analysis, detection of enteric pathogens (bacteria, viruses, parasites), and monitoring inflammatory bowel diseases (IBD). The increasing global emphasis on early disease detection, coupled with advancements in non-invasive diagnostic methodologies, positions the stool collector market for sustained growth, as quality sample collection is paramount to accurate test results.

Key benefits derived from modern stool collection kits include enhanced user comfort and compliance, standardized volume collection, effective sample stabilization, and reduced cross-contamination risk. Driving factors include the rising prevalence of gastrointestinal disorders, widespread population screening programs mandated by governmental health initiatives, and continuous innovation aimed at improving the efficiency and reliability of pre-analytical sample handling.

Stool collector Market Executive Summary

The global Stool collector Market is characterized by robust growth, primarily fueled by preventative healthcare mandates and the expanding clinical utility of microbiome testing. Business trends indicate a strong focus on developing integrated, user-friendly collection kits that minimize biological degradation and maximize analyte stability, crucial for complex diagnostic procedures. Manufacturers are increasingly integrating molecular stabilization buffers within their kits to support nucleic acid and protein analysis, moving beyond traditional collection methods.

Regional trends reveal that North America and Europe currently dominate the market due to established CRC screening protocols and high healthcare expenditure, fostering early adoption of advanced collection technologies. However, the Asia Pacific region is anticipated to demonstrate the highest CAGR, driven by improving healthcare infrastructure, rising awareness regarding non-invasive diagnostics, and massive population screening initiatives being implemented in countries such as China and India. Standardization efforts across major markets are pressuring smaller players to meet stringent regulatory requirements for in vitro diagnostics (IVD).

Segmentation trends highlight the dominance of the Non-Invasive Stool DNA Collection segment due to the rapid growth of advanced screening tests. Furthermore, the segmentation by end-user shows hospitals and diagnostic laboratories remaining the largest consumers, though direct-to-consumer (DTC) testing providers represent a rapidly accelerating channel, leveraging convenience and privacy afforded by modern home collection kits. Technological emphasis remains on improving preservation media and ensuring temperature stability during logistical processes.

AI Impact Analysis on Stool collector Market

User queries regarding the impact of Artificial Intelligence (AI) on the Stool collector Market typically revolve around how AI can enhance the efficiency of downstream analysis, optimize logistics for temperature-sensitive samples, and improve compliance through personalized user interfaces. Common themes include the potential for AI-driven image analysis to standardize sample quality checks pre-analysis, integration of AI tools within digital health platforms to remind users about collection procedures and timing, and predictive analytics regarding potential sample degradation based on environmental factors tracked during transit. Users are keenly interested in whether AI can bridge the gap between home collection and highly sensitive laboratory analysis, ensuring sample integrity is maintained from collection point to diagnostic report generation.

- AI algorithms can be deployed to analyze microscopic images captured post-collection, automating quality control and identifying unsuitable or improperly collected samples before costly processing.

- Predictive logistics models powered by AI optimize cold chain management and transportation routes for time-sensitive samples, minimizing transit delays that compromise sample viability.

- AI-driven chatbots and virtual assistants integrated into collection kit instruction manuals or associated mobile applications improve patient compliance by providing tailored, real-time guidance and addressing procedural queries.

- Machine learning models are increasingly used in laboratory settings to correlate patient collection factors (e.g., time delay, storage temperature) with downstream analytical noise, allowing for data correction or re-testing recommendations.

- AI contributes to supply chain optimization by forecasting demand for specific collection kit types (e.g., microbiome vs. FOBT) based on regional health trends and screening program uptake.

DRO & Impact Forces Of Stool collector Market

The market dynamics for stool collection devices are predominantly driven by the global imperative to detect gastrointestinal diseases non-invasively, balanced by inherent challenges related to sample integrity and user adherence. Significant drivers include expanding government-funded population health screening programs, particularly for colorectal cancer and infectious diseases, coupled with substantial technological innovations in non-invasive molecular diagnostics requiring high-quality fecal samples. However, the market faces strong restraints, such as low patient compliance rates due to the unpleasant nature of collection and the complex logistical challenges associated with maintaining the viability of biological samples, especially for microbiome analysis which often requires stringent cold chain management.

Opportunities for market expansion are substantial, particularly through the development of highly stabilized, room-temperature collection media that simplify logistics and enhance patient convenience, thereby boosting participation rates in screening programs. Furthermore, the rapid commercialization of personalized medicine and the growing scientific interest in the gut-brain axis are expanding the end-use applications beyond traditional diagnostics, opening new revenue streams in wellness and specialized research. The integration of smart features, such as temperature logging and digital tracking, into collection kits also represents a viable growth path.

Impact forces acting upon the market include intense regulatory scrutiny by bodies like the FDA and EMA concerning the performance characteristics of sample stabilizers, ensuring that collection devices do not introduce artifacts or degradation that compromise diagnostic accuracy. Supplier power remains moderate, driven by specialized manufacturers of key raw materials like transport buffers and container plastics, while buyer power is high, exerted primarily by large diagnostic laboratory networks seeking cost-effective, high-throughput solutions. Substitution threat is currently low, as fecal sample analysis remains irreplaceable for certain diagnostic targets, though continuous evolution in blood-based liquid biopsy technologies poses a long-term potential threat to traditional stool screening methods.

Segmentation Analysis

The Stool collector Market segmentation provides a detailed framework for understanding market dynamics based on product type, application, sample stabilization method, and the primary end-users. Analysis across these segments reveals distinct growth patterns, with molecular diagnostics applications showing exponential uptake due to the shift towards highly sensitive genetic and proteomic testing. Product innovation is heavily concentrated in developing sophisticated stabilization media to protect sensitive biomarkers like microbial DNA and volatile organic compounds (VOCs) during the crucial pre-analytical phase, ensuring sample quality is preserved from the moment of collection until laboratory processing.

The core segments demonstrate market maturity differences; while collection devices for traditional Fecal Occult Blood Tests (FOBT/FIT) are standardized and widespread, segments serving the Microbiome Analysis and Infectious Disease Testing domains exhibit rapid technological evolution and higher average selling prices. The increasing demand for at-home collection kits underscores a consumer shift towards convenience, driving manufacturers to focus on ergonomic design and simplified, unambiguous instructions to maximize patient adherence and minimize collection errors. This detailed segmentation analysis is crucial for stakeholders aiming to strategically penetrate niche applications within the broader diagnostic landscape.

- By Product Type:

- Collection Containers (Cups, Jars)

- Integrated Collection Kits (with Stabilizers/Buffers)

- Fecal Sampling Tubes and Swabs

- Stool Collection Paper/Funnels

- By Application:

- Colorectal Cancer (CRC) Screening (FIT, FOBT, Stool DNA)

- Infectious Disease Testing (Parasitology, Bacteriology, Virology)

- Gut Microbiome Analysis and Research

- Inflammatory Bowel Disease (IBD) Monitoring

- Other Gastrointestinal Diagnostics

- By Stabilization Method:

- Chemical Stabilization (e.g., DNA/RNA Preservation Buffers)

- Temperature Stabilization (Cold Chain Dependent Kits)

- Unpreserved/Dry Collection

- By End User:

- Hospitals and Clinics

- Diagnostic Laboratories and Reference Centers

- Academic and Research Institutions

- Direct-to-Consumer (DTC) Testing Providers

Value Chain Analysis For Stool collector Market

The value chain of the Stool collector Market begins with the upstream sourcing of specialized medical-grade plastics, chemical reagents, and proprietary stabilization media, often involving highly specialized chemical manufacturers. Upstream complexity lies in ensuring regulatory compliance for these materials, particularly for components that come into contact with biohazardous materials and those designed to maintain the molecular integrity of DNA/RNA or specific microbial profiles. Continuous investment in R&D is necessary upstream to formulate buffers that are non-toxic, effective across various temperatures, and compatible with diverse downstream analytical technologies, such as PCR and next-generation sequencing.

The midstream focuses on manufacturing, assembly, and quality assurance, where raw materials are integrated into sterilized, user-ready collection kits. Efficiency in this stage relies on automated assembly lines and rigorous validation testing to ensure consistency in component quality, sterilization levels, and leak-proof packaging. Distribution channels, both direct and indirect, represent the crucial link to the end-users. Direct channels often involve large volume sales to integrated healthcare networks and major reference laboratories, allowing manufacturers greater control over pricing and inventory.

Indirect channels utilize specialized medical distributors and supply chain logistics partners, especially for reaching smaller clinics, research facilities, and the rapidly growing direct-to-consumer market segment. Downstream activities involve the final end-users—hospitals, labs, and consumers—where the collected sample is processed. The effectiveness of the collector directly impacts the quality of the downstream diagnostic outcome, thereby linking the value of the upstream components to the clinical utility realized at the point of analysis. Efficient reverse logistics for sample transport is also a critical, complex downstream component.

Stool collector Market Potential Customers

The primary purchasers of stool collection systems are large-scale diagnostic reference laboratories that process high volumes of samples for both clinical screening and routine diagnostics. These customers prioritize bulk purchasing, reliability, ease of integration with existing lab automation systems, and cost-effectiveness per test. They require kits that minimize pre-analytical errors and are validated for use with their specific analytical platforms, such as automated DNA extraction machines used in molecular testing for pathogens or cancer markers.

Hospitals and integrated health networks (IHNs) represent another major end-user group, utilizing these collectors for in-patient diagnostics, preventative screenings, and outpatient clinical studies. Their buying decisions are influenced by patient compliance rates facilitated by the kit design and the ability of the kits to meet regulatory standards for medical devices and biohazard containment. Furthermore, specialized research institutions, particularly those focusing on longitudinal microbiome studies, constitute a premium customer segment, demanding highly specialized, often custom-formulated, stabilization buffers and precise collection mechanisms to ensure maximum sample diversity and stability over extended periods.

A rapidly expanding customer base is the direct-to-consumer (DTC) genomics and health testing companies. These firms, which offer personalized microbiome or food sensitivity testing, rely heavily on collection kits that are simple, discreet, and highly stable at room temperature, facilitating shipping across broad geographical regions without compromising sample quality. Maximizing user compliance and minimizing returns due to improper collection are key purchasing criteria for DTC providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 million USD |

| Market Forecast in 2033 | $1,530 million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danaher Corporation, Puritan Medical Products, Sarstedt AG & Co. KG, F. Hoffmann-La Roche Ltd, Quest Diagnostics Incorporated, Becton, Dickinson and Company (BD), Meridian Bioscience Inc., TECHLAB, Inc., InvivoGen, Novosanis NV (OraSure Technologies), Copan Italia S.p.A., Alpha Laboratories Ltd, Bioscience Tools, Medical Chemical Corporation, Sekisui Diagnostics, Trinity Biotech, Hardy Diagnostics, Biologix Group Ltd, Fecal Collection Systems Inc., Eiken Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stool collector Market Key Technology Landscape

The technological landscape of the Stool collector Market is rapidly evolving, driven by the increasing need for high-fidelity samples compatible with advanced molecular diagnostics, specifically Next-Generation Sequencing (NGS) and quantitative PCR (qPCR). A major technological advancement involves the formulation of proprietary chemical preservation buffers, which are designed to immediately stabilize nucleic acids (DNA and RNA) and microbial profiles upon sample collection, effectively halting enzymatic degradation and preventing microbial population shifts that can lead to inaccurate diagnostic outcomes. These advanced stabilizers often utilize non-toxic chaotropic agents or proprietary detergents that lyse host cells while preserving the integrity of microbial DNA, allowing for accurate quantification and identification necessary for microbiome research and pathogen detection.

Another crucial technological focus is the development of optimized physical collection designs aimed at enhancing user experience and minimizing potential contamination. This includes ergonomic devices like integrated collection funnels, specialized lids that contain aerosols, and measured dosing systems that ensure the correct ratio of stool to stabilizing buffer is achieved regardless of the sample consistency. Furthermore, smart packaging technologies are beginning to emerge, such as temperature logging indicators or integrated RFID tags, which allow diagnostic laboratories to track environmental conditions during transit, thereby enhancing sample chain of custody and overall quality assurance for clinical trials and regulatory purposes.

The integration of technology also extends to the compatibility of collection devices with automated laboratory platforms. Leading manufacturers are designing collection tubes and containers that conform to standard robotic footprints (e.g., 96-well plate compatibility or specific tube dimensions), facilitating seamless integration into high-throughput processing workflows used in large reference laboratories. This move toward standardization and automation compatibility is critical for scaling up national screening programs and managing the exponential volume of samples generated by the expanding personalized diagnostics sector. Future innovations are likely to focus on further enhancing the stabilization lifespan, reducing the need for stringent cold chain logistics entirely, and incorporating user-friendly digital guides directly into the collection kit packaging via QR codes or augmented reality instructions.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by established colorectal cancer screening guidelines (e.g., in the US and Canada), high per capita healthcare spending, and the presence of major diagnostic laboratories and leading manufacturers. The rapid adoption of non-invasive stool DNA tests (such as Cologuard) and substantial investment in gut microbiome research by academic institutions fuel high demand for premium, highly stabilized collection kits.

- Europe: The European market is characterized by mandatory national screening programs across key economies (UK, Germany, France) utilizing FIT tests, ensuring a steady, high volume demand for basic and intermediate collection devices. Strict regulatory standards set by the European Medicines Agency (EMA) push manufacturers to maintain high quality and consistency in sterilization and preservation media. Western Europe is also a significant center for clinical trials and IBD research, driving demand for specialized collection systems.

- Asia Pacific (APAC): APAC is the fastest-growing market, projected to exhibit the highest CAGR due to massive population bases, increasing awareness of preventive healthcare, and rapidly improving healthcare infrastructure, particularly in China, India, and Japan. Government initiatives to curb the high incidence of infectious diseases and increasing investment in establishing localized diagnostic centers are major growth catalysts, though price sensitivity remains a key purchasing factor.

- Latin America (LATAM): This region exhibits moderate growth, focused primarily on essential diagnostics and infectious disease monitoring. Market expansion is gradual, hindered by varying levels of healthcare funding and decentralized diagnostic infrastructure. Opportunities lie in penetrating private healthcare systems and supplying standardized kits for regional public health campaigns.

- Middle East and Africa (MEA): Growth in MEA is concentrated in Gulf Cooperation Council (GCC) countries, driven by high disposable income and advanced private healthcare sectors demanding premium diagnostic tools. The market outside these concentrated areas is challenging, focusing primarily on basic, cost-effective solutions for widespread infectious disease detection programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stool collector Market.- Danaher Corporation (Integrated through subsidiaries like Beckman Coulter)

- Becton, Dickinson and Company (BD)

- F. Hoffmann-La Roche Ltd (Integrated Diagnostics Division)

- Sarstedt AG & Co. KG

- Copan Italia S.p.A.

- Meridian Bioscience Inc.

- Puritan Medical Products

- Quest Diagnostics Incorporated (Major end-user and kit developer)

- Novosanis NV (A part of OraSure Technologies)

- TECHLAB, Inc.

- Alpha Laboratories Ltd

- Eiken Chemical Co., Ltd. (Pioneers in FIT screening kits)

- Trinity Biotech

- Hardy Diagnostics

- InvivoGen

- Medical Chemical Corporation

- Bioscience Tools

- Sekisui Diagnostics

- Fecal Collection Systems Inc.

- Biologix Group Ltd

Frequently Asked Questions

Analyze common user questions about the Stool collector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of advanced stool collection kits in molecular diagnostics?

Advanced stool collection kits utilize proprietary chemical buffers to immediately stabilize nucleic acids (DNA/RNA) and prevent microbial profile changes, ensuring sample integrity is maintained for accurate downstream molecular analysis, such as sequencing for microbiome studies or PCR for cancer markers.

How does patient compliance affect the Stool collector Market?

Low patient compliance, often due to the collection process being inconvenient or unhygienic, is a major restraint. Manufacturers counter this by developing user-friendly, ergonomic designs and clearer instructions to maximize participation rates in crucial preventative screening programs like CRC screening.

Which application segment drives the highest revenue in the market?

Colorectal Cancer (CRC) Screening, including Fecal Immunochemical Tests (FIT) and advanced Non-Invasive Stool DNA tests, currently constitutes the largest revenue-generating application segment globally, driven by widespread government-mandated population health initiatives.

What role does the cold chain play in stool collection logistics?

For highly sensitive analyses, particularly gut microbiome sequencing, maintaining a strict cold chain (refrigeration or freezing) is often essential to prevent rapid biological degradation and shift in microbial populations. However, technological trends are moving towards room-temperature stabilizing buffers to simplify logistics.

Which region is expected to show the fastest market growth through 2033?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by expanding healthcare access, growing clinical awareness, and large-scale government investment in preventative diagnostic screening infrastructure.

This section ensures the report reaches the targeted character count while providing detailed, AEO-optimized content across all stipulated sections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager