Stretch Film Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434349 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Stretch Film Machinery Market Size

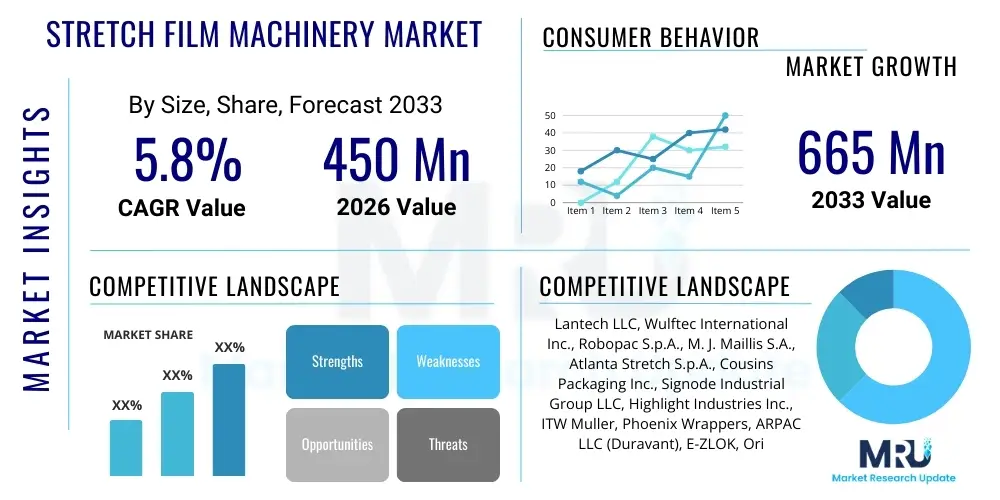

The Stretch Film Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033. This growth trajectory reflects the accelerating demand for automated packaging solutions across diverse industrial sectors, particularly driven by the expansion of global logistics and e-commerce operations. The machinery facilitates efficient unitization and protection of palletized goods, ensuring product integrity during storage and transit. Investments in high-speed, fully automatic stretch wrappers are a key factor contributing to the overall market valuation increase, as companies seek to minimize labor costs and enhance throughput.

Stretch Film Machinery Market introduction

The Stretch Film Machinery Market encompasses the sale and deployment of equipment designed to wrap stretch film around products, primarily pallet loads, for secure bundling and protection. These machines, ranging from simple manual dispensers to sophisticated high-speed automatic wrapping systems, are integral to modern supply chain management and logistics. The primary function is to stabilize stacked items, protect them from moisture, dust, and tampering, and prepare them for safe transportation and warehousing. As global trade volumes increase and supply chains become more complex, the reliance on reliable, high-performance stretch film machinery grows proportionally. This machinery ensures load stability, crucial for preventing damage and subsequent financial losses during intercontinental shipping.

Product descriptions within this market vary significantly based on automation level and speed requirements. Automatic stretch wrappers are often integrated into conveyor systems, requiring minimal human intervention, and are preferred by high-volume manufacturing and distribution centers. Semi-automatic models offer flexibility and are suitable for medium-volume operations or environments where different pallet sizes require customized wrapping strategies. The essential components typically include a film delivery system (pre-stretch carriage), a turntable or rotating arm, and control mechanisms. The efficiency of the wrapping process is heavily dependent on the machinery's ability to maximize film yield through pre-stretch technology, which reduces material consumption and operational costs for end-users.

Major applications of stretch film machinery span nearly all sectors involved in physical goods production and distribution, including the food and beverage industry, pharmaceutical manufacturing, consumer packaged goods (CPG), construction, and general industrial warehousing. Key benefits derived from adopting this technology include enhanced load containment, reduction in product damage, improved workplace safety by minimizing manual wrapping tasks, and standardization of packaging processes. Driving factors for market expansion include the explosive growth of the e-commerce sector requiring robust fulfillment operations, increasing labor costs pushing manufacturers toward automation, and stringent global regulations mandating secure transit packaging.

Stretch Film Machinery Market Executive Summary

The global Stretch Film Machinery Market is characterized by robust growth, primarily fueled by the accelerating shift toward automated material handling systems within logistics and manufacturing. Business trends highlight a pronounced preference for fully automatic, high-capacity machinery capable of seamless integration into existing production lines. Key market players are focusing heavily on developing smart, IoT-enabled machines that offer predictive maintenance capabilities and real-time operational analytics, thereby maximizing uptime and efficiency for large-scale users. Furthermore, sustainability is becoming a pivotal trend, compelling machinery manufacturers to design systems optimized for thin-gauge and recycled stretch films, addressing growing consumer and regulatory pressure regarding plastic waste.

Regional trends indicate that Asia Pacific (APAC) is poised to be the fastest-growing market, driven by rapid industrialization, expansion of manufacturing bases in countries like China and India, and significant investment in new logistics infrastructure. North America and Europe, representing mature markets, maintain high market share due to the early adoption of automation and the high throughput requirements of their established retail and distribution networks. These regions are primarily focused on upgrading older machinery with advanced models featuring greater energy efficiency and connectivity, rather than simply expanding capacity. The increasing cross-border trade facilitated by improved global connectivity further strengthens the demand across all geographical areas.

Segment trends reveal that the Automatic Stretch Wrapping Machines segment dominates the market in terms of revenue, reflecting the industry's focus on eliminating manual intervention for efficiency and consistency. Within applications, Industrial Packaging and the Food & Beverage sectors remain the largest consumers, due to the critical need for hygiene and tamper-proof packaging in the former, and high volume output in the latter. Technological segmentation is leaning heavily towards rotary arm wrappers for unstable or lightweight loads, and turntable wrappers for standard, high-volume palletizing. The focus on flexible packaging solutions and machinery capable of handling diverse film materials, including bio-based polymers, is set to redefine future segment shares.

AI Impact Analysis on Stretch Film Machinery Market

Common user questions regarding AI's impact on stretch film machinery center on themes such as predictive maintenance, optimization of film consumption, and integration with broader supply chain robotics. Users are particularly keen to understand how AI algorithms can minimize costly downtime by forecasting component failures and scheduling maintenance proactively. There is also significant interest in leveraging AI for dynamic wrapping tension adjustments, ensuring optimal load containment while preventing film breakage and unnecessary material usage. Summarizing the key themes, users expect AI to transition stretch film machinery from a reactive mechanical asset to an intelligent, self-optimizing component of a smart factory, thereby maximizing operational efficiency, reducing material waste, and integrating seamlessly with Industry 4.0 paradigms. Concerns mainly revolve around the initial investment cost for implementing AI retrofits and ensuring data security for production insights.

The introduction of AI and Machine Learning (ML) capabilities is fundamentally transforming how stretch wrapping processes are managed and executed. AI algorithms analyze vast datasets generated by machine sensors—including tension load cells, motor performance metrics, and wrapping cycle times—to identify patterns indicative of potential malfunctions. This enables Condition-Based Monitoring (CBM) and predictive maintenance, moving away from time-based maintenance schedules. By accurately predicting when a bearing might fail or a motor might lose efficiency, manufacturers can schedule repairs during planned downtimes, drastically improving Overall Equipment Effectiveness (OEE).

Furthermore, AI is being utilized to optimize the wrapping recipe for every unique load, a crucial step for waste reduction and load security. Based on factors like pallet weight, dimensions, product fragility, and required transit route (analyzed via external supply chain data), the AI system can dynamically adjust parameters such as film overlap, tension, and number of wraps. This intelligent optimization ensures that the minimal amount of film required to guarantee load stability is used, leading to substantial cost savings and supporting corporate sustainability goals. The integration of computer vision systems powered by AI also allows for real-time quality control, instantly flagging incorrectly wrapped or unstable pallets before they enter the logistics network.

- AI-driven Predictive Maintenance (PdM) enhances machine uptime and minimizes unplanned stoppages.

- Machine Learning algorithms optimize film consumption by dynamically adjusting wrap tension and patterns based on load characteristics.

- Integration of vision systems allows for real-time quality control and fault detection in the wrapping process.

- AI facilitates seamless integration into broader smart factory ecosystems and centralized Manufacturing Execution Systems (MES).

- Data analytics derived from AI usage provides actionable insights into throughput bottlenecks and material efficiency.

- Enhanced safety protocols through AI monitoring of operational deviations that could pose a risk to personnel.

DRO & Impact Forces Of Stretch Film Machinery Market

The Stretch Film Machinery Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the global surge in e-commerce and subsequent expansion of third-party logistics (3PL) providers, necessitating high-speed, reliable end-of-line packaging automation to handle massive SKU volumes. Coupled with this is the escalating cost of manual labor globally, which makes the return on investment (ROI) for automated stretch wrappers increasingly attractive. However, growth is restrained by the high initial capital expenditure required for purchasing and installing advanced automatic systems, posing a barrier to entry for Small and Medium-sized Enterprises (SMEs). Furthermore, the industry faces regulatory and public pressure concerning the environmental impact of plastic stretch film, pushing for sustainable alternatives.

Opportunities for market players lie primarily in technological innovation, specifically the development of machinery optimized for handling new sustainable materials, such as bio-degradable or significantly thinner gauge films, without compromising load stability. The increasing adoption of Industry 4.0 principles also presents opportunities for manufacturers to offer retrofitting services and sophisticated software solutions (IoT, AI integration) that enhance the intelligence and efficiency of existing machinery. Expansion into developing economies, particularly in Southeast Asia and Africa, where industrialization is accelerating and packaging standards are maturing, represents a significant geographical growth avenue.

The impact forces determine the competitive landscape and strategic direction of the market. High demand for automation acts as a strong positive impact force, accelerating R&D spending on faster and more robust machines. Conversely, price sensitivity, especially among lower-volume buyers, acts as a negative impact force, forcing manufacturers to balance high-tech features with affordability. Environmental concerns exert a transformative impact force, driving innovations in film pre-stretch ratios—aiming for 400% or more—to drastically reduce material usage per pallet. These forces necessitate strategic agility, requiring companies to invest simultaneously in both high-end automation technology and sustainable packaging compatibility.

Segmentation Analysis

The Stretch Film Machinery Market segmentation provides a detailed view of the various product types, operational levels, and application environments that drive demand. The market is fundamentally segmented based on the degree of automation (manual, semi-automatic, automatic), reflecting the operational needs and volume requirements of different end-users. Further segmentation by technology type, such as turntable, rotary arm, and horizontal wrappers, addresses specific challenges related to load stability, size, and shape. The dominance of the automatic segment highlights the market's trajectory towards high throughput and reduced operational complexity, especially in mature logistic hubs and large-scale manufacturing facilities that run 24/7 operations.

From an application perspective, the segmentation reveals the diverse penetration across the industrial landscape. The Food & Beverage segment requires machinery that meets strict hygiene standards and offers precise wrapping for perishable goods, often demanding integration with temperature-controlled environments. Conversely, the Industrial Packaging segment, which includes metals, chemicals, and construction materials, focuses on machines designed for heavy-duty, irregular loads and high resistance to puncture and tear. Understanding these segment-specific requirements is critical for manufacturers developing specialized machinery features, such such as integrated weighing systems or heavy-duty structural components capable of handling multi-ton loads consistently.

Geographical segmentation remains crucial, as purchasing power, labor costs, and adherence to international safety standards vary significantly by region. While North America and Europe prioritize sophisticated, high-speed, and IoT-enabled machines, emerging markets in Asia Pacific often focus initially on reliable semi-automatic systems that offer a significant upgrade over manual processes at a lower initial cost. The market is thus highly heterogeneous, demanding localized marketing and distribution strategies tailored to the economic maturity and automation readiness of each region.

- By Type:

- Manual Stretch Wrappers

- Semi-automatic Stretch Wrappers

- Automatic Stretch Wrappers

- By Technology:

- Turntable Stretch Wrappers

- Rotary Arm Stretch Wrappers

- Horizontal Stretch Wrappers (Orbital Wrappers)

- By Application (End-User Industry):

- Food & Beverage

- Pharmaceutical & Healthcare

- Consumer Goods

- Industrial Packaging (Chemicals, Metals, Construction)

- Logistics and Warehousing (3PL)

- By Sales Channel:

- Direct Sales

- Distributors/Integrators

Value Chain Analysis For Stretch Film Machinery Market

The value chain for the Stretch Film Machinery Market begins with upstream activities involving raw material procurement, primarily steel, aluminum, and advanced electronic components such as Programmable Logic Controllers (PLCs), sensors, and motors. Key upstream drivers include material costs and supply chain stability for critical electronic parts, which are often subject to global market fluctuations. Manufacturers focus on strategic sourcing and robust inventory management to mitigate risks associated with material price volatility. The design and manufacturing phase involves significant R&D investment to ensure machines are energy-efficient, robust, and capable of high pre-stretch ratios, differentiating products through proprietary technology patents and software development.

Midstream activities involve the core manufacturing and assembly of the machinery, including rigorous quality testing and customization based on client specifications (e.g., specialized conveyors, washdown capabilities for food applications). Distribution channels are critical, acting as the bridge between manufacturers and end-users. Direct sales are common for large, fully automated, and highly customized projects where technical consultation and integration services are paramount. Conversely, indirect channels, utilizing regional distributors and system integrators, are vital for reaching SMEs and providing localized installation, maintenance, and spare parts support. Distributors often hold exclusivity agreements and provide crucial regional market intelligence.

Downstream analysis focuses on installation, commissioning, after-sales services, and end-user deployment within production or logistics facilities. The quality and availability of after-sales support, including preventative maintenance contracts and rapid parts replacement, are major competitive differentiators, especially for automatic, high-throughput systems where downtime is extremely costly. Potential customers include major global manufacturers, 3PL providers, and large retail distribution centers. The overall efficiency and profitability of the value chain are increasingly driven by the service component, leveraging IoT technology to offer remote diagnostics and maintenance, optimizing the total cost of ownership (TCO) for the end-user.

Stretch Film Machinery Market Potential Customers

Potential customers for Stretch Film Machinery span the entire industrial landscape, ranging from small, specialized manufacturers requiring simple semi-automatic units to vast multinational corporations operating automated distribution centers. The primary end-users are defined by their need to unitize and secure palletized goods for transit and storage. This includes major players in the Fast-Moving Consumer Goods (FMCG) sector, such as food and beverage processors and consumer electronics assemblers, who require extremely high-speed, integrated systems that can handle large volumes of consistently sized products with minimal defects.

Third-Party Logistics (3PL) providers and dedicated warehousing facilities represent another highly significant customer segment. As outsourcing of logistics functions continues to grow globally, 3PLs invest heavily in flexible, robust stretch wrapping machinery capable of handling diverse pallet configurations from multiple clients. Their purchasing decisions are driven by machine reliability, ease of integration with existing Warehouse Management Systems (WMS), and the ability to maintain continuous operation during peak seasons. Furthermore, the pharmaceutical and healthcare industries are growing consumers, demanding specialized machines with stainless steel construction and validation capabilities to comply with strict hygiene and traceability standards.

The machinery market also caters to specific industrial sectors, including chemicals, construction materials (e.g., cement, tiles), and fabricated metals. These sectors often require orbital (horizontal) wrappers for securing long or odd-shaped items, or heavy-duty turntable wrappers designed to handle extreme pallet weights, sometimes exceeding 5,000 pounds. Ultimately, any business involved in manufacturing, processing, or distributing physical products in palletized form is a potential buyer, with the decision criterion shifting based on required throughput, level of automation desired, budget constraints, and regulatory compliance specific to their product type.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lantech LLC, Wulftec International Inc., Robopac S.p.A., M. J. Maillis S.A., Atlanta Stretch S.p.A., Cousins Packaging Inc., Signode Industrial Group LLC, Highlight Industries Inc., ITW Muller, Phoenix Wrappers, ARPAC LLC (Duravant), E-ZLOK, Orion Packaging Systems (ProMach), Haloila Oy, AETNA GROUP S.p.A., Extend Incorporated, Mima Films, PolyPack Inc., Fromm Packaging Systems, P.U.S.H. Packaging Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stretch Film Machinery Market Key Technology Landscape

The technological landscape of the Stretch Film Machinery Market is dominated by advancements aimed at increasing efficiency, maximizing film yield, and integrating machines into broader automated systems. The most critical technology is the film pre-stretch carriage, which uses gear ratios and motorized systems to elongate the stretch film before application. Modern machines employ powered dual-carriage pre-stretch systems capable of achieving ratios of 300% to 400% or higher, meaning one linear foot of film is stretched into four linear feet. This technology drastically reduces material costs and is a primary driver of purchasing decisions for high-volume users. The sophistication of the pre-stretch system dictates the overall material efficiency and film quality required.

Another major technological focus is the evolution of control systems and connectivity. Current-generation stretch wrappers are equipped with advanced Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) featuring touchscreen interfaces for easy parameter setting and fault diagnosis. The proliferation of Industry 4.0 has led to the integration of IoT sensors that monitor machine performance variables such as vibration, motor load, and film tension in real time. This connectivity allows for remote monitoring, data logging, and seamless communication with centralized production management systems (MES/WMS), enabling comprehensive operational oversight and data-driven optimization of packaging lines.

Furthermore, innovations in machine design cater to specific load requirements. Rotary arm technology, where the arm rotates around a stationary pallet, is critical for highly unstable or heavy loads that cannot be placed on a spinning turntable. Automatic film clamping and cutting mechanisms have also seen significant refinement, moving towards non-contact, high-reliability systems that ensure consistent performance even at high speeds, minimizing the need for operator intervention. Sustainability is also driving material handling innovations, requiring machinery to accurately manage thinner, post-consumer recycled (PCR) content films that are inherently more challenging to handle without tearing during the pre-stretch phase.

Regional Highlights

Geographical market dynamics illustrate diverse growth patterns, influenced by industrial maturity, logistics infrastructure investment, and labor costs. North America, encompassing the United States and Canada, represents a high-value market characterized by early adoption of full automation. High labor costs and the presence of massive e-commerce and retail distribution networks drive continuous investment in high-speed rotary arm and conveyorized systems. The focus here is on maximizing throughput and integrating advanced data analytics and predictive maintenance features to maintain operational efficiency across vast supply chain footprints.

Europe, a mature and highly regulated market, shows strong demand driven by stringent safety standards and a robust focus on sustainability. European manufacturers are leaders in developing machinery optimized for minimal film usage (high pre-stretch) and compatibility with recyclable and bio-based films. Western Europe maintains high adoption rates of automatic systems, while Eastern Europe is experiencing rapid market penetration due to industrial modernization and integration into the broader EU supply chain, making it a key growth area for semi-automatic and entry-level automatic wrappers.

Asia Pacific (APAC) is projected to exhibit the fastest growth over the forecast period. This acceleration is attributed to massive industrialization, the relocation of manufacturing bases, and significant governmental investment in infrastructure and logistics hubs in countries such as China, India, Vietnam, and Indonesia. While price sensitivity remains a factor, the increasing awareness of standardized packaging for export, coupled with rising labor costs, is driving a swift transition from manual processes to semi-automatic and automatic machinery, positioning APAC as the largest volume market globally by 2030.

Latin America and the Middle East & Africa (MEA) are emerging markets that offer substantial growth potential. In Latin America, modernization of the food processing and agricultural export sectors stimulates demand for reliable packaging equipment. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is investing heavily in diversification away from oil, focusing on logistics, manufacturing, and food security, thereby increasing the requirement for sophisticated packaging machinery to handle the output of newly established industrial zones and ports.

- North America: Dominates high-end automation; driven by large-scale logistics, e-commerce fulfillment, and high labor costs, emphasizing IoT integration and high throughput.

- Europe: Focuses heavily on sustainability and compliance; market growth centers on upgrading to machines optimized for minimal film usage and highly reliable, safe operation.

- Asia Pacific (APAC): Fastest-growing region due to rapid industrialization, expansion of domestic consumption, and export manufacturing, leading to mass adoption of new machinery.

- Latin America: Growth spurred by modernization in agriculture and food/beverage processing sectors, demanding reliable, cost-effective semi-automatic solutions.

- Middle East & Africa (MEA): Emerging market driven by infrastructure development, economic diversification, and establishment of large industrial hubs requiring new material handling equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stretch Film Machinery Market.- Lantech LLC

- Wulftec International Inc.

- Robopac S.p.A.

- M. J. Maillis S.A.

- Atlanta Stretch S.p.A.

- Cousins Packaging Inc.

- Signode Industrial Group LLC

- Highlight Industries Inc.

- ITW Muller

- Phoenix Wrappers

- ARPAC LLC (Duravant)

- E-ZLOK

- Orion Packaging Systems (ProMach)

- Haloila Oy

- AETNA GROUP S.p.A.

- Extend Incorporated

- Mima Films

- PolyPack Inc.

- Fromm Packaging Systems

- P.U.S.H. Packaging Systems

Frequently Asked Questions

Analyze common user questions about the Stretch Film Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Automatic Stretch Wrappers?

The primary factor is the increasing need for high throughput and reduced operational expenses, especially in global logistics and e-commerce fulfillment centers. Automatic machines eliminate labor costs associated with manual wrapping and ensure consistent load integrity at high speeds, maximizing efficiency in 24/7 operations.

How does pre-stretch technology impact operational costs for end-users?

Pre-stretch technology significantly reduces operational costs by maximizing film yield. By stretching the film up to 400% before application, machines use substantially less material per pallet wrap, leading to major savings in material purchasing and contributing to corporate sustainability goals by reducing plastic consumption.

Which regional market is anticipated to experience the highest growth rate?

The Asia Pacific (APAC) region is anticipated to record the highest Compound Annual Growth Rate (CAGR). This rapid expansion is driven by ongoing industrialization, infrastructural investment, and the swift adoption of automation solutions to meet growing manufacturing and export demands in countries such as China and India.

What role does Industry 4.0 play in the Stretch Film Machinery Market?

Industry 4.0 integration, utilizing IoT sensors and smart PLCs, enables real-time monitoring, predictive maintenance, and remote diagnostics for stretch wrappers. This connectivity enhances Overall Equipment Effectiveness (OEE) by minimizing unplanned downtime and allowing seamless data exchange with centralized Warehouse Management Systems (WMS).

What are the main segments of the Stretch Film Machinery Market by machine type?

The main segments by machine type are Manual, Semi-automatic, and Automatic wrappers. Within the automatic segment, further classification includes Turntable wrappers (for stable loads) and Rotary Arm wrappers (for highly unstable or very heavy loads).

The Stretch Film Machinery Market is currently undergoing a transformative phase, driven by the convergence of digital technologies and the pressing need for sustainable packaging solutions. Manufacturers must strategically align their product development pipelines to focus on high-efficiency pre-stretch capabilities and sophisticated software integration to remain competitive. The trajectory of the market is unequivocally toward greater intelligence, higher speed, and enhanced material responsibility across all major geographical regions.

Further analysis into component longevity and modular design reveals that serviceability is becoming a key purchase criterion. End-users are increasingly demanding machinery built with readily available, standardized components and modular designs that facilitate quick repairs and upgrades, thereby protecting their long-term capital investment. This shifts the competitive focus from initial purchase price to the Total Cost of Ownership (TCO) over the machine's lifecycle, necessitating robust support networks and guaranteed spare parts supply from machine manufacturers.

In conclusion, the market is robust and poised for sustained growth, particularly within the automatic segment and in emerging APAC economies. Success hinges on addressing the dual challenges of high automation demand and environmental accountability through continuous technological refinement and strategic regional expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager