Straight Grinders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432709 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Straight Grinders Market Size

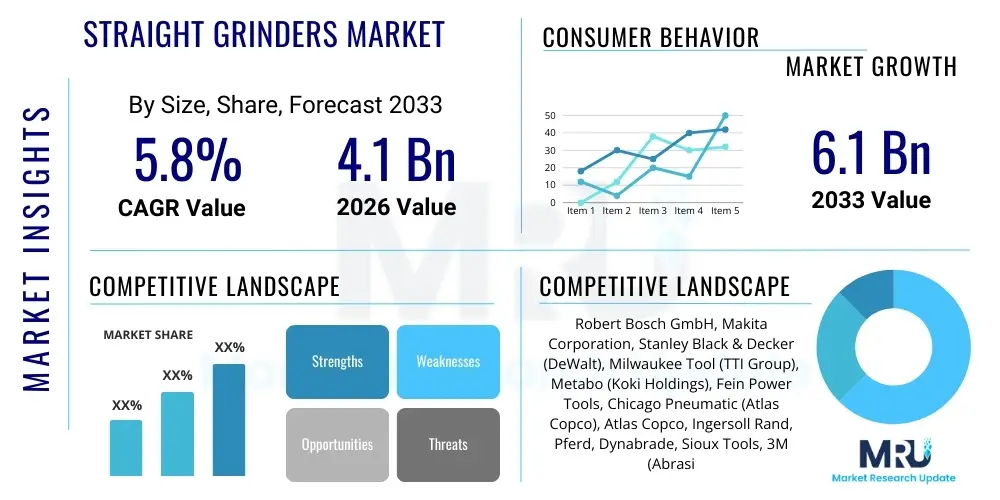

The Straight Grinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This consistent growth is primarily fueled by increasing industrial automation across developing economies, coupled with stringent quality control requirements in precision-dependent sectors like aerospace and automotive manufacturing. The demand for ergonomic and high-power cordless straight grinders also contributes significantly to this upward trajectory, addressing portability and safety concerns in challenging work environments.

Straight Grinders Market introduction

The Straight Grinders Market encompasses the sale and distribution of high-speed rotary tools designed for abrasive applications such as grinding, deburring, polishing, and cutting. These tools are characterized by their extended spindle design, allowing access to confined or internal spaces where conventional angle grinders cannot reach. Product descriptions typically highlight features like variable speed controls, robust motor designs (often brushless DC for cordless units), and enhanced vibration damping systems crucial for prolonged operator comfort and precision work. Straight grinders are essential components in metalworking and fabrication workshops globally.

Major applications of straight grinders span diverse heavy industries. In the automotive sector, they are utilized for preparing welds, cleaning engine components, and precision finishing dies and molds. The aerospace industry relies on these tools for crucial material removal tasks on complex alloys and turbine components, demanding exceptional accuracy and surface integrity. Furthermore, construction and infrastructure projects employ straight grinders for masonry work, pipe fabrication, and general maintenance. The versatility and power-to-weight ratio of modern straight grinders make them indispensable tools in manufacturing processes that require high-quality surface preparation and finishing.

Key benefits driving market adoption include improved operational efficiency, enhanced worker safety through ergonomic designs, and the capability to handle extremely tough materials. Driving factors center around the global increase in infrastructure investment, the expansion of the manufacturing base in Asia Pacific, and the perpetual innovation in battery technology, which is continually boosting the performance and runtime of cordless models, making them competitive alternatives to traditional pneumatic and corded versions. These technological advancements facilitate quicker project completion times and reduce reliance on complex air compression systems.

Straight Grinders Market Executive Summary

The global Straight Grinders Market exhibits robust growth driven by accelerating industrialization and the persistent demand for high-precision finishing tools across fabrication and manufacturing sectors. Business trends indicate a significant shift toward battery-powered cordless solutions, emphasizing portability, reduced setup time, and increased safety, particularly in mobile service operations and confined spaces. Manufacturers are intensely focused on integrating advanced materials and ergonomic designs to minimize operator fatigue and maximize tool durability, positioning product longevity as a key competitive differentiator in procurement decisions. Furthermore, the rise of specialized abrasives optimized for high-speed straight grinders is augmenting overall operational performance.

Regionally, the Asia Pacific (APAC) market is poised to lead growth, primarily due to massive investments in automotive production, shipbuilding, and infrastructure development in countries like China, India, and South Korea. North America and Europe, characterized by mature industrial bases, focus more on replacement cycles, digitalization integration (e.g., IoT for tool tracking and maintenance prediction), and the adoption of high-performance tools adhering to stringent labor safety standards. The Middle East and Africa (MEA) region shows promising demand, propelled by ongoing oil and gas infrastructure expansion and diversification into general manufacturing.

Segment trends reveal that the Cordless segment is experiencing the fastest growth rate, steadily capturing market share from traditional Pneumatic and Corded segments, although Pneumatic tools retain dominance in environments requiring sustained high torque and continuous operation, such as heavy-duty foundries. By application, the Metal Fabrication segment remains the largest consumer, but the Maintenance, Repair, and Overhaul (MRO) segment demonstrates reliable, steady expansion, reflecting the increasing age and complexity of global industrial assets requiring regular upkeep using reliable grinding equipment.

AI Impact Analysis on Straight Grinders Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Straight Grinders Market primarily revolve around predictive maintenance, automated quality control, and the integration of smart sensors into traditional power tools. Users are keen to understand how AI can prevent catastrophic tool failures, optimize abrasive consumption, and ensure consistent grinding quality, especially in high-volume production lines. Key concerns include the cost-benefit ratio of integrating complex sensing technology into relatively low-cost tools and ensuring data security and interoperability across different manufacturing execution systems (MES). Expectations center on AI transitioning grinding from a highly manual, subjective skill to a data-driven, quality-assured process, fundamentally changing how tool maintenance and surface finishing are managed.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms on vibration and temperature data collected by embedded sensors to anticipate tool failure, thereby maximizing uptime and reducing unplanned downtime in critical manufacturing operations.

- Optimized Abrasive Selection: AI systems recommending the optimal grinding speed and abrasive type based on material hardness, desired surface roughness, and environmental factors, reducing material waste and improving surface finish consistency.

- Automated Quality Inspection: Integrating machine vision and deep learning models post-grinding to automatically verify dimensional accuracy and surface defect detection, supplementing or replacing manual inspection processes.

- Ergonomics and Operator Training: AI analyzing operator movement and pressure application to provide real-time feedback, aiding training for new operators and preventing repetitive strain injuries by optimizing handling techniques.

- Inventory Management Automation: Using usage data analyzed by AI to forecast demand for specific grinder models and spare parts, leading to more efficient supply chain management and inventory reduction for distributors and manufacturers.

DRO & Impact Forces Of Straight Grinders Market

The Straight Grinders Market dynamics are shaped by powerful forces encompassing technological innovation, industrial growth, regulatory environment, and competitive pressures. Key drivers include rapid industrialization in APAC and increased demand for high-performance precision tools in the aerospace and medical device sectors. The shift toward cordless technology, offering superior mobility and safety, further accelerates adoption. Conversely, market growth faces restraints such as the high initial cost of premium industrial-grade grinders, particularly battery-powered units, and the intense competition from low-cost manufacturers, which pressures pricing strategies and margins for established brands. Furthermore, the reliance on skilled labor for achieving optimal finishing results remains a significant constraint, demanding continuous investment in operator training programs.

Opportunities for growth are abundant, notably in the development of specialized tools for niche applications, such as composites grinding in electric vehicle (EV) manufacturing and customized ergonomic designs for elderly or specialized workforces. The expansion of MRO activities globally presents a persistent, non-cyclical revenue stream. Technological advancements in lightweight materials and motor efficiency provide a platform for continuous product differentiation, allowing manufacturers to maintain premium pricing points for superior performance models. Strategic partnerships with abrasive manufacturers to offer integrated system solutions represent another significant avenue for market expansion.

The impact forces currently influencing the market structure involve substitution threats and competitive intensity. The threat of substitutes, primarily from advanced robotic grinding systems in high-volume, repetitive tasks, is moderate but growing, pushing handheld grinder manufacturers to focus on highly flexible, intricate, or low-volume applications where human dexterity is irreplaceable. However, the intra-market competitive rivalry among major players (Bosch, Makita, DeWalt, etc.) remains extremely high, driving relentless product innovation cycles, aggressive marketing, and expansion into emerging markets. Suppliers of specialized motors and high-capacity battery packs exert moderate forward integration pressure, necessitating strong supply chain resilience from grinder OEMs.

Segmentation Analysis

The Straight Grinders Market is comprehensively segmented based on various technical characteristics and end-user applications, providing a granular view of demand patterns and growth vectors. Segmentation by Type differentiates the power source, separating the market into Corded, Cordless (battery-powered), and Pneumatic (air-powered) categories. This segmentation is crucial as the choice of power source is directly linked to the application environment, required power output, and accessibility of utilities on site. Furthermore, the market is analyzed by Operation, distinguishing between handheld portability models and bench/pedestal units used for fixed-location grinding tasks that often require greater stability and power. This detailed breakdown aids in understanding specific consumer needs within different industrial workflows.

Analyzing the market by Application provides insight into the major end-user industries that rely heavily on straight grinders. Key sectors include Metal Fabrication, which covers general welding, casting, and finishing; Automotive, focusing on vehicle assembly, bodywork, and component repair; Construction, involving structural steel and masonry preparation; and the demanding Aerospace and Defense segment, which requires extreme precision for specialized materials. Growth rates vary significantly across these application segments, with Aerospace often demanding the highest specifications and commanding premium pricing due to stringent safety and quality requirements. Understanding these segment dynamics is vital for effective product development and targeted marketing strategies.

- By Type:

- Corded Straight Grinders: Used for continuous, high-power applications where portability is less critical.

- Cordless Straight Grinders: Fastest-growing segment, offering flexibility and safety in areas without immediate power access; relies heavily on Lithium-ion battery performance.

- Pneumatic Straight Grinders: Preferred in environments like foundries or shipyards due to high power-to-weight ratio and ability to withstand harsh operating conditions.

- By Operation:

- Handheld Straight Grinders: Dominant segment, focusing on ergonomic design and operator comfort for precision and flexibility.

- Bench/Pedestal Straight Grinders: Fixed units used for repeatable tasks or components that can be easily brought to the machine.

- By Application:

- Metal Fabrication: Largest application area, encompassing deburring, weld preparation, and general cleaning.

- Automotive Industry: Used for engine maintenance, body repairs, and manufacturing of molds and dies.

- Aerospace and Defense: Critical for precision finishing of complex, high-tolerance components made from specialty alloys.

- Construction and Infrastructure: Used for preparing materials, grinding concrete, and general maintenance of heavy machinery.

- Other Industrial Applications (e.g., Shipbuilding, Medical Devices).

Value Chain Analysis For Straight Grinders Market

The value chain for the Straight Grinders Market begins with upstream activities involving the sourcing of critical components, including high-performance motors, specialized gearing, plastic or composite housing materials, and, crucially, high-capacity Lithium-ion battery cells for cordless models. Suppliers of these core components dictate material quality and often influence final product pricing and innovation cycles. Manufacturing involves complex assembly processes focused on precision engineering, balancing power output with ergonomic design and vibration control. Quality control at this stage is paramount, especially for industrial-grade tools, ensuring compliance with global safety standards (e.g., OSHA, CE).

Downstream activities center on distribution, sales, and aftermarket services. Distribution channels are highly diverse, utilizing both direct sales models for large industrial clients (e.g., aerospace manufacturers) and indirect distribution through a robust network of specialized industrial distributors, hardware wholesalers, and increasingly, large e-commerce platforms. The complexity of tool specification often necessitates highly trained sales staff who can advise end-users on the best tool and abrasive combination for specific materials and applications. Effective inventory management at the distributor level is essential to meet the immediate MRO demands of industrial customers.

The direct channel facilitates customized bulk orders and ongoing technical support, favored by large enterprises seeking long-term supply agreements and specialized technical consultations. Conversely, the indirect channel, dominated by retailers and third-party logistics (3PL) providers, caters efficiently to smaller workshops, independent contractors, and general consumer needs, emphasizing accessibility and competitive pricing. Aftermarket services, including repairs, calibration, and the provision of genuine spare parts, are critical profit centers and powerful tools for maintaining customer loyalty, underlining the importance of a strong, regionally optimized service network.

Straight Grinders Market Potential Customers

Potential customers for straight grinders are defined by their reliance on high-precision material removal, deburring, and surface finishing in demanding environments. End-users span across all industries that engage in metalworking, including dedicated metal fabrication shops, large-scale automotive manufacturing plants involved in assembly and component production, and heavy construction companies requiring structural steel preparation. These buyers prioritize tool durability, power, and the availability of specialized attachments and abrasives tailored to complex materials such as titanium alloys or hardened steel. Procurement decisions are often based on total cost of ownership (TCO) rather than just initial purchase price.

Specific niche customer segments offer high-value potential. The Aerospace sector, encompassing OEMs and MRO providers, represents a critical buyer group, demanding grinders that offer superior precision, low vibration characteristics, and meticulous traceability, often requiring tools qualified for use on sensitive aircraft components. Similarly, the Mold and Die manufacturing industry relies heavily on straight grinders for intricate tool finishing and polishing tasks, where ergonomic design and fine control are essential. These users typically invest in premium, high-frequency, or micro-grinding equipment to achieve exacting tolerances required in their operations.

Furthermore, independent contractors, small-to-medium enterprises (SMEs) in repair services, and vocational training institutions form the broader customer base. While SMEs may prioritize value and versatility, large industrial customers increasingly seek integrated solutions, where the grinder, abrasive, and maintenance tracking system are optimized as a single unit. The growing demand for electric vehicle components (requiring new material processing techniques) and the steady expansion of oil and gas pipeline infrastructure continue to generate consistent demand for robust, reliable straight grinding tools capable of continuous, heavy-duty operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Makita Corporation, Stanley Black & Decker (DeWalt), Milwaukee Tool (TTI Group), Metabo (Koki Holdings), Fein Power Tools, Chicago Pneumatic (Atlas Copco), Atlas Copco, Ingersoll Rand, Pferd, Dynabrade, Sioux Tools, 3M (Abrasives & Tools), Flex Power Tools, Hilti Corporation, Walter Surface Technologies, Suhner Abrasive Expert, Grinding Wheel Industries, KWH Mirka Ltd., Dremel (Bosch). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Straight Grinders Market Key Technology Landscape

The Straight Grinders Market is rapidly evolving through the adoption of advanced engineering and digital technologies, fundamentally transforming product capabilities and end-user efficiency. A primary technological focus is the development and integration of brushless DC (BLDC) motors, particularly in cordless models. BLDC technology provides superior power efficiency, significantly extending battery runtime while minimizing heat generation and wear, thus contributing to a longer tool lifespan compared to traditional brushed motors. Furthermore, modern grinders incorporate sophisticated electronic protection systems that safeguard the motor and battery against overload, overheating, and deep discharge, ensuring reliable performance under strenuous industrial conditions.

Ergonomic innovation is another critical technological pillar. Manufacturers are utilizing Finite Element Analysis (FEA) and specialized composite materials to design lighter tool bodies that minimize vibration transmission to the operator's hands. Active Vibration Dampening (AVD) technologies, often employing mechanical or electronic counterweights, are becoming standard features in premium models to comply with stricter occupational health and safety regulations regarding Hand-Arm Vibration Syndrome (HAVS). These design considerations are vital for securing contracts in highly regulated markets such as Germany, the UK, and North America, where employee health is a top priority.

The advent of connectivity and the Internet of Things (IoT) marks a significant advancement. High-end straight grinders are now being equipped with Bluetooth connectivity and embedded sensors that monitor usage patterns, running hours, and tool location. This data is transmitted to proprietary or integrated cloud platforms, enabling predictive maintenance schedules, optimizing resource allocation, and ensuring tool compliance and traceability across large construction sites or manufacturing facilities. This integration of smart technology elevates the straight grinder from a simple mechanical tool to a component of a digitalized industrial ecosystem, supporting Industry 4.0 initiatives aimed at enhanced overall equipment effectiveness (OEE).

Regional Highlights

The regional analysis of the Straight Grinders Market reveals distinct growth trajectories and dominant technological preferences shaped by regional industrial policies and economic maturity. Asia Pacific (APAC) currently holds the largest market share and is projected to exhibit the highest Compound Annual Growth Rate (CAGR) through the forecast period. This dominance is attributed to massive government and private sector investments in infrastructure, the rapid expansion of the automotive and electronics manufacturing bases in China, India, and Southeast Asian nations, and the growing requirement for modern, efficient power tools to replace manual processes.

North America and Europe represent mature markets characterized by stable, high-value demand, primarily driven by replacement cycles, stringent safety standards, and a high uptake of premium cordless and pneumatically powered professional tools. In these regions, the focus is less on volume growth and more on technological differentiation, emphasizing ergonomic safety features, dust extraction capabilities, and IoT integration for fleet management and safety compliance. Strict regulations governing workplace vibration exposure further stimulate the adoption of high-performance, specialized low-vibration straight grinders.

Latin America and the Middle East & Africa (MEA) are emerging regions offering substantial long-term growth potential. Latin America's growth is tied to fluctuations in mining and infrastructure projects, creating cyclical demand for rugged, reliable tools. The MEA market, bolstered by significant investments in oil and gas infrastructure, shipbuilding, and industrial diversification initiatives (particularly in the GCC countries), shows a steady upward trend. Demand here often favors heavy-duty pneumatic grinders capable of sustained operation in challenging environmental conditions, though interest in high-power cordless technology is steadily rising.

- Asia Pacific (APAC): Market leader and fastest-growing region, fueled by infrastructure development, expanding automotive manufacturing, and high adoption rates of affordable and mid-range industrial tools. Key markets include China, India, Japan, and South Korea.

- North America: High-value market focused on advanced ergonomics, safety compliance, and the adoption of premium cordless tools and digitalized fleet management solutions. Strong presence in aerospace and high-precision manufacturing.

- Europe: Characterized by mature industrial processes and stringent regulatory environment (e.g., HAVS directives), driving demand for specialized, low-vibration, high-quality power tools. Germany, the UK, and France are dominant contributors.

- Latin America: Growth tied to cyclical commodity sectors (mining, oil and gas) and infrastructural development, leading to variable but substantial demand for robust straight grinders.

- Middle East and Africa (MEA): Emerging market driven by heavy industry projects, including petrochemicals, construction, and shipbuilding. Increasing shift towards professional-grade tools for enhanced efficiency and safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Straight Grinders Market, emphasizing their strategic positions, product portfolios, and recent developmental activities.- Robert Bosch GmbH

- Makita Corporation

- Stanley Black & Decker (DeWalt)

- Milwaukee Tool (TTI Group)

- Metabo (Koki Holdings)

- Fein Power Tools

- Chicago Pneumatic (Atlas Copco)

- Atlas Copco

- Ingersoll Rand

- Pferd

- Dynabrade

- Sioux Tools

- 3M (Abrasives & Tools)

- Flex Power Tools

- Hilti Corporation

- Walter Surface Technologies

- Suhner Abrasive Expert

- Grinding Wheel Industries

- KWH Mirka Ltd.

- Dremel (Bosch)

Frequently Asked Questions

Analyze common user questions about the Straight Grinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Cordless and Pneumatic straight grinders in industrial use?

Cordless straight grinders offer superior mobility, quiet operation, and are ideal for fieldwork or sites lacking compressed air infrastructure. Pneumatic grinders, conversely, provide sustained high torque and durability under continuous, heavy-duty load conditions, making them preferred in foundries and environments where compressed air is readily available, often at a lower initial cost.

Which application segment holds the largest share in the Straight Grinders Market?

The Metal Fabrication application segment consistently holds the largest market share. This dominance is due to the ubiquitous need for straight grinders in preparing welds, deburring rough edges, and precision finishing components across general manufacturing, structural steelwork, and machinery production globally.

How is the integration of IoT influencing the professional Straight Grinders sector?

IoT integration allows professional users to monitor tool utilization, location, and operational data via connected platforms. This capability supports predictive maintenance scheduling, optimizes tool inventory tracking across large sites, improves safety compliance, and ensures maximum operational efficiency and uptime, aligning with Industry 4.0 objectives.

What are the main growth constraints faced by the Straight Grinders Market?

Key constraints include the relatively high capital expenditure required for premium industrial-grade straight grinders, especially advanced battery-powered units. Furthermore, the market faces limitations from the persistent dependency on highly skilled labor for executing precision finishing tasks and intense price pressure from numerous low-cost competitors.

Which regional market is expected to demonstrate the fastest growth rate for straight grinders?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This accelerated growth is primarily attributed to sustained high levels of investment in regional infrastructure, robust expansion of the automotive and defense manufacturing sectors, and increasing adoption of professional-grade power tools across industrializing economies like India and China.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager