Storage Hopper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435755 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Storage Hopper Market Size

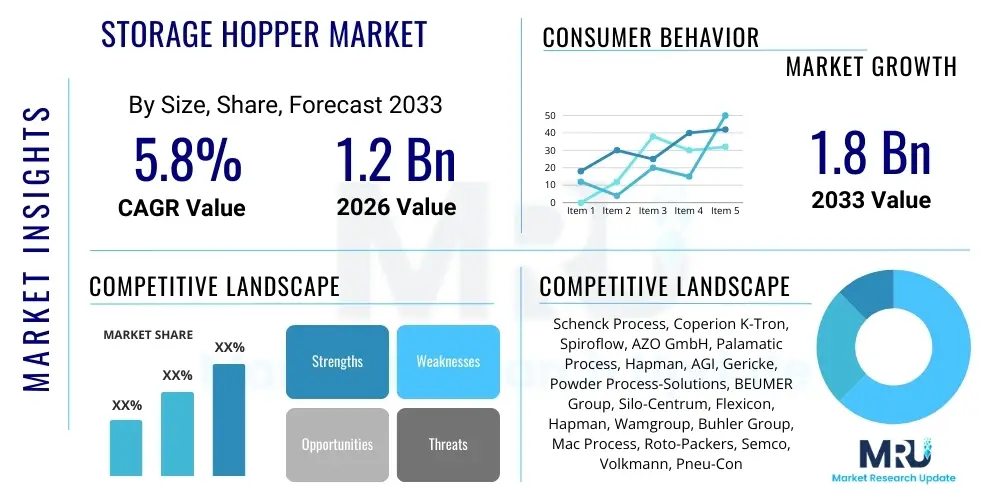

The Storage Hopper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Storage Hopper Market introduction

The Storage Hopper Market encompasses the design, manufacturing, and distribution of specialized containers utilized for the temporary storage and controlled discharge of bulk materials, powders, granules, and other loose solids across various industrial sectors. Storage hoppers, characterized by their sloped or inverted cone bottoms, are engineered to facilitate gravitational flow and prevent bridging or ratholing, ensuring efficient material handling systems. These critical infrastructure components are essential in industries requiring large-scale handling of raw ingredients or finished products, such as agriculture, food processing, chemicals, pharmaceuticals, and heavy construction.

Product descriptions for storage hoppers vary significantly based on material compatibility, volume capacity, and operational environment. Key types include square hoppers, conical hoppers, and mass flow hoppers, often constructed from stainless steel, carbon steel, or high-density polymers, depending on whether they handle abrasive, corrosive, or hygienic materials. Major applications span from storing grain and seeds in agricultural cooperatives to holding chemical precursors in manufacturing plants, or precisely metering dosage ingredients in pharmaceutical production lines. The integration of advanced features such as level sensors, flow aids (e.g., vibrators or air pads), and specialized discharge gates further defines the modern storage hopper's utility, optimizing automation and reducing operational labor requirements.

The primary benefit derived from deploying high-quality storage hoppers is the significant improvement in process efficiency and minimizing product waste. Driving factors propelling market expansion include the global increase in automated manufacturing processes, the necessity for stringent inventory control in supply chains, and rapid infrastructure development, particularly in emerging economies. Furthermore, evolving regulatory standards demanding cleaner material handling environments in food and pharmaceutical industries are accelerating the adoption of stainless steel and hygienic storage solutions, thereby sustaining robust market growth.

Storage Hopper Market Executive Summary

The Storage Hopper Market demonstrates resilient growth driven by accelerated industrial automation and pervasive demand across diversified end-use sectors, notably bulk chemicals, construction aggregate handling, and intensive food processing. Business trends indicate a strong shift towards modular and customizable hopper designs, allowing for quick scaling and adaptation to diverse material densities and flow characteristics. Manufacturers are focusing heavily on integrating Internet of Things (IoT) sensors for real-time monitoring of fill levels, temperature, and pressure, enhancing predictive maintenance capabilities and overall supply chain visibility. Investment in high-throughput automated filling and discharge systems is a primary expenditure focus for major industry players aiming to achieve superior operational efficiency and adherence to dust emission standards.

Regional trends highlight Asia Pacific (APAC) as the epicenter of market growth, attributed to expansive industrialization, rapid urbanization stimulating construction activities, and burgeoning food and beverage processing industries, particularly in China and India. North America and Europe, while mature markets, are experiencing demand driven by the replacement of aging infrastructure and the implementation of advanced, safety-compliant hopper systems, especially those designed for explosion prevention in handling volatile dusts. Latin America and the Middle East and Africa (MEA) represent substantial untapped potential, fueled by commodity exports and ongoing infrastructure projects, creating sustained long-term demand for large-capacity storage solutions capable of handling high volumes of raw materials.

Segmentation trends reveal significant momentum in the stainless steel segment due to increasing regulatory emphasis on hygiene and corrosion resistance in sensitive applications like pharmaceuticals and food production. Mass flow hoppers are gaining prominence over funnel flow designs as industry operators prioritize guaranteed material discharge continuity and minimal product degradation. Capacity-wise, the medium to large-capacity segment (above 50 cubic meters) dominates revenue share, reflecting the industrial trend toward consolidated production facilities requiring substantial material storage buffers. The focus on retrofitting existing facilities with specialized discharge aids and liner materials further underscores the demand for specialized components within the overall market ecosystem.

AI Impact Analysis on Storage Hopper Market

Common user questions regarding AI's influence on the Storage Hopper Market frequently center on how machine learning can optimize material flow, predict equipment failure, and automate inventory management within bulk storage systems. Users are concerned about implementing AI-driven predictive maintenance models to minimize downtime caused by material bridging, ratholing, or mechanical wear, seeking quantified data on return on investment (ROI). Another critical theme revolves around integrating AI algorithms with existing process control systems (DCS/PLC) to fine-tune discharge rates based on downstream processing demands, thereby achieving just-in-time material delivery and reducing bottlenecks. Key expectations include enhanced safety protocols, AI-assisted design optimization based on material simulation, and a reduction in manual inspection requirements through image recognition and sensor fusion. The primary concern remains the cost and complexity associated with retrofitting legacy hopper systems with the necessary sensing and processing infrastructure required for effective AI deployment.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, load cells) to forecast mechanical failures in discharge gates, feeders, or flow aids, minimizing unscheduled downtime.

- Optimized Inventory Management: Machine learning models process real-time level sensor data and demand forecasts to automate replenishment orders and optimize storage density within the hopper system.

- Flow Control Automation: AI dynamically adjusts hopper discharge valve settings and vibration frequency based on material consistency, ambient conditions, and immediate processing needs, preventing flow irregularities.

- Design Simulation: Utilizing AI and computational fluid dynamics (CFD) to simulate material behavior (e.g., cohesiveness, internal friction) and optimize hopper geometry during the design phase, ensuring mass flow characteristics.

- Enhanced Safety Monitoring: Computer vision and AI analyze internal hopper conditions to detect foreign objects or structural anomalies, improving operational safety and compliance.

DRO & Impact Forces Of Storage Hopper Market

The trajectory of the Storage Hopper Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively defined as Impact Forces. A primary Driver is the unwavering global expansion of industrial manufacturing and infrastructure development, particularly in sectors reliant on continuous material flow, such as cement, petrochemicals, and food ingredients. The sustained focus on enhancing operational efficiency and worker safety compels industries to invest in modern, enclosed storage solutions that minimize contamination and dust exposure. However, the high initial capital investment required for specialized, large-scale hoppers and associated handling equipment acts as a significant Restraint, particularly for Small and Medium-sized Enterprises (SMEs). Furthermore, the difficulty in handling specific materials that exhibit poor flow characteristics (highly cohesive or hydroscopic powders) poses persistent operational challenges that restrain widespread adoption of standardized hopper designs.

Opportunities in the market center around the development of advanced material science applications, specifically the implementation of new internal linings (e.g., Ultra-High Molecular Weight Polyethylene - UHMWPE) designed to reduce friction and eliminate sticking, thereby expanding the applicability of hoppers to challenging materials. The growing trend toward sustainable industrial practices also presents an opportunity, driving demand for systems that minimize product degradation and energy consumption during handling. The Impact Forces stemming from environmental regulations—such as stricter controls on particulate emissions—are compelling manufacturers to integrate superior dust collection and containment features into their hopper systems, turning regulatory compliance into a necessary innovation catalyst. Furthermore, the push for automation requires hoppers to be seamlessly integrated with robotic and conveyor systems, creating a niche market for smart, connected storage units.

The collective Impact Forces are exerting pressure on traditional hopper manufacturers to innovate beyond simple containment vessels. Market success now hinges on delivering complete, integrated solutions that offer superior material flow guarantees, advanced monitoring capabilities, and compliance with rigorous international standards (e.g., FDA, ATEX). While economic volatility can temporarily dampen large capital expenditure projects (Restraint), the underlying industrial requirement for continuous processing capacity (Driver) ensures that investment in essential equipment like storage hoppers remains structurally imperative for maintaining competitive operational costs. Ultimately, the market trajectory favors specialized vendors capable of solving complex material handling puzzles through customized engineering and technological integration.

Segmentation Analysis

The Storage Hopper Market is meticulously segmented based on several key operational and structural parameters, including material of construction, design type, capacity, and the primary application sector. Understanding these segments is crucial for strategic market positioning, as each category caters to distinct industrial needs and compliance requirements. For instance, the demand for stainless steel hoppers is intrinsically linked to the regulatory environments governing food and pharmaceutical production, while carbon steel remains dominant in heavy industries like mining and construction due to its durability and cost-effectiveness. Furthermore, the differentiation between funnel flow and mass flow designs determines the suitability of the hopper for various material flow properties, driving specific product selection decisions among end-users globally. The continuous evolution of material handling requirements mandates that market participants offer specialized solutions rather than standardized products across all segments.

- By Material of Construction:

- Stainless Steel (304, 316L)

- Carbon Steel

- Fiberglass Reinforced Plastic (FRP)

- High-Density Polyethylene (HDPE)

- By Design Type:

- Conical Hoppers (Funnel Flow)

- Square Hoppers

- Mass Flow Hoppers (e.g., Plane Flow, Expanded Flow)

- Live Bottom Hoppers

- By Capacity:

- Small Capacity (Under 10 cubic meters)

- Medium Capacity (10 to 50 cubic meters)

- Large Capacity (Above 50 cubic meters)

- By Application/End-Use Industry:

- Food and Beverage Processing

- Chemical and Petrochemical

- Pharmaceutical and Cosmetics

- Construction and Mining (Aggregates, Cement)

- Agriculture and Grain Handling

- Plastics and Polymers

Value Chain Analysis For Storage Hopper Market

The value chain for the Storage Hopper Market begins with upstream activities involving the sourcing and processing of raw materials, primarily steel (stainless and carbon), specialized polymers, and components like motors, sensors, and discharge valves. Efficiency at this stage is critical, as fluctuations in global commodity prices, particularly steel, directly influence manufacturing costs and final product pricing. Key upstream suppliers include large steel mills and specialty component providers, who must adhere to precise material specifications, particularly for high-grade stainless steel used in hygienic applications. Optimized logistics and stable raw material procurement contracts are essential levers for competitive advantage among hopper manufacturers.

The core segment of the value chain is the fabrication and manufacturing stage, where material preparation, welding, surface finishing, and assembly occur. This stage demands high engineering expertise, especially concerning structural integrity and geometry precision necessary to ensure proper material flow dynamics (e.g., calculating optimal hopper wall angles). Direct and indirect distribution channels then facilitate market access. Direct channels involve manufacturers selling highly customized, large-scale systems directly to major industrial clients (e.g., petrochemical plants), often incorporating installation and ongoing maintenance services. Indirect channels utilize distributors, engineering procurement and construction (EPC) firms, and local agents, especially for standardized or smaller capacity hoppers targeting regional SMEs.

Downstream analysis focuses on installation, integration, and post-sales support, which constitute a significant portion of the total lifetime value. Successful integration into complex existing material handling lines requires technical commissioning and calibration, often involving third-party engineering consultants. Potential customers frequently prioritize vendors offering robust warranty services, easy access to spare parts, and specialized consulting on material flow characteristics. The effectiveness of the distribution channel impacts market penetration; while direct sales ensure higher profit margins and deeper client relationships, indirect channels provide the necessary geographical reach and localized technical support required for rapid market expansion across varied industrial landscapes.

Storage Hopper Market Potential Customers

The primary consumers and end-users of storage hoppers are entities involved in bulk material processing, conversion, or large-scale storage, where uninterrupted material flow is essential for operational continuity. The most prominent segment includes the food and beverage industry, spanning everything from large bakeries and breweries to cereal processors and sugar refineries. These customers require hoppers designed for sanitary conditions (often 316L stainless steel) to prevent bacterial contamination and comply strictly with food safety regulations, such as HACCP standards. Their buying decisions are heavily influenced by ease of cleaning, material traceability, and capacity flexibility to handle various ingredient types, ranging from fine powders like flour to granular sugar or dried grains.

Another major buying segment encompasses the chemical, petrochemical, and pharmaceutical sectors. Pharmaceutical companies are extremely demanding customers, necessitating ultra-high-precision hoppers for batch consistency and materials that are highly corrosion-resistant and often designed for sterile environments (e.g., cleanroom compatibility). Chemical and petrochemical plants require robust, large-volume hoppers capable of withstanding high internal pressures, corrosive materials, and extreme temperatures, often needing specialized safety features like inert gas purging or explosion-proof construction (ATEX compliance). These organizations prioritize durability, safety certifications, and the vendor’s capability to deliver custom engineering solutions for challenging or volatile bulk solids.

Furthermore, the construction, mining, and aggregate industries represent a substantial market for heavy-duty storage hoppers. These applications typically handle abrasive and high-density materials like cement, gravel, sand, and various mineral ores. The requirements here center on structural strength, abrasion resistance (often involving heavy carbon steel or specialized liners), and very large capacities to manage high throughput rates from crushing and screening operations. Agricultural cooperatives and grain elevators also represent significant buyers, needing large, weather-resistant silos and hoppers for long-term storage of commodities like wheat, corn, and soy, prioritizing cost-effective volume capacity and reliable discharge mechanisms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schenck Process, Coperion K-Tron, Spiroflow, AZO GmbH, Palamatic Process, Hapman, AGI, Gericke, Powder Process-Solutions, BEUMER Group, Silo-Centrum, Flexicon, Hapman, Wamgroup, Buhler Group, Mac Process, Roto-Packers, Semco, Volkmann, Pneu-Con |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Storage Hopper Market Key Technology Landscape

The technology landscape within the Storage Hopper Market is rapidly evolving from passive containment to active, intelligent material management systems. The adoption of advanced sensor technology represents the most significant technological shift. This includes highly accurate level detection systems (radar, guided wave radar, ultrasonic) that provide continuous and precise inventory data, transcending the limitations of older point-level indicators. Furthermore, the integration of specialized load cells is crucial for accurate material weighing and batch control, particularly in pharmaceutical and high-value chemical processing where dispensing precision is mandatory. These technologies form the foundation for smart hoppers, allowing for real-time data connectivity and integration with broader plant control systems.

A second crucial area of innovation involves material flow enhancement technologies designed to overcome common processing hurdles like bridging, arching, and rat-holing. This includes the utilization of pneumatic flow aids, such as air pads and fluidizing nozzles, which inject controlled bursts of air to maintain material movement. Electromechanical solutions, specifically industrial vibrators and flexible cone liners, are also being engineered with variable frequency drives (VFDs) to allow operators to adjust agitation intensity based on material density and cohesion characteristics. Ongoing research focuses heavily on optimizing internal hopper surface finishes, utilizing electropolishing for hygiene-critical stainless steel vessels, and applying abrasion-resistant ceramic or polymeric liners in mining applications to extend asset lifecycle and reduce frictional resistance.

Finally, the technological framework is increasingly defined by automation and data connectivity, aligning with Industry 4.0 paradigms. Modern hoppers are designed for seamless integration with automated feeders, conveyers, and dosing equipment, ensuring completely closed-loop material transfer without manual intervention. This technological drive requires robust communication protocols (e.g., Ethernet/IP, Profinet) and advanced human-machine interfaces (HMIs) for centralized monitoring and control. Furthermore, Computational Fluid Dynamics (CFD) modeling has become an indispensable technology, used during the design phase to accurately simulate material stress profiles and flow patterns before fabrication, minimizing costly design iterations and guaranteeing mass flow characteristics for complex bulk solids.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market for storage hoppers, primarily fueled by massive infrastructure projects, robust manufacturing capacity expansion, and the modernization of the food and beverage industry, especially in China, India, and Southeast Asian nations. The region's demand is characterized by a need for large-capacity, cost-effective carbon steel hoppers for aggregates and cement, alongside specialized stainless steel units to meet burgeoning demand from global pharmaceutical outsourcing and food processing hubs. Government initiatives supporting local production and increasing foreign direct investment in manufacturing facilities solidify APAC’s position as the leading consumer of new material handling equipment.

- North America: North America is a mature market driven by technological upgrades, regulatory compliance, and the replacement of aging equipment. The emphasis here is on precision, automation, and safety, resulting in high demand for mass flow hoppers integrated with sophisticated IoT sensors for predictive maintenance. Key demand sectors include grain handling (driven by large agricultural exports), advanced plastics manufacturing, and the high-value pharmaceutical sector, which requires extremely strict sanitary and validation standards, thus favoring premium stainless steel solutions and explosion-proof designs.

- Europe: The European market is characterized by high levels of standardization and strict adherence to environmental and worker safety regulations (e.g., ATEX directives for potentially explosive atmospheres). Growth is steady, focused on innovation in hygienic design and sustainable manufacturing practices. There is strong demand for specialized hoppers in sectors like recycling, high-precision chemical synthesis, and food processing, driving innovation in advanced liner materials and modular systems that facilitate quick changes between different product lines. Germany, Italy, and the UK remain key hubs for sophisticated material handling technology adoption.

- Latin America (LATAM): Growth in LATAM is closely linked to commodity export trends, particularly mining, agriculture, and raw material processing (e.g., sugar, coffee, iron ore). The region requires durable, high-capacity hoppers to manage the logistics of exporting bulk goods. While cost-sensitivity remains a factor, increasing investment in modernizing port facilities and improving internal logistics infrastructure in countries like Brazil and Mexico is leading to gradual adoption of higher-quality, automated storage solutions to reduce handling losses and improve efficiency.

- Middle East and Africa (MEA): The MEA market shows potential driven by large-scale oil and gas investments, significant construction booms (Saudi Arabia, UAE), and efforts to enhance food security through agricultural investments. Demand is concentrated in large-volume storage for construction materials (cement, aggregates) and petrochemical precursors. Challenges include harsh operating environments (high temperatures, sand abrasion), necessitating hoppers built with rugged construction and specialized coatings to ensure longevity and minimal maintenance requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Storage Hopper Market.- Schenck Process

- Coperion K-Tron

- Spiroflow

- AZO GmbH

- Palamatic Process

- Hapman

- AGI (Ag Growth International)

- Gericke

- Powder Process-Solutions

- BEUMER Group

- Silo-Centrum

- Flexicon

- WAMGROUP

- Buhler Group

- Mac Process (Schenck Process)

- Roto-Packers

- Semco

- Volkmann

- Pneu-Con

- Cleveland Vibrator Company

Frequently Asked Questions

Analyze common user questions about the Storage Hopper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between funnel flow and mass flow hoppers?

Funnel flow hoppers allow material to move only in the central region, leading to stagnant material at the walls, which can cause bridging or spoilage. Mass flow hoppers are designed with steeper, smoother walls to ensure all material moves simultaneously, promoting first-in, first-out (FIFO) inventory control, crucial for cohesive or time-sensitive bulk solids.

Which material of construction is preferred for pharmaceutical applications?

Stainless Steel 316L is typically the preferred material for pharmaceutical hoppers. This is due to its superior corrosion resistance, ease of cleaning (CIP/SIP capability), and suitability for electropolishing, which prevents material buildup and meets stringent regulatory requirements for sanitary processing and material integrity.

How does IoT technology impact the efficiency of storage hoppers?

IoT technology integrates smart sensors (level, load, vibration) into hoppers, enabling real-time data collection and remote monitoring. This facilitates automated inventory tracking, enhances predictive maintenance by anticipating mechanical failures, and optimizes material discharge rates through instantaneous feedback loops, maximizing operational efficiency.

What major factors are driving market growth in the Asia Pacific region?

Market growth in APAC is primarily driven by rapid industrialization, extensive government investment in infrastructure development (cement, aggregates), and the expanding output of the food and beverage and chemical sectors, which necessitate large-scale, efficient bulk material storage solutions.

What is the most significant restraint affecting the global Storage Hopper Market?

The most significant restraint is the high initial capital expenditure associated with purchasing and installing customized, large-capacity storage hoppers, particularly those requiring specialized engineering for difficult materials or mandatory adherence to explosion protection standards (e.g., ATEX compliance).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager