Structural Glass Curtain Walls Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439085 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Structural Glass Curtain Walls Market Size

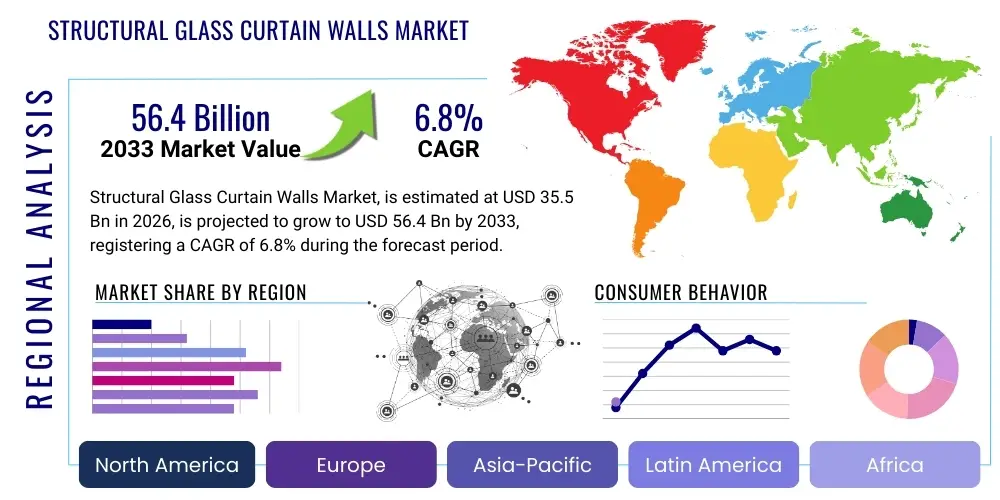

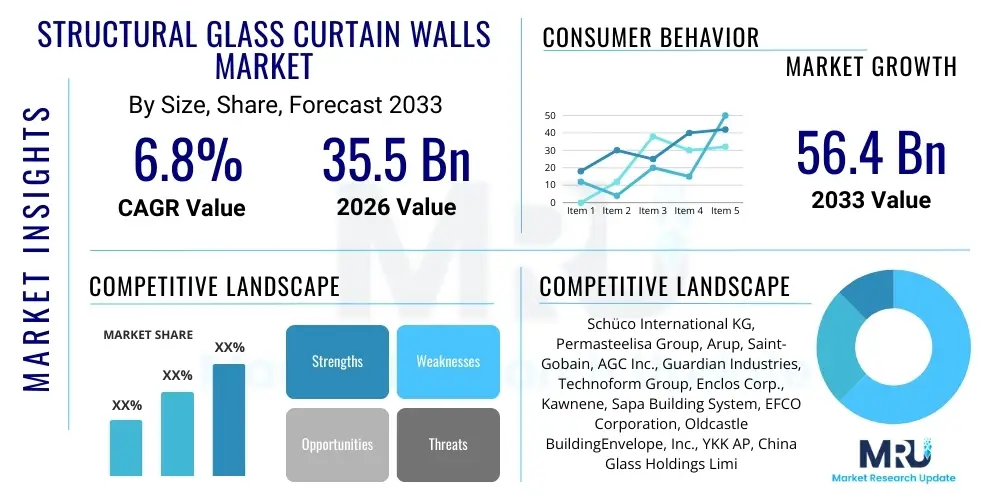

The Structural Glass Curtain Walls Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 56.4 Billion by the end of the forecast period in 2033.

Structural Glass Curtain Walls Market introduction

Structural Glass Curtain Walls represent advanced non-structural exterior enclosures of buildings, distinguished by their ability to transfer wind loads and gravity loads back to the primary building structure without relying on traditional exposed metal framing on the exterior façade. These systems utilize specialized hardware, such as spider fittings, tension rods, or structural silicone sealants (SSG), to create seamless, monolithic glass envelopes. The primary objective is to maximize natural daylight penetration, enhance aesthetic appeal, and provide superior thermal and acoustic performance. Modern systems increasingly incorporate high-performance glass coatings, such as Low-E glass, to improve energy efficiency, aligning with global sustainability initiatives in the construction sector. The elegance and functional benefits of structural glass walls have made them indispensable in contemporary commercial and high-end residential architecture.

The core product description encompasses custom-engineered systems designed to meet specific building codes and performance requirements, including blast resistance, seismic stability, and extreme weather tolerance. Major applications span high-rise commercial offices, institutional buildings, luxury retail centers, airports, and specialized healthcare facilities, where unobstructed views and premium design are prioritized. Key benefits driving adoption include architectural versatility, enhanced occupant well-being due to increased daylighting, long-term durability, and reduced structural weight compared to precast concrete or traditional masonry facades. The demand is heavily influenced by the global boom in high-value infrastructure projects and the continuous evolution of smart building technologies that integrate dynamic shading and integrated photovoltaic (BIPV) systems within the curtain wall framework.

Driving factors propelling market expansion include stringent regulatory mandates requiring improved energy performance in new buildings, particularly in developed economies across North America and Europe. Furthermore, rapid urbanization and the proliferation of megacities in the Asia Pacific region necessitate the construction of iconic, structurally sound, and energy-efficient skyscrapers. Innovations in glass manufacturing, such as chemically strengthened glass and advanced lamination techniques, allow for larger, safer glass panels, further expanding the design possibilities and applications for structural glass curtain wall systems globally. The synergy between material science advancements and architectural ambition fuels sustained growth in this specialized construction segment.

Structural Glass Curtain Walls Market Executive Summary

The Structural Glass Curtain Walls Market is characterized by robust growth, driven primarily by favorable business trends centered around sustainable building practices and rapid urbanization, particularly in the APAC region. Business trends indicate a strong industry shift towards integrated facade solutions, where curtain walls are no longer passive barriers but active components contributing to a building’s energy management profile. This includes the rising adoption of Building Information Modeling (BIM) for precise planning and prefabricated unitized curtain wall systems for faster installation, improving project timelines and reducing on-site labor costs. Competition remains high, focused on technological differentiation, material quality (specifically aluminum alloy framing and specialized sealants), and certified installation expertise, making supply chain integrity a critical factor for market participants.

Regional trends highlight Asia Pacific as the dominant market, fueled by massive investments in commercial and mixed-use real estate development in countries like China, India, and Southeast Asia, where high-density construction is prevalent. North America and Europe represent mature markets focusing on retrofitting existing commercial stock to meet modern thermal efficiency standards and utilizing high-specification, custom-designed facades for premium real estate. The Middle East continues to show strong demand, particularly for large-scale, architecturally complex projects requiring sophisticated climate control and robust structural glass solutions capable of withstanding extreme heat and dust, thereby sustaining above-average revenue streams in this geographic area.

Segment trends reveal that the commercial application segment, encompassing office buildings and retail complexes, maintains the largest market share due to the prestige and functional benefits offered by structural glass. Within the structural type, point-fixed systems are experiencing the fastest growth, particularly in aesthetically driven projects, offering the maximum level of transparency and minimalist design. Furthermore, the rising cost consciousness in construction is driving demand for hybrid systems that balance the cost efficiency of two-sided supported walls with the aesthetic appeal of fully frameless structural glazing. Material innovation focusing on lighter, stronger aluminum alloys and high-performance structural silicone sealants (SSG) is crucial for maintaining market segmentation differentiation and optimizing system longevity.

AI Impact Analysis on Structural Glass Curtain Walls Market

User inquiries regarding AI's impact on the Structural Glass Curtain Walls Market frequently center on automation potential, design optimization, and predictive maintenance capabilities. Key themes revolve around how AI can enhance the precision of complex facade designs, specifically optimizing glass panel shapes, stress distribution under varying load conditions, and thermal performance simulation, which are currently intensive tasks requiring significant engineering hours. Users are also concerned with the integration of AI-powered systems into the manufacturing process for quality control and the deployment of machine learning algorithms to predict the degradation or failure of structural sealants and fittings, aiming for proactive maintenance schedules that extend the lifespan of these high-value installations. Expectations are high that AI will democratize sophisticated facade engineering, making optimized, high-performance structural glass solutions more accessible while ensuring compliance with increasingly stringent global safety and energy standards.

- AI-driven optimization of structural geometry and load-bearing capacity, reducing material waste.

- Machine learning algorithms enhancing thermal performance modeling and energy efficiency simulations during the design phase.

- AI integration into manufacturing robotics for precise cutting, assembly, and quality assurance of unitized facade panels.

- Predictive maintenance analytics using sensor data to monitor sealant health, detect micro-cracks, and schedule proactive repairs, minimizing operational downtime.

- Automated BIM modeling enhancement, allowing faster generation of complex structural glass detailing and clash detection in integrated building models.

- Improved supply chain logistics optimization for specialized glass panels, fittings, and customized aluminum profiles based on real-time project schedules.

DRO & Impact Forces Of Structural Glass Curtain Walls Market

The dynamics of the Structural Glass Curtain Walls Market are heavily shaped by compelling drivers, persistent restraints, emerging opportunities, and competitive impact forces. The primary drivers include the global push for aesthetically pleasing, light-maximizing commercial architecture and the increasing mandate for energy-efficient building envelopes, particularly the performance benefits offered by advanced low-emissivity (Low-E) glass coatings integrated into these systems. However, the market is significantly restrained by the high initial capital investment required for these complex, custom-engineered facades, coupled with the need for highly specialized installation labor, which can be scarce, particularly in developing regions. Opportunities lie primarily in the immense market potential for retrofitting older commercial buildings to meet modern energy codes and the development of cost-effective, standardized modular structural glass units suitable for mid-market applications.

Impact forces stem from the intense competitive landscape where differentiation is achieved through material science innovation, particularly in structural silicone and spider fitting technology. Regulatory scrutiny regarding building safety, especially post-fire events, exerts a significant influence, demanding rigorous testing and certification (Impact Force). Economically, fluctuations in raw material costs, specifically aluminum and high-grade silica for glass production, directly influence profitability and pricing strategies (Restraint/Impact Force). Conversely, the persistent architectural demand for transparent, structurally sound, and high-performance facades serves as a constant upward pressure, sustaining market momentum (Driver).

The integration of Building Integrated Photovoltaics (BIPV) into structural glass systems represents a substantial long-term opportunity, transforming the curtain wall from a passive barrier into an active energy generator, aligning perfectly with global net-zero commitments. Addressing the skill gap in installation and developing certified training programs are crucial steps for mitigating the labor restraint. Successfully navigating the complex interplay between design flexibility (Driver) and the inherent complexity of engineering high-performance structural joints (Restraint) determines the success of market players in securing high-value, iconic projects globally.

Segmentation Analysis

The Structural Glass Curtain Walls Market is comprehensively segmented based on Type, Application, and Supporting Material, reflecting diverse functional requirements and architectural preferences across the global construction industry. Segmentation by Type, including point-fixed, two-sided supported, and four-sided supported systems, addresses varying structural needs and aesthetic objectives, with frameless point-fixed systems commanding premium pricing due to their high transparency and intricate engineering. The application breakdown, dominated by the commercial sector (offices, hotels), dictates performance requirements, focusing heavily on thermal integrity and acoustic dampening, while the rapidly growing high-end residential segment prioritizes bespoke design and security features. Material segmentation is crucial, as the performance and longevity of the system depend heavily on the quality of the primary supportive structure, typically aluminum alloys chosen for their strength-to-weight ratio and corrosion resistance.

Analyzing these segments provides strategic insights into market hotspots. For example, the strong regulatory environment in Europe encourages demand for highly insulated, two-sided supported unitized systems designed for superior energy efficiency, whereas the design-centric commercial projects in the Middle East often favor complex, large-scale point-fixed structural glazing for maximum architectural impact. The shift towards prefabrication is predominantly driving the two-sided and four-sided supported segments, as these unitized systems are easier to manufacture off-site and install rapidly, offering cost and timeline advantages over traditional stick-built construction methods. Understanding this granular segmentation is essential for manufacturers tailoring their R&D investments toward specific regional and end-user needs.

- By Type:

- Point-Fixed Systems (Spider Glazing)

- Two-Sided Supported Systems

- Four-Sided Supported Systems (Structural Silicone Glazing - SSG)

- Unitized Systems (Hybrid)

- By Application:

- Commercial Buildings (Offices, Retail, Hospitality)

- Residential Buildings (High-End Apartments, Custom Homes)

- Institutional (Educational Facilities, Healthcare)

- Industrial/Infrastructure (Airports, Transit Hubs)

- By Supporting Material:

- Aluminum Frames/Profiles

- Steel Frames/Substructures

- Other Materials (e.g., Wood composites, Specialized Polymers)

Value Chain Analysis For Structural Glass Curtain Walls Market

The Value Chain for Structural Glass Curtain Walls is complex, spanning raw material extraction, high-precision manufacturing, specialized engineering design, and highly skilled installation. The upstream segment involves the production of critical raw materials, primarily silica sand for glass manufacturing, bauxite for aluminum extrusion, and specialized chemical compounds for structural silicone sealants. Control over the quality and supply stability of these materials is vital, as any variability directly impacts the facade system's structural integrity and thermal performance. Downstream activities are dominated by specialized facade engineers and architects who design the custom system, ensuring compliance with local seismic and wind load requirements, followed by the highly critical fabrication stage, often involving CNC machinery for precise profile cutting and assembly, particularly for unitized systems.

Distribution channels for structural glass curtain walls are predominantly indirect and project-specific. Direct channels are generally limited to large, vertically integrated facade contractors who manage the entire process from design to installation, often bypassing standard distributors. However, the majority of the market utilizes specialized distributors and project management firms that facilitate the movement of custom-manufactured components (glass panels, aluminum profiles, fittings) from fabricators to the construction site. Due to the custom nature of the product, efficient logistics, and timely delivery of components are critical. The final stage involves expert installation teams who must apply precise techniques, especially for structural silicone glazing and point-fixed systems, where failure in application can lead to long-term performance issues and safety risks. This reliance on highly skilled labor makes the installation phase a significant value-add component.

The crucial differentiator in the value chain is the seamless integration between design engineering and fabrication, supported by advanced software tools like BIM. Collaboration among architects, structural engineers, and fabricators minimizes errors and ensures the high precision required for structural glass systems. Furthermore, post-installation services, including regular inspection and maintenance of sealants and fixings, represent a growing segment of the value chain, ensuring the long-term performance and warranties of the high-value facade investment. Manufacturers that offer comprehensive turnkey solutions, integrating material supply, engineering, and installation support, often capture greater value and enhance client trust in this highly technical market.

Structural Glass Curtain Walls Market Potential Customers

The primary end-users and potential buyers of structural glass curtain wall systems are large-scale real estate developers and institutional investors focusing on Grade A commercial properties and high-visibility infrastructure projects. These customers prioritize design excellence, brand image, and long-term asset value, viewing the curtain wall as a crucial element of modern, sustainable, and prestigious architecture. Government agencies responsible for public infrastructure, such as major airport authorities, railway hubs, and cultural centers, also constitute a significant customer base, often requiring structural glass solutions that combine superior safety features, durability, and expansive public viewing areas.

Another rapidly expanding customer segment includes multinational corporations building iconic headquarters or large-scale technology campuses, where employee well-being, energy efficiency, and abundant natural light are paramount strategic considerations. These corporate clients often mandate certifications like LEED or BREEAM, driving the demand for the highest performance specifications in thermal glazing and integrated renewable energy features (BIPV). Finally, high-net-worth individuals and specialized luxury residential developers represent the third key segment, seeking bespoke, architecturally complex structural glass installations for premium residential towers and custom homes, where cost is secondary to unique aesthetic execution and structural innovation.

Targeting these customer groups requires manufacturers and contractors to demonstrate a proven track record in executing complex projects, adherence to stringent safety standards, and the capability to provide detailed engineering support from conception through completion. Procurement decisions are heavily influenced by the contractor’s certification status, the warranty offered on the structural elements (especially sealants and fittings), and the demonstrated energy-saving performance capabilities of the proposed system, underscoring the technical sales nature of this market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 56.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schüco International KG, Permasteelisa Group, Arup, Saint-Gobain, AGC Inc., Guardian Industries, Technoform Group, Enclos Corp., Kawnene, Sapa Building System, EFCO Corporation, Oldcastle BuildingEnvelope, Inc., YKK AP, China Glass Holdings Limited, Alutech Group, Harmon, Inc., Yuanda China Holdings Limited, Fletcher Building, Stella Group, Gartner GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Structural Glass Curtain Walls Market Key Technology Landscape

The technological landscape of the Structural Glass Curtain Walls Market is defined by continuous innovation aimed at enhancing structural integrity, thermal performance, and design versatility. Key advancements center on the evolution of structural fittings and sealants. Point-fixed systems heavily rely on sophisticated spider fittings, often manufactured from marine-grade stainless steel, which allow for minimal visual obstruction while securely distributing wind and seismic loads to the building structure. Parallel innovation in structural silicone glazing (SSG) involves the development of high-performance, weather-resistant, and UV-stable sealants that provide durable, invisible structural bonds, crucial for four-sided supported systems. Furthermore, tension rod and cable net structural systems are increasingly deployed for large, expansive facades, offering lightweight and highly transparent alternatives for atrium enclosures and building entrances.

Glass technology constitutes another cornerstone of market innovation. The widespread adoption of low-emissivity (Low-E) coatings has become standard, significantly reducing heat transfer and improving the overall U-value of the curtain wall system, directly addressing energy conservation goals. Complementary advancements include the use of chemically strengthened and heat-soaked tempered glass to enhance safety and prevent spontaneous breakage, alongside dynamic glazing technologies (electrochromic and thermochromic glass) that allow occupants to control light transmission and solar heat gain actively. These smart glass integrations move the facade from a static component to an interactive element of the building envelope, optimizing interior comfort and energy use based on real-time environmental conditions.

The manufacturing process itself is undergoing a technological transformation driven by digitalization. The application of Building Information Modeling (BIM) is now standard practice, enabling precise fabrication of unitized panels off-site, drastically reducing on-site waste and improving construction speed. Prefabrication methodologies, particularly for complex unitized curtain walls, leverage robotic assembly and automated quality control checks, ensuring millimetric precision in assembly, which is paramount for the long-term weather performance and structural reliability of the facade system. These integrated technologies facilitate the construction of increasingly taller, complex, and energy-efficient buildings globally while maintaining strict quality parameters.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, technology adoption, and competitive landscape of the Structural Glass Curtain Walls Market. Each major region demonstrates unique drivers based on economic development, architectural trends, and regulatory mandates concerning energy efficiency and seismic resilience. The distinct growth trajectories across North America, Europe, and Asia Pacific necessitate tailored marketing and product development strategies for market participants.

- Asia Pacific (APAC): This region is the undisputed leader in market size and growth rate, primarily driven by massive infrastructure spending, rapid urbanization, and the proliferation of megacities demanding modern commercial skyscrapers in China, India, and Southeast Asia. The focus is often on speed of construction, leading to high adoption rates of prefabricated, unitized structural glass systems. Architectural ambition frequently leads to the commissioning of complex, iconic structures, favoring large-scale, custom structural glazing projects.

- North America: Characterized by a mature construction sector, North America exhibits strong demand for high-performance structural glass, particularly in major metropolitan areas requiring adherence to stringent energy codes and sophisticated hurricane/seismic resistance standards. The market is driven by new commercial tower construction and a significant retrofitting wave in existing buildings, demanding advanced thermal break technology and automated facade systems.

- Europe: The European market is highly regulated, placing exceptional emphasis on environmental performance, thermal efficiency (passivhaus standards), and sustainability. This drives strong demand for structural glass systems utilizing triple glazing, integrated sun-shading solutions, and innovative aluminum profiles with exceptionally low U-values. Germany, the UK, and France are key markets focused on quality and long-term durability, with a preference for certified, technically superior products.

- Middle East and Africa (MEA): Demand in the MEA region, particularly the Gulf Cooperation Council (GCC) states, is fueled by large-scale, government-backed prestige projects in hospitality, retail, and commercial sectors. The key technical driver is the necessity for specialized structural glass capable of managing extreme solar heat gain and dust storms, requiring advanced solar control glass and robust sealing technologies.

- Latin America: This region presents emerging opportunities, driven by increasing foreign investment in commercial and mixed-use developments, particularly in Brazil and Mexico. Market growth is sensitive to economic stability, with demand focusing on a balance between cost-effectiveness and meeting international aesthetic standards for modern high-rises.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Structural Glass Curtain Walls Market.- Schüco International KG

- Permasteelisa Group

- Arup (Focus on Design and Engineering)

- Saint-Gobain

- AGC Inc.

- Guardian Industries

- Technoform Group

- Enclos Corp.

- Kawneer

- Sapa Building System

- EFCO Corporation

- Oldcastle BuildingEnvelope, Inc.

- YKK AP

- China Glass Holdings Limited

- Alutech Group

- Harmon, Inc.

- Yuanda China Holdings Limited

- Fletcher Building

- Stella Group

- Gartner GmbH

Frequently Asked Questions

Analyze common user questions about the Structural Glass Curtain Walls market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between structural glass curtain walls and traditional curtain walls?

Structural glass curtain walls (SGCWs) primarily use structural silicone sealant (SSG) or specialized point fixings (spider fittings) to transfer loads, resulting in an aesthetically frameless, monolithic glass exterior. Traditional systems rely on exposed exterior metal caps or pressure plates for mechanical retention, which are more visible and offer less design transparency than SGCWs.

How does the structural glass curtain wall system contribute to a building's energy efficiency?

SGCWs enhance energy efficiency by integrating high-performance glazing, such as Low-E coatings, argon-filled insulating glass units (IGUs), and thermal breaks within the supporting frame. This minimizes heat transfer (improving U-values) and controls solar heat gain, reducing the reliance on HVAC systems and lowering operational energy costs.

Which segments of the structural glass market are experiencing the fastest technological adoption?

The Unitized Systems and Point-Fixed Systems segments are experiencing the fastest technological adoption. Unitized systems benefit from prefabrication and BIM integration for high-speed installation, while point-fixed systems are rapidly integrating advanced materials like specialized stainless steel alloys and tension rod systems for enhanced transparency and structural resilience.

What are the main safety concerns associated with structural glass facades?

Key safety concerns include preventing spontaneous glass breakage (often mitigated by heat soaking tempered glass), ensuring robust resistance to extreme wind and seismic loads, and maintaining the long-term integrity of the structural silicone sealant bonds, which are critical for holding the glass panels in place.

How does AI technology influence the design and maintenance of structural glass curtain walls?

AI assists in the design phase by optimizing structural engineering calculations, predicting thermal performance, and ensuring compliance with complex load requirements faster than traditional methods. For maintenance, AI algorithms analyze sensor data (IoT) to predict sealant degradation or fitting failures, enabling proactive, scheduled maintenance to maximize the facade's service life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager