Strawberry Syrups Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432650 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Strawberry Syrups Market Size

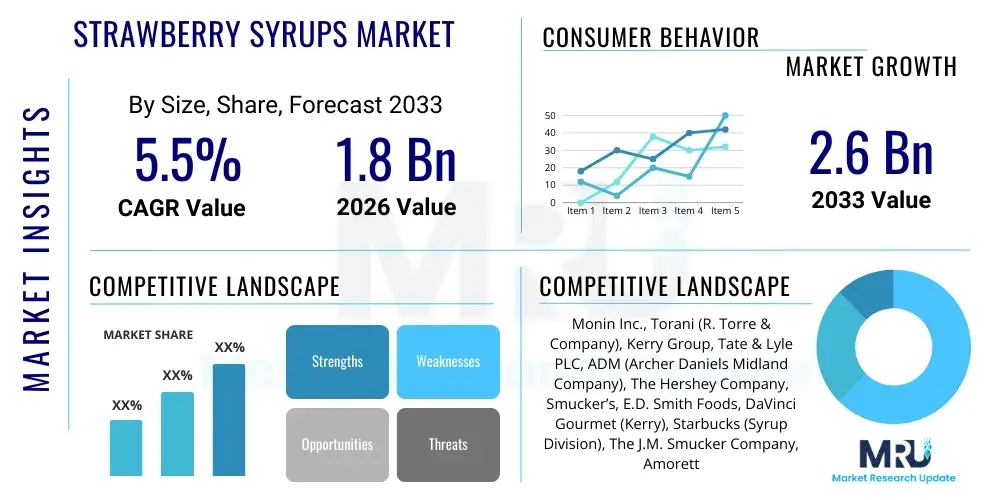

The Strawberry Syrups Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

Strawberry Syrups Market introduction

Strawberry syrups represent a specialized segment within the broader food flavoring and sweetener industry, primarily used to enhance the taste, aroma, and aesthetic appeal of various food and beverage products. These liquid concentrates are typically composed of strawberries (or strawberry flavorings), sugar, water, and often stabilizers or preservatives. The market’s resilience stems from its versatile applications, ranging from staple breakfast items like pancakes and waffles to sophisticated culinary uses in cocktails, specialty coffees, and premium dessert manufacturing. The consistent global demand for fruit flavors, coupled with the inherent popularity and recognition of strawberry, solidifies its position as a key market player, particularly in regions with strong dessert and beverage consumption cultures.

The product description encompasses both natural syrups, which prioritize real strawberry content and minimal artificial additives, and artificial or high-fructose corn syrup (HFCS) based variants, which offer cost efficiency and extended shelf life, catering to different consumer segments and price points. Major applications span across the HoReCa sector (Hotels, Restaurants, Cafes), industrial food processing (dairy, confectionery, bakery), and direct consumer use (retail). Benefits of using strawberry syrups include flavor standardization, ease of use compared to fresh fruit, and the ability to incorporate seasonal flavors year-round.

Driving factors fueling market expansion include the rapid growth of the global foodservice industry, particularly specialty coffee shops and mixology culture, which heavily utilize flavored syrups. Moreover, increased consumer interest in convenience foods and ready-to-drink beverages incorporating natural fruit flavors is boosting demand for high-quality, clean-label strawberry syrup options. Product innovation focusing on low-sugar, organic, and locally sourced strawberry variants also plays a crucial role in attracting health-conscious consumers and sustaining market momentum across developed economies.

Strawberry Syrups Market Executive Summary

The Strawberry Syrups Market is characterized by robust growth, driven primarily by expanding application scope in the beverage and dairy industries and significant innovation in product formulation, particularly toward natural and organic ingredients. Business trends indicate a strong move toward supply chain transparency and sustainable sourcing, as major manufacturers respond to consumer preferences for ethical and traceable ingredients. Furthermore, the rise of e-commerce channels is fundamentally altering distribution dynamics, providing smaller, specialized syrup producers with direct access to global consumer bases, thereby intensifying competition with established industry giants. Investment in efficient manufacturing processes and flexible packaging solutions remains a core strategy for maintaining profitability in a price-sensitive yet quality-focused market environment.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market due to rapid urbanization, increasing disposable incomes, and the Westernization of dietary patterns, leading to higher consumption of desserts, milkshakes, and specialty coffee drinks. North America and Europe, while mature, maintain dominant market shares, driven by sophisticated foodservice sectors and continuous demand for premium, clean-label, and artisanal syrups. Regulatory harmonization concerning food additives and labeling across major trade blocs also significantly influences market entry and product acceptability, forcing global companies to adapt their formulations to local standards.

Segment trends underscore the dominance of the foodservice application segment, though the retail channel is experiencing accelerated growth, particularly in the premium and organic segments. By type, the natural strawberry syrup segment is outpacing the artificial segment, reflecting a global shift towards healthier eating and ingredient scrutiny. Manufacturers are increasingly focusing on developing variants optimized for specific uses, such as heat-stable syrups for baking or concentrated versions for industrial beverage mixing, ensuring product suitability across the highly diversified end-user landscape and capturing value across the entire food processing chain.

AI Impact Analysis on Strawberry Syrups Market

Common user questions regarding AI's influence on the Strawberry Syrups Market center on how technology can optimize flavor profiles, improve supply chain efficiency (especially regarding strawberry sourcing and spoilage), and personalize consumer recommendations. Users are keen to understand if AI can predict flavor trends faster than traditional R&D and how automation impacts manufacturing quality control. The key themes revolve around achieving cost reduction through predictive maintenance in production lines and ensuring consistent quality of raw materials (fresh strawberries), which is highly susceptible to climate variability. Expectations include AI-driven customization of syrup bases for regional tastes and automated inventory management to minimize waste across the extensive distribution network, promising a revolution in both operational efficiency and product innovation speed.

- AI-driven Predictive Analytics: Optimizing strawberry harvesting schedules and storage conditions to maximize freshness and minimize raw material spoilage before processing.

- Automated Quality Control (AQC): Utilizing computer vision and machine learning models for real-time analysis of syrup color, viscosity, and particle size during bottling, ensuring strict quality adherence.

- Flavor Formulation Optimization: AI algorithms analyzing consumer data and sensory evaluation results to recommend novel ingredient combinations or adjust sweetness levels for new product development.

- Supply Chain Resilience: Using AI to predict geopolitical or climate-related disruptions impacting strawberry production regions, enabling proactive sourcing adjustments.

- Personalized Consumer Engagement: Deploying recommendation engines in e-commerce platforms to suggest tailored strawberry syrup recipes or usage ideas based on individual purchase history.

DRO & Impact Forces Of Strawberry Syrups Market

The dynamics of the Strawberry Syrups Market are fundamentally shaped by a complex interplay of consumer demands for natural ingredients, intense competition from alternative sweeteners, and global supply chain volatility affecting strawberry production. The primary drivers include the burgeoning popularity of flavored milkshakes, smoothies, and craft beverages globally, alongside the convenience offered by shelf-stable syrup formats in both retail and commercial settings. Restraints often center on the fluctuating price and availability of high-quality raw strawberries, which directly impacts production costs, and increasing consumer scrutiny regarding high sugar content in traditional syrups, pushing the market toward expensive low-calorie alternatives. These forces create a dual challenge for manufacturers: maintaining competitive pricing while simultaneously investing in premium, healthier formulations.

Opportunities for market growth lie significantly in developing specialized functional syrups, such as those fortified with vitamins or incorporating natural fibers, appealing to the wellness trend. Moreover, penetrating emerging markets in Asia and Latin America through targeted product development, addressing local culinary preferences, and leveraging digital marketing platforms presents substantial avenues for expansion. The shift towards plant-based diets also creates a niche for innovative, vegan-friendly strawberry syrups that substitute traditional gelatin or animal-derived stabilizing agents, capturing a valuable and growing consumer demographic focused on ethical consumption.

Impact forces currently shaping the market are centered around sustainable practices and regulatory compliance. Environmental and social governance (ESG) factors are increasingly influencing purchasing decisions, compelling companies to demonstrate transparent sourcing and environmentally friendly packaging. Furthermore, the consolidated structure of the flavor and ingredients industry allows large players to exert significant influence over pricing and distribution channels, while smaller, artisanal producers capitalize on niche demand for unique, high-quality offerings. Overall, the market remains moderately fragmented but is highly sensitive to input costs and evolving health-related consumer mandates.

Segmentation Analysis

The Strawberry Syrups Market is extensively segmented across Type, Application, and Distribution Channel, reflecting the diverse consumption patterns and end-user requirements worldwide. Analyzing these segments provides strategic insights into consumer preferences and market maturity levels across different regions. The fundamental distinction between natural and artificial types dictates ingredient sourcing and pricing strategies, while the application segmentation (beverages vs. food items) highlights the key revenue streams and areas of future product innovation. Understanding the distribution landscape, especially the rapid expansion of online retail, is crucial for optimizing market reach and logistical efficiency for both established and emerging syrup brands.

- By Type:

- Natural Strawberry Syrup (High Fruit Content, Organic, Clean Label)

- Artificial/Synthetic Strawberry Syrup (Economical, Stabilized, Conventional)

- By Application:

- Beverages (Milkshakes, Cocktails/Mocktails, Sodas, Specialty Coffee)

- Dairy & Desserts (Ice Cream Toppings, Yogurt, Puddings)

- Bakery & Confectionery (Cake Fillings, Glazes, Candies)

- Retail/Household Use (Pancakes, Waffles, Breakfast Items)

- By Distribution Channel:

- Supermarkets & Hypermarkets (Mass Retail)

- Convenience Stores

- Online Retail (E-commerce Platforms, Direct-to-Consumer)

- Institutional/Foodservice (B2B Sales to Restaurants, Cafes, Industrial Manufacturers)

Value Chain Analysis For Strawberry Syrups Market

The value chain for the Strawberry Syrups Market initiates with upstream activities focused heavily on the sourcing and processing of raw strawberries and primary sweeteners. Upstream analysis involves assessing the efficiency of agricultural production, which is geographically dispersed but concentrated in major growing regions like California, Poland, and China. Manufacturers often engage in contract farming to ensure consistent supply and quality control. Key considerations at this stage include minimizing post-harvest losses, managing pest control, and ensuring compliance with organic or sustainability certifications, as the quality of the raw fruit directly determines the appeal and market value of the final syrup product, particularly in the premium segment.

The midstream stage involves manufacturing and processing, where raw strawberries are concentrated, pureed, or flavored, and combined with sweeteners, stabilizers, and preservatives. This stage requires significant investment in specialized equipment for pasteurization, filtration, and aseptic filling to ensure product safety and shelf stability. Downstream activities focus on reaching the end consumer through sophisticated distribution channels. The proliferation of distribution channels, encompassing both traditional retail and modern foodservice supply chains, necessitates precise inventory management and efficient logistics to prevent spoilage and ensure timely delivery, particularly across international borders.

Distribution channels are broadly categorized into direct and indirect sales. Direct distribution primarily targets large institutional clients (B2B, industrial food processors) or increasingly, direct-to-consumer sales via brand-specific e-commerce platforms, offering higher margins but demanding significant logistical infrastructure. Indirect distribution relies on wholesalers, distributors, and large retail networks (supermarkets/hypermarkets) to reach the mass consumer market. The rise of digital platforms has significantly lowered barriers to entry for small-scale artisanal syrup producers, increasing competitive intensity and requiring established players to diversify their market penetration strategies beyond traditional brick-and-mortar retail outlets.

Strawberry Syrups Market Potential Customers

Potential customers for the Strawberry Syrups Market are highly diverse, spanning major commercial entities and individual consumers. The largest end-user group comprises the institutional/foodservice sector, including coffee chains, quick-service restaurants (QSRs), full-service restaurants, and bars, where syrups are indispensable for standardizing flavor across large volumes of specialty beverages and desserts. These commercial buyers prioritize consistency, bulk packaging options, and reliable supply chains, often engaging in long-term contracts with key manufacturers to meet predictable, high-volume demand.

Another significant segment includes industrial food manufacturers in the dairy, confectionery, and bakery industries. These businesses use strawberry syrups as a key ingredient for flavoring yogurts, ice cream bases, processed baked goods, and candies. Their purchasing criteria are centered on specific technical requirements such as heat stability, precise pH levels, and compatibility with other processing ingredients, driving demand for specialized, highly concentrated syrup formulas optimized for industrial application rather than direct consumption.

Finally, the retail consumer base represents the direct market, purchasing syrups for household use, primarily for breakfast items (pancakes, waffles) and home baking or beverage preparation. This segment is highly fragmented and sensitive to branding, packaging convenience, and perceived health attributes (low sugar, organic status), driving the demand for diverse product sizes and attractive, informative labeling. The increasing popularity of home mixology and baking during and post-pandemic has further amplified the consumer segment's importance, particularly through online retail channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Monin Inc., Torani (R. Torre & Company), Kerry Group, Tate & Lyle PLC, ADM (Archer Daniels Midland Company), The Hershey Company, Smucker’s, E.D. Smith Foods, DaVinci Gourmet (Kerry), Starbucks (Syrup Division), The J.M. Smucker Company, Amoretti, Sonoma Syrup Co., Giffard, Toschi Vignola s.r.l., Teisseire (Britvic), W. & P. Ltd., Reàl Cocktail Ingredients, Agropur Dairy Cooperative. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Strawberry Syrups Market Key Technology Landscape

The technology landscape in the Strawberry Syrups Market is centered on optimizing raw material utilization, ensuring product stability, and enhancing consumer safety through modern processing techniques. Advanced extraction and concentration technologies, such as vacuum evaporation and membrane filtration, are crucial for retaining the volatile flavor and nutritional compounds of fresh strawberries while achieving the required syrup consistency and brix levels. Manufacturers are continuously adopting high-pressure processing (HPP) and pulsed electric fields (PEF) as non-thermal preservation methods. These technologies offer the advantage of extending shelf life while significantly minimizing the detrimental effects of traditional heat pasteurization on the delicate strawberry flavor and color profile, appealing strongly to the clean-label trend.

Furthermore, automation and smart manufacturing are increasingly deployed within production facilities. Robotics are utilized for precise ingredient dosing and high-speed packaging, drastically improving operational efficiency and reducing labor costs. Sensor technology and the Internet of Things (IoT) enable real-time monitoring of critical parameters such as temperature, pH, and viscosity throughout the blending and bottling phases. This data-driven approach allows for instantaneous adjustments, minimizing batch variations, ensuring rigorous compliance with food safety standards, and providing robust traceability from raw input to final packaged product, which is essential for managing product recalls efficiently.

Innovation in packaging technology also forms a critical part of the landscape. Manufacturers are investing in barrier packaging materials and aseptic processing techniques to allow for ambient storage of premium, natural syrups without relying heavily on synthetic preservatives. Developments include lightweight, recyclable PET bottles and flexible pouches that reduce transportation costs and environmental impact, addressing sustainability concerns. The increasing adoption of custom dispensing mechanisms and pumps, particularly for the foodservice sector, further enhances the user experience, ensuring accurate portion control and minimizing waste in high-volume commercial environments.

Regional Highlights

The global Strawberry Syrups Market exhibits distinct growth trajectories and consumption patterns across major geographical regions, influenced by culinary traditions, economic development, and regulatory frameworks. North America holds a dominant market share, characterized by high per capita consumption of flavored beverages and desserts. The region benefits from a highly mature and competitive foodservice sector, driving continuous demand for high-quality, standardized syrups. Consumer preference in North America leans towards premiumization, resulting in strong growth for organic, non-GMO, and natural strawberry syrup alternatives, often accompanied by innovative flavor combinations.

Europe represents another key region, driven by strong traditional consumption in bakery and dairy applications, especially in countries like Germany, France, and the UK. The European market is highly regulated regarding sugar content and artificial additives, stimulating significant R&D investment into natural sweeteners and clean-label solutions. The established cocktail and coffee culture across Western Europe further cements the demand for specialized, high-end syrups, favoring European manufacturers known for artisanal and high-fruit-content formulations.

Asia Pacific (APAC) is projected to be the fastest-growing market during the forecast period. This rapid expansion is fueled by rising disposable incomes, rapid urbanization, and the adoption of Western dietary trends, including increased consumption of milk teas, ice cream, and specialized blended drinks. Countries like China, India, and Southeast Asian nations present significant untapped potential. While price sensitivity remains a factor in certain sub-regions, there is a burgeoning middle class demanding imported, high-quality, and branded strawberry syrup products, prompting global players to expand their local manufacturing and distribution footprints within APAC.

- North America: Market leader, driven by mature foodservice sector and high demand for premium, clean-label, and low-sugar variants. Significant consumption in coffee shops and breakfast applications.

- Europe: High regulatory standards encouraging innovation in natural sweeteners and organic certification. Strong presence in dairy processing and traditional bakery applications.

- Asia Pacific (APAC): Fastest-growing region due to rising middle-class disposable income, rapid adoption of Western beverage culture, and expanding quick-service restaurant (QSR) chains.

- Latin America (LAMEA): Market expansion linked to increasing demand for confectionery and processed fruit beverages. Growth potential in local flavor adaptations and cost-effective bulk formats.

- Middle East and Africa (MEA): Emerging market, growth concentrated in urban centers and Gulf Cooperation Council (GCC) countries, supported by expanding hotel and tourism sectors that drive premium beverage consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Strawberry Syrups Market.- Monin Inc.

- Torani (R. Torre & Company)

- Kerry Group

- Tate & Lyle PLC

- ADM (Archer Daniels Midland Company)

- The Hershey Company

- Smucker’s

- E.D. Smith Foods

- DaVinci Gourmet (Kerry)

- Starbucks (Syrup Division)

- The J.M. Smucker Company

- Amoretti

- Sonoma Syrup Co.

- Giffard

- Toschi Vignola s.r.l.

- Teisseire (Britvic)

- W. & P. Ltd.

- Reàl Cocktail Ingredients

- Agropur Dairy Cooperative

Frequently Asked Questions

Analyze common user questions about the Strawberry Syrups market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards natural strawberry syrups?

The shift is primarily driven by heightened consumer awareness regarding health and wellness, leading to demand for clean-label products free from artificial colors, flavors, and excessive high-fructose corn syrup. Regulatory pressures in regions like Europe also favor natural, transparent ingredients.

How does the volatile price of raw strawberries affect market profitability?

Fluctuations in the price of raw strawberries, often caused by adverse weather conditions or seasonal variability, directly impact production costs. Manufacturers often mitigate this by entering long-term supply contracts or utilizing advanced processing techniques to use lower-grade fruit efficiently, affecting profit margins in the commodity segment.

Which application segment holds the largest share of the Strawberry Syrups Market?

The Beverages segment, encompassing specialty coffees, milkshakes, and cocktails/mocktails in the Foodservice sector, currently holds the largest revenue share. This is due to the high volume of consumption and the essential need for flavor consistency in commercial drink preparation across global chains.

What role does e-commerce play in the distribution of strawberry syrups?

E-commerce, particularly online retail, is a rapidly expanding distribution channel. It enables small artisanal brands to reach a global niche audience and allows established manufacturers to offer a wider product range (including bulk and specialty sizes) directly to consumers, bypassing traditional retail intermediaries and improving market penetration.

What are the key technological advancements impacting the shelf life of strawberry syrups?

Key advancements include non-thermal preservation technologies like High-Pressure Processing (HPP) and advanced aseptic packaging. These methods extend the product's shelf stability significantly while better preserving the natural flavor, color, and nutritional integrity compared to traditional high-heat pasteurization methods.

In-Depth Analysis of Market Dynamics and Competitive Landscape

The global Strawberry Syrups Market is currently navigating a period of intensive transformation, where consumer health trends and sustainability mandates are reshaping traditional product offerings. A detailed examination of market dynamics reveals that innovation is highly focused on sugar reduction and the incorporation of functional benefits. Traditional syrup formulations, rich in refined sugars, are facing displacement by versions sweetened with alternatives like stevia, erythritol, and monk fruit extract. This shift is not merely a passing trend but a structural change, driven by global public health campaigns against excessive sugar intake and corresponding legislative actions, such as sugar taxes, implemented in various countries across the globe.

Furthermore, the competitive landscape is highly influenced by strategic alliances and mergers and acquisitions (M&A). Large multinational flavor houses frequently acquire niche, clean-label syrup manufacturers to rapidly integrate premium ingredients and specialized production capabilities into their portfolio. This strategy allows major players to mitigate the risk associated with developing new health-focused products from scratch and simultaneously eliminate potential market disruptors. Pricing strategies are complex, with premium natural syrups commanding higher price points, while conventional, artificial variants remain crucial for volume sales in cost-sensitive industrial and developing markets, creating a bifurcated pricing structure.

The resilience of the strawberry flavor is a major underlying factor contributing to the market's stability. Strawberry remains one of the top five globally preferred fruit flavors, ensuring continuous baseline demand regardless of economic cycles. However, the market must constantly contend with substitutes, ranging from other fruit syrups (raspberry, cherry) to specialized flavoring extracts and powders. Successfully maintaining market dominance requires continuous investment in sensory research to perfect the flavor profile, ensuring that manufactured syrups closely mimic the taste and aroma of fresh, ripe strawberries, thereby justifying premium pricing and consumer loyalty.

Detailed Drivers Analysis

The expansion of the global coffee culture and the rapid growth of non-alcoholic specialized beverages serve as powerful catalysts for the Strawberry Syrups Market. Coffee shops, both global chains and independent artisanal cafes, rely heavily on flavored syrups to diversify their menu offerings and cater to seasonal consumer preferences. Strawberry syrup is a staple ingredient in lattes, iced coffees, and frappuccinos, providing a reliable source of customized flavor. This commercial demand is inelastic, as flavored drinks typically carry higher profit margins, incentivizing outlets to maintain a wide array of syrup options, thereby securing substantial B2B sales volumes for syrup manufacturers.

Another crucial driver is the increasing globalization of food and beverage trends. Recipes and consumption patterns, particularly those originating from North America and Europe, rapidly diffuse into emerging economies via social media and international restaurant chains. This process introduces consumers in APAC and LAMEA to strawberry syrup as a desirable ingredient for modern desserts, milkshakes, and cocktails. As middle-class populations grow in these regions, the affordability and availability of internationally branded syrup products improve, further stimulating volume growth and expanding the geographical reach of the market.

Moreover, the consumer desire for convenience and versatility in cooking and baking fuels retail demand. Strawberry syrup offers a simple, ready-to-use solution for flavoring breakfast items, baking glazes, and homemade beverages without the need for preparing fresh fruit. The long shelf life of these products compared to fresh produce makes them an attractive pantry staple for busy households. Manufacturers capitalize on this convenience factor by offering user-friendly packaging, such as squeeze bottles and decorative glass jars, enhancing the product's appeal for direct consumer purchase and boosting household consumption rates significantly.

Detailed Restraints Analysis

One of the most persistent restraints faced by the Strawberry Syrups Market is the inherent volatility and seasonality associated with sourcing high-quality raw strawberries. Strawberry farming is susceptible to climate change, pests, and unexpected weather events, leading to unpredictable harvest yields and sharp price spikes for the raw fruit. Since the quality of the final syrup product is often directly linked to the quality of the input fruit, manufacturers are forced to either absorb higher input costs—thereby shrinking margins—or pass these costs on to consumers, potentially impacting market demand, especially for conventional, price-sensitive syrups.

Consumer concerns regarding high sugar content represent a major structural challenge, directly impeding growth in mature markets like North America and Western Europe. Health-conscious consumers are actively reducing sugar intake, leading them to avoid traditional syrups. Although manufacturers are innovating with low-calorie and zero-sugar formulations, these alternatives often require expensive synthetic or natural high-intensity sweeteners, sometimes resulting in off-flavors or requiring additional stabilizers, which complicates the manufacturing process and may deter clean-label consumers who are skeptical of artificial sugar substitutes. This restraint forces manufacturers into complex R&D cycles to find the perfect balance between sweetness, texture, and health profile.

Furthermore, intense competition from a myriad of flavoring and topping alternatives dilutes market focus. Consumers have access to a wide range of fruit spreads, jams, honey, agave nectar, and specialized flavor extracts that serve similar functional purposes. The easy availability and lower perceived unhealthy attributes of whole fruit or low-processed sweeteners (like honey or maple syrup) sometimes position them as healthier substitutes for strawberry syrups, particularly in home-use and artisanal foodservice environments. Effectively competing requires syrup producers to continuously highlight the convenience, concentrated flavor profile, and standardization benefits that syrups offer over these direct substitutes.

Detailed Opportunity Analysis

A significant opportunity for market expansion lies in the development and vigorous marketing of functional and fortified strawberry syrups. As consumers increasingly link food consumption with personalized health goals, syrups infused with added health benefits such as vitamins (Vitamin C, B vitamins), antioxidants, or probiotics can capture a high-value consumer segment. Targeting the breakfast and wellness markets with nutrient-enhanced strawberry syrups for smoothies, protein shakes, or immunity boosters presents a unique opportunity to transcend the product's classification as merely a sweetener and reposition it as a functional health ingredient, commanding a substantial price premium.

The penetration of untapped emerging markets, particularly in remote or rapidly developing urban centers in Africa and parts of Southeast Asia, represents a high-potential long-term opportunity. While logistics can be challenging, these markets often have high population growth rates and a rapidly expanding youthful demographic eager to adopt Western food and beverage trends. Tailoring product offerings to local taste profiles, utilizing economical packaging formats, and establishing efficient localized distribution networks are key strategies for successfully accessing these millions of new potential consumers who are just starting to incorporate flavored products into their diets.

Finally, leveraging sustainable and ethical sourcing practices offers a competitive advantage, especially among environmentally and socially conscious consumers in developed economies. Obtaining certifications for fair trade strawberries, utilizing sustainable water management in production, and switching entirely to recyclable or biodegradable packaging materials are powerful differentiators. Brands that can credibly communicate their commitment to environmental, social, and governance (ESG) standards throughout the value chain will enhance brand loyalty, justify premium pricing, and gain preference among retailers and B2B partners who are increasingly scrutinized for their sustainability footprint.

Deep Dive: Segmentation by Type (Natural vs. Artificial)

The segmentation of the Strawberry Syrups Market by type—Natural and Artificial—is perhaps the most decisive factor influencing strategic decisions, pricing, and consumer perception. The Natural Strawberry Syrup segment, which includes organic, high fruit content, and clean-label products, is experiencing significantly faster growth. This surge is predicated on consumers’ willingness to pay a premium for ingredients they perceive as healthier and less processed. Natural syrups face the challenge of shorter shelf life and higher input costs dueating to the dependency on seasonal, non-GMO, and often organically grown strawberries. Manufacturers in this category focus heavily on sophisticated preservation techniques that avoid chemical additives while maintaining color and flavor integrity, catering primarily to the retail premium and artisanal foodservice markets.

Conversely, the Artificial/Synthetic Strawberry Syrup segment, while growing at a slower pace, still commands a substantial market volume, primarily driven by cost-effectiveness and stability. These syrups often utilize artificial flavor compounds to achieve a consistent taste profile year-round, regardless of raw material quality. They rely on conventional sweeteners, stabilizers, and artificial coloring to ensure vibrant visual appeal and extended shelf stability. This segment is dominant in large-scale industrial applications, such as mass-produced sodas, economy confectionery, and budget-conscious foodservice operations, where price and operational reliability outweigh clean-label preference.

The divergence between these two types reflects the global economic inequality and diverse market priorities. Developed markets prioritize the natural segment for health reasons, while developing markets often rely on the affordability and widespread availability of artificial syrups. The competitive interplay between these segments forces manufacturers to maintain dual product lines, managing complex supply chains and R&D pipelines simultaneously—one focused on purity and the other on efficiency and price optimization—to capture market share across the entire spectrum of consumer income and health mandates.

Deep Dive: Segmentation by Application (Beverages vs. Dairy & Desserts)

Application segmentation reveals critical revenue drivers, with the Beverages category dominating market consumption. Strawberry syrup is a fundamental component in global specialty beverage preparation, including seasonal limited-time offers (LTOs) and standardized menu items. The ease of mixing syrup into both hot and cold liquids, combined with its highly appealing visual and aromatic properties, makes it indispensable for quick-service restaurants, bars, and especially coffee chains. This segment requires manufacturers to focus on solubility, concentration levels, and formulations that perform consistently across varied temperature ranges and mixing requirements, ensuring that the final drink flavor remains balanced and true to the expected profile.

The Dairy & Desserts segment represents the second major revenue stream, involving its use as a topping for ice cream, frozen yogurt, and as a flavoring base for milkshakes and specialty dairy products. In this application, the syrup's viscosity and texture are crucial; it must pour easily but resist rapid mixing or dilution, maintaining its structure on top of a dessert. Industrial use also includes flavoring and coloring for mass-produced yogurts and ice cream inclusions. Manufacturers serving this segment often need to provide highly concentrated, heat-stable versions for industrial mixers and baking processes, ensuring the strawberry flavor survives rigorous manufacturing steps without degradation.

The distinction in demand between these segments dictates different R&D priorities. The beverage sector demands liquid homogeneity and cold-mix stability, whereas the dessert sector requires textural integrity and higher viscosity. This specialization is leading to product diversification, where leading brands offer application-specific syrup lines, such as ‘Barista Blend’ strawberry syrup for beverages and ‘Topping Grade’ syrup for desserts, maximizing their penetration across distinct end-user environments and optimizing product performance in specific culinary contexts.

Regional Deep Dive: North America and Europe

North America’s dominance in the Strawberry Syrups Market is sustained by its well-established consumer culture of convenience foods and highly customized beverage consumption. The region’s advanced retail infrastructure and the large presence of global food chains ensure easy access and consistent high volume demand. The core market dynamic here is the rapid adoption of health-focused versions; consumers frequently seek certifications like USDA Organic or Non-GMO Project Verified. This preference mandates that manufacturers invest heavily in clean supply chains and transparent ingredient labeling. The intense competition drives continuous product line expansion, including seasonal flavors and functional syrups tailored for fitness enthusiasts and specific dietary needs like keto or vegan lifestyles, maintaining a strong, albeit highly demanding, market environment.

Europe, while mature, showcases unique market characteristics heavily influenced by national culinary traditions and stringent regulatory oversight. Countries in Western Europe, such as France and Italy, utilize syrups extensively in traditional desserts and patisserie, valuing authentic, high-quality fruit content and artisanal production methods. Regulatory bodies, especially the European Food Safety Authority (EFSA), enforce strict rules on food additives, necessitating that manufacturers prioritize natural colorants and low-additive formulations. The European market, therefore, tends to favor established, high-end brands with traceable sourcing and premium packaging, differentiating it from the volume-driven, price-sensitive segments found elsewhere. The region also exhibits strong growth in syrups designed for professional mixology and high-end cafes.

Both regions serve as innovation hubs. North America often pioneers marketing techniques and convenience features, while Europe leads in natural ingredient innovation and strict quality control. The key challenge shared by both is navigating the ongoing sugar debate; successful manufacturers must demonstrate measurable sugar reduction without compromising the critical texture and mouthfeel that consumers associate with high-quality strawberry syrup, necessitating significant investment in taste sensory panels and food technology research.

Regional Deep Dive: Asia Pacific and Rest of the World

The Asia Pacific (APAC) region stands out for its explosive growth potential, driven by demographic factors and swift socioeconomic changes. Urbanization and the expansion of the middle class across China, India, and Southeast Asia have resulted in significantly increased exposure to, and acceptance of, Western dietary components like flavored desserts and specialized drinks. Local consumption trends, such as the popularity of bubble tea and specialized milk drinks, provide substantial new application avenues for strawberry syrup manufacturers. While price sensitivity is higher compared to Western markets, particularly in tier-two cities, the sheer volume potential and the rising appetite for premium, imported goods make APAC a strategic priority for global market leaders seeking long-term revenue diversification and expansion.

Latin America (LAMEA) and the Middle East and Africa (MEA) constitute the Rest of the World segments, each presenting specific opportunities. LAMEA’s market growth is supported by a large youthful population and a strong culture of vibrant, sweet beverages and confectionery, providing a fertile ground for high-volume syrup sales. However, economic instability and complex trade barriers in certain countries pose logistical challenges, requiring localized manufacturing or robust import partnerships. The MEA region, particularly the GCC countries, is witnessing growth fueled by significant tourism and high disposable incomes, creating demand for premium, luxury, and international flavor profiles in high-end hotels and dining establishments, favoring imported, high-quality branded syrups.

Success in these emerging regions hinges on localization strategy. Manufacturers must adapt their products to withstand warmer climates (requiring enhanced heat stability and packaging), address local flavor preferences (e.g., combining strawberry with regional fruits or spices), and tailor distribution strategies to navigate developing retail infrastructures. Investment in localized production facilities helps mitigate tariff risks, shortens lead times, and demonstrates commitment to regional market needs, which is crucial for building trust and achieving sustainable market share in these dynamic geographies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager