Structured Cabling System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433085 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Structured Cabling System Market Size

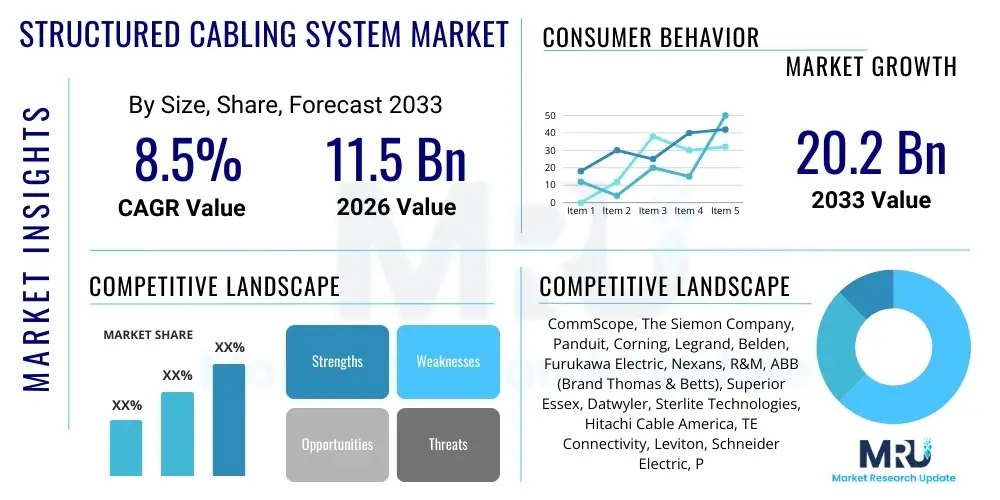

The Structured Cabling System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 20.2 Billion by the end of the forecast period in 2033.

Structured Cabling System Market introduction

The Structured Cabling System Market encompasses the integrated system of cabling and associated hardware that provides a comprehensive telecommunications infrastructure. This infrastructure typically supports a wide range of applications, including voice, data, video, security systems, and increasingly, Power over Ethernet (PoE) devices. The core product description involves standardized components such as copper cables (e.g., Category 6A, 8), fiber optic cables, patch panels, connectors, and cable management hardware, all organized according to specific standards (e.g., TIA/EIA 568 series). The crucial benefit of adopting a structured cabling system lies in its ability to centralize and simplify network management, offering superior reliability, scalability, and ease of troubleshooting compared to point-to-point non-structured wiring.

Major applications for structured cabling are predominantly found within data centers, commercial enterprises, residential smart buildings, and industrial facilities. Data centers represent the highest growth segment due to the relentless demand for hyperscale cloud services and high-speed interconnectivity (40G, 100G, and 400G Ethernet). Within commercial and residential settings, these systems are fundamental to supporting advanced building management systems (BMS), security surveillance, VoIP telephony, and widespread Internet of Things (IoT) deployments. The standardized nature of the infrastructure ensures compatibility with multi-vendor active equipment, minimizing proprietary lock-in and maximizing the lifecycle investment of the physical layer.

Key driving factors accelerating the market expansion include the global surge in internet traffic, rapid migration toward cloud computing models, and the widespread adoption of bandwidth-intensive applications such as high-definition video conferencing and augmented reality. Furthermore, regulatory mandates and industry standards continuously evolve, necessitating infrastructure upgrades. For instance, the transition from older Category 5e/6 installations to Category 6A (supporting 10 Gigabit Ethernet) and Category 8 (for short-reach data center applications) is a significant driver. The proliferation of edge computing architectures and 5G network rollouts also requires robust and standardized backhaul and premise infrastructure, making structured cabling essential for modern digital transformation initiatives across all sectors.

Structured Cabling System Market Executive Summary

The Structured Cabling System Market is poised for substantial growth, driven primarily by favorable business trends focused on digital resilience and capacity expansion. Business trends indicate a strong move toward Automated Infrastructure Management (AIM) solutions, allowing organizations to monitor, manage, and document the physical layer automatically, addressing the complexities introduced by high-density environments like hyperscale data centers. Enterprise businesses are prioritizing flexibility and future-proofing, leading to increased adoption of modular cabling solutions and hybrid copper/fiber architectures that can adapt quickly to changing technological demands. Mergers and acquisitions among key market players are also shaping the competitive landscape, focused on integrating specialized fiber optic technologies and expanding geographic reach, particularly in emerging Asian markets.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, propelled by massive investments in digital infrastructure, urbanization, and government initiatives promoting smart cities and industrial automation in countries like China, India, and Southeast Asia. North America and Europe, while mature, maintain significant market shares, driven by continuous data center expansion and the necessity of upgrading legacy infrastructure to meet stringent regulatory requirements (such as data localization and security standards). Specifically, the deployment of 5G networks is fueling localized growth in metropolitan areas across all regions, demanding enhanced fiber optic density for backhaul and fixed wireless access infrastructure, thereby boosting investment in specialized outdoor plant cabling solutions.

Segment trends underscore the dominance of fiber optic cable solutions in high-speed, long-distance applications, particularly within data center backbone links and campus networks, owing to their superior bandwidth capacity and immunity to electromagnetic interference. However, copper cabling remains crucial for horizontal cabling within commercial buildings and for supporting Power over Ethernet (PoE) applications, where it offers a cost-effective, standardized solution for powering devices like security cameras and Wi-Fi access points. The application segment growth is led by data centers, followed by the industrial sector, which is increasingly adopting robust, industrial-grade structured cabling (IP65/IP67 rated) to facilitate Industry 4.0 initiatives and reliable industrial IoT (IIoT) connectivity.

AI Impact Analysis on Structured Cabling System Market

User queries regarding the impact of Artificial Intelligence (AI) on structured cabling systems primarily revolve around how AI's stringent computational requirements influence infrastructure design, whether AI can manage complex cabling systems, and the longevity of current copper standards in the face of massive AI data flows. Key themes emerging from this analysis include the demand for ultra-high-density cabling architectures to support AI clusters and high-performance computing (HPC) environments, the reliance on specialized fiber optic solutions (e.g., short-reach multi-mode fiber for intra-rack connectivity) to minimize latency, and the integration of AI-powered Automated Infrastructure Management (AIM) tools. Users are keen to understand if AI will accelerate the obsolescence of existing Category standards or necessitate entirely new physical layer technologies capable of handling the unprecedented speed and volume of training data.

The immediate and tangible impact of AI is the explosive demand it creates for specialized data center infrastructure. Training large language models (LLMs) and performing complex neural network calculations require vast arrays of interconnected GPUs, necessitating extremely low-latency interconnections often measured in millimeters or centimeters. This environment is driving the adoption of high-performance fiber optic solutions (like OM5 and OS2) and specific copper technologies (Category 8) over shorter distances within the server racks and rows. AI models depend on uninterrupted data flow, meaning the physical layer must support extreme resilience and thermal management, pushing cable manufacturers to innovate in areas of cable jacket materials and bend radius optimization.

Furthermore, AI is transitioning from being just a demand driver for cabling infrastructure to becoming an integral management tool within the structured cabling ecosystem itself. AI algorithms are increasingly deployed within Automated Infrastructure Management (AIM) software to monitor real-time performance, predict potential points of failure (such as overheating cables or port inconsistencies), and automate provisioning processes. This AI-enabled management enhances operational efficiency, reduces downtime, and ensures adherence to compliance standards, making the overall network infrastructure smarter, self-optimizing, and significantly more efficient in high-complexity environments like large-scale co-location facilities and hyperscale cloud providers.

- AI algorithms necessitate ultra-low latency, accelerating the demand for Category 8 copper and short-reach fiber optic backbones in data centers.

- Increased power consumption by AI hardware drives higher adoption of thicker-gauge copper cables to handle increased Power over Ethernet (PoE) demands and thermal dissipation requirements.

- AI-powered Automated Infrastructure Management (AIM) solutions are transforming monitoring and predictive maintenance of the physical cabling layer.

- The complexity of AI clusters requires ultra-high-density patching solutions and specialized trunking to manage the physical cabling footprint efficiently.

- AI deployment significantly boosts investment in edge data centers, requiring standardized, resilient structured cabling solutions closer to the source of data generation.

DRO & Impact Forces Of Structured Cabling System Market

The structured cabling market is shaped by a powerful interplay of drivers, restraints, and opportunities. The primary driver is the exponentially increasing global demand for bandwidth, fueled by cloud services, video streaming, and the proliferation of IoT devices, compelling organizations to continuously upgrade their network infrastructure from 1 Gbps to 10 Gbps and higher speeds. Simultaneously, opportunities arise from the global push toward smart infrastructure, including smart cities, smart factories (Industry 4.0), and smart commercial buildings, all of which rely on robust, centralized structured networks for integrated management systems and seamless data aggregation. However, market growth faces restraints, notably the relatively high initial capital expenditure associated with high-performance cabling (especially fiber optics) and the scarcity of certified, skilled professionals required for complex installation and termination procedures, particularly in emerging economies.

The key driving forces sustaining market momentum include technological advancements in cabling standards, specifically the ratification and implementation of standards like Category 8 for high-density switching environments, and enhancements in fiber optic technology such as low-loss connectors and high-density multifiber push-on (MPO) systems. These advancements ensure that the physical layer can support the next generation of active equipment and emerging protocols. Furthermore, the mandatory requirement for structured cabling in newly constructed commercial and public infrastructure projects worldwide provides a stable, foundational demand base. The regulatory push for energy efficiency is also impactful, favoring solutions like optimized copper cabling that supports higher-power PoE standards (e.g., 90W) to reduce the overall separate electrical wiring requirements.

Conversely, the impact of market restraining forces is felt acutely in smaller enterprises and developing regions where budgetary constraints dictate slower adoption rates of premium solutions. Another significant restraint is the market complexity introduced by differing regional standards and certification requirements, which can impede global manufacturers' speed to market. The primary opportunity remains the immense potential within the retrofitting segment, where millions of aging commercial buildings globally require complete infrastructure overhaul to enable modern converged network capabilities. Companies that offer comprehensive, easy-to-deploy, and standardized solutions tailored for retrofit projects, combined with strong localized training programs to address the skilled labor shortage, are strategically positioned to capitalize on these impactful market forces.

Segmentation Analysis

The Structured Cabling System Market is extensively segmented across multiple dimensions, including component type, cable type, application area, and end-use sector, providing a granular view of market dynamics and specialized infrastructure demands. Component segmentation is critical, dissecting the market into revenue generated by physical cables (copper and fiber), connecting hardware (jacks, patch panels), and management tools (racks, enclosures, and Automated Infrastructure Management software). This analysis allows stakeholders to understand where investments are concentrated—for example, the growing revenue share attributable to sophisticated patch panel management systems indicates a focus on operational efficiency rather than just raw cable volume.

Furthermore, segmentation by end-use sector highlights differential growth rates and specific technology requirements. Data centers necessitate ultra-high-density, low-latency fiber solutions, whereas commercial offices prioritize flexibility, manageability, and high-power PoE compatibility using Category 6A copper. This detailed market breakdown is essential for strategic planning, enabling manufacturers to tailor their product development efforts, channel strategies, and marketing communication to align with the unique needs and regulatory environments of various industry verticals, from healthcare and education to government and manufacturing.

- Component Type

- Cables (Copper, Fiber Optic)

- Connecting Hardware (Patch Panels, Connectors & Cross-Connects)

- Outlets & Termination Blocks

- Racks & Enclosures

- Cable Management Solutions

- Cable Type

- Copper Cables (Category 5e, Category 6/6A, Category 7/7A, Category 8)

- Fiber Optic Cables (Single-mode, Multi-mode)

- Application Area

- Local Area Network (LAN)

- Wide Area Network (WAN)

- Data Center Infrastructure

- Video and CCTV Systems

- Building Management Systems (BMS)

- End-Use Sector

- IT & Telecommunications

- Commercial Real Estate

- Industrial (Manufacturing & Energy)

- Government & Defense

- Residential & Education

- Healthcare

Value Chain Analysis For Structured Cabling System Market

The value chain for the Structured Cabling System Market begins with the upstream suppliers responsible for raw material sourcing and component manufacturing. This upstream segment involves specialized suppliers providing raw copper rod, optical fiber preforms, polymer compounds for cable jacketing, and specialized electronic components for connectors and modules. The quality and cost volatility of these raw materials, particularly copper, significantly influence the final product pricing and availability. Manufacturers must maintain strong relationships with these primary suppliers to ensure stable supply chains and adherence to stringent material specifications required for performance standards (e.g., TIA/EIA, ISO/IEC compliance), establishing the foundational quality of the entire network system.

The midstream involves the core manufacturing and assembly processes, where raw materials are converted into finished structured cabling products such as terminated patch cords, assembled patch panels, and specialized trunk cables. This stage is dominated by major global brand manufacturers who invest heavily in R&D to innovate in areas like cable performance, connector density, and automated infrastructure management software integration. Distribution channels then link these manufacturers to the end-users. The distribution channel is bifurcated into direct sales to large hyperscale data center operators or government entities, and indirect sales through a vast network of authorized distributors, system integrators, and certified installers. Indirect channels are crucial for reaching small and medium-sized enterprises (SMEs) and managing complex building installations.

Downstream analysis focuses on the installation, certification, and ongoing maintenance services provided by certified structured cabling installers and network contractors. These professional service providers are critical, as the performance of a structured cabling system is heavily dependent on the quality of installation and adherence to termination best practices. Direct channels often serve high-volume, standardized projects, ensuring tight integration with customer requirements, while indirect channels provide broader market reach and specialized local expertise for tailored solutions. Successful companies leverage strong partnerships within the integrator community, offering continuous training and certification programs to ensure high standards of deployment quality across the entire market ecosystem, solidifying the long-term system performance guarantee for the end-user.

Structured Cabling System Market Potential Customers

Potential customers and end-users of structured cabling systems span across virtually every industry sector that relies on data communication, centralized management, or security infrastructure. Hyperscale and colocation data center operators represent the most crucial customer segment due to their immense demand for high-density, high-speed fiber connectivity and premium Category 8 copper solutions for server-to-switch links. These customers purchase high volumes and prioritize operational efficiency, ultra-low latency, and scalability above initial cost, driving the demand for advanced, modular, and pre-terminated systems that facilitate rapid deployment and reconfiguration within massive footprints.

Beyond the core IT sector, the commercial and institutional segments—including corporate offices, large university campuses, healthcare facilities, and government administration buildings—are significant buyers. These end-users demand solutions that support converged networks, integrating IT, telephony (VoIP), security (IP cameras, access control), and building automation (HVAC, lighting) onto a single, standardized IP-based infrastructure. Their purchasing decisions are often influenced by the total cost of ownership (TCO), warranty periods, and the ability of the system to support future Power over Ethernet (PoE) demands for increasingly sophisticated smart building technologies, making Category 6A the standard choice for most new installations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 20.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CommScope, The Siemon Company, Panduit, Corning, Legrand, Belden, Furukawa Electric, Nexans, R&M, ABB (Brand Thomas & Betts), Superior Essex, Datwyler, Sterlite Technologies, Hitachi Cable America, TE Connectivity, Leviton, Schneider Electric, Prysmian Group, FiberHome, AFL Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Structured Cabling System Market Key Technology Landscape

The technology landscape of the Structured Cabling System Market is rapidly evolving, driven by the necessity to support faster data rates, higher power delivery, and increased infrastructure density. A core technology advancement is the maturation and deployment of Category 8 cabling systems, which are specifically designed to support 25GBASE-T and 40GBASE-T applications over short distances (up to 30 meters), predominantly within data center aggregation layers and server/storage connectivity. While Category 8 addresses high-speed copper needs, the broader technology shift is centered on fiber optics, particularly the utilization of multi-fiber push-on (MPO/MTP) connectors and trunking cables. These high-density solutions minimize installation time and human error while maximizing port density, which is critical for 100G, 200G, and 400G Ethernet deployments utilizing parallel optics technology.

Another significant technology shaping the market is the widespread adoption of advanced Power over Ethernet (PoE) standards, including IEEE 802.3bt (PoE++ or 4PPoE), which enables the delivery of up to 90W of power over standard Category 6A or better twisted-pair copper cabling. This capability is fundamentally transforming building infrastructure by allowing devices like high-resolution cameras, LED lighting systems, thin clients, and Wi-Fi 6 access points to be powered directly from the data network, eliminating the need for local AC power outlets. This convergence simplifies installation, enhances energy efficiency, and improves centralized power management, especially vital for smart building systems and IoT integration.

Finally, the proliferation of Automated Infrastructure Management (AIM) systems represents a software-driven technology overlay on the physical cabling layer. AIM systems utilize intelligent patch panels, smart patch cords, and specialized sensors to continuously monitor connectivity, track moves, adds, and changes (MACs), and provide real-time documentation of the physical layer. This technology is vital for complex, dynamic environments like hyperscale data centers, as it drastically reduces the administrative burden, eliminates manual inventory errors, and supports proactive network maintenance. The synergy between physical cabling standards (Cat 6A/8, OS2/OM5 fiber) and digital management tools (AIM) defines the current state-of-the-art infrastructure, ensuring optimal performance and operational longevity in increasingly demanding network environments.

Regional Highlights

Geographical market dynamics show distinct trends based on technological maturity, regulatory environment, and economic development, offering diversified growth patterns for structured cabling manufacturers. North America continues to lead the market in terms of technology adoption and total revenue, primarily driven by massive capital expenditure in hyperscale data centers by technology giants, coupled with high demand from the financial and government sectors. The continuous deployment of 5G infrastructure and widespread adoption of IoT and edge computing necessitate constant upgrades to high-speed fiber and Cat 6A networks, maintaining the region's premium market position despite its relative maturity.

Asia Pacific (APAC) stands out as the most vibrant and rapidly expanding region globally. Economic development, rapid urbanization, and significant government investments in digital infrastructure, particularly in countries like China, India, and Southeast Asia, are fueling unprecedented demand. The region is seeing rapid construction of new commercial and residential buildings, along with large-scale data center projects supported by local cloud providers and international technology firms seeking market entry. This robust construction activity, combined with the push for smart cities and Industry 4.0 adoption, makes APAC the primary focus for future market growth and competitive expansion, often prioritizing cost-effective yet high-performance solutions.

Europe represents a stable and highly regulated market, where emphasis is placed on sustainability, compliance with EU directives (such as GDPR affecting data center design), and energy efficiency. Demand is strong for high-performance structured cabling driven by the need to retrofit legacy corporate networks and the expansion of secondary data center markets across Nordic countries and Central Europe. The Middle East and Africa (MEA), while smaller, are exhibiting accelerated growth, largely attributed to significant infrastructure projects in the UAE and Saudi Arabia (e.g., NEOM project) and growing data center construction in South Africa, reflecting increasing digitalization initiatives backed by sovereign wealth funds.

- North America: Market dominance driven by hyperscale data center expansion, early adoption of Category 8, and intense demand from finance and telecommunications sectors.

- Asia Pacific (APAC): Highest growth rate, fueled by smart city development, urbanization, and vast government spending on digital transformation in China and India.

- Europe: Stable growth centered on regulatory compliance, sustainability standards, and continuous retrofitting of commercial buildings for advanced PoE applications and high-density fiber backbones.

- Latin America (LATAM): Emerging market characterized by increasing foreign investment in localized data centers and growing demand from the governmental and educational sectors.

- Middle East and Africa (MEA): Growth concentrated in large-scale infrastructure projects, oil & gas digitalization, and the establishment of new regional cloud hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Structured Cabling System Market.- CommScope

- The Siemon Company

- Panduit

- Corning Incorporated

- Legrand

- Belden Inc.

- Furukawa Electric Co., Ltd.

- Nexans SA

- Reichle & De-Massari (R&M)

- ABB (Thomas & Betts)

- Superior Essex

- Datwyler IT Infra

- Sterlite Technologies Limited (STL)

- Hitachi Cable America Inc.

- TE Connectivity Ltd.

- Leviton Manufacturing Co., Inc.

- Schneider Electric SE

- Prysmian Group

- FiberHome Telecommunication Technologies Co., Ltd.

- AFL Global (Fujikura Ltd.)

Frequently Asked Questions

Analyze common user questions about the Structured Cabling System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current standard for structured cabling in new commercial buildings?

The prevailing standard for horizontal structured cabling in new commercial buildings is Category 6A (Cat 6A) shielded or unshielded twisted pair copper, which supports 10 Gigabit Ethernet (10GBASE-T) up to 100 meters. This standard is favored for its robust support of high-speed data and high-power Power over Ethernet (PoE) applications, ensuring the infrastructure is future-proofed for modern IoT and converged networks for at least a decade.

How does 5G deployment affect the demand for structured cabling systems?

5G deployment drives significant demand for structured cabling by requiring massive fiber optic backhaul infrastructure to connect dense small cell networks and central offices to core networks. Within the enterprise and residential sectors, 5G demands higher capacity in-building distributed antenna systems (DAS) and fixed wireless access points, which rely heavily on high-speed Category 6A or fiber optic cabling for reliable indoor distribution and backhaul.

What role do Automated Infrastructure Management (AIM) systems play in this market?

AIM systems are crucial software and hardware overlays that provide real-time physical layer documentation, manage connectivity, and automate provisioning processes. They significantly reduce operational costs, minimize human error during moves, adds, and changes (MACs), and are essential for maintaining the operational integrity and compliance required in large, complex, and high-density environments, especially hyperscale data centers.

Is copper cabling becoming obsolete due to the rise of fiber optics?

No, copper cabling is not becoming obsolete; rather, its role is shifting. While fiber optics dominates long-distance and data center backbone links due to bandwidth superiority, high-performance copper (Cat 6A and Cat 8) remains essential for short-reach applications (e.g., server-to-switch links) and is indispensable for powering endpoints via Power over Ethernet (PoE), a capability fiber currently cannot replicate efficiently. Both technologies coexist in hybrid network architectures.

Which end-use sector is expected to show the highest growth in the structured cabling market?

The IT and Telecommunications sector, specifically the Data Center segment (both hyperscale and edge facilities), is expected to show the highest growth. This growth is driven by the relentless expansion of cloud computing, AI processing demands, and the necessity for continuous infrastructure upgrades to support bandwidth standards exceeding 100G and 400G Ethernet, necessitating premium fiber and specialized high-density components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager