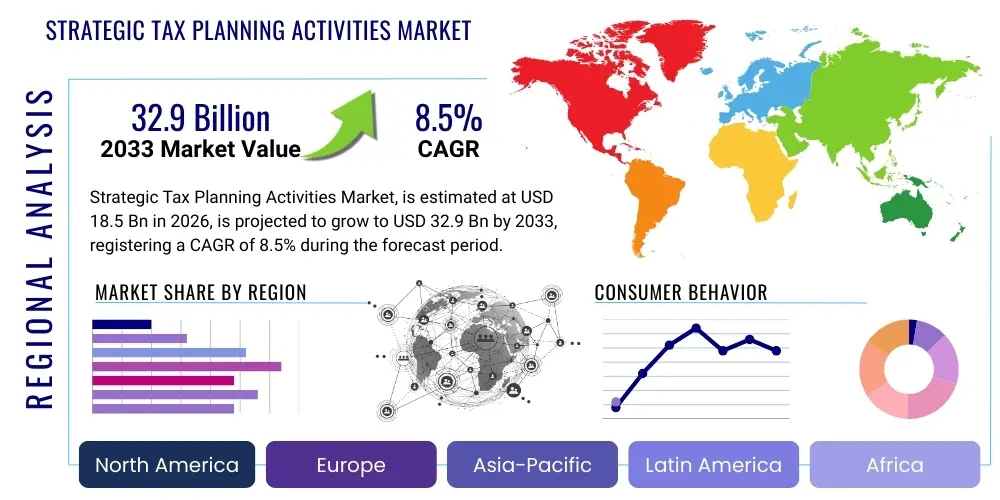

Strategic Tax Planning Activities Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439107 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Strategic Tax Planning Activities Market Size

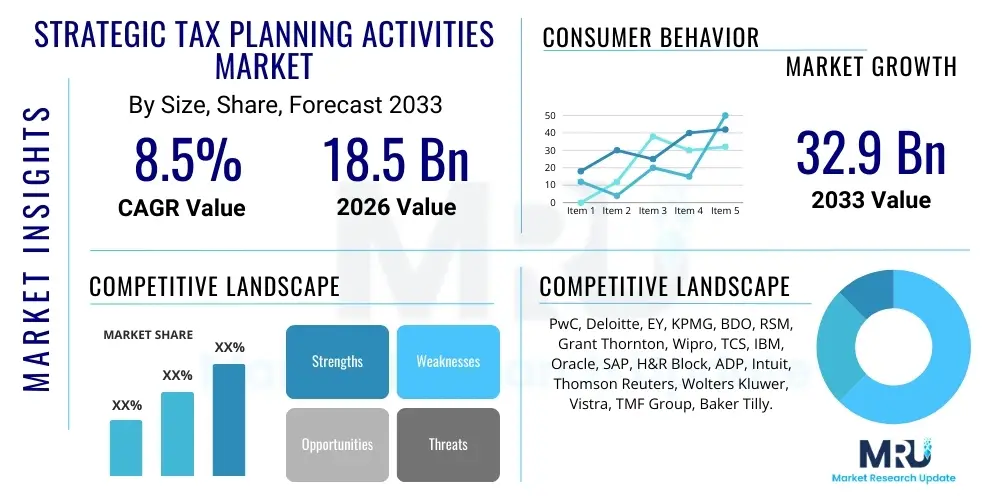

The Strategic Tax Planning Activities Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 32.9 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing globalization, which necessitates complex cross-border tax compliance and structuring, coupled with the rapid digital transformation of financial and regulatory processes across all major economic sectors. Organizations are proactively seeking specialized advisory services to optimize their tax liabilities and ensure adherence to increasingly stringent and often volatile global tax regulations, making strategic planning a critical operational requirement rather than merely a compliance task.

Strategic Tax Planning Activities Market introduction

The Strategic Tax Planning Activities Market encompasses the specialized services, software, and advisory solutions designed to legally minimize tax obligations, defer tax payments, and ensure full compliance with current and anticipated tax laws across multiple jurisdictions. This market is defined by the high-value consulting and sophisticated technology employed by organizations—ranging from large multinational corporations to high-net-worth individuals—to structure their financial transactions, investments, and operational footprints in the most tax-efficient manner possible. The core product offering transcends basic compliance, focusing instead on long-term fiscal strategy, risk management concerning tax audits, and the optimization of capital allocation based on global tax incentives and treaties.

Major applications of strategic tax planning include cross-border merger and acquisition (M&A) structuring, supply chain realignment for tax efficiency, transfer pricing documentation, effective utilization of R&D tax credits, and navigating the complexities arising from digital economy taxation (such as OECD’s Pillar One and Pillar Two initiatives). The inherent benefits derived by clients include significant reduction in the effective tax rate (ETR), improved cash flow management through tax deferral mechanisms, enhanced corporate governance, and a minimized risk exposure associated with aggressive tax avoidance practices that might lead to reputational damage or substantial financial penalties. These activities are crucial for maintaining shareholder value and ensuring competitive advantage in a fiscally complex global environment.

Key driving factors accelerating the growth of this market include continuous changes in global fiscal policies, particularly post-BEPS (Base Erosion and Profit Shifting) regulatory implementation, the exponential growth in complex digital business models requiring specialized tax treatment, and the persistent need for corporations to generate greater efficiencies in their operating costs. Furthermore, the increasing sophistication of tax administration technologies, including artificial intelligence and machine learning tools, is both a challenge and an opportunity, driving demand for expert services that can effectively leverage these technologies for complex calculations and risk assessments.

Strategic Tax Planning Activities Market Executive Summary

The Strategic Tax Planning Activities Market is experiencing transformative growth, fueled by intensified regulatory scrutiny, the shift toward real-time tax reporting, and the necessity for global enterprises to adapt quickly to diverse fiscal landscapes. Business trends indicate a strong move away from traditional, reactive tax compliance toward proactive, strategic fiscal management integrated deeply within core business operations, particularly through sophisticated tax technology stacks and integrated enterprise resource planning (ERP) systems. Service providers are increasingly specializing in niche areas, such as indirect tax implications of e-commerce and the tax optimization of intangible assets, which are critical in the modern, knowledge-based economy. There is a noticeable consolidation among smaller firms, while larger accounting and consulting firms invest heavily in AI-driven tools to enhance service delivery efficiency and analytical capabilities.

Regionally, North America and Europe remain the largest revenue contributors due to the presence of numerous multinational corporations and highly complex, well-established tax legal frameworks. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid industrialization, burgeoning cross-border investment flows, and regulatory modernization in emerging economies like India, China, and Southeast Asia. Latin America is also showing heightened demand, primarily due to efforts to combat corruption and implement more transparent tax regimes, necessitating external expertise for compliance and strategic maneuvering. Overall, the market's growth is inherently tied to global economic stability and regulatory harmonizing efforts.

Segmentation trends highlight the increasing significance of the Advisory and Consulting service types over simple Compliance services, reflecting the shift toward high-value strategic input. Furthermore, the market for large enterprises remains the backbone, but the Small and Medium-sized Enterprises (SMEs) segment is growing faster, often driven by cloud-based, accessible tax software solutions that lower the barrier to entry for strategic planning. Industry vertical analysis shows that the Banking, Financial Services, and Insurance (BFSI) and Technology, Media, and Telecommunications (TMT) sectors are leading the adoption curve, given their high transaction volumes, complex capital structures, and intense regulatory obligations worldwide.

AI Impact Analysis on Strategic Tax Planning Activities Market

User inquiries concerning the impact of Artificial Intelligence (AI) on strategic tax planning frequently revolve around themes of automation, job displacement, accuracy improvement, and predictive modeling capabilities. Common questions focus on whether AI can handle complex, nuanced strategic decisions traditionally requiring human judgment, how AI tools ensure compliance with ever-changing global rules (like BEPS 2.0), and the necessary integration challenges between existing legacy tax systems and new AI platforms. Users are keen to understand how AI can transition tax functions from mere cost centers to strategic value drivers by facilitating dynamic scenario modeling and real-time risk assessment, while simultaneously seeking assurances regarding data security and the ethical implications of automated tax advice.

The introduction of AI and Machine Learning (ML) is fundamentally reshaping the landscape of strategic tax planning, moving routine compliance tasks toward full automation, thus freeing up highly skilled human analysts to focus on complex, high-value strategic decision-making. AI algorithms excel at processing vast datasets related to financial transactions, identifying patterns, calculating complex transfer pricing adjustments, and monitoring changes in international tax treaties far more rapidly than conventional methods. This efficiency translates directly into faster scenario analysis, enabling corporations to dynamically adjust their operating models—such as shifting intellectual property domicile or optimizing debt structures—in response to regulatory changes or anticipated fiscal policy shifts.

Furthermore, AI-driven tools enhance the quality of strategic tax advice by improving predictive capabilities. These systems can simulate the financial impact of various planning options under different economic and regulatory conditions, providing probabilistic outcomes that inform optimal decision paths. This predictive accuracy helps in minimizing unexpected tax liabilities and in structuring mergers, acquisitions, and divestitures with optimal fiscal results. The integration of AI into tax planning ultimately results in higher accuracy, faster response times to regulatory changes, and the ability to maintain a continuous, globally consistent tax position, significantly bolstering the strategic value proposition of the tax function within an organization.

- AI-driven automation reduces manual effort in data extraction, validation, and preparation for tax filings.

- Predictive analytics enables proactive scenario planning for global minimum tax (Pillar Two) implications.

- Machine learning algorithms enhance transfer pricing documentation accuracy and risk flagging for audits.

- Natural Language Processing (NLP) rapidly interprets and synthesizes complex changes in tax legislation globally.

- AI tools facilitate continuous monitoring of cross-border transactions for immediate compliance checks.

- Improved internal controls and enhanced transparency through auditable, automated transaction tracking.

DRO & Impact Forces Of Strategic Tax Planning Activities Market

The Strategic Tax Planning Activities Market is fundamentally driven by the escalating complexity of global tax laws (Drivers) and the intense pressure on multinational corporations to optimize financial performance. However, this growth is constrained by factors such as the high initial cost of sophisticated tax technology adoption and a persistent shortage of highly specialized, dual-skilled professionals (Restraints). Opportunities abound in the development of hyper-specialized advisory services focusing on intangible assets and digital taxation, and the expansive adoption of cloud-based solutions by the underserved SME segment (Opportunities). These elements coalesce into powerful Impact Forces, characterized by regulatory enforcement intensity and the pervasive need for digital integration across corporate tax functions, making proactive fiscal strategy mandatory for long-term viability.

Key drivers include the continuous implementation of anti-avoidance measures globally, such as the OECD BEPS framework and the resulting national legislation updates, which require ongoing expertise to navigate. The globalization of business operations means companies are inherently exposed to multiple tax jurisdictions, necessitating strategic planning to manage complex VAT, GST, and corporate income tax rules simultaneously. Furthermore, stakeholder demand for greater corporate transparency and adherence to ESG (Environmental, Social, and Governance) standards is indirectly driving demand for ethical, strategic tax planning that avoids aggressive maneuvers and maintains long-term compliance integrity.

Restraints impeding market growth include regulatory unpredictability, where sudden changes in political or fiscal policy can rapidly devalue existing tax strategies, creating a perception of risk among potential clients. The cost associated with investing in cutting-edge tax software, integrating it with legacy ERP systems, and continuously training staff remains prohibitive for smaller firms. Furthermore, the market faces a significant challenge in recruiting talent with expertise in both finance/tax law and advanced data science/AI, a critical combination needed to implement and manage modern strategic tax solutions effectively. Despite these restraints, the opportunities presented by emerging markets and niche specialization far outweigh the limitations, solidifying a positive long-term growth trajectory.

Opportunities are largely centered around leveraging digital transformation. The shift toward cloud-based tax engines offers scalable, pay-as-you-go solutions accessible to SMEs, significantly expanding the addressable market. The focus on tax structuring for highly mobile assets, such as Intellectual Property (IP) and digital services, provides lucrative specialized consulting avenues. Moreover, the increased global cooperation on data sharing between tax authorities (e.g., Common Reporting Standard) creates opportunities for firms that specialize in establishing robust, centralized data governance frameworks to ensure global compliance and mitigate information exchange risks.

Segmentation Analysis

The Strategic Tax Planning Activities Market is comprehensively segmented based on Service Type, Organization Size, Deployment Model, and Industry Vertical, reflecting the diverse needs and operational scales of the end-users. The segmentation provides granular insights into which services are dominating, the deployment preferences of different enterprise sizes, and the distinct requirements across various economic sectors. Understanding these segments is crucial for providers to tailor their offerings, whether focusing on high-volume compliance automation through cloud deployment or high-value consulting services targeted at large multinational enterprises in complex sectors like BFSI and TMT.

- By Service Type:

- Tax Advisory and Consulting

- Tax Compliance and Reporting

- Tax Technology and Software Integration

- Tax Litigation Support

- Transfer Pricing Services

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises (LEs)

- By Deployment Model:

- On-Premise

- Cloud-Based

- Hybrid Solutions

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecommunications

- Healthcare and Pharmaceuticals

- Manufacturing and Automotive

- Retail and E-commerce

- Energy and Utilities

Value Chain Analysis For Strategic Tax Planning Activities Market

The value chain for the Strategic Tax Planning Activities Market involves several key stages, starting with upstream activities related to software development and knowledge generation, moving through service delivery via specialized consultants, and culminating in downstream usage by end-user organizations. Upstream activities are dominated by technology firms and global accounting giants that invest heavily in developing proprietary tax software, AI/ML tools, and maintaining up-to-date global tax law knowledge bases. This stage focuses on creating scalable, efficient platforms for data aggregation, analysis, and regulatory modeling, forming the foundational technology used for strategic advice delivery.

Midstream activities involve the professional service delivery component. This includes direct consulting, advisory services, and implementation support, typically offered by the "Big Four" accounting firms, specialized tax law firms, and boutique consulting houses. The distribution channel is predominantly direct for large enterprises, involving bespoke engagement models and dedicated partner relationships. For the SME segment, distribution often utilizes indirect channels, such as reseller partnerships, integrated software ecosystems (like linking tax modules to popular accounting software), or subscription-based cloud platforms, allowing for broader market reach and lower client acquisition costs.

Downstream analysis focuses on the end-user adoption and integration of these strategic plans. Successful execution requires seamless integration of the strategic tax advice into the client's internal finance, legal, and operational departments. The impact of the service is measured by metrics like Effective Tax Rate reduction, audit risk mitigation, and compliance efficiency. The continuous feedback loop from the downstream stage (e.g., changes in audit focus or legislative requirements) informs the upstream technology development and knowledge updating processes, ensuring the entire value chain remains responsive to the dynamic global tax environment. Technology plays a crucial role in enabling both direct (one-to-one consulting) and indirect (self-service software) service delivery models.

Strategic Tax Planning Activities Market Potential Customers

The primary consumers and end-users of Strategic Tax Planning Activities span a broad spectrum of entities, but they share a common need for fiscal efficiency and robust compliance in complex regulatory settings. The most significant segment comprises multinational corporations (MNCs) operating in numerous countries, particularly those involved in capital-intensive industries or those reliant on cross-border intellectual property (IP) transfers. These entities require sophisticated transfer pricing strategies, global supply chain tax optimization, and expertise in managing permanent establishment risks. Their demand is typically for high-end, customized advisory and consulting services delivered by top-tier global professional firms.

Another rapidly growing customer segment includes Small and Medium-sized Enterprises (SMEs) that are expanding internationally, often through e-commerce or digital services. While their total revenue share is smaller, the sheer volume of these businesses drives demand for accessible, scalable, and primarily cloud-based tax planning software solutions that automate cross-border VAT/GST compliance and simplify foreign corporate registration requirements. Additionally, high-net-worth individuals and family offices constitute a niche but lucrative segment, seeking complex estate and succession planning structured to minimize global inheritance and capital gains taxes, often involving trust structures and multi-jurisdictional residency planning.

Finally, governmental agencies, non-profit organizations, and large public sector enterprises also represent a specialized customer base. Although their goal is not minimizing corporate tax liability in the traditional sense, they require strategic planning to manage complex indirect taxes, ensure compliance with specific public-sector financial regulations, and optimize the taxation aspects of public-private partnerships. The common factor across all these customer types is the necessity for expert guidance to navigate fiscal complexity, manage financial risk, and ensure regulatory adherence, thereby driving the sustained demand across all market segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 32.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PwC, Deloitte, EY, KPMG, BDO, RSM, Grant Thornton, Wipro, TCS, IBM, Oracle, SAP, H&R Block, ADP, Intuit, Thomson Reuters, Wolters Kluwer, Vistra, TMF Group, Baker Tilly. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Strategic Tax Planning Activities Market Key Technology Landscape

The Strategic Tax Planning Activities Market is undergoing a significant technological revolution driven by the need for speed, accuracy, and scalability in a rapidly evolving regulatory environment. The technological landscape is dominated by advanced software platforms leveraging Artificial Intelligence (AI) and Machine Learning (ML) to automate data extraction, standardize tax calculations across multiple jurisdictions, and identify potential compliance risks proactively. These technologies are foundational for modern strategic planning, allowing consultants and corporate tax departments to move away from tedious manual data preparation toward sophisticated analytical and strategic functions. Enterprise Resource Planning (ERP) systems, such as those offered by SAP and Oracle, are now integrating robust tax modules that centralize financial data, ensuring that tax considerations are embedded in real-time operational decision-making, rather than being an afterthought.

Cloud computing is perhaps the most democratizing technology in this market. Cloud-based Tax Engine (CTE) solutions offer flexible, subscription-based access to updated tax logic, enabling SMEs and medium-sized enterprises to access capabilities previously reserved only for the largest multinational corporations. This deployment model facilitates rapid adoption, reduces infrastructure overhead, and ensures automatic updating of tax rates and rules based on jurisdiction. Furthermore, technologies focusing on specialized compliance, such as sophisticated transfer pricing software and tools for managing the complexities of indirect taxation (VAT/GST), are essential, providing audit-ready documentation and minimizing risk exposure in cross-border trade.

Blockchain technology, while still nascent, holds strong potential, particularly for enhancing data integrity and transaction verification, which could radically streamline audit processes and improve the reliability of tax reporting data. Moreover, robust data visualization and business intelligence (BI) tools are critical, enabling tax professionals to quickly understand the fiscal implications of various business strategies, model multiple scenarios, and present complex information to executive boards. The market’s future is intrinsically linked to the seamless integration of these technologies, fostering a truly digitized and globally harmonized tax function.

Regional Highlights

The global Strategic Tax Planning Activities Market exhibits distinct growth patterns and maturity levels across different geographical regions, heavily influenced by local economic activities, regulatory environments, and technological adoption rates. These regional nuances shape the demand for specific service types, ranging from highly sophisticated cross-border structuring in developed markets to fundamental compliance and system implementation in emerging economies.

- North America (U.S. and Canada): This region dominates the market share due to the presence of a vast number of Fortune 500 companies, a highly complex corporate tax structure, and intensive regulatory enforcement (IRS and state-level complexities). Demand is high for advanced tax technology integration, sophisticated M&A tax structuring, and expertise in managing intangible asset taxation. The U.S. remains the epicenter for tax tech innovation and service delivery excellence.

- Europe (UK, Germany, France): Europe holds the second-largest share, driven by the need to navigate the fiscal complexities of the European Union, including VAT harmonization issues, and the early adoption of BEPS directives. Significant demand exists for cross-border transfer pricing services and specialized advice relating to digital service taxes (DSTs), particularly in countries with evolving domestic tax regimes.

- Asia Pacific (APAC) (China, Japan, India, Australia): APAC is the fastest-growing market, primarily fueled by rapid economic expansion, increasing foreign direct investment, and regulatory reforms aimed at transparency and modernization. While established economies like Japan and Australia require advanced strategic planning, emerging markets like India and China are seeing surging demand for core compliance services and assistance in establishing efficient, centralized tax functions for global operations.

- Latin America (LATAM): This region is characterized by high volatility, complex local tax rules, and frequent legislative changes. Demand is concentrated on localized compliance, minimizing audit risks, and structuring operations to mitigate currency and political risks. The shift towards greater fiscal transparency in nations like Brazil and Mexico is boosting the need for external professional advisory services.

- Middle East and Africa (MEA): Growth in the MEA region is driven by economic diversification efforts away from oil reliance, the introduction of VAT (e.g., in the GCC countries), and increasing cross-border transactions involving Western companies. The market currently favors localized regulatory compliance and expertise in establishing tax-efficient regional headquarters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Strategic Tax Planning Activities Market.- PwC (PricewaterhouseCoopers)

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited (EY)

- KPMG International Limited

- BDO Global

- RSM International

- Grant Thornton International Ltd

- Wipro Limited

- Tata Consultancy Services (TCS)

- International Business Machines Corporation (IBM)

- Oracle Corporation

- SAP SE

- Thomson Reuters Corporation

- Wolters Kluwer N.V.

- Intuit Inc.

- H&R Block, Inc.

- Automatic Data Processing, Inc. (ADP)

- Vistra Group

- TMF Group

- Baker Tilly International

Frequently Asked Questions

Analyze common user questions about the Strategic Tax Planning Activities market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is Strategic Tax Planning different from basic Tax Compliance?

Strategic Tax Planning (STP) is a proactive, long-term approach focused on optimizing a company's financial structure, supply chain, and cross-border transactions to legally minimize the Effective Tax Rate (ETR) and defer tax liabilities. Basic Tax Compliance is a reactive function centered on accurately filing required returns and reports after transactions have occurred, ensuring adherence to existing laws without necessarily seeking optimization.

What impact will OECD’s Pillar Two Global Minimum Tax rules have on market demand?

The implementation of Pillar Two (Global Anti-Base Erosion rules) is a major market driver, dramatically increasing the demand for complex strategic modeling and consulting services. Multinational corporations require expert advice and specialized software to accurately calculate their GloBE effective tax rate (ETR) in every jurisdiction, requiring substantial investment in tax technology and specialized advisory to manage the top-up tax implications.

Is cloud-based tax technology secure enough for strategic corporate data?

Yes, leading cloud-based tax technology providers utilize enterprise-grade security protocols, including advanced encryption, multi-factor authentication, and robust data residency controls, making them highly secure. The shift to the cloud is driven by scalability and automated updates, allowing clients to maintain high security standards and meet regional data governance requirements more efficiently than traditional on-premise legacy systems.

Which industry vertical is adopting Strategic Tax Planning technologies fastest?

The Information Technology (IT) and Telecommunications sector, alongside Banking, Financial Services, and Insurance (BFSI), are the fastest adopters. This is due to their high volume of cross-border digital transactions, complex IP structures, and intense regulatory obligations concerning capital flows and data privacy, necessitating real-time, automated strategic tax management solutions.

What is the most critical restraint facing market growth for tax planning services?

The most critical restraint is the ongoing scarcity of dual-skilled professionals—individuals possessing deep expertise in both complex international tax law and advanced data science/AI implementation. This talent gap hinders the ability of many firms, particularly mid-tier and smaller organizations, to fully leverage sophisticated tax technology and deliver comprehensive, integrated strategic advice.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager