Stroke Diagnostics and Therapeutics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439791 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Stroke Diagnostics and Therapeutics Market Size

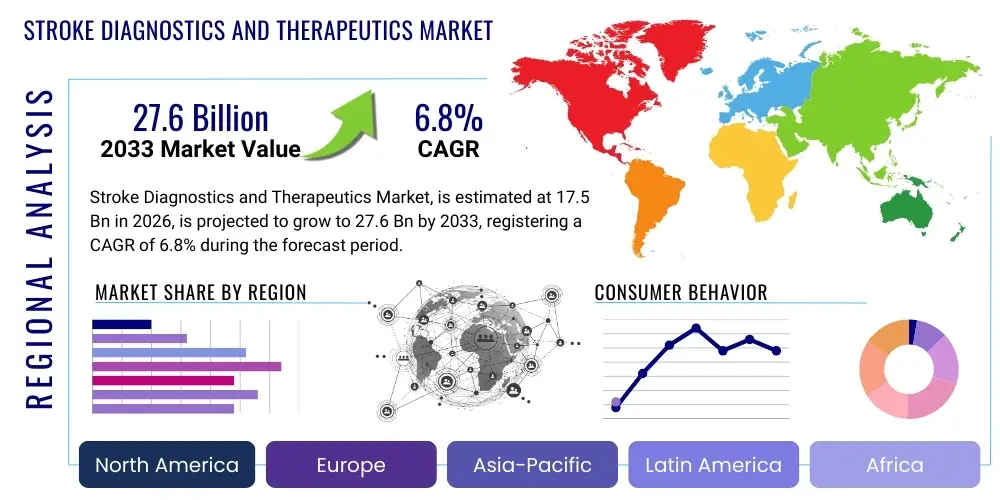

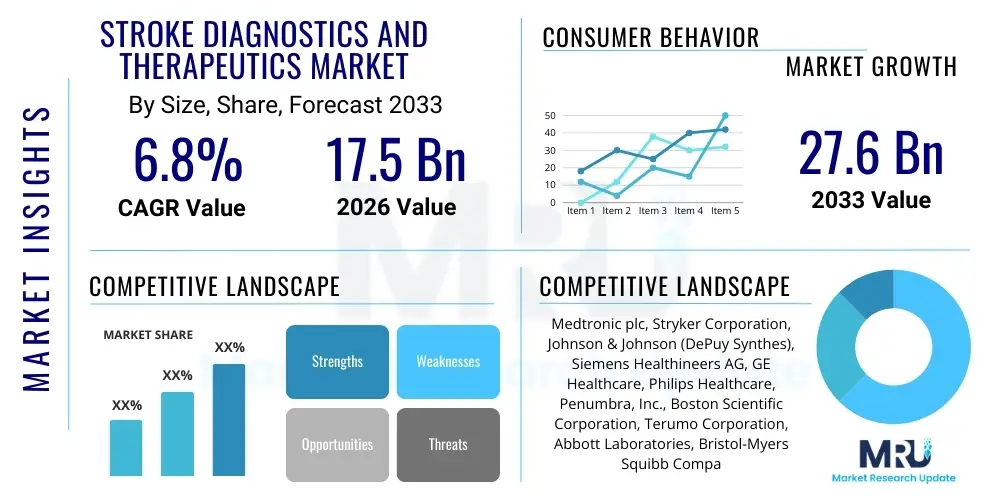

The Stroke Diagnostics and Therapeutics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 27.6 Billion by the end of the forecast period in 2033.

Stroke Diagnostics and Therapeutics Market introduction

The Stroke Diagnostics and Therapeutics Market is undergoing a period of significant expansion, fueled by the rising global incidence of stroke, an aging demographic increasingly susceptible to cerebrovascular events, and continuous advancements in medical technology. Stroke, a leading cause of long-term disability and mortality worldwide, necessitates swift and accurate diagnosis followed by effective therapeutic interventions to mitigate its devastating effects. The product landscape within this market is diverse, encompassing a wide array of diagnostic tools such as advanced neuroimaging systems (CT scans, MRI, MRA, cerebral angiography, transcranial Doppler), blood tests for biomarkers, and sophisticated neurological examination techniques. On the therapeutic front, products range from acute pharmacotherapy, including thrombolytic agents (e.g., tissue plasminogen activator or tPA) for ischemic stroke and antiplatelet/anticoagulant drugs for prevention, to interventional devices such as mechanical thrombectomy systems for acute ischemic stroke, endovascular coiling for hemorrhagic stroke, and carotid stents for stroke prevention. Major applications span across acute stroke management in emergency settings, secondary stroke prevention, rehabilitation post-stroke, and long-term patient care. The primary benefits offered by innovations in this market include significantly improved diagnostic accuracy and speed, which are crucial for time-sensitive interventions; enhanced patient outcomes through more effective and less invasive therapeutic options; a reduction in the severity of disability; and ultimately, an improvement in the overall quality of life for stroke survivors. Key driving factors propelling market growth include increasing public and professional awareness regarding stroke symptoms and the importance of early intervention, substantial investments in research and development by pharmaceutical and medical device companies, and supportive government initiatives and healthcare reforms aimed at improving stroke care pathways globally. The complex interplay of these factors underscores the critical and expanding role of the stroke diagnostics and therapeutics market in addressing a major global health challenge.

Stroke Diagnostics and Therapeutics Market Executive Summary

The Stroke Diagnostics and Therapeutics Market is witnessing dynamic shifts driven by a confluence of evolving business strategies, significant regional disparities in incidence and healthcare infrastructure, and nuanced segment-specific trends. In terms of business trends, the market is characterized by a strong emphasis on strategic collaborations, mergers, and acquisitions aimed at consolidating market share, expanding product portfolios, and leveraging technological synergies. Companies are increasingly investing in research and development to introduce next-generation diagnostic imaging modalities with enhanced precision and speed, alongside novel therapeutic agents offering improved efficacy and safety profiles. Furthermore, there's a growing trend towards integrated stroke care solutions, combining diagnostics, acute intervention, and rehabilitation services to offer comprehensive patient management. Digital health platforms and telemedicine are also gaining traction, particularly for remote patient monitoring and follow-up care, which is enhancing accessibility and continuity of care. From a regional perspective, North America and Europe currently dominate the market due to well-established healthcare systems, high awareness levels, and significant healthcare expenditure. However, the Asia Pacific region is poised for the most rapid growth, driven by its large and aging population, increasing prevalence of stroke risk factors, improving healthcare infrastructure, and rising disposable incomes. Latin America and the Middle East & Africa regions are also expected to exhibit steady growth, albeit from a smaller base, as healthcare access and diagnostic capabilities improve. Segment-wise, the diagnostics segment is being propelled by advancements in neuroimaging techniques and biomarker discovery, enabling earlier and more accurate stroke identification. Within therapeutics, the mechanical thrombectomy devices sub-segment is experiencing robust growth due to compelling clinical evidence supporting its effectiveness in acute ischemic stroke, while pharmaceutical interventions continue to evolve with newer antithrombotic and neuroprotective agents. The market is also seeing increased focus on preventative therapies, given the significant economic and social burden of stroke. These overarching trends highlight a vibrant and competitive landscape, continually adapting to meet the complex demands of stroke care globally.

AI Impact Analysis on Stroke Diagnostics and Therapeutics Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Stroke Diagnostics and Therapeutics Market frequently center on its potential to revolutionize diagnosis speed and accuracy, personalize treatment plans, and optimize workflow efficiency within acute care settings. Common concerns include data privacy and security, the ethical implications of AI-driven decisions, the cost of implementing AI technologies, and the need for robust validation studies to ensure clinical reliability. Users are keen to understand how AI can address the critical "time is brain" factor in stroke management, particularly in identifying stroke types and lesion locations more rapidly than traditional methods, thereby facilitating faster therapeutic intervention. There is also significant interest in AI's role in predicting stroke risk and recurrence, as well as its capacity to support drug discovery for novel neuroprotective or regenerative therapies. Expectations are high that AI will lead to more precise patient stratification, enabling tailored treatments that improve outcomes and reduce adverse events, ultimately transforming the entire stroke care pathway from prevention to rehabilitation.

AI's influence is already becoming increasingly tangible, particularly in the diagnostic phase. Machine learning algorithms are being trained on vast datasets of neuroimaging scans (CT, MRI) to detect subtle signs of stroke, differentiate between ischemic and hemorrhagic types, and quantify infarct volume with remarkable speed and accuracy. This capability significantly reduces interpretation time for radiologists and neurologists, allowing for quicker decision-making in critical acute care scenarios where every minute counts. Furthermore, AI-powered predictive analytics can analyze patient historical data, genetic predispositions, and lifestyle factors to identify individuals at high risk for stroke, enabling proactive preventative strategies. This includes not only primary prevention but also the prediction of recurrent strokes, allowing for intensified secondary prevention measures and closer monitoring.

Beyond diagnostics, AI is poised to enhance therapeutic strategies and rehabilitation. In acute treatment, AI can assist clinicians in selecting the most appropriate mechanical thrombectomy devices or dosages of thrombolytic agents by integrating real-time patient physiological data and imaging characteristics. During rehabilitation, AI-driven platforms can personalize therapy regimens, monitor patient progress, and provide biofeedback, making rehabilitation more engaging and effective. For example, AI-powered exoskeletons or virtual reality therapies can adapt exercises to individual patient needs, accelerating recovery. Moreover, AI's capability to analyze large-scale clinical trial data can accelerate the discovery and development of new stroke drugs by identifying potential drug candidates and predicting their efficacy and safety profiles, thereby streamlining the R&D pipeline and bringing innovative treatments to market faster.

- Accelerated and more accurate interpretation of neuroimaging scans (CT, MRI) for stroke detection and classification.

- Enhanced prediction of stroke risk and recurrence, facilitating targeted preventative interventions.

- Personalized treatment recommendations for acute stroke, including optimal thrombolytic dosing and mechanical thrombectomy approaches.

- Improved efficiency in emergency departments through AI-assisted triage and workflow optimization for stroke patients.

- Support for drug discovery and development by identifying novel therapeutic targets and predicting drug efficacy.

- Advanced post-stroke rehabilitation through AI-driven personalized therapy programs and robotic assistance.

- Real-time monitoring of neurological parameters and vital signs to detect deterioration or secondary complications.

- Data-driven insights for clinical research, helping to identify patient subgroups that respond best to specific treatments.

DRO & Impact Forces Of Stroke Diagnostics and Therapeutics Market

The Stroke Diagnostics and Therapeutics Market is significantly shaped by a powerful interplay of drivers, restraints, opportunities, and inherent impact forces. Major drivers include the increasing global prevalence of stroke, primarily attributed to an aging population and a rising incidence of risk factors such as hypertension, diabetes, obesity, and sedentary lifestyles. Public and professional awareness campaigns about stroke symptoms and the critical need for rapid intervention (e.g., "time is brain") are also propelling demand for advanced diagnostics and therapeutics. Furthermore, continuous technological advancements in neuroimaging, minimally invasive surgical techniques like mechanical thrombectomy, and innovative pharmaceutical agents are expanding the scope and effectiveness of stroke care. Government initiatives and funding for stroke research, along with improving healthcare infrastructure, particularly in emerging economies, are providing significant impetus. However, several restraints temper this growth. The high cost associated with advanced diagnostic equipment and innovative therapeutic devices, coupled with limited reimbursement policies in some regions, poses a substantial barrier to adoption. A shortage of skilled neurologists, interventional neuroradiologists, and trained personnel, especially in rural and underserved areas, also limits access to specialized stroke care. The lack of awareness and delayed presentation of stroke symptoms in certain populations, particularly in low-income countries, continues to be a significant challenge. Additionally, the stringent regulatory approval processes for novel devices and drugs can prolong market entry and increase development costs. Opportunities within this market are vast and include the immense potential of telemedicine and mobile stroke units to extend specialized care to remote areas, bridging geographical gaps in expertise. The growing focus on personalized medicine, leveraging genetic and biomarker research, promises more tailored and effective treatments. Furthermore, the development of cost-effective and portable diagnostic solutions suitable for primary care settings and resource-limited regions represents a significant untapped market. Strategic collaborations between academic institutions, industry players, and healthcare providers can accelerate research and facilitate the translation of innovations into clinical practice. The primary impact force on this market is the "time-sensitive" nature of stroke intervention; the profound difference in patient outcomes based on how quickly diagnosis and treatment are initiated directly influences investment in faster, more efficient technologies. The second major impact force is the devastating socio-economic burden of stroke, which compels governments and healthcare systems to prioritize effective prevention, acute care, and long-term rehabilitation strategies, thereby stimulating market growth and innovation.

Segmentation Analysis

The Stroke Diagnostics and Therapeutics Market is intricately segmented across various dimensions, including product type, application, end-user, and geography, each revealing unique market dynamics and growth trajectories. Understanding these segmentations is crucial for stakeholders to identify key growth areas, tailor marketing strategies, and optimize resource allocation. The product type segment typically differentiates between diagnostic devices and therapeutic interventions, with further sub-segmentation within each. Diagnostics often include imaging systems like CT, MRI, and ultrasound devices, as well as consumables and reagents for biomarker detection. Therapeutics encompass pharmaceutical agents such such as thrombolytics, antiplatelets, and anticoagulants, along with mechanical thrombectomy devices, carotid stents, and neurosurgical tools. The application segment delineates between ischemic stroke, hemorrhagic stroke, and transient ischemic attack (TIA), recognizing that each type requires distinct diagnostic approaches and therapeutic protocols. The end-user analysis distinguishes between hospitals, diagnostic centers, ambulatory surgical centers, and specialized stroke clinics, each having specific purchasing patterns and infrastructure requirements. This detailed segmentation allows for a granular understanding of where demand is highest and which specific solutions are gaining traction.

Within the diagnostic product segment, neuroimaging continues to dominate due to its indispensable role in confirming stroke, identifying its type, and localizing the affected brain regions. Advancements in artificial intelligence and machine learning are further enhancing the capabilities of these imaging systems, improving speed, accuracy, and efficiency of interpretation. The demand for portable and point-of-care diagnostic devices is also on the rise, particularly for pre-hospital assessment and use in rural or remote areas, aiming to reduce the critical time to treatment. Biomarker research, though still nascent, holds significant promise for non-invasive and early detection of stroke, as well as for predicting outcomes and guiding personalized therapy. The therapeutic segment is predominantly driven by the success of mechanical thrombectomy for large vessel occlusions in acute ischemic stroke, leading to significant investment and innovation in device design and procedural techniques. Concurrently, ongoing research into new neuroprotective drugs and agents that enhance neurorecovery post-stroke continues, seeking to expand treatment windows and improve long-term functional outcomes.

The application-based segmentation highlights the significant market share held by ischemic stroke treatments, given its higher prevalence compared to hemorrhagic stroke. However, advancements in neurosurgical techniques and endovascular coiling for hemorrhagic stroke are steadily expanding this sub-segment. End-user wise, hospitals, especially those designated as comprehensive stroke centers, remain the largest consumers of both diagnostic and therapeutic products due to their integrated care capabilities and high patient volumes. The increasing establishment of specialized stroke units within hospitals, equipped with dedicated multidisciplinary teams and advanced technology, further solidifies this trend. Diagnostic centers also play a vital role in outpatient follow-up and screening. The regional segmentation reveals disparities in market maturity and growth potential, with developed regions demonstrating high adoption rates of advanced technologies, while emerging markets present substantial opportunities for growth as healthcare infrastructure and access to care improve. These distinct segment behaviors underscore a complex market landscape requiring nuanced approaches for successful penetration and sustained growth.

- By Product Type:

- Diagnostic Devices

- Imaging Systems (CT, MRI, Ultrasound, Angiography)

- ECG Devices

- Reagents & Kits

- Biomarker Assays

- Therapeutic Devices

- Mechanical Thrombectomy Devices

- Carotid Stents

- Embolic Coils

- Surgical Instruments

- Neurothrombectomy Devices

- Pharmaceuticals

- Thrombolytics (e.g., tPA)

- Anticoagulants

- Antiplatelets

- Neuroprotectants

- Antihypertensives

- Diagnostic Devices

- By Application:

- Ischemic Stroke

- Hemorrhagic Stroke

- Transient Ischemic Attack (TIA)

- By End-User:

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers

- Specialty Clinics

- Neurology Centers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Stroke Diagnostics and Therapeutics Market

The value chain for the Stroke Diagnostics and Therapeutics Market is a multi-faceted process, starting from upstream research and development, progressing through manufacturing and distribution, and culminating in downstream patient care and outcomes. Upstream activities are dominated by pharmaceutical and medical device companies, as well as academic research institutions, which engage in extensive R&D to discover new biomarkers, develop novel drug candidates, design advanced imaging technologies, and engineer innovative therapeutic devices. This phase involves significant investment in basic science, preclinical testing, and rigorous clinical trials to ensure product safety and efficacy, often requiring specialized expertise in neuroscience, pharmacology, and biomedical engineering. The intellectual property generated during this stage, including patents for drugs, devices, and diagnostic methods, forms a critical component of market value. Strategic collaborations with contract research organizations (CROs) and university labs are common to accelerate discovery and development timelines, leveraging external expertise and resources. This initial stage is crucial for innovation, setting the foundation for all subsequent value creation in the market.

Midstream activities involve the manufacturing, assembly, and quality control of diagnostic and therapeutic products. This segment is characterized by specialized production facilities adhering to stringent regulatory standards such as FDA good manufacturing practices (GMP) and ISO certifications to ensure product quality, consistency, and safety. Companies in this stage focus on optimizing production costs, scaling manufacturing capabilities, and implementing robust supply chain management to meet global demand. Following manufacturing, products move into the distribution channel, which is a complex network involving direct sales forces, third-party distributors, wholesalers, and logistics providers. The choice of distribution strategy depends on the product type, target market, and regional regulatory landscape. High-value, specialized devices often utilize a direct sales approach to ensure technical support and training for healthcare professionals, while pharmaceuticals and consumables might leverage broader wholesale networks for wider reach. Effective distribution is critical for ensuring timely delivery of life-saving products to hospitals and clinics, particularly for acute stroke interventions where time is of the essence.

Downstream activities center around the utilization of these products within healthcare settings and their impact on patient care. This involves hospitals, specialized stroke centers, diagnostic laboratories, and rehabilitation facilities that purchase, utilize, and integrate these solutions into their patient management protocols. Healthcare professionals, including neurologists, interventional neuroradiologists, emergency physicians, and nurses, are key decision-makers and end-users, requiring comprehensive training and ongoing support from manufacturers. The final stage of the value chain is patient outcomes and post-market surveillance. This includes monitoring the real-world effectiveness and safety of products, collecting data for further research, and managing adverse events. Direct distribution channels are often preferred for highly specialized or complex devices, enabling manufacturers to provide direct technical support, maintenance, and training to hospital staff. Indirect channels, through distributors and wholesalers, are typically used for broader market reach for pharmaceuticals and less complex diagnostic consumables, leveraging existing supply networks. The efficiency and integrity of each stage of this value chain are vital for ensuring that stroke patients receive timely, accurate diagnoses and effective therapies, ultimately improving health outcomes.

Stroke Diagnostics and Therapeutics Market Potential Customers

The potential customers and end-users of products and services within the Stroke Diagnostics and Therapeutics Market are diverse, encompassing various segments of the healthcare ecosystem, all united by the common goal of preventing, diagnosing, treating, and rehabilitating stroke patients. The primary and most significant customer segment comprises hospitals, particularly large acute care hospitals and those designated as Comprehensive Stroke Centers or Primary Stroke Centers. These institutions are equipped with the specialized infrastructure, multidisciplinary teams, and advanced technology required for rapid stroke diagnosis and intervention. They are major purchasers of high-end neuroimaging systems (CT, MRI), mechanical thrombectomy devices, interventional neuroradiology equipment, and acute thrombolytic medications. Their purchasing decisions are driven by patient volume, clinical guidelines, reimbursement policies, and the need to maintain cutting-edge capabilities to deliver optimal stroke care. These facilities also invest heavily in continuous staff training and technological upgrades to remain at the forefront of stroke treatment, making them central to the market's demand landscape. The increasing focus on establishing dedicated stroke units further solidifies hospitals as key end-users.

Beyond acute care hospitals, diagnostic imaging centers represent another crucial customer segment. These centers specialize in various imaging modalities and serve as referral points for outpatient diagnostics and follow-up scans for stroke patients. They primarily purchase advanced CT and MRI scanners, as well as ultrasound equipment for carotid artery screening, focusing on efficiency, image quality, and patient throughput. Their demand is often influenced by referral patterns from primary care physicians and neurologists. Ambulatory Surgical Centers (ASCs) and specialty clinics, including dedicated neurology clinics, also constitute a growing customer base, especially for less invasive procedures or for managing secondary stroke prevention. These facilities might procure specific diagnostic tools or therapeutic devices relevant to their scope of services, often focusing on cost-effectiveness and ease of use in an outpatient setting. Their purchasing patterns are typically smaller in scale compared to large hospitals but are vital for specialized or regional care needs. The rise of telemedicine and mobile stroke units further expands the definition of potential customers, with these units requiring compact, portable, and rapid diagnostic equipment for pre-hospital assessment.

Furthermore, government healthcare agencies and public health organizations also act as indirect customers by influencing market demand through policy-making, funding research initiatives, and implementing public health campaigns for stroke awareness and prevention. These entities often drive bulk purchases for national healthcare programs or invest in infrastructure development that necessitates the procurement of diagnostic and therapeutic equipment. Academic and research institutions are also significant consumers, utilizing advanced diagnostic tools and experimental therapeutic agents for clinical trials and basic science research, contributing to the innovation pipeline of the market. Lastly, pharmaceutical retailers and pharmacies are crucial for the distribution of prescription medications used in stroke prevention and management (e.g., antiplatelets, anticoagulants, antihypertensives). The overarching goal of all these diverse customer segments is to minimize stroke incidence, improve acute outcomes, and enhance the long-term quality of life for individuals affected by stroke, thereby sustaining a continuous demand for innovative and effective solutions across the entire stroke care continuum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 27.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Siemens Healthineers AG, GE Healthcare, Philips Healthcare, Penumbra, Inc., Boston Scientific Corporation, Terumo Corporation, Abbott Laboratories, Bristol-Myers Squibb Company, Boehringer Ingelheim GmbH, Merck & Co., Inc., Sanofi, Daiichi Sankyo Company, Limited, Canon Medical Systems Corporation, Hitachi Ltd., Koninklijke Philips N.V., Vascular Solutions, Inc., MicroVention, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stroke Diagnostics and Therapeutics Market Key Technology Landscape

The Stroke Diagnostics and Therapeutics Market is profoundly shaped by a rapidly evolving technological landscape, where innovation is continuously driving improvements in patient outcomes and care delivery. In diagnostics, the evolution of neuroimaging is paramount. Multimodal Computed Tomography (CT) and Magnetic Resonance Imaging (MRI) techniques, including CT angiography (CTA), CT perfusion (CTP), MR angiography (MRA), and MR perfusion (MRP), have become standard for rapid and accurate stroke assessment. These technologies provide crucial information on stroke type, location, extent of brain damage, and penumbral tissue, guiding acute treatment decisions. Advancements in these systems focus on faster acquisition times, higher resolution, and integration with artificial intelligence for automated interpretation and quantification of stroke lesions. Portable CT scanners and specialized ambulances equipped with advanced imaging capabilities (mobile stroke units) are also emerging to facilitate pre-hospital diagnosis and reduce time to treatment, particularly in geographically challenging areas. Furthermore, Transcranial Doppler (TCD) ultrasound and carotid ultrasound remain vital for assessing cerebrovascular blood flow and detecting extracranial carotid stenosis, contributing to both diagnosis and secondary prevention strategies. The development of novel blood biomarkers for early stroke detection and differentiation, though still in research phases, holds significant promise for future non-invasive diagnostic approaches, potentially enabling even earlier intervention than current imaging modalities.

On the therapeutic front, technological advancements are equally transformative. Mechanical thrombectomy devices represent a groundbreaking innovation for acute ischemic stroke caused by large vessel occlusion. These devices, primarily stent retrievers and aspiration catheters, are designed for the swift and effective removal of blood clots from cerebral arteries, significantly improving functional outcomes when performed within a critical time window. Ongoing technological refinement focuses on improving navigability through tortuous vessels, enhancing clot capture efficiency, and reducing procedural complications. For hemorrhagic stroke, advancements in neurosurgical techniques, such as minimally invasive clot evacuation systems, and endovascular coiling for aneurysms, have revolutionized treatment. These technologies aim to reduce invasiveness, decrease recovery times, and improve patient safety. Additionally, the field of neuroprotection, though challenging, continues to explore pharmacological agents and devices that can mitigate secondary brain injury following a stroke, extending the therapeutic window for intervention. The integration of robotics and virtual reality in rehabilitation therapy is also a key technological development. Robotic systems assist patients with motor impairments, enabling repetitive and precise movements to retrain affected limbs, while VR platforms provide engaging and customizable environments for cognitive and physical therapy, accelerating recovery and improving patient adherence. These technologies underscore a market driven by continuous innovation, seeking to address the complex and time-sensitive nature of stroke management and long-term recovery.

Moreover, the burgeoning field of digital health and telemedicine is significantly impacting the delivery of stroke care. Tele-stroke platforms enable remote neurologists to evaluate patients, review imaging, and guide treatment decisions in rural or underserved hospitals, ensuring access to specialist expertise regardless of geographical location. This is particularly crucial given the shortage of stroke specialists. Wearable devices and remote monitoring technologies are also gaining traction for long-term management and secondary prevention, allowing continuous tracking of vital signs, activity levels, and medication adherence. Data analytics and artificial intelligence are being applied across the entire stroke care continuum, from predicting stroke risk and optimizing treatment algorithms to personalizing rehabilitation plans and identifying trends in patient outcomes. AI-powered image analysis tools are accelerating diagnosis by flagging critical findings in neuroimaging scans. Furthermore, advancements in drug delivery systems are improving the efficacy and safety of pharmaceutical interventions, exploring targeted delivery methods to maximize therapeutic effect while minimizing systemic side effects. The convergence of these diverse technologies—from advanced imaging and interventional devices to digital health and AI—is collectively pushing the boundaries of what is possible in stroke diagnosis and treatment, continually enhancing the market's potential for growth and innovation.

Regional Highlights

- North America: This region holds a significant share of the Stroke Diagnostics and Therapeutics Market, primarily driven by a high prevalence of stroke risk factors, advanced healthcare infrastructure, substantial healthcare expenditure, and a strong presence of key market players. The U.S. and Canada benefit from early adoption of advanced diagnostic imaging technologies and innovative therapeutic devices, coupled with favorable reimbursement policies and increasing awareness campaigns for stroke management. Stringent regulatory frameworks also ensure high-quality product development and clinical validation.

- Europe: Europe represents another major market, with countries like Germany, the UK, France, and Italy contributing substantially to market growth. Factors such as an aging population, increasing incidence of stroke, robust research and development activities, and a well-developed healthcare system drive demand. The region is also characterized by a growing focus on improving stroke care pathways and establishing comprehensive stroke networks, leading to higher adoption rates of advanced diagnostics and mechanical thrombectomy procedures.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate during the forecast period. This growth is attributed to a large and rapidly aging population, increasing prevalence of stroke risk factors (e.g., hypertension, diabetes), improving healthcare infrastructure, rising disposable incomes, and growing medical tourism. Countries like China, India, Japan, and South Korea are witnessing significant investments in healthcare facilities and an expanding patient pool, creating lucrative opportunities for market players, despite challenges related to healthcare access and awareness in some areas.

- Latin America: This region is experiencing steady growth in the stroke diagnostics and therapeutics market, driven by improving economic conditions, expanding healthcare access, and increasing awareness of stroke. Countries like Brazil, Mexico, and Argentina are investing in upgrading their medical facilities and adopting more advanced treatment protocols. However, challenges related to healthcare affordability and infrastructure disparities across different nations still exist, presenting both opportunities and hurdles for market penetration.

- Middle East and Africa (MEA): The MEA market is anticipated to show moderate growth, primarily fueled by rising healthcare expenditure, a growing burden of non-communicable diseases including stroke, and increasing government initiatives to modernize healthcare infrastructure, particularly in countries like Saudi Arabia, UAE, and South Africa. While fragmented healthcare systems and limited access to advanced technologies in certain parts of Africa pose challenges, increasing medical tourism and investments in specialized healthcare facilities offer potential for growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stroke Diagnostics and Therapeutics Market.- Medtronic plc

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Siemens Healthineers AG

- GE Healthcare

- Philips Healthcare

- Penumbra, Inc.

- Boston Scientific Corporation

- Terumo Corporation

- Abbott Laboratories

- Bristol-Myers Squibb Company

- Boehringer Ingelheim GmbH

- Merck & Co., Inc.

- Sanofi

- Daiichi Sankyo Company, Limited

- Canon Medical Systems Corporation

- Hitachi Ltd.

- Koninklijke Philips N.V.

- Vascular Solutions, Inc.

- MicroVention, Inc.

Frequently Asked Questions

What is a stroke, and what are the main types?

A stroke occurs when blood supply to part of the brain is interrupted or reduced, depriving brain tissue of oxygen and nutrients, leading to brain cell death. The two main types are ischemic stroke, caused by a clot blocking a blood vessel to the brain, and hemorrhagic stroke, caused by a blood vessel rupturing and bleeding into the brain. Transient Ischemic Attack (TIA), or "mini-stroke," is a temporary disruption of blood flow without permanent damage.

How is a stroke typically diagnosed?

Stroke diagnosis typically involves a rapid clinical assessment of symptoms, followed by immediate neuroimaging, primarily Computed Tomography (CT) or Magnetic Resonance Imaging (MRI). These scans differentiate between ischemic and hemorrhagic stroke, crucial for guiding treatment. Additional diagnostics may include CT angiography (CTA), MR angiography (MRA), carotid ultrasound, and blood tests to identify underlying causes or risk factors.

What are the key therapeutic options for acute ischemic stroke?

For acute ischemic stroke, the primary therapeutic options are intravenous thrombolysis using tissue plasminogen activator (tPA) to dissolve the clot, and mechanical thrombectomy, a minimally invasive procedure using devices like stent retrievers to physically remove large blood clots from brain arteries. The choice and timing of these treatments are critical and depend on factors like stroke onset time and vessel occlusion location.

What are the major driving factors for growth in the Stroke Diagnostics and Therapeutics Market?

The market's growth is primarily driven by the increasing global prevalence of stroke due to an aging population and rising chronic disease rates, continuous technological advancements in diagnostic imaging and interventional devices, growing public and professional awareness campaigns regarding early stroke recognition, and supportive government initiatives aimed at improving stroke care pathways and infrastructure worldwide.

How does artificial intelligence (AI) impact stroke diagnostics and therapeutics?

AI significantly impacts stroke care by accelerating and enhancing the accuracy of neuroimaging interpretation, aiding in rapid stroke detection and classification. It also contributes to personalized treatment planning, predicts stroke risk, optimizes workflow in emergency settings, and assists in post-stroke rehabilitation by tailoring therapy programs. AI holds promise for identifying new drug targets and improving clinical trial efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager