Stud Welding Gun Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437484 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Stud Welding Gun Market Size

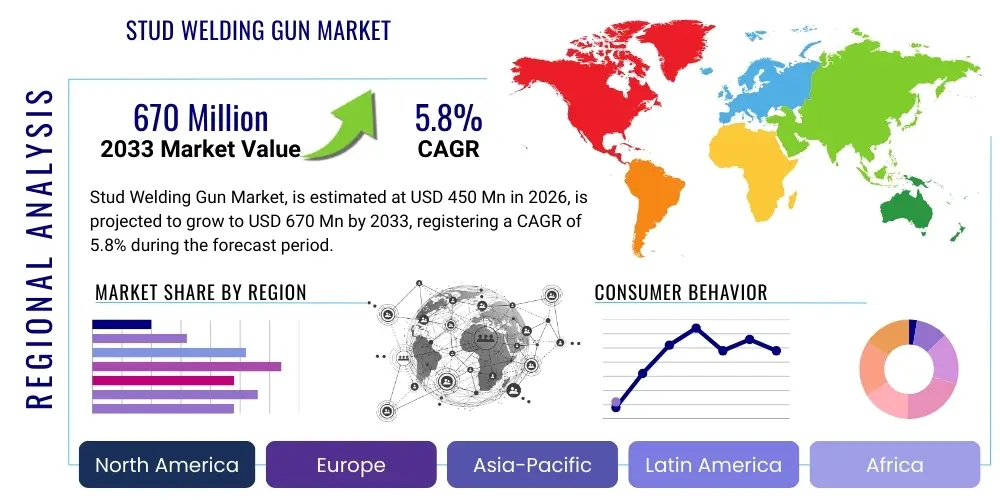

The Stud Welding Gun Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $670 Million USD by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by robust growth in global infrastructure development, coupled with increasing demand for automated and highly reliable fastening solutions across manufacturing and construction sectors. The inherent precision and speed offered by modern stud welding technologies provide a significant efficiency advantage over traditional fastening methods, solidifying its adoption across high-volume production lines.

Market valuation reflects the increasing sophistication of stud welding systems, which now frequently incorporate advanced features such as inverter technology, digital controls, and integration capabilities for robotic applications. While the market for basic capacitor discharge (CD) systems remains stable, the primary growth momentum is concentrated in high-performance drawn arc and short-cycle systems required for demanding applications in heavy engineering, shipbuilding, and energy infrastructure. The need for stronger, more uniform welds that can withstand high stress and environmental variability is pushing end-users toward premium, digitally controlled equipment, contributing positively to the overall market size value.

Furthermore, geographical expansion, particularly in emerging economies within the Asia Pacific region, plays a critical role in market size enhancement. These regions are experiencing rapid urbanization and massive investments in public infrastructure, creating an unprecedented demand for reliable, high-speed construction and assembly tools. Regulatory mandates enforcing higher safety and structural integrity standards in sectors like automotive and aerospace also necessitate the use of precise welding systems, thereby broadening the application base and supporting the projected CAGR through 2033.

Stud Welding Gun Market introduction

Stud welding guns are specialized tools designed to fasten studs or metallic fasteners onto another metal workpiece quickly and effectively, creating a strong, integral bond without the need for pre-drilled holes or manual thread insertion. The process involves creating an electrical arc between the stud and the base material, melting both surfaces, and then forging them together under controlled pressure. The resulting bond is exceptionally durable, leak-proof, and characterized by high tensile strength, making it superior to traditional bolting or riveting in many structural applications. These devices are pivotal in modern assembly lines where speed, material integrity, and aesthetic finish are paramount, such as in the installation of thermal insulation or securing internal components.

Major applications of stud welding technology span critical industries including automotive manufacturing, where studs are used for securing exhaust components or internal panels; construction and civil engineering, primarily for securing shear connectors in composite steel structures; and shipbuilding, where vast quantities of insulation, pipe supports, and cable hangers are affixed to hulls and decks. The key benefits driving adoption include high productivity due to extremely fast welding cycles (often milliseconds for capacitor discharge), minimal thermal distortion to the base material, and the ability to weld dissimilar metals or coated materials effectively. This versatility makes stud welding guns indispensable across various fabrication environments requiring high throughput and uncompromising quality control.

The market growth is primarily driven by global intensification of infrastructure projects, particularly bridges, high-rise buildings, and large industrial facilities requiring robust shear connection mechanisms. Additionally, the automotive sector’s shift towards lighter materials and complex designs demands precise, rapid fastening methods that minimize structural stress, favoring sophisticated stud welding systems. Technological advancements, such as the miniaturization of power sources and the development of integrated automation features that enhance repeatability and reduce operator error, further act as powerful market accelerators, ensuring the consistent upward trajectory of the Stud Welding Gun Market.

Stud Welding Gun Market Executive Summary

The Stud Welding Gun Market is characterized by robust business trends centered on automation integration, technological refinement, and specialization tailored to specific material requirements. Key business trends include the rising adoption of robotic stud welding cells, particularly in high-volume industries like automotive and heavy machinery, aimed at improving consistency and reducing labor costs. There is a noticeable market shift towards inverter-based power sources that offer superior portability, energy efficiency, and precise control over the welding parameters compared to older transformer-rectifier units. Furthermore, manufacturers are focusing on developing specialized guns and studs optimized for welding onto thin-gauge materials and high-strength, low-alloy (HSLA) steels, catering to the lightweighting mandates in transportation sectors.

Regionally, the Asia Pacific (APAC) market exhibits the highest growth momentum, fueled by massive government investments in infrastructure development, burgeoning shipbuilding activities, and the rapid expansion of manufacturing facilities in countries like China, India, and South Korea. North America and Europe, while maturing, remain crucial markets driven by technological innovation, strict quality regulations (especially in aerospace and energy), and the continual retrofitting of existing industrial facilities. Regional trends also reflect increasing scrutiny over environmental and worker safety standards, prompting manufacturers to innovate solutions that reduce noise levels and minimize fume generation during the welding process.

Segmentation trends highlight the dominance of the Capacitor Discharge (CD) segment by volume, due to its speed and suitability for cosmetic applications involving thin materials, while the Drawn Arc (DA) segment leads in terms of value, owing to its application in high-stress, heavy-duty structural engineering where maximum weld strength is required. The end-user segment reveals strong consistent demand from the construction and general fabrication industries, but the fastest growth trajectory is anticipated within the specialized segments such as shipbuilding and boiler/pressure vessel manufacturing, requiring highly reliable stud welding equipment for critical installations. Suppliers are increasingly offering bundled solutions, integrating guns, power sources, and feeder systems to enhance operational efficiency for end-users.

AI Impact Analysis on Stud Welding Gun Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Stud Welding Gun Market primarily revolve around operational efficiency, quality assurance, and predictive maintenance capabilities. Users frequently ask: "How can AI reduce defect rates in stud welding?", "Will AI optimize welding parameters autonomously?", and "What is the timeline for AI-driven predictive failure analysis in stud welding systems?". The core concerns center on leveraging AI to move beyond traditional quality checks (like torque testing) to real-time, in-process monitoring and adaptive parameter control. Expectations are high that AI will minimize setup time, automate fault detection, and significantly extend equipment lifespan by anticipating wear and tear before catastrophic failure. The key themes are focused on transforming stud welding from a skill-dependent process into a fully optimized, data-driven manufacturing operation, ensuring consistency across millions of welds.

- AI-Powered Quality Control: Utilizing machine vision and acoustic sensors to monitor the arc and molten pool dynamics in real-time, comparing patterns against acceptable standards, and instantly flagging or correcting substandard welds, drastically reducing rework.

- Predictive Maintenance: Analyzing sensor data (current, voltage, heat cycle duration, gun movement) from the welding equipment to predict component failure (e.g., solenoid wear, capacitor degradation) and schedule maintenance proactively, minimizing unplanned downtime.

- Parameter Optimization: Employing AI algorithms to autonomously adjust welding parameters (time, current) based on material thickness, coating type, and environmental conditions to achieve optimal bond strength and penetration for every specific application.

- Robotic Path Planning and Collision Avoidance: Enhancing the programming and efficiency of automated stud welding cells through smarter trajectory planning and adaptive movement adjustments in dynamic fabrication environments.

- Data Integration and Reporting: Centralizing welding data across multiple stations or sites, enabling comprehensive reports on process stability, compliance, and material traceability, crucial for aerospace and nuclear applications.

DRO & Impact Forces Of Stud Welding Gun Market

The Stud Welding Gun Market is driven primarily by the global surge in infrastructure spending and the persistent industrial push for higher assembly speeds and lower per-unit fastening costs. Key restraints include the high initial capital expenditure required for advanced, automated stud welding systems, particularly those incorporating robotic integration and sophisticated quality monitoring. Opportunities are abundant in developing specialized applications, such as welding onto coated materials (like galvanized steel) using optimized short-cycle processes and integrating stud welding capabilities into additive manufacturing post-processing. The primary impact forces shaping the market trajectory are the stringent quality mandates in critical sectors like automotive and power generation, which necessitate reliable, repeatable welding processes, and the ongoing labor shortage in skilled trades, which accelerates the transition toward automated solutions.

The demand for robust, high-strength fastening in heavy industries, alongside the increasing complexity of material combinations in modern manufacturing, acts as a primary market driver. Stud welding provides an exceptionally reliable and rapid method for structural connections, which traditional methods often struggle to match in terms of integrity and speed, especially on large-scale projects like bridge construction and large pressure vessel fabrication. However, the high purchase price of advanced Drawn Arc equipment, coupled with the need for highly specific consumables (studs) and specialized operator training, presents a restraint, particularly for smaller fabrication shops or those with fluctuating production volumes. Furthermore, competitive threats from alternative fastening methods, such as adhesive bonding or specialized mechanical fasteners, require stud welding manufacturers to continually improve cost-effectiveness and process stability.

Opportunities lie significantly in the integration of Industry 4.0 principles, enabling remote diagnostics, real-time process monitoring via IoT, and seamless data exchange within Smart Factories. The push for electric vehicles (EVs) also offers a growth avenue, as complex battery enclosures and lightweight structural components require specialized, distortion-free fastening methods. The overall impact force matrix indicates that technology adoption and regulatory compliance are the most critical factors; manufacturers that successfully embed AI and smart features into their products while adhering to international welding standards (e.g., ISO, AWS) will capture the maximum market share, overcoming pricing pressures through demonstrated superior performance and reliability.

Segmentation Analysis

The Stud Welding Gun Market is primarily segmented based on the welding technology utilized, which dictates the application suitability, the types of studs handled, and the end-user industry. The segmentation by technology includes Capacitor Discharge (CD), Drawn Arc (DA), and Short Cycle (SC) stud welding, each serving distinct requirements regarding material thickness and required weld strength. Further segmentation examines the degree of automation (manual vs. automated/robotic systems) and the application base (Construction, Automotive, Shipbuilding, General Fabrication). This granular segmentation helps market participants tailor product offerings and marketing strategies to address specific industry demands, focusing either on high-speed, low-distortion welding for consumer goods or high-integrity welding for structural engineering projects.

- By Welding Type:

- Capacitor Discharge (CD) Stud Welding

- Drawn Arc (DA) Stud Welding

- Short Cycle (SC) Stud Welding

- By Operation Mode:

- Manual Stud Welding Guns

- Automated/Robotic Stud Welding Heads

- By End-User Industry:

- Automotive and Transportation

- Construction and Infrastructure

- Shipbuilding and Marine

- Heavy Machinery and Industrial Equipment

- Aerospace and Defense

- General Fabrication and Sheet Metal Work

- By Power Source Technology:

- Inverter-Based Systems

- Transformer-Rectifier Based Systems

Value Chain Analysis For Stud Welding Gun Market

The value chain for the Stud Welding Gun Market starts with the sourcing of essential raw materials, primarily copper, aluminum, and various steel alloys required for both the power sources and the gun components, alongside specialized materials for the studs themselves. Upstream activities involve complex manufacturing processes, including precision machining, electronic assembly of power circuitry (capacitors, rectifiers, inverters), and the fabrication of the specialized welding gun bodies and accessories. Efficiency in this stage is crucial, as the quality and lifespan of the gun are highly dependent on the precision of the electromagnetic components and cooling systems incorporated. Suppliers of high-performance electronic components and specialized wire feeders hold significant leverage in the upstream segment, dictating costs and technological capacity.

Midstream activities encompass the assembly, rigorous quality testing, and branding of the final stud welding systems. Manufacturers invest heavily in R&D to optimize welding cycles, enhance portability, and integrate digital controls, differentiating their products based on reliability and ease of use. Distribution channels are varied, incorporating direct sales for large, custom automated systems to major OEMs (Original Equipment Manufacturers) and an extensive network of indirect distributors and industrial equipment resellers for standard, off-the-shelf manual guns. Specialized distributors often provide crucial after-sales support, maintenance, and operator training, adding significant value and acting as the primary point of contact for most end-users in general fabrication and construction sectors.

Downstream activities focus on post-sale services, including maintenance contracts, calibration services, and the continual supply of consumables, specifically the welding studs themselves. Direct channels are vital for managing relationships with major shipbuilding yards or automotive assembly plants where large volumes of automated equipment are installed. The indirect distribution channel, facilitated by regional industrial suppliers, effectively handles the fragmented demand from thousands of small-to-medium enterprises (SMEs). The success of the downstream operation is tied directly to the availability of certified technicians and readily accessible spare parts, ensuring minimal operational disruption for end-users relying on the equipment for critical production activities.

Stud Welding Gun Market Potential Customers

Potential customers for stud welding guns are concentrated in industries where rapid, high-integrity metal fastening to structural components is a foundational requirement for assembly or construction. The primary segment comprises heavy engineering and construction companies, which rely on drawn arc systems for installing shear connectors on steel decking and beams in composite structures, ensuring the stability of high-rise buildings and bridges. These buyers prioritize high duty cycles, robust build quality, and compliance with stringent structural codes. The procurement cycle often involves specifying equipment capable of operating reliably in harsh outdoor environments and connecting with certified welding consumables.

Another major customer segment includes automotive OEMs and tier suppliers. These entities predominantly utilize capacitor discharge (CD) and short-cycle systems for rapid, low-distortion welding of fasteners onto thin body panels, securing wiring harnesses, insulation, and interior components. For these customers, the key purchasing criteria are cycle speed, weld repeatability, and minimal heat impact to prevent panel warpage or degradation of pre-coated materials. The integration capability with robotic arms is also a critical factor, driving the demand for specialized automated welding heads rather than traditional manual guns.

Furthermore, the shipbuilding, marine, and energy sectors (including boiler and pressure vessel manufacturing) represent high-value potential customers. These industries demand the absolute highest level of weld integrity and traceability due to extreme operating conditions and safety regulations. They require heavy-duty Drawn Arc systems for affixing insulation pins, pipe hangers, and machinery supports to hulls and containment structures. These buyers often engage directly with manufacturers to procure customized or highly specialized welding solutions and extensive training programs, recognizing the specialized nature and critical application of the welding process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $670 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swaraj Stud Welding, Inc., Stud Welding Products, Inc., Midwest Fasteners, LLC, HBS Bolzenschweiß-Systeme GmbH & Co. KG, Nelson Stud Welding (Doncasters Group), Soyer Bolzenschweißtechnik GmbH, KMT International Stud Welding, Taylor Studwelding Systems Ltd., Tru-Weld Stud Welding, ARCON Stud Welders, Image Industries, Ltd., The Lincoln Electric Company, Genesis Stud Welding Inc., Sunbelt Stud Welding Inc., Koco Studwelding Systems GmbH, Pro-Weld Stud Welding, Fastarc Stud Welding, TS Stud Welding, RFI Stud Welding, Shanghai Stud Welding Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stud Welding Gun Market Key Technology Landscape

The Stud Welding Gun market is defined by three primary technological processes: Capacitor Discharge (CD), Drawn Arc (DA), and Short Cycle (SC) welding, each requiring specialized gun designs and power control mechanisms. CD welding systems, which utilize stored electrical energy from capacitors, are prominent for welding studs onto very thin materials (gauge 12 to 26) without causing visible distortion or burn-through on the reverse side. The technology relies on extremely short weld times (3 to 6 milliseconds) and specialized contact or gap guns. The technological advancement in this segment focuses on optimizing capacitor banks for higher energy density and repeatability, alongside integrating digital monitors to ensure precise voltage release, which is critical for consistent weld quality across high volumes in the sheet metal industry.

Drawn Arc (DA) welding technology is the standard for heavy-duty structural applications, involving significantly higher currents and longer weld cycles (up to 1.5 seconds) to achieve deep penetration and maximum strength welds, often utilizing ceramic ferrules to shield the arc and control the weld pool. The technological focus here is on developing advanced thyristor or IGBT-based inverter power sources that offer superior control over the arc profile and current slope, leading to more uniform and stronger bonds, particularly when welding onto thick steel or complex alloys. The guns used for Drawn Arc must be robust, often equipped with electromagnetic plungers and hydraulic damping mechanisms to ensure controlled stud movement and proper forging pressure. Innovations are also focused on lightweighting the gun assemblies without compromising durability, improving operator ergonomics.

Short Cycle (SC) stud welding, a hybrid approach, bridges the gap between CD and DA by offering high-speed welding onto medium-gauge materials with relatively low distortion, often eliminating the need for ferrules. The technological progression in the entire stud welding sector is heavily reliant on integration, specifically the incorporation of highly precise sensor technology within the welding gun itself. These sensors monitor lift height, plunge speed, and current flow in real-time, feeding data back to the power source’s microprocessor. This digital feedback loop ensures that welding parameters are automatically adjusted mid-cycle if necessary, drastically improving the consistency and certifiability of the weld, a feature indispensable for advanced robotic welding cells that demand absolute process control and minimal variability.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by extensive government investments in infrastructure, including rail networks, industrial parks, and massive shipbuilding contracts, particularly in China, India, South Korea, and Japan. The region benefits from lower manufacturing costs and a burgeoning domestic demand for high-speed automated assembly tools. The construction industry's rapid adoption of pre-fabricated and modular construction techniques, which rely heavily on fast and reliable fastening solutions like stud welding, further accelerates market growth.

- North America: This region holds a significant market share, characterized by high adoption rates of advanced automated welding solutions and a strong focus on high-precision applications in aerospace, energy (oil & gas, renewables), and heavy machinery manufacturing. The market is mature but highly focused on quality control and safety standards. Demand is driven by the replacement of older transformer-based systems with modern, energy-efficient inverter-based equipment and the push for robotic integration to mitigate rising labor costs.

- Europe: Europe represents a technologically sophisticated market with a strong emphasis on quality certification (e.g., CE marking and ISO standards) and sustainability. Germany, the UK, and Italy are key contributors, primarily driven by the high-end automotive sector and specialized fabrication for the chemical and nuclear industries. European manufacturers are leaders in developing highly ergonomic and portable stud welding systems, as well as complex multi-gun automation systems tailored for high-mix, low-volume production lines.

- Latin America (LATAM): The LATAM market is poised for steady growth, contingent on economic stability and revitalization of the construction and mining sectors, particularly in Brazil and Mexico. While penetration of automated systems is lower compared to North America and Europe, there is increasing demand for reliable, entry-level and mid-range manual Drawn Arc systems required for fundamental structural integrity projects and general fabrication activities.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries due to large-scale construction projects (megacities, energy facilities) and significant investment in oil and gas infrastructure, requiring robust, corrosion-resistant stud welding for pipelines and specialized industrial structures. Market drivers include the need for equipment capable of operating efficiently in high-heat, often remote, environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stud Welding Gun Market.- Swaraj Stud Welding, Inc.

- Stud Welding Products, Inc.

- Midwest Fasteners, LLC

- HBS Bolzenschweiß-Systeme GmbH & Co. KG

- Nelson Stud Welding (Doncasters Group)

- Soyer Bolzenschweißtechnik GmbH

- KMT International Stud Welding

- Taylor Studwelding Systems Ltd.

- Tru-Weld Stud Welding

- ARCON Stud Welders

- Image Industries, Ltd.

- The Lincoln Electric Company

- Genesis Stud Welding Inc.

- Sunbelt Stud Welding Inc.

- Koco Studwelding Systems GmbH

- Pro-Weld Stud Welding

- Fastarc Stud Welding

- TS Stud Welding

- RFI Stud Welding

- Shanghai Stud Welding Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Stud Welding Gun market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Drawn Arc and Capacitor Discharge stud welding technologies?

Drawn Arc (DA) is utilized for welding studs onto thick materials, producing high-strength, full-penetration structural welds, requiring a longer cycle time (up to 1.5 seconds) and often using ceramic ferrules for arc shielding. In contrast, Capacitor Discharge (CD) welding is designed for thin sheet metal (down to gauge 26), offering extremely fast, low-heat welds (milliseconds) with minimal backside marking, suitable for cosmetic and non-structural applications like insulation fastening.

How is the integration of robotics affecting the demand for manual stud welding guns?

Robotic integration is significantly increasing the demand for specialized automated stud welding heads and power sources capable of continuous, high-duty cycles, primarily in high-volume industries such as automotive manufacturing. While this automation reduces the need for manual guns in large assembly lines, manual guns maintain robust demand in general fabrication, repair, maintenance, and small-batch construction, where flexibility and portability are prioritized over massive throughput.

Which end-user segment drives the highest market revenue for stud welding equipment?

The Construction and Infrastructure segment typically drives the highest market revenue, largely due to the demand for heavy-duty Drawn Arc systems and large quantities of shear connectors required for commercial high-rise buildings, bridges, and complex steel structures. These applications require high-value, robust equipment that adheres to stringent safety and structural engineering standards, commanding premium pricing and consistent replacement demand.

What are the key technological advancements expected to shape the future of stud welding guns?

Future technological advancements are focused heavily on digital control, process monitoring, and energy efficiency. Key developments include the widespread adoption of inverter technology for superior arc control and portability, real-time quality assurance through integrated sensing and AI-driven process optimization, and the development of specialized guns for welding advanced materials like aluminum and high-strength steels with improved consistency and reduced heat input.

What role do inverter-based power sources play in the modern stud welding market?

Inverter-based power sources are replacing traditional transformer-rectifier units due to their significant advantages in size, weight, and operational control. Inverters offer precise, repeatable control over the welding current waveform and slope, which is crucial for maximizing weld quality and consistency, particularly for Drawn Arc and Short Cycle processes. Their energy efficiency and portability also make them highly preferred for site work and integration into modern, flexible manufacturing environments compliant with global energy regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager