Strip Width Gauge Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435192 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Strip Width Gauge Market Size

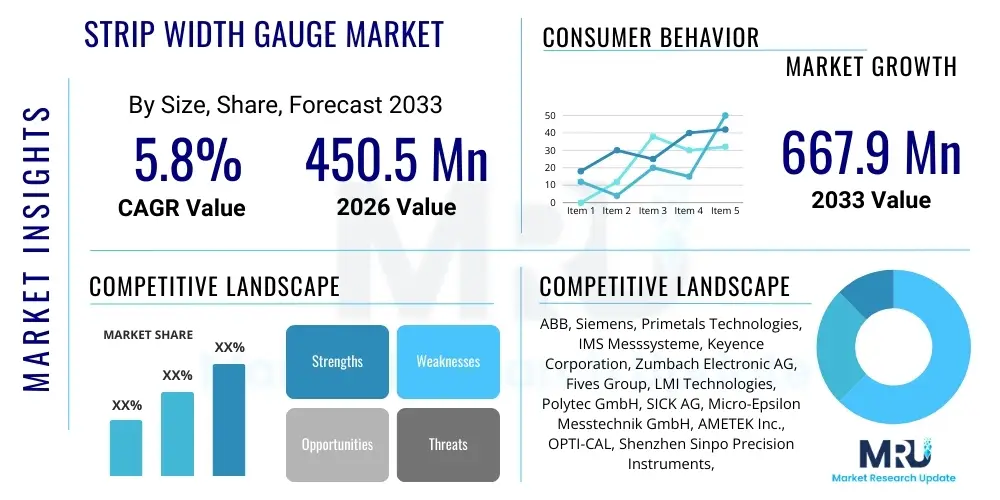

The Strip Width Gauge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 667.9 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for high-quality, precision-rolled metal products, coupled with stringent quality control standards implemented across industries such as automotive, aerospace, and construction.

Strip Width Gauge Market introduction

The Strip Width Gauge Market encompasses advanced non-contact measuring systems designed to precisely monitor and control the width of continuously moving metal strips, typically steel, aluminum, or non-ferrous alloys, during rolling and processing operations. These devices utilize sophisticated technologies, primarily based on lasers, optical sensors, and high-speed cameras, to provide real-time dimensional feedback, which is crucial for maximizing material yield, ensuring product conformity, and optimizing production line efficiency. Major applications include hot and cold rolling mills, slitting lines, and various metal finishing processes. The core benefit of these gauges is the reduction of material waste and the mitigation of costly production errors stemming from dimensional variations. Driving factors include the global push towards Industry 4.0 integration, the necessity for tighter tolerances in high-performance materials, and the accelerating infrastructure development projects worldwide demanding consistent material quality.

Strip Width Gauge Market Executive Summary

The Strip Width Gauge Market is undergoing rapid evolution driven by technological advancements and shifting industrial demands. Current business trends indicate a strong move towards integrated measurement solutions offering comprehensive thickness and width monitoring within a single system, significantly enhancing operational synergy. Regional trends highlight the Asia Pacific (APAC) region as the dominant growth engine, fueled by massive investments in steel production and modernization of existing rolling mills in China, India, and Southeast Asian nations. Conversely, mature markets in North America and Europe are focusing primarily on upgrading legacy systems with AI-enhanced and high-precision laser triangulation sensors to maintain competitive advantage and meet stringent regulatory specifications. Segment trends show that laser-based triangulation gauges are leading the market due to their unparalleled accuracy and resilience in harsh industrial environments, particularly within hot rolling applications, while the adoption of customized solutions tailored for lightweight materials like specialized aluminum alloys in the automotive sector is accelerating.

AI Impact Analysis on Strip Width Gauge Market

User inquiries frequently center on how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the precision, efficiency, and predictive maintenance capabilities of existing strip width gauging systems. Users are concerned about the implementation costs, integration complexity with legacy Production Monitoring Systems (PMS), and the potential for AI algorithms to minimize measurement drift and variability caused by environmental factors like temperature fluctuations or steam. Key expectations revolve around using AI for predictive quality control, where the system analyzes real-time width deviations alongside historical process data (such as rolling speed, temperature, and material composition) to anticipate and mitigate future dimensional errors before they occur. Furthermore, there is strong interest in using ML to automate the complex calibration processes and interpret large datasets for operational optimization, leading to significant material yield improvements.

- AI facilitates predictive maintenance by analyzing sensor data patterns to schedule proactive component replacement, thereby minimizing unexpected downtime.

- Machine Learning algorithms optimize gauge calibration processes automatically, reducing manual intervention and measurement uncertainty.

- AI enhances real-time anomaly detection, identifying subtle width variations that traditional statistical methods might overlook.

- Data integration powered by AI allows for correlation analysis between width measurement and upstream process variables (e.g., rolling force, temperature), leading to root cause analysis for deviation.

- Generative AI models are being explored to simulate new material rolling profiles, optimizing width control parameters before physical production begins.

DRO & Impact Forces Of Strip Width Gauge Market

The dynamics of the Strip Width Gauge Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant impact forces on market evolution. The primary driver is the pervasive demand for high-precision measurement necessitated by modern manufacturing standards, particularly in demanding sectors such as specialized steel production and electric vehicle component manufacturing, where material tolerances are extremely tight. This is augmented by the global trend of manufacturing facility modernization (Industry 4.0), which requires seamless integration of real-time monitoring devices. Conversely, the high initial capital expenditure associated with purchasing and installing sophisticated laser-based systems, coupled with the need for specialized technical expertise for calibration and maintenance, acts as a significant restraint, particularly affecting small and medium-sized enterprises (SMEs).

Opportunities in the market are largely defined by the rising adoption of gauges utilizing advanced sensor fusion techniques (combining laser, vision, and thermal data) to enhance robustness and accuracy across diverse material types and harsh environments. The increasing focus on sustainability and material efficiency also creates opportunities, as precise width gauging directly contributes to reduced scrap rates and optimized resource consumption, aligning with circular economy objectives. The key impact forces driving market penetration include stringent governmental quality regulations and the competitive pressure among manufacturers to achieve superior material yield and product reliability, pushing them towards investment in state-of-the-art measurement technologies. Geopolitical stability affecting the prices and availability of raw materials, particularly steel and aluminum, also indirectly influences investment cycles in new gauging equipment.

Furthermore, the market benefits significantly from the transition toward producing advanced high-strength steels (AHSS) and specialized lightweight aluminum alloys used extensively in high-performance automotive structures. These materials necessitate superior quality control at every stage of the rolling process, directly increasing the demand for advanced, highly accurate strip width gauges capable of handling high rolling speeds and varying surface conditions. Restraints are also compounded by the long lifespan of existing conventional measurement equipment, making the replacement cycle slow unless a compelling ROI case based on dramatic scrap reduction can be proven. Successfully navigating these forces requires manufacturers to focus on modular, scalable, and easy-to-integrate gauging solutions that offer quick returns on investment through demonstrable yield improvements.

Segmentation Analysis

The Strip Width Gauge Market is segmented based on critical technical and application parameters, providing a granular view of market dynamics and adoption patterns across diverse industrial ecosystems. Segmentation by technology highlights the shift from traditional contact methods towards non-contact measurement systems, with laser triangulation and optical (CCD camera) systems dominating due to their accuracy, speed, and resilience in extreme operational conditions. Segmentation by end-user industry shows that the primary demand originates from heavy industries requiring massive material throughput and consistent dimensional accuracy, focusing on maintaining quality specifications required for subsequent manufacturing stages.

- By Technology

- Laser-based Triangulation Gauges

- CCD Camera Based Gauges (Optical Gauges)

- Optical Micrometer Systems

- Other (e.g., X-ray/Gamma Ray-based)

- By Application

- Hot Rolling Mills

- Cold Rolling Mills

- Slitting and Cut-to-Length Lines

- Process and Finishing Lines

- By End-User Industry

- Metal and Steel Manufacturing

- Aluminum Production

- Automotive (Component Production)

- Aerospace and Defense

- Others (e.g., Non-ferrous Metals, Paper, Plastics)

- By Measurement Range

- Narrow Strips (Below 500 mm)

- Medium Strips (500 mm to 1500 mm)

- Wide Strips (Above 1500 mm)

Value Chain Analysis For Strip Width Gauge Market

The value chain for the Strip Width Gauge Market begins with upstream activities involving the sourcing of highly specialized components, including high-speed industrial cameras, precision laser emitters and detectors, sophisticated optical lenses, and robust industrial computing hardware capable of real-time data processing. Key upstream suppliers are focused on providing high-reliability, low-drift components that can withstand the severe vibrations, dust, and temperature extremes inherent in rolling mill environments. The manufacturing and assembly stage involves integrating these components, developing proprietary algorithms for thermal compensation and surface anomaly filtering, and rigorous calibration to ensure sub-millimeter accuracy under dynamic conditions. Differentiation at this stage often relies on software intellectual property related to signal processing and data synchronization with mill control systems.

Downstream activities are dominated by system installation, commissioning, and comprehensive post-sales service, which is critical due to the complex nature of integrating these gauges into existing mill automation frameworks. The distribution channel is predominantly direct, especially for large, customized hot rolling mill installations, requiring close collaboration between the gauge manufacturer and the end-user engineering teams to tailor the system to specific strip dimensions, speeds, and environmental factors. Indirect distribution channels, utilizing specialized system integrators or regional agents, are more common for standardized, off-the-shelf gauges used in slitting or finishing lines.

The final value delivery hinges on the provision of continuous software updates and calibration services, ensuring the long-term accuracy and compliance of the gauging system. The direct relationship between manufacturers and major steel/aluminum producers ensures efficient feedback loops for product refinement and customization, which is paramount in a market driven by precision and reliability. The high value added is concentrated in the R&D phase and the subsequent maintenance contract, reflecting the knowledge-intensive nature of the non-contact measurement technology.

Strip Width Gauge Market Potential Customers

The primary consumers and end-users of strip width gauging technology are large-scale industrial processors involved in the foundational stages of material manufacturing. These customers include integrated steel manufacturers operating vast hot and cold rolling complexes, where precise width control is paramount for achieving the mechanical properties and consistency required for end products. Similarly, major aluminum producers, especially those serving the aerospace and beverage can industries, represent high-value customers due to their strict quality standards regarding surface finish and dimensional tolerances. The investment decisions of these companies are driven by the necessity of minimizing scrap material—where even minor width deviations translate into significant financial losses due to high material costs—and adhering to international quality certifications.

Secondary but rapidly growing customer segments include specialized metal service centers and coil processors, often focusing on high-volume slitting and cutting operations. For these players, width gauges are essential for verifying incoming material quality and guaranteeing the precise dimensions of slit coils delivered to the automotive and construction sectors. Furthermore, equipment manufacturers (OEMs) specializing in supplying complete rolling mill packages are key indirect customers, as they integrate these advanced gauges into their offerings as part of a turnkey solution for new plant construction or major mill upgrades. The trend towards lightweighting in transportation ensures sustained demand from specialized alloy producers serving the electric vehicle battery casing and structure markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 667.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, Primetals Technologies, IMS Messsysteme, Keyence Corporation, Zumbach Electronic AG, Fives Group, LMI Technologies, Polytec GmbH, SICK AG, Micro-Epsilon Messtechnik GmbH, AMETEK Inc., OPTI-CAL, Shenzhen Sinpo Precision Instruments, NDC Technologies, Yaskawa Electric Corporation, Cognex Corporation, Lap Laser, Quality Vision International (QVI), Tesa SA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Strip Width Gauge Market Key Technology Landscape

The technological landscape of the Strip Width Gauge Market is defined by the dominance of non-contact measurement methodologies, primarily utilizing advanced optics and lasers to achieve sub-millimeter accuracy at high production speeds. Laser-based triangulation systems represent the core technology, favored for their ability to measure strip edges even in extremely harsh environments, such as the high temperatures and heavy steam found in hot rolling mills. These systems typically employ multiple synchronized laser sensors positioned symmetrically across the strip to calculate the precise edge locations, subsequently determining the total width, often incorporating advanced algorithms to compensate for strip flutter and lateral movement.

Complementary to laser systems are CCD camera-based optical gauges, which are highly effective in cold rolling and finishing lines where the strip surface is cleaner and temperatures are lower. These systems capture the entire width of the strip within their field of view, utilizing sophisticated image processing software to precisely define the strip edges against a controlled background. The recent trend involves merging these two technologies (sensor fusion) to create hybrid systems that leverage the robustness of lasers for edge detection under difficult conditions and the comprehensive view provided by CCD cameras for surface profile analysis, resulting in enhanced data redundancy and overall reliability.

Further innovation is concentrated in the realm of computing and data integration. Modern gauges are equipped with high-speed Industrial PCs capable of processing thousands of data points per second, ensuring real-time feedback for mill automation systems (Level 1 and Level 2 control). The development of software is paramount, focusing on features like self-diagnosis, remote calibration capability, and seamless integration with Manufacturing Execution Systems (MES) to allow operators to track width quality against specific order parameters. The adoption of EtherCAT and Profinet protocols is standardizing communication interfaces, simplifying deployment and data exchange across complex production environments.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in the Strip Width Gauge Market, primarily driven by China and India, which are experiencing massive capacity expansion and modernization projects in their respective steel and aluminum industries. Government initiatives supporting infrastructure development and the increasing consumption of high-grade steel for automotive manufacturing are fueling demand. Japan and South Korea maintain strong demand for replacement and technology upgrades to support their high-tech manufacturing sectors.

- North America: This region is characterized by high adoption rates of advanced, integrated gauging systems, focusing less on capacity expansion and more on optimizing existing facilities for high efficiency and precision. The robust aerospace and specialty alloy sectors demand the highest accuracy gauges. Key drivers include stringent quality standards and the need for seamless data integration into sophisticated digital factories.

- Europe: Europe represents a mature market focusing on technological leadership, particularly in Germany and Italy. Demand is strong for highly customized solutions that comply with strict EU environmental and quality regulations. The region is a pioneer in implementing AI and ML algorithms into gauging systems to maximize yield and minimize environmental impact. The automotive sector, particularly the electric vehicle segment, drives continuous innovation.

- Latin America (LATAM): Growth in LATAM is cyclical, closely tied to commodity prices and infrastructure investments in Brazil and Mexico. The region generally seeks cost-effective and rugged solutions. While modernization is occurring, adoption rates are slower compared to APAC, focusing primarily on essential quality control rather than advanced predictive capabilities.

- Middle East and Africa (MEA): This region is an emerging market, driven by localized production goals, particularly in Saudi Arabia and the UAE, aiming for self-sufficiency in steel and aluminum. Major investments in new industrial zones create fresh opportunities for market entry, predominantly favoring highly reliable systems proven in severe climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Strip Width Gauge Market.- ABB Ltd.

- Siemens AG

- Primetals Technologies (A Mitsubishi Heavy Industries and Siemens Company)

- IMS Messsysteme GmbH

- Keyence Corporation

- Zumbach Electronic AG

- Fives Group

- LMI Technologies

- Polytec GmbH

- SICK AG

- Micro-Epsilon Messtechnik GmbH

- AMETEK Inc.

- OPTI-CAL

- Shenzhen Sinpo Precision Instruments Co., Ltd.

- NDC Technologies

- Yaskawa Electric Corporation

- Cognex Corporation

- Lap Laser LLC

- Quality Vision International (QVI)

- Tesa SA (Hexagon Group)

Frequently Asked Questions

Analyze common user questions about the Strip Width Gauge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of laser-based strip width gauges over older technologies?

Laser-based gauges offer superior non-contact precision and repeatability, achieving sub-millimeter accuracy (often down to +/- 0.1 mm) at high strip speeds. They are less susceptible to measurement interference from strip surface temperature variations, steam, or flutter compared to traditional mechanical or optical measurement systems, making them ideal for hot rolling applications.

How does the integration of Industry 4.0 affect strip width gauge functionality?

Industry 4.0 integration mandates that strip width gauges provide real-time, highly granular data directly to Level 2 automation systems and MES/ERP platforms. This allows for automated feedback control, predictive quality analysis, remote diagnostics, and seamless data logging, transforming quality control from a static measurement into a dynamic, integrated process parameter.

Which end-user segment drives the highest demand for new strip width gauging equipment?

The Metal and Steel Manufacturing segment, particularly integrated producers operating hot and cold rolling mills, represents the largest demand component. This segment requires high-robustness, large-range gauges to manage vast throughput volumes and ensure the consistency of foundational materials supplied to other industries like construction and automotive.

What are the key challenges associated with maintaining optimal gauge accuracy in rolling mills?

Maintaining accuracy is challenged by environmental factors, including high temperatures, heavy dust/scale, and strip vibration (flutter). Sensor drift over time and the complexity of compensating algorithms for thermal expansion and lateral strip movement require regular, expert calibration and specialized protective sensor housings to ensure consistent measurement integrity.

Is the market growth concentrated in greenfield projects or brownfield modernization efforts?

While greenfield investments, especially in APAC, contribute significant volume, the majority of current market growth revenue stems from brownfield modernization efforts in mature markets (North America, Europe). Existing mills are replacing obsolete contact gauges with advanced non-contact, AI-enabled systems to boost efficiency, meet stricter tolerances, and reduce operating costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager