Structural Firefighting Garment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436527 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Structural Firefighting Garment Market Size

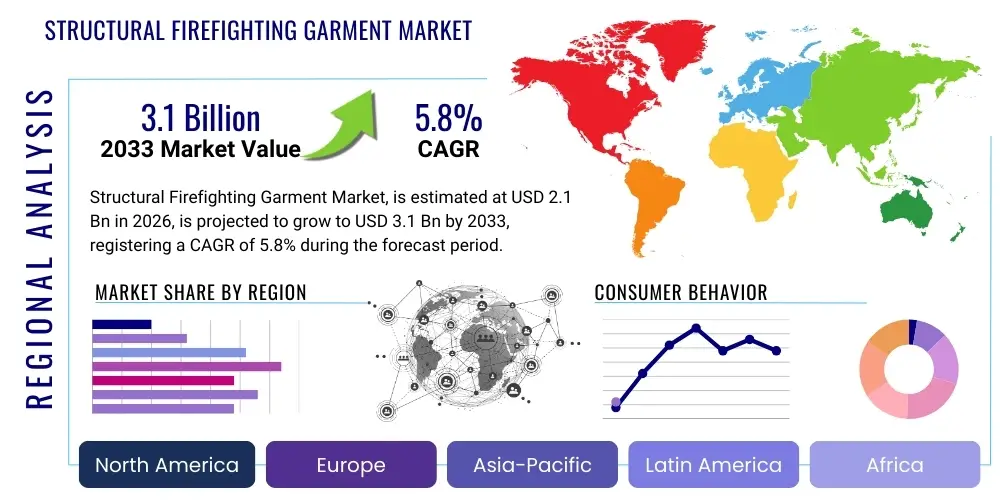

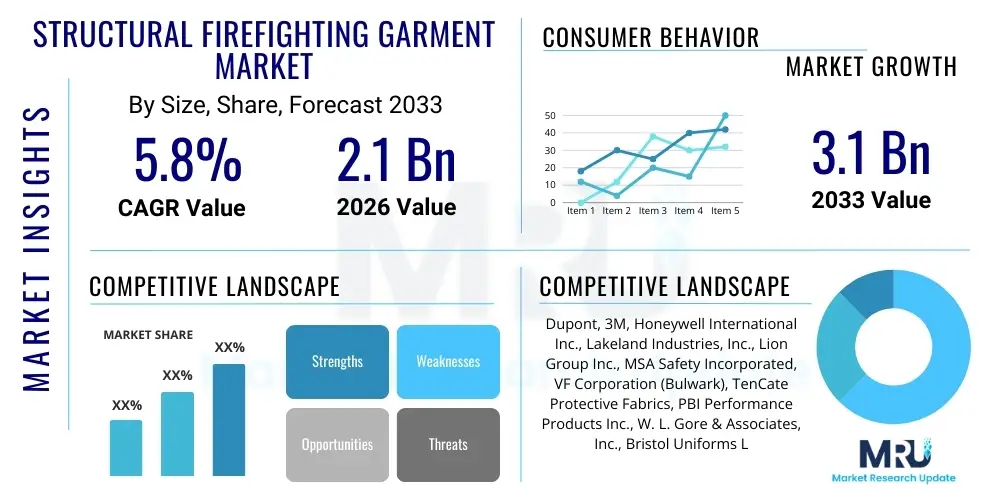

The Structural Firefighting Garment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Structural Firefighting Garment Market introduction

The Structural Firefighting Garment Market encompasses the manufacturing and distribution of specialized protective clothing, often referred to as turnout gear or bunker gear, designed explicitly for firefighters engaging in structural fire suppression. These garments are multi-layered systems engineered to provide comprehensive protection against immediate threats, including extreme heat, direct flame exposure, steam, flashover events, and sharp objects. The primary function is to create a thermal barrier while also offering high levels of durability and maneuverability for the wearer, balancing protection with operational efficiency. Key components typically include an outer shell for flame resistance and abrasion protection, a moisture barrier to prevent hot liquid and steam penetration, and a thermal liner for insulation against high temperatures.

Major applications for structural firefighting garments span municipal firefighting services, where adherence to international safety standards such as NFPA 1971 (North America) and EN 469 (Europe) is mandatory, and industrial firefighting teams operating in high-risk environments like oil refineries, chemical processing plants, and manufacturing facilities. The continuous evolution of material science, particularly the utilization of advanced materials like aramid fibers (Kevlar, Nomex), PBI (Polybenzimidazole), and sophisticated proprietary blends, is central to market development. These materials offer superior performance metrics in terms of thermal stability, reduced weight, and improved breathability, directly addressing the critical issue of heat stress faced by firefighters.

The market is predominantly driven by increasingly stringent occupational safety regulations enforced globally by governmental bodies, mandating the use of certified and high-performance Personal Protective Equipment (PPE). Furthermore, rising public awareness regarding firefighter safety and the modernization efforts of fire departments in developed and rapidly urbanizing developing nations contribute significantly to market expansion. The core benefit of these garments is the drastic reduction in injuries and fatalities related to thermal exposure, positioning them as non-negotiable assets for emergency response units worldwide. Continuous replacement cycles, mandated by material degradation and regulatory shelf-life requirements, ensure sustained demand across the forecast period.

Structural Firefighting Garment Market Executive Summary

The Structural Firefighting Garment Market is experiencing robust business trends characterized by a shift towards lightweight, ergonomic, and technologically integrated protective solutions. Key industry participants are heavily investing in research and development to introduce materials that offer higher thermal protective performance (TPP) while simultaneously reducing the overall weight burden on the firefighter, addressing critical concerns related to heat stress and fatigue. Digital integration, manifesting as the incorporation of smart textiles capable of monitoring physiological parameters or environmental heat flux, represents a significant emerging segment trend, moving the market beyond traditional passive protection towards active safety monitoring. Manufacturers are also focusing on sustainable production practices and extending the service life of garments through modular and repairable designs.

From a regional perspective, North America continues to dominate the market share, largely due to the stringent enforcement of NFPA standards, high levels of governmental funding for fire services, and a pervasive culture of occupational safety investment. Europe follows closely, driven by the harmonized EN standards and strong emphasis on CE certification. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This acceleration is fueled by rapid urbanization, substantial growth in industrial infrastructure (necessitating private industrial firefighting teams), and the increasing adoption of Western-style safety standards in populous economies like China and India. These regional dynamics highlight a bifurcated market: mature markets focus on technological enhancement, while emerging markets prioritize basic safety compliance and standardized equipment procurement.

Segmentation trends indicate a preference for high-performance thermal liners and advanced moisture barriers that utilize PTFE (Polytetrafluoroethylene) membranes for enhanced breathability without compromising barrier integrity. The demand for customized sizing and gender-specific garment designs is also rising, aimed at improving fit and reducing operational hindrance. While municipal firefighting remains the largest application segment, the industrial safety sector, particularly within the petrochemical and advanced manufacturing industries, is showing accelerated growth, driving demand for specialized structural garments tailored for specific industrial hazards beyond standard house fires. Overall, the market remains resilient, underpinned by mandatory safety replacement schedules and continuous material innovation.

AI Impact Analysis on Structural Firefighting Garment Market

Common user questions regarding AI’s influence on the structural firefighting garment market typically revolve around three core themes: enhancement of firefighter safety through real-time data analysis, optimization of garment design and material selection, and improvement of maintenance and replacement cycles. Users are keen to understand how AI-driven predictive analytics can leverage data from smart textiles—such as temperature sensors, heart rate monitors, and GPS trackers embedded in the gear—to provide early warnings of heat stress or hazardous environmental changes, thereby facilitating critical decision-making in high-risk scenarios. Furthermore, there is significant interest in using AI algorithms to analyze material stress patterns, optimizing material layering for weight reduction while maintaining thermal protection, and predicting the precise moment a garment requires repair or retirement based on usage history and exposure metrics, ultimately enhancing the efficacy and cost-efficiency of PPE management.

- AI enables predictive maintenance scheduling by analyzing textile stress and thermal degradation data, maximizing garment lifespan and reliability.

- Integration of AI in smart textiles allows for real-time physiological monitoring (heart rate, core temperature), providing early warnings for firefighter heat stress and fatigue.

- AI algorithms optimize garment sizing and ergonomic design based on extensive anthropometric data, improving fit, mobility, and reducing associated fatigue.

- Artificial intelligence aids in advanced material simulation, accelerating the R&D cycle for lighter, more effective flame-resistant materials and multilayer systems.

- AI-driven simulation tools enhance firefighter training by modeling fire conditions and assessing gear performance in virtual environments before physical deployment.

- Supply chain optimization through AI forecasting ensures timely procurement and distribution of specialized textile components and finished garments, managing inventory effectively.

DRO & Impact Forces Of Structural Firefighting Garment Market

The market trajectory is shaped by a confluence of accelerating drivers, persistent restraints, and significant long-term opportunities, all influenced by powerful external impact forces. Key drivers include the global proliferation of stringent governmental safety regulations, notably NFPA and ISO standards, which mandate the use of certified, high-performance structural firefighting gear, necessitating regular upgrades and replacements. Restraints largely center around the high capital expenditure required for premium, multi-layered structural garments, which challenges procurement budgets, particularly in smaller fire departments or developing regions. Opportunities reside in the integration of innovative smart technologies, such as embedded sensors and communication capabilities, transforming traditional gear into connected protective systems. The primary impact forces driving change are technological advancements in material science (focusing on lightweight aramid blends) and escalating regulatory enforcement focused on reducing occupational heat stress and chemical exposure.

One major driver is the increasing recognition of non-thermal hazards, specifically exposure to carcinogens trapped within gear post-fire. This has spurred a demand for easily decontaminable outer shells and enhanced cleaning protocols, creating a substantial replacement cycle driven not only by physical wear but by contamination concerns. Conversely, a significant restraint is the challenge associated with managing the end-of-life cycle for these high-tech garments. The multi-material composition (aramids, PTFE, PBI) makes recycling complex and expensive, leading to sustainability concerns that manufacturers are actively attempting to mitigate through modular design and specific take-back programs. Navigating these environmental challenges while maintaining high safety standards presents a critical balancing act for market participants.

The market potential is significantly bolstered by the growing global focus on industrial safety, especially in burgeoning sectors like renewable energy manufacturing and large-scale data center operations, which require dedicated and specialized internal fire suppression teams equipped with structural gear. Furthermore, regulatory bodies are continually raising the bar for required Thermal Protective Performance (TPP) and Total Heat Loss (THL) values, effectively forcing a continuous cycle of innovation among manufacturers. This continuous improvement mandate, coupled with the lifecycle limitation of high-performance materials (typically 5 to 10 years depending on use and regulation), ensures sustained, predictable demand throughout the forecast period, positioning material science advancements as a dominant impact force.

Segmentation Analysis

The Structural Firefighting Garment Market is comprehensively segmented based on the critical characteristics that define product functionality, application environment, and material composition. These segmentations are crucial for understanding procurement patterns and technological focus areas across different end-user groups. The primary segmentation by Type details the specific layered components—the Outer Shell, Moisture Barrier, and Thermal Liner—each optimized for distinct protective functions. By understanding the demand drivers for each layer (e.g., preference for lightweight thermal liners or highly durable outer shells), manufacturers can tailor product development and strategic marketing efforts to address specific performance needs within the global firefighting community.

The Application segmentation distinguishes between Municipal Firefighting, which represents the largest segment and adheres strictly to government standards, and Industrial Firefighting, which demands specialized gear resistant to specific chemicals or extended heat exposure common in industrial settings. The Material segmentation, covering Aramid, PBI, and various Blends, reflects the ongoing competition and innovation among textile suppliers. The choice of material directly impacts the cost, TPP rating, and overall durability of the final product. The market analysis reveals a steady trend towards premium, proprietary blends that seek to maximize protection and comfort simultaneously, offering superior value proposition over traditional, single-source materials.

- By Type:

- Outer Shell (Primary resistance against flame and abrasion)

- Moisture Barrier (Protection from steam and liquid penetration)

- Thermal Liner (Insulation against conductive and convective heat)

- By Material:

- Aramid Fibers (e.g., Nomex, Kevlar)

- PBI (Polybenzimidazole)

- Blends and Composites (Proprietary high-performance materials)

- By Application:

- Municipal Firefighting

- Industrial Firefighting (Oil and Gas, Chemical, Manufacturing)

- Military and Defense Emergency Response

Value Chain Analysis For Structural Firefighting Garment Market

The value chain for structural firefighting garments begins with complex upstream activities involving the sourcing and processing of highly specialized technical textiles and chemicals. This stage is dominated by a few key suppliers of high-performance fibers like aramid, PBI, and specialized membrane materials (e.g., PTFE films for moisture barriers). Quality control and certification of these raw materials are paramount, as they determine the final garment’s compliance with stringent safety standards. High dependency on these specialized material suppliers often results in significant supplier power, making long-term contractual agreements and vertical integration strategic necessities for leading garment manufacturers.

Downstream analysis focuses on the manufacturing and assembly process, which requires precision cutting, specialized stitching (using heat-resistant threads), and strict adherence to certification requirements like NFPA 1971. Assembly is labor-intensive and highly regulated, ensuring that the critical layering system is correctly constructed to maintain the thermal barrier integrity. The distribution channel is often multi-faceted, involving both direct sales to large governmental bodies (Direct Distribution) and the utilization of specialized, certified distributors who handle sales, local inventory, and critical after-sales support (Indirect Distribution). These distributors play a vital role in providing sizing expertise, maintenance guidance, and ensuring local compliance.

The final step involves the end-user procurement, lifecycle management, and mandatory disposal or replacement. Due to the critical nature of the product, purchasing decisions are usually bureaucratic, influenced by technical specifications, budget cycles, and regulatory compliance rather than purely cost factors. Furthermore, the downstream support, including authorized cleaning and repair services which maintain the garment’s certification status, forms a crucial part of the value proposition. The complexity of material handling and the mandatory certification requirements create high barriers to entry, reinforcing the position of established manufacturers and certified distributors across the entire value chain.

Structural Firefighting Garment Market Potential Customers

The primary customer base for structural firefighting garments consists of organized emergency response units that operate within environments presenting immediate and severe thermal risks. The largest and most consistent buyers are municipal and metropolitan fire departments across developed and rapidly developing nations. These entities procure gear based on long-term capital improvement plans and mandatory replacement cycles dictated by governmental safety organizations. Their purchasing criteria prioritize NFPA/EN compliance, durability, and features that enhance firefighter mobility and mitigate heat stress, often favoring high-end, multi-layered gear systems from established, certified vendors.

Another significant segment comprises industrial safety and emergency response teams. Industries such as petrochemical refining, chemical manufacturing, deep-sea oil and gas drilling platforms, and heavy manufacturing facilities maintain internal, fully equipped firefighting squads. These industrial buyers often require specialized garments that provide protection against specific chemicals (acid resistance, solvent repellency) in addition to fire protection, leading to customized product demands. The procurement process here is often driven by corporate safety mandates and internal risk assessment protocols, sometimes exceeding baseline regulatory requirements.

Furthermore, military and governmental agencies, including airport rescue and firefighting services (ARFF), military base fire departments, and specialized defense force units, constitute a strong niche customer segment. These customers require gear that integrates seamlessly with existing military-specific equipment and often necessitates higher levels of durability and specific camouflage or color standards. The consistent replacement needs and expansion of global infrastructure across all three customer segments ensure a stable and growing demand landscape for manufacturers of structural firefighting garments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dupont, 3M, Honeywell International Inc., Lakeland Industries, Inc., Lion Group Inc., MSA Safety Incorporated, VF Corporation (Bulwark), TenCate Protective Fabrics, PBI Performance Products Inc., W. L. Gore & Associates, Inc., Bristol Uniforms Ltd., Rosenbauer International AG, Drägerwerk AG & Co. KGaA, S-GARD Schutzkleidung (Hubert Schmitz GmbH), Globe Manufacturing Company LLC, INNOTEX, Inc., WENAAS Group, Fire-Dex, TECGEN, Frosch L.P. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Structural Firefighting Garment Market Key Technology Landscape

The technological landscape of the structural firefighting garment market is highly dynamic, moving beyond fundamental thermal protection towards integrating advanced materials and digital capabilities. A cornerstone of current innovation is the development of ultra-lightweight, high-performance textiles. Manufacturers are utilizing nanotechnology to enhance the fire-resistant properties and durability of fabrics, creating thermal liners with reduced bulk while maintaining superior insulation. Furthermore, the focus on reducing heat stress has driven the adoption of highly breathable PTFE-based moisture barriers, which effectively block external liquids while allowing internal body heat and sweat vapor to escape, significantly improving the wearer's comfort and endurance during prolonged operations. Ergonomic design, utilizing advanced 3D body mapping and modular construction, is also a critical technology, ensuring the gear fits better, reduces movement restriction, and minimizes fatigue.

The most transformative trend involves the incorporation of smart textile technology, transforming garments into 'connected PPE'. This includes embedding micro-sensors for real-time monitoring of both the firefighter's physiological status (core temperature, heart rate, fatigue level) and the environmental conditions (external temperature, toxic gas levels). Data captured by these sensors can be transmitted wirelessly to incident commanders, enabling immediate intervention if a firefighter is at risk of heat exhaustion or structural collapse. This proactive safety feature significantly enhances incident command capabilities and is becoming a key competitive differentiator, particularly in highly funded municipal departments seeking cutting-edge safety enhancements.

Another area of concentrated technological investment is focused on decontamination and longevity. Technologies like specific surface treatments (e.g., enhanced oleophobic and hydrophobic finishes) are being applied to outer shells to repel contaminants and make routine cleaning more effective in removing hazardous particulate matter and carcinogens, thereby extending the garment's safe service life. The entire technological push is governed by the need to meet increasingly strict standards regarding Thermal Protective Performance (TPP) and Total Heat Loss (THL), forcing constant material science breakthroughs to achieve better performance ratios, often involving complex fiber blending and layering techniques to create proprietary, highly certified protective systems.

Regional Highlights

- North America (Dominant Market Share): North America, particularly the United States and Canada, leads the global market in terms of revenue generation and technological adoption. This dominance is attributed to the widespread and mandatory compliance with the rigorous NFPA 1971 standard, which dictates strict requirements for structural gear performance and mandates periodic replacement. High budget allocations for fire services, strong emphasis on firefighter health and safety, and the presence of major industry players and textile innovators (like Dupont and W. L. Gore & Associates) ensure continuous demand for premium, technologically advanced turnout gear systems.

- Europe (Stringent Standards and Innovation): The European market is characterized by mandatory adherence to EN 469 and associated ISO standards, emphasizing both high protection levels and standardized testing across the continent. Countries like Germany, the UK, and France are major consumers, driving demand for multi-functional, ergonomic gear. The region exhibits a strong focus on sustainability and eco-friendly material alternatives, often pushing the envelope in terms of textile recyclability and reduced environmental impact throughout the product lifecycle.

- Asia Pacific (Fastest Growth Rate): The APAC region, driven by massive urbanization, infrastructure development, and industrial expansion (especially in China, India, and Southeast Asian nations), is the fastest-growing market segment. This growth is fueled by the gradual transition from basic protective wear to certified, multi-layered structural garments as safety standards are adopted and enforced, often mirroring Western regulatory frameworks. While price sensitivity remains a factor, the massive scale of industrial and municipal expansion assures long-term, accelerating demand.

- Latin America (Emerging Compliance Market): Latin American countries are experiencing gradual market maturation, often supported by international aid and bilateral safety improvement programs. The market is highly sensitive to government expenditure, but rising industrial foreign direct investment is boosting the demand for high-quality protective gear in specialized industrial applications (mining, oil). Standardization efforts are slowly improving, contributing to a steady, albeit slower, increase in certified garment procurement.

- Middle East and Africa (MEA) (Oil and Gas Sector Focus): Demand in the MEA region is heavily concentrated in the Gulf Cooperation Council (GCC) states, primarily driven by substantial investments in the petrochemical, oil and gas, and construction sectors, which require robust industrial firefighting capabilities. High purchasing power in states like Saudi Arabia and the UAE allows for the procurement of advanced, premium gear from international suppliers, emphasizing extreme heat and chemical resistance alongside structural fire protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Structural Firefighting Garment Market.- Dupont

- 3M

- Honeywell International Inc.

- Lakeland Industries, Inc.

- Lion Group Inc.

- MSA Safety Incorporated

- VF Corporation (Bulwark)

- TenCate Protective Fabrics

- PBI Performance Products Inc.

- W. L. Gore & Associates, Inc.

- Bristol Uniforms Ltd.

- Rosenbauer International AG

- Drägerwerk AG & Co. KGaA

- S-GARD Schutzkleidung (Hubert Schmitz GmbH)

- Globe Manufacturing Company LLC

- INNOTEX, Inc.

- WENAAS Group

- Fire-Dex

- TECGEN

- Frosch L.P.

Frequently Asked Questions

Analyze common user questions about the Structural Firefighting Garment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between structural and proximity firefighting garments?

Structural firefighting garments (turnout gear) are designed for interior structure fires, focusing on thermal protection (TPP) and abrasion resistance. Proximity gear is specialized for intense radiant heat environments, such as aircraft fires or industrial melts, utilizing aluminized outer shells for maximum reflectivity.

Which mandatory safety standards govern the structural firefighting garment market?

The market is primarily governed by the National Fire Protection Association (NFPA) Standard 1971 in North America and the European Norm (EN) 469 in Europe. Compliance with these standards is mandatory for procurement by municipal fire departments, ensuring minimum performance requirements for heat, flame, and moisture protection.

How do smart textiles enhance the safety of structural firefighting garments?

Smart textiles integrate sensors into the gear’s layers to monitor critical parameters such as the firefighter’s vital signs (e.g., heart rate, heat stress) and environmental conditions (e.g., internal heat buildup). This real-time data allows incident commanders to proactively manage risks and prevent heat-related injuries.

What are the primary material components used in structural firefighting gear?

The primary materials are high-performance synthetic fibers, predominantly aramid fibers (like Nomex and Kevlar) and PBI (Polybenzimidazole). These are used in the outer shell and thermal liner layers for flame resistance, durability, and insulation. PTFE membranes are crucial for the moisture barrier layer.

What factors are driving the fastest growth in the Asia Pacific Structural Firefighting Garment Market?

Growth in the APAC region is predominantly driven by rapid urbanization, significant investment in industrial infrastructure (especially oil, gas, and chemical processing), and the increasing adoption and enforcement of certified international safety standards by governmental and industrial entities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager