Stromal Vascular Fraction Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434463 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Stromal Vascular Fraction Market Size

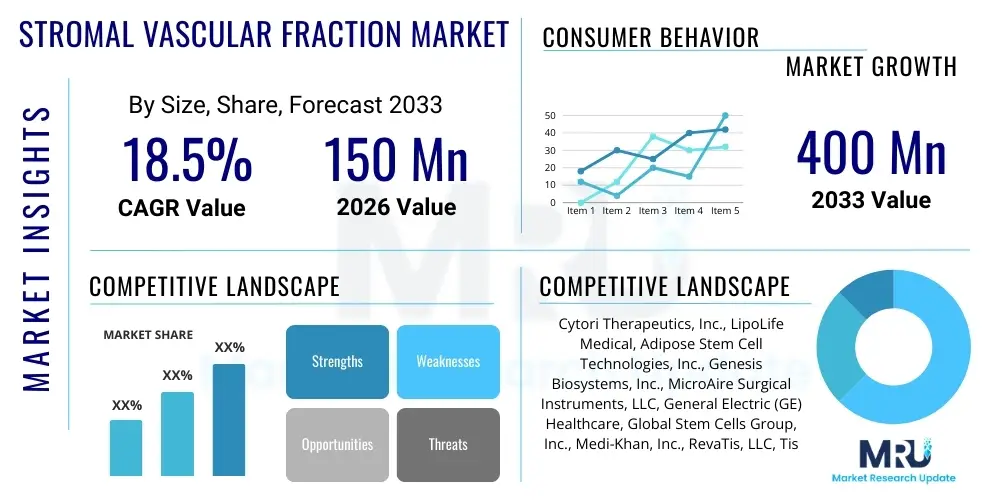

The Stromal Vascular Fraction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $150 Million in 2026 and is projected to reach $400 Million by the end of the forecast period in 2033.

Stromal Vascular Fraction Market introduction

The Stromal Vascular Fraction (SVF) Market encompasses technologies and services related to the isolation, processing, and application of SVF derived primarily from adipose tissue. SVF is a heterogeneous population of cells containing mesenchymal stem cells (ADSCs), endothelial progenitor cells, pericytes, smooth muscle cells, and various immune cells. This rich cellular cocktail holds immense promise in regenerative medicine due to its multi-potency, immunomodulatory, and pro-angiogenic properties. The utilization of autologous SVF minimizes rejection risk, making it a highly attractive option across diverse therapeutic areas, including orthopedics, chronic wound healing, cardiovascular diseases, and cosmetic enhancements.

Major applications driving market expansion include orthopedic repair, particularly for osteoarthritis and ligament damage, where SVF offers a minimally invasive alternative to traditional surgeries. Furthermore, the aesthetic and reconstructive medicine fields utilize SVF for breast reconstruction, fat grafting enhancement, and scar revision due to its ability to improve tissue viability and texture. The product description largely centers on specialized disposable kits and automated processing devices designed for efficient, sterile isolation of high-quality SVF at the point of care, significantly reducing laboratory processing time and ensuring greater patient accessibility to this innovative therapeutic approach.

The primary benefit of SVF therapies is their potential for tissue regeneration and repair using the patient's own resources, which translates into reduced recovery times and lower systemic risk profiles compared to conventional pharmaceutical interventions or complex surgeries. Key driving factors include the escalating global prevalence of chronic degenerative diseases, an aging population seeking effective anti-aging and regenerative treatments, increased investment in cell-based research and clinical trials, and growing regulatory acceptance of minimally manipulated autologous cell products in certain jurisdictions. These factors collectively establish SVF as a cornerstone technology within the burgeoning field of advanced therapies.

Stromal Vascular Fraction Market Executive Summary

The Stromal Vascular Fraction market is characterized by rapid technological innovation focused on developing closed-system, automated isolation devices that adhere to good manufacturing practice (GMP) standards, thereby addressing past concerns regarding standardization and safety. Current business trends indicate a strong shift towards strategic partnerships between device manufacturers and clinical service providers, aimed at increasing the penetration of SVF processing technologies into ambulatory surgical centers (ASCs) and specialized regenerative medicine clinics. Investment remains concentrated on optimizing cell yield and viability from minimal adipose tissue samples, which is crucial for maximizing therapeutic efficacy and streamlining clinical protocols. The competitive landscape is intensely focused on intellectual property related to cell separation methods—specifically differentiating between enzymatic digestion, which yields higher cell counts, and mechanical dissociation, which is favored for maintaining regulatory compliance in specific markets as a minimally manipulated product.

Regional trends demonstrate North America maintaining market dominance, propelled by substantial research funding, a sophisticated healthcare infrastructure, and a relatively permissive (though evolving) regulatory environment that supports early-stage clinical adoption and commercialization of autologous cell therapies. Europe is following closely, driven by rising demand for personalized medicine and significant regulatory clarity provided by guidelines governing advanced therapy medicinal products (ATMPs), although local country adoption rates vary significantly based on national reimbursement policies. The Asia Pacific region, led by China, Japan, and South Korea, exhibits the fastest growth trajectory, primarily due to expanding healthcare expenditure, increasing patient awareness regarding regenerative medicine benefits, and governmental support for biotechnology and stem cell research initiatives. These regions are also becoming key manufacturing hubs for affordable SVF isolation kits.

Segment trends highlight the application of SVF in orthopedic applications (such as knee osteoarthritis and rotator cuff repair) as the largest and fastest-growing segment, driven by robust clinical data and high patient volumes. The technology segment is dominated by automated enzymatic systems, valued for their high throughput and consistency, though mechanical isolation methods are gaining traction due to regulatory simplicity. Furthermore, end-user trends show that specialized hospitals and dedicated stem cell centers are the primary consumers of high-end SVF processing equipment, while smaller ASCs prefer user-friendly, point-of-care disposable kits, indicating a clear bifurcation in the market based on operational scale and investment capacity. Regulatory advancements, particularly in defining "minimal manipulation," will continue to heavily influence which technologies and segments experience the most rapid commercial success.

AI Impact Analysis on Stromal Vascular Fraction Market

Common user questions regarding AI's influence on the Stromal Vascular Fraction market frequently revolve around its potential to enhance therapeutic efficacy, standardize cell processing, and accelerate regulatory approval. Users are keenly interested in how machine learning algorithms can analyze complex cellular images to quantify cell viability and count (critical for quality control), predict patient outcomes based on pre-treatment cellular profiles, and automate the optimization of bioreactor conditions during expansion phases. Key concerns often center on data privacy, the validation of AI models in heterogeneous cell populations like SVF, and the cost barrier associated with integrating sophisticated AI platforms into existing clinical workflows, especially for smaller clinics. Users expect AI to reduce the variability inherent in human-dependent cell processing steps and unlock deeper insights into the specific subpopulation mechanisms driving therapeutic success.

AI's primary role is emerging in the quality assurance and manufacturing segments of the SVF pipeline. By leveraging advanced computer vision and deep learning models, manufacturers can achieve unprecedented consistency in the isolation and characterization of the SVF product. This includes real-time monitoring of enzymatic digestion efficiency, objective measurement of viable cell yields, and precise identification and sorting of specific regenerative cell subtypes (like ADSCs) that may be most effective for a target indication. This integration transforms a previously art-driven process into a data-centric, highly controllable manufacturing protocol, directly addressing a major historical restraint: product variability.

Moreover, AI is pivotal in advancing clinical research and personalized SVF therapy. Machine learning can rapidly sift through vast datasets from clinical trials—including genetic markers, patient demographics, and detailed cellular characteristics—to identify biomarkers that predict patient responsiveness to SVF treatment. This predictive capability allows clinicians to better stratify patients, select optimal SVF doses, or even customize the isolation protocol to enrich for specific beneficial cell components. This personalized approach not only improves success rates but also streamlines clinical trials, potentially accelerating the development and validation of SVF-based treatments across challenging indications such as chronic heart failure or neurodegenerative disorders, ultimately broadening the market adoption horizon.

- AI enhances SVF quality control through automated cell counting and viability assessment, standardizing the final product.

- Machine learning algorithms predict therapeutic efficacy by analyzing patient and cellular biomarkers, enabling patient stratification.

- AI optimizes cell processing parameters (e.g., enzyme concentration, incubation time) in real-time within automated bioreactors.

- Deep learning aids in the non-invasive monitoring of tissue regeneration following SVF application via advanced medical imaging analysis.

- AI accelerates clinical trial design and data analysis, reducing time-to-market for new SVF applications.

DRO & Impact Forces Of Stromal Vascular Fraction Market

The Stromal Vascular Fraction market is currently shaped by a delicate balance of strong biological promise and significant commercialization hurdles, summarized by key Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global geriatric population, which necessitates regenerative therapies for age-related degenerative conditions like osteoarthritis and chronic wounds, and the strong preference among patients for minimally invasive, autologous treatments that offer superior safety profiles compared to allogeneic alternatives. The growing body of positive clinical evidence supporting SVF efficacy across various therapeutic areas (e.g., orthopedic, cardiovascular, aesthetic) further validates its utility and encourages adoption by specialized clinics. However, these positive forces are countered by pervasive restraints, primarily centered around the lack of unified, stringent global regulatory guidelines, particularly concerning whether specific SVF isolation methods classify the resulting product as minimally manipulated or require full drug approval. This regulatory ambiguity complicates commercial scaling and inhibits broader market entry.

The primary impact forces driving the market trajectory include technological advancements focusing on developing automated, closed-system devices. These innovations are critical for standardizing the isolation process, improving cellular yield, and ensuring compliance with emerging regulatory requirements, thereby mitigating the restraint of variability and safety concerns. Economic forces, such as the high initial investment cost for advanced processing equipment and the subsequent lack of widespread insurance reimbursement for these elective or experimental procedures, significantly restrict market growth, particularly in developing economies. Conversely, demographic shifts are providing a perpetual tailwind: the rising demand for anti-aging and cosmetic procedures that utilize SVF for facial rejuvenation and volumetric restoration contributes substantially to the market's commercial viability outside of traditional medical applications. This interplay of technology, regulation, and demographics dictates the pace and direction of market evolution.

Opportunities for exponential market growth lie in securing regulatory clarity and expanding applications into chronic and life-threatening diseases, such as treating myocardial ischemia or Crohn's disease, where current therapies are inadequate. Developing standardized, validated potency assays for SVF products is a key opportunity to overcome the regulatory challenge of product heterogeneity, enabling easier clinical translation. Furthermore, the development of specialized delivery systems—such as injectable hydrogels or scaffolds specifically engineered to enhance the engraftment and survival of transplanted SVF cells—represents a significant technological opportunity to maximize therapeutic outcomes. The pursuit of evidence-based clinical guidelines and securing dedicated reimbursement codes will be transformative, moving SVF from an experimental, out-of-pocket treatment to a standard therapeutic option, thus unlocking its vast market potential.

Segmentation Analysis

The Stromal Vascular Fraction market is segmented comprehensively based on the method of isolation, the targeted therapeutic application, and the end-user setting, reflecting the diversity in technology and clinical practice. Segmentation by isolation method distinguishes between enzymatic dissociation, which utilizes collagenase to break down the adipose tissue matrix, and mechanical methods, which rely on physical forces like agitation or filtration. Enzymatic methods generally offer higher cell yield and are preferred in research settings or where rigorous control over cell yield is necessary. Conversely, mechanical methods are favored in clinical settings where minimal manipulation criteria are paramount for regulatory compliance, even if the cell yield is slightly lower.

Application-based segmentation is crucial, with orthopedics and aesthetics dominating market share. Orthopedics, encompassing conditions such as chronic joint pain and cartilage regeneration, is experiencing robust growth supported by escalating demand for non-surgical solutions. The aesthetic segment, including fat grafting and skin rejuvenation, is stable and driven by high consumer spending on cosmetic enhancements. Emerging applications in wound healing, cardiovascular repair, and neurology present long-term high-growth avenues, although these segments are highly dependent on successful outcomes from ongoing Phase II and Phase III clinical trials and subsequent regulatory approvals.

End-user segmentation clearly defines the primary consumers of SVF processing technologies. Hospitals and academic research institutes are crucial for high-volume, complex processing and clinical trial execution, demanding sophisticated, high-cost isolation systems. However, the future growth is increasingly being driven by Ambulatory Surgical Centers (ASCs) and specialized cell therapy clinics, which prefer smaller, highly automated, and user-friendly point-of-care devices that enable rapid patient turnaround and streamline the therapeutic procedure. This shift towards outpatient settings emphasizes the market need for simplicity, speed, and regulatory-friendly technology platforms.

- By Isolation Method:

- Enzymatic Dissociation (Collagenase-based)

- Mechanical Dissociation (Centrifugation, Filtration, Agitation)

- By Application:

- Orthopedics (Osteoarthritis, Tendon/Ligament Repair)

- Aesthetics & Dermatology (Fat Grafting, Skin Rejuvenation, Scar Revision)

- Wound Healing & Plastic Surgery

- Cardiovascular Disease

- Neurology & Autoimmune Disorders (Emerging)

- By End-User:

- Hospitals & Academic Research Institutes

- Ambulatory Surgical Centers (ASCs)

- Specialized Cell Therapy Clinics

- By Product Type:

- Isolation Systems (Automated Devices)

- Disposable Kits & Reagents (Enzymes, Buffers)

Value Chain Analysis For Stromal Vascular Fraction Market

The Stromal Vascular Fraction market value chain is intricate, commencing with the upstream supply segment involving the manufacturing and supply of specialized components. This includes the production of high-grade surgical instruments (for liposuction), proprietary enzymatic reagents (like GMP-grade collagenase), sterile disposable processing kits, and the complex automated devices required for tissue dissociation and cell isolation. Key upstream drivers focus on achieving high purity, low variability, and adherence to strict regulatory standards (e.g., USP and cGMP guidelines) for all reagents and consumables. Manufacturers must ensure the complete sterility and non-pyrogenicity of their isolation kits, which is critical for patient safety and regulatory acceptance, adding significant cost and technical complexity to this initial phase.

The midstream phase focuses on the actual processing and administration. This involves the adipose tissue harvesting (liposuction, typically performed by a surgeon), the subsequent processing of the tissue using the isolation devices (either in an operating room or a nearby cleanroom facility), and the preparation of the final SVF product dose. Quality control and assurance are paramount here, requiring standardized operating procedures (SOPs) to ensure consistent cell yield, viability, and sterility prior to injection. The rapid, bedside nature of many SVF therapies necessitates highly efficient closed-system technology, minimizing contamination risk and allowing for immediate re-implantation, thereby linking the processing and application phases tightly.

The downstream component involves the distribution channel and the clinical application/monitoring. Distribution relies heavily on direct sales models or specialized distributors capable of handling high-value medical devices and regulated reagents. Direct channels are preferred for high-cost automated systems where technical training and immediate support are required for the end-user (hospitals/clinics). The final steps include the administration of the SVF product to the patient, usually via injection, and subsequent long-term patient follow-up and data collection regarding therapeutic efficacy and safety. The ability to collect and analyze this post-treatment data is crucial for future clinical validation and securing wider insurance coverage, closing the loop between clinical practice and evidence generation.

Stromal Vascular Fraction Market Potential Customers

The primary consumers and end-users of Stromal Vascular Fraction technologies and services are clinical entities focused on providing advanced regenerative therapies to patients. The largest segment of potential customers includes orthopedic surgeons and specialized orthopedic clinics treating chronic joint conditions, sports injuries, and complex fractures, driven by the high prevalence of osteoarthritis and the compelling clinical data demonstrating SVF's effectiveness in reducing pain and improving function. These customers seek reliable, high-yield isolation systems that can be integrated seamlessly into their existing surgical workflows, often prioritizing point-of-care solutions to maintain the autologous, single-session nature of the treatment.

Another major customer base comprises plastic surgeons and cosmetic dermatologists. These practitioners utilize SVF primarily for aesthetic enhancement, specifically for improved fat graft retention, facial rejuvenation, and soft tissue augmentation, offering premium, elective procedures. For this group, the appeal lies in the enhanced quality and longevity of results provided by SVF enrichment, positioning the technology as a high-value differentiator in a competitive market. They are particularly interested in systems that are compact, user-friendly, and minimize the time and staff required for cell processing, allowing them to focus on the surgical aspect of the procedure.

Finally, academic medical centers, large hospital systems, and specialized cell therapy research centers represent critical potential customers, particularly those engaged in Phase I and Phase II clinical trials across novel indications such as cardiovascular repair, autoimmune disease modulation, and neurological disorders. These customers require sophisticated, flexible systems capable of higher volume processing, stringent quality control features, and compliance with institutional review board (IRB) and regulatory protocols. Their purchasing decisions are driven less by immediate cost and more by technological superiority, data tracking capabilities, and suitability for complex cell manipulation protocols, reflecting their role at the cutting edge of translational research.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $150 Million |

| Market Forecast in 2033 | $400 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cytori Therapeutics, Inc., LipoLife Medical, Adipose Stem Cell Technologies, Inc., Genesis Biosystems, Inc., MicroAire Surgical Instruments, LLC, General Electric (GE) Healthcare, Global Stem Cells Group, Inc., Medi-Khan, Inc., RevaTis, LLC, Tissue Genesis, LLC, BCT, Inc., Intellicell Biosciences, Inc., InGeneron, Inc., R-Squared Laboratories, Cellumed Co., Ltd., LifeVac Bioscience, Puregraft, Inc., Mesoblast Ltd., Athersys, Inc., Lonza Group Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stromal Vascular Fraction Market Key Technology Landscape

The technological landscape of the Stromal Vascular Fraction market is dominated by proprietary closed-system processing platforms designed to streamline cell isolation from lipoaspirate at the point of care. These technologies are crucial as they minimize human interaction, maintain sterility, and address the challenge of heterogeneity by standardizing the cell yield and viability across different procedures. The primary technological distinction lies between systems employing enzymatic digestion, typically using highly purified collagenase, and those relying solely on mechanical forces (such as filtration, agitation, and centrifugation). Enzymatic systems often yield a higher total nucleated cell count, maximizing the regenerative potential of the final product, but their regulatory approval is more complex, as the use of an enzyme can classify the SVF as more than minimally manipulated in certain jurisdictions like the United States (FDA 361 vs 351). Conversely, mechanical systems appeal to clinics operating under stricter regulatory interpretations, valuing compliance over maximum cell yield.

A significant trend involves the integration of automated quality control measures within these isolation devices. Newer generations of SVF systems are incorporating spectrophotometry or advanced optical sensors to provide immediate feedback on the processed sample's volume, clarity, and initial cell concentration, ensuring a minimum threshold of viability before administration. This real-time validation capability is essential for clinical accountability and improving patient outcomes, directly contributing to the market's professionalization. Furthermore, research focuses on developing customized disposable kits tailored to specific application volumes, optimizing reagent usage, and reducing per-treatment costs, making SVF therapy more economically viable for ASCs and smaller practices, thus broadening the technology's geographical reach beyond major academic centers.

The peripheral technology landscape includes specialized liposuction cannulas and harvesting techniques designed to minimize trauma to the adipose tissue, thereby maximizing the quantity and quality of viable ADSCs within the tissue. Advanced cryopreservation protocols and technologies are also crucial, particularly in markets where SVF banking for future use is permitted, requiring sophisticated biological storage solutions and validated freezing/thawing protocols that maintain cell function. Overall, the market is shifting toward compact, cassette-based, fully automated systems that prioritize regulatory compliance and ease of use, pushing older, open-system benchtop methodologies towards obsolescence, particularly as the demand for repeatable clinical outcomes intensifies and drives technological competition among device manufacturers.

Regional Highlights

- North America (United States and Canada): North America maintains its position as the market leader, predominantly due to the high concentration of key market players, aggressive research and development investments, and a sophisticated healthcare infrastructure capable of early adoption of advanced therapies. The United States market is complex, driven by robust activity in clinical trials and a growing number of specialized regenerative medicine clinics operating under the 'minimal manipulation' exemption (FDA 21 CFR 1271.10(a)). High patient willingness to pay out-of-pocket for novel aesthetic and orthopedic treatments further fuels demand, despite ongoing regulatory clarification challenges which occasionally lead to procedural pauses or adjustments in technology use.

- Europe (Germany, UK, France, Italy, Spain): Europe represents the second-largest market, characterized by strong regulatory frameworks, especially those governed by the European Medicines Agency (EMA) concerning Advanced Therapy Medicinal Products (ATMPs). Countries like Germany and the UK are major hubs for stem cell research, benefiting from supportive government policies and comprehensive public health systems. While reimbursement remains a challenge across various member states, the strong consumer interest in non-surgical solutions, coupled with a well-established medical tourism sector focusing on high-end treatments, ensures steady market growth, particularly in aesthetic and early-stage clinical applications for chronic diseases.

- Asia Pacific (APAC) (China, Japan, South Korea, India): APAC is projected to be the fastest-growing region, driven by rapidly improving healthcare infrastructure, massive patient populations, and increasingly favorable regulatory landscapes, particularly in Japan and South Korea, which have established specific fast-track approval pathways for regenerative medical products. Government initiatives in countries like China to support domestic biotechnology innovation and the increasing prevalence of lifestyle-related degenerative diseases are creating enormous commercial opportunities. Cost-effectiveness is a major purchasing criterion in this region, favoring the proliferation of locally manufactured, more affordable SVF isolation systems.

- Latin America (Brazil, Mexico): The Latin American market exhibits growth potential fueled by a significant medical tourism industry and a large private healthcare sector. Brazil, in particular, has seen substantial activity in cosmetic and orthopedic applications of SVF. However, market adoption faces restraints due to fragmented regulatory policies, limited research funding, and socioeconomic disparities that restrict access to high-cost advanced therapies to only a segment of the population.

- Middle East and Africa (MEA): The MEA region is an emerging market, primarily concentrated in high-income Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia). Market growth is driven by government investments in specialized healthcare cities and centers of excellence aimed at diversifying services beyond oil revenues. Adoption remains niche, focused mainly on wealthy patient segments seeking luxury aesthetic procedures and early clinical trials for complex diseases. Regulatory oversight is rapidly developing, mirroring European and North American standards in quality and safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stromal Vascular Fraction Market.- Cytori Therapeutics, Inc.

- LipoLife Medical

- Adipose Stem Cell Technologies, Inc.

- Genesis Biosystems, Inc.

- MicroAire Surgical Instruments, LLC

- General Electric (GE) Healthcare

- Global Stem Cells Group, Inc.

- Medi-Khan, Inc.

- RevaTis, LLC

- Tissue Genesis, LLC

- BCT, Inc.

- Intellicell Biosciences, Inc.

- InGeneron, Inc.

- R-Squared Laboratories

- Cellumed Co., Ltd.

- LifeVac Bioscience

- Puregraft, Inc.

- Mesoblast Ltd.

- Athersys, Inc.

- Lonza Group Ltd.

Frequently Asked Questions

Analyze common user questions about the Stromal Vascular Fraction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Stromal Vascular Fraction (SVF) and its primary function in regenerative medicine?

SVF is a heterogeneous population of regenerative cells, including Adipose-Derived Stem Cells (ADSCs), isolated from adipose tissue. Its primary function is tissue repair, regeneration, and immunomodulation due to the potent pro-angiogenic and anti-inflammatory properties of its diverse cellular components.

What are the key regulatory challenges impacting the commercialization of SVF products globally?

The main challenge is defining whether the SVF product, especially when isolated using enzymatic methods, constitutes a "minimally manipulated" tissue product (regulated lightly) or a complex biological drug requiring lengthy and expensive clinical trials for approval.

Which application segment holds the largest market share for SVF therapy?

The Orthopedics segment, particularly the treatment of osteoarthritis and chronic joint degeneration, holds the largest market share, driven by a high prevalence of conditions and strong clinical evidence supporting SVF as a viable non-surgical treatment option.

How do enzymatic and mechanical SVF isolation methods differ, and which is preferred?

Enzymatic methods use collagenase to break down tissue, yielding higher cell counts, often favored in research. Mechanical methods use physical force, adhering more closely to "minimal manipulation" guidelines, and are often preferred for direct point-of-care clinical applications due to regulatory simplicity.

What role does automation play in the future growth of the SVF market?

Automation is crucial for future growth by ensuring standardization, reducing variability, improving sterility, and enabling high-yield processing at the point of care, thereby addressing the regulatory concerns and scalability issues historically restraining market expansion.

The complexities surrounding the purification and therapeutic dosing of SVF cells necessitate continuous innovation in bioprocessing technologies. The long-term stability and efficacy of SVF require the development of novel storage and delivery modalities that maintain cell viability ex vivo and ensure targeted delivery in vivo. For instance, advanced research is exploring encapsulation techniques using biocompatible materials to protect SVF cells after injection, thereby enhancing their survival rate and localizing their regenerative effects within damaged tissue sites. This area of technological advancement is crucial for validating SVF as a reliable, repeatable treatment, moving it further away from its current status as a highly variable clinical intervention.

Furthermore, the technology trend is moving towards integrating diagnostics directly into the processing unit. Future SVF isolation systems are expected to feature real-time cytometry capabilities that allow clinicians to characterize the cellular makeup of the isolated product instantly, providing immediate confirmation of the critical regenerative cell subtypes present before patient re-injection. This integration of process and analysis is vital for establishing standardized potency assays—a significant current gap in the market. Achieving standardization through smart devices and robust analytics will be the key differentiator for technology providers, enabling them to gain a decisive edge in securing clinical adoption and navigating the stringent requirements of international regulatory bodies seeking proof of concept and consistency in cell therapies.

The increasing focus on regenerative medicine has also spurred the development of specialized cell culture media and expansion technologies for SVF-derived ADSCs. While immediate autologous SVF use bypasses the need for large-scale expansion, certain protocols, particularly in complex clinical trials for systemic diseases or where high cell numbers are required, necessitate ex vivo expansion. The technology here focuses on creating serum-free, GMP-compliant media formulations and advanced bioreactor systems that maximize ADSC proliferation while preserving their multipotent characteristics and genomic integrity, ensuring that expanded cells remain safe and effective for therapeutic use, thereby opening new application pathways beyond the immediate bedside treatment model.

The market faces ongoing pressure to reduce the high operational costs associated with SVF processing. Technological evolution, therefore, prioritizes the design of cost-effective, disposable consumables and systems that minimize procedure time and reliance on highly trained laboratory personnel. The trend towards compact, fully enclosed 'plug-and-play' devices supports this objective, transforming the SVF preparation process into a standard, replicable medical procedure rather than a complex laboratory task. Success in this area is paramount for achieving critical mass adoption in routine medical practice and eventually gaining favorable reimbursement status from private and governmental payers, which remains a key barrier to widespread commercial success and market penetration.

Beyond isolation and quality control, the innovation cycle extends into the methods of cell tracking and long-term functional assessment post-implantation. New imaging technologies and non-invasive molecular markers are being developed to monitor the fate and regenerative activity of transplanted SVF cells in the patient's body over several months. This advanced tracking technology is essential for providing the robust clinical data required by regulatory agencies to fully approve SVF for specific indications. Companies investing in these auxiliary technologies that support evidence generation—such as specialized ultrasound or MRI sequences optimized for cellular resolution—will be better positioned to partner with academic institutions and secure favorable outcomes in critical large-scale clinical validation studies.

The rise of personalized medicine strongly influences technology development in the SVF space. Future devices are expected to incorporate adaptive processing protocols based on patient-specific factors, such as age, body mass index, and target indication, to optimize the cellular composition of the SVF product. This next generation of smart SVF systems will utilize integrated software and algorithms to fine-tune enzyme concentration, incubation times, or mechanical forces, ensuring that the isolated cell product is customized for maximum efficacy for that individual patient. This bespoke approach represents the pinnacle of technological sophistication in the market and will likely define the premium segment of SVF technology offerings globally in the coming years.

In summary, the key technological thrusts include enhancing automation for consistency, integrating real-time quality assurance metrics, developing cost-efficient closed systems, and pioneering smart, adaptive processing capabilities. These developments are directly aimed at mitigating regulatory hurdles, improving clinical predictability, and expanding the indications for which SVF therapy can be reliably and safely utilized, ensuring the continued rapid growth predicted for the market forecast period through 2033. The competition among manufacturers to create the most efficient and compliant system is intensifying, driving continuous incremental improvements in cell yield and purity while emphasizing user-friendly interfaces suitable for non-laboratory clinical settings.

The integration of digital health solutions is another vital technological area. Manufacturers are exploring ways to connect their SVF processing devices to cloud-based platforms for data logging, compliance reporting, and predictive maintenance. This connectivity allows clinics to securely store processing parameters, cell count reports, and patient demographic data, facilitating retrospective analysis and ensuring regulatory traceability. Such data logging capabilities are indispensable for clinical governance and for supporting multi-center clinical trials, where data standardization is critical. These digital platforms enhance transparency and help validate the procedural consistency necessary for broad insurance reimbursement approval down the line.

Finally, the development of integrated delivery systems is crucial. The isolated SVF must be safely and accurately administered to the target tissue. Technology includes specialized injection systems, fine-gauge cannulas, and imaging-guided delivery techniques (such as fluoroscopy or ultrasound guidance) to ensure optimal placement of the cellular product. Ensuring that the cells are deposited directly into the site of pathology—whether a degenerated joint, an ischemic heart muscle, or a non-healing wound bed—is as important as the quality of the SVF itself. Innovation in needle and catheter design aimed at minimizing shear stress during injection, which can harm delicate regenerative cells, is a subtle but highly impactful technological frontier in the overall SVF market landscape.

The ongoing push towards non-enzymatic dissociation methods, particularly those leveraging advanced acoustic or microfluidic technologies, is gaining momentum as an alternative to both traditional mechanical and enzymatic approaches. These novel technologies aim to achieve cell yields comparable to enzymatic digestion but without the regulatory baggage associated with external agents, offering a pathway toward true minimal manipulation while ensuring high cell quality. However, these methods are currently more complex and capital-intensive, limiting their immediate widespread adoption, though they represent a significant technological direction for long-term disruptive innovation in the SVF processing space, potentially establishing a new benchmark for regulatory compliance and yield optimization.

The emphasis on developing robust and rapid sterility testing protocols is also paramount. Given the rapid, point-of-care nature of SVF treatments, traditional microbial culture methods are often too slow. Technological advancements are focusing on rapid molecular diagnostics and point-of-care testing systems that can detect contamination within minutes or hours, significantly reducing the risk of administering a compromised cellular product. This technical reliance on rapid diagnostics underscores the market's stringent safety requirements and the necessity for integrated, comprehensive solutions that cover every step from tissue harvest to cell injection, ensuring patient safety remains the highest priority in the technological roadmap.

Ultimately, the successful technologies in the Stromal Vascular Fraction market will be those that achieve the best balance between high cell yield, operational simplicity, cost-efficiency, and, most critically, unwavering regulatory compliance in diverse global markets. The competitive edge belongs to companies that can simplify the complex biological process into a standardized, certified medical procedure, making SVF therapy accessible to a broader range of specialists and patients seeking effective, evidence-based regenerative solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager